Nihon Nohyaku Company Profile

Hiroyuki Iwata (hereinafter "Iwata"): My name is Hiroyuki Iwata, President and Representative Director of Nihon Nohyaku. Thank you very much for taking time out of your busy schedule today to participate in our interim financial results briefing for the fiscal year ending March 31, 2026. Since some of you may be attending the briefing for the first time, we will begin with a brief introduction of Nihon Nohyaku.

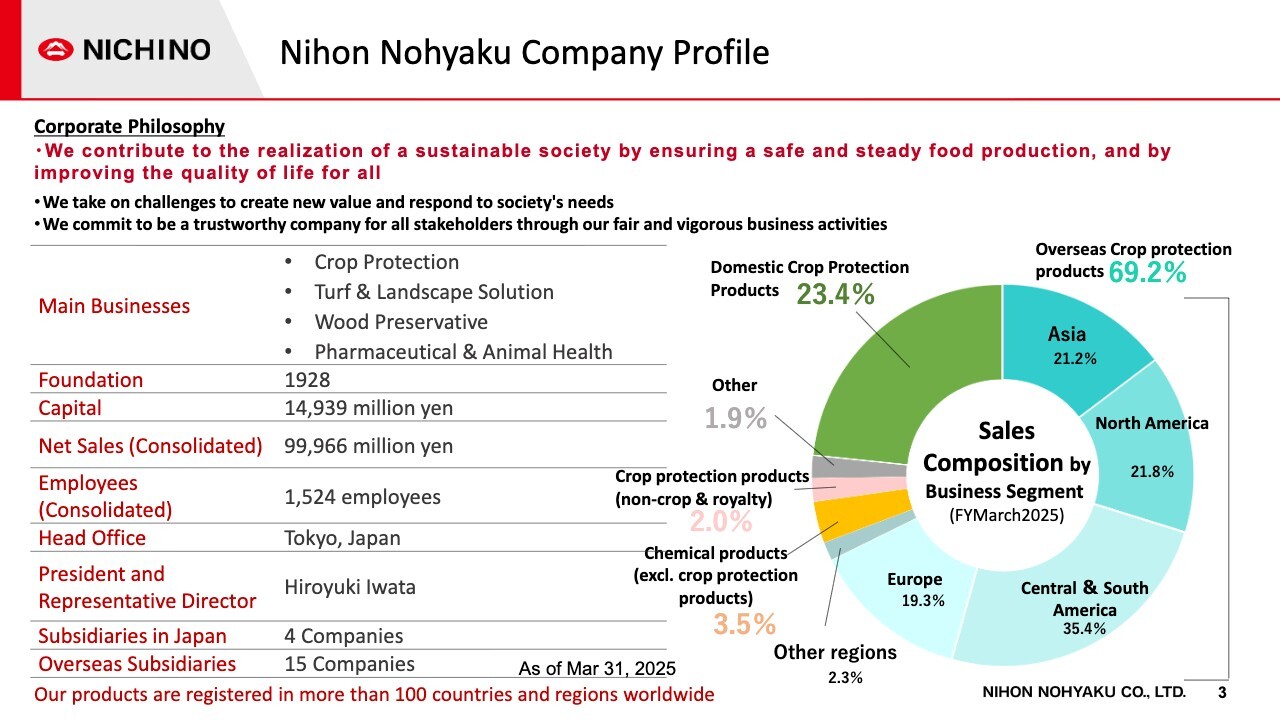

Since its establishment in 1928 as Japan's first manufacturer specializing in crop protection products, Nihon Nohyaku has developed with a focus on the crop protection products business under the corporate motto of "Protecting Food and Life."

In the previous fiscal year, net sales were approximately 100,000 million yen. The company sells products in over 100 countries and, as shown in the pie chart at right, is a global company with approximately 70% of its sales overseas and 30% in Japan.

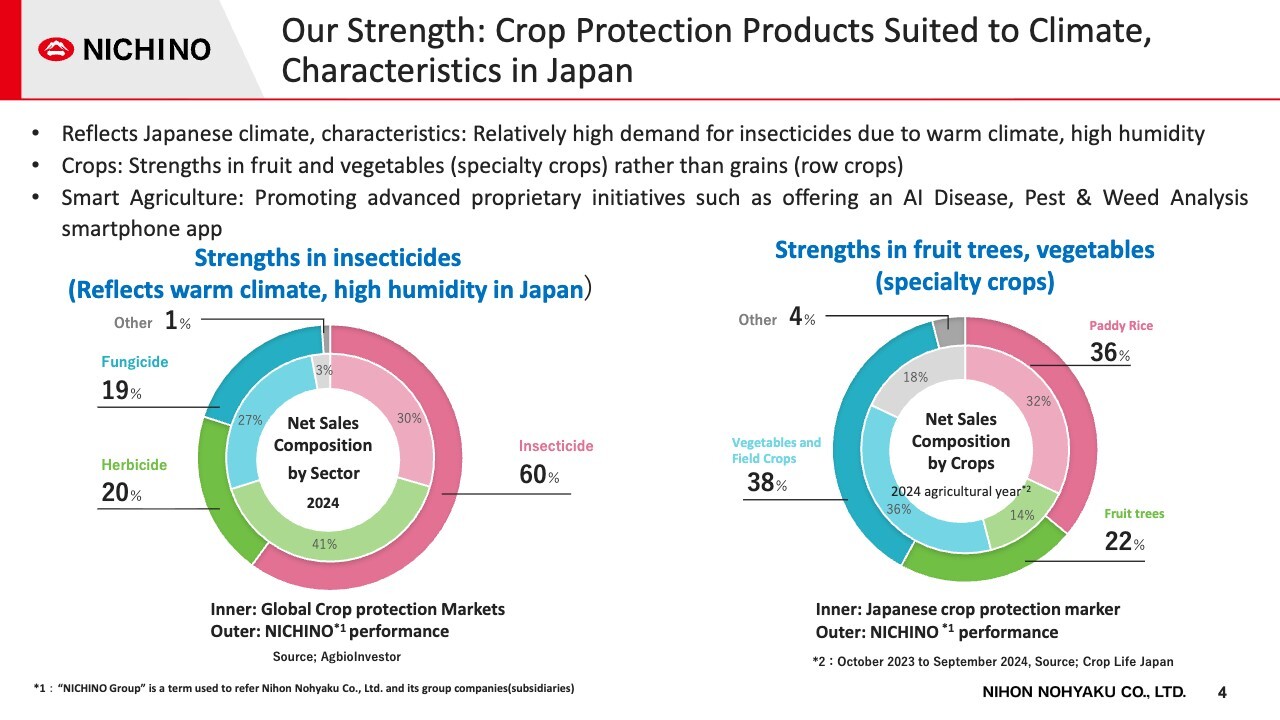

Our Strength: Crop Protection Products Suited to Climate, Characteristics in Japan

This slide presents characteristics of the company. The graph at left shows the net sales composition of the global crop protection products market by sector on the inside and our net sales composition on the outside. Reflecting the warm and humid climate of Japan, the company is relatively strong in insecticides.

The graph at right shows the composition of net sales by crop in the domestic crop protection products market on the inside and our net sales composition on the outside. We are particularly strong in the areas of fruit trees and vegetables.

The company is also preempting competitors in advancing a unique approach to smart agriculture, including the provision of an AI-based disease, pest and weed diagnostic application.

That constitutes a brief introduction to the company.

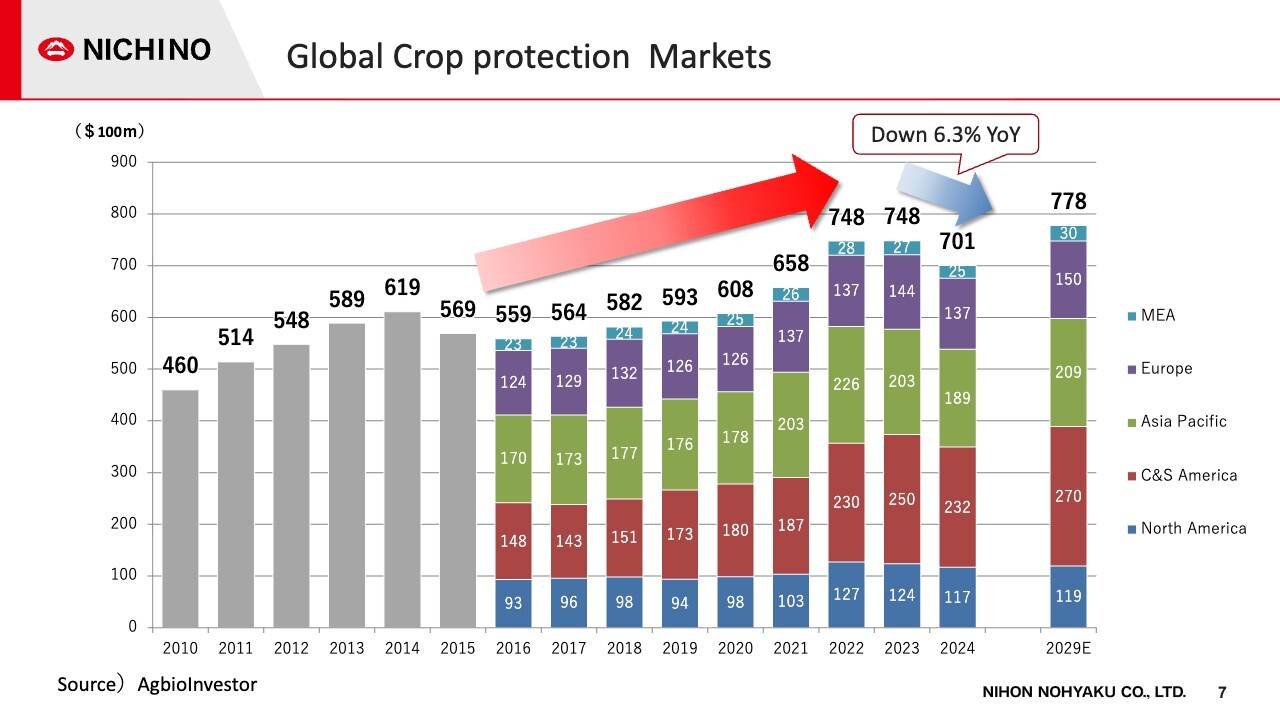

Global Crop Protection Markets

Moving on to today's main topic, an overview of financial results, I will first discuss the global crop protection products market. The graph shows global crop protection products market performance from 2010 to 2024.

This market, which has been on an expansionary trend for the past several years due to increased demand in the Americas and other regions, was significantly affected in 2024 by falling prices, bad weather, and an increase in distribution inventories, resulting in a 6.3% decrease from the previous year to $70.1 billion.

However, the market is expected to expand under growing demand for food against a backdrop of global population growth and economic development in emerging countries.

The global crop protection products market is expected to grow at a compound annual growth rate of 2.1% over the next five years, reaching $77.8 billion (approximately 11 trillion yen) by 2029.

Global Crop Protection Markets

This slide looks at the global crop protection products market by region. In Japan, demand for crop protection products remained strong due to continued high temperatures, which have led to an increase in pests such as stink bugs and lepidopteran species, and due to an increase in rice paddy planted acreage under soaring rice prices.

In North America and Latin America, inexpensive generic pesticides are gaining ground as a result of falling prices for major crops such as corn and soybeans, which places constraints on costs associated with production.

In Europe, overall demand for agrochemicals weakened due to drought and other unfavorable weather conditions in some regions.

In Asia, agrochemical prices and demand for agrochemicals remained weak due to effects of distribution inventories and due to reduced opportunities to apply crop protection products in some parts of India due to heavy rains.

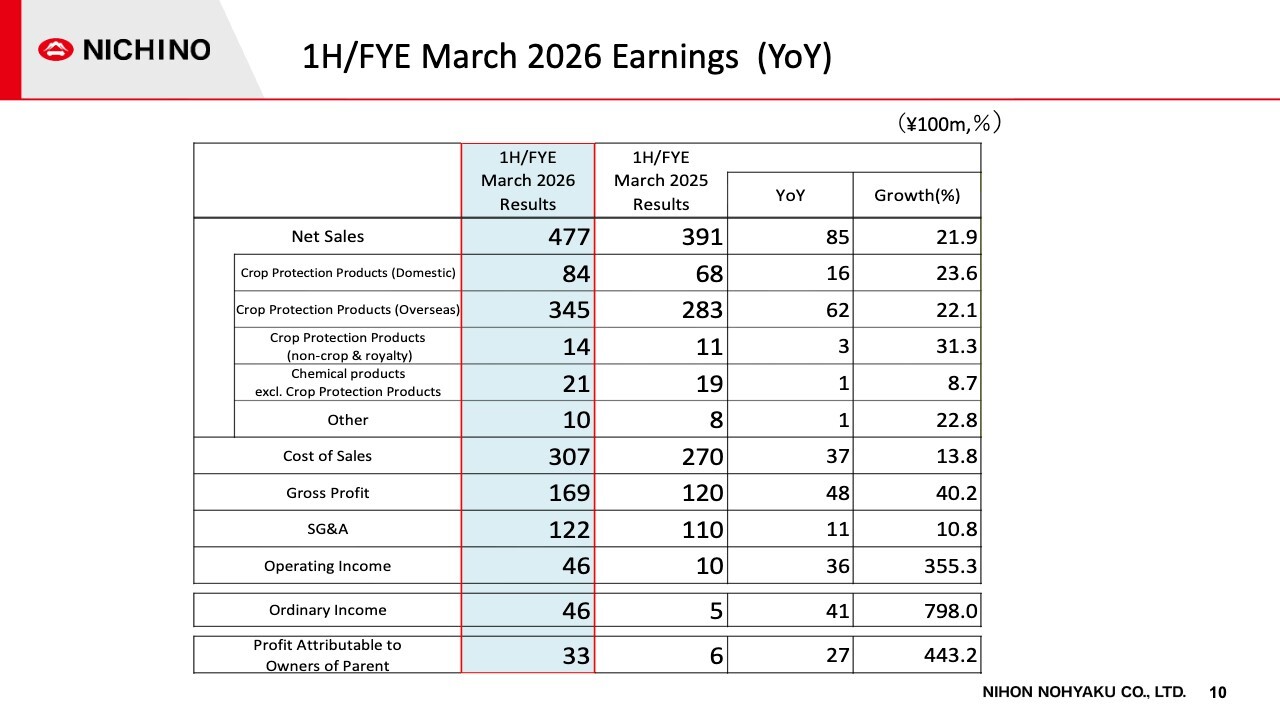

1H/FYE March 2026 Earnings (YoY)

Looking at results for the first half of the fiscal year ending March 31, 2026, net sales were up more than 20% year on year due to strong sales in our core crop protection products business.

In Japan, sales of products for paddy rice were strong thanks to production motivation under soaring rice prices. In North America and Europe, sales of acaricides were strong as dry weather led to an increase in mite infestations. Sales of herbicides were also strong, with a particularly strong contribution from increased demand in Canada.

Operating profit increased by 3,600 million yen to 4,600 million yen, ordinary profit increased by 4,100 million yen to 4,600 million yen, and profit attributable to owners of parent increased by 2,700 million yen to 3,300 million yen.

The ratio of overseas net sales to total sales was 72.4%, unchanged year on year.

