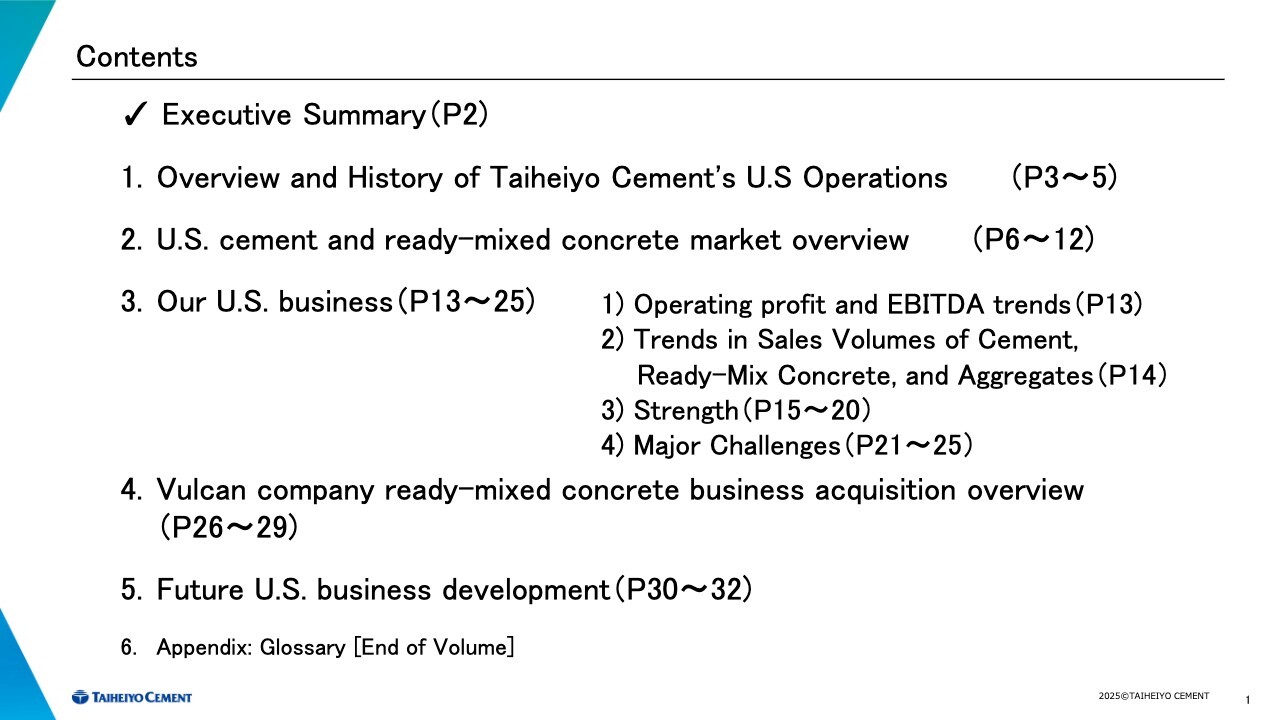

Contents

Shinji Fukami: I am Shinji Fukami, Vice President and Director and Senior General Manager of Global Business Division at Taiheiyo Cement Corporation. Thank you very much for taking the time out of your busy December schedules to attend or view today’s presentation. I would like to once again express my sincere gratitude.

We decided to hold this briefing session in response to requests from our investors for an opportunity to provide a more detailed explanation of our U.S. business, with the aim of deepening your understanding.

Recently, we completed a major acquisition in California. Looking ahead, we anticipate various changes in the business environment in other regions as well.

In response to such changes, and taking into account requests from our investors, we intend to hold briefing sessions like this as appropriate, with the aim of providing further opportunities to deepen mutual understanding. We appreciate your continued support.

I will begin by providing a brief summary. The details will then be explained by Mr. Hara, our Managing Executive Officer, who also serves as President of Taiheiyo Cement U.S.A. Inc., the holding company of CalPortland Company. Thank you for your attention.

Executive Summary

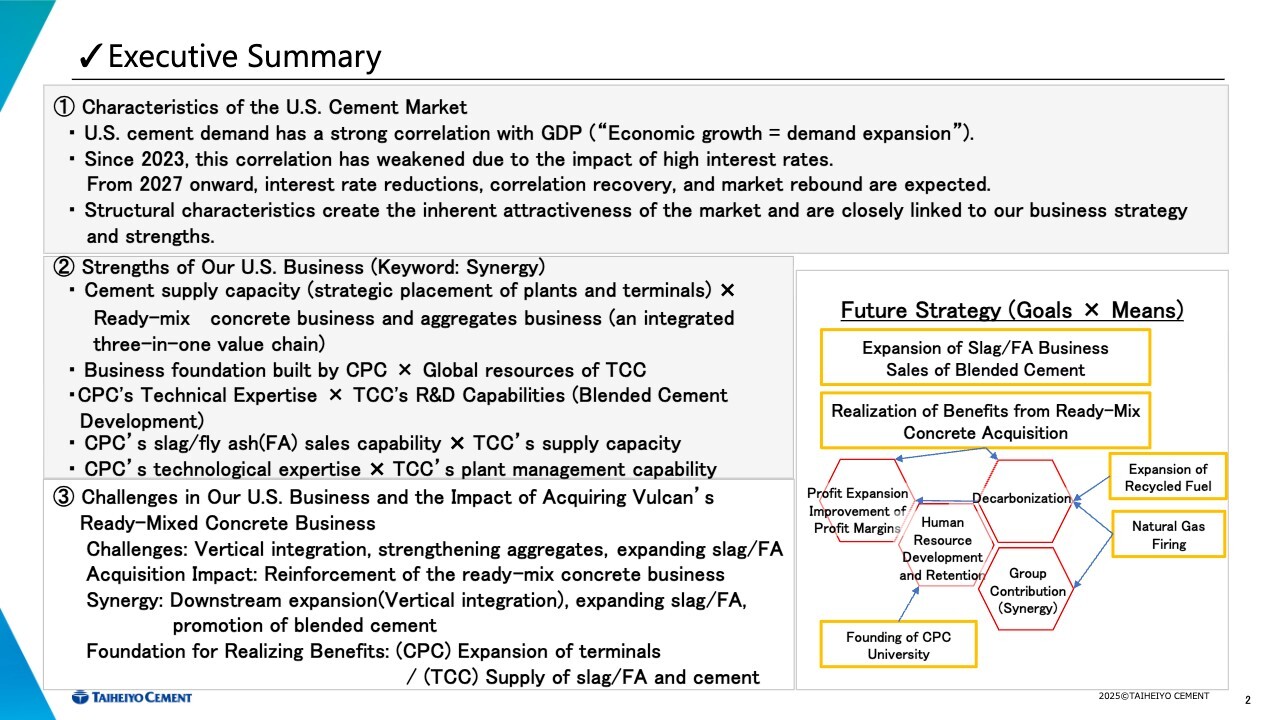

Here is the executive summary. I have three points to share. First, the characteristics and attractiveness of the U.S. cement market.

The second point is how we strategically approach the U.S. market. Third, the acquisition benefits of the ready-mixed concrete business acquired from Vulcan Materials Company. I will discuss these topics today.

Let’s start with the U.S. market. While it may seem obvious, U.S. cement demand has a very strong correlation with GDP. Simply put, we view it as a highly attractive market where economic growth drives cement demand growth.

Of course, every market experiences economic cycles depending on the current environment and timeframe. However, we view the future of the U.S. market as exceptionally resilient, resulting in a solid cement market with reliable outlooks.

Let me address the structural characteristic listed as the third bullet point under Point No. 1. This refers to the limited domestic production capacity. Currently, imports account for about 25% of cement used nationwide in the U.S.

This limitation in domestic production capacity means that by adjusting import volumes according to economic conditions, domestic production can be managed without being heavily influenced by economic fluctuations. In other words, we view the U.S. market as one in which the advantages of owning domestic manufacturing facilities can be fully leveraged.

Moving on to the second point, our business strategy. The key word comes down to one word: “synergy.” The strategy is built on the mutual synergistic effects between CalPortland Company (CPC) and TCC’s management resources.

Specifically, by utilizing our plant management capabilities, we have been able to maintain high operating rate at each of CPC’s plants.

Next, let me briefly talk about blended cement. In addition to our R&D capabilities, CPC also has research laboratories. Synergy arises through exchanges between these laboratories, fostering new technological developments.

Additionally, in relation to blended cement, CPC also operates a business in what we traditionally call supplementary cementitious materials, or SCMs. On the other hand, we have a network supplying cement, slag, and fly ash from Asia and Japan.

Therefore, the fusion of these two and the resulting synergy can further boost profits for the business.

Furthermore, while not listed here, another example is technology related to carbon neutrality. The carbon neutrality technologies we are developing could potentially be utilized in the U.S. market in the future.

Moreover, CPC has grown through a series of M&A transactions and has accumulated extensive expertise in this field. Naturally, the company also possesses strong know-how in PMI to maximize synergies following acquisitions.

Therefore, we can consider leveraging CPC’s expertise to achieve synergies when conducting M&A in other countries.

In addition, CPC currently operates the Mojave Plant, which uses 100% natural gas for firing. In Japan as well, as part of our effort to address carbon neutrality, we are conducting trials of gas firing operations domestically.

Since CPC already possesses this gas firing technology, we believe we can expect synergy flowing from CPC to our company.

Then, to answer the question “You mention synergy, but what specific examples do you have?,” I’ll briefly touch on blended cement, though this moves slightly away from the slide.

Blended cement has rapidly gained popularity across the U.S. over the past four years and now accounts for 60% of the market. This widespread adoption has been driven by the growing momentum toward carbon neutrality.

Specifically, by increasing the use of SCMs, it is possible to reduce the amount of clinker—the primary source of CO2 emissions—used in cement production.

Based on this rationale, efforts to lower the amount of clinker used per ton of cement, commonly referred to as the “clinker factor,” have been advancing across the U.S. As a result, the adoption rate of blended cement has increased significantly over the past several years and now stands at approximately 60%.

We also made the full transition from cement to blended cement in October last year, particularly in the states of Oregon and Washington.

The mainstream product today is Type IL quality cement, a blended cement containing approximately 10% limestone. However, in regions like California, Arizona, and Nevada, the adoption of blended cement has barely progressed in the last few years.

This is attributable to the unique soil properties specific to these three regions. California, Nevada, and Arizona are inherently characterized as desert regions, featuring strata formed from dried-up lakes and marshes.

These strata contain large quantities of sulfate salts, such as gypsum.

These salts have a highly corrosive effect on concrete, causing erosion of concrete piles and floors. Consequently, without proper countermeasures, buildings and structures may face the risk of collapse.

For this reason, in these regions, special cements designed to prevent chemical reactions are used in this region, with Type I/II and Type II/V cements being the mainstream choices.

We tried to replace these with the Type IL cement mentioned earlier. Unfortunately, we concluded that Type IL cement had low resistance to such chemicals and thus proved unsuitable for this application. Consequently, conversion rates remain very low.

Our research laboratory and the CPC’s research laboratory have been aware of this issue for several years. We have launched a joint working group to explore new countermeasures capable of withstanding this unique soil type.

We have further advanced technological development aimed at producing a cement with a higher blending ratio and strength comparable to conventional products.

This year, that cement was launched on the market. The generic name for this cement is Type IT blended cement. The difference between Type IT and Type IL is that Type IT denotes a ternary system, with the “T” standing for ternary. Type IT consists of clinker, limestone, with the addition of pozzolan (volcanic ash).

This can be replaced by fly ash emitted from coal-fired power plants, and the product is basically composed of these three elements.

With a blending ratio of approximately 20%, higher than Type IL, we have successfully developed a cement with an extremely low CO2 emission factor.

You might ask, “How good is it actually?,” or “OK, CO2 emissions are down, but what about the economic benefits?,” but as you know, California has adopted a cap-and-trade system.

Let’s take a simple example: suppose CO2 is currently traded at $30 per ton. If we switch from regular cement to this Type IT cement, how much would that reduce emissions? Increasing SCMs by 1% can reduce CO2 emissions by 8 kilograms.

Therefore, a 10% increase in SCMs would reduce 80 kilograms of CO2, and a 20% increase would reduce 160 kilograms of CO2. 160 kilograms equals 0.16 tons. Multiplying this by $30 yields $4.80, meaning an economic benefit is calculated at just under $5.

The product can be marketed to users as cement and concrete with exceptionally low CO2 emissions. Another major advantage is that reducing this clinker factor increases production capacity.

For example, compared to producing one unit of cement from one unit of clinker, producing one unit of cement from 0.8 units of clinker would increase production capacity by 25% based on simple calculations. This economic benefit of increased production capacity is another reason we promote blended cement.

We consider our technical development as a prime example where the synergy between TCC and CPC was fully realized.

The next challenge in advancing this IT cement will be how to secure pozzolan and fly ash for use as SCMs.

We have taken a long-term approach to this issue. We obtained permits for natural volcanic ash mines since around 2018 and last year opened the Gem Hill pozzolan mine, located near the Mojave Plant. The pozzolan from this mine is sufficient to produce Type IT cement.

As we announced in June last year, we have been constructing two silos with a combined capacity of 50,000 tons at the Stockton Terminal, a cement import terminal located east of San Francisco.

These silos are designed to import SCMs such as fly ash and slag from Japan and Asia.

We view this as another example of how our global network delivers synergies for our U.S. business.

In the recent transaction with Vulcan Materials Company, we acquired many ready-mixed concrete plants in Northern California. This allows us to directly mix and use SCMs sourced from the Stockton Terminal, creating new synergies.

Overall, we did not plan all this overnight. Through systematic, long-term efforts, we have built our current U.S. business piece by piece, from mine development and terminal establishment to research and development.

Looking ahead, we will continue to pursue our U.S. business with a forward-looking mindset. With this recent large-scale acquisition, we believe that the initiatives we have steadily built up over time are expected to generate meaningful synergies and have reached a stage where they can deliver reliable returns in terms of profitability.

This concludes the summary of our presentation.

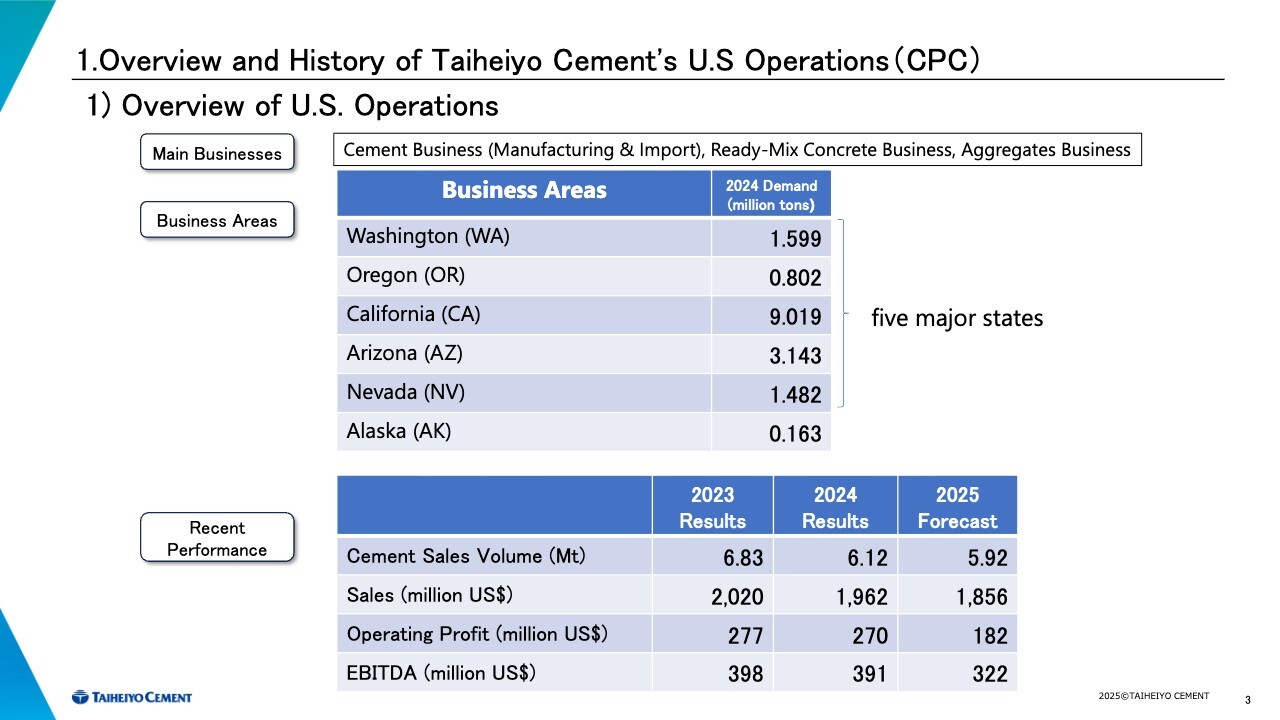

1. Overview and History of Taiheiyo Cement’s U.S Operations (CPC): 1) Overview of U.S. Operations

Tsuyoshi Hara: My name is Tsuyoshi Hara, Managing Executive Officer, Deputy Senior General Manager of Global Business Division of Taiheiyo Cement and President of Taiheiyo Cement U.S.A. Thank you for taking the time out of your busy schedule today.

For the first topic, I will explain the overview and history of our U.S. operations.

In the United States, we operate primarily in the cement business, along with the ready-mixed concrete and aggregates businesses.

Geographically, we mainly operate in five states: Washington and Oregon, collectively called the Northwest region, and California, Arizona, and Nevada, collectively called the Southwest region. Collectively, these five states form a market internally referred to as the “five major states.”

We also own an import terminal in Alaska. Additionally, though small in scale, we operate an inland terminal in Vancouver, Canada.

Turning to recent performance, as shown on the slide, our business and demand bottomed out in 2010 following the 2008 financial crisis and have expanded steadily since then. As a result, by 2023, sales had grown to over four times the 2010 level.

