Contents

Muneyuki Hashimoto (“Hashimoto”): Thank you for joining our earnings presentation. I am Hashimoto, the CFO of Sansan, Inc.

Today, I will present our Q2 and H1 results for the fiscal year ending May 31, 2026 (FY2025) and our full-year forecasts. CEO Terada will discuss our growth strategies later.

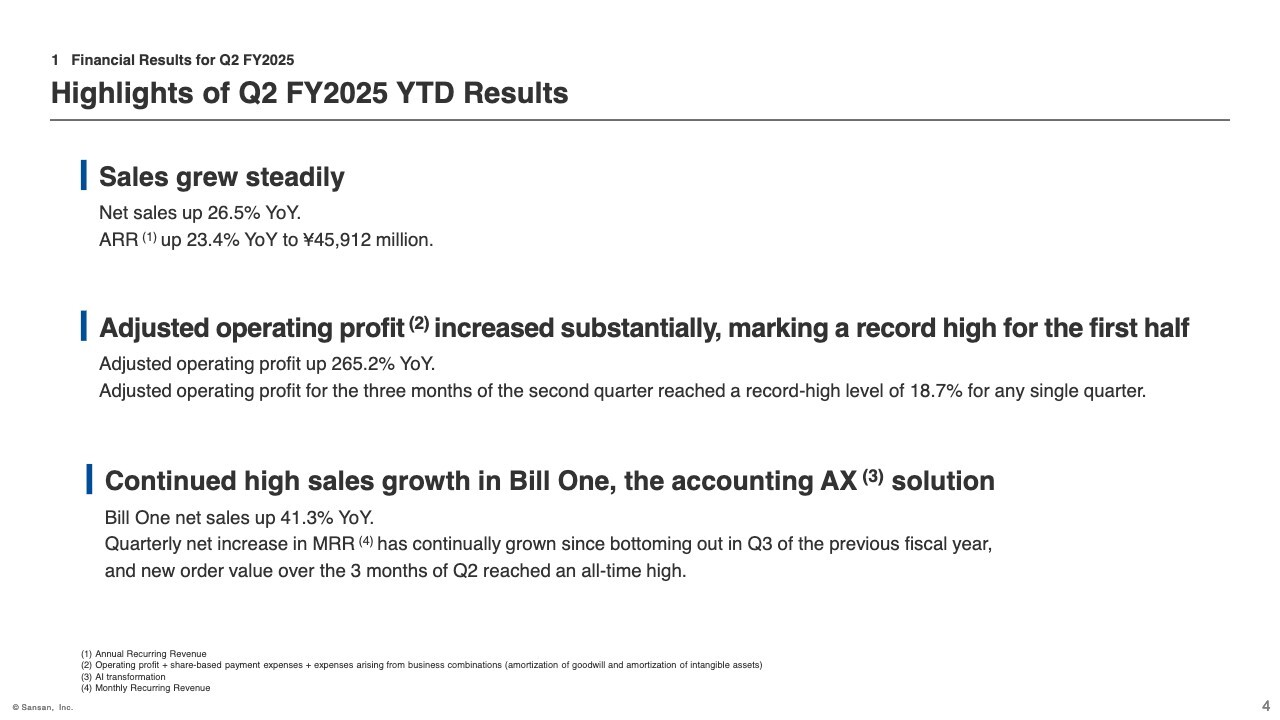

Highlights of Q2 FY2025 YTD Results

This is about the H1 FY2025 results. I will explain three highlights for H1 FY2025.

First, net sales increased by 26.5% YoY, maintaining robust growth. Consolidated Annual Recurring Revenue (ARR) reached ¥45.9 billion as of the end of November 2025.

Second, adjusted operating profit increased substantially, marking a record high for the first half, despite ongoing investments.

Third, we continued high sales growth in Bill One, the accounting AX solution. Quarterly net increase in Monthly Recurring Revenue (MRR) has continually grown since bottoming out in Q3 of the previous fiscal year, and new order value over the 3 months of Q2 reached an all-time high on a quarterly basis since the service launch.

Overview of Financial Results

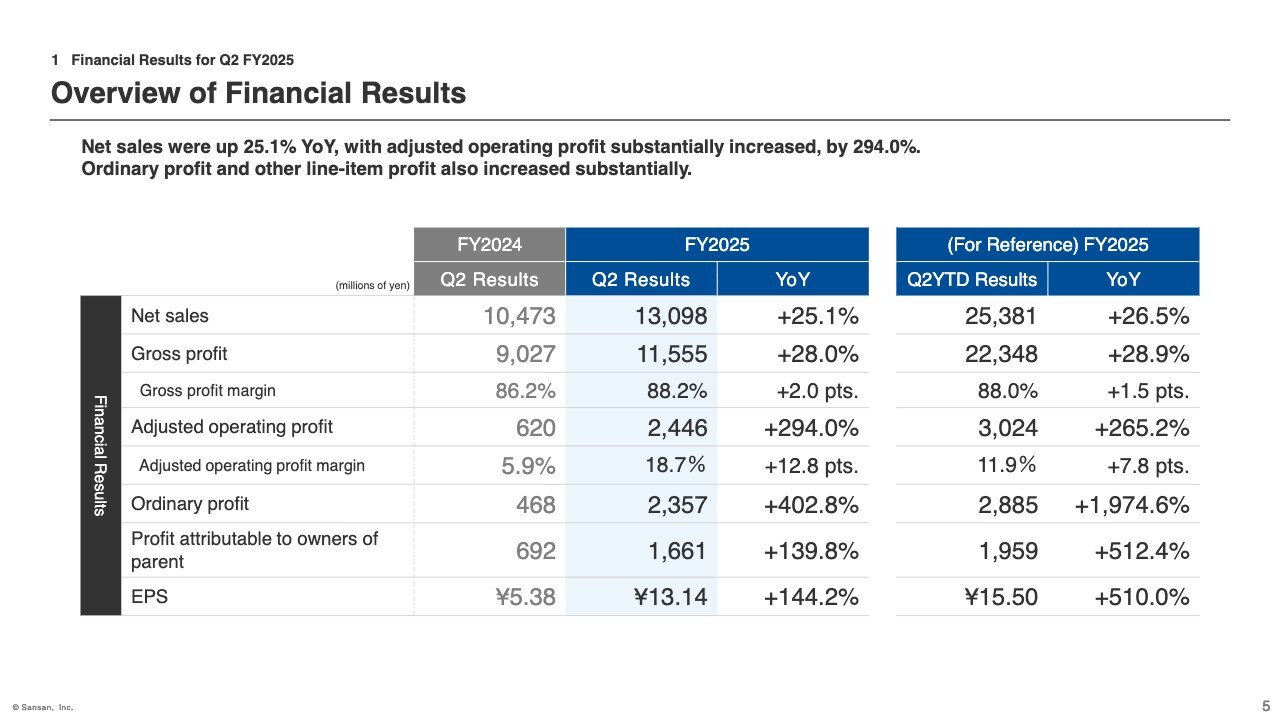

I will move on to the results for the 3 months of Q2. Net sales grew steadily, up 25.1% YoY. Gross profit margin improved by 2.0 percentage points YoY, primarily due to enhanced operational efficiency in digitizing Bill One data. Adjusted operating profit substantially increased by 294.0% YoY, driven by sales expansion, improved gross profit margin, and a decrease in the SG&A ratio.

As a result, the adjusted operating margin reached 18.7%, marking a record-high level on a quarterly basis. Against this backdrop, ordinary profit and other line-item profits also increased substantially.

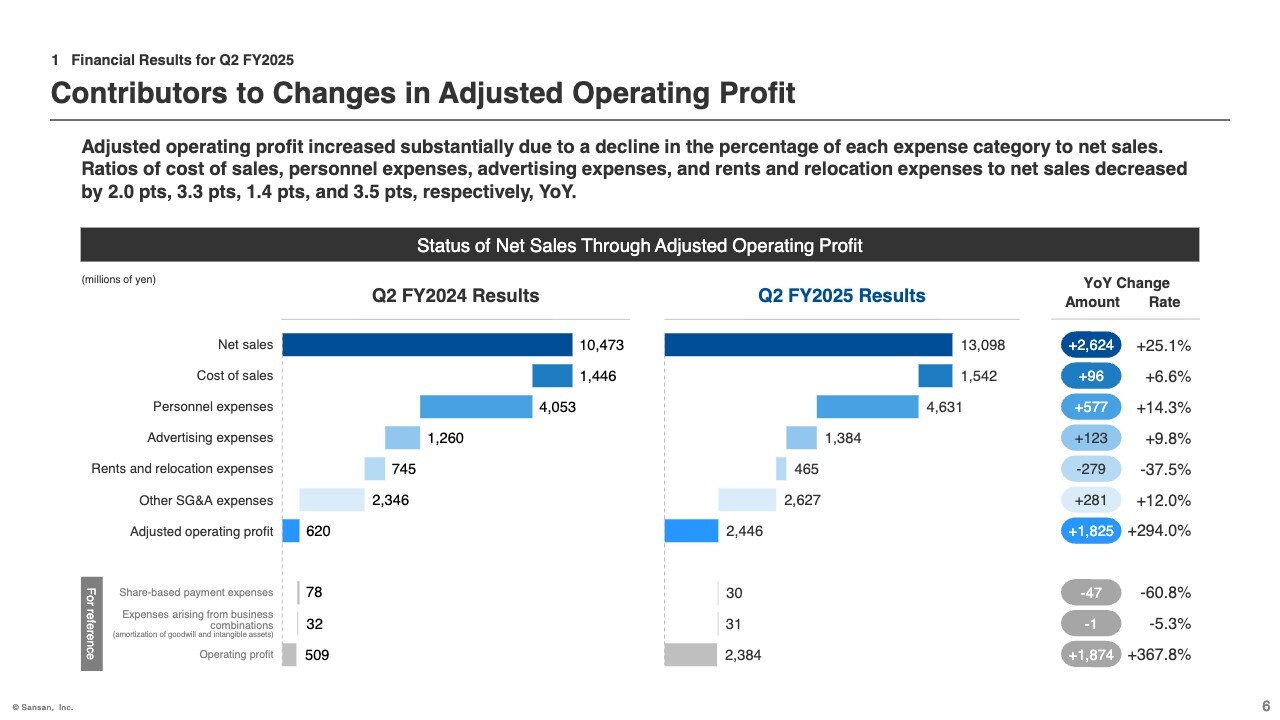

Contributors to Changes in Adjusted Operating Profit

I will now explain the details of adjusted operating profit. Net sales remained solid, and the gross profit margin increased by 2.0 percentage points YoY due to an improvement in the ratios of cost of sales.