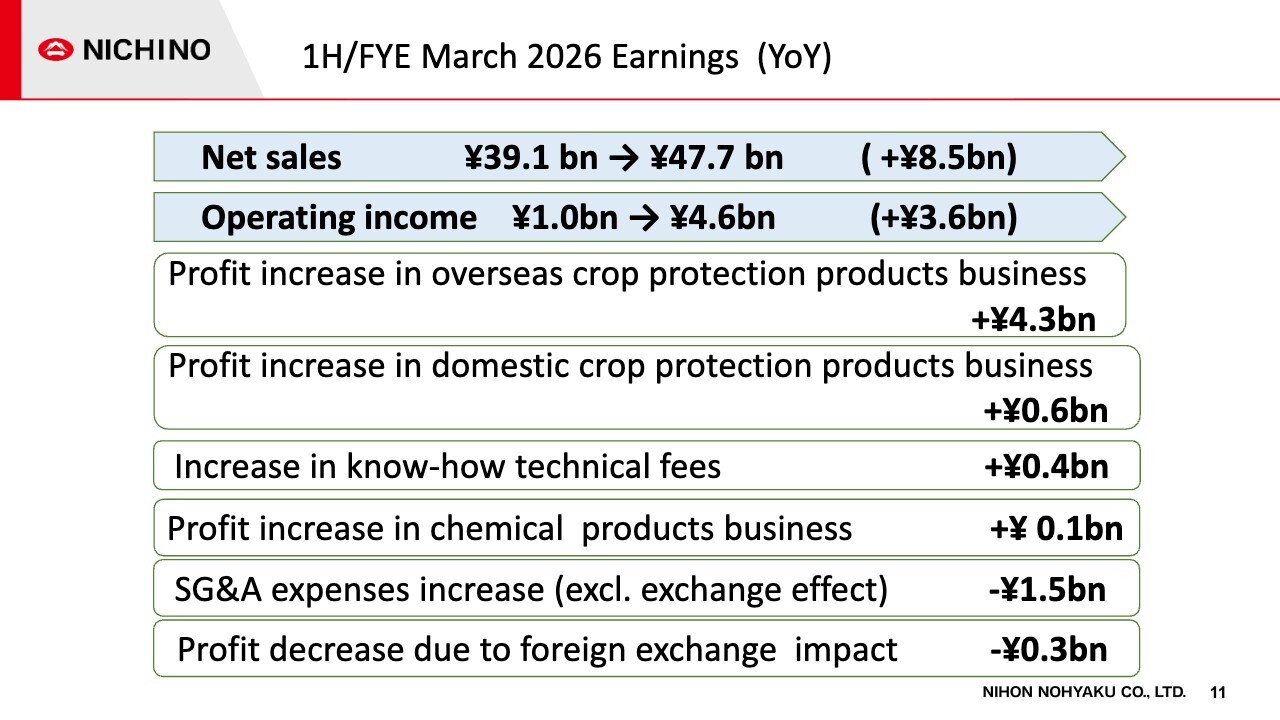

1H/FYE March 2026 Earnings (YoY)

Here I would like to explain factors behind the year-on-year increase in operating profit. Overseas crop protection products sales, which were strong mainly in North America and Europe, contributed 4.3 billion yen, domestic crop protection products sales contributed 0.6 billion yen, and know-how technical fees, which include patent royalties, contributed 0.4 billion yen.

Increased R&D and other SG&A expenses resulted in a 1.5 billion yen decrease in profit while foreign exchange impacts resulted in a 0.3 billion yen decrease. Overall, operating income increased by 3.6 billion yen.

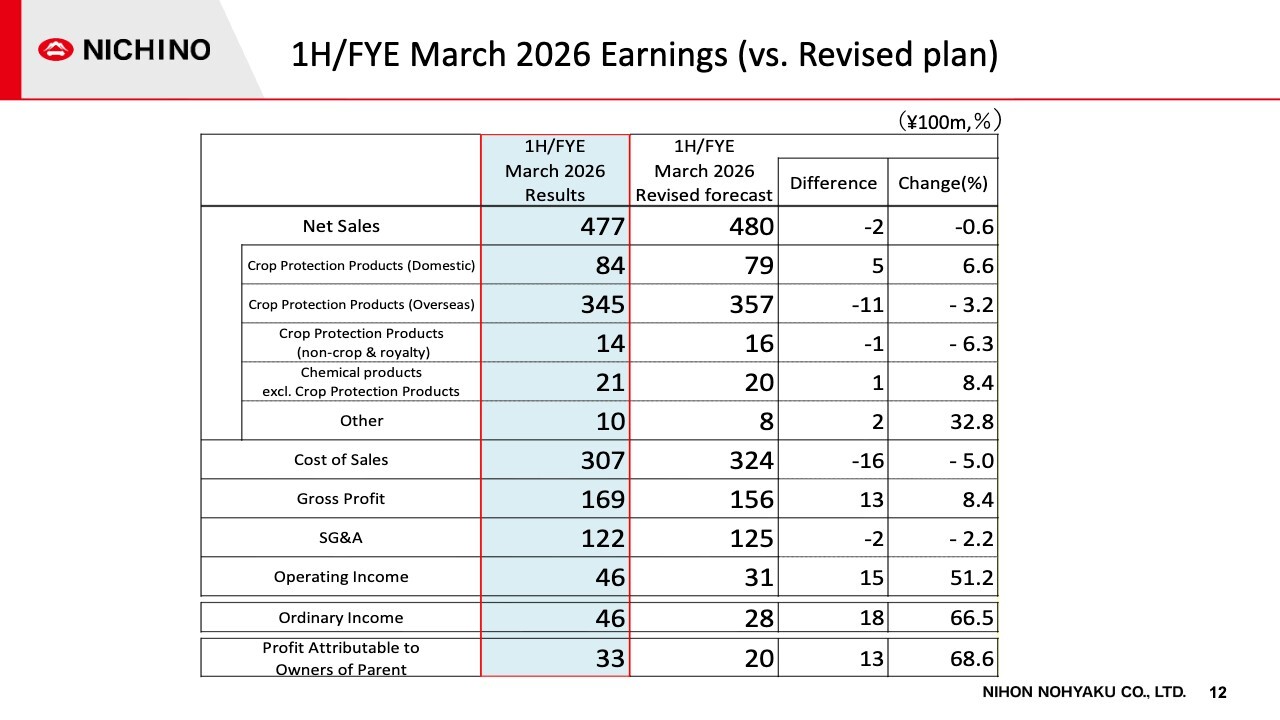

1H/FYE March 2026 Earnings (vs. Revised plan)

This table compares results for the first half of the current fiscal year with the revised forecast announced on August 7.

Net sales declined due to a decrease in pesticide application opportunities at our Indian subsidiary due to torrential rains in some areas. Sales of crop protection products overseas declined as a result of the shift of some sales at our North American subsidiary to the second half of the year, but this was offset by higher sales of crop protection products for paddy rice in Japan, yielding results that were largely in line with expectations.

In overseas crop protection products, the cost of sales declined by 1,600 million yen due to a change in the product mix, reflecting strong sales in the high-margin North American market. Overall, operating profit increased by 1,500 million yen from the time of the previous revision to 4,600 million yen.

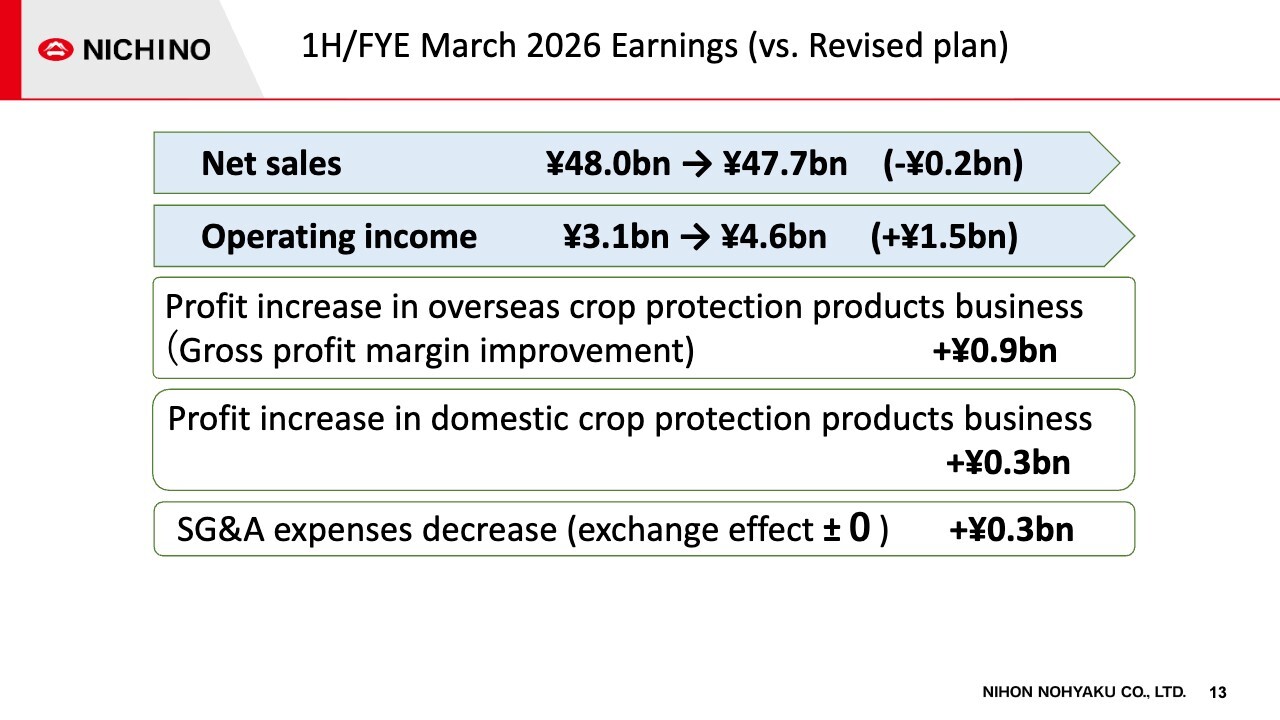

1H/FYE March 2026 Earnings (vs. Revised plan)

Here I would like to explain factors behind the increase in operating profit compared to the revised plan. Overseas crop protection products sales accounted for 0.9 billion yen, domestic crop protection products sales for 0.3 billion yen, and a decrease in SG&A expenses for 0.3 billion yen amid the postponement of some R&D expenses to the second half of the year. Overall, operating income increased by 1.5 billion yen.

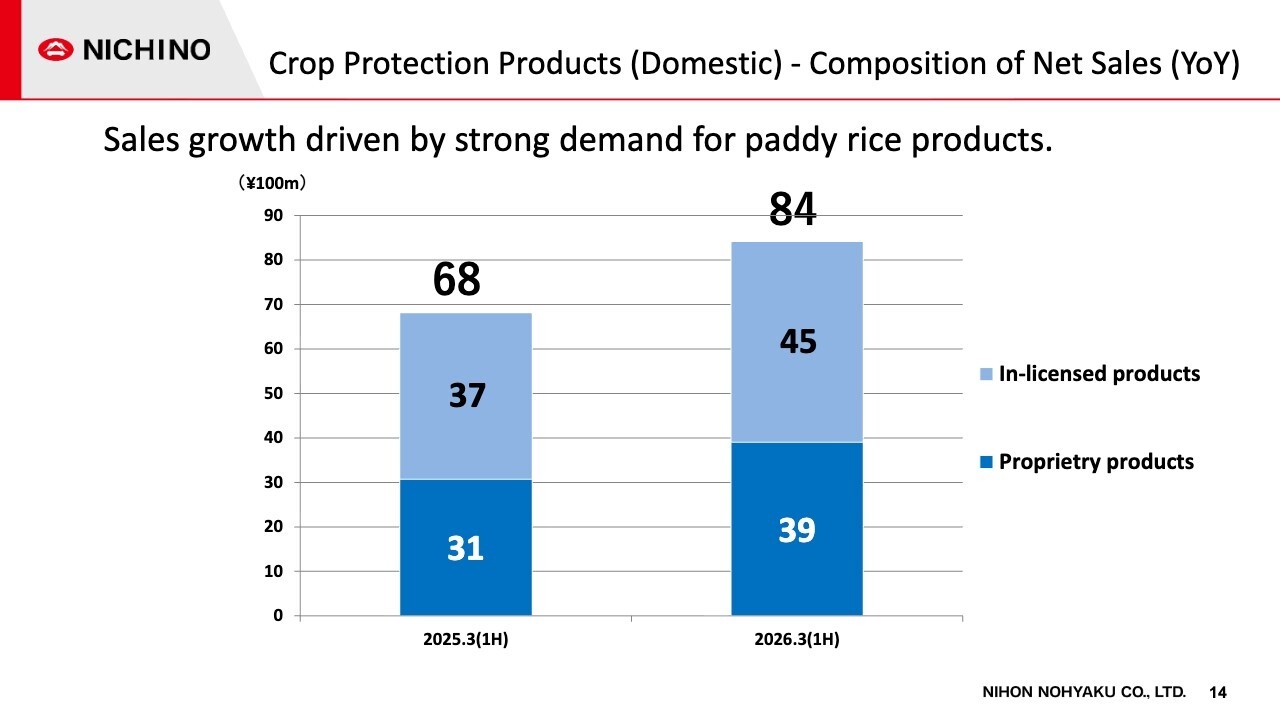

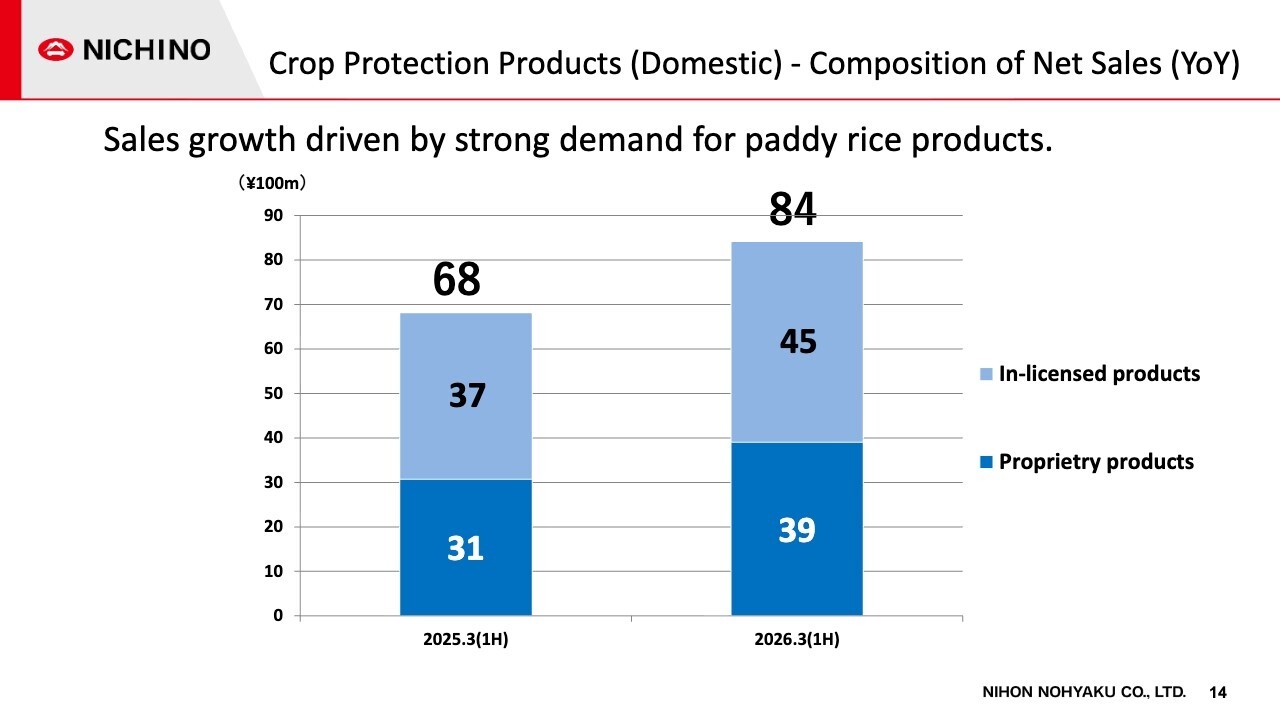

Crop Protection Products (Domestic) – Composition of Net Sales (YoY)

This graph shows the net sales composition of domestic crop protection products sales for the previous year and for the first half of the current fiscal year. During the interim period, products for paddy rice were strong. We made efforts to promote and expand sales of mainstay products developed in-house, such as the insecticide benzpyrimoxan.

Sales of Corteva products were strong, due in part to a nationwide outbreak of stink bugs, resulting in net sales of 8,400 million yen, up 1,600 million yen year on year.