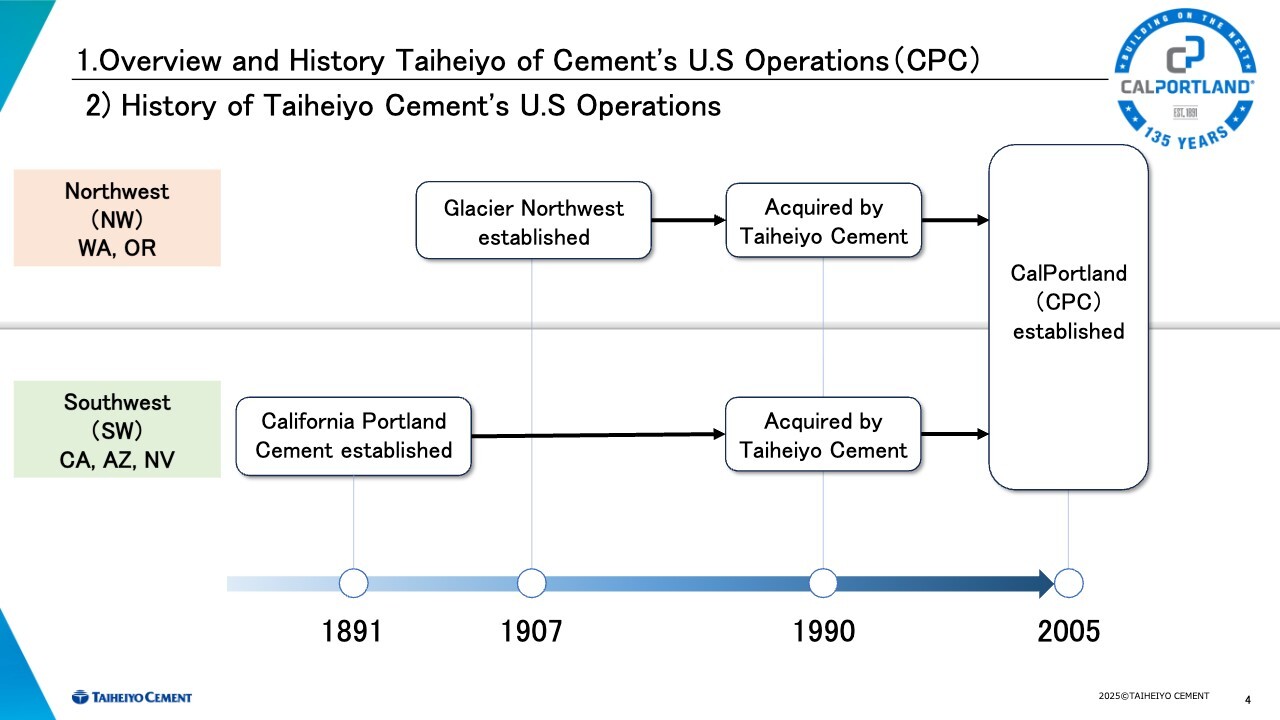

1. Overview and History Taiheiyo of Cement’s U.S Operations (CPC): 2) History of Taiheiyo Cement’s U.S Operations

Let me explain our history. While Northwest and Southwest have different origins, CalPortland Cement Company (CPC) has a very long history, celebrating its 135th anniversary next year.

By the way, CPC’s former Colton Plant is widely regarded as the first cement plant located west of the Mississippi River. This plant supplied cement for the construction of the iconic Hoover Dam, meaning that the dam itself was built using CPC cement. In this respect, much like our own company, the cement industry is characterized by its exceptionally long and enduring history.

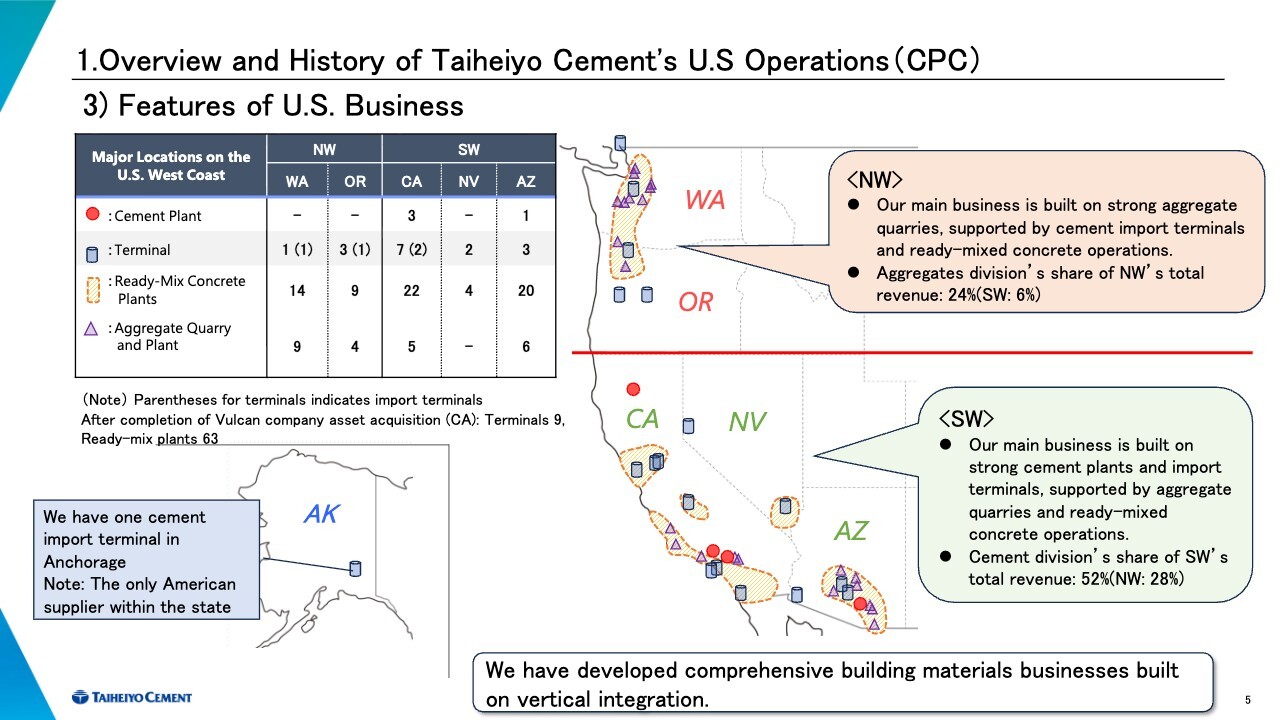

1. Overview and History of Taiheiyo Cement’s U.S Operations (CPC): 3) Features of U.S. Business

The slide shows the number of our business locations in each state along with a map.

We have developed a comprehensive building materials business on vertical integration, covering the entire supply chain from upstream to downstream. However, the Northwest and Southwest regions have somewhat different characteristics due to their distinct origins.

In the Northwest, our main business is built on strong aggregate quarries, supported by cement import terminals and ready-mixed concrete operations. Meanwhile, in the Southwest, our main business is built on strong cement plants and import terminals, supported by aggregate quarries and ready-mixed concrete operations.

In addition, we have one import terminal in Anchorage, Alaska, and a small inland terminal in Fairbanks, making us the only American cement supplier located in the state.

As you are well aware, the natural gas project in Alaska, which recently attracted attention due to President Trump’s remarks, has been launched and is expected to significantly increase demand. We also have high expectations for this project.

2. U.S. Cement and Ready-Mixed Concrete Market Overview: 1) Demand Trends (Cement Demand in the Five Major States)

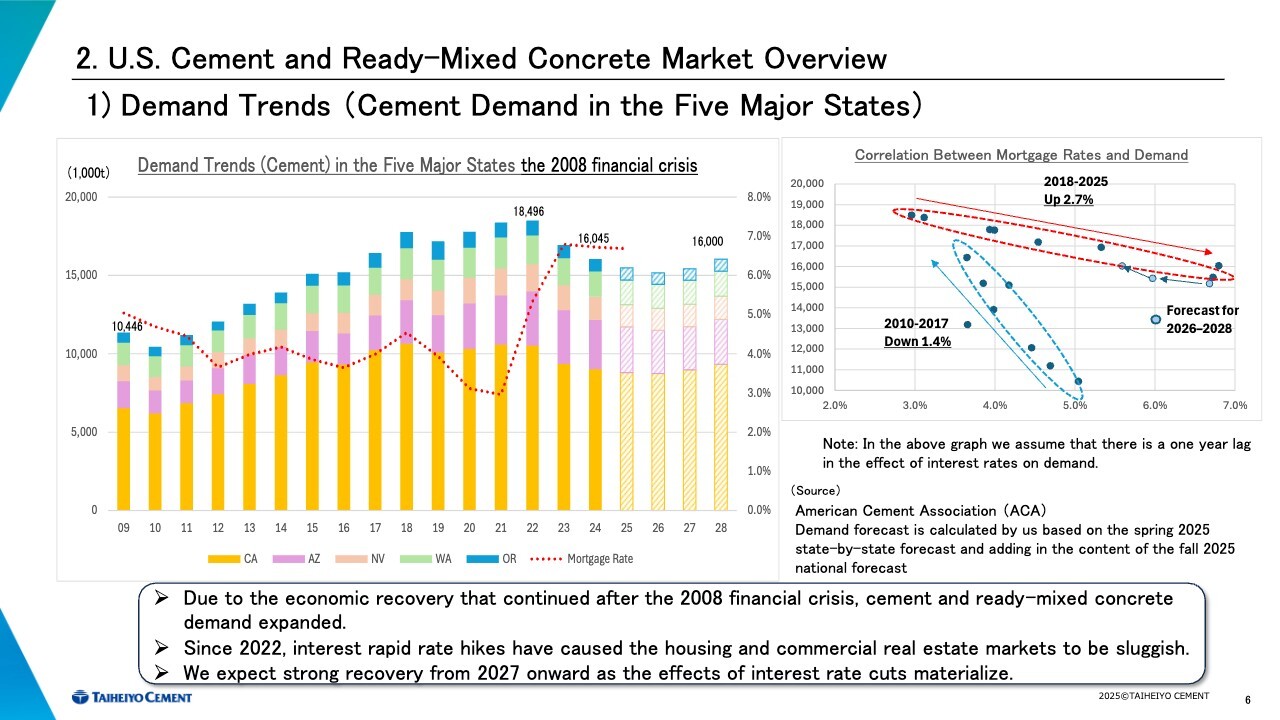

Starting on page 6, I will explain today’s second topic: the characteristics, overview, and structure of the U.S. cement and ready-mixed concrete market.

First, please turn to page 6 on the screen, which shows demand trends across the five major states. Following a sharp decline after the 2008 financial crisis, demand increased almost consistently through 2022. However, since then, demand has begun to decline, primarily due to rising and persistently high interest rates.

The chart in the upper right shows the correlation between mortgage rates and demand. As the impact of interest rates on demand is assumed to materialize with some delay, the correlation is analyzed with a one-year lag.

When we divide the period since 2010 into two phases, a relatively strong correlation between demand and interest rates becomes apparent. While there were some irregular years, such as during the COVID-19 pandemic, demand generally increased in tandem with declining interest rates over the period from 2010 to 2017, when interest rates were on a downward trend.

In contrast, since 2018, when interest rates entered an upward phase, demand has decreased almost linearly. Of course, there are some fluctuations, but this is the overall trend. Therefore, we expect demand to recover going forward if interest rates decline.

Furthermore, the projections from the American Cement Association (ACA, formerly known as PCA) for the period from 2026 to 2028 generally align with this trend line. Consequently, we believe demand will reach this level if interest rates decline.

2. U.S. Cement and Ready-Mixed Concrete Market Overview: 1) Demand Trends (Relationship Between U.S. Cement Demand and Economic Growth)

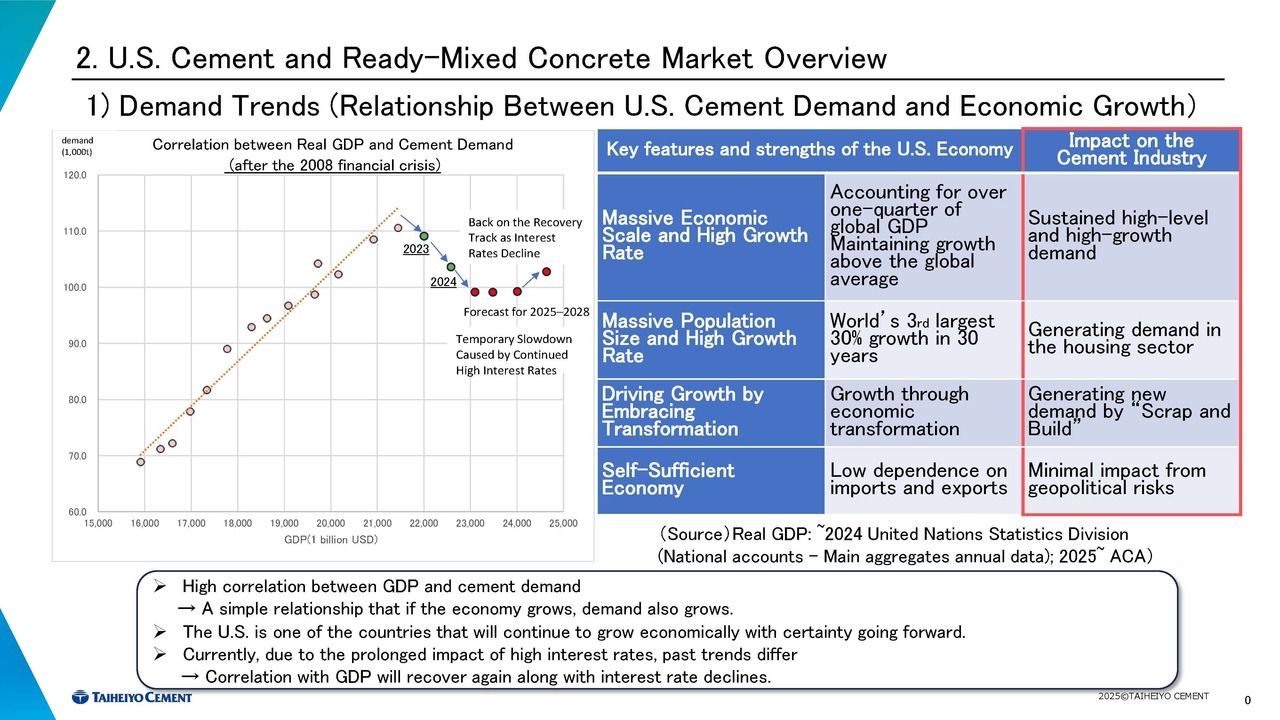

This slide shows the correlation between the U.S. cement demand and GDP. As Fukami mentioned earlier, the correlation is extremely strong. In the annual data spanning 2009 to 2022, the correlation coefficient is remarkably high at 0.98.

You might think this correlation is perfectly natural, but in reality, the U.S. is one of the few countries showing such a strong correlation among developed countries, making it a very rare case.

Furthermore, such a correlation is rarely seen in developing countries. For example, in China, this correlation has disappeared since 2015. This means that even as the economy grows, cement demand does not increase. Similarly, the same trend can be observed in Thailand and Malaysia.

Of course, we have not examined every country globally; however, India is likely one of the few markets where a similarly strong correlation can still be observed. Conversely, this indicates that, from the perspective of the cement industry, the U.S. cement market remains highly attractive and continues to offer meaningful growth potential.

Therefore, the U.S. exhibits a very straightforward relationship: economic growth leads to increased cement demand. Given its economic characteristics as shown in the table on the right, we are confident that the U.S. will remain one of the countries where both the economy and cement demand continue to grow.

Currently, prolonged high interest rates have caused some deviation from past trends. As you can see, since 2023, the trend has shifted downward and to the right from this linear path.

However, we believe the correlation will recover once interest rates decline. Although the causes and nature of the deviation differ entirely from the 2008 financial crisis, a similar phenomenon was observed back then.

Nevertheless, after the 2008 financial crisis, growth resumed within five years, and the correlation angle recovered to similar levels. This time, while the correlation has been deviating since 2023, ACA forecasts a recovery starting in 2028, leading to renewed growth. Coincidentally, this timeframe also aligns precisely with five years.

2. U.S. Cement and Ready-Mixed Concrete Market Overview: 1) Demand Trends (Ready-Mixed Concrete Demand in the Five Major States)

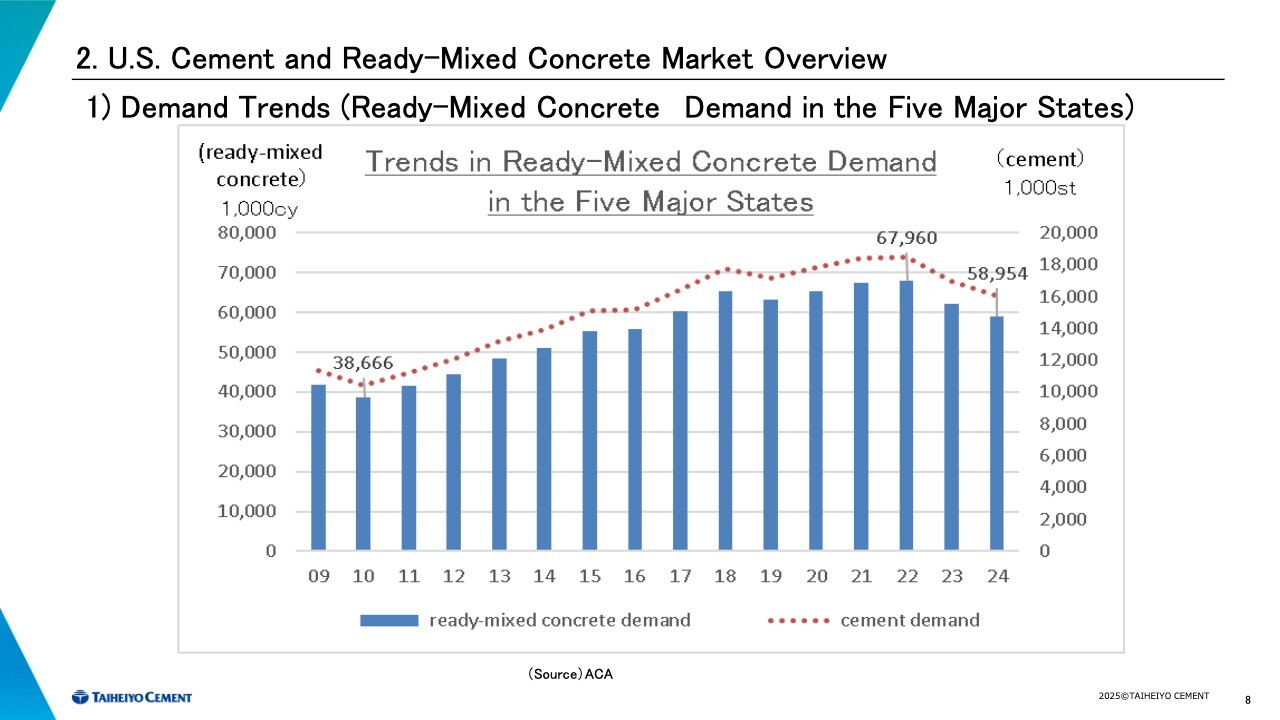

This slide shows the trends in ready-mixed concrete demand in the five major states. The trend broadly correlates with cement demand.

