SECTION

Kosuke Kiyokawa (hereinafter “Kiyokawa”): Good evening, everyone. I am Kosuke Kiyokawa, CEO of COPRO-HOLDINGS. Co., Ltd. Thank you all for taking the time out of your busy schedules to join us today. I will now begin the financial results briefing for 2Q FYE3/2026.

Today’s briefing consist of Sections 1 through 4. Sections 5 through 7 are provided as reference materials.

2Q FYE3/2026 Consolidated Financial Highlights

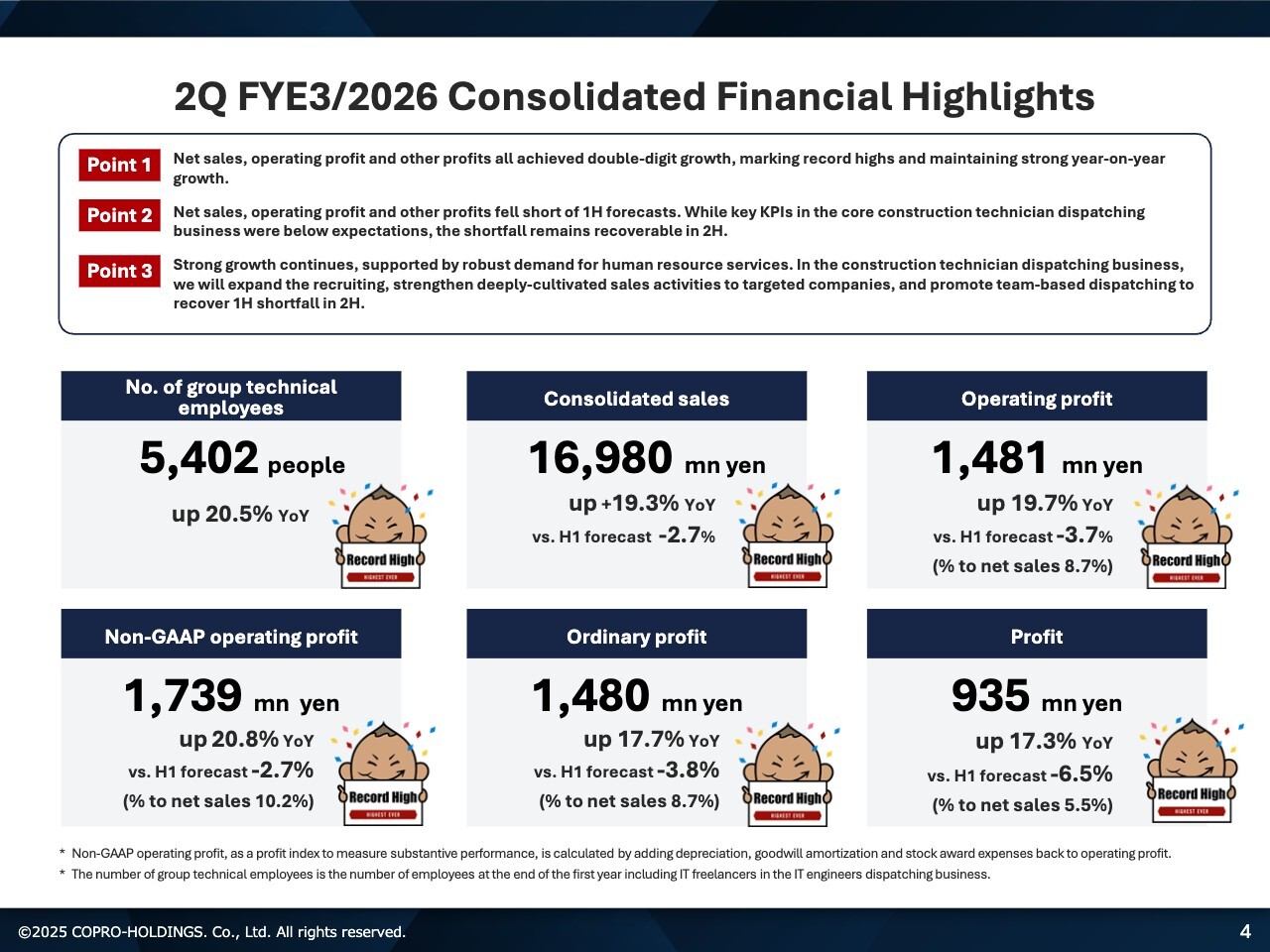

Kiyokawa: In Section 1, I will explain the summary of financial results for 1H FYE3/2026. The slide shows the consolidated financial highlights. I have three points to cover.

Point 1. Both net sales and operating profit margin achieved double-digit growth, setting new all-time highs. We continue to maintain high growth YoY.

Point 2. Net sales and operating profit fell short of 1H forecasts. Whereas key KPIs in the core construction technician dispatching business were below expectations, we recognize the shortfall remains recoverable in 2H.

Point 3.Strong growth continues, supported by robust demand for human resource services. In the construction technician dispatching business, we will expand the recruiting, strengthen deeply-cultivated sales activities to targeted companies, and promote team-based dispatching to steadily recover 1H shortfall in 2H.

I will explain the six key figures. The number of group technical employees was up 20.5% YoY to 5,402 people, consolidated sales were up 19.3% YoY to ¥16,980 million, and operating profit was up 19.7% YoY to ¥1,481 million.

Non-GAAP operating profit was up 20.8% YoY to ¥1,739 million, ordinary profit was up 17.7% YoY to ¥1,480 million, and profit was up 17.3% YoY to ¥935 million.

As shown on the slide, we achieved record highs across all areas.