Regarding the breakdown of SG&A expenses, personnel expenses increased by approximately ¥577 million YoY, but the ratio of personnel expenses decreased by 3.3 percentage points YoY. Additionally, the ratio of advertising expenses decreased by 1.4 percentage points YoY. Furthermore, rents and relocation expenses decreased by approximately ¥279 million YoY. This was due to the absence of expenses related to the head office relocation incurred in the same period a year ago and the elimination of double rent payments at both the old and new locations.

As a result, the SG&A ratio decreased by 11.3 percentage points YoY, leading to a significant increase in adjusted operating profit.

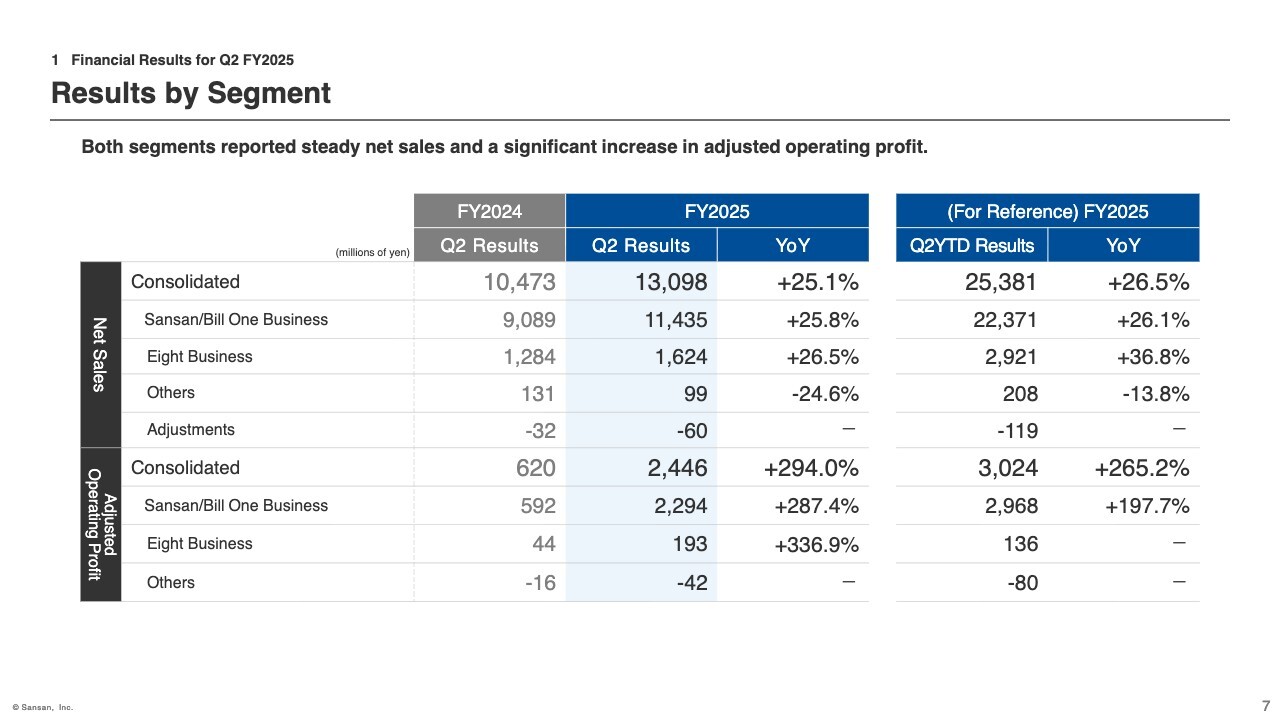

Results by Segment

Here is the overview by segment. Both the Sansan/Bill One business and the Eight business reported steady net sales growth and a significant increase in adjusted operating profit.

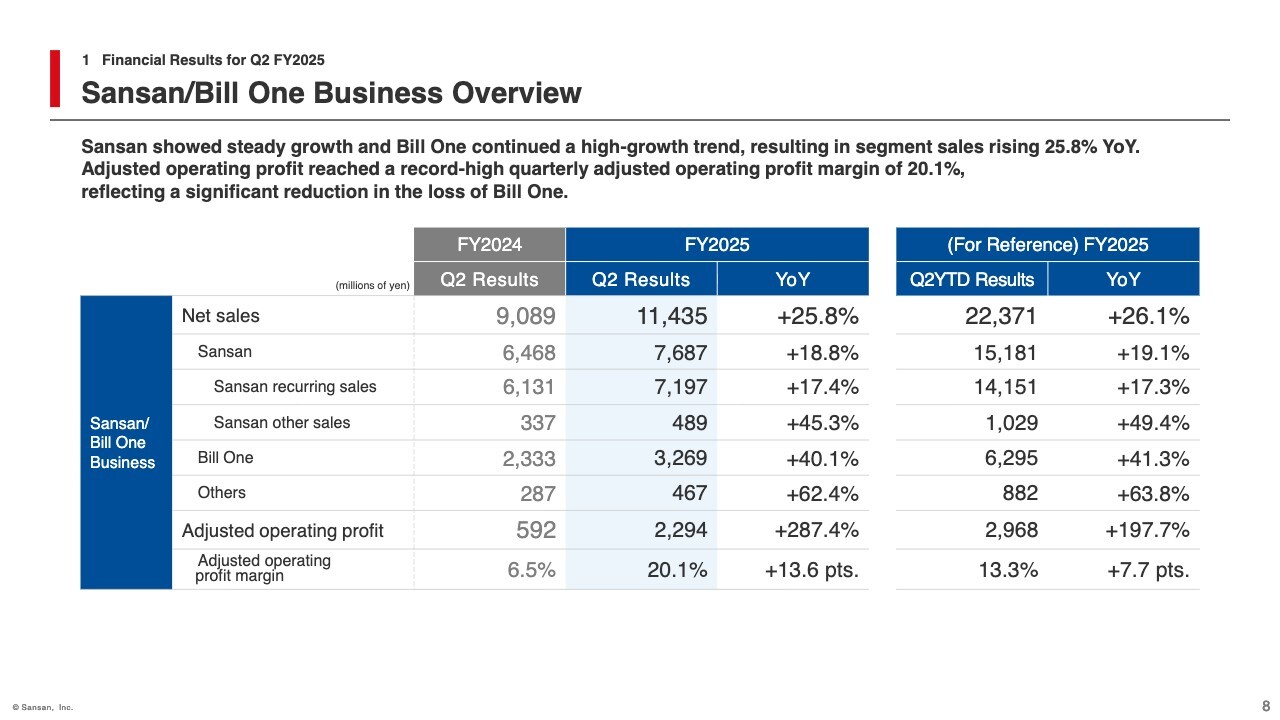

Sansan/Bill One Business Overview

This slide shows detailed segment information. Net sales for the Sansan/Bill One business increased by 25.8% YoY. By solution, Sansan grew 18.8% YoY, maintaining the same level of growth as in Q1. Bill One grew 40.1% YoY, continuing its high growth rate.

“Others” includes the performance of Contract One and the group company Ninout, Inc., both of which are growing steadily. Of which, Contract One sales increased by 93.6% YoY, and the number of subscriptions reached 569, a 99.0% increase YoY.

As a result, adjusted operating profit increased significantly, rising 287.4% YoY. By solution, Sansan grew 27.5% YoY, while Bill One recorded a loss of approximately ¥298 million, representing an improvement of approximately ¥1.3 billion YoY.