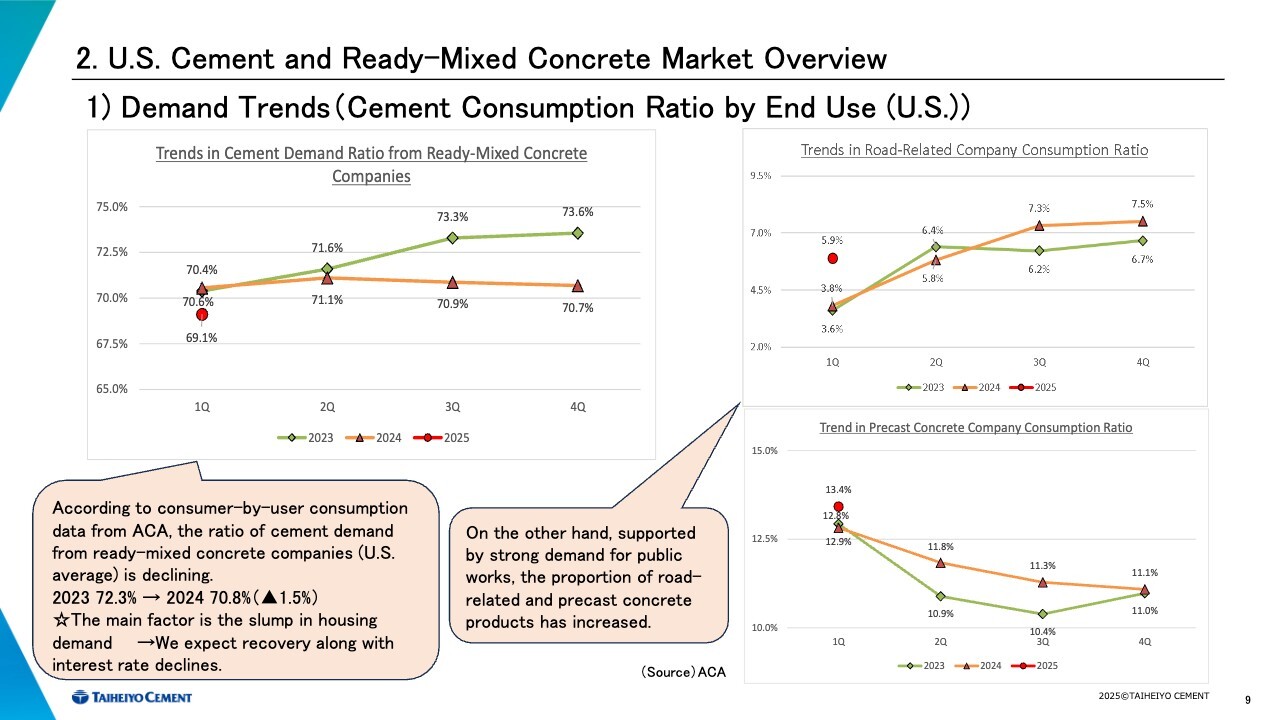

2. U.S. Cement and Ready-Mixed Concrete Market Overview: 1) Demand Trends (Cement Consumption Ratio by End Use (U.S.))

The graphs on page 9 showing the recent trend in the consumption ratio by end use reveal noticeable changes.

Currently, private demand is declining while the ratio of public works and government demand is increasing. As a result, the ratio of ready-mixed concrete has decreased, while the shipment ratios for road construction and precast concrete have increased.

We believe that the ratio of ready-mixed concrete will rise again when the effects of lower interest rates materialize.

2. U.S. Cement and Ready-Mixed Concrete Market Overview: 2) Characteristics of the U.S. Cement Market

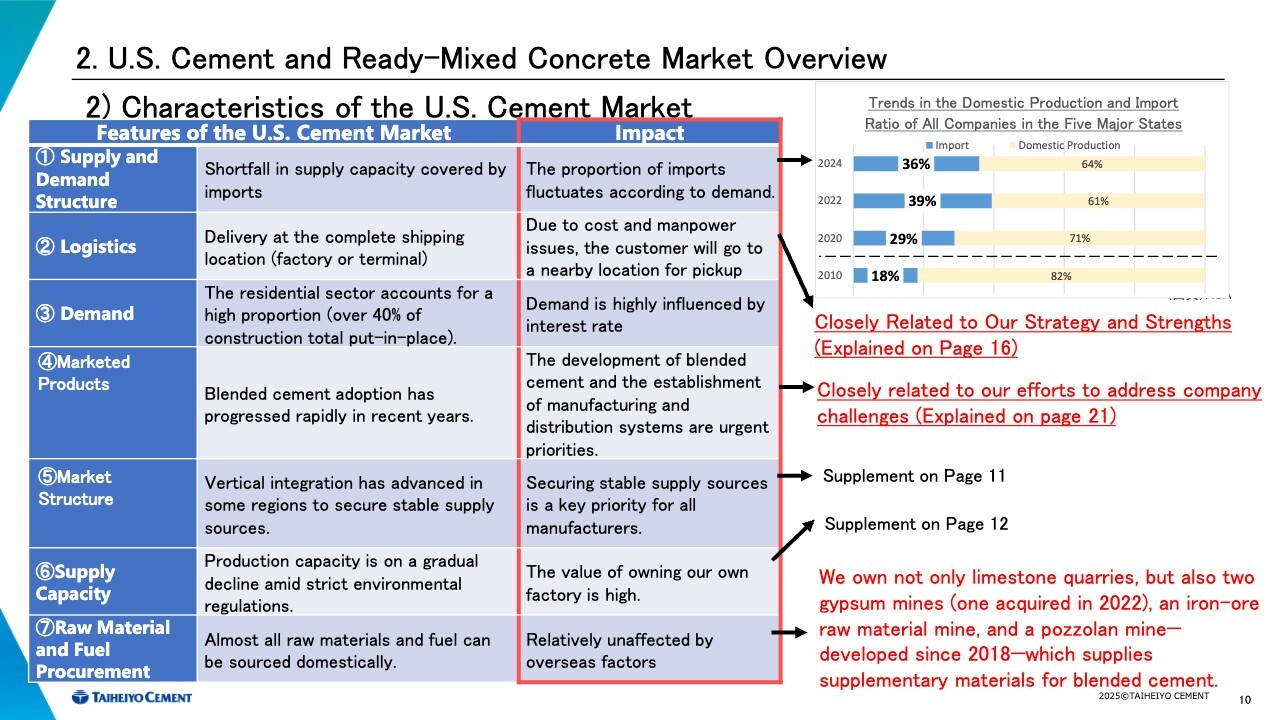

This slide lists characteristics of the U.S. cement market that differ from those in Japan. I will now elaborate on six key features, focusing on those relevant to our strategy and strengths.

The first point relates to the demand structure. As Fukami explained earlier, the U.S. market is characterized by a structure in which insufficient domestic supply capacity is supplemented by imports. As a result, even when demand declines, imports can be reduced first, allowing domestic plants to maintain their operating ratios. This is a key structural characteristic of the market and an important source of its attractiveness.

The graph in the upper right of the slide shows the balance between domestic production and imports in the five major states. While imports currently account for roughly 40%, this ratio dropped to a little under 20% in 2010 when demand hit bottom.

In other words, imports act as a buffer against demand declines.

I will explain the second and fourth characteristics—logistics and marketed products—in the next section. The fifth and sixth characteristics—market structure and supply capacity—will be detailed on the following pages. Here, I will supplement the seventh characteristic: raw material and fuel procurement.

In the United States, nearly all raw materials and fuels can be sourced domestically, which represents a significant strength.

In particular, as noted on the right, CPC owns two gypsum mines in addition to limestone quarries that typical Japanese cement plants possess.

One of these mines was acquired in 2022. CPC also owns one iron-ore raw material mine. Furthermore, it possesses one pozzolan mine.

These mines represent a major strength for CPC in terms of stable procurement and costs.

As discussed earlier, pozzolan is used as SCMs for IT blended cement. CPC anticipated the advancement of blended cement use in the U.S. as early as 2018 and began development accordingly. I will discuss this further later, but it has become an indispensable raw material for CPC’s IT cement.

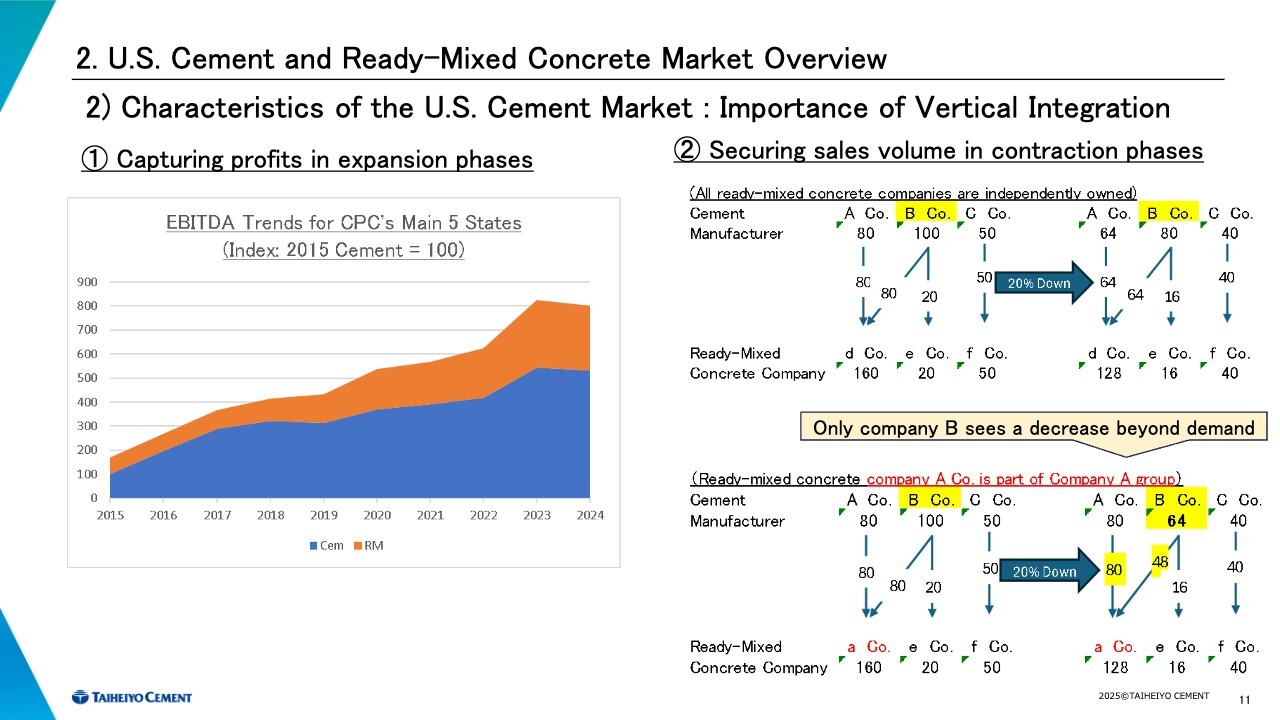

2. U.S. Cement and Ready-Mixed Concrete Market Overview: 2) Characteristics of the U.S. Cement Market – Importance of Vertical Integration

Now, let me provide additional explanation on the fifth characteristic of the market structure, the so-called vertical integration.

As described on page 11, vertical integration refers to owning both upstream components like cement and aggregates manufacturers, and downstream components like ready-mixed concrete and asphalt companies within the supply chain. While this structure is not commonly seen in Japan, it is prevalent particularly in high-demand urban centers in the United States.

Let me explain the business model. I believe its primary objectives are twofold. As shown on the left side of the slide, the first is to capture profits during expansion phases. Characteristically, profits increase during periods of growing demand.

Please look at the graph on the left. It shows CPC’s EBITDA trend from 2015 to 2024, indexed on 2015. By 2024, it has increased to approximately 1.5 times compared to a cement-only business model, demonstrating the ability to capture profits from both segments.

To explain the second point, I have prepared a simplified diagram on the right. As the diagram on the bottom illustrates, in highly vertically integrated markets, cement manufacturers like Company B, which lag in downstream expansion, tend to experience significant declines in sales volume during periods of demand contraction. Therefore, vertical integration becomes a highly effective means of mitigating such risks.

I believe this aspect holds greater significance, and CPC in Northern California, in particular, was in a situation similar to Company B. Therefore, I expect the recent acquisition will substantially improve the situation.

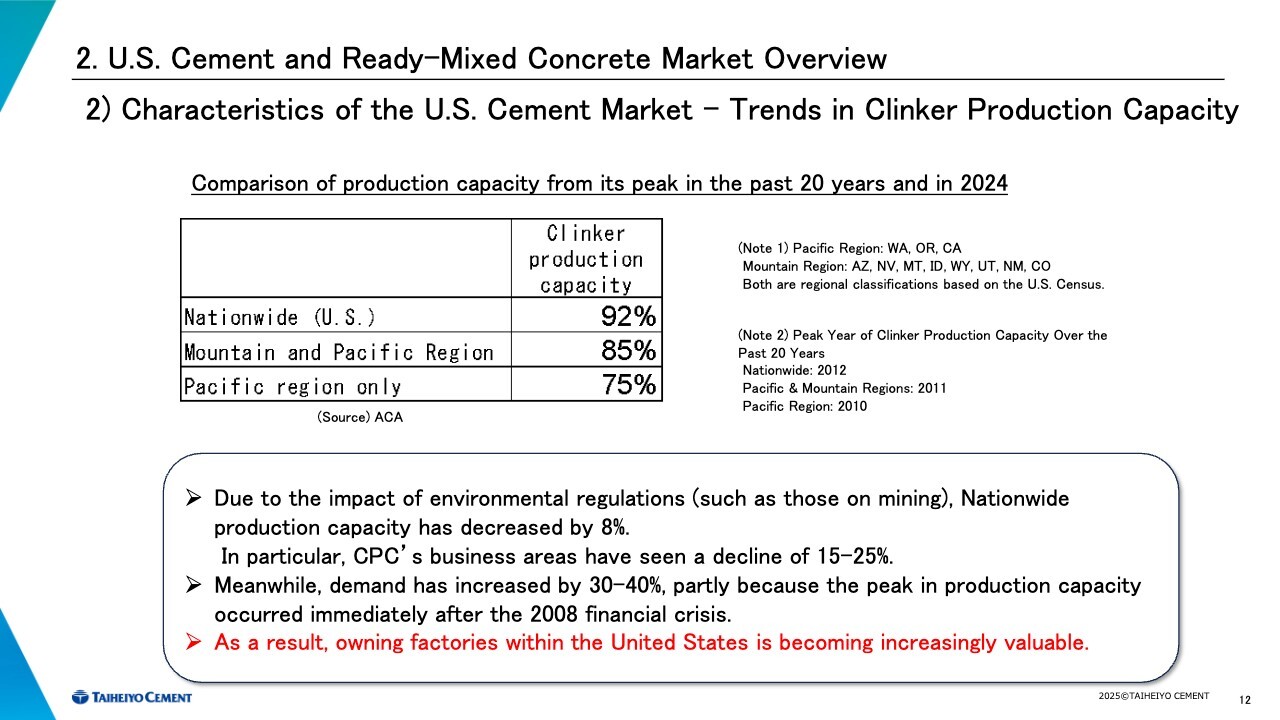

2. U.S. Cement and Ready-Mixed Concrete Market Overview: 2) Characteristics of the U.S. Cement Market – Trends in Clinker Production Capacity

Moving on to the characteristics of supply capacity. This slide covers clinker production capacity. Clinker is defined in the glossary at the end of the presentation material for your future reference.

Clinker is a semi-finished product produced after completing approximately 70% to 80% of the cement production process. The ability to produce clinker is therefore a critical factor in cement production.

Looking at clinker production capacity, the peak was around 2010. Since then, despite a significant recovery in demand, production capacity has actually tended to decrease, largely due to the impact of environmental regulations.

As you can see, capacity has decreased by approximately 10% nationwide in the U.S., and by 15% to 25% in CPC’s business areas.

We believe new plant construction will remain extremely difficult, particularly in California. Since we own four plants in the Southwest, we consider this asset itself to be increasingly valuable.

Furthermore, given that the Trump tariffs are intended to promote domestic industry, we are reminded once again of the importance of owning factories within the United States.

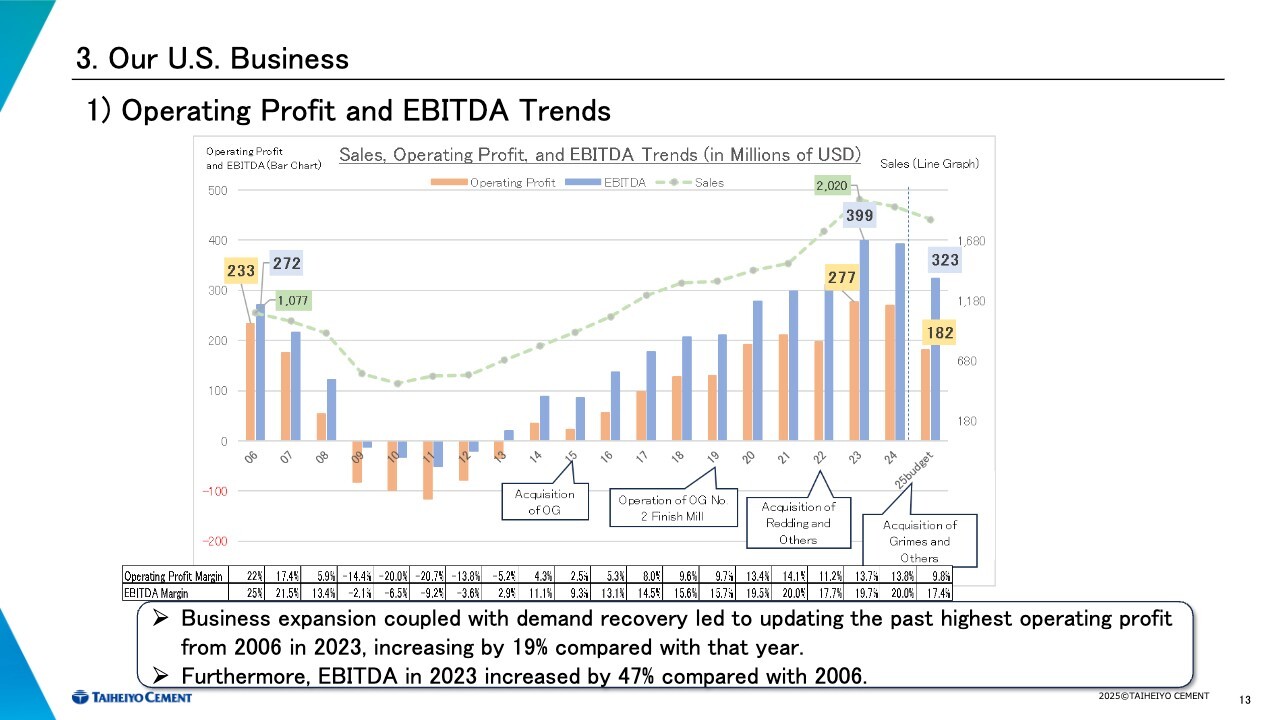

3. Our U.S. Business: 1) Operating Profit and EBITDA Trends

From page 13, I will explain the third topic: an overview of our U.S. business. First, let me discuss the trends in operating profit and EBITDA. We have disclosed EBITDA starting in financial results briefing materials this year, and here we present again the historical trends since 2006.

In 2006, we recorded our highest-ever profit. While profits declined significantly after the 2008 financial crisis, by 2023, our operating profit reached 1.2 times and EBITDA reached 1.5 times the 2006 levels, driven by demand recovery and business expansion.

As shown below, the operating profit margin and EBITDA margin were approximately 14% and 20% in 2023 and 2024, respectively. While both margins are expected to decline this year, they are still expected to remain at around 10% and 17%, respectively.