Progress of Consolidated Financial Results

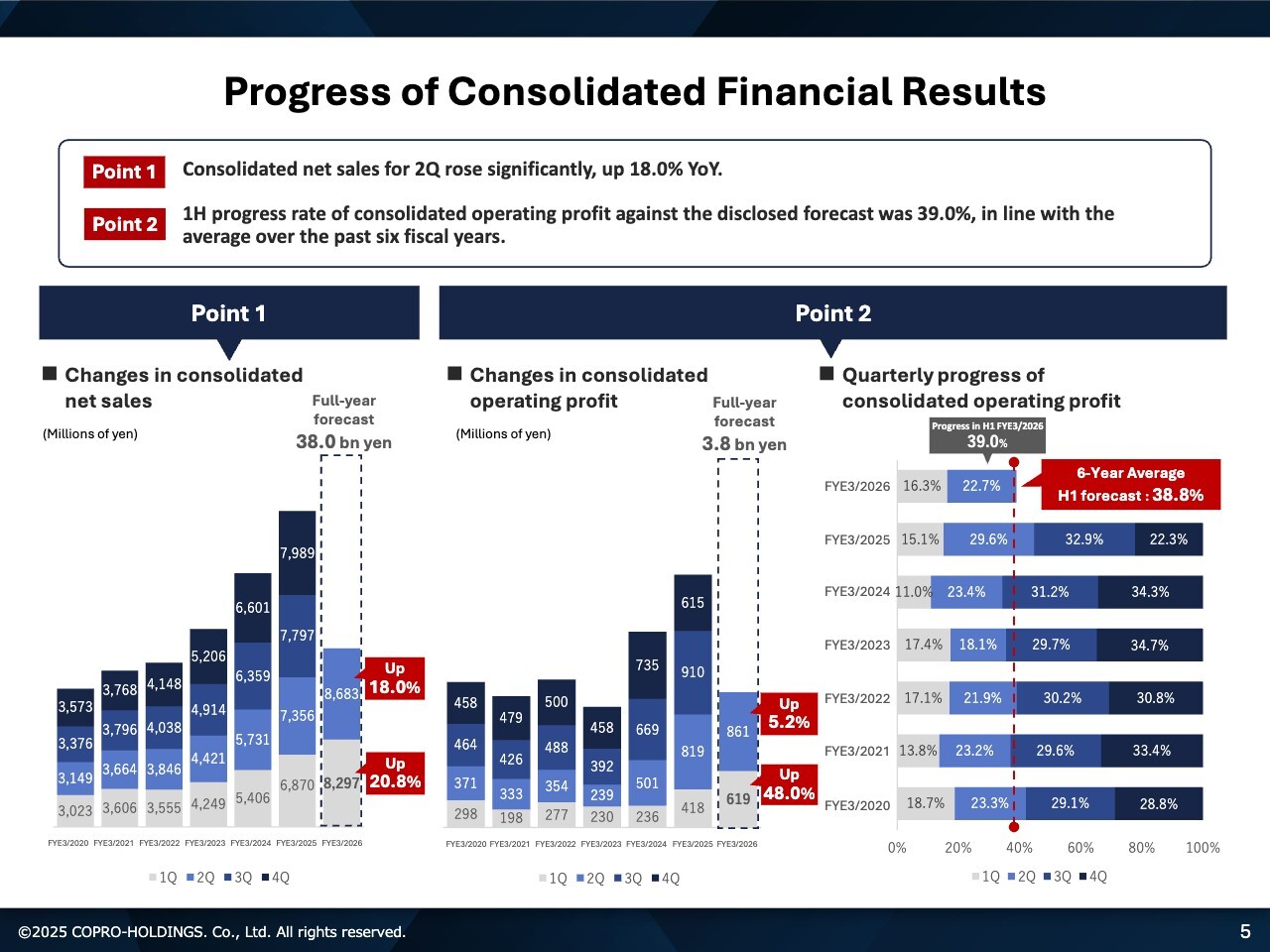

Kiyokawa: Here is the progress of consolidated financial results. Our performance is slightly below the 1H forecast. However, I recognize these figures can be fully recovered in 2H. To achieve the full-year consolidated results, all employees are committed to moving forward together as one team.

1H progress rate of consolidated operating profit against the disclosed forecast was 39%. However, the industries we serve, with the construction sector as our main target, will enter a further boom phase heading into 2H. This is because public sector work, among other factors, tends to concentrate around the fiscal year-end of March 31.

Please understand that the 1H progress rate of 39% is broadly in line with the average of the past six fiscal years.