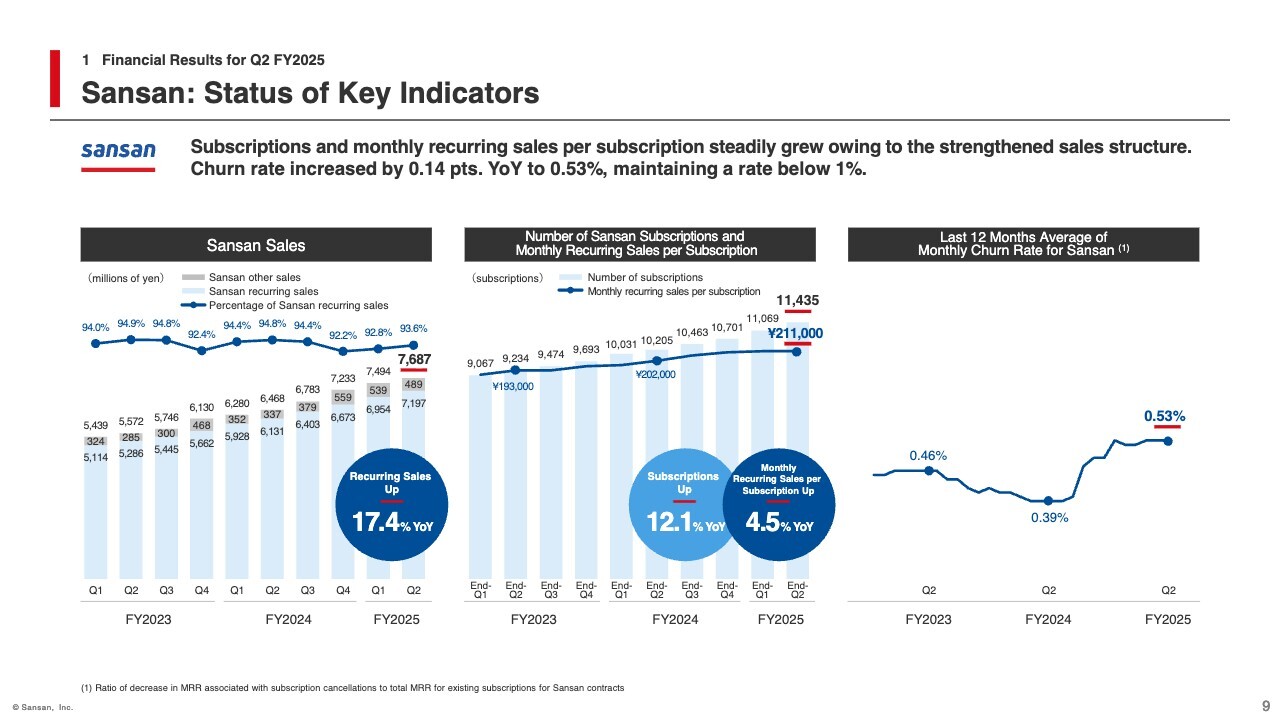

Sansan: Status of Key Indicators

Here is an explanation of KPIs for Sansan. The left side of the slide shows recurring sales with a solid 17.4% YoY increase.

In the center of the slide, the number of Sansan subscriptions increased by 12.1% YoY, with a net quarterly increase of 366 subscriptions, accelerating growth from Q1. Additionally, the monthly recurring sales per paid subscription increased by 4.5% YoY, showing stable performance.

The last 12 months average of monthly churn rate, shown on the right side of the slide, increased slightly, primarily due to the higher churn rate in the previous fiscal year’s Q4. However, subsequent churn rates since then have remained stable at a low level below 1%, posing no particular concern.

For reference, I will explain the new order situation for Q2. The new order value shown here reflects reductions due to cancellations and is close to the new recurring sales that will be added going forward. This includes orders already reflected in Q2 sales, as well as orders beginning to be recognized in Q3 and beyond.

In Q2 of the previous fiscal year, new order value reached a record-high quarterly level due to a concentration of orders from mid-sized and large enterprises with higher unit prices. In Q2 of the current fiscal year, new order value decreased 14.2% YoY but increased 13.1% QoQ, and remains at a high level.

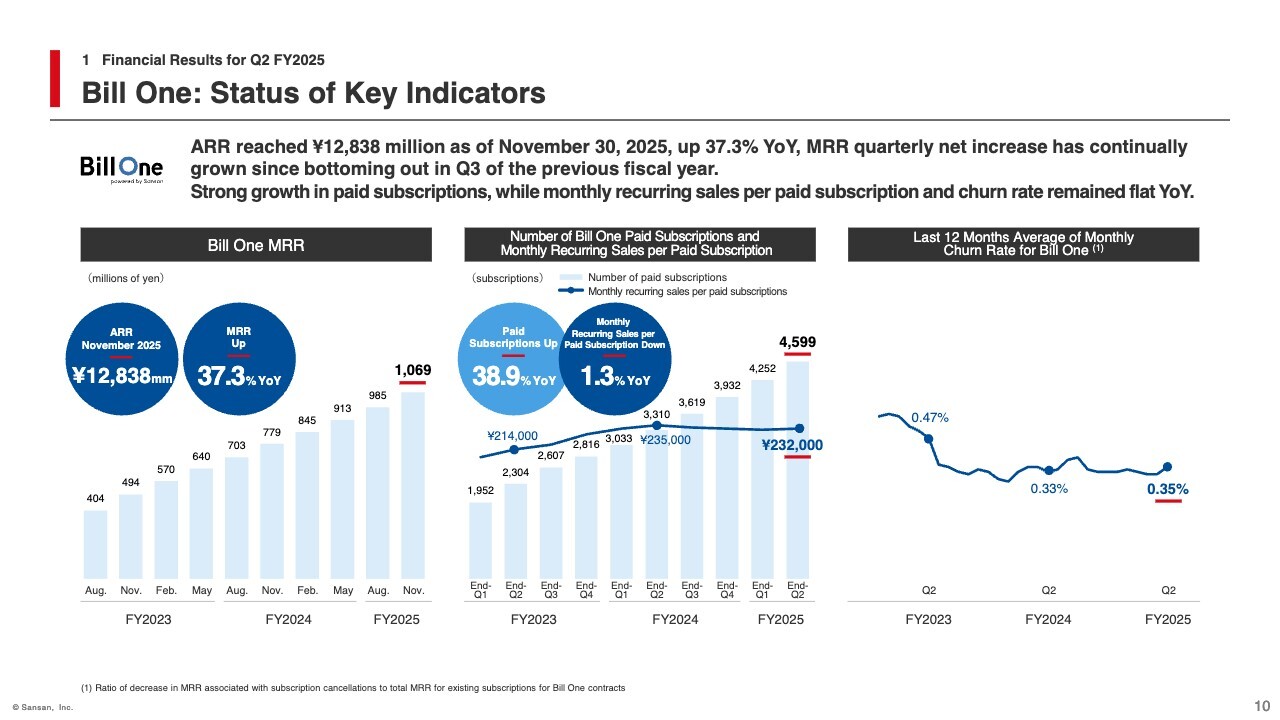

Bill One: Status of Key Indicators

Here is an explanation of the KPIs for Bill One. On the left side of the slide, MRR reached approximately ¥1,069 million in November 2025, up 37.3% YoY. While the quarterly net increase has continuously grown at a moderate pace, this quarter’s net increase of approximately ¥83 million marks a robust performance, surpassing that level for the first time in a year.

In the center of the slide, the number of paid subscriptions increased by 38.9% YoY, with a net quarterly increase of 347 subscriptions. This also continues the stable growth of exceeding 300 subscriptions per quarter since Q3 of the previous fiscal year. Meanwhile, monthly recurring sales per paid subscription decreased by 1.3% YoY due to an increase in acquiring smaller customers. However, it remains at a high level, so it is not a situation of particular concern.

The last 12 month average of monthly churn rate, shown on the right side of the slide, remains low at 0.35%.

The new order value for Q2 increased 16.9% YoY and 57.8% QoQ, reaching a record-high quarterly level since the launch of the business. As a result of strengthening our sales organization and sales approach, not only our invoice receipt service but also our expense reimbursement service has begun to grow steadily, and we view this as further increasing the likelihood of MRR growth from Q3 onward.

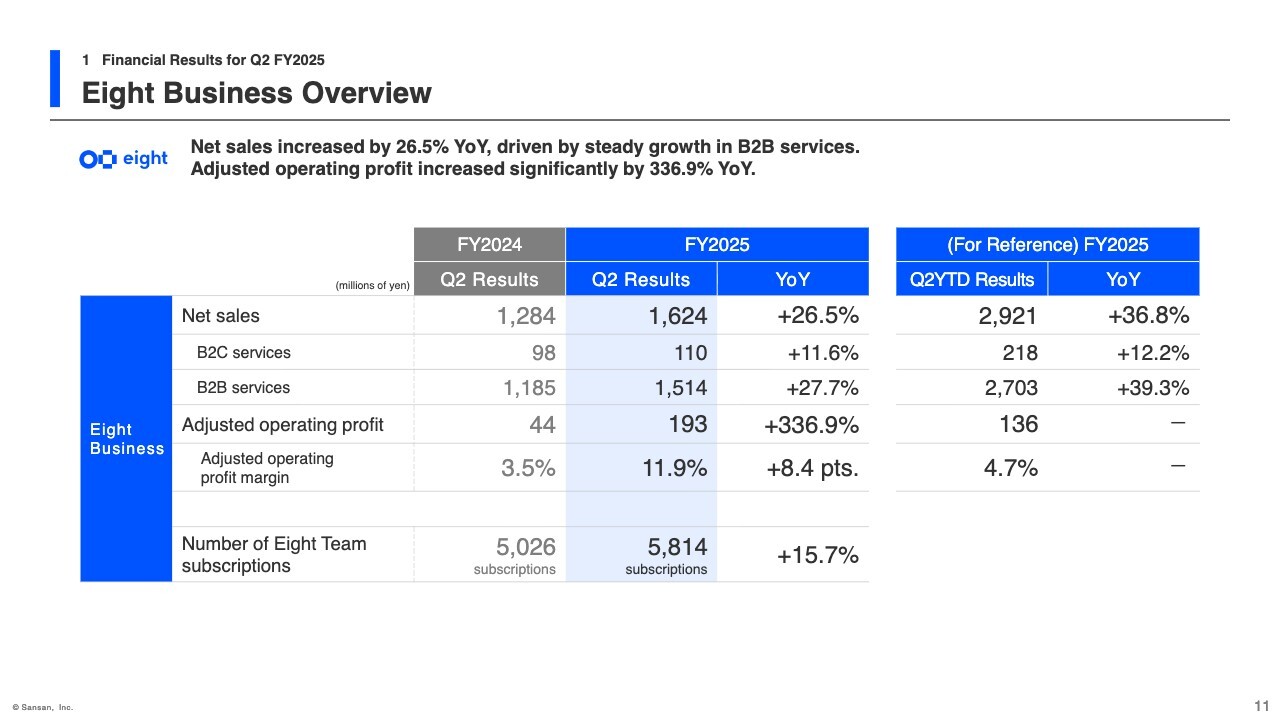

Eight Business Overview

I will now explain the Eight business. Net sales from B2C services remained robust, increasing 11.6% YoY. Net sales from B2B services increased by 27.7% YoY, driven by steady growth in business events and strong growth in recruitment-related services.