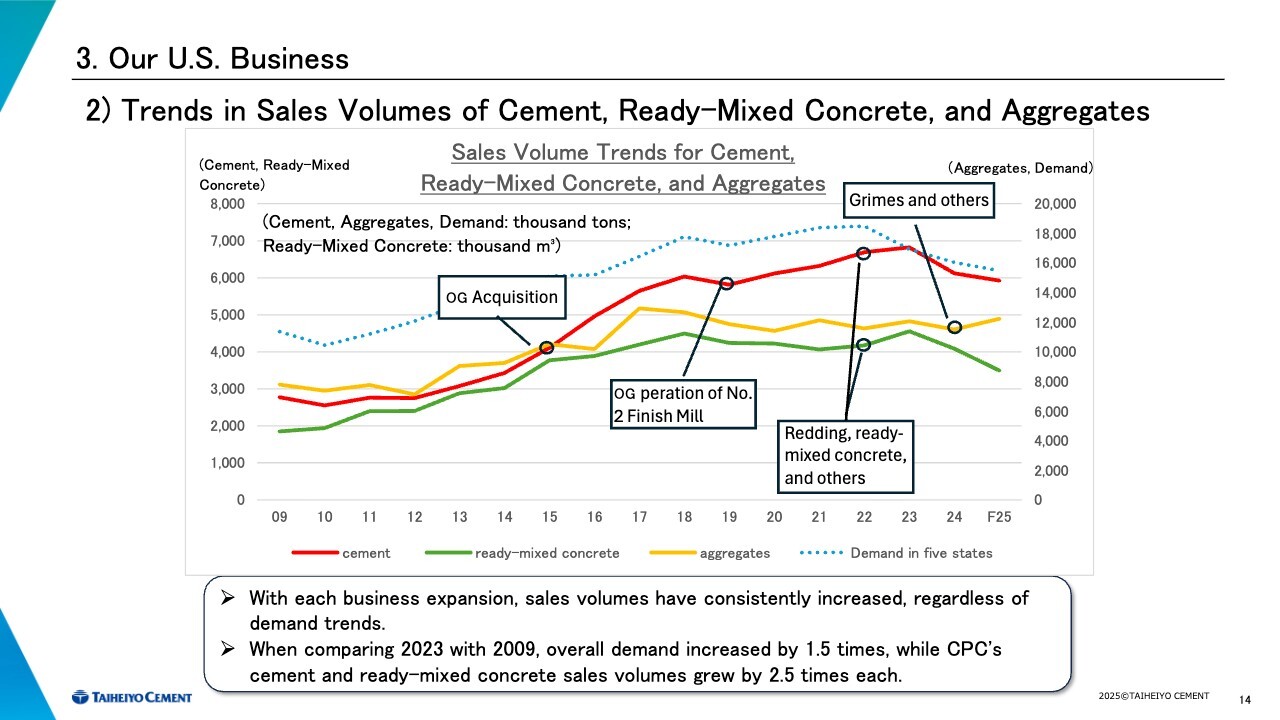

3. Our U.S. Business: 2) Trends in Sales Volumes of Cement, Ready-Mixed Concrete, and Aggregates

Once again, we are presenting the trend in sales volume for cement, ready-mixed concrete, and aggregates. While this data begins in 2009, after the 2008 financial crisis, I hope this clearly shows how each business expansion consistently demonstrated growth exceeding demand.

As a result, by 2023, overall demand increased by 1.5 times the 2009 level, while CPC’s sales volume for both cement and ready-mixed concrete grew roughly 2.5 times.

For aggregates, partly due to the effect of acquiring Grimes Quarry late last year, sales volume is expected to increase this year, despite anticipated declines in construction demand.

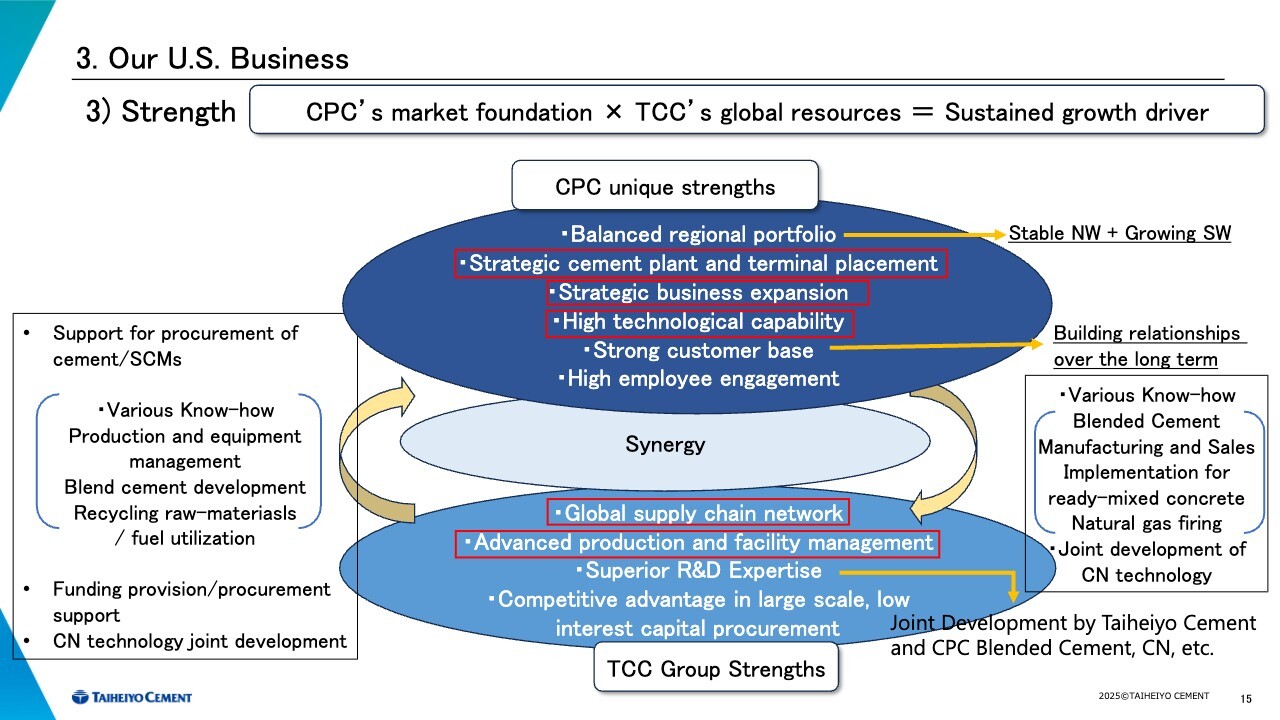

3. Our U.S. Business: 3) Strengths

The slide illustrates the strengths of our U.S. business.

As shown at the top, our strengths include the solid CPC’ market foundation built through business expansion, which we have discussed several times before, along with our group’s human resources, which are plant management capabilities, R&D expertise, global product procurement capabilities, and also physical resources, meaning cement supply capacity from our affiliated companies.

We believe the synergy of these elements forms the strengths of our U.S. business.

Next, focusing on the section highlighted in red, I will explain one strength unique to CPC and two synergies of the TCC Group, along with specific examples.

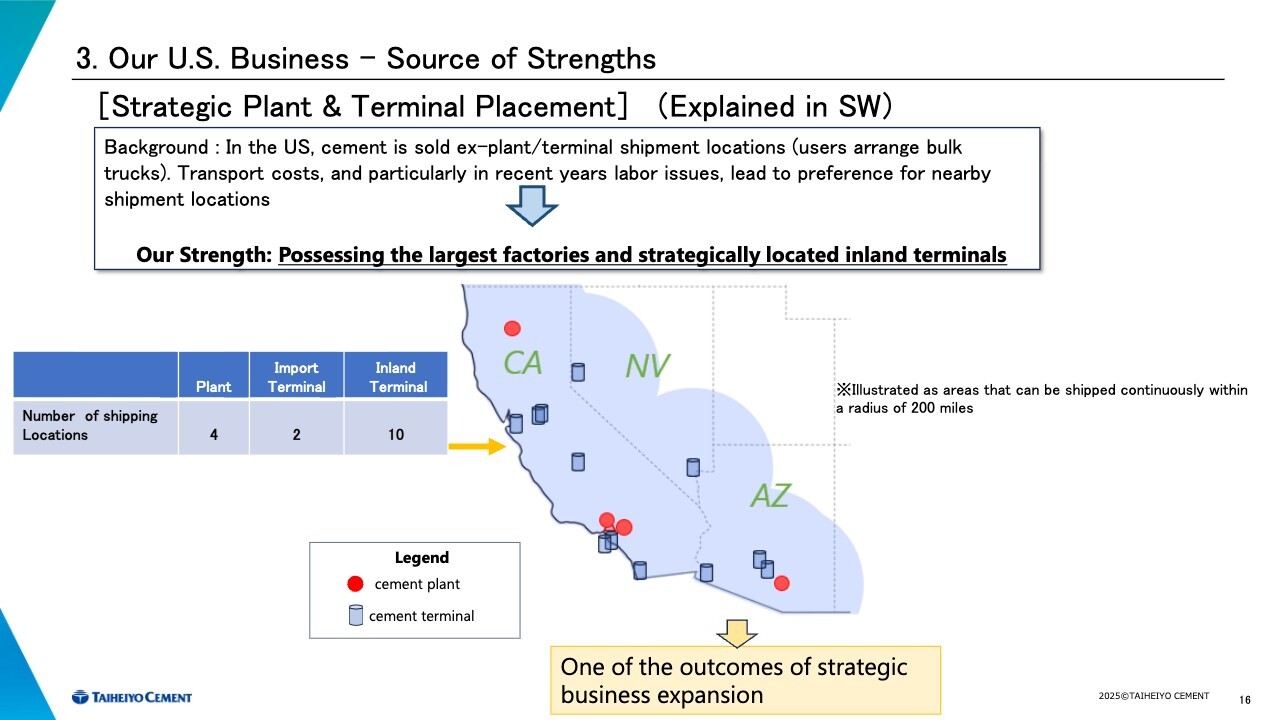

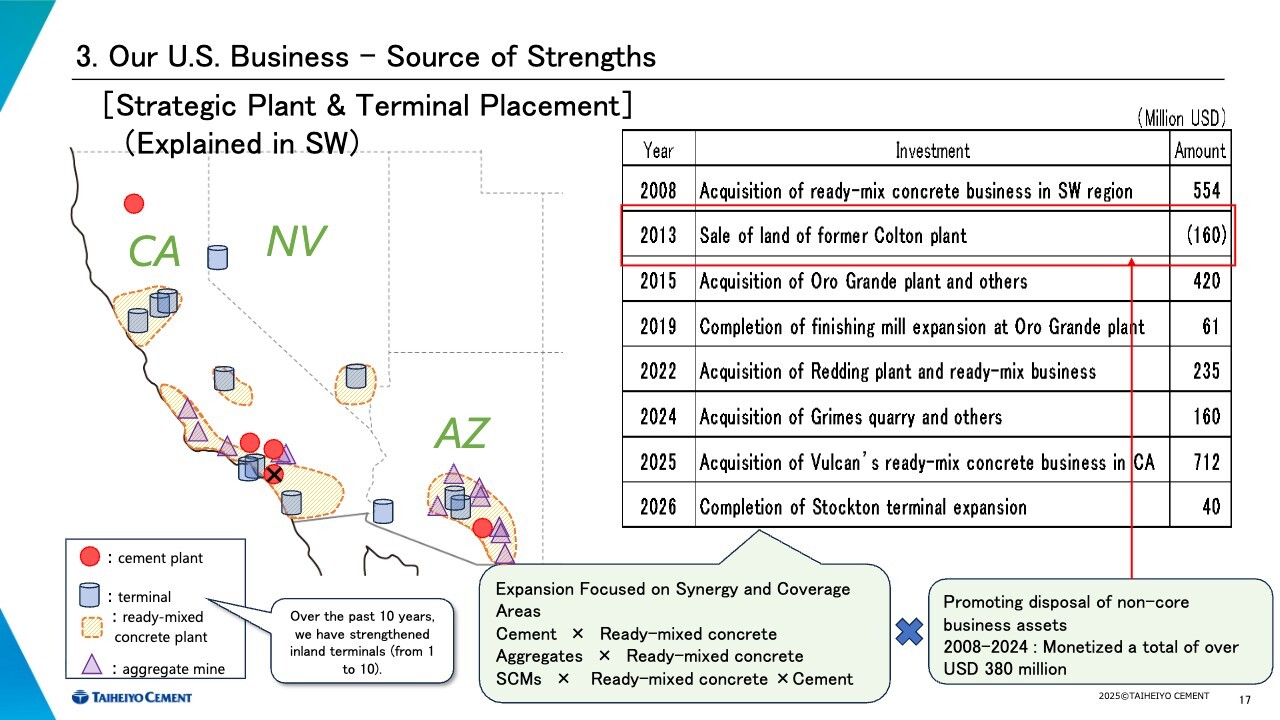

3. Our U.S. Business: 3) Strengths – Source of Strengths [Strategic Plant & Terminal Placement] (Explained in SW)

The slide illustrates CPC’s strategic placement of cement plants and terminals, one of its key strengths, using the Southwest region as an example.

On page 10, I touched on logistics as a characteristic of the U.S. cement market. In the United States, cement is sold entirely on an ex-works basis, meaning that users pick up the product at the shipping location. As a result, establishing facilities close to users, or near the market, provides a clear advantage.

From the user’s perspective, this structure also helps reduce transportation costs and, particularly in the current environment of labor shortages, serves to mitigate related operational constraints.

In this context, CPC possesses a highly balanced plant portfolio: one in Arizona, two in Southern California flanking the Los Angeles area, the region’s largest demand center, and one in Northern California.

Furthermore, its import and inland terminals cover major cities, enabling shipments across a wide area.

This slide maps the areas where we can provide a continuous and stable supply of cement. As you can see, it covers nearly all the key areas and major urban centers in the Southwest region.

This is the outcome of our strategic business expansions to date, which I will explain on the next page.

3. Our U.S. Business: 3) Strengths – Source of Strengths [Strategic Business Expansion] (Explained in SW)

Looking back to 2006, CPC’s operations in the Southwest region were quite limited. At that time, the company operated only three cement plants, two import terminals in California, one inland terminal in Las Vegas. Ready-mixed concrete operations were confined to the greater Los Angeles area and vicinity of the Rillito Plant in Arizona.

Then,from 2007 to 2008, CPC rapidly expanded its ready-mixed concrete operations across California, Phenix/Arizona, and Las Vegas.

Meanwhile, the Colton Plant near Los Angeles was idle, so the land was sold to secure funds. CPC then acquired the Oro Grande Plant and two inland terminals, and furthermore, expanded the finishing mill, doubling the cement production capacity of that plant.

Additionally in 2022, CPC acquired Redding Plant and four inland terminals, along with the ready-mixed concrete businesses in Central California and the San Diego area. Moreover, late last year, CPC acquired a quarry and ready-mixed plant near Los Angeles.

And in the recent transaction, we have acquired ready-mixed concrete businesses in Northern California, San Diego, and their surrounding areas. Next year, we are also poised to fully enter the SCMs business utilizing the silos scheduled for expansion at the Stockton Terminal.

This slide shows our current placement, including other inland terminals. As you can see, in addition to acquiring cement plants, we have increased our inland terminals tenfold over the past 10 years.

This has significantly expanded our coverage area, enabling us to develop ready-mixed concrete business in these areas. Synergies across divisions, extensive and urban-focused deployment, and these strategic investments have shaped our current standing.

Meanwhile, we have been advancing disposal of non-core business assets, including the land of the former Colton Plant, raising over $380 million in total over the 17 years since 2008. We are simultaneously pursuing initiatives to reinvest these funds.

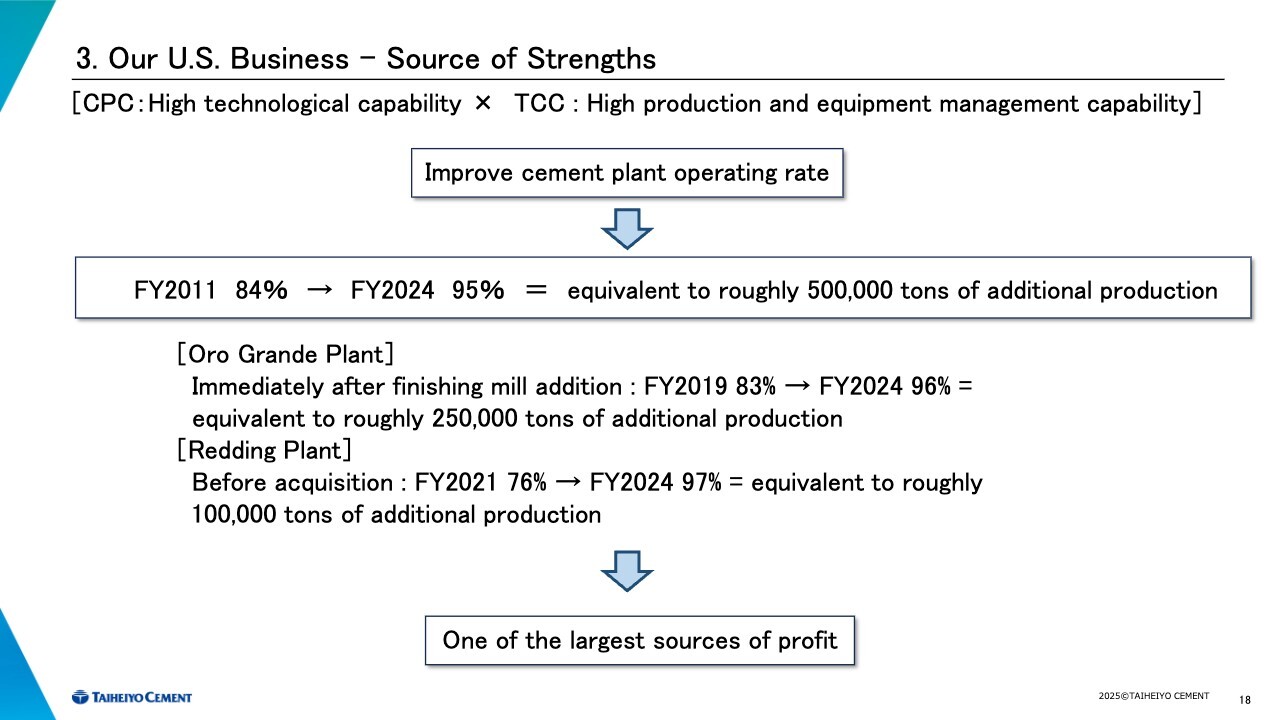

3. Our U.S. Business: 3) Strengths – Source of Strengths [CPC: High technological capability × TCC: High production and equipment management capability]

I will explain the synergies within our Group. First, on the technical front, the integration of CPC’s technological capability with our operational and equipment management capability cultivated in Japan has significantly improved cement plant operating rates from 2011 to 2024.

Converting this operating rate into production volume, it is equivalent to roughly 500,000 tons of additional production. This represents an outcome leading to substantial profits.

Notably, the acquired Oro Grande and Redding plants saw their operating rates rise from around 80% or slightly below to over 95%. As such, our characteristic approach, which is acquiring plants with particularly low operating rates and significantly improving them, has become one of our largest sources of profit.