Consolidated Financial Results

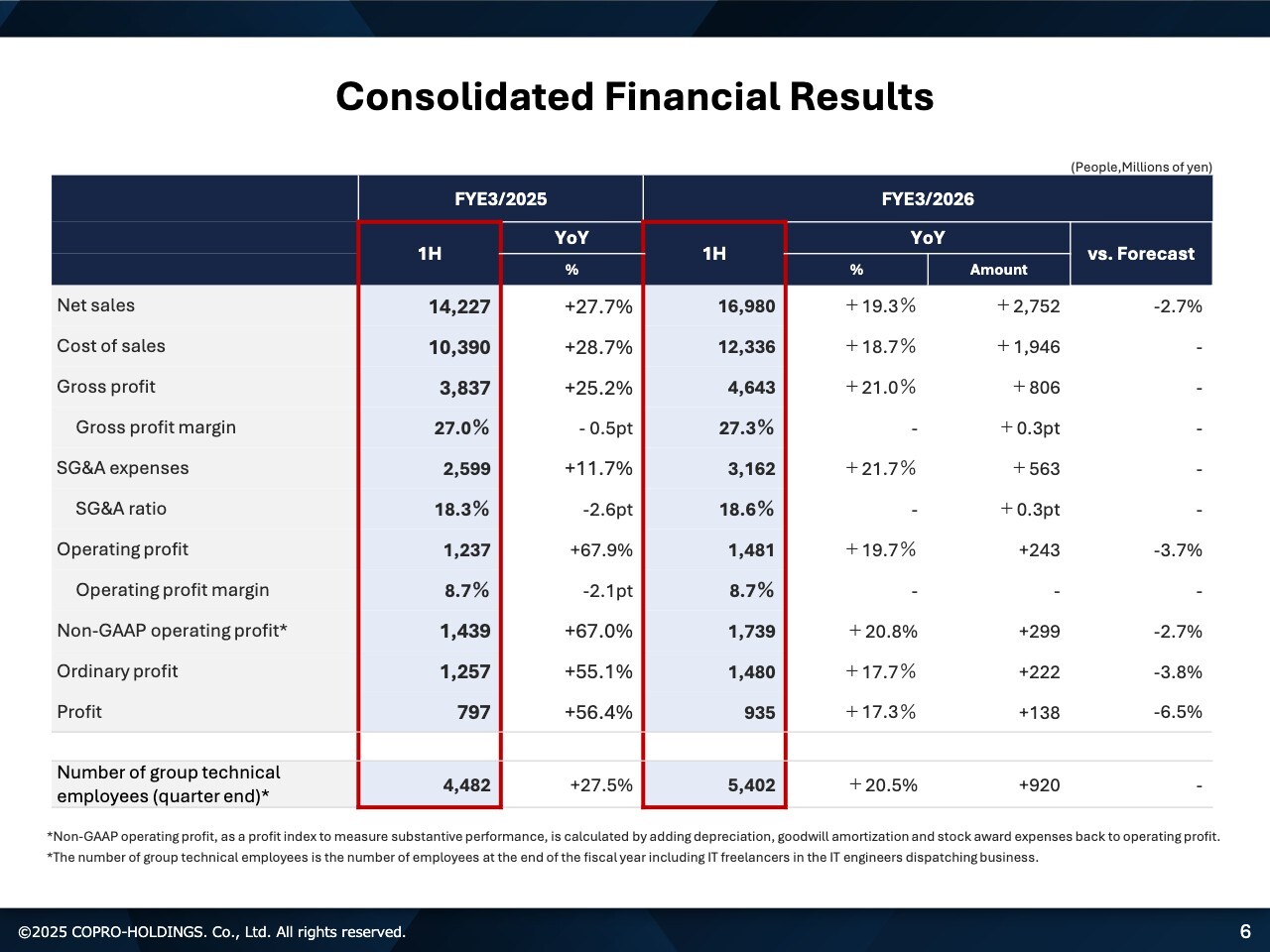

Kiyokawa: This slide shows the consolidated P/L results. Please refer to the figures here.

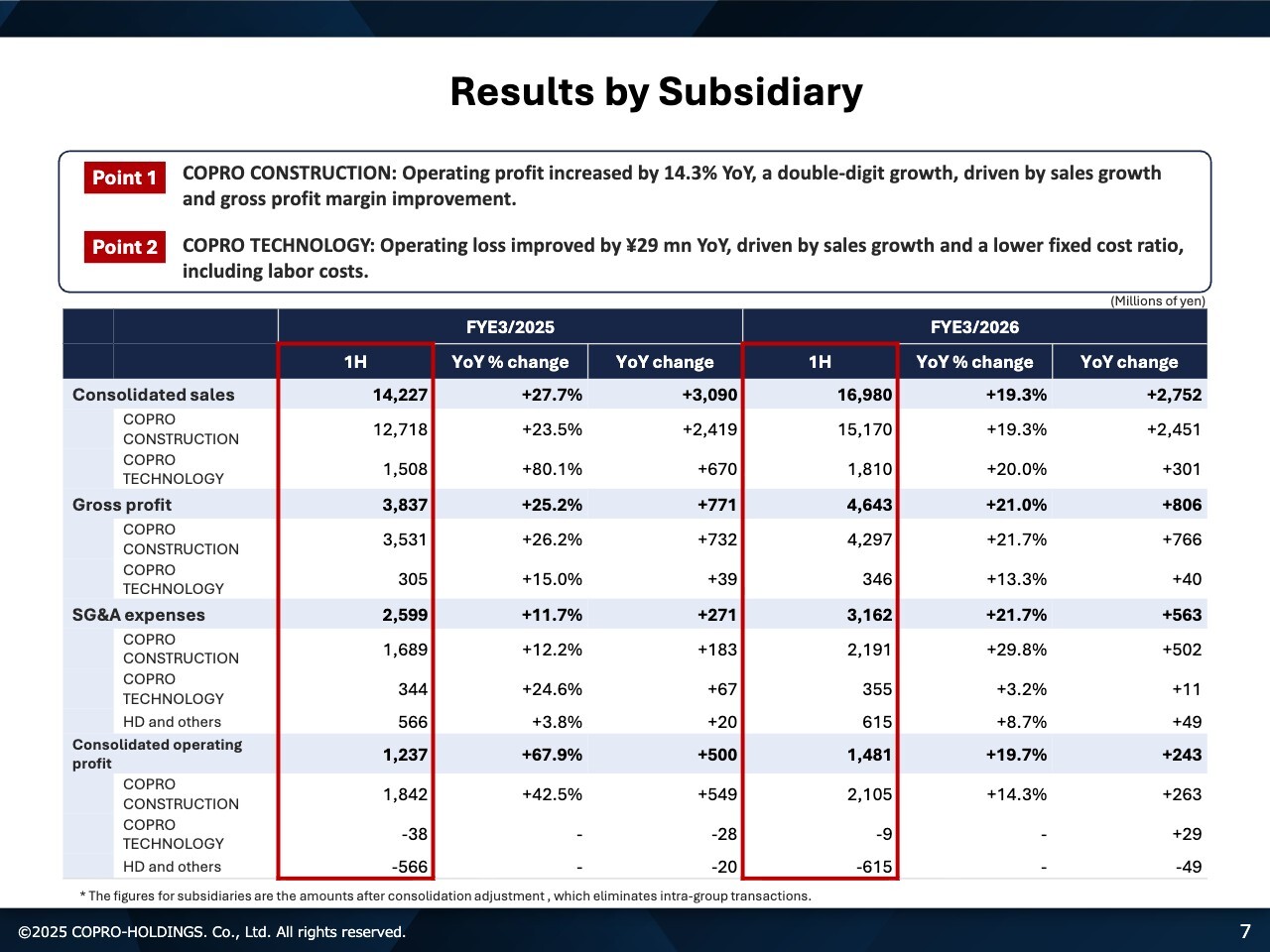

Results by Subsidiary

Kiyokawa: I will now explain the results by subsidiary. As Point 1, COPRO CONSTRUCTION achieved operating profit increased by 14.3% YoY, a double-digit growth, driven by sales growth and gross profit margin improvement in our core construction field.