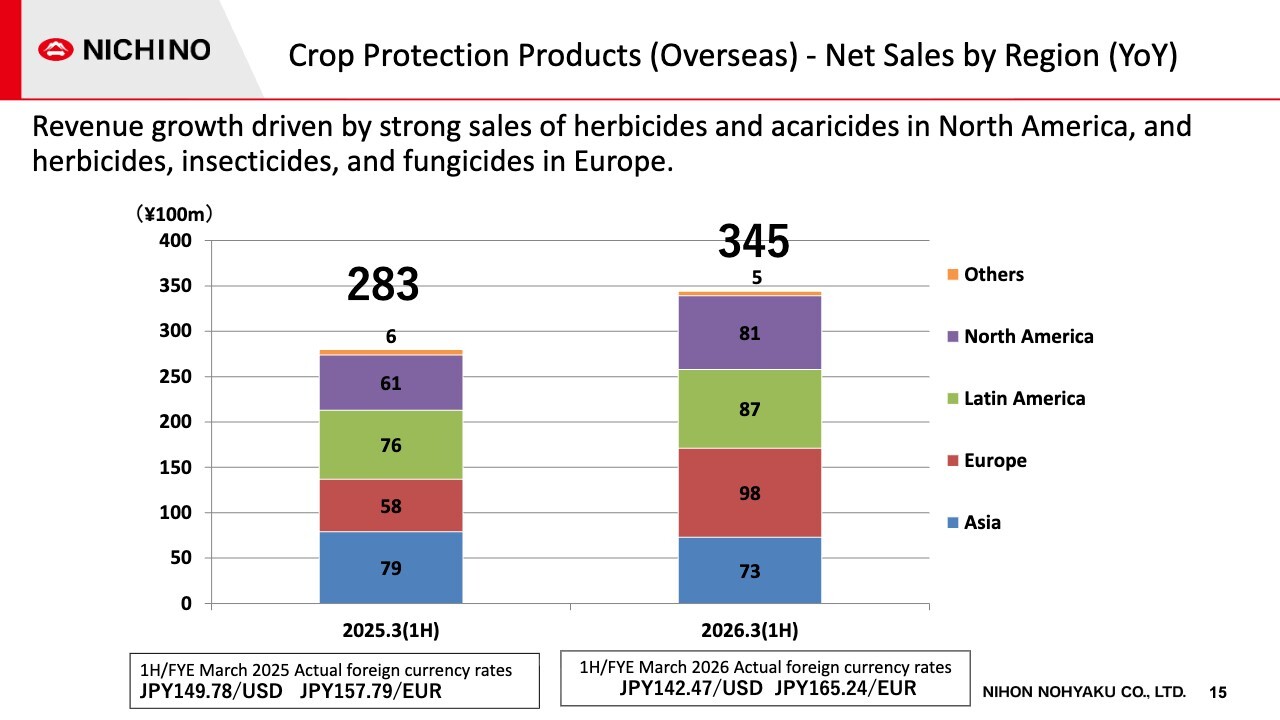

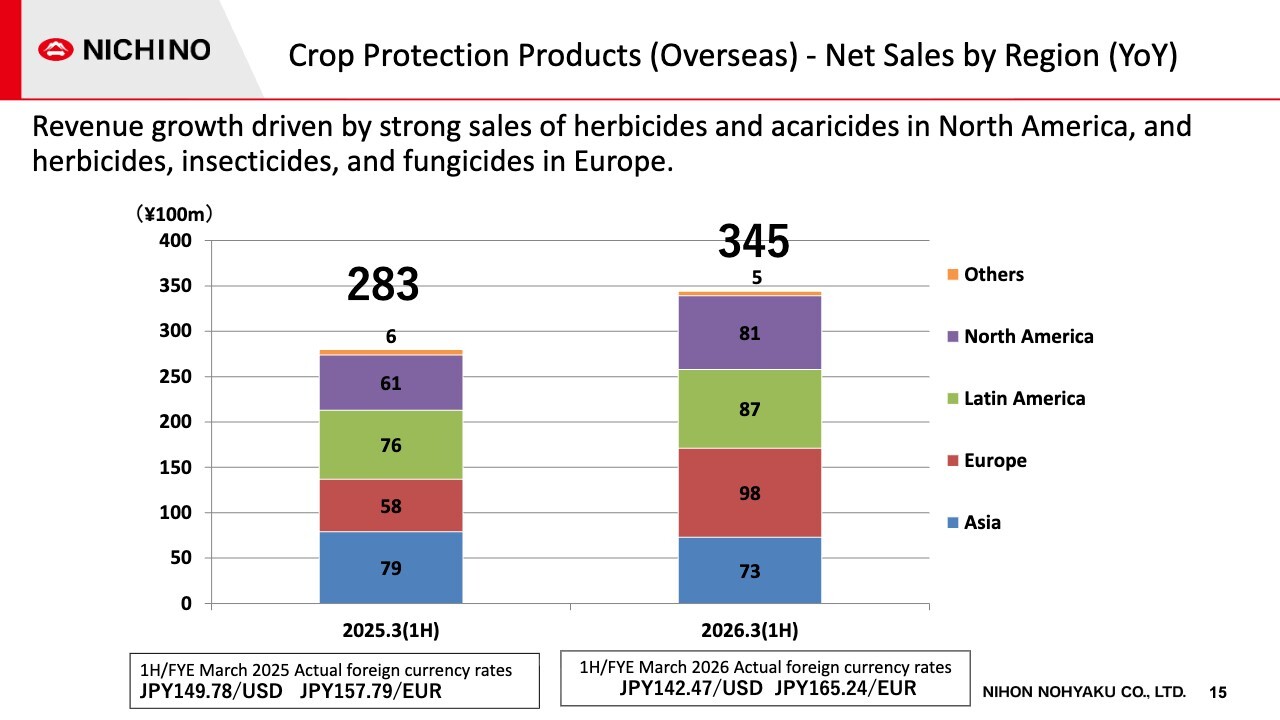

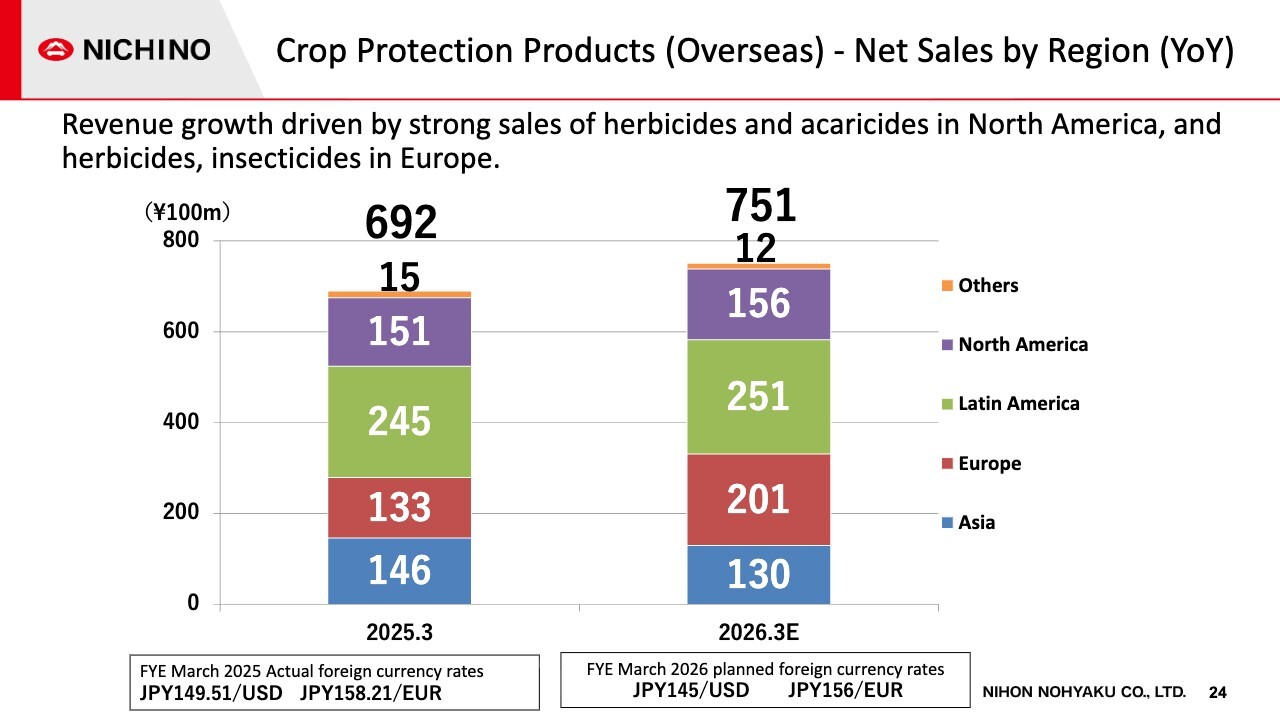

Crop Protection Products (Overseas) – Net Sales by Region (YoY)

The graph shows overseas crop protection products net sales by region. During the period under review, net sales grew mainly in Europe and North America.

In North America, shown in purple, net sales increased by 2,000 million yen due to strong sales of herbicides and acaricides.

In Latin America, shown in green, net sales increased by approximately 1,000 million yen as a result of optimization of distribution inventory in Brazil.

In Europe, shown in red, net sales increased by 4,000 million yen due to strong sales of herbicides and acaricides, the consolidation of Interagro(UK)Ltd, and sales of Flubendiamide active ingredient to Bayer CropScience.

In Asia, shown in blue, sales increased year-on-year due to strong sales to other companies in the same industry at our Indian subsidiary, but sales in other Asian countries struggled, resulting in a 600 million decrease.

Overall net sales of crop protection products overseas were 34,500 million yen, up 6,200 million yen year on year.

Exchange rates for the interim period are shown on the slide.

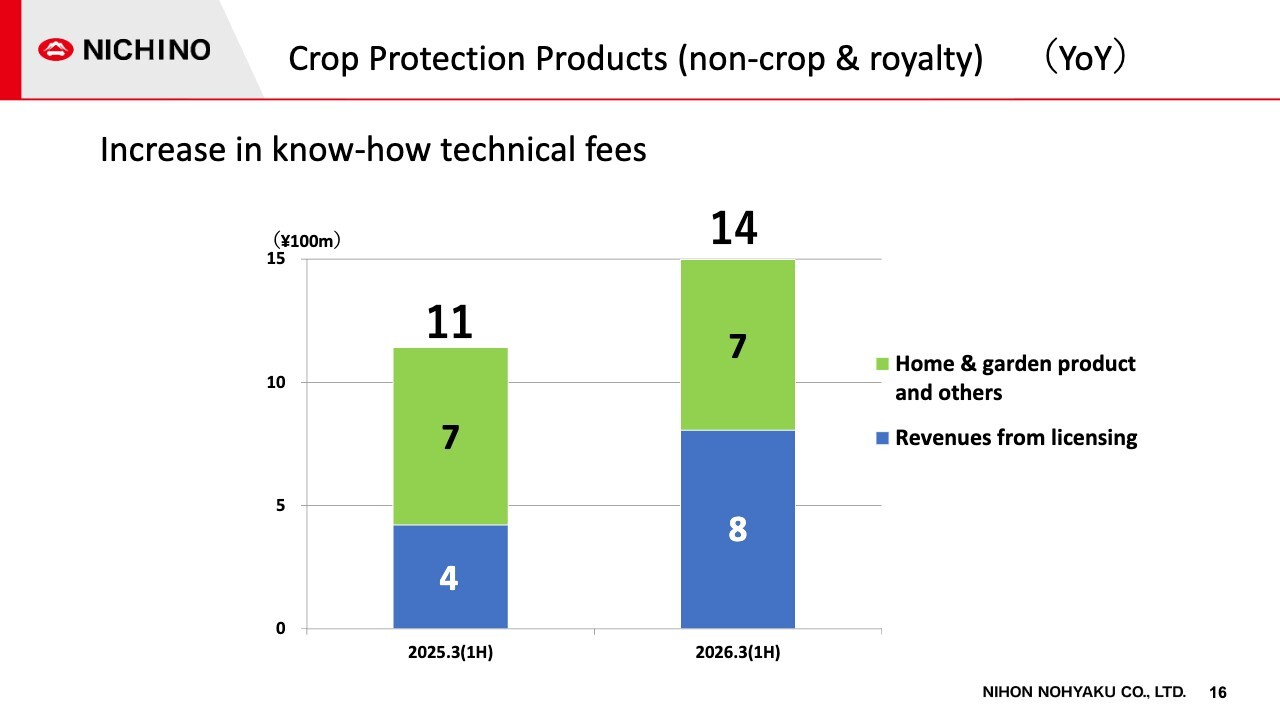

Crop Protection Products (non-crop & royalty) (YoY)

The graph shows net sales related to the crop protection products business excluding domestic and overseas crop protection products, broken down into two categories: revenues from licensing (blue) and home & garden products and others (green). During the interim period, revenues from licensing increased by 400 million yen.

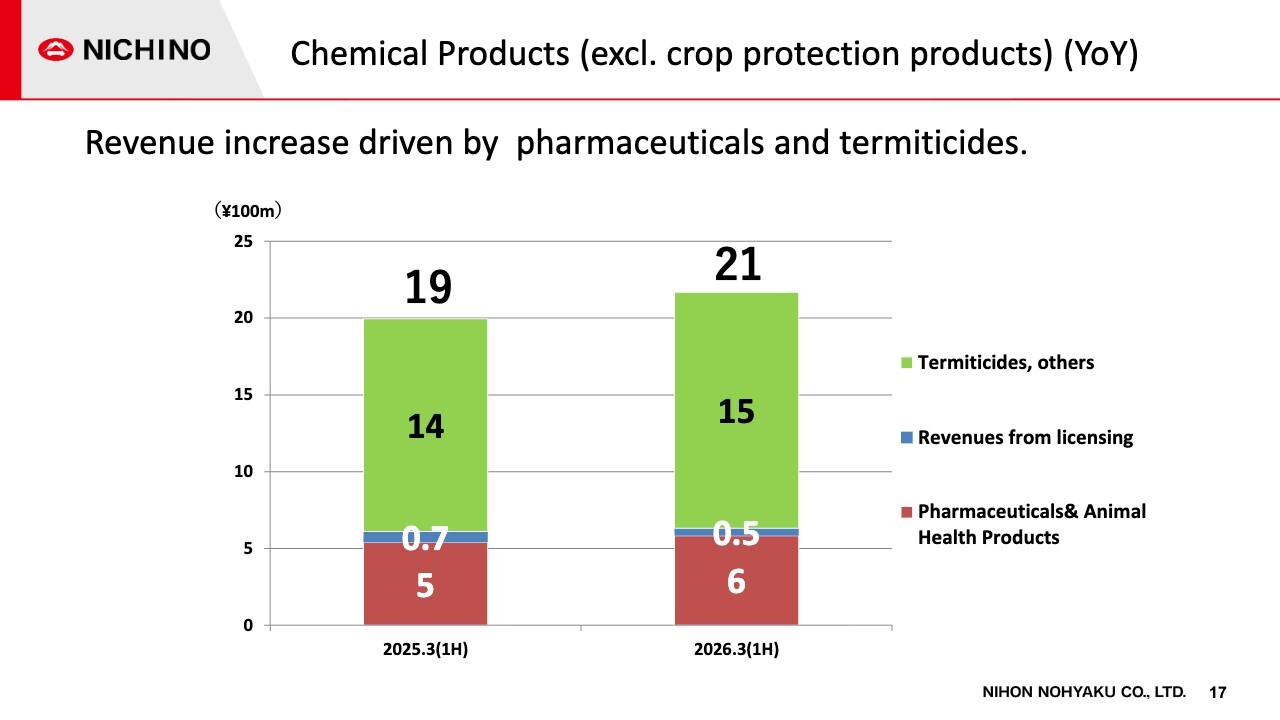

Chemicals Products (excl. crop protection products) (YoY)

This graph shows the results of the chemical products business excluding crop protection products, divided into the following categories: pharmaceuticals & animal health products in red, revenues from licensing in blue, and termiticides and others in green. Net sales for the interim period increased slightly year on year.

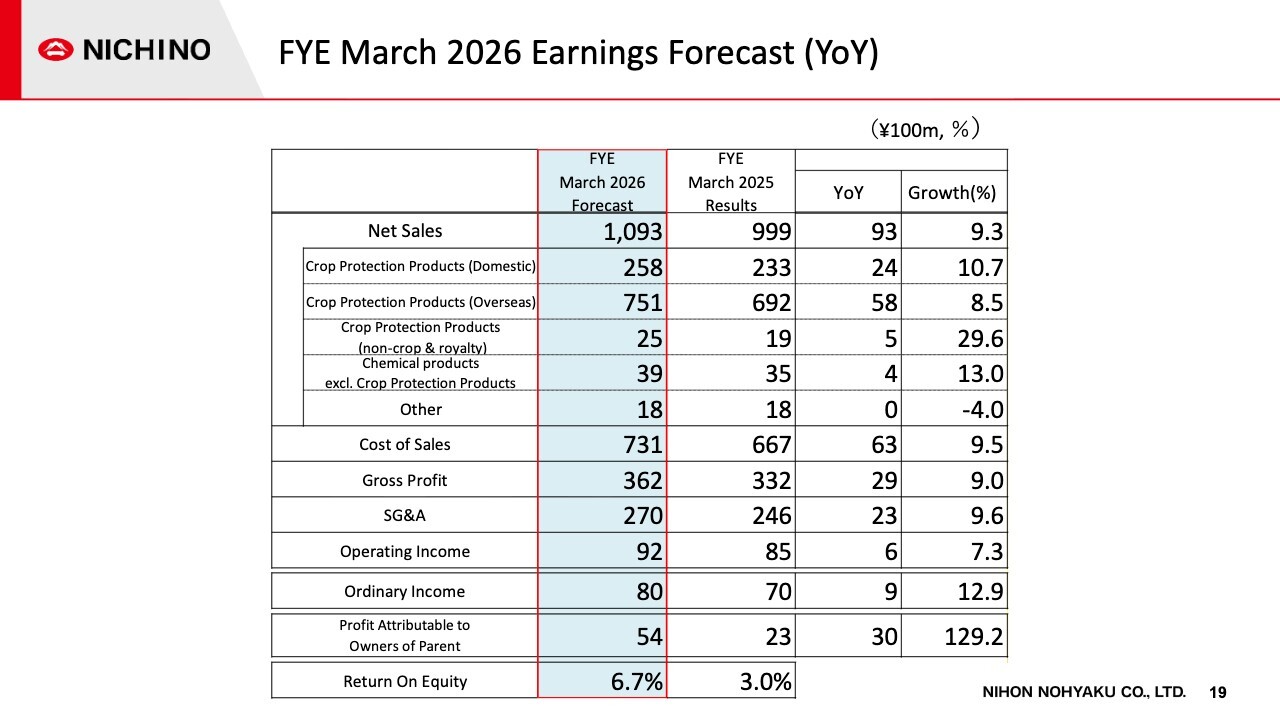

FYE March 2026 Earnings Forecast (YoY)

Here I would like to present our business forecast for the fiscal year ending March 31, 2026. The full-year forecast has been revised again since the previous announcement of financial results.