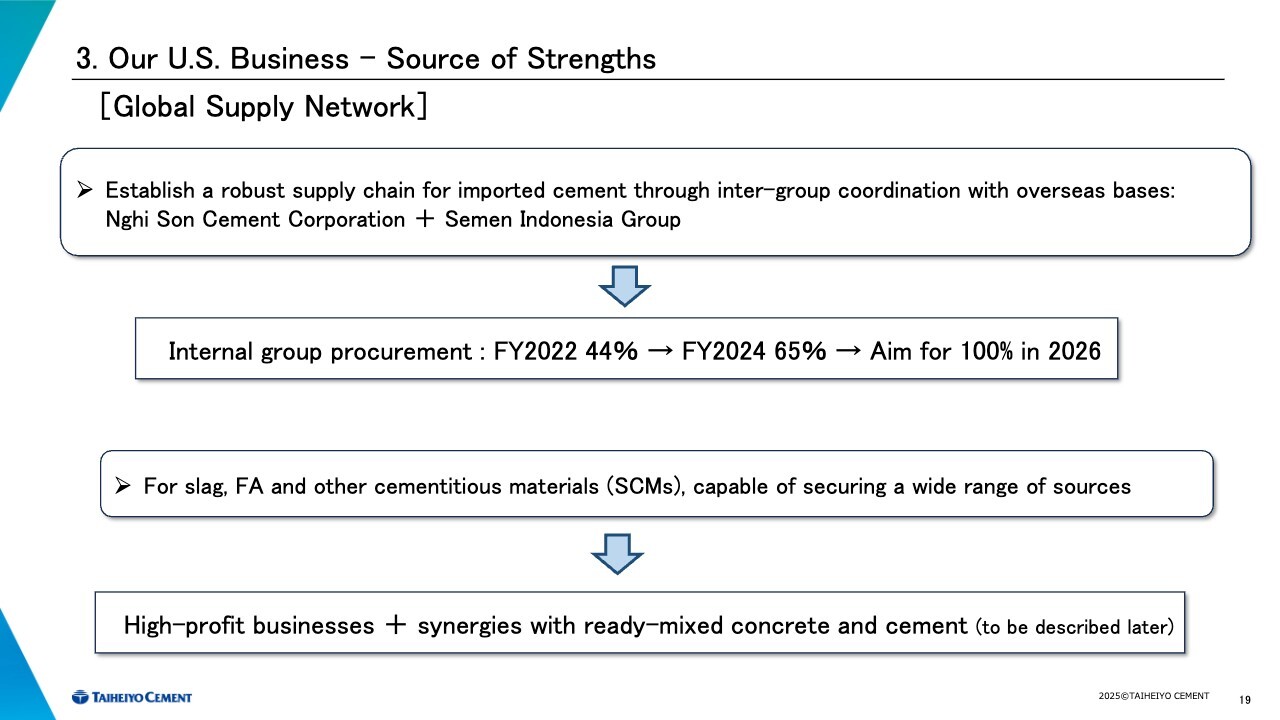

3. Our U.S. Business: 3) Strengths – Source of Strengths [Global Supply Network]

Our Group’s cement supply and procurement capabilities also play a significant role, serving as a foundation for synergies with CPC.

After Jiangnan-Onoda Cement Co., Ltd. in China ceased operations, the internal procurement rate for the Group dropped significantly. However, we subsequently expanded imports from our Vietnamese subsidiary, Nghi Son Cement Corporation, restoring the procurement rate to over 60%. This has greatly contributed to stabilizing our operations.

Furthermore, starting next year, we plan to begin imports from our Indonesian affiliate, PT Solusi Bangun Indonesia Tbk, which is expected to provide further stability.

Procurement from within the Group is characterized by its ability to reduce risks associated with fluctuations in export prices and volumes arising from conditions in each exporting country. In addition, when we request product modifications, we can count on them to reliably implement the requested modifications and improvements, which is a major benefit of internal procurement.

Furthermore, we plan to procure and supply slag and fly ash in addition to cement, from Japan and other countries within our Group network. Once the expansion of the Stockton Terminal is complete, we expect to significantly expand our highly profitable SCMs business.

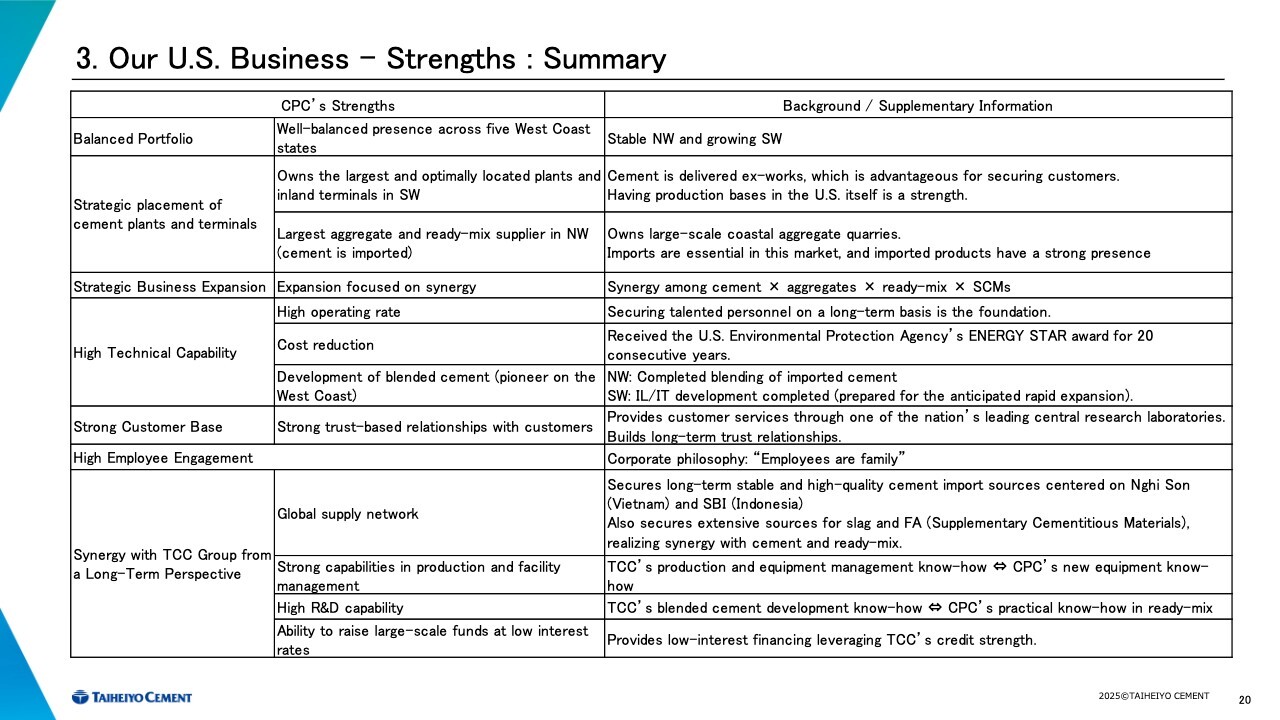

3. Our U.S. Business: 3) Strengths – Summary

This page briefly summarizes the strengths of our U.S. business, including the points I discussed earlier, for your future reference.

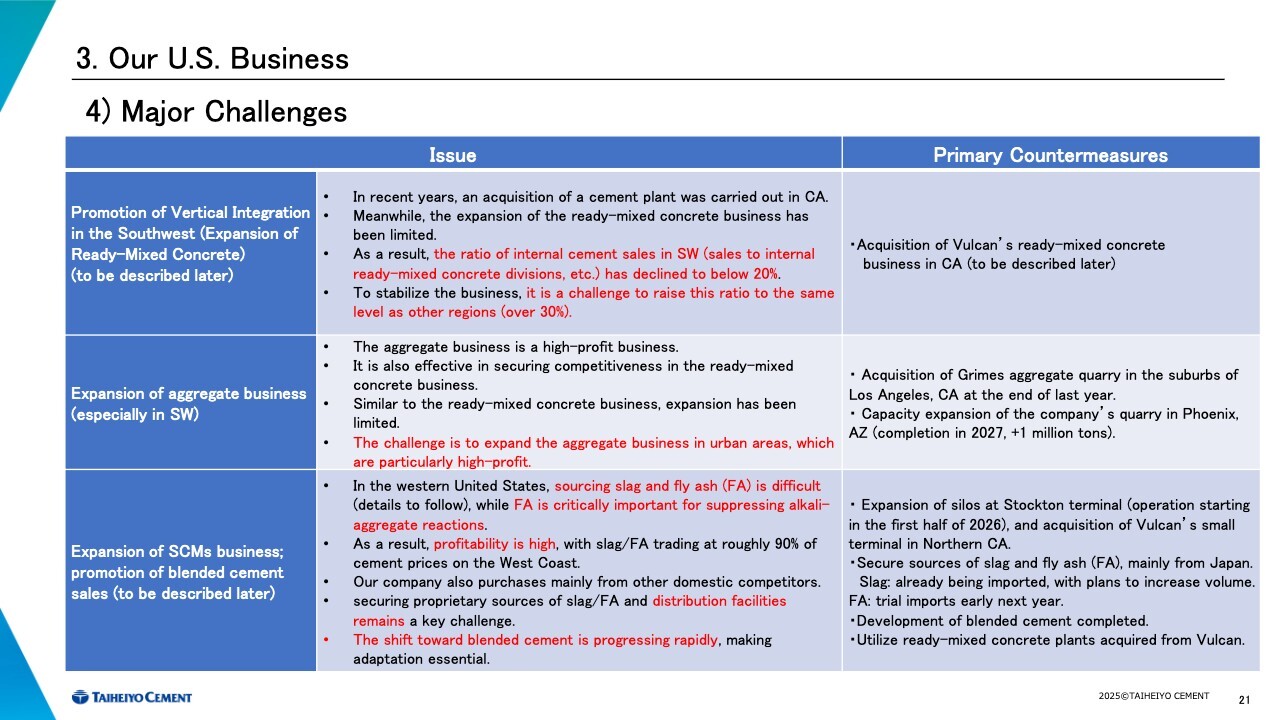

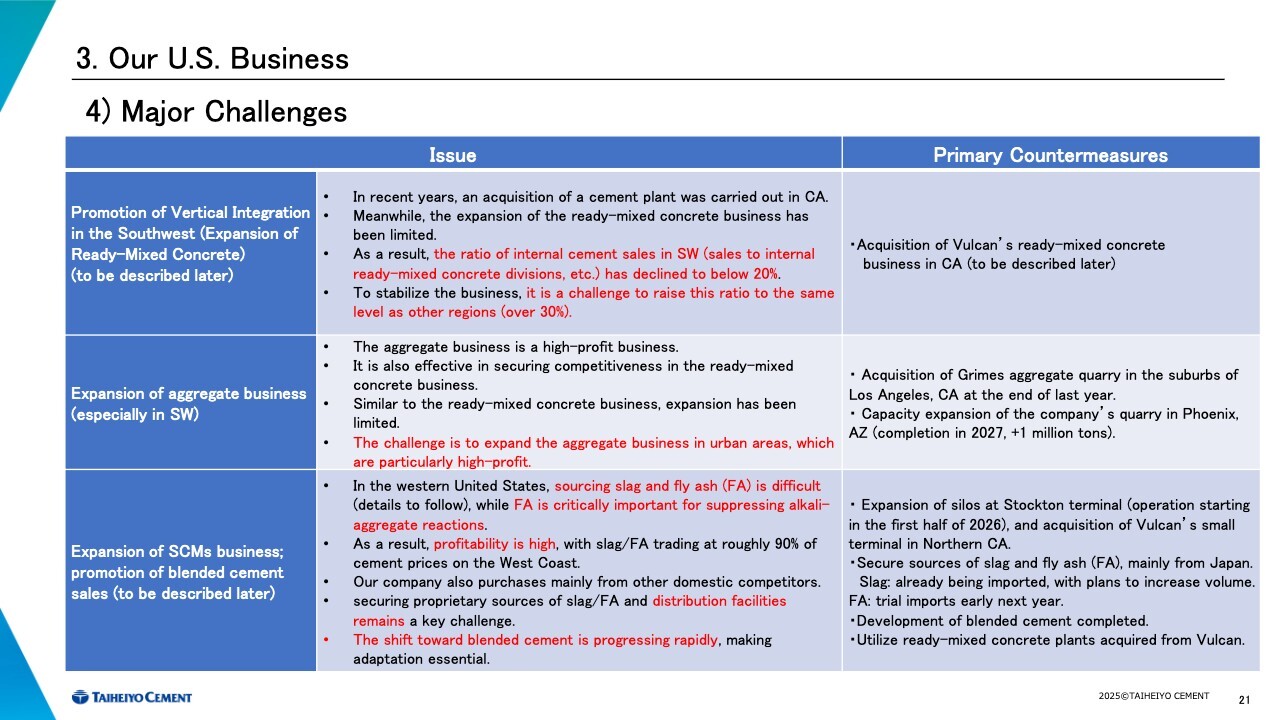

3. Our U.S. Business: 4) Major Challenges

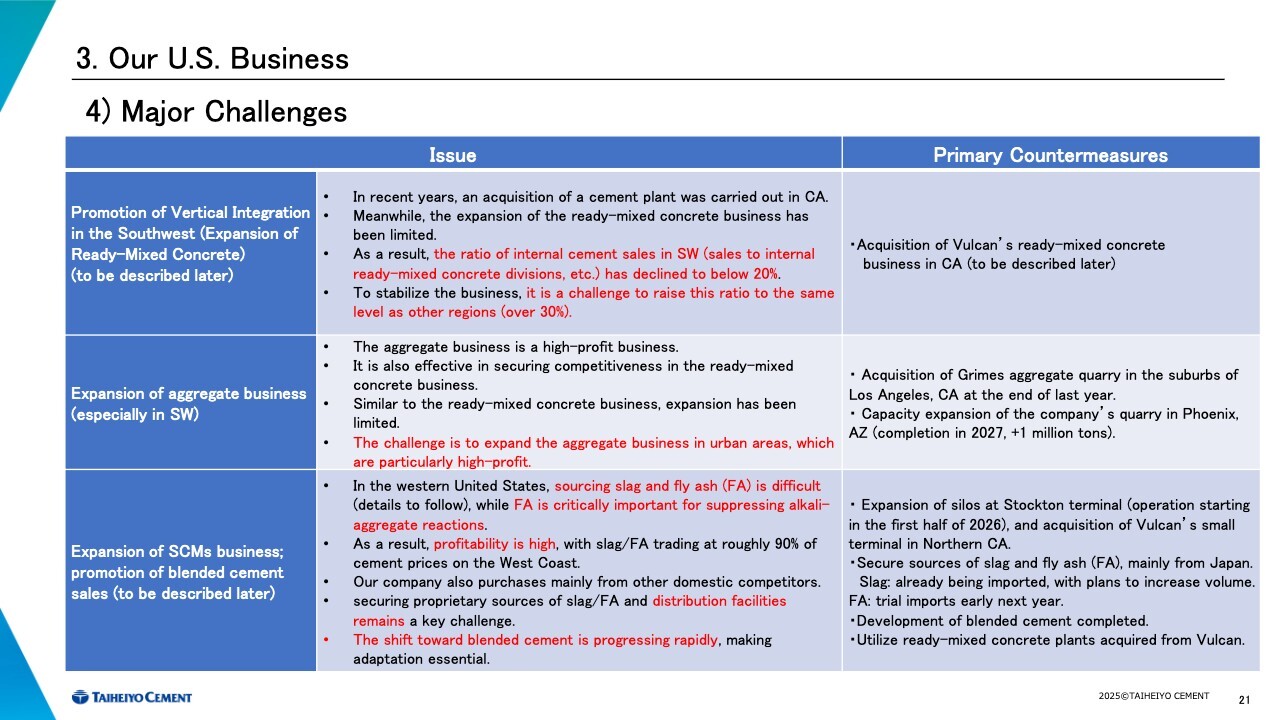

We will outline three key challenges in our U.S. business and the actions we are taking to address them. First, we face delays in achieving vertical integration in the Southwest region.

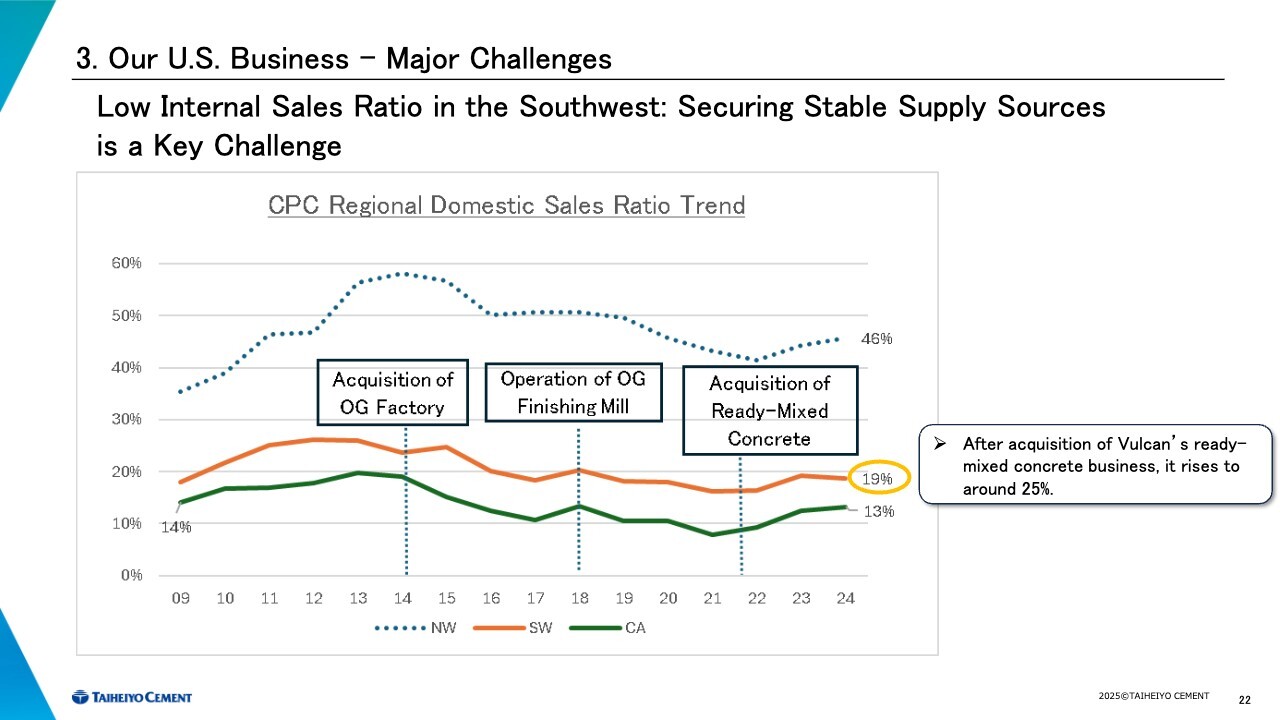

3. Our U.S. Business 4) Major Challenges – Low Internal Sales Ratio in the Southwest: Securing Stable Supply Sources is a Key Challenge

The chart on this slide illustrates the share of consumption attributable to our own ready-mixed concrete plants. Internally, we refer to this as internal sales and the internal sales ratio from the cement business perspective. In essence, the chart tracks the trend in the internal sales ratio over time.

The Northwest region, including Washington and Oregon, has historically maintained a high internal sales ratio. By contrast, the Southwest began with cement plants, and as a result, its internal sales ratio has remained relatively low.