Point 2. COPRO TECNOLOGY, operating in the mechanical & electrical, semiconductor, and IT sector, saw its operating loss improved by ¥29.0 million YoY, driven by sales growth and a lower fixed cost ratio, including labor costs.

The red box on the right side of the slide shows the P/L section, detailing net sales, gross profit, SG&A expenses, and operating profit.

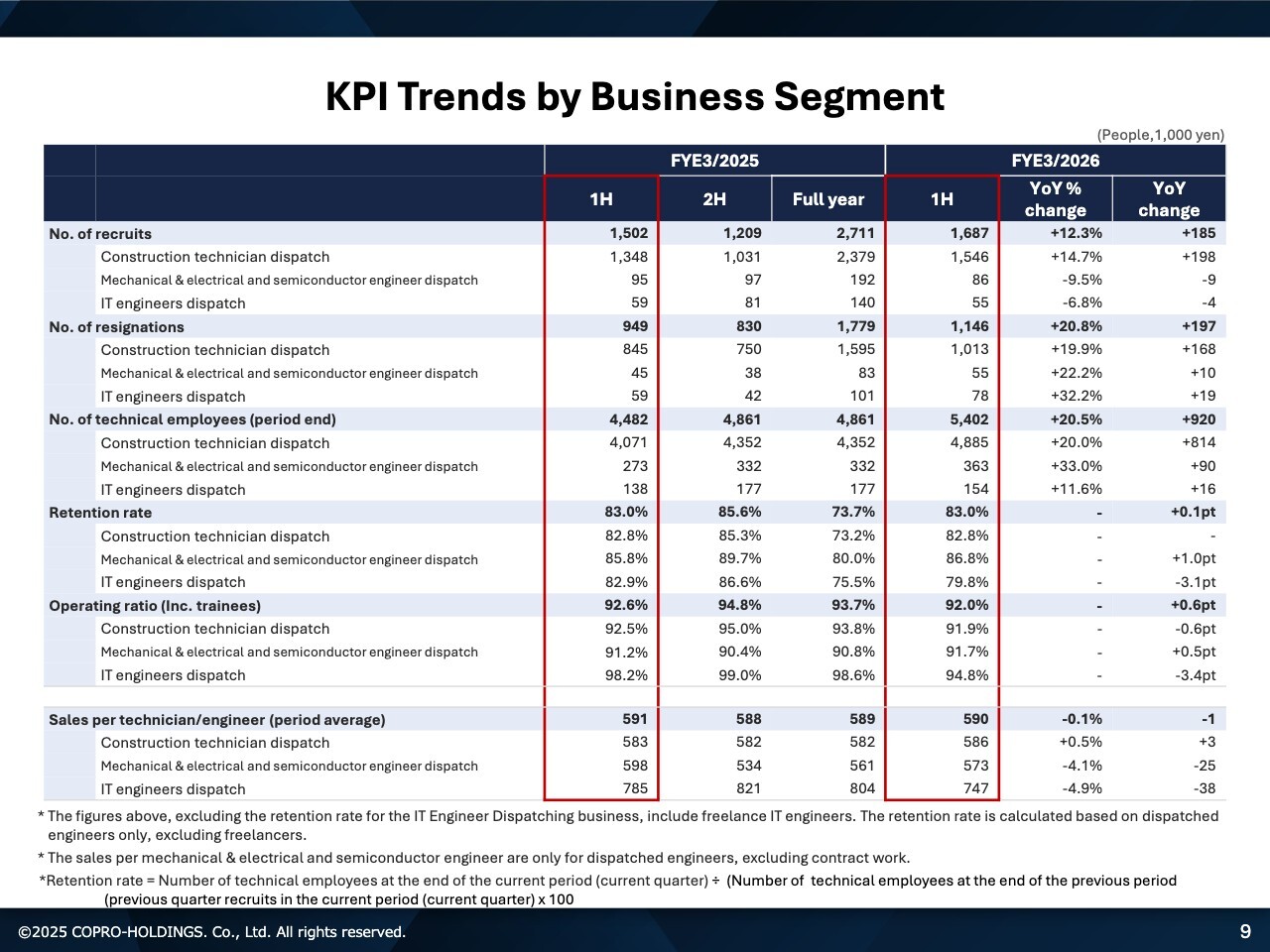

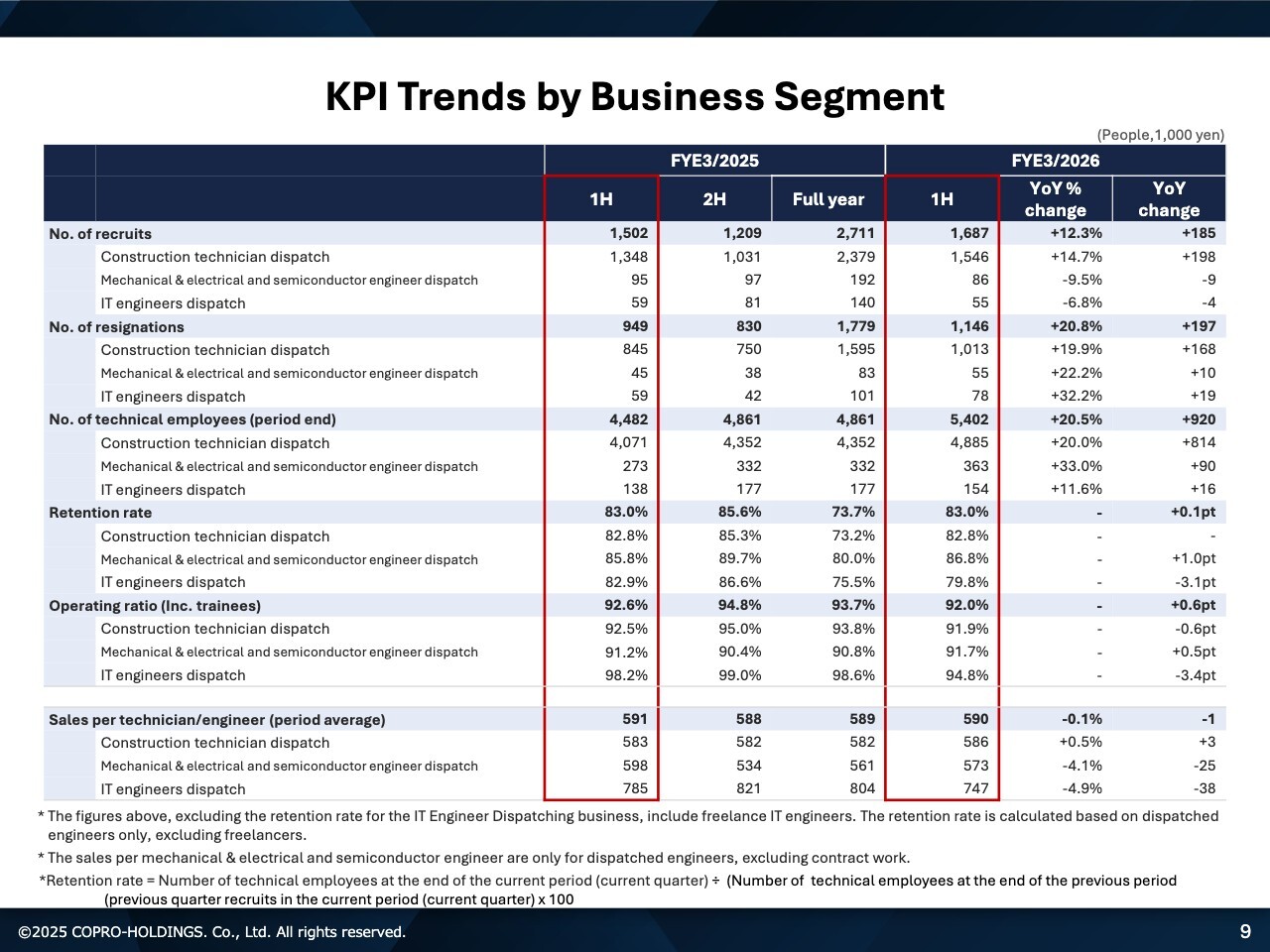

KPI Trends by Business Segment

Kiyokawa: In Section 2, I will explain the analysis of KPIs by business. The slide shows the number of recruits, number of resignations, number of technical employees, retention rate, operating ratio, and sales per technician/engineer for each business segment.

I will now outline our notable challenges, analyzing the causes of what happened in 1H reveals that demand remains robust. While we pushed recruitment quite aggressively, our hired talent didn't match the projects coming in from clients, leading to increased standby labor costs. Consequently, the operating ratio dropped by about 2 pts YoY, which I assume is one of major contributing factors.

Aside from the above, while the number of recruits increased by 12.3% YoY, we recognize that it has not yet met the full-year plan.

To recover the ground lost in 1H during 2H, we further accelerate recruitment and ensure a solid match with incoming orders. We will conclusively pursue this basic fundamental approach to make up for the losses.

I recognize that our retention strategies—such as thoroughly promoting team-based staffing and intensifying deeply-cultivated sales efforts targeting our main clients, the super general contractors—are fundamentally sound. While pursuing the strategies further, we will rigorously implement initiatives to boost retention rates among young talent, aiming to improve overall retention.

Regarding sales per technician/engineer, higher billing rate for existing employees continue to accumulate in a positive manner. However, due to the retirement of veteran employees, we are currently operating primarily with inexperienced, lower-billing-rate personnel, which prevents sales per technician/engineer from growing significantly.

To address this situation, increasing the number of employees with two, three, or four years of tenure or those considered part of the mid-level workforce should lead to further growth in sales per technician/engineer. Our first step is to ensure the retention of young employees in their first year, guiding them into their second and third years. Then, we aim to move the mid-tier price range upward and achieve higher charge levels.