Net sales are expected to be 109,300 million yen, an increase of 9,300 million yen or 9.3% from the previous fiscal year, mainly due to growth in the core crop protection products business.

Operating profit is expected to be 9,200 million yen, an increase of 600 million yen or 7.3% year on year. Ordinary profit is expected to be 8,000 million yen, an increase of 900 million yen or 12.9% year on year. Profit attributable to owners of parent is expected to be 5,400 million yen, an increase of 3,000 million yen or 129.2% year on year.

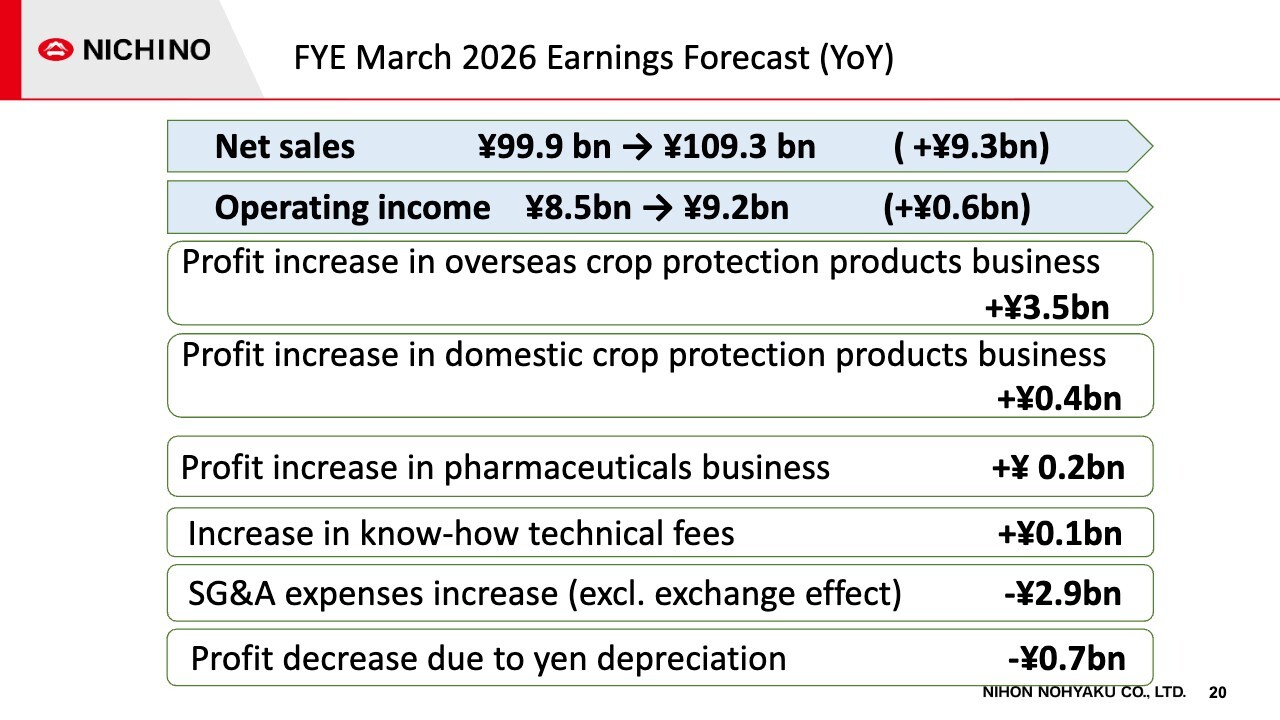

FYE March 2026 Earnings Forecast (YoY)

This slide analyzes factors that contribute to changes in operating profit. We expect an operating profit increase of 3.5 billion yen in overseas crop protection products, with strong sales mainly in North America and Europe, as well as operating profit increases of 0.4 billion yen in domestic crop protection products and 0.2 billion yen in the pharmaceuticals business.

At the same time, we expect an operating profit decrease of 2.9 billion yen from increased R&D expenses and other SG&A expenses and a decrease of 0.7 billion yen from foreign exchange impacts, yielding a net increase of 0.6 billion yen.

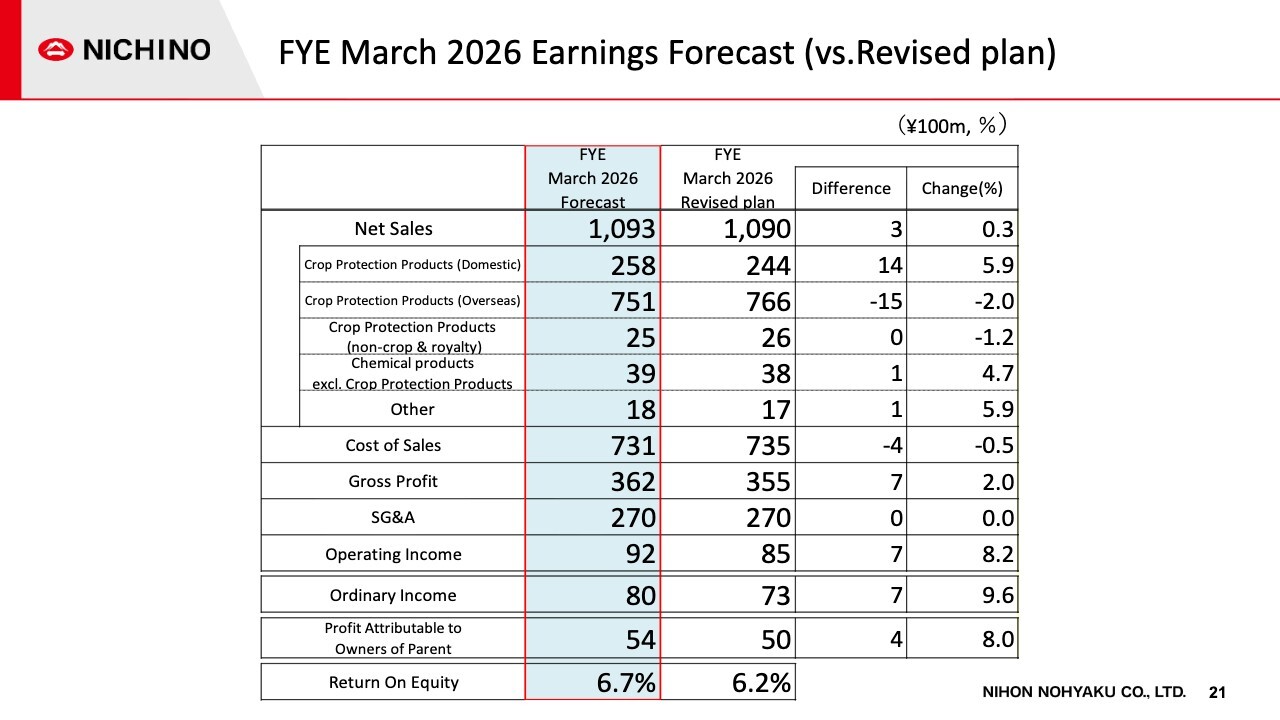

FYE March 2026 Earnings Forecast (vs. Revised plan)

This table compares the latest forecast figures for the current fiscal year with the revised forecast figures announced on August 7.

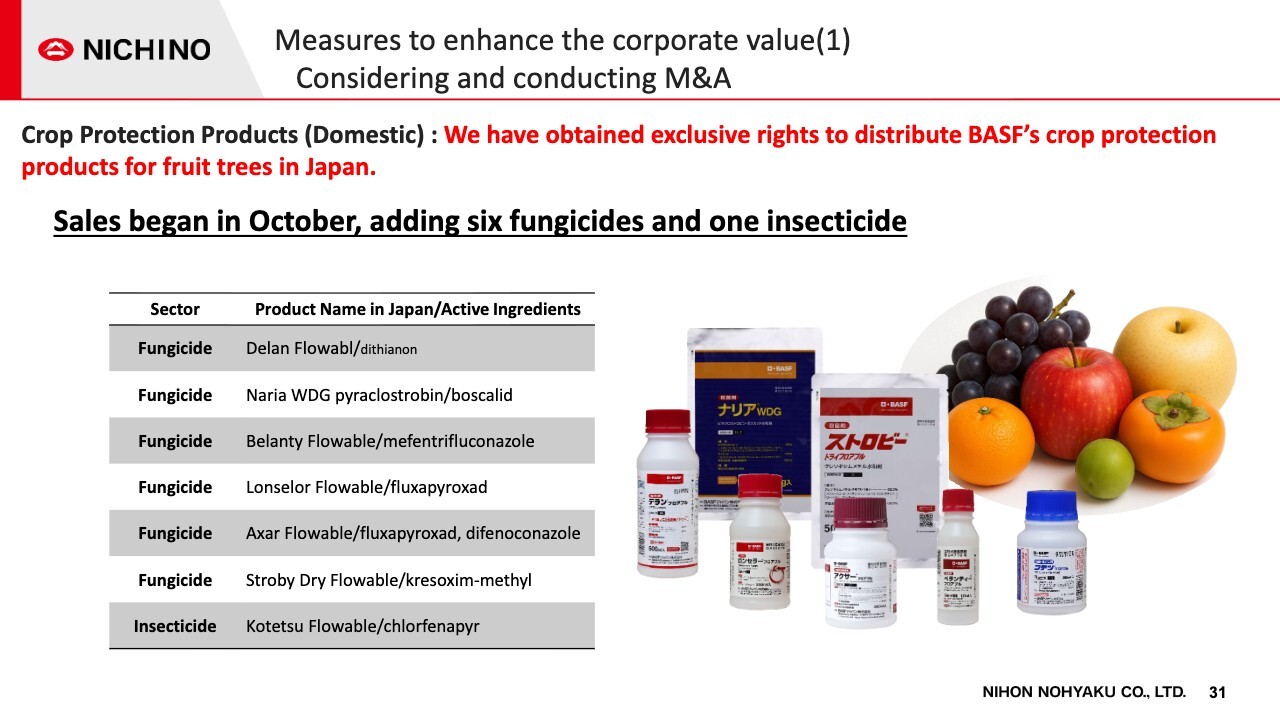

We expect an increase of 1,400 million yen in net sales of domestic crop protection products, mainly due to the acquisition of exclusive rights to sell BASF's crop protection products for fruit trees.

At the same time, we expect a 1,500 million yen decrease in net sales of overseas crop protection products as a result of factoring in certain risks involving rising costs and downward-trending grain prices, especially in Brazil. Overall, we project net sales of 109,300 million yen.

We expect operating profit to increase by 700 million yen to 9,200 million yen, ordinary profit to increase by 700 million yen to 8,000 million yen, and profit attributable to owners of parent to increase by 400 million yen to 5,400 million yen from the previous revision.

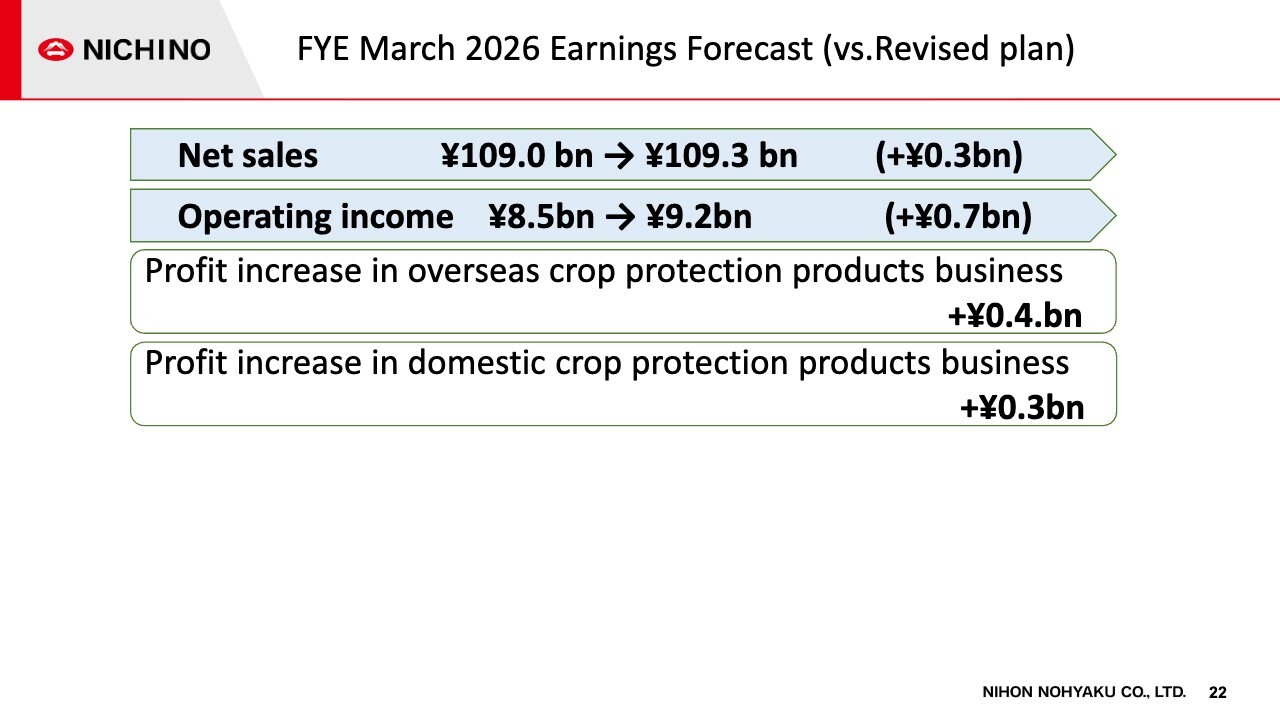

FYE March 2026 Earnings Forecast (vs. Revised plan)

Factors contributing to change in operating profit were a 0.4 billion yen increase in operating profit from overseas crop protection products, mainly in Europe and the United States, and a 0.3 billion yen increase in operating profit from domestic crop protection products.

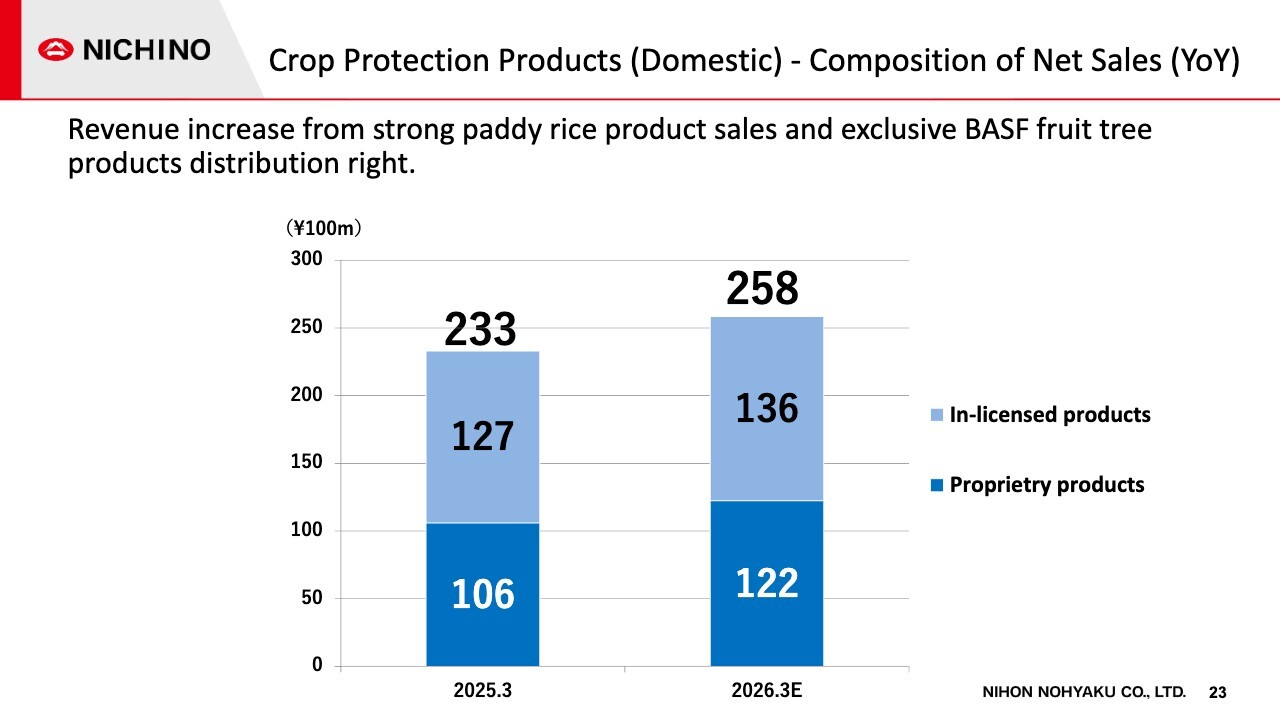

Crop Protection Products (Domestic) – Composition of Net Sales (YoY)

This graph shows the net sales composition of domestic crop protection products for the current fiscal year. For the fiscal year, we forecast net sales of 25,800 million yen, up year on year, due to the proliferation and expansion of our own products for paddy rice and the introduction of products from other companies, such as sales of BASF's crop protection products for fruit trees in the general products category.