While conditions vary by competitor, we estimate that roughly 30% or more of their cement is consumed at their own ready-mixed concrete plants. Regardless of peer performance, we have set a target internal sales ratio of around 30%.

As shown, California’s internal sales ratio stands at 13%, and the Southwest as a whole is at 19%. Raising these levels is a key challenge.

To address this, we are acquiring Vulcan Materials Company’s ready-mixed concrete business. After the acquisition, we expect the Southwest’s internal sales ratio to rise to around 25%, representing a significant improvement. This move brings us much closer to our 30% target.

3. Our U.S. Business: 4) Major Challenges

The second challenge is our limited presence in the aggregates business. Not all segments of the aggregates business deliver high margins. The most attractive profitability and margins concentrate in quarries located near demand centers and urban areas.

Against this backdrop, Grimes—acquired at the end of last year—operates a highly valuable, high-margin quarry in the Los Angeles area. It has contributed to earnings on a full-year basis starting this year.

As our second major initiative, we are pursuing more than acquisitions. In parallel, we are expanding capacity at our strongest existing quarries.

Finally, the third challenge is expanding our SCMs business and accelerating sales of blended cement. In the western U.S., sourcing slag and fly ash is difficult, and we are taking steps to address this constraint.

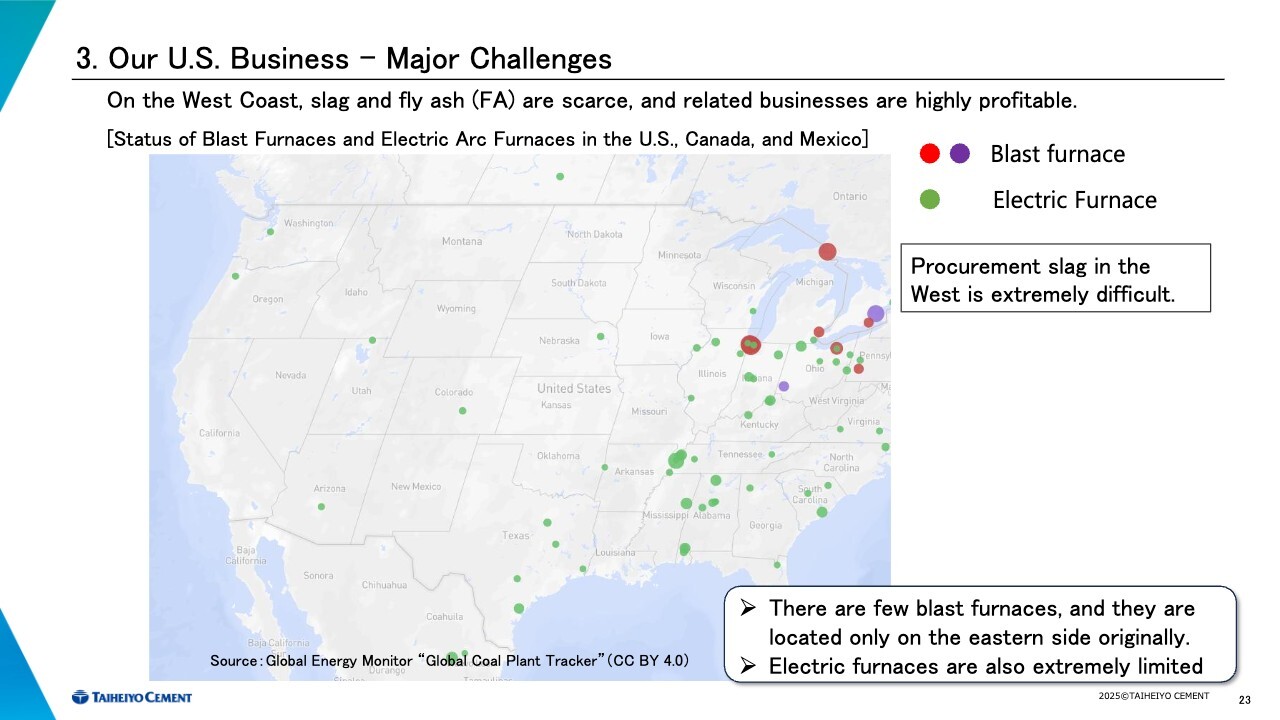

3. Our U.S. Business: 4) Major Challenges – On the West Coast, slag and fly ash (FA) are scarce, and related businesses are highly profitable

Slag is a byproduct of the steelmaking process. This map shows the locations of blast furnaces and electric furnaces across the United States. As you can see, blast furnaces are few in number and are concentrated primarily on the East Coast.

By contrast, in the western region—including Canada—only a limited number of electric furnaces are in operation. As a result, supply conditions remain highly constrained.

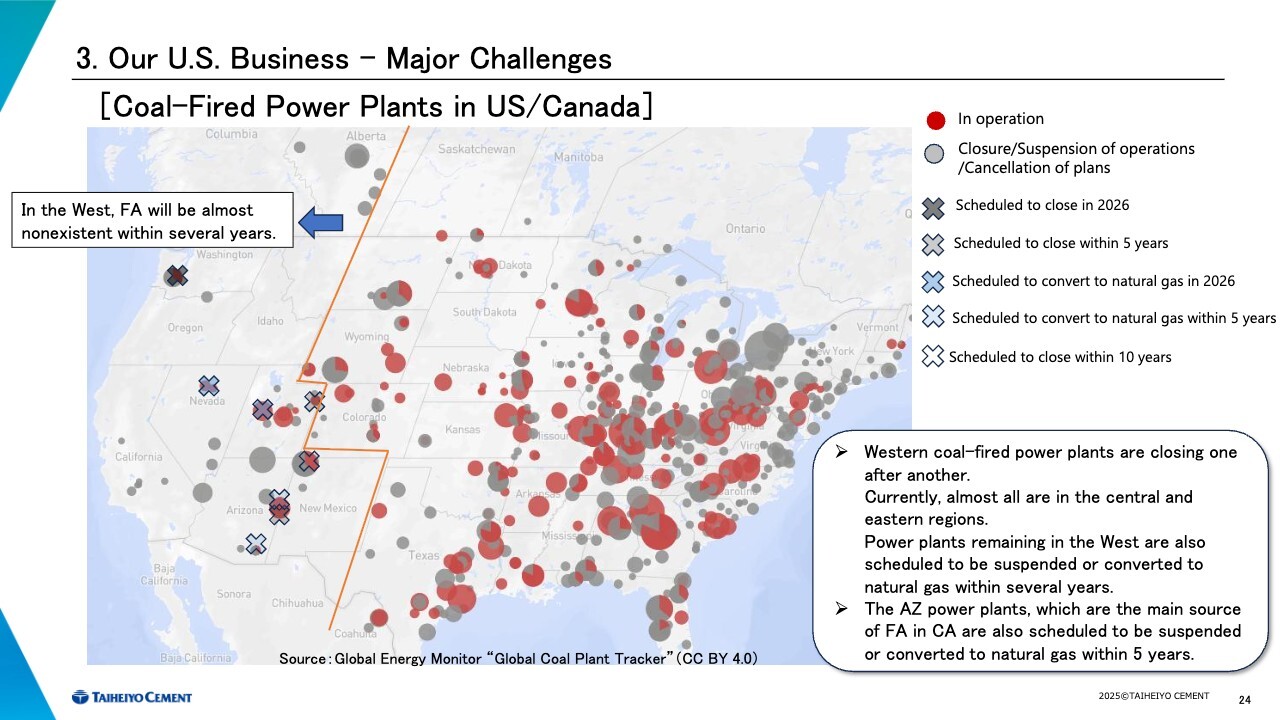

3. Our U.S. Business: 4) Major Challenges – Coal-Fired Power Plants in US/Canada

Turning to fly ash, it is a byproduct of coal-fired power plants, and this map shows the locations of those plants. Because coal-fired power plants in the western U.S. have closed one after another, most remaining plants are now concentrated in the central and eastern regions.

In addition, the remaining plants in the western U.S., including those near the West Coast, are scheduled to be suspended or converted to natural gas over the next five to ten years, making sourcing increasingly difficult.

Moreover, under these conditions, the slag and fly ash currently available in the market tend to be of inconsistent, and in some cases, insufficient, quality.

3. Our U.S. Business: 4) Major Challenges

As sourcing becomes more difficult, the Southwest faces another challenge: its aggregates are high in silica. The table refers to “alkali–aggregate reaction,” but in practice this mainly means alkali–silica reaction. Fly ash and slag are therefore essential to suppress this reaction.

In short, demand is extremely strong. When supply is limited and demand is high, prices rise. As a result, SCMs are sold at roughly 90% of the price of cement on the West Coast , making the SCMs business highly profitable.

Although this table does not show it, our peers are also focusing on this business. For example, this year CRH acquired Eco Material Technologies, a North American supplier of fly ash and pozzolans, for $2.1 billion.

At present, CPC sources slag and related materials mainly from competing suppliers in the U.S., including significant volumes from Eco Material Technologies. Going forward, purchases will shift to CRH, but moving to self-sourcing requires securing independent supply sources and import and distribution infrastructure.

By shifting to in-house sourcing and expanding the Stockton Terminal, we will resolve these issues and enable large-scale intake.

Starting in the second half of next year, we plan to import and supply high-quality slag and fly ash on a stable basis and build this into a major profit-generating business.

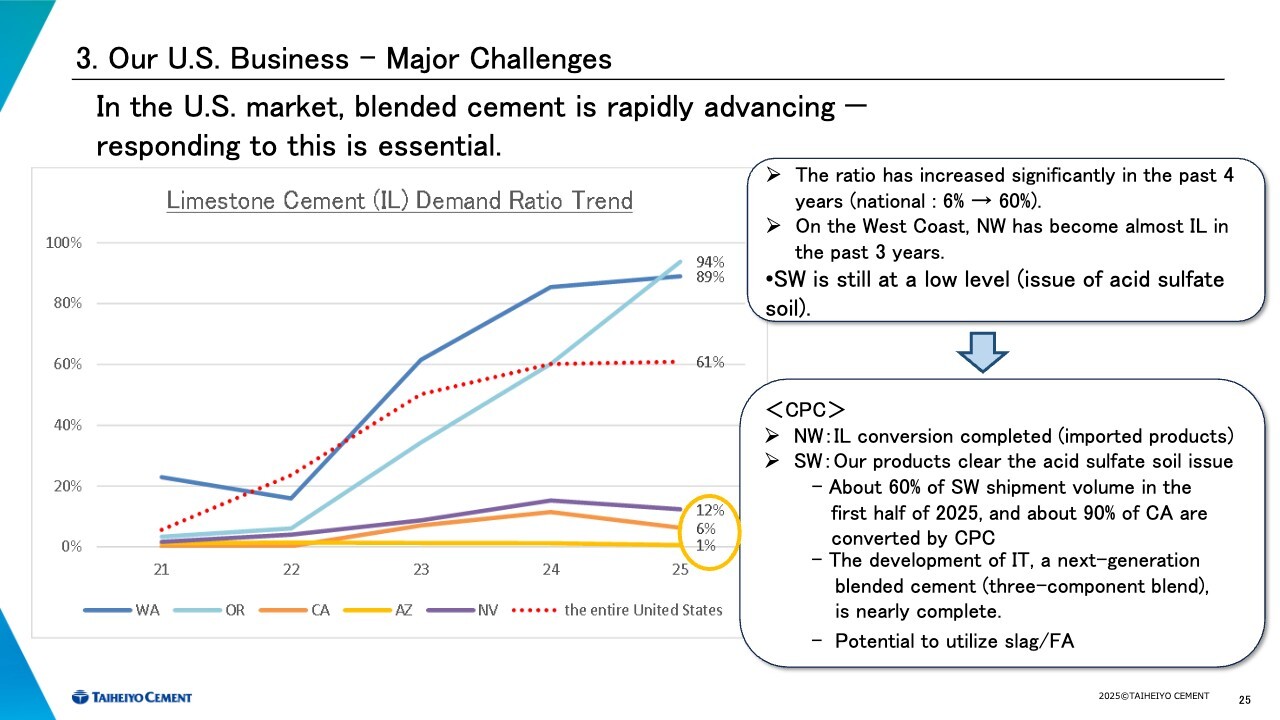

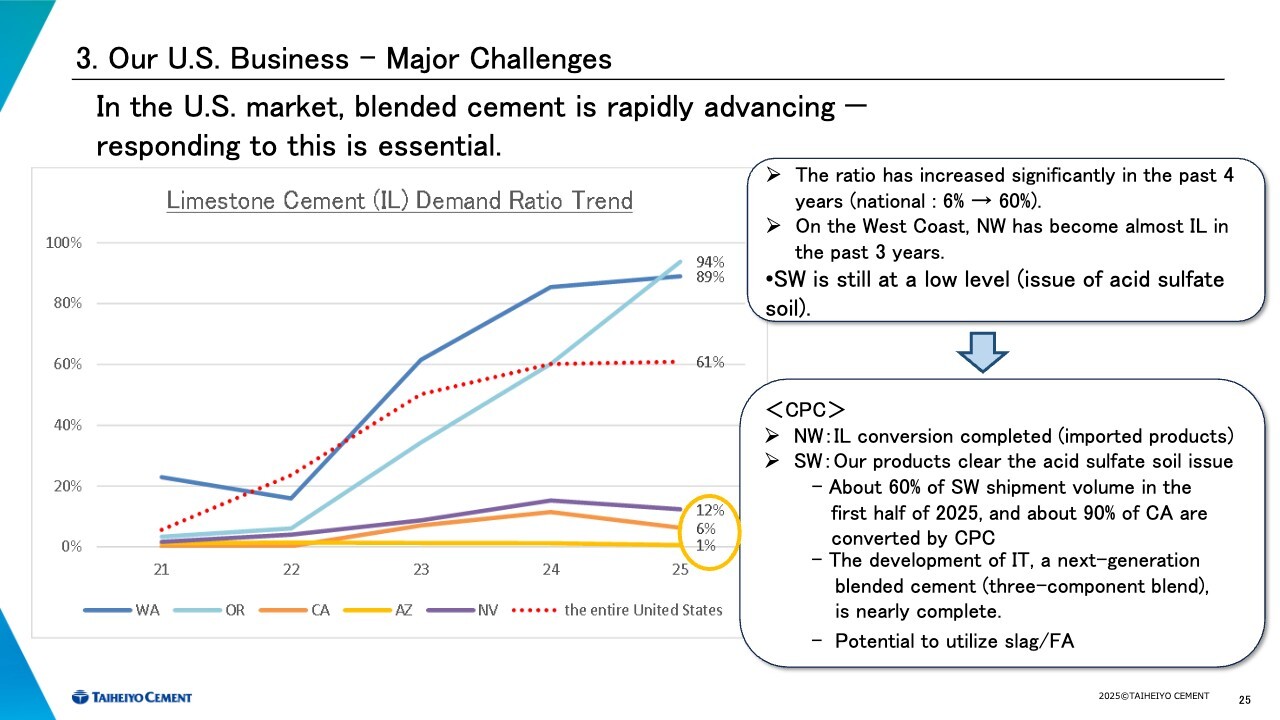

3. Our U.S. Business: 4) Major Challenges – In the U.S. market, blended cement is rapidly advancing — responding to this is essential.

As Fukami explained earlier, blended cement adoption has accelerated rapidly across the U.S. in recent years. In particular, Type IL cement, which blends limestone, is gaining broad acceptance.

Adoption was nearly zero in 2021, but by 2024 it is expected to account for about 60% of the total. However, adoption varies widely by region, and the West Coast has lagged.

However, in Washington and Oregon—both environmental leaders—strong guidance from state governments rapidly accelerated adoption, lifting it to around 90% in a short period.

In this region, all of our imported products have shifted entirely to Type IL. By contrast, adoption in the Southwest remains limited due to issues such as acid sulfate soils—even in California, widely regarded as the most environmentally focused state in the U.S.

However, the state is not standing still. In 2022, Caltrans, the California Department of Transportation approved the use of Type IL cement, and adoption is steadily advancing.

In addition, as part of California’s building code, the CALGreen Code mandates the use of low-carbon concrete in both public and private construction projects.

Starting in 2024, this code mandates embodied-carbon reductions for non-residential buildings larger than 100,000 square feet and for schools larger than 50,000 square feet.

From next year, the scope will expand, and the threshold for non-residential buildings will drop from 100,000 to 50,000 square feet.

In this way, California is advancing multiple initiatives, and once the quality issues discussed earlier are resolved, adoption is likely to accelerate rapidly—much like it did in the state of Washington.

Blended cement adoption is a cornerstone of our carbon-neutral strategy and a key pillar of our long-standing U.S. business strategy.