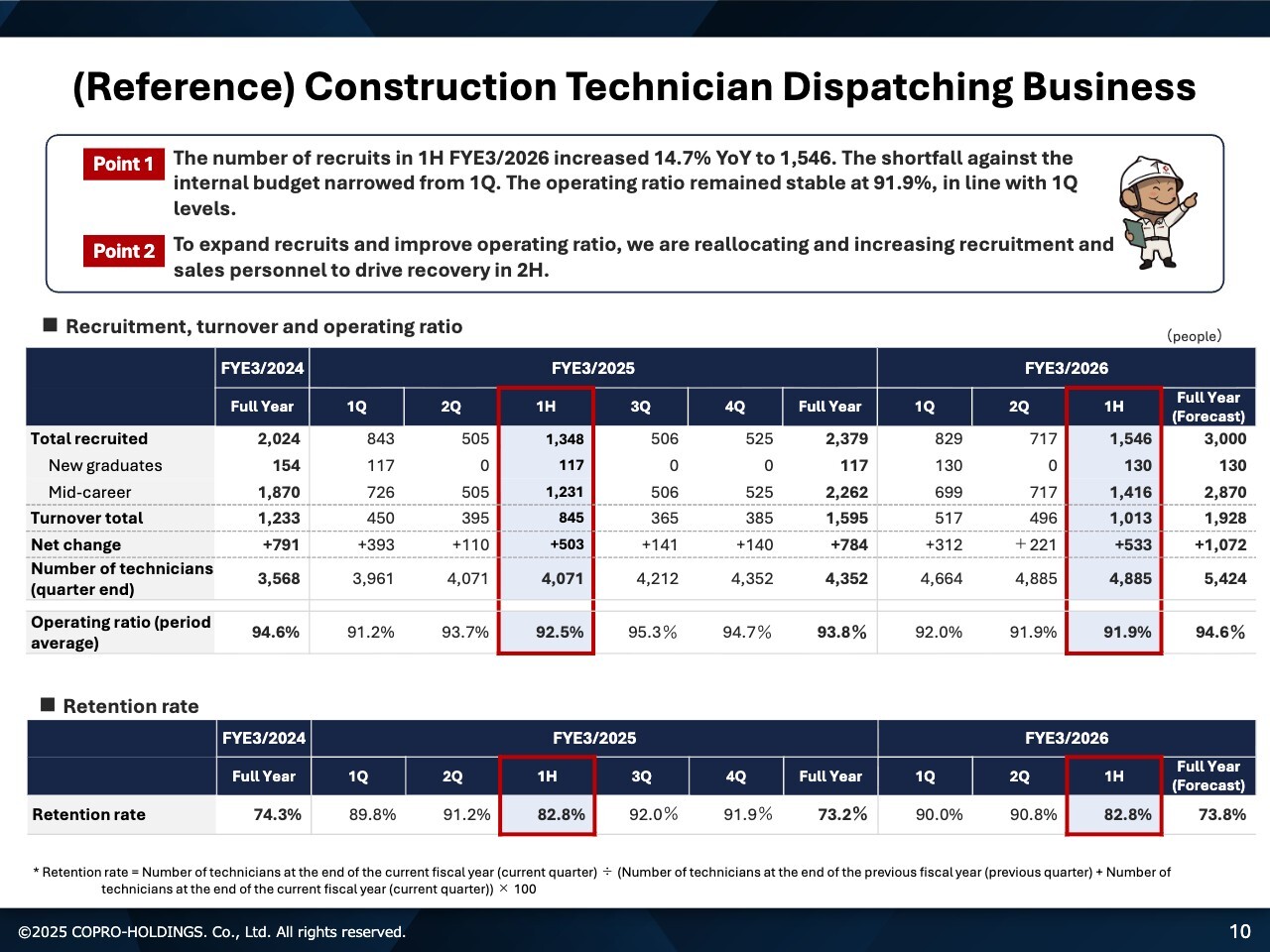

(Reference) Construction Technician Dispatching Business

Kiyokawa: For your reference, regarding the construction field. Please refer to the figures here.

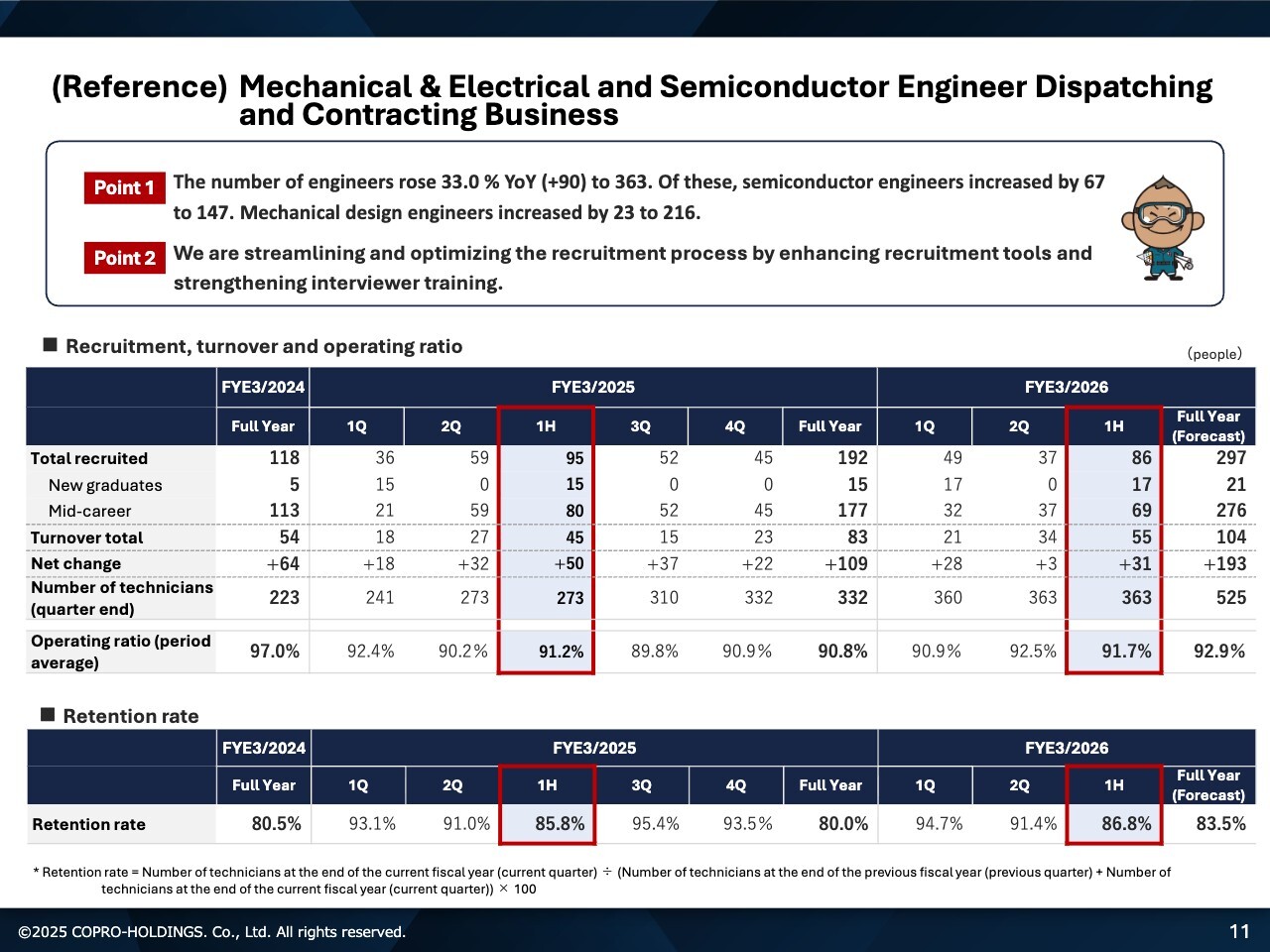

(Reference) Mechanical & Electrical and Semiconductor Engineer Dispatching and Contracting Business

Kiyokawa: This is the domain of COPRO TECNOLOGY, dispatching mechanical & electrical and semiconductor engineers. The mechanical & electrical, semiconductor, and IT sectors are experiencing sluggish growth.