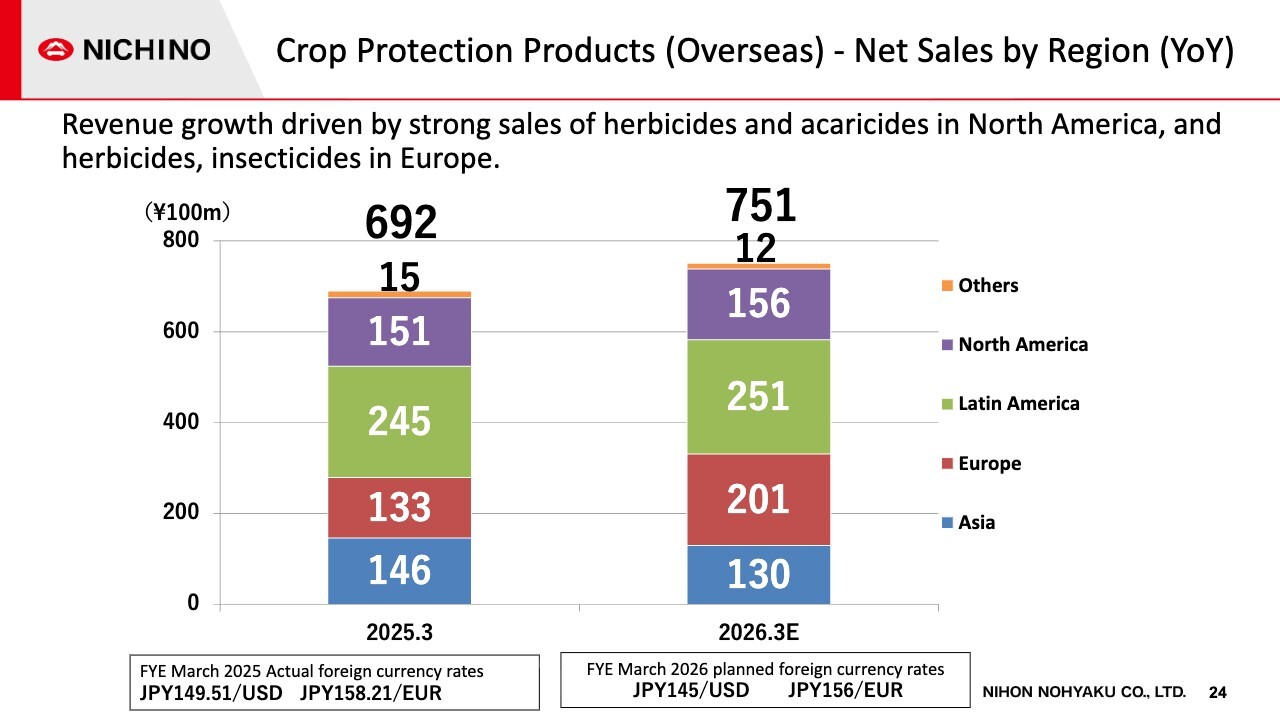

Crop Protection Products (Overseas) – Net Sales by Region (YoY)

This graph shows overseas crop protection products net sales by region for the current fiscal year. Europe, shown in red, and North America, shown in purple, continue to perform well, with further revenue growth expected.

For Latin America, shown in green, we expect a year-on-year increase in revenue, although the increase is smaller than in the previous earnings announcement due to the inclusion of risks in Brazil.

In Asia, shown in blue, we expect a recovery in net sales at our Indian subsidiary but a decline in revenue due to struggling sales in other Asian markets.

Overall, overseas crop protection products net sales are expected to increase significantly from the previous year to 75,100 million yen.

The planned exchange rate for the fiscal year is shown at the bottom of the slide. The planned exchange rate for the second half of the fiscal year remains unchanged from the beginning of the fiscal year.

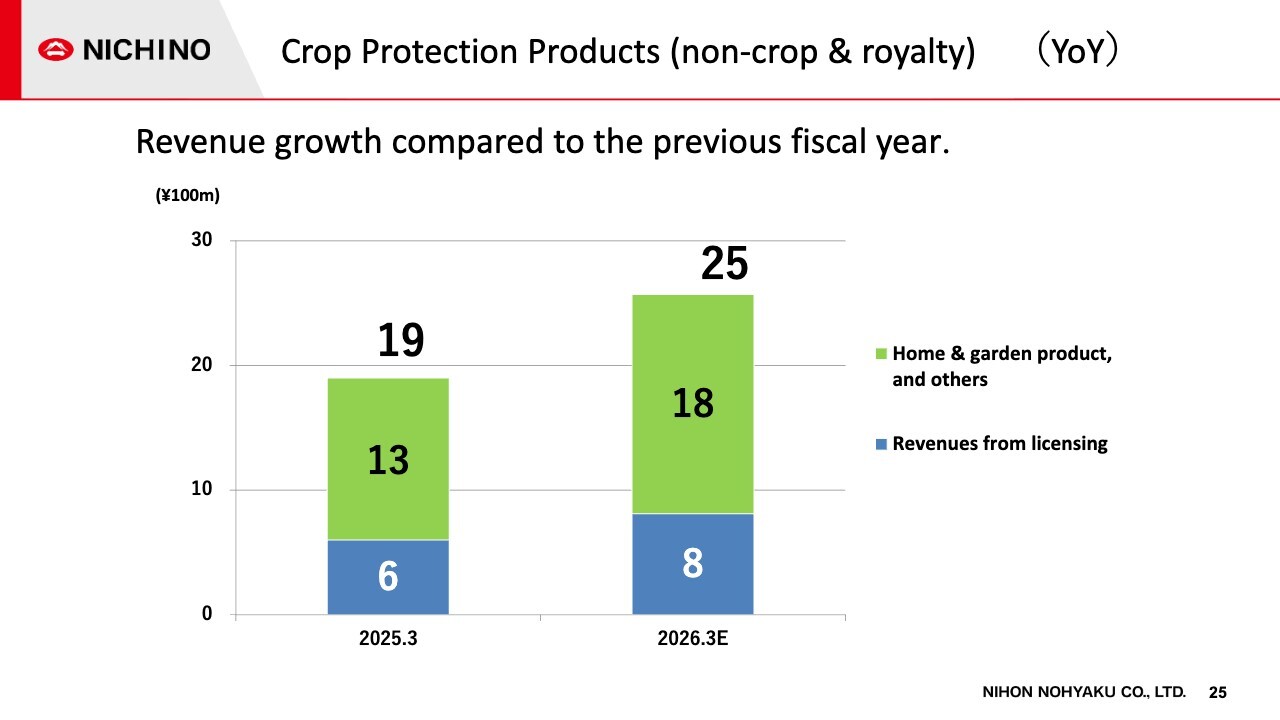

Crop Protection Products (non-crop & royalty) (YoY)

The graph shows the forecast for the current fiscal year for revenues from licensing and home & garden products and others related to the crop protection products business. We expect revenue to increase year on year in both revenues from licensing and home & garden products and others.

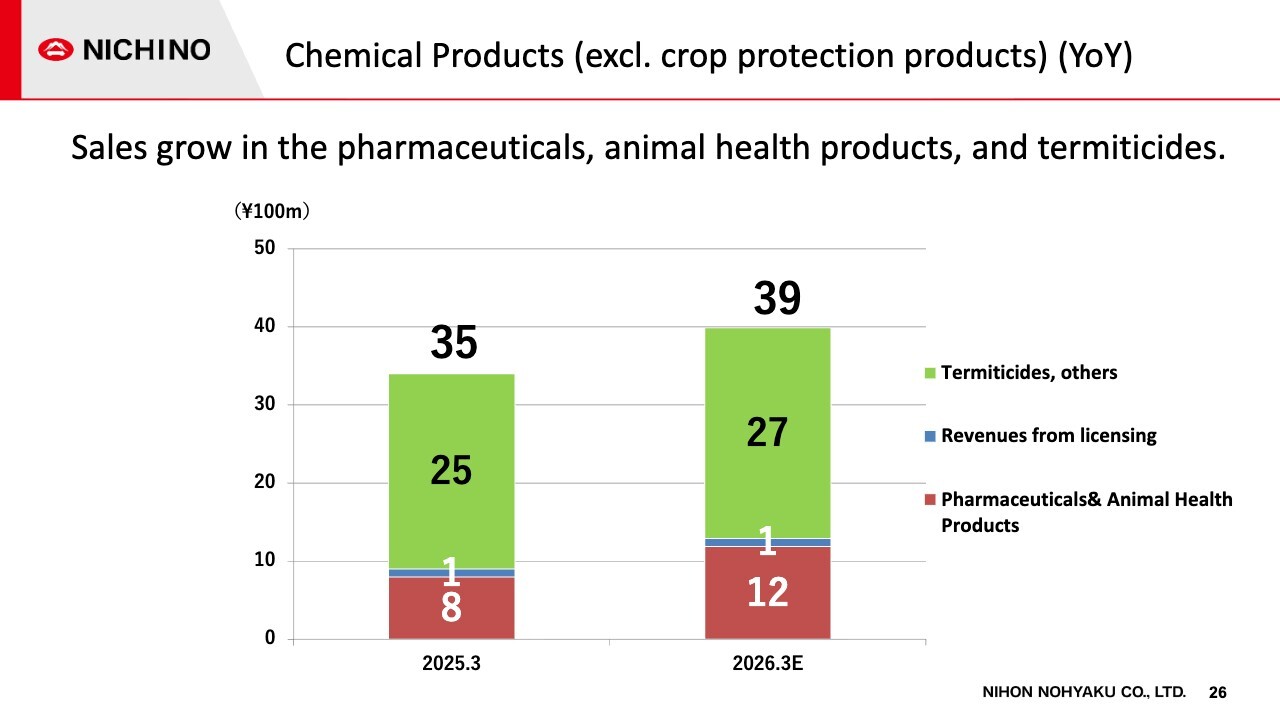

Chemical Products (excl. crop protection products) (YoY)

This graph shows the current fiscal year outlook for chemical products excluding crop protection products. Sales growth is expected in both Pharmaceuticals & Animal Health Products and in termiticides and others during the fiscal year.

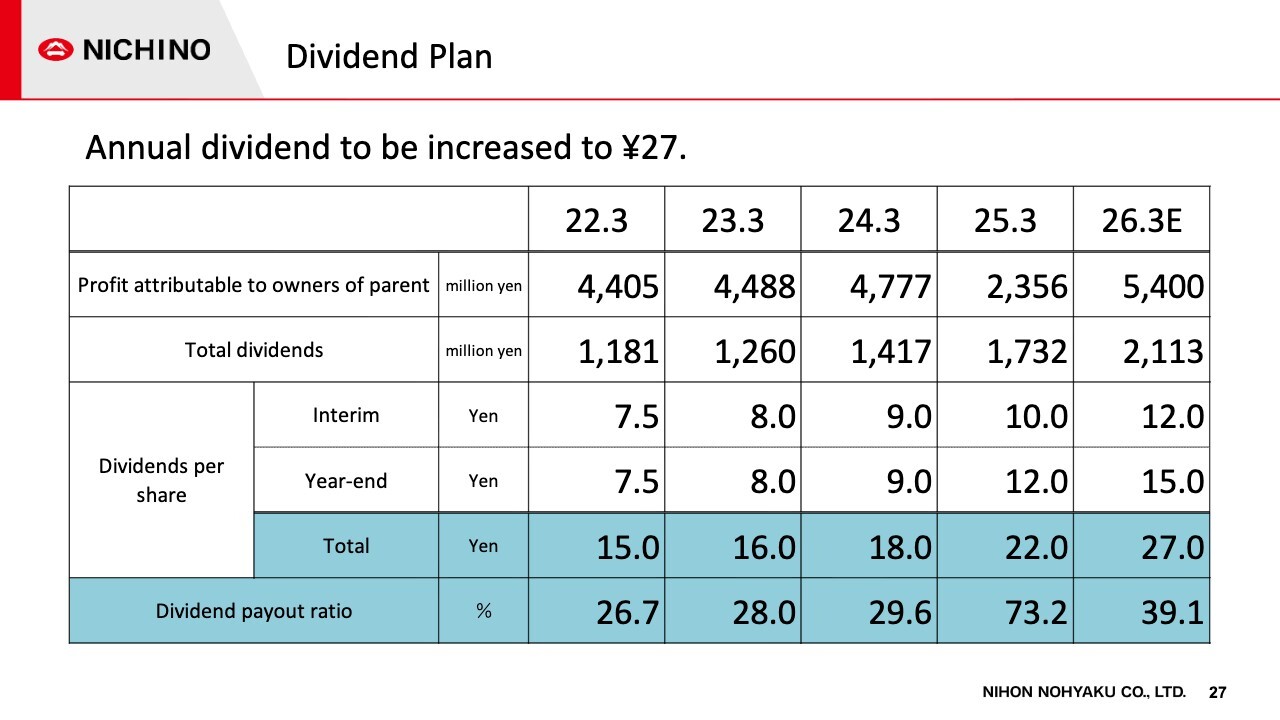

Dividend Plan

In line with the upward revision of financial results, we have decided to increase the year-end dividend by 2 yen, based on the Mid-term Management Plan dividend policy of a progressive dividend payout ratio of about 40%. As a result, the annual dividend is expected to be 27 yen per share.