Furthermore, under business operations focused on profitability, net sales remained robust, resulting in adjusted operating profit increasing significantly by 336.9% YoY.

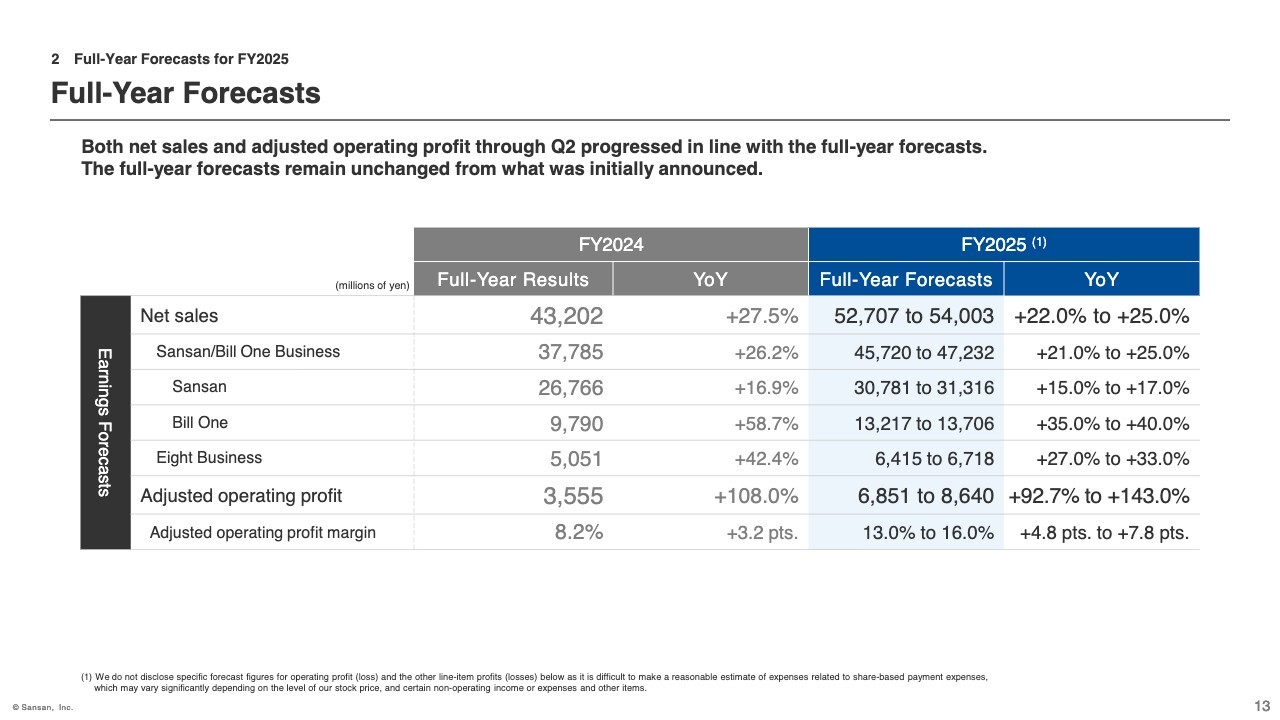

Full-Year Forecasts

I will now discuss the progress of our full-year forecasts. Both net sales and adjusted operating profit through Q2 progressed in line with the full-year forecasts. In particular, adjusted operating profit exceeded our initial expectations for the first half, driven by robust sales growth and progress in cost efficiency.

As I have explained, we achieved significant YoY profit growth, demonstrating the increasing leverage in our profit generation. We also view this as further solidifying the path toward enhanced profitability outlined in our medium-term financial policy.

Meanwhile, from a plan-versus-actual perspective, the first-half results also reflect the impact of certain expenses originally planned for the first half being deferred to the second half. As a result, there has been a change in the profit recognition mix between the first and second halves that we previously communicated.

Looking at the full year, our policy remains unchanged: we will continue making the necessary investments to achieve further sales and profit growth in the next fiscal year and beyond. In addition, a portion of the costs not incurred in the first half is expected to be incurred in the second half. Accordingly, there is no change to the full-year earnings forecast at this time.

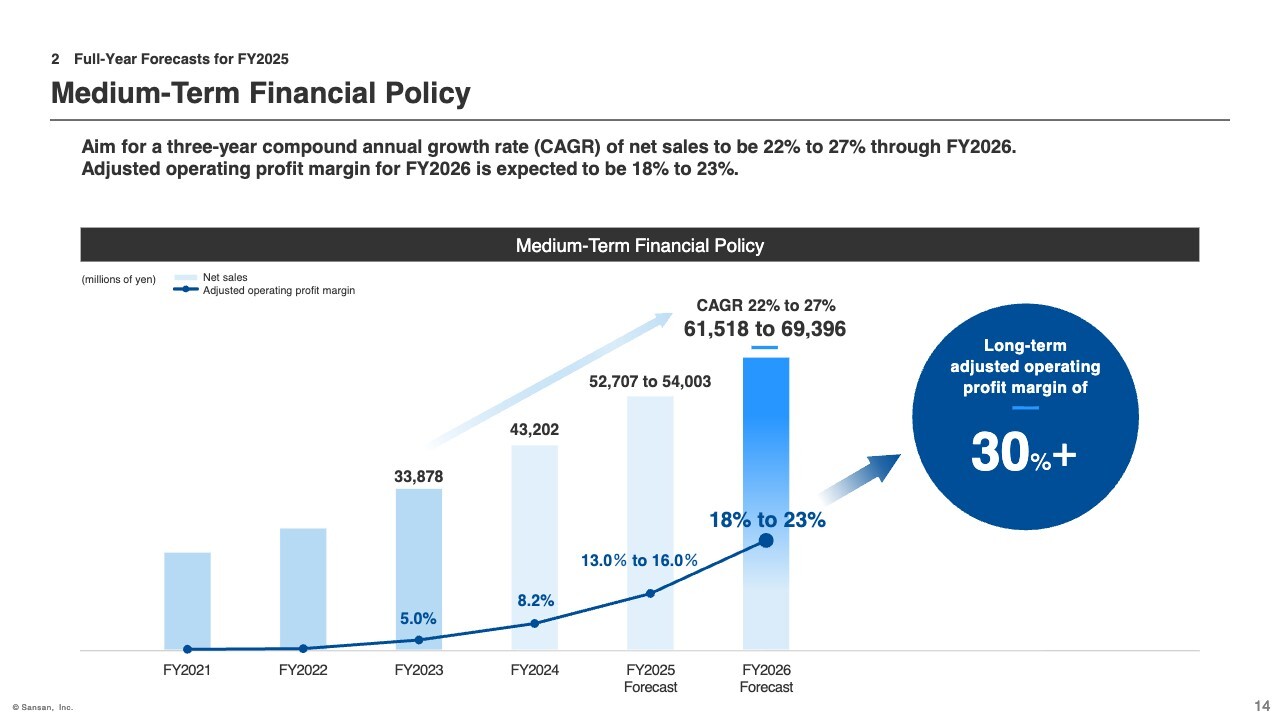

Medium-Term Financial Policy

As for our mid-term financial policy, performance remains on track, and the figures remain unchanged at this time.

That concludes my explanation. Next, Terada will discuss our growth strategy.