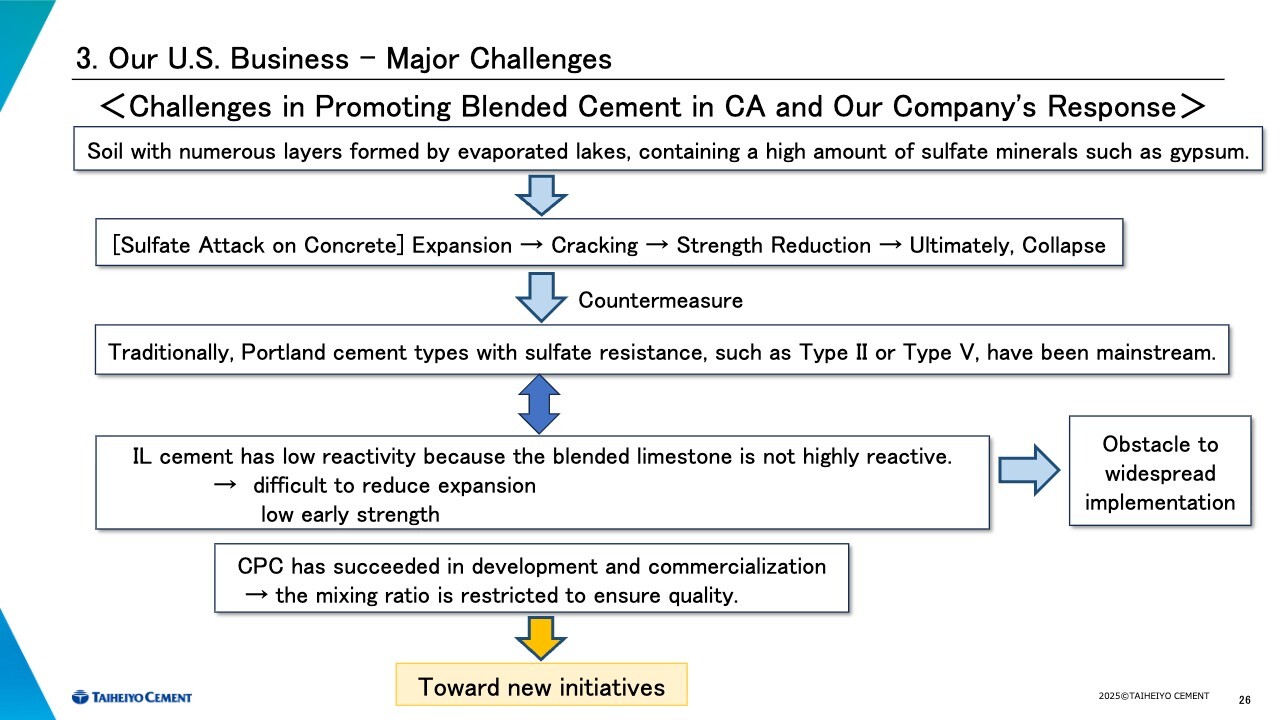

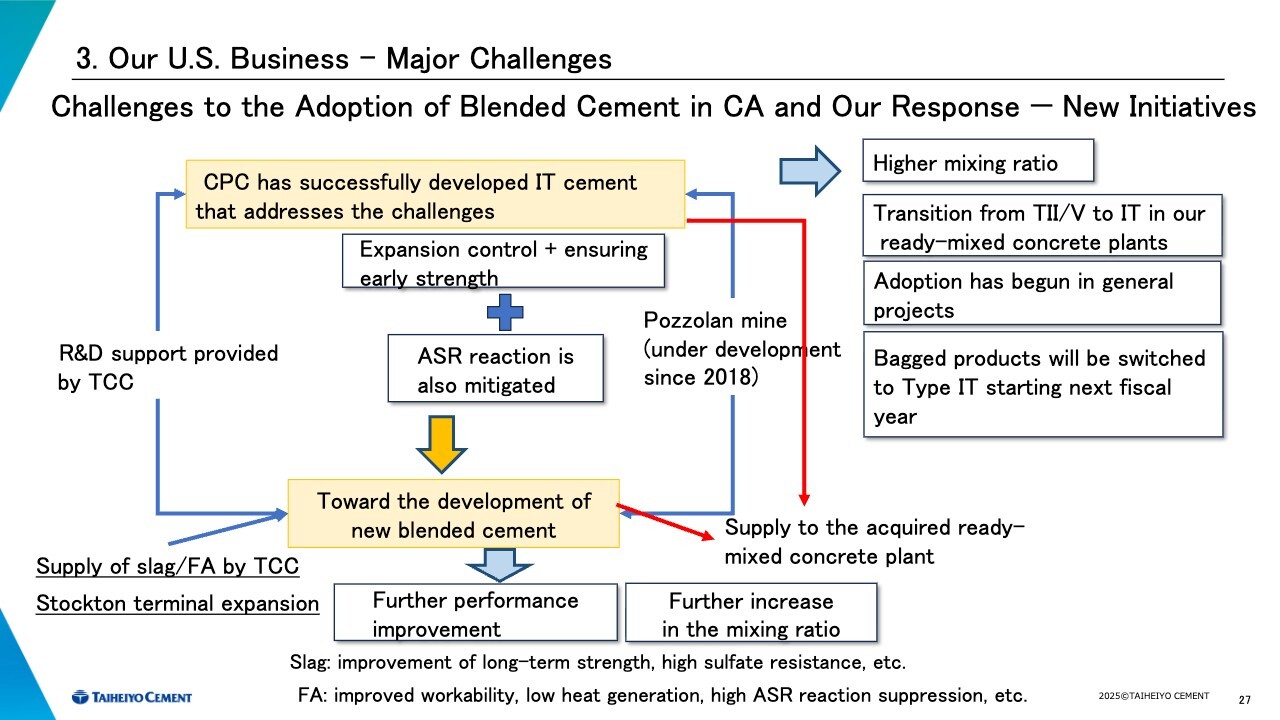

3. Our U.S. Business: 4) Major Challenges – Challenges in Promoting Blended Cement in CA and Our Company's Response

We revisited why blended cement adoption has lagged in California. A key challenge for concrete in California is the impact of acidic sulfate soils, as shown in the second item from the top of the slide. This condition leads to sulfate attack.

Sulfate attack causes expansion and cracking and, in severe cases, can lead to collapse. As a result, traditional Portland cement applications have favored sulfate-resistant Type II or Type V, rather than standard Type I.

By contrast, current Type IL blends low-reactivity limestone into the cement, which makes expansion difficult to control and limits early strength development. These performance constraints have limited blended cement adoption in California and similar markets.

In response, CPC has developed and launched a Type IL cement that addresses these issues. However, maintaining quality limits how much we can increase the mixing ratio, creating the need for new approaches.

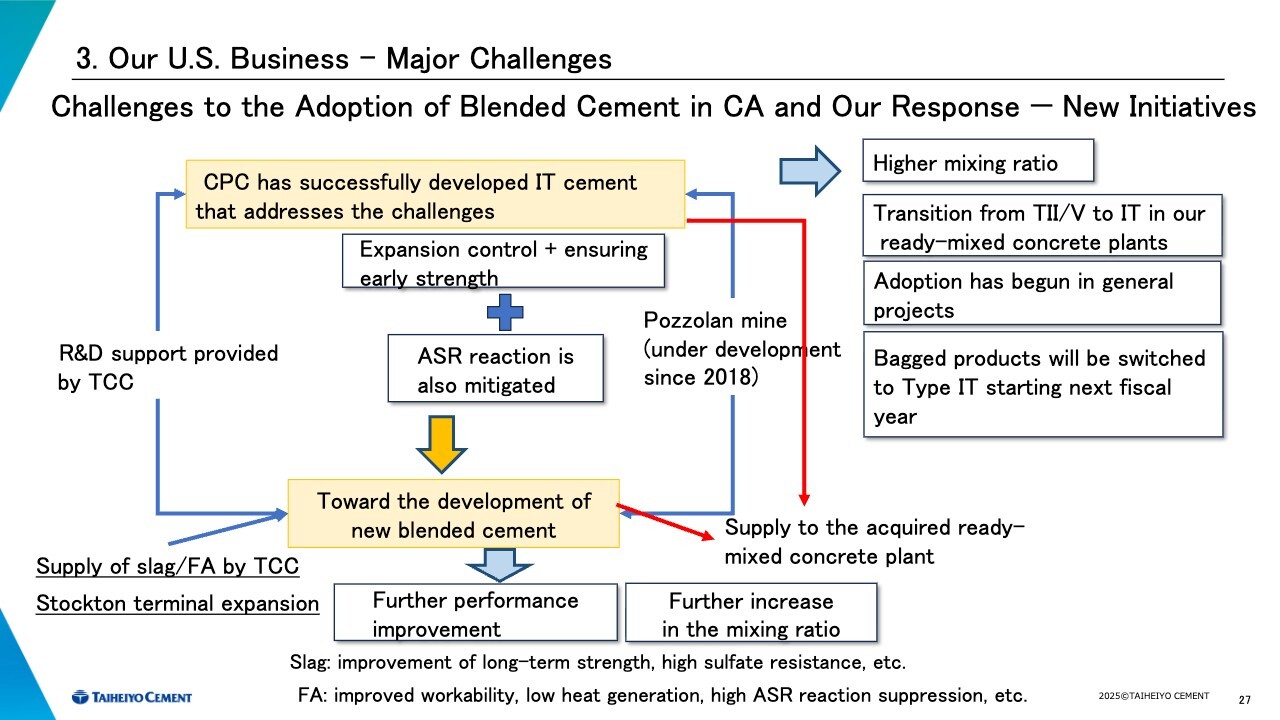

3. Our U.S. Business: 4) Major Challenges – Challenges to the Adoption of Blended Cement in CA and Our Response — New Initiatives

That new initiative is our next-generation Type IT blended cement, which we recently succeeded in developing. The achievement reflects years of combined efforts, including blended material supply from pozzolan quarries pursued since 2018 with support from our R&D division. The newly developed Type IT cement allows for a significantly higher mixing ratio compared with Type IL.

Type IT brings us closer to carbon neutrality. It also helps includes a feature that mitigates alkali-silica reactions, a common issue with aggregates in the Southwest region.

This advantage was recognized, leading to its adoption in the U.S.–Mexico border wall project in Arizona.

The key advantage is that Type IT cement reduces more CO₂ than Type IL cement from a carbon-neutral perspective, while matching the properties and usability of conventional Portland cement—and even outperforming it in several areas. This delivers a significant competitive edge.

As a result, CPC is transitioning its ready-mixed concrete plants from Type II/V to IT cement and continues to expand external sales.

This has also been recognized. For the bagged cement supplied by CPC, we have decided—at the request of distributors of bagged cement—to switch entirely to Type IT cement starting in the first quarter of next year.

In our operating regions, CPC is the only company actively selling Type IT cement. Competitors still primarily offer Type II/V, with some selling Type IL cement. We are the only company offering IT cement, and we believe this will become an increasingly significant competitive advantage going forward.

Starting next year, with the expansion of the Stockton Terminal, we plan to supply slag and fly ash to support the implementation of new cements. Specifically, we aim to produce blended cements combining either pozzolan with slag or pozzolan with fly ash.

As shown on the slide, slag and fly ash can be enhanced to add new functionalities. By strategically combining these materials, we aim to develop even more advanced new products.

Moreover, supplying the recently acquired ready-mixed concrete plants will strengthen the competitiveness of our concrete business and generate added value, creating new synergies. In this way, multiple strategies are closely interconnected, building both current and future profits.

Blended cement holds significant growth potential, and we expect it to definitely expand rapidly in California in the near future. By then, it will serve as a powerful asset, giving us a substantial current advantage.

4. Vulcan Company California Ready-Mixed Concrete Business Acquisition: 1) Deal Overview (Excerpted from FY2025 Q2 financial results briefing materials)

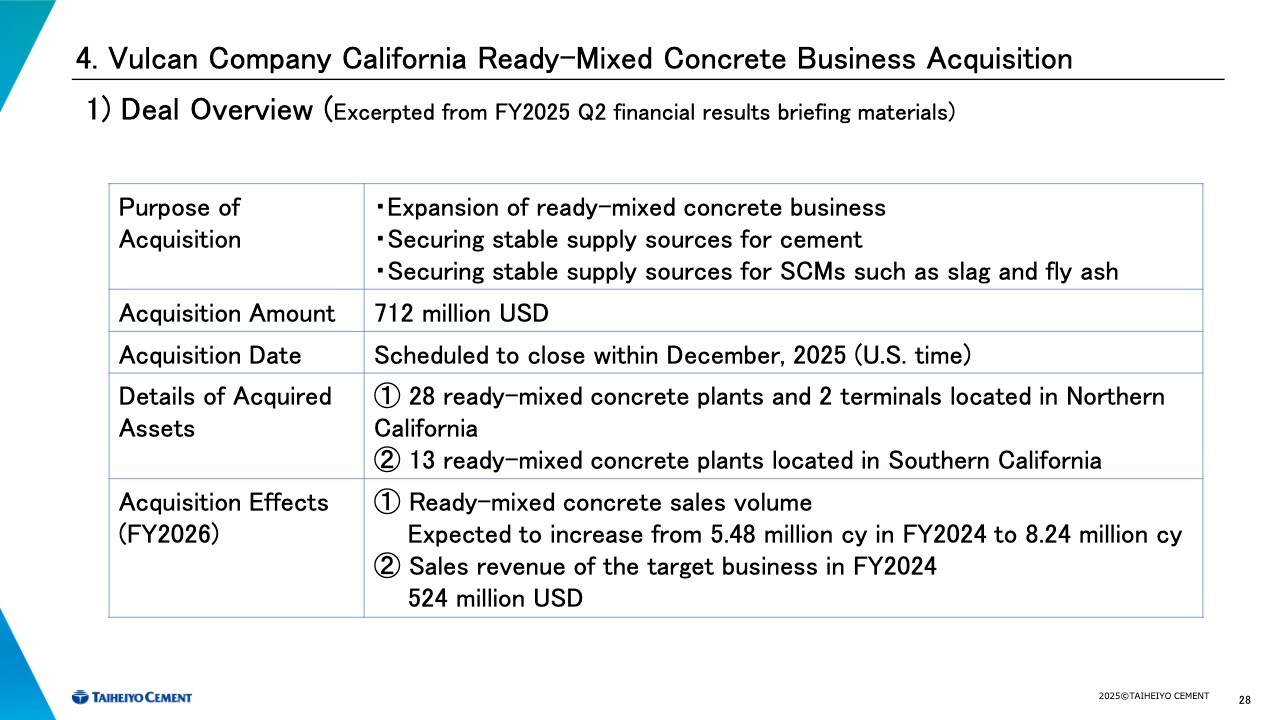

The fourth topic covers an overview of the acquisition of Vulcan Materials Company’s ready-mixed concrete business in California and its impact.

This is based on our official disclosure. For scale, the acquisition adds 2.8 million cubic yards, equivalent to approximately 2.1 million cubic meters. This volume is roughly equivalent to the Tokyo District Ready-mixed Concrete Cooperative Association’s projected shipments for the 2025 calendar year, making it a very significant deal.

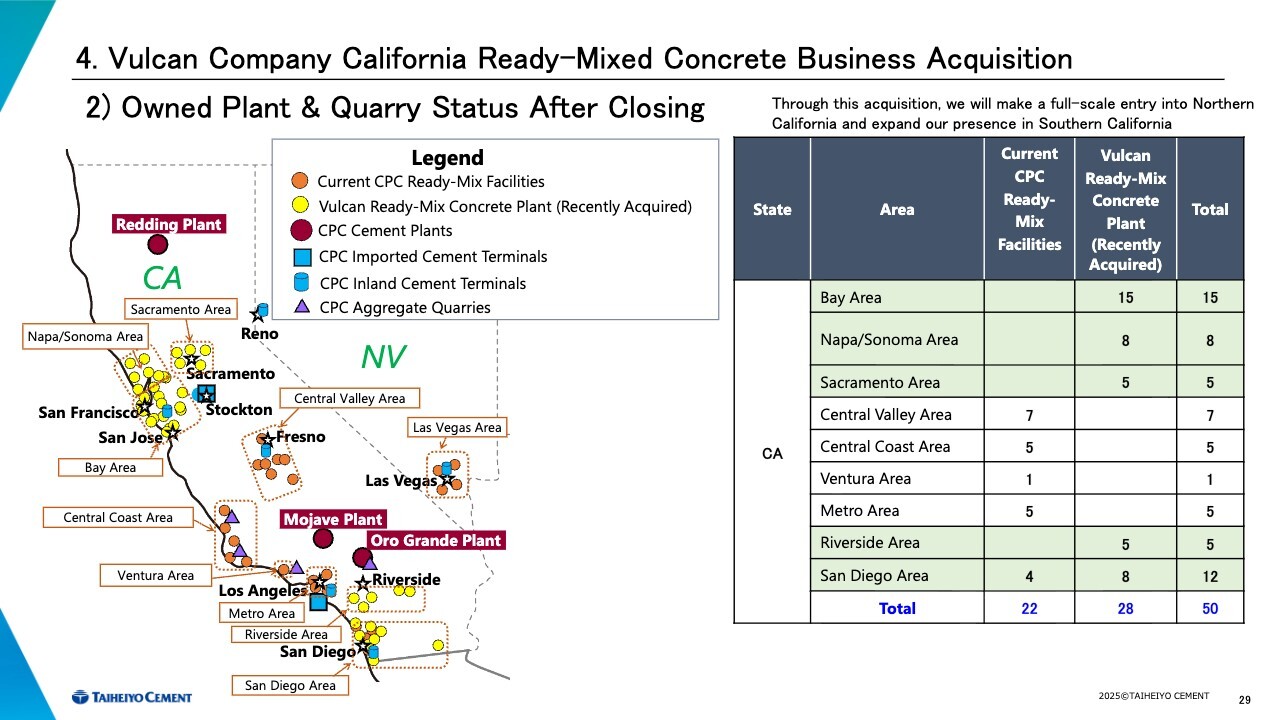

4. Vulcan Company California Ready-Mixed Concrete Business Acquisition: 2) Owned Plant & Quarry Status After Closing

This slide shows the location map of the plants to be acquired and the number of plants by region. Strategically, the key point is gaining a major presence in Northern California, particularly the Bay Area. In Southern California, the acquisition creates synergies with our existing plants in San Diego and enables entry into a new market in Riverside.

As a result, the acquisition nearly doubles our coverage of California’s top 30 cities by population. With coverage extending to almost all major cities, we can build a well-balanced ready-mixed concrete business tightly focused on demand centers.

4. Vulcan Company California Ready-Mixed Concrete Business Acquisition: 3) Examples of Acquired Plants

For reference, we include photos of the major plants in Northern and Southern California.

4. Vulcan Company California Ready-Mixed Concrete Business Acquisition: 3) Effects of the Acquisition

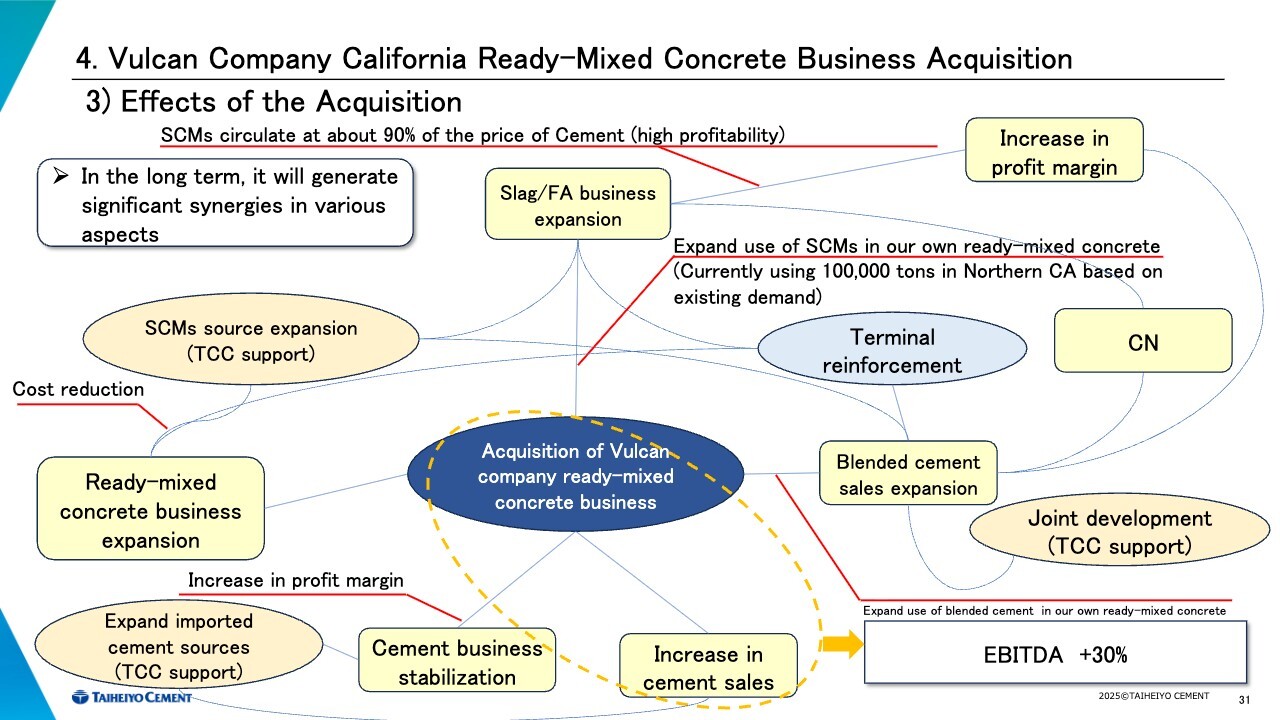

This slide outlines the expected benefits of the acquisition and illustrates the synergies it will generate.