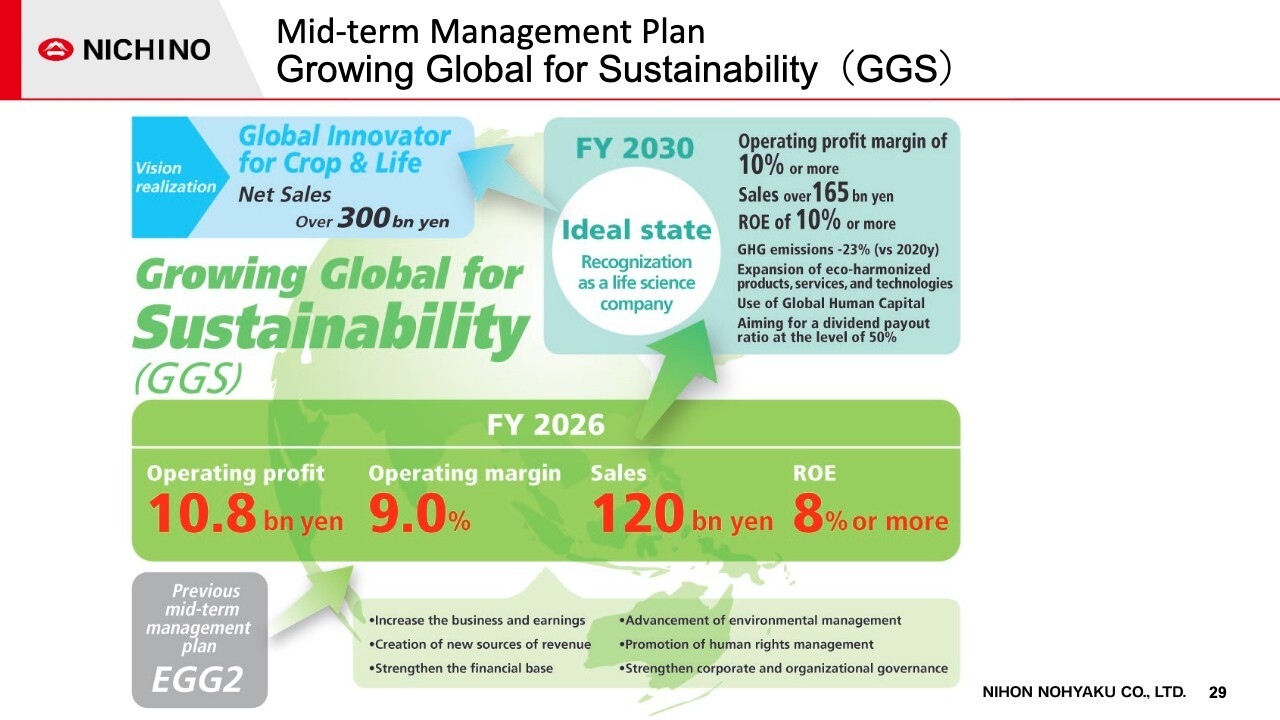

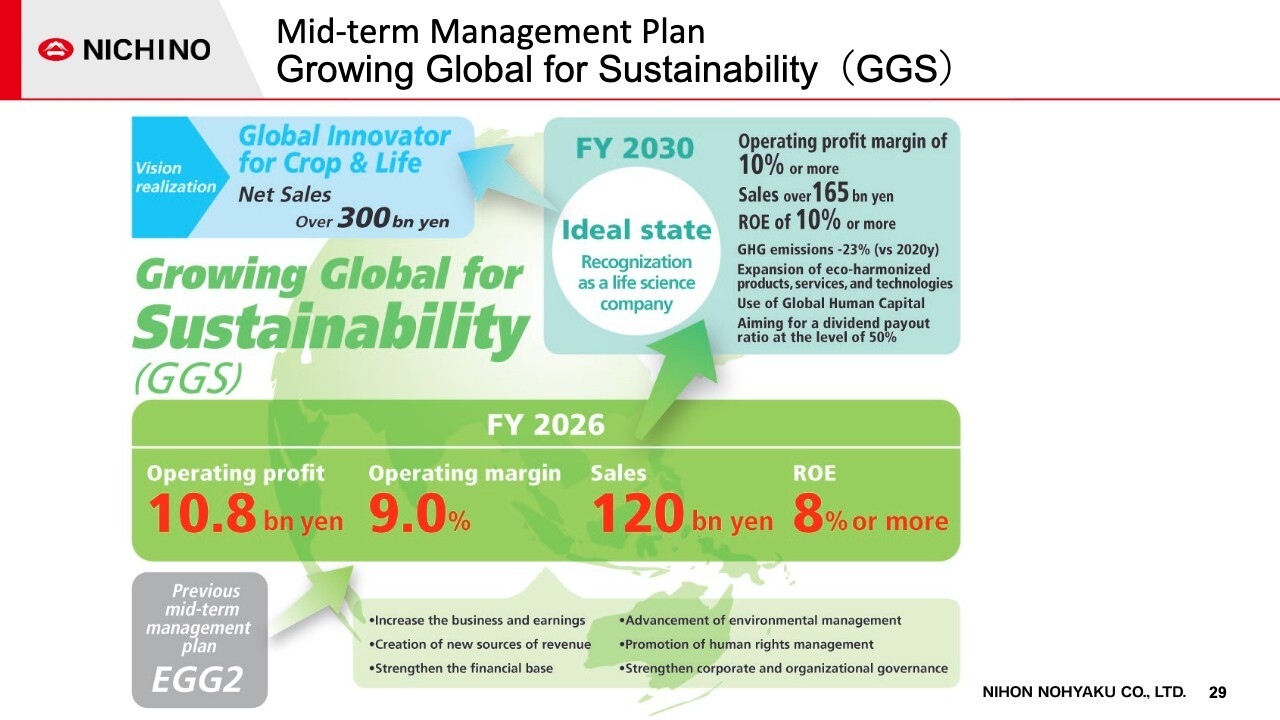

Mid-term Management Plan – Growing Global for Sustainability (GGS)

Here I would like to discuss the status of our Mid-term Management Plan initiatives. In the final year of the "Growing Global for Sustainability (GGS)" Mid-term Management Plan, we plan to achieve net sales of 120 billion yen, operating profit of 10.8 billion yen, and operating profit margin of 9.0%.

We set a new ROE target under the Mid-term Management Plan and are undertaking management with an awareness of our cost of capital.

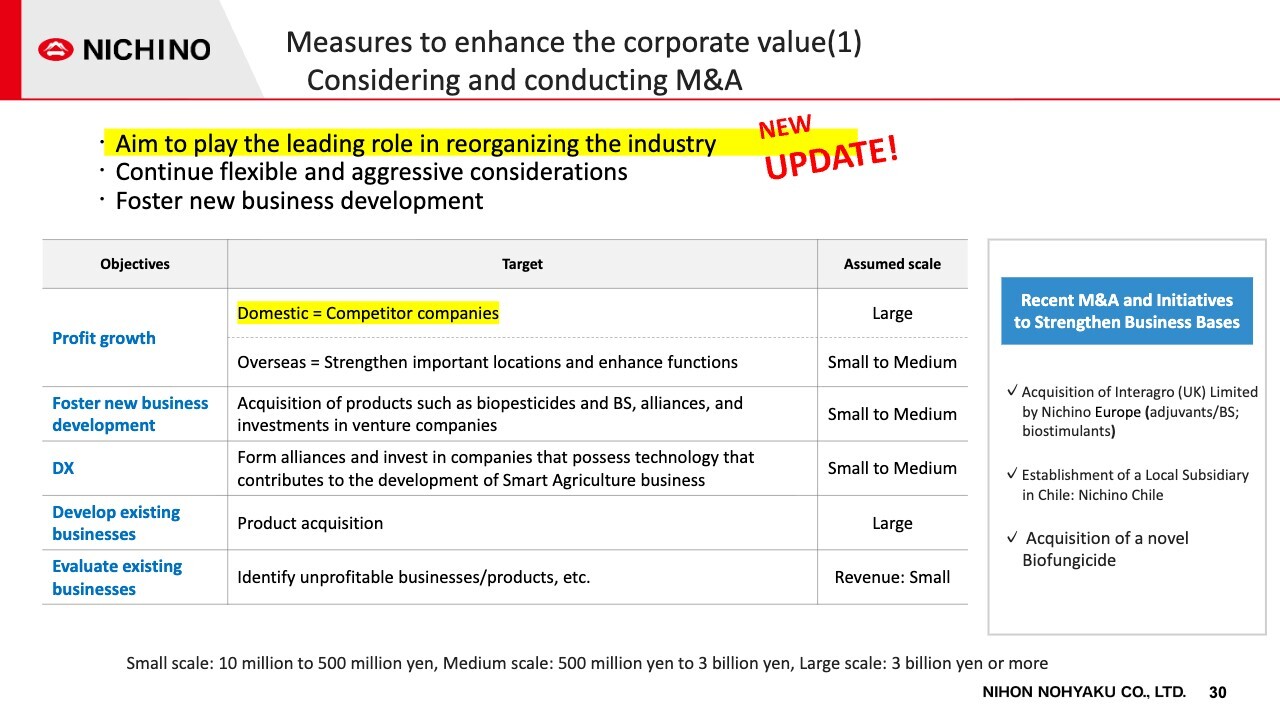

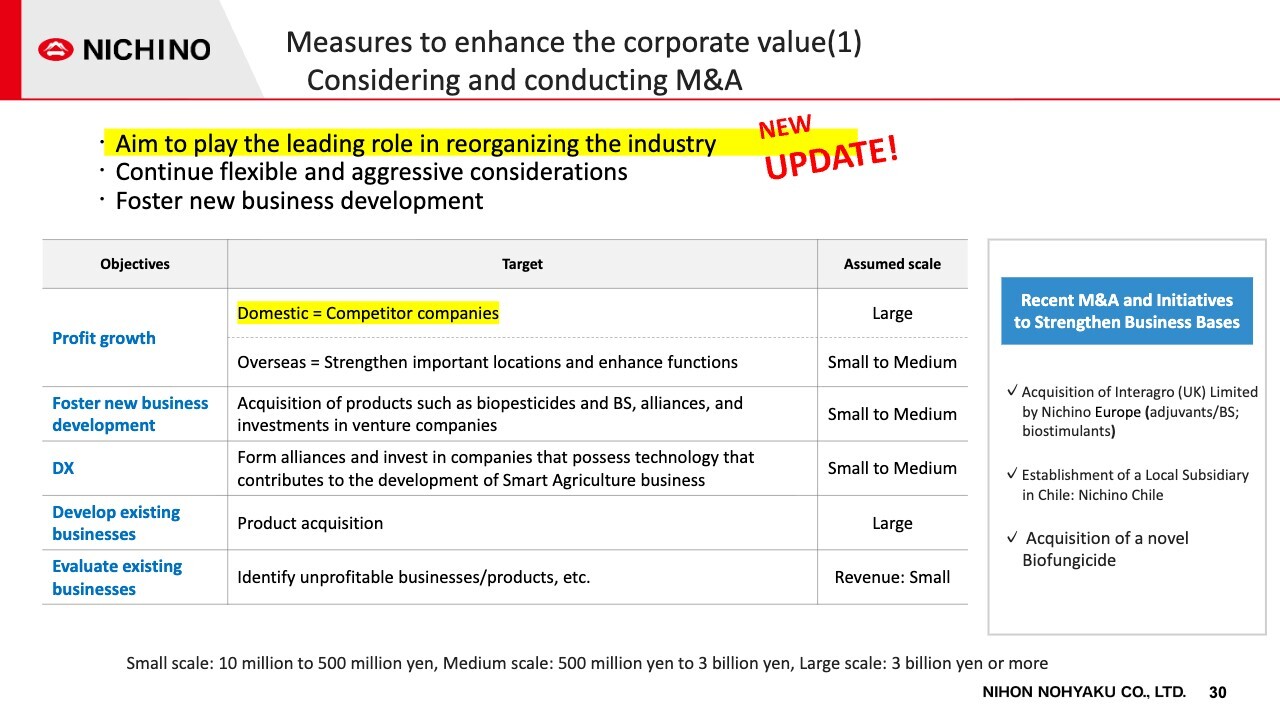

Measures to enhance the corporate value (1) Considering and conducting M&A

By considering and carrying out mergers and acquisitions as a measure to enhance corporate value under the Mid-term Management Plan, the company aims to play a leading role in the restructuring of the industry.

As shown in the table, we have established objective-specific targets for M&A and other strategic investments and continue to study these in a flexible and proactive manner. I would next like to explain the progress we have made in our efforts to expand sales in Japan.

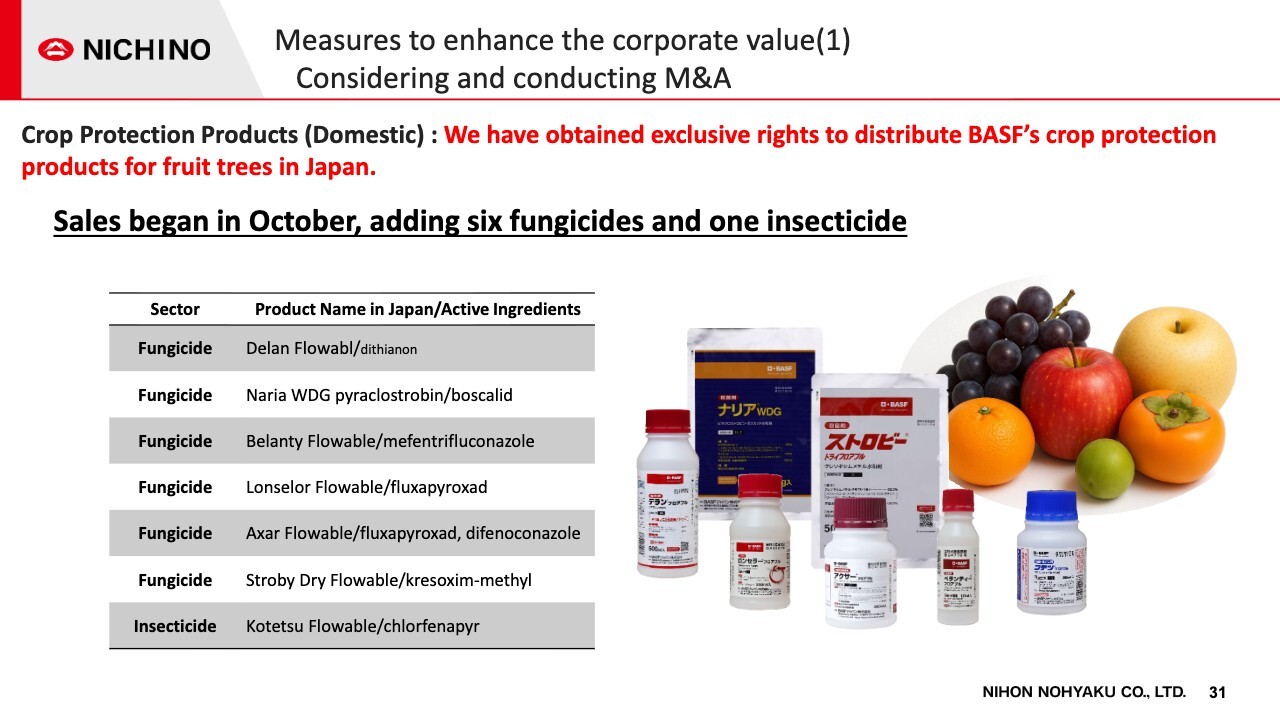

Measures to enhance the corporate value (1) Considering and conducting M&A

To better meet the needs of fruit growers by leveraging the strengths and expertise of our company and of BASF, we reached an agreement with said company by which we will serve as the exclusive distributor of BASF products for the fruit industry in Japan, and began sales in October.

With the addition of seven new products (six fungicides and one insecticide) to our lineup, we are now able to meet the varied pest control needs of fruit tree growers through products that we handle.

Measures to enhance the corporate value (1) Considering and conducting M&A

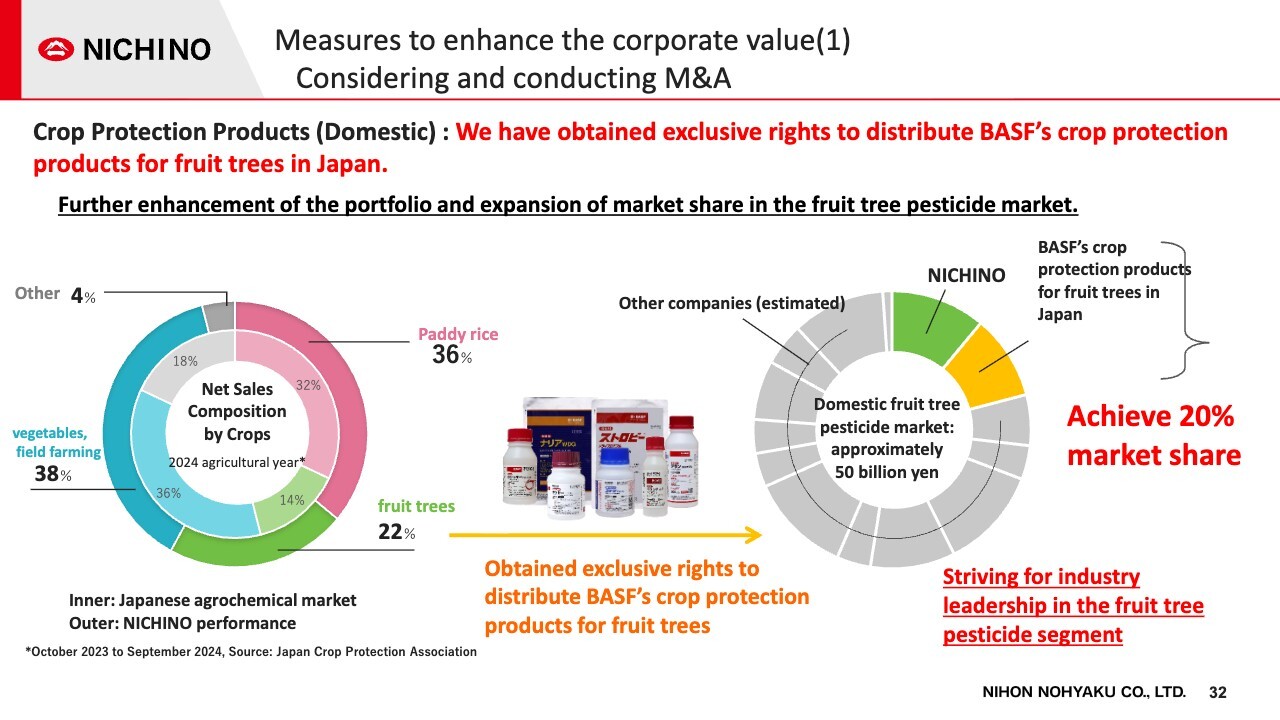

The graph at left shows our net sales composition by crop in the domestic crop protection products market.

We have traditionally excelled in the fruit tree and vegetable fields, and with the addition of BASF's fruit tree products to our portfolio, we expect sales of products for fruit trees to reach approximately 10 billion yen.

With this move, we believe that we will be able to capture approximately 20% share of the fruit tree pesticide market, which is estimated to be worth approximately 50 billion yen in Japan, and will be able to establish a leading position in the industry in this field.