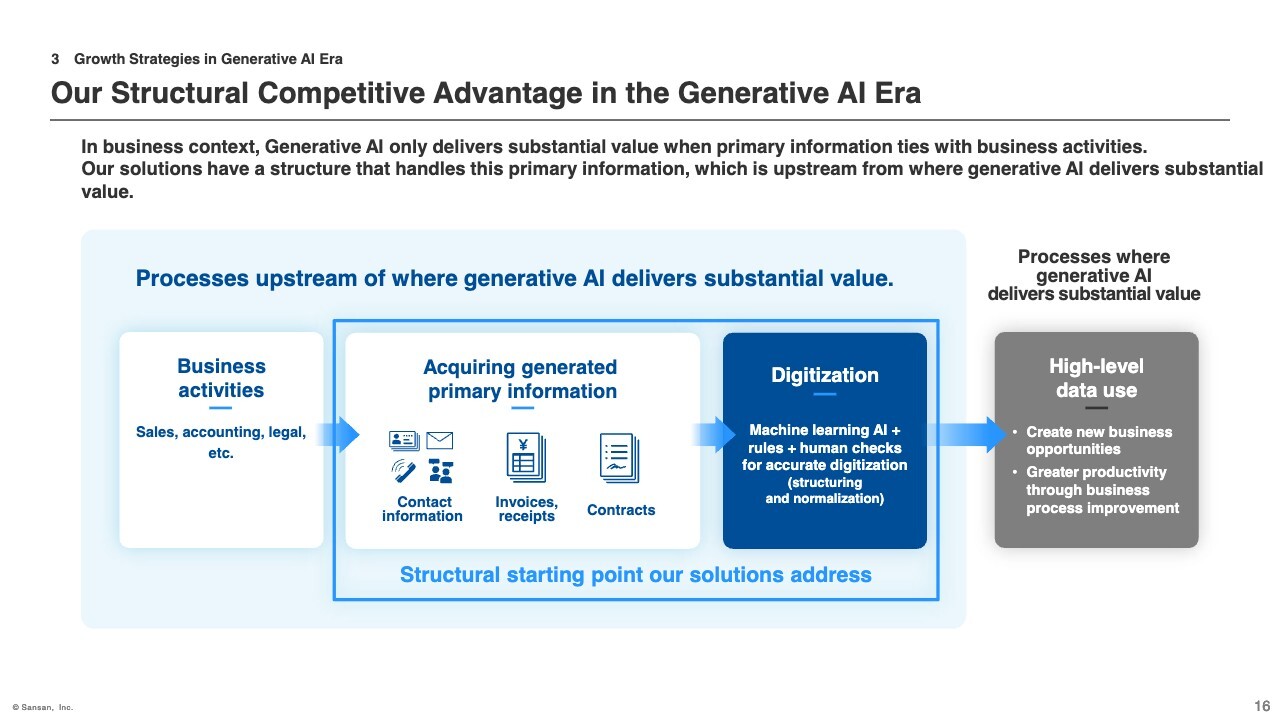

Our Structural Competitive Advantage in the Generative AI Era

Chikahiro Terada (“Terada”): I’m Terada, the CEO. I’ll explain our strengths in the generative AI era and our growth strategy.

With the rapid adoption of generative AI, we are hearing more skepticism, such as “SaaS is dead” and “Will all SaaS be replaced by AI?” At the same time, in actual corporate settings, there are also increasing voices that, despite adopting generative AI, companies are not achieving the results they had expected.

Why is that? The reason is very clear. In business, generative AI can only demonstrate its full potential when there is data that is properly structured and normalized, and made available for use, in close connection with a company’s activities. It is the combination of such data and generative AI that unlocks its true power.

Generative AI can easily reference and synthesize publicly available information on the internet. However, it cannot independently obtain and reference the unique primary information held by a company.

For example, information such as “Who is the counterparty in a sales discussion?”, “What types of invoices have been received for which transactions?”, and “What was agreed in the contract?” constitutes primary information derived from actual business activities. While generative AI can process and analyze such information, it cannot enter corporate workplaces and obtain it directly.

Therefore, in the era of generative AI, we believe that whether a company has a structure that enables the continuous acquisition of primary information will be one of the key criteria that differentiates SaaS competitiveness.

Why Our Services Can Inevitably Acquire Primary Information

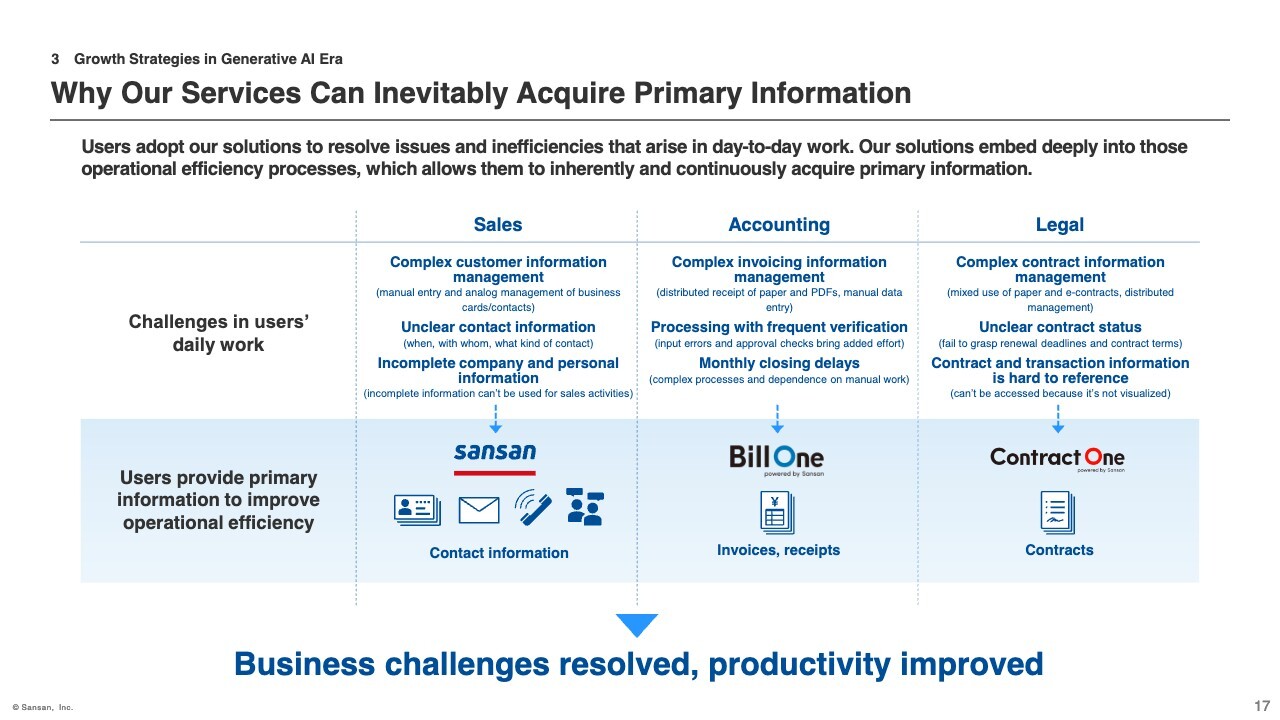

From here, I would like to focus on the key reasons why we believe our services will not be replaced by generative AI, but will instead benefit from it as a tailwind for growth.

First, let me explain why our services are able to acquire primary information. Fundamentally, from the user’s perspective, our services are not simply tools for entering data or creating data for generative AI to use. Rather, they are designed to solve specific, practical challenges that arise in companies’ day-to-day operations, such as sales, accounting, and legal functions.

For example, our services are used to manage customer information for sales activities, to process invoices accurately and efficiently, and to understand contract terms in order to control risk. In this way, they are embedded in daily business operations to improve operational efficiency.

As a result, the information users provide to our services constitutes primary information located at the entry point of business processes. With Sansan, this includes information such as “who met with whom,” which represents the starting point of sales activities and the initial point of contact between a company and its customers—information that underpins the operation of CRM and SFA systems.

Bill One captures transaction-related information such as amounts and payment terms stated on invoices and receipts, which forms the foundation for all subsequent accounting processes. Contract One manages information contained in contracts, which is directly tied to corporate decision-making, and the terms agreed upon have long-term implications for future transactions.

This information is unique to each individual company and cannot be obtained by generative AI from publicly available sources. It is, by definition, primary information. Because the act of providing primary information through our solutions is deeply embedded in customers’ operational workflows, our solutions are inherently structured to acquire primary information continuously and inevitably.

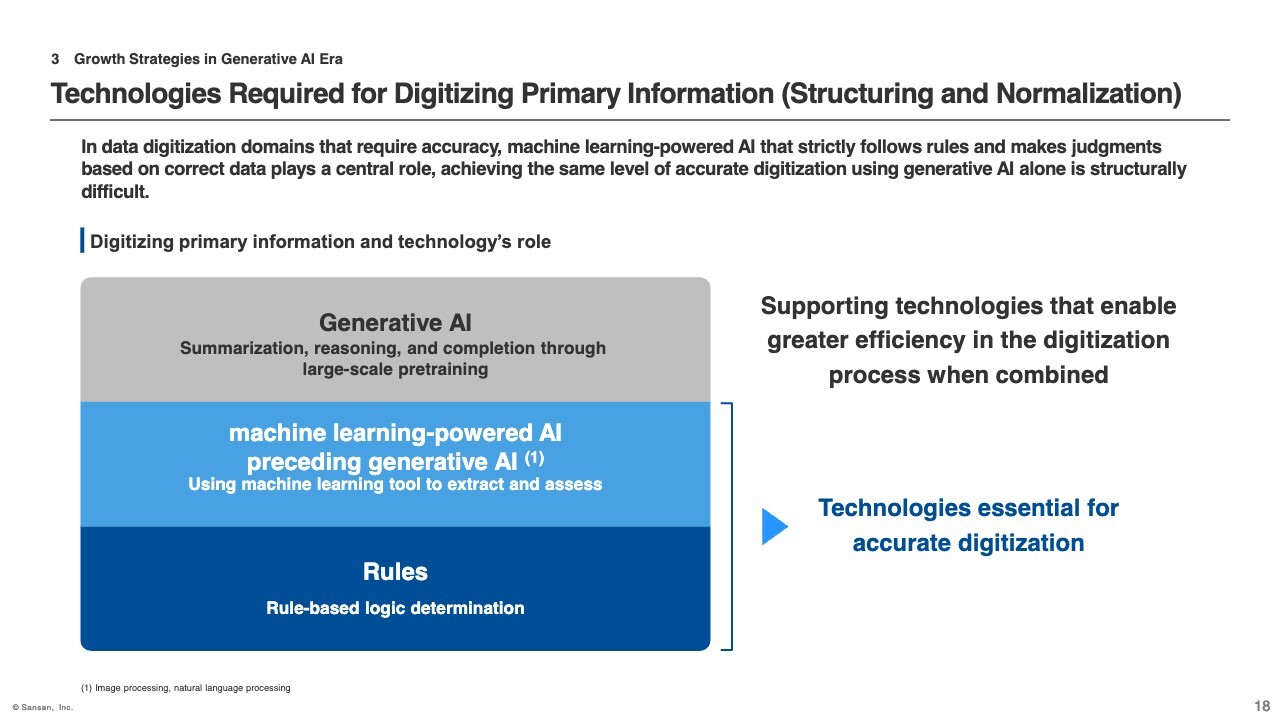

Technologies Required for Digitizing Primary Information (Structuring and Normalization)