The key message is that this acquisition goes beyond expanding our ready-mixed concrete business and the cement supply that supports it. It also drives growth in slag and fly ash business, expands sales of blended cement, and creates significant synergies toward achieving carbon neutrality.

At the November financial results briefing, we explained that this acquisition would lift EBITDA by roughly 30%. That estimate reflects only the impact from expanding the ready-mixed concrete and cement businesses.

However, this acquisition is strategically significant and has the potential to generate far greater spillover effects and profit beyond those initial estimates.

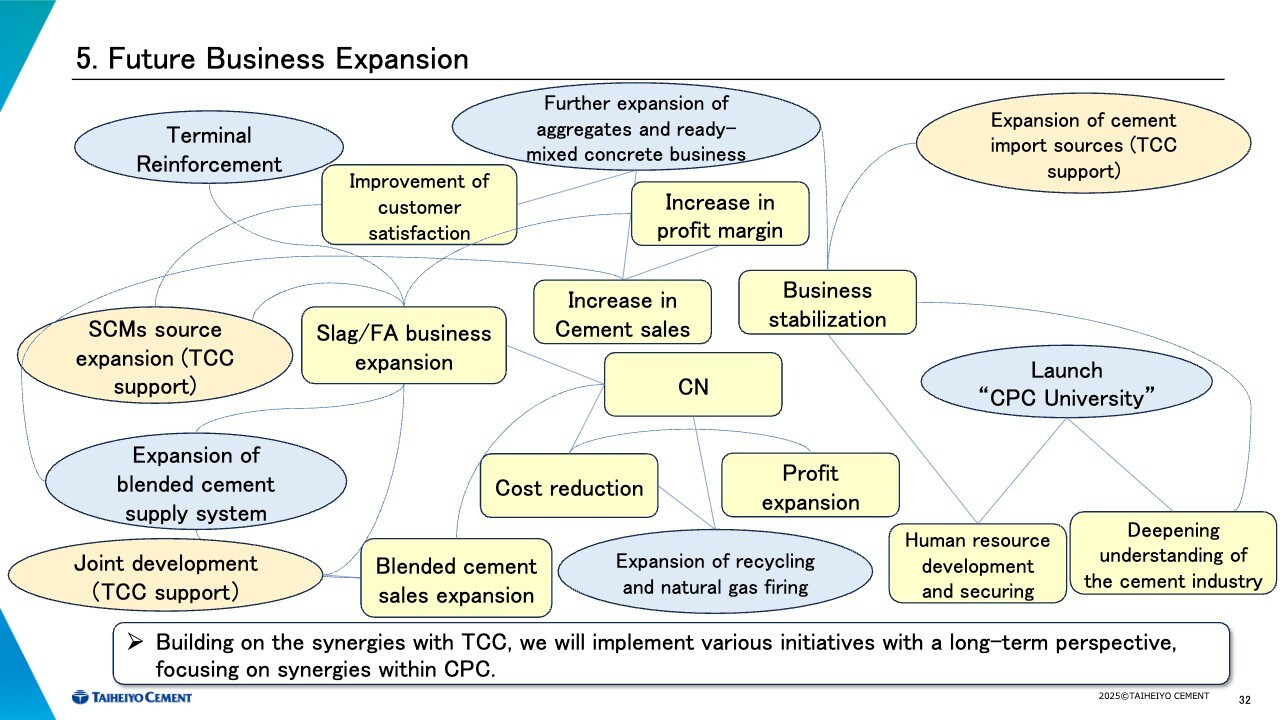

5. Future Business Expansion

Let me outline our plans for business expansion.

We will leverage group-wide synergies and pursue initiatives that prioritize synergy realization within our U.S. business, rather than focusing solely on short-term gains. In particular, we will concentrate on maximizing the value created by this acquisition.

We will also leverage the acquired ready-mixed concrete plants to expand higher-margin slag and fly ash businesses and accelerate sales of blended cement, driving profit growth and margin improvement.

On the cost side, we will pursue carbon neutrality while reducing costs by expanding the use of recycled fuels and increasing natural gas firing.

From a long-term perspective, CPC has established the “CPC University,” formally named the Advancement Institute, with the aim of developing and securing talent and promoting broader understanding of the cement industry within society. The program has initially been launched for employees, with plans to gradually expand its scope to the broader industry and local communities.

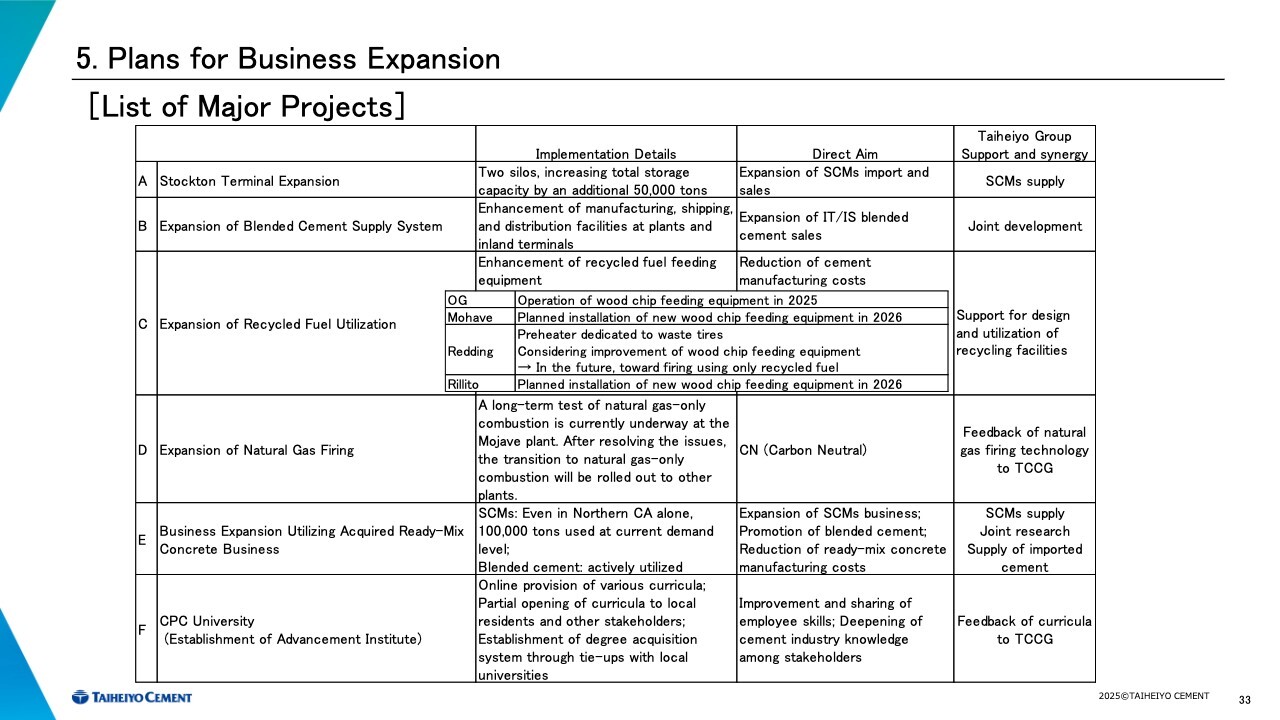

5. Plans for Business Expansion: List of Major Projects

The following pages summarize our key initiatives and how they align with our management objectives. Please review them later.

That concludes my presentation. Thank you for your attention and for staying with us throughout.

Q&A: Our strategy to expand the adoption of blended cement in California

Questioner: I’d like to ask about your blended cement strategy. Referring to page 25 of the materials, is the blended cement share in California still very low—around 6%?

What level of increase in this ratio do you expect toward 2030? Also, at that point, do you expect your cement supply to be primarily Type IT or Type IL?

Respondent 1: First, on why blended cement adoption accelerated in Washington and Oregon: adoption was initially low in both states. The turning point came in 2024, when a requirement to disclose EPD (Environmental Product Declaration) metrics was introduced under a new state policy, the Buy Clean Washington Act.

In addition, CPC moved swiftly from 2023 to 2024 to convert its imported products to Type IL cement. We believe this shift, combined with strong government leadership—particularly long-standing guidance from transportation authorities promoting low-carbon cement and concrete—has been a major driver of adoption.

In addition, the presence of leading companies such as Google and Microsoft has created strong demand from end users. The combination of government leadership and user-driven requirements has accelerated adoption significantly.

Oregon is in a largely similar position. Turning to California, we are not standing still. The regulatory framework is expected to tighten steadily, and as mentioned earlier, both the CALGreen Code and Caltrans, the California Department of Transportation have clearly stated their intent to actively promote the use of low-carbon concrete.

As regulations tighten, quality concerns have remained a constraint. However, once these issues are largely resolved for Type IT and certain Type IL products, we expect these factors to align and drive a rapid increase in adoption.

While the exact share in 2030 remains uncertain, several research organizations project that blended cement penetration could reach 50% to 60%.

I share that view and believe penetration could reach those levels, assuming the government tightens regulations as planned. In that scenario, CPC would clearly focus on supplying Type IT cement.

Currently, CPC’s Type IT cement blends clinker, limestone, and pozzolan. Over time, it may evolve to include clinker, limestone and fly ash, or clinker, pozzolan and fly ash formulations.

It is critical to steadily increase mixing ratios while maintaining high quality, contributing to carbon neutrality. We expect to be able to supply a new formulation under the same Type IT designation at that time.

Q&A: Outlook for sustaining a competitive advantage in Type IT cement

Questioner: You explained that securing slag and fly ash is the key to Type IT cement. At present, only your company can produce it. How long do you expect this advantage to last, and do you believe competitors will be unable to produce Type IT cement in the near term, and what is your outlook for sustaining this competitive edge?

Respondent 1: This is a very challenging question. One key fact is that selling a new product in Washington requires registration on the Qualified Products List (QPL).

This shows that Amrize, the former Holcim, has registered Type IL product in Washington and Oregon.

Product registration takes close to a year and cannot be completed in just one or two months. As a result, even if competitors try to launch sales immediately, near-term entry would be difficult.

Amrize has registered products only in Washington and Oregon and cannot yet sell in other states. That is the current situation.

Accordingly, we expect this competitive advantage to persist for at least one year. Based on our assessment of competitors’ development progress, it could last even longer.

We do not have full visibility into competitors’ plans, so this concludes our response.

Q&A: Overview of competitors in the California market

Questioner: Amrize appears to have limited presence in California. How do you assess the risk of competitors catching up in California, which is your most critical market?

Respondent 1: It is difficult to assess competitors in detail, but among companies supplying Type IL cement, CPC and National, a subsidiary of France’s Vicat, are the primary players.

There are also reports that some products made by Mexico-based Cemex qualify as Type IL, but in the U.S.—and particularly in California—CPC and National account for the vast majority of Type IL supply.

As shown here, in the first half of 2025, CPC supplied roughly 90% of Type IL shipments in California within the Southwest region. Taken together, CPC and National account for nearly all Type IL supply in the state.

In this context, it would be extremely challenging for companies that do not currently produce blended cement to suddenly start manufacturing Type IT cement.

Q&A: Slag sourcing and profitability in blended cement

Questioner: I’d like to ask about slag sourcing. In the U.S., the share of electric furnaces is expected to rise further as the move toward carbon neutrality accelerates. Globally, we also anticipate a shift from blast furnaces to electric furnaces.

In that case, slag sourcing will become an increasingly critical issue. As the share of electric furnaces grows, will you be able to continue producing blended cement while securing a stable supply of slag?

Additionally, as slag prices rise, cement prices may also increase. How do you assess profitability under those conditions?

Respondent 2: Regarding slag sourcing, we are currently considering several supply sources for planned imports to the Stockton Terminal, including Japan, Indonesia, and potentially China.

You are correct that there is a trend toward shifting from blast furnaces to electric furnaces. However, we do not currently expect slag prices to double suddenly or significantly impact our business profitability. That said, this is an important point, and we must remain vigilant and proactive as the transition from blast furnaces to electric furnaces progresses.

Another key point is that we are also considering importing fly ash. It is practical to evaluate how to blend fly ash and slag under different conditions. Since both materials can essentially be imported, we plan to manage operations with them in mind.

Domestically, you are correct that sourcing within the U.S. will likely become increasingly challenging. On the other hand, this suggests that our import terminal business should maintain a competitive advantage for the foreseeable future.

Respondent 1: This is not about the profitability of the import terminal. One key driver behind our 2018 plan to develop a pozzolan quarries was the belief that we should own and control cementitious material resources rather than depend on other industries. In this regard, we believe the pozzolan quarries will become increasingly important moving forward.

Questioner: If you proceed with importing fly ash, can we assume it will remain economically viable even after accounting for costs?

Respondent 2: That is correct.

Q&A: Cement production capacity and profitability in the U.S.

Questioner: I’d like to ask about cement production capacity in the U.S. Overall, imports account for roughly 20% to 30% of supply, which allows for some flexibility in adjustments.

However, during events like the Lehman Shock, falling prices led to losses. Given the current environment, can you explain whether operations can maintain strong profitability while keeping fixed costs under control?

Respondent 1: Referring to the Lehman Shock, conditions varied by state, but demand fell by roughly 40% over two to three years, with some cases seeing demand drop to only 40% of its original level, creating extremely challenging circumstances. As a result, cost reductions could not keep pace, and manufacturers prioritized volumes to recover fixed costs.

Although demand is still gradually declining, the decrease is slow. This allows us to manage the situation to some extent through measures such as reducing fixed costs. Therefore, prices have not fallen at this time.

Questioner: If demand were to drop by 30% to 40%, as during the Lehman Shock, which would obviously be very challenging. Under normal conditions, is it correct to understand that you can maintain profitability by properly managing fixed costs?

Respondent 1: That is correct. Please note that this applies only to scenarios where demand drops sharply by 30% to 40% within two to three years.

Q&A: Adoption of Type IT cement

Questioner: I have a question about Type IT cement. It appears to be a product that primarily benefits your company—do you really expect adoption to increase significantly across the entire state under current conditions?

Respondent 1: We understand your concern. Regarding Type IT, as mentioned earlier, we view it as a viable alternative to Type II or V cement and do not intend to promote Type IT exclusively.

The government is also expected to manage blended cement adoption carefully, balancing supply and demand to ensure production and supply capacity keep pace and avoid a sudden surge in demand that outpaces supply.

On the other hand, given California’s strong commitment to reducing CO₂, we expect low-carbon cement is increasingly likely to be specified for certain projects, particularly public works.

In particular, favorable EPD (Environmental Product Declaration) scores are expected to give CPC a significant competitive advantage.

However, because competitors cannot ramp up supply immediately, we do not expect rapid adoption. At the same time, we expect growing recognition that “since no one else is producing it, we have the opportunity to capture the market.”

Q&A: Post-M&A self-sufficiency rate in aggregates

Questioner: From a numbers perspective, if this M&A goes through, the combined ready-mixed concrete volume would exceed 8 million cubic yards. Based on that volume, how should we estimate your current aggregate self-sufficiency rate?

Respondent 1: Assessing the internal sales ratio for aggregates is particularly challenging. Unlike cement, which is mainly used in ready-mixed concrete (with some use outside of ready-mixed concrete), most aggregates tend to be used for road base materials when measured purely by volume.

One reason aggregate companies are generally not motivated to “own ready-mixed concrete businesses farther downstream” likely stems from this dynamic. Instead, they tend to prefer holding downstream asphalt. This is probably because lower-grade material sells more easily in road base applications.

As for aggregates, margins are relatively high, but lower pricing and absolute profit than cement severely limit their ability to absorb transportation costs.

Accordingly, a sound management strategy is to sell to customers with reliable demand in well-located markets rather than maximizing internal sales. As a result, while we monitor the internal sales ratio, we do not treat it as a key performance metric.

Q&A: Acquisition of aggregate quarries

Questioner: Including California, resource development is extremely difficult, which makes permitted assets scarce and highly valuable. As recent M&A activity shows, a meaningful number of quarries remain family-owned.

We understand that Mitsubishi UBE Cement Corporation is evaluating a range of opportunities. Strategically, is it fair to say that you would pursue acquisitions of aggregate quarries when attractive assets become available?

Respondent 2: That is correct.

Q&A: Carbon intensity

Moderator: We received a question on how carbon intensity across the U.S. business will evolve as the transition progresses from Type IL to Type IT, and how we are addressing improvements in carbon intensity from a Scope 3 perspective.

Respondent 1: Some of these are technical questions and therefore difficult to answer precisely. That said, initiatives such as using recycled fuels, increasing natural gas utilization, and expanding blended cement should reduce carbon intensity per ton of cement.

At present, Scope 3 for ready-mixed concrete covers delivery to the end user, including transport to the job site. For cement, while we are evaluating Scope 3 boundaries, we have not yet implemented reduction initiatives.

Q&A: ETS in California

Moderator: We received a question on our views on the future direction of the emissions trading system (ETS) in California and how we expect it to impact our cost burden.

Respondent 1: Regarding the emissions trading system (ETS) in California, we noted that market prices are currently around $30, although they briefly exceeded $40 in early 2024.

However, as you might expect, prices fell sharply after President Trump took office and have since declined to near the government-set reserve price.

Looking ahead, younger generations in the U.S. are highly sensitive to environmental issues. As a result, even a Trump administration may need to maintain a degree of engagement on environmental policy to remain electorally competitive.

We expect prices may recover modestly. At the same time, we are advancing CO₂ reduction initiatives to limit any significant increase in costs.

Q&A: Adoption and profitability of Type IT cement

Questioner: We see significant added value in Type IT cement. What does current customer demand look like?

As you expand sales, how do you expect profitability to evolve? Specifically, does its carbon-neutral positioning allow you to command a higher price?

Respondent 1: Adoption of Type IT remains limited, as the product is still relatively new. Despite the significant time invested in its development, we have not yet reached a point where, for example, 80% of cement production has shifted to Type IT.

That said, as discussed earlier, we plan to transition all bagged cement products to Type IT starting next year. In addition, bag distributors want to label these products as “low-carbon cement,” and we believe adopting Type IT will help drive cement sales.

This is critically important. Selling Type IT strengthens our customers’ sales efforts and ultimately increases our cement sales volumes.

We believe this is particularly effective at the consumer-facing end of the value chain. It also resonates strongly with environmentally focused technology companies such as Google, and we expect adoption to continue to expand.

As a reference point, we expect the shift in bagged cement to add approximately 200,000 tons.

As mentioned earlier in the context of the Arizona border wall, alkali–silica reaction occurs in that region. Without additives such as fly ash, ready-mixed concrete is prone to cracking.

As a result, cement that incorporates these properties upfront is easier to use and requires no additional silos, which drove its adoption.

In short, pre-blended cement is highly effective both operationally and environmentally, and we expect this to drive a significant increase in sales volumes going forward.

On the cost side, maintaining high quality means Type IT does not currently offer a meaningful cost advantage versus Type II/V. However, we see potential for cost reductions over time through higher production volumes and process improvements.

On pricing, we view it as highly important that blended cement is currently sold at the same price as Type II/V. Going forward, we plan to maintain at least price parity while enhancing its value as a green cement and exploring opportunities for price increases.