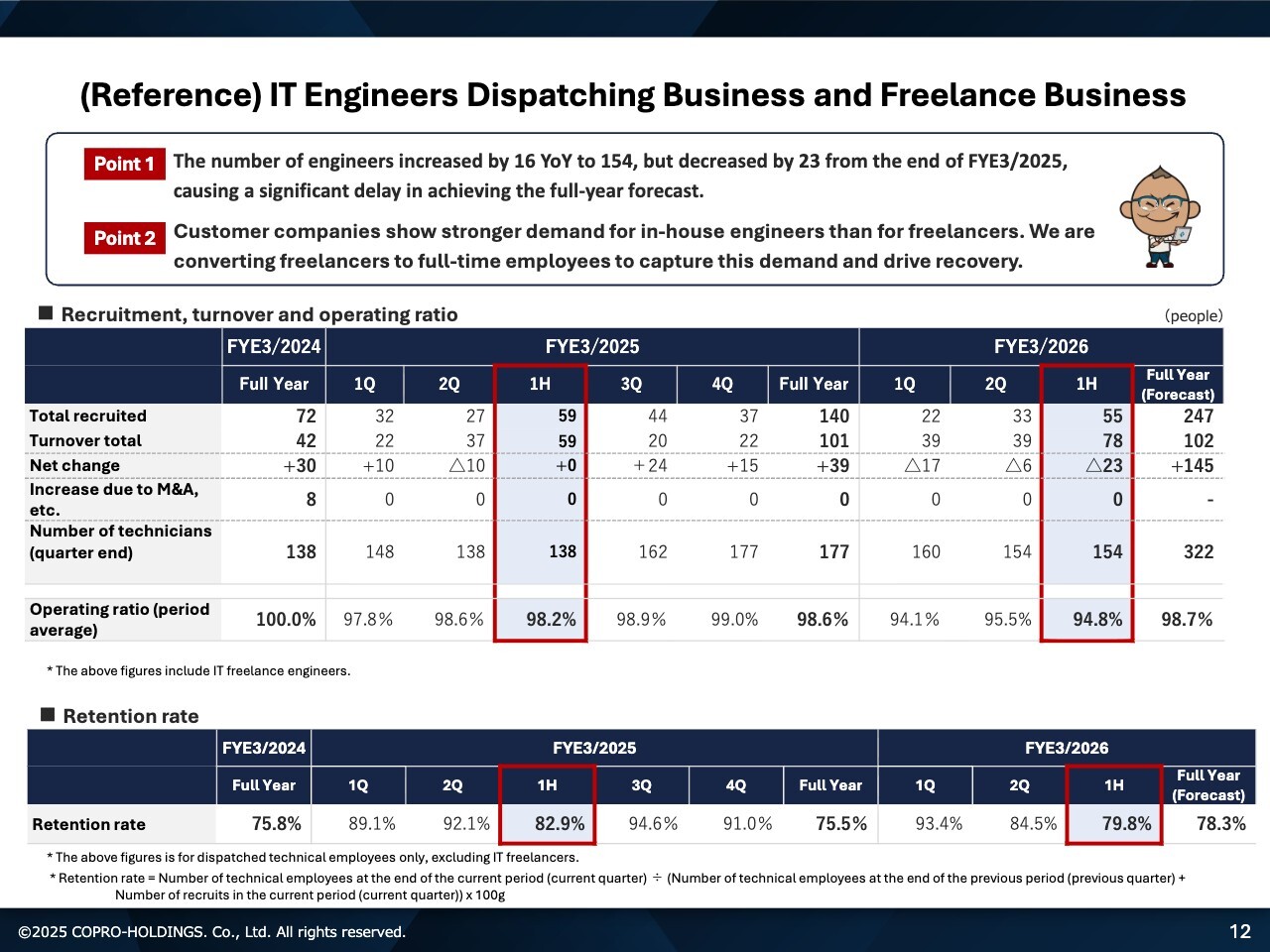

(Reference) IT Engineers Dispatching Business and Freelance Business

Kiyokawa: In the IT engineers dispatching business, the number of engineers has not increased compared to FYE3/2025. The biggest challenge in this field is that customer companies show stronger demand for dispatched staff directly employed by our company than for freelancers.

On the other hand, in the current recruitment efforts, applicants express a preference for freelance work rather than direct employment. We see a significant challenge in effectively matching customer demand with potential candidates from our applicant pool.

We recognize customer needs remain unchanged. Therefore, we will focus on promoting the appeal of working as a dispatched employee to those who come to our interviews seeking freelance work, and on advancing matching efforts as we transition them to direct employment.

Aiming for an Overwhelming No.1 Position in the Industry for Construction Technician Dispatch

Kiyokawa: We aim for an overwhelming No.1 position in the field of construction technician dispatch.

We identify two points. Point 1 involves building on a strong sales foundation—anchored in deeply cultivated sales activities targeting companies that prioritize engineers—we have established and continuously strengthened a low-cost hiring system that does not rely on external recruitment agencies. With this as our foundation, we aim for an overwhelming No.1 position in the industry.

Point 2 consists of expanding industry share and improving retention rates, a key measure of satisfaction for both engineers and customer companies, to aim for an overwhelming No.1 position in the industry. We pursue a world where the value of dispatched engineers is fully recognized, embodying our commitment to copro, the responsive pros.