Next, I would like to explain why digitizing primary information itself is difficult using generative AI alone, and to clarify the respective roles of primary information digitization and AI.

The majority of the primary information we handle is non-standardized and analog in nature. For example, business cards vary in layout by company and individual, invoices differ in format from one company to another, and contracts are written in free-form text with no fixed structure, including the terms agreed upon. In this way, primary information is inherently unstructured and lacks standardized formats.

Generative AI generally excels at inferring patterns from the large volumes of data and text it has learned from and generating optimal responses based on those patterns. At the same time, however, it has a tendency to fill in blanks or missing elements. As a result, when generative AI alone is used for digitization, the generation of incorrect information—so-called hallucinations—is difficult to avoid.

Mistakes such as misidentifying field names, numerical errors, or supplementing information that does not exist can be critical in the domains of sales, accounting, and legal operations. In these areas, what is required is not inference, but the digitization of facts themselves.

To achieve this level of accuracy, what is needed is AI trained on primary information created under strict rules—namely, machine learning models that predate generative AI—as well as rule-based logic for deterministic judgment. By leveraging these technologies, patterns can be learned from large volumes of data, and acquired primary information can be structured and normalized.

That said, as we have previously explained, it is not possible to achieve near-100% accuracy in digitization without final quality assurance performed by humans. For this reason, an operational model that combines machine learning–based AI with human input is essential.

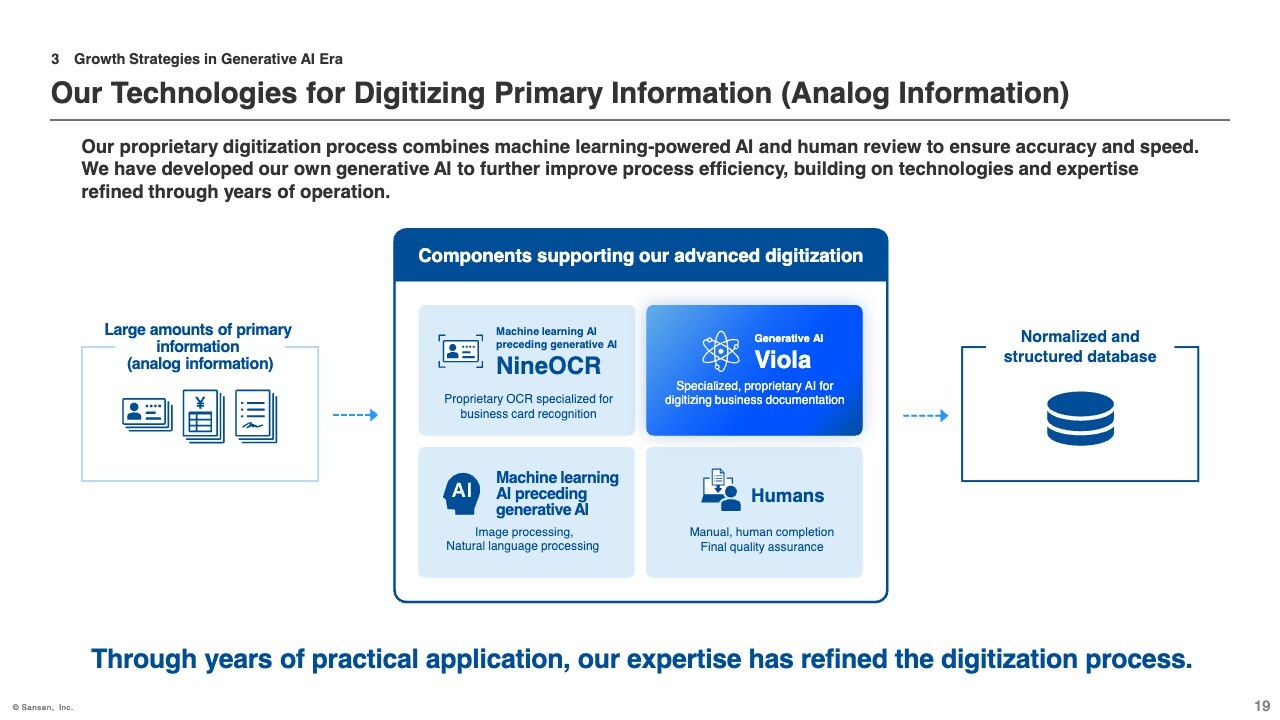

Our Technologies for Digitizing Primary Information (Analog Information)

With these premises in mind, I would like to revisit and explain our technology for digitizing analog information.

Over many years, we have continuously refined three core elements: AI that evolves through machine learning, standardized digitization rules that support it, and a framework for final quality control performed by humans.

Through this process, we have developed pre-generative-AI machine learning technologies such as image processing and natural language processing, as well as proprietary OCR specialized in reading business cards. These capabilities constitute our competitive advantage—one that remains firmly intact even in today’s era of widespread generative AI adoption.

Even if, in the future, generative AI becomes more effective in certain aspects of digitization—for example, as hallucination issues are mitigated—we believe that companies with a proven track record in delivering highly accurate digitization and rigorous quality control will be best positioned to implement and operate such technologies. In this respect, we see ourselves as having a significant advantage.

In fact, we have successfully developed our proprietary generative AI, “Viola,” which has already had a meaningful impact on reducing digitization costs in recent periods. Going forward, we will continue to advance our data technologies by leveraging the expertise and know-how we have accumulated over many years.

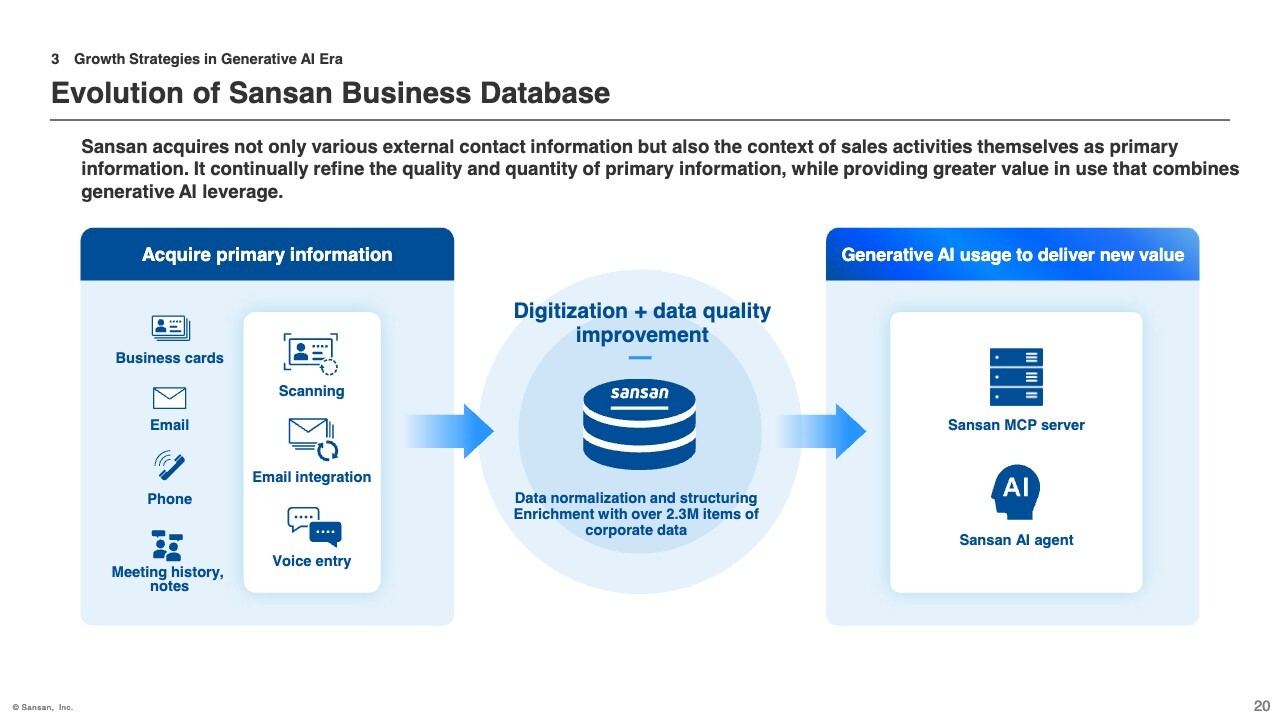

Evolution of Sansan Business Database

From here, I will explain the characteristics and growth strategies of each of our solutions. I will begin with Sansan. When categorizing SaaS offerings along a spectrum from data-oriented to process-oriented, Sansan is positioned as a data- and knowledge-centric SaaS.