Measures to enhance the corporate value (1) Considering and conducting M&A

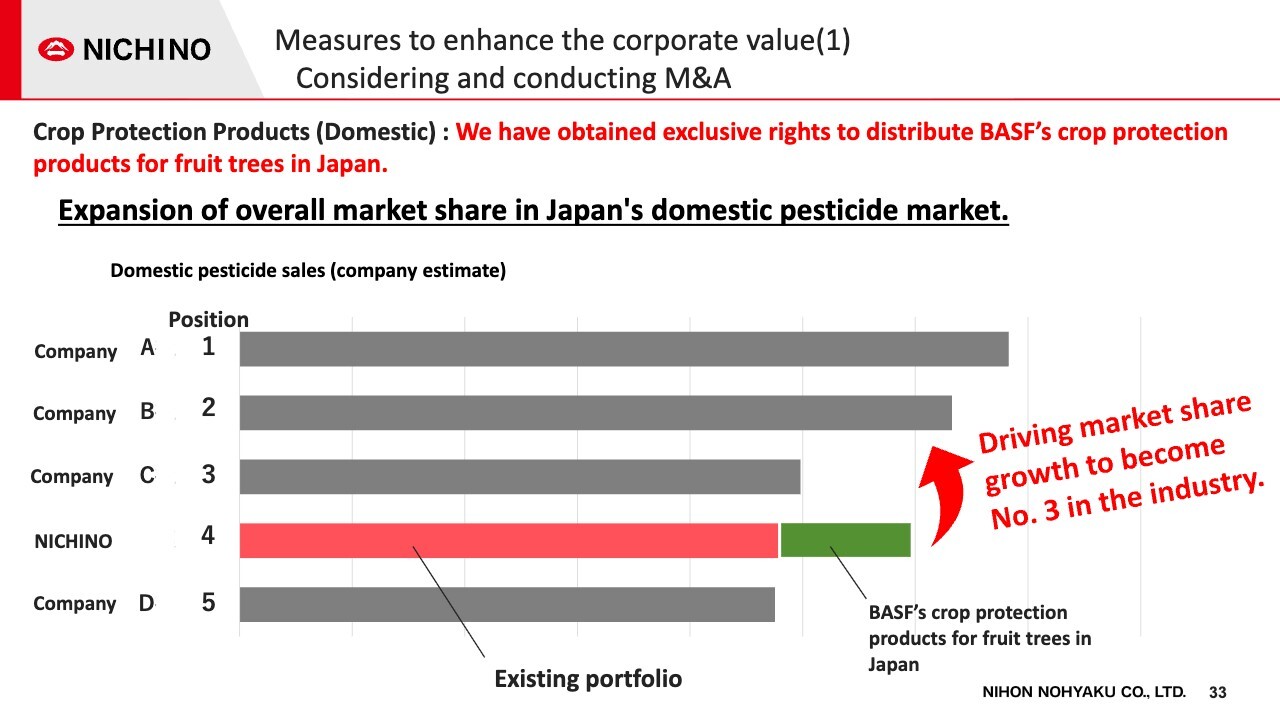

The slide shows our position in the crop protection products market in Japan. With the acquisition of Corteva's products, we estimate that our crop protection products shipments now rank fourth in the industry.

BASF's product line for fruit trees is expected to add approximately 5 billion yen to our total, lifting us to third place in the industry.

We believe that we will then close in on second place, further strengthen our presence in the domestic crop protection products market, and establish a foundation for further growth.

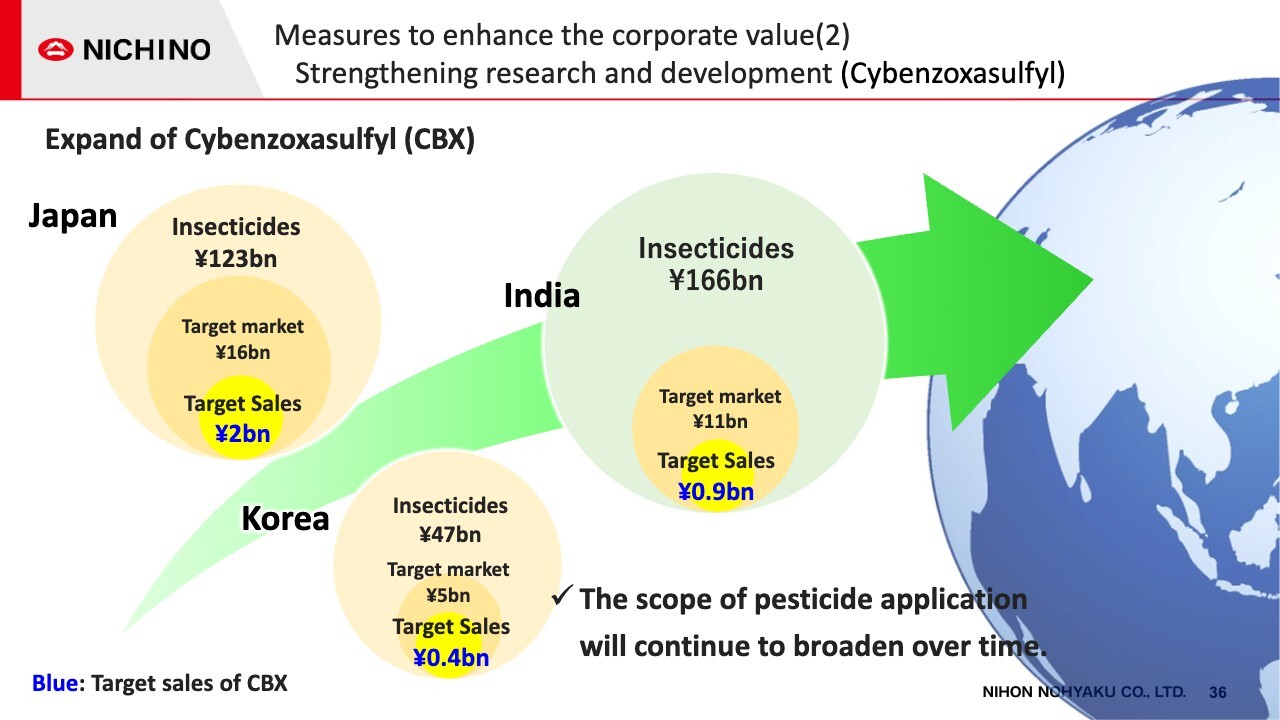

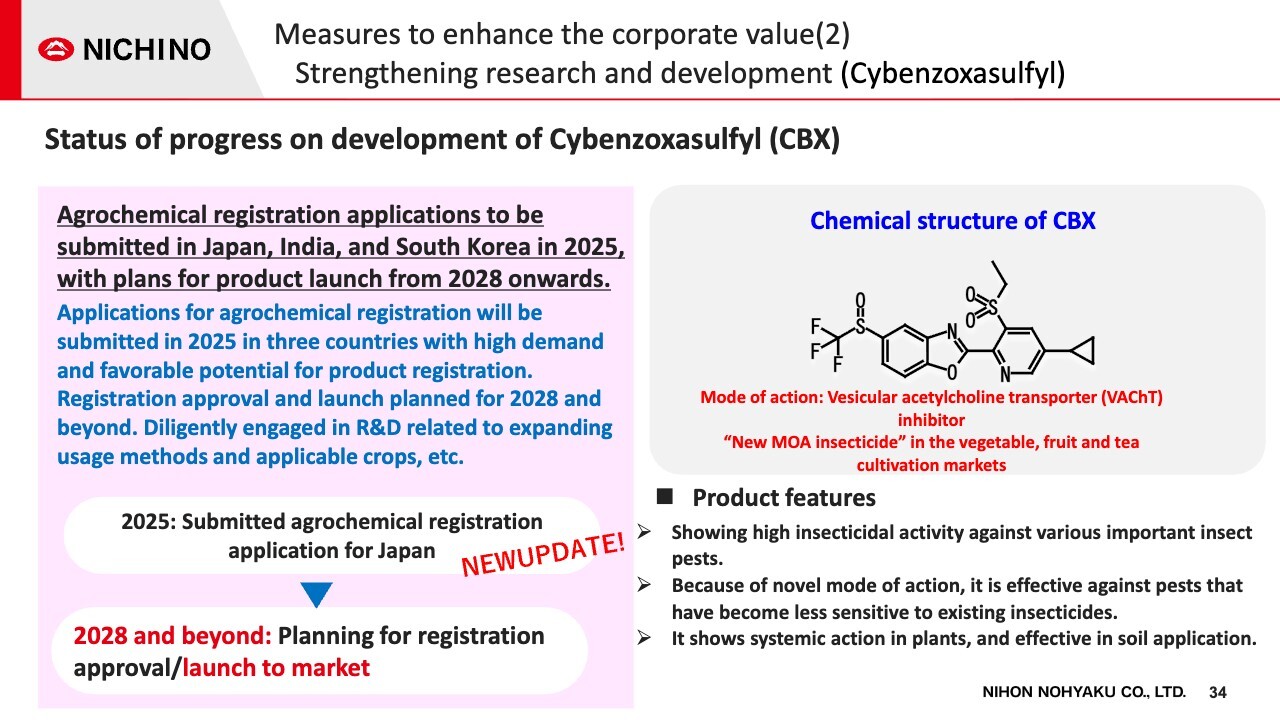

Measures to enhance the corporate value (2) Strengthening research and development (Cybenzoxasulfyl)

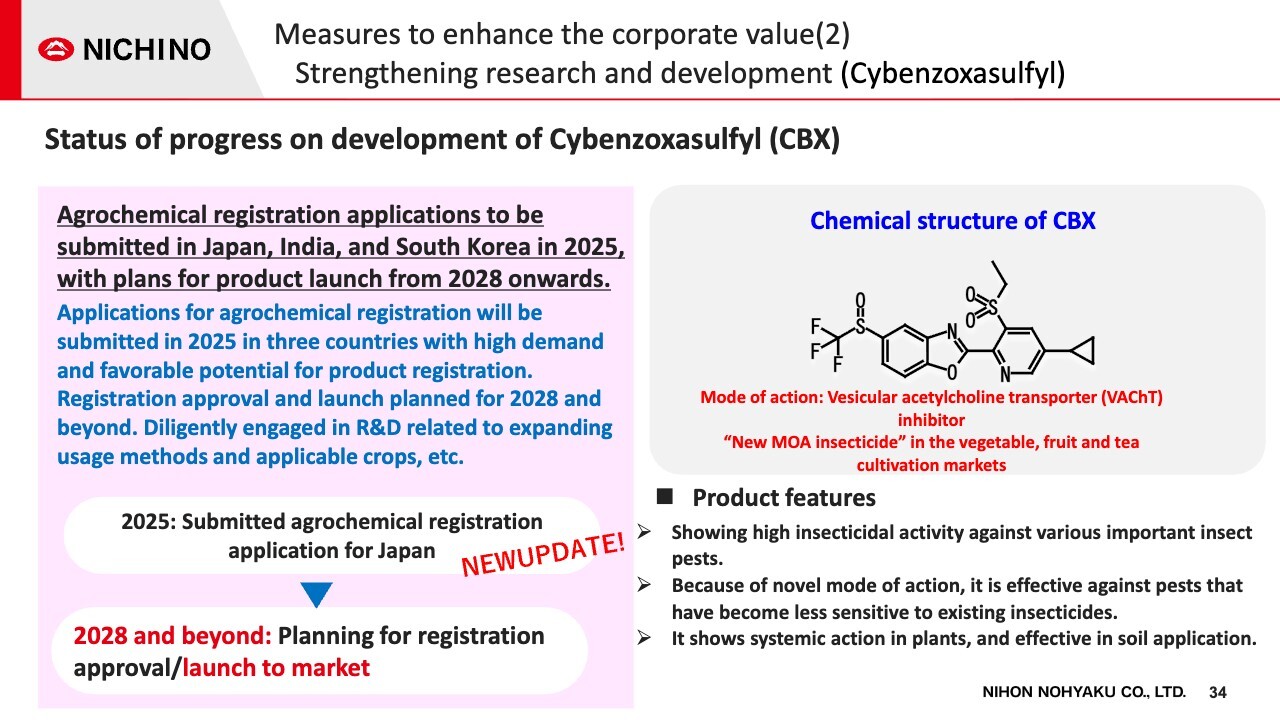

This slide presents our efforts to strengthen research and development of Cybenzoxasulfyl (abbreviation: CBX).

CBX is under active development in Japan, South Korea, and India with the aim of registration and launch in 2028. We recently filed an application for agrochemical registration in Japan.

The product is characterized by its novel mode of action and powerful insecticidal efficacy against a wide range of pest species, as well as its effectiveness against pests that have increased resistance to existing insecticides. In addition, its powerful systemic penetrative action makes it an excellent soil treatment.

The mode of action is inhibition of the acetylcholine transporter in the nervous system of insect pests. We believe that this novel mode of action, not present in existing products for vegetables, fruit trees, and tea plants, will allow us to create strong differentiation for the product.

Measures to enhance the corporate value (2) Strengthening research and development (Cybenzoxasulfyl)

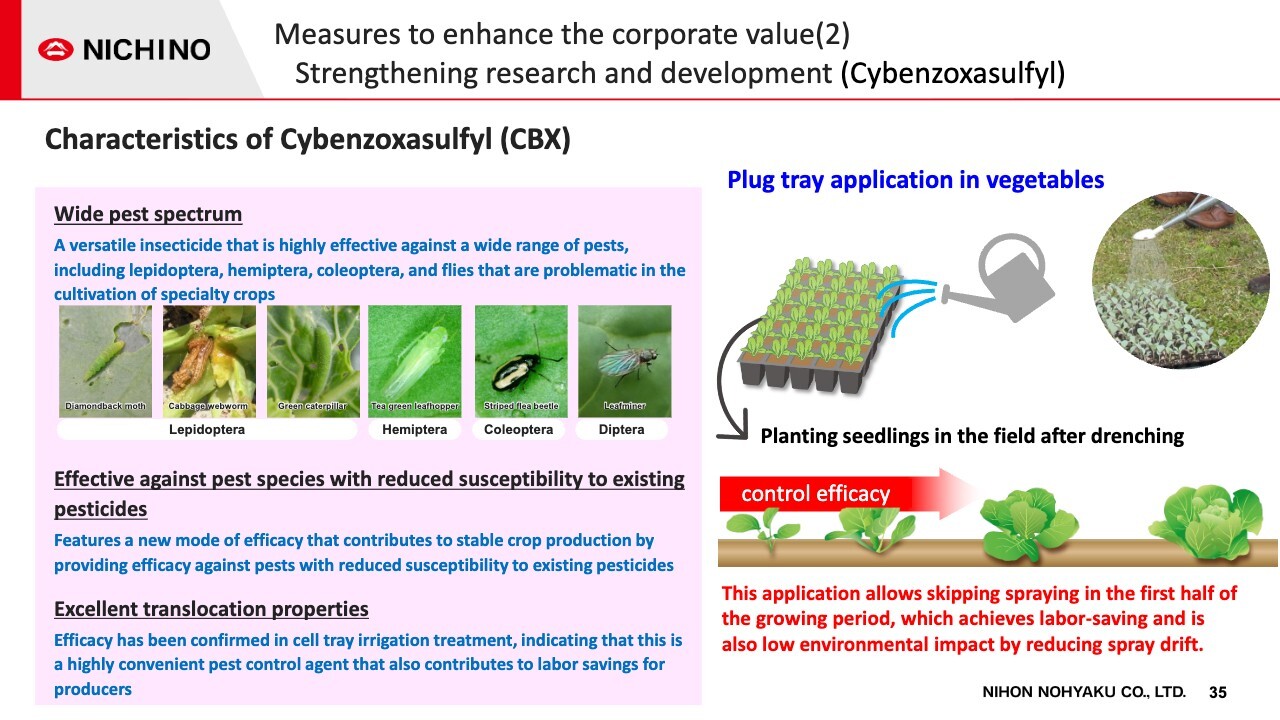

CBX is a high-performance insecticide with a broad insecticidal spectrum. It is highly versatile, with excellent efficacy against a wide variety of insect pests, including lepidoptera, hemiptera, coleoptera, and diptera, which are problematic in the cultivation of specialty crops.

It also features excellent systemic penetrative action, and is being developed with a view to application in cell tray irrigation. With this treatment method, CBX can be applied to seedlings, eliminating spraying-based pest control in the first half of the growing season.

We believe that this will contribute to labor savings for growers and also help reduce environmental impacts through lower water consumption.

Measures to enhance the corporate value (2) Strengthening research and development (Cybenzoxasulfyl)

CBX is currently under development in Japan, South Korea, and India , with peak sales of over 3 billion yen expected in those countries.

In the future, we aim to achieve net sales of 5 billion yen or more by further expanding national and regional registrations, target crops, and methods of use through further evaluation in other countries and regions where the product has registrability and marketability.