What Sansan handles is not merely customer contact information, but the context of corporate activities themselves. For example, it digitizes and accumulates primary information that forms the foundation of sales activities, such as “who met with whom and when,” “what kind of relationship exists with which company,” and “which deals progressed based on whose actions.”

By structuring and normalizing this accumulated information and further enriching it with more than 2.3 million company profiles and other data, we enhance data quality and develop it into foundational data that supports activities across the entire organization.

This foundational data is highly compatible with generative AI. As a result, value creation through AI utilization is expanding in areas such as prioritizing sales opportunities and generating proposals based on past experiences.

To enable this, we are currently rolling out features such as the Sansan MCP Server and the Sansan AI Agent, with proof-of-concept initiatives already underway at large enterprises.

The Sansan MCP Server connects Sansan’s business data with external generative AI tools such as ChatGPT, enabling advanced data utilization. Meanwhile, the Sansan AI Agent allows integrated business data to be leveraged through simple instructions, supporting enhanced organizational capabilities in sales and marketing functions.

In this way, Sansan is evolving the sales context accumulated within organizations into business data that can be effectively utilized by generative AI. We view these initiatives as important growth drivers in the era of generative AI.

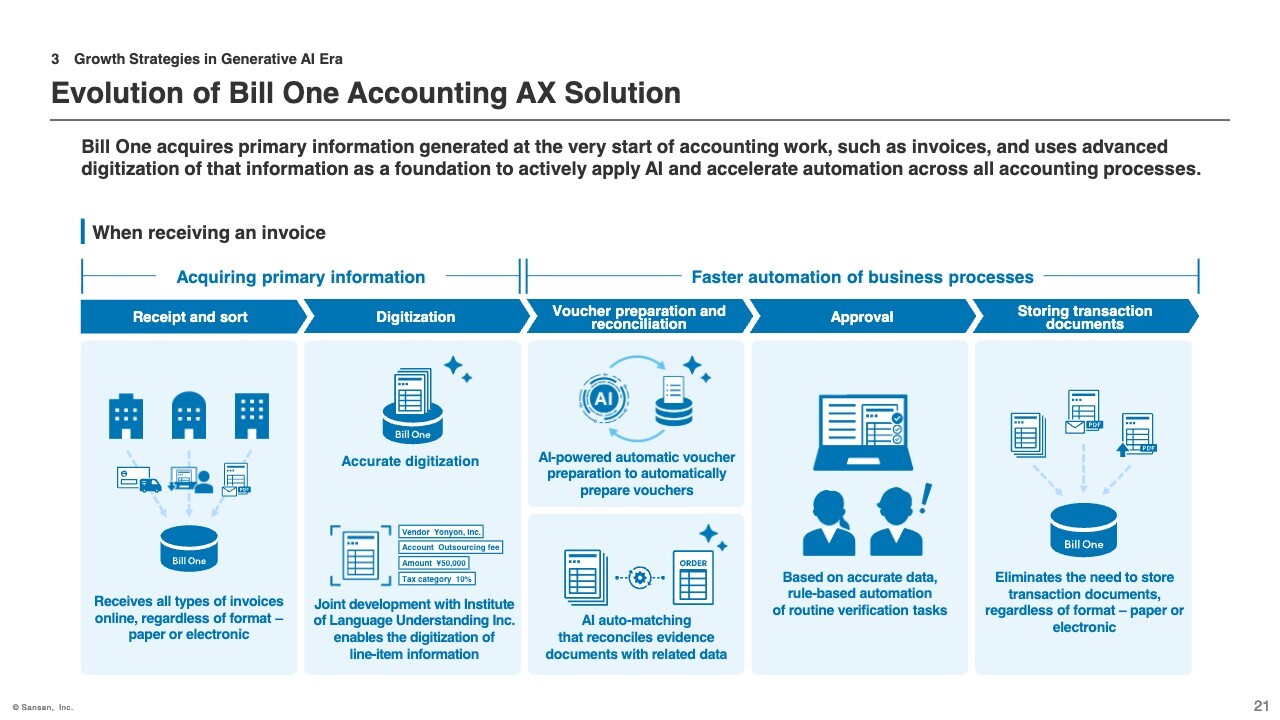

Evolution of Bill One Accounting AX Solution

Next, I will explain Bill One. Among our solutions, Bill One is positioned as a process-oriented SaaS with a strong focus on improving and automating operational workflows. Its core value does not lie in the secondary use of generated data, but rather in how effectively it can streamline accounting workflows themselves.

Against this backdrop, the reason Bill One can continue to evolve in the era of generative AI is that it securely captures primary information at the very upstream of the accounting process.

In invoice processing, a series of steps—from receiving invoices to creating records, matching line items, approval, and journal entry—are carried out sequentially, and many of these steps are still handled manually today. The reason automation through AI has not progressed as much as expected is clear, and one key factor is the lack of complete and accurate primary data.

Bill One reliably receives invoices, which constitute primary information, whether in paper or PDF format, and digitizes them with high accuracy. In addition, it has succeeded in digitizing line-item details, which had previously been difficult to achieve. With this high-quality primary data in place, we have been able to develop new features such as AI-powered automatic matching and AI-powered automatic entry, enabling us to access areas that were previously difficult to automate.

An important point is that AI-driven automation only becomes viable when both “accurate primary information” and “continuity across business processes” are present. By capturing this structure from the entry point, Bill One has begun to evolve into a platform that can automate accounting processes end to end, from upstream to downstream, across the entire organization.

By combining advanced digitization centered on rule-based logic with machine learning–based AI technologies such as image recognition and natural language processing, and further integrating generative AI, Bill One is automating accounting workflows. We view this as representing significant growth potential in the era of generative AI.

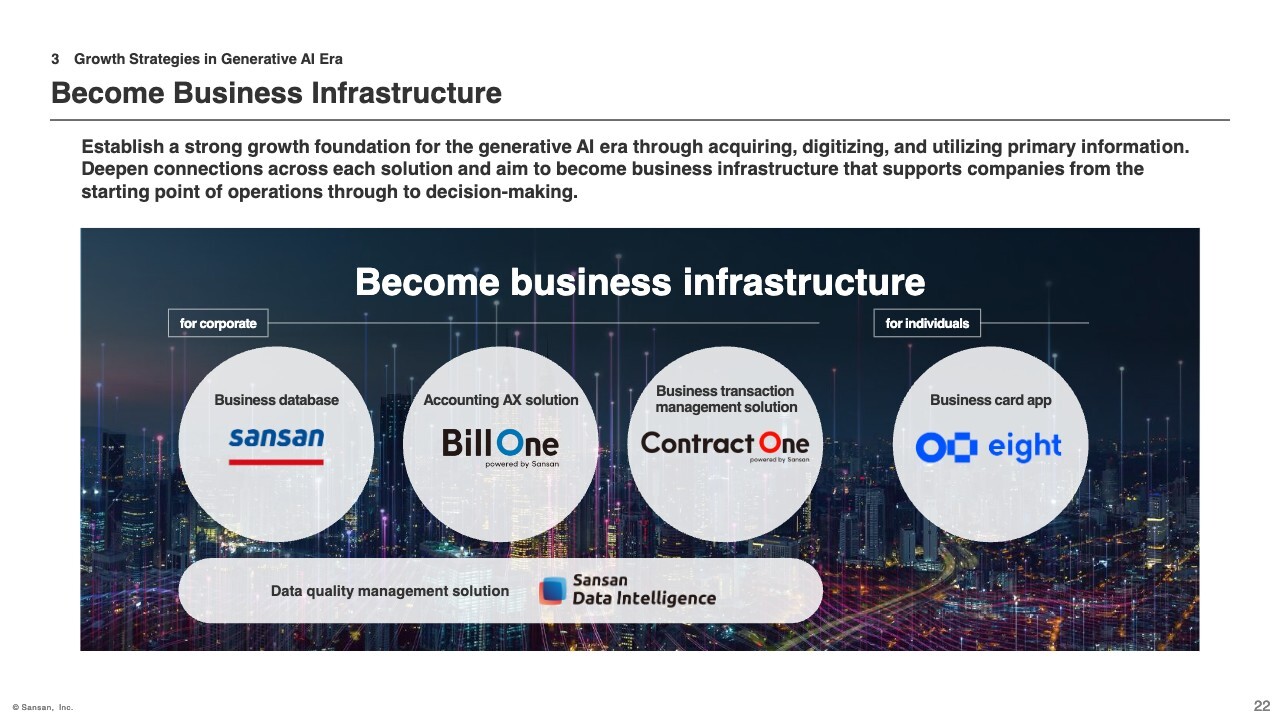

Become Business Infrastructure

To conclude, the common element across all of our solutions is that they capture primary information generated at the entry point of core business operations that underpin corporate activities.

The digitization, structuring, normalization, and utilization of primary information form the essential foundation that enables downstream systems and generative AI to deliver meaningful value. We believe that our ability to consistently acquire, digitize, and leverage primary information represents a strong competitive advantage in the era of generative AI and serves as a core growth platform that we intend to further strengthen going forward.

Currently, Sansan, Bill One, and Contract One are offered as independent solutions. Looking ahead, however, we envision deepening the connectivity among these solutions to a greater extent.

Over the longer term, our goal is to move beyond individual functional domains such as sales, accounting, and legal, and to become a “business infrastructure” that supports everything from the starting point of corporate activities through to decision-making across the organization.

That concludes my presentation. Thank you very much for your attention.

Q&A: Impacts of generative AI adoption and higher operational efficiency

Questioner: We have seen some cases where accountants and tax professionals develop low-code solutions on their own, using tools such as Claude Code, to handle invoice processing and similar tasks. How do you currently view the potential impact of this trend on your business?

Terada: We have been actively working on operational efficiency initiatives using various generative AI tools, including Claude Code, within our own organization, so we have a practical sense of their capabilities. At the same time, we view automation using a range of tools, including OCR, as a constant and ongoing aspect of operations even prior to the generative AI era.

Of course, there may be cases, particularly among smaller businesses, where companies with a high level of digital literacy use such tools to build workflows that are sufficient for their needs. However, based on our own engagement with the market, we do not have a sense that this represents a meaningful threat. This is because Bill One is being adopted by customers who value workflow design grounded in a rigorous and well-defined digitization process. Rather, our practical experience is that we actively leverage a variety of tools, including Claude Code and ChatGPT, and incorporate them into our own services to enhance operational efficiency.

Questioner: Given the increasing use of AI on the customer side, it seems that demand for your products and services is rising. Has this made lead generation more favorable or easier?

Terada: With respect to the relationship between lead generation and AI, we do not feel that AI itself has had a particularly significant impact on making lead acquisition easier. That said, what we do see as important is the ability to propose solutions where AI can be practically utilized in day-to-day operations. This overlaps with what I mentioned earlier, but elements such as Sansan, Bill One, and Contract One as databases are critical in this regard. By having digitized data and robust databases in place and combining them with AI, we are able to improve operational efficiency. For example, in the case of Bill One, we use the concept of “eliminating work,” and we feel that this value proposition is being very well received by customers.

Q&A: CAC trends

Questioner: How do you view customer acquisition cost (CAC) from the second half of this fiscal year into the next fiscal year? With strong demand and ongoing efficiency improvements within the company, how do these factors translate into improvements, and what is your outlook for CAC going forward?

Hashimoto: With regard to CAC, we believe it is more appropriate to look at it on an annualized basis rather than over short three-month periods. The CAC we monitor includes advertising and promotional expenses, and when we conduct mass marketing campaigns, including TV commercials, CAC can temporarily increase. However, when measured over a 12-month period, it remains relatively stable, and our overall sense is that CAC has been gradually improving and trending lower.

There are several contributing factors, but one that has become particularly evident recently is the extent to which our sales personnel and front-office staff involved in sales-related operations are actively using AI to improve their own productivity.

In fact, while the number of field sales personnel declined in the second quarter compared with the first quarter, we were still able to achieve strong order intake. This indicates improved efficiency, and conversely, we view this as a reduction in CAC.

Q&A: Profit levels for the second half

Questioner: I would like to ask about your approach to profit levels in the second half. Earlier, you mentioned factors such as the timing shift of costs and your intention to continue growth investments. What is the approximate scale of these investments, and what will they be used for? Taking these costs into account, what profit range do you realistically see as your target?

Hashimoto: We believe there is no change from the earnings forecast we announced at the beginning of the fiscal year. With regard to revenue growth, we have communicated a range of 22% to 25%, and we believe we can achieve results comfortably within that range. At this point, our expectation is to land around the midpoint of the range.

As for profits, as mentioned earlier in the earnings presentation, part of the initiatives planned for the first half shifted into the second half, and hiring progressed somewhat more slowly than expected. As a result, some costs were not fully incurred in the first half. However, heading into the second half, we plan to further accelerate hiring and implement mass marketing initiatives in certain areas. These activities are all within our original plan, and we expect the adjusted operating margin to land in the range of 13% to 16%. Based on our current assessment, we expect to finish toward the higher end of this range.

In terms of investment content, the primary items are advertising expenses and personnel costs. For advertising expenses, our sense is that spending will remain within the approximately ¥6.5 billion level that was planned at the beginning of the fiscal year.

Questioner: You are undertaking various initiatives related to generative AI, and we assume that some level of investment in generative AI will be required. Is it correct to understand that these investments will also remain within the previously communicated range?

Hashimoto: Yes. We do not believe at all that generative AI initiatives will require investments on the scale of tens of billions of yen, and it is therefore correct to understand that they will remain within the previously communicated range.

Q&A: Quarterly profit fluctuations

Questioner: Since the second half of the previous fiscal year, quarterly profit results appear to have shown some volatility. While revenue seems to be accumulating steadily, profits fluctuate from quarter to quarter. What is driving this pattern, and do you have a policy to expand profits more steadily over time?

Hashimoto: While it would be desirable if we could fully smooth profits on a quarterly basis, we place greater importance on maximizing absolute profit levels over the medium to long term rather than prioritizing quarterly stability. To do so, it is necessary to make efficient investments over certain periods, and we expect a degree of continued concentration of investments in specific timing, particularly in mass marketing.

Accordingly, we would encourage you to focus on profit levels on a full-year basis rather than on quarterly fluctuations. Our business model and P/L structure are that of a pure SaaS company, and we believe it is unlikely that we will miss our full-year earnings guidance. We would therefore appreciate it if you could view our performance from a longer-term perspective, such as over a 12-month horizon.

Q&A: Trends in AI adoption among companies as observed through Sansan

Questioner: Earlier, you discussed the evolution of the Sansan database. Given that your business is focused primarily on enterprise customers, how do you assess the current stage of AI adoption among companies overall? If possible, could you share any case studies.

Related to that, we understand your narrative around offering proprietary Sansan services such as the Sansan MCP Server and the Sansan AI Agent. How are you currently thinking about the timing at which these functions could scale, and when they might have a tangible impact on monthly recurring revenue per paid subscription?

In the past, you have transformed Sansan into a sales DX platform. However, we do not necessarily have the impression that usage of other functions has expanded significantly or that cross-selling has accelerated. If our understanding differs from yours, could you clarify your view?

Terada: If I am not fully capturing the intent of your question, please feel free to clarify. If the question is, in a broad macro sense, “How are companies approaching AI adoption?,” what we can observe is limited to our own situation and the behavior of customers through our services.

Expanding on that perspective, as I mentioned earlier, we feel that many companies are coming to understand that without firmly connecting their own primary information, AI risks becoming little more than an extension of a highly capable search engine. For this reason, at present, we are positioning Sansan itself as a core database.

With respect to AI utilization within Sansan, we have been working on this for quite some time. Recently, for example, we have increasingly positioned the Sansan AI Agent as an upsell offering to Sansan. There are also companies that are building operational workflows on the Sansan AI Agent by referencing data from both Sansan and Contract One. We view the Sansan MCP Server as something akin to an API for a new era.

Internally, we already have a form of AI agent operating within Sansan. When we ask questions about a specific company, the system aggregates data from Sansan, Bill One, Contract One, Salesforce, and other sources, and returns responses such as “This is the relationship we have had with that company to date.”

As Hashimoto mentioned earlier, this is being widely used in sales settings and is contributing to improved operational efficiency. At present, we are both practicing these approaches internally and proposing them to our customers.

Regarding expansion of monthly recurring revenue per paid subscription, we do not believe we are at a stage where we can provide concrete figures yet. However, we have been saying for many years that our ultimate vision is for Sansan, Bill One, and Contract One to evolve into a single integrated suite. This is also a personal ambition of mine.

With the progress generative AI has made, we believe this vision is no longer unrealistic. Over time, we hope to reach a point where we can discuss monthly recurring revenue per paid subscription on a company-wide basis.

Q&A: Outlook for monthly recurring sales per paid subscription and cross-selling

Questioner: I would like to ask again about the timing of cross-selling for Bill One. While the number of paid accounts continues to grow, it appears to be centered mainly on SMB customers. How do you view the timing for expanding cross-selling and acquiring enterprise customers going forward, and what is your perspective on the time horizon for growth in monthly recurring revenue per paid subscription?

Terada: With respect to the term “cross-selling” in relation to Bill One, Bill One has already been making significant inroads into the enterprise segment and is currently winning large-scale deals. That said, whether this should be characterized strictly as cross-selling is open to interpretation. One could also view this as leveraging the relationships that Sansan has built with executives at large enterprises and using those channels to expand Bill One adoption. In that sense, Bill One is steadily deepening its penetration into enterprise customers, even if it is not always labeled explicitly as cross-selling.

Q&A: Potential for further utilization of business card data through collaboration with other companies

Questioner: Congratulations on your strong earnings. From another valuation perspective, is there potential for you to further utilize the business card data you hold through collaboration with other companies?

Terada: As a company entrusted with our customers’ data, it would not be accurate to say that we “hold” that data. Rather, our role is to safeguard customer information and provide it as a service in a form that enables effective utilization.

In that sense, initiatives such as integrating Sansan data with Salesforce or other marketing automation tools are something we have been offering for many years. These efforts represent exactly our approach of handling customer data with care and connecting it to external platforms so that customers can utilize their data across different databases and systems. We expect to continue this approach going forward.