Smart agriculture initiative AI Diagnosis of Diseases, Pests, and Weeds

This slide presents some of our "smart agriculture" initiatives. We have released a new solution that links our "Diagnose Your Crops with AI!" smartphone app with JA Zen-Noh's "Z-GIS" farm management system.

This service allows users to record information on pests, weeds, and farming operations with the "Diagnose Your Crops with AI!" application, and display the information on visual maps with "Z-GIS".

The service is already in use by JA and local government instructors, and has received high praise as a recording and sharing tool that anyone can use. We expect the system to see use in varied situations including assessing the distribution of pests and diseases, recording farming operations, and checking damage after a disaster.

As growers expand in scale and face shortages of labor, we will contribute to the realization of sustainable agriculture by improving convenience for growers through smart agriculture.

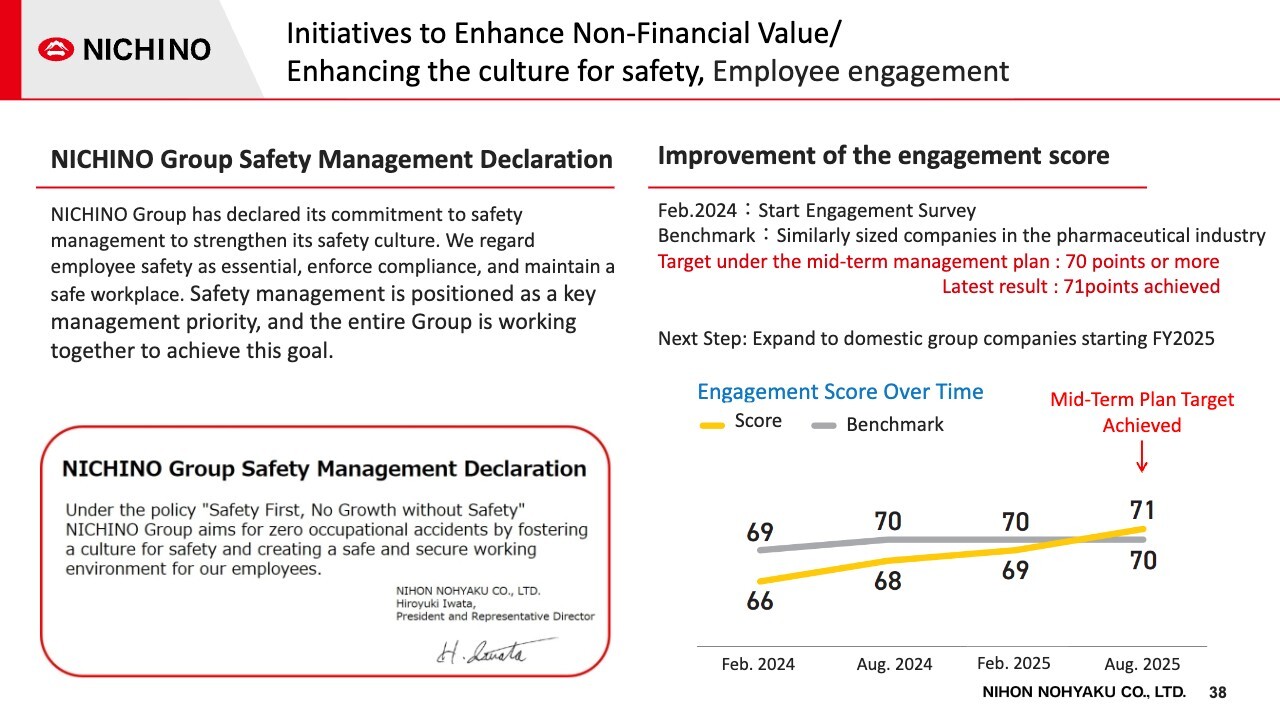

Initiatives to Enhance Non-Financial Value / Enhancing the culture for safety, Employee engagement

To further foster a safety culture and strengthen ongoing safety activities, the NICHINO Group issued the NICHINO Group Safety Management Declaration.

Based on our conviction that employee safety is essential, the Group will always maintain an environment in which employees can work safely and in compliance with rules and regulations. We position safety management as an important management issue and will work across the Group to address it.

We began conducting engagement surveys in February 2024 and set targets in our Mid-term Management Plan, using similarly sized companies in the pharmaceutical industry as benchmarks. As a result of various initiatives, our most recent overall score was 71 points, achieving our initial target.

We plan to expand this survey to domestic Group companies to further enhance engagement.

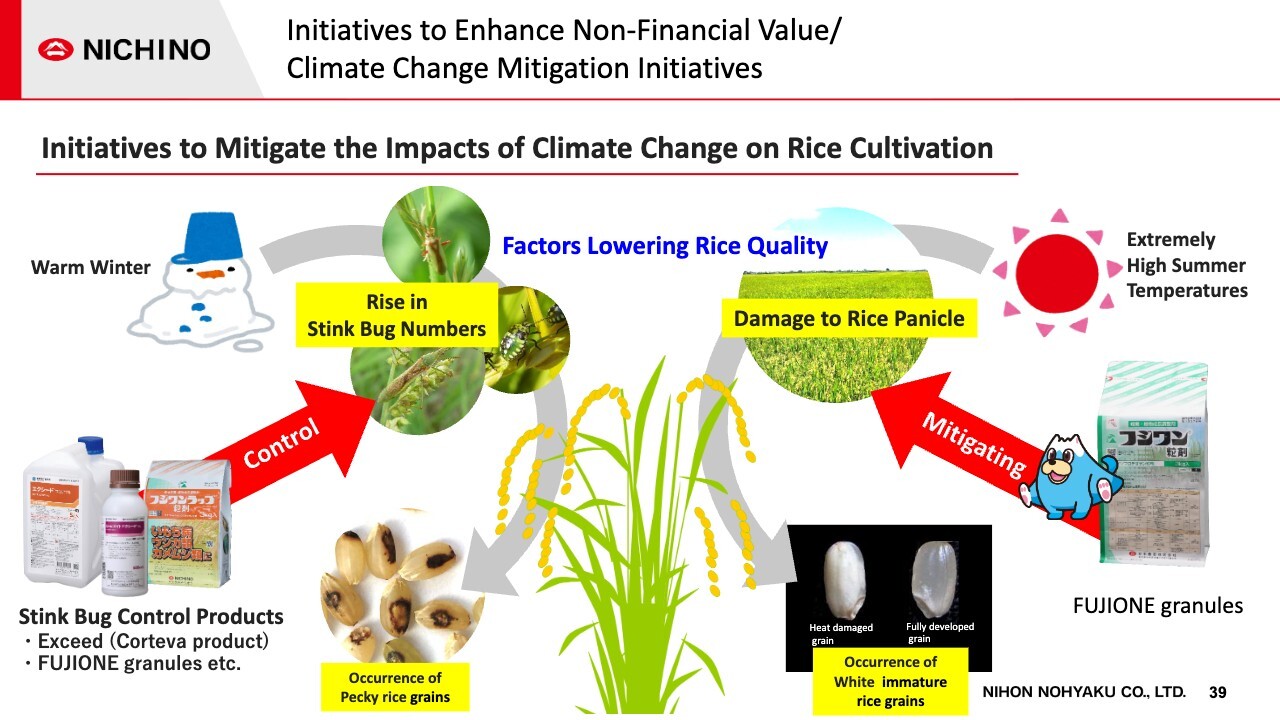

Initiatives to Enhance Non-Financial Value / Climate Change Mitigation Initiatives

According to the Ministry of Agriculture, Forestry and Fisheries, inspections of the 2025 rice crop as of the end of September showed that the ratio of top-grade rice averaged 77.5% nationwide, a significant improvement from 60% the previous year when quality declined significantly due to climate change.

We are promoting stink bug control products to address increased damage caused by warm winters. To address the occurrence of white immature grains due to intense heat, we are promoting the use of FUJIONE, which are effective in mitigating high temperature damage. Our first product developed in-house, FUJIONE has been on the market for 50 years.

Through these efforts, we hope to continue contributing to stable production and quality improvement in rice.

Promoting Dialogue with Stakeholders / Issuance of Integrated Report

As part of our information disclosure efforts to enhance our corporate value, we released our first Integrated Report on October 30 of this year.

In the report, we present the NICHINO Group's value creation framework and priority issues that the Group should address to achieve medium- to long-term growth, under the mission of contributing to the realization of a sustainable society by protecting safe, stable foods and enriched lifestyles.

To meet the growing demand for information disclosure in recent years, we have focused on disclosing ESG information, including information on environmental and climate change initiatives, our approach to human resources, and our corporate governance.

We encourage you to read this report on our website and provide us with your comments.

Message from Mr. Iwata

Since our founding, we have contributed to the stable production of food through the control of pests and weeds through our crop protection products.

The NICHINO Group will continue to provide advanced technologies to meet the needs of society in a wide range of fields, including crop protection products, pharmaceuticals, and pharmaceuticals for animals, to secure stable food supplies, protect people's lifestyles, and contribute to the realization of a sustainable society through the promotion of sustainable management.

This concludes my presentation. Thank you for your attention.

Q&A: Impact of the Change of Minister of Agriculture, Forestry and Fisheries on Business Performance

Moderator: We have the following question. "It was noted that products for paddy rice are doing well due to increased area under paddy rice cultivation, spurred by soaring rice prices. Norikazu Suzuki has replaced Shinjiro Koizumi as the Minister of Agriculture, Forestry and Fisheries, and there have been some changes in agricultural policy and policy. Do you believe these changes will affect financial results from the next fiscal year?"

Iwata: In the past, especially under the Ishiba administration, there was a policy shift toward increased rice production. With the change of administration, there has been a shift in direction toward demand-driven production.

However, demand for rice has grown significantly since last year. This is due in part to inbound demand and to the government's aggressive expansion of exports.

The government has announced that the estimated area of rice planted for staple food next year will be 7.11 million hectares. Although this is smaller than last year's crop area, we believe that a leveling off of this decline will be confirmed this year, and crop area will trend slightly upward.

We do not expect demand itself to decline significantly, and with current rice prices remaining high, we expect growers to continue to be highly motivated to grow and to control damage.

We recognize that stink bug damage and high temperature disorders remain a major problem. We believe that the need for crop protection products will increase even more with the trend toward pest control in paddy rice and toward weed control mainly through direct seeding in dry rice paddies.

The Group's sales ratios are approximately 30% in Japan and 70% overseas, and we believe that overseas markets can continue to grow steadily. In the domestic market, BASF's crop protection products for fruit trees are joining our product lineup. We will continue to maintain our growth path and engage in future-oriented activity.

Q&A: Reasons for the strength of business in Canada and the outlook for the business

Moderator: We have the following question. "Please elaborate on the reasons for the strong sales to Canada in the North American market. Are these transitory or structural factors?"

Iwata: Sales to Canada are currently covered by Nichino America, which is developing sales of a herbicide called pyraflufen-ethyl through Nufarm.

Nufarm has traditionally promoted the sale of multiple compounds and is gradually expanding its market share thanks to its long-standing efforts to promote the use of these products.

We plan to develop new formulations and compounds in the future. We believe that the growth is not transitory and that our business in Canada will continue to grow.

Q&A: Prospects for CBX and regions in which it will be deployed

Moderator: We have the following request. "Looking at the future for CBX, please elaborate on promising regions following Japan, India, and South Korea and the timing for entering those regions."

Iwata: In Japan, India, and South Korea, we are proceeding with pesticide applications this year. In Japan, we have already completed the application and aim for registration and market launch a few years after application.

Evaluation studies are currently underway in other countries. Specifically, we expect to move forward in Brazil and Southeast Asia. Mexico is also currently under consideration. Wherever possible, we intend to continue strengthening our global reach.

Q&A: The proliferation of generic pesticides outside of Latin America

Moderator: We have the following request. "Please discuss the proliferation of generic pesticides outside of Latin America, by region."

Iwata: Outside of Latin America, too, we believe that Chinese and Indian generics will be the main products. The rollout of generics is underway in India, Asia, and Europe as well, we believe.

However, due to regulatory and other issues, we believe that these rollouts are not occurring all at once but rather in accordance with regulatory status of specific regions.

Our Group will continue to focus on original products and will solidly promote their proliferation to compete with generic agrochemicals.

Q&A: New policy for M&A

Moderator: We have the following request. "The item 'Aim to play the leading role in reorganizing the industry' was added to the discussion concerning M&A. Please provide some background on the timing of this."

Iwata: We have continued to work on M&A. From the perspective of industry restructuring, there had been a tendency for multinational companies to begin direct sales in Japan and to strengthen their sales.

In recent years, however, Japan's relative positioning has declined as demand has leveled off in the country.

In this context, our recent acquisition of rights to BASF's crop protection products for fruit trees and the strategic partnership we launched with Corteva four years ago are all founded on our company, which possesses a base for proliferation of products in Japan, serving as the recipient for these products, under our policy working toward their future development.

Naturally, in the global market, the policy of Nihon Nohyaku and the NICHINO Group is to strengthen direct sales in our target regions.

Within these efforts, we hope to roll out a broader range of solutions at the individual regional level by filling in portfolio gaps while establishing a structure that accepts not only our original products but also third-party products.

Q&A Session: The company's approach to parent-subsidiary listing and future policies

Moderator: We have the following question. "Are there any updates to the company's thoughts on the 'parent-subsidiary listing'? To the extent possible, please explain whether the company believes the current structure to be best or whether there is a possibility it will seek a different structure."

Iwata: We are often asked about parent-subsidiary listing, but since the 2018 capital and business alliance with ADEKA, we have maintained our current form.

Under a policy of developing synergies with the parent company, the company operates independently and there is no change in that policy at this time. Although future change is possible in response to changes in the environment and other factors, in terms of current policy there is no change to the stance of seeking to increase total corporate value while identifying synergies.

We also believe that the level of conflict of interest with the parent company is at an acceptable level, and we recognize that we have cleared governance issues associated with the parent-subsidiary listing. We will continue working to further enhance our corporate value as a listed subsidiary.

Q&A: Inventory outlook under the exclusive distribution agreement for BASF's crop protection products for fruit trees

Moderator: We have the following question. "You mentioned that the exclusive sales agreement with BASF for seven crop protection products for fruit trees will increase net sales by 5 billion yen. Will inventories also increase? Please provide an outlook for the extent of any increase."

Iwata: Because we will purchase seven formulations and products from BASF through BASF Japan for sale through our company, we expect temporary increases in inventories, that is, internal inventories. However, as we plan to sell the products in a timely manner, we expect the impact to be at the level of several hundred million yen.

At the same time, the NICHINO Group is strengthening inventory optimization on a non-consolidated basis. We are currently in the process of making significant improvements in internal inventories, which expanded somewhat under the COVID-19 pandemic.

In global operations, too, the company intends to continue to optimize inventories and to further advance cash flow management.

Q&A: Future profit margin trends

Moderator: We have the following question. "What is your outlook for profitability in the next fiscal year and beyond? Is there a possibility of a gradual decline in profit margins in the future due to the promotion of direct sales and the expansion of sales of other companies' products, including BASF's products?"

Iwata: Regarding direct sales, we have traditionally sold directly to wholesalers in Japan. Looking at recent conditions overseas, too, Nichino Europe, as an example, converted to a direct sales structure in the U.K. and Ireland, which we understand will enhance profitability.

Regarding BASF's products, we are aiming for sales in the 5 billion yen range and so do not expect a significant decline in overall profitability as a result.

Note that the current Mid-term Management Plan calls for an operating profit margin of 9% and ROE of 8%, with net sales of 120 billion yen. In this context, we intend to further expand revenue and profitability through cost reductions and other initiatives.

By 2030, as indicated in the Mid-term Management Plan, we aim to achieve net sales of over 165 billion yen, operating profit margin of 10%, and ROE of 10%. We continue to operate under measures that will gradually increase our profit margin into the future.

Q&A: Impacts of exchange rate sensitivity on business performance

Moderator: We have the following request. "There appears to be a gap between the current exchange rate and the company's exchange rate assumptions for the current fiscal year. Please elaborate on the company's exchange rate sensitivity."

Iwata: Regarding exchange rate sensitivity, the first half of the year has already finished. Discussing the exchange rate for the second half, a difference of one yen to the dollar will have an impact of about 100 million yen on net sales and 30 million yen on operating profit.

The exchange rate is currently set to 145 yen to the dollar, but the yen is weakening and was 156 yen to the dollar around yesterday and today. In this case, we expect increases of approximately 1 billion yen in net sales and 300 million yen in operating profit as a result of currency translation.

Looking at Brazil, we have set a value of 26 yen to the real, but the rate is currently about 29 yen. Similarly, an increase in the real exchange rate of 1 yen will result in increases of approximately 350 million yen in net sales and 40 million yen in operating profit.

Accordingly, a depreciation of the yen by 3 yen at the current rate is expected to increase net sales by approximately 1 billion yen and operating profit by approximately 100 million yen. Please understand that this is what you will see if the current exchange rate continues.