We firmly believe the strategy we are currently pursuing is absolutely correct. Continuing to refine our sales and recruiting process, we will repeatedly achieve organic growth, the industry’s No.1 growth potential, and reach the pinnacle of an overwhelming No.1 position in the industry in both scale and quality.

What we fundamentally need to do is clear. How we achieve this has already been mapped out. The key lies in how effectively we share them with our field members and continue driving them forward. We intend to thoroughly hone both our strategy and the execution capabilities of our field teams.

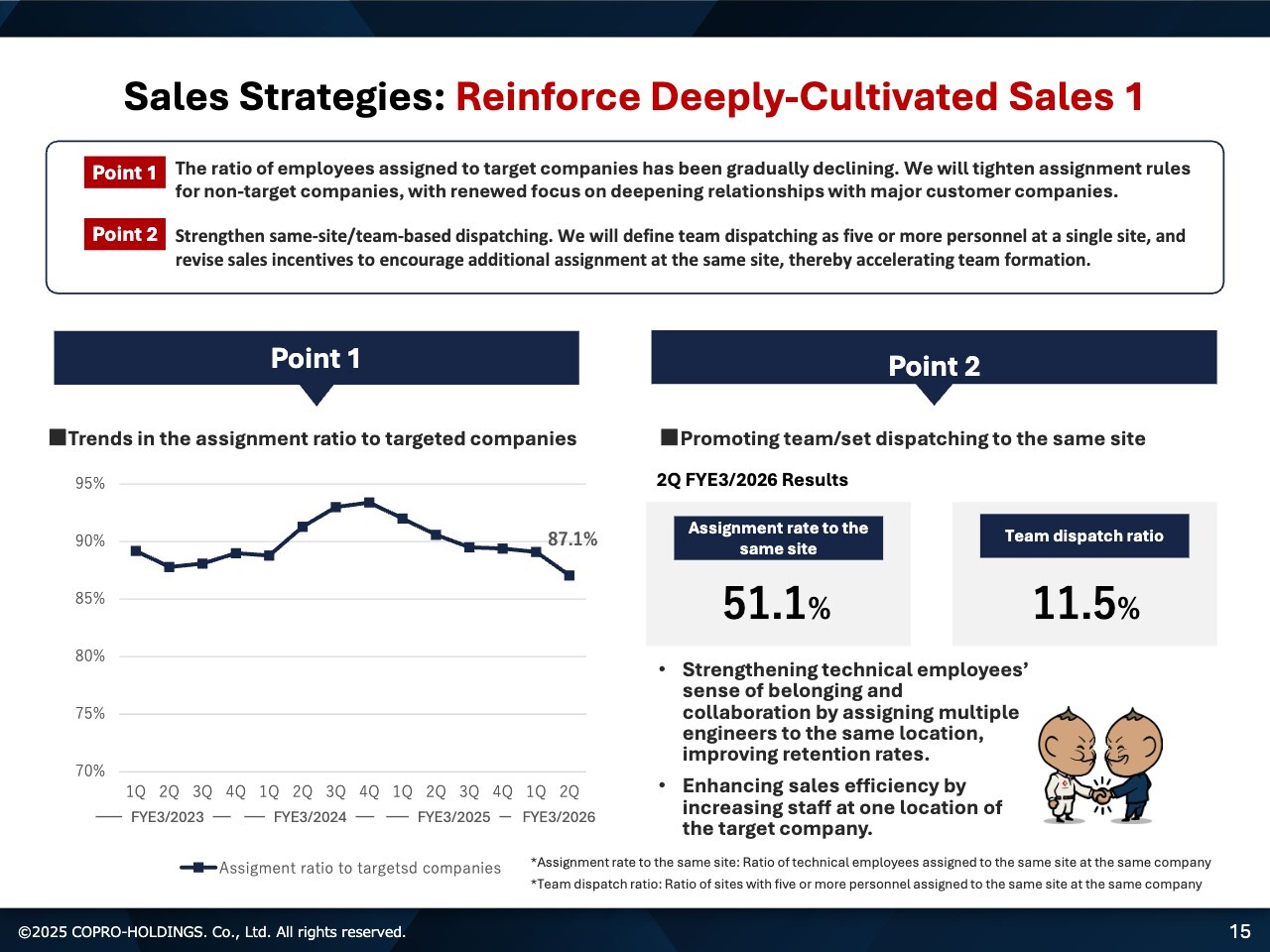

Sales Strategies: Reinforce Deeply-Cultivated Sales 1

Kiyokawa: I will explain the first measure to reinforce deeply-cultivated sales in our sales strategies. We are working on a strategy focused not on new business development but on deeply cultivating sales with existing target companies.

In the chart on the left side of the slide, you can see that the ratio of employees assigned to target companies is trending downward. One contributing factor is that we struggled to achieve good matches with the companies we target though we accelerated hiring and successfully recruited in 1H.

Consequently, assigning to non-target companies led to poor matching, early contract terminations, and resignations, creating a vicious cycle.

We aim to increase the ratio of employees assigned to target companies and improve retention rate by deeply exploring the five major general contractors and midsized companies we are targeting as our focus companies.

Point 2 is promoting assignments to the same site and team dispatching. With an assignment rate to the same site of 51.1%, it is crucial not to dispatch young employees with one year of experience alone or as the second person.

In our defined team dispatching, it is extremely important to increase the number of first-year or similar junior employees as the sixth, seventh, or eighth member to sites where five or more engineers or active personnel are already dispatched from COPRO.

This approach builds relationships where new hires can immediately consult with experienced COPRO employees, senior colleagues, or peers of close age if they encounter difficulties. It is extremely important.

Thoroughly assigning the sixth and seventh members to sites already staffed with five or more COPRO personnel is key to retaining new hires. We firmly intend to execute this action.

In the team dispatching, we previously did not explicitly designate a leader role for the engineers. However, we have now appointed one veteran or senior employee as a team leader for each site with five or more team members. We have the leader closely monitor the team.

It will enable effective control, further increase team dispatching, and ultimately improve the retention rate of young employees, a key challenge for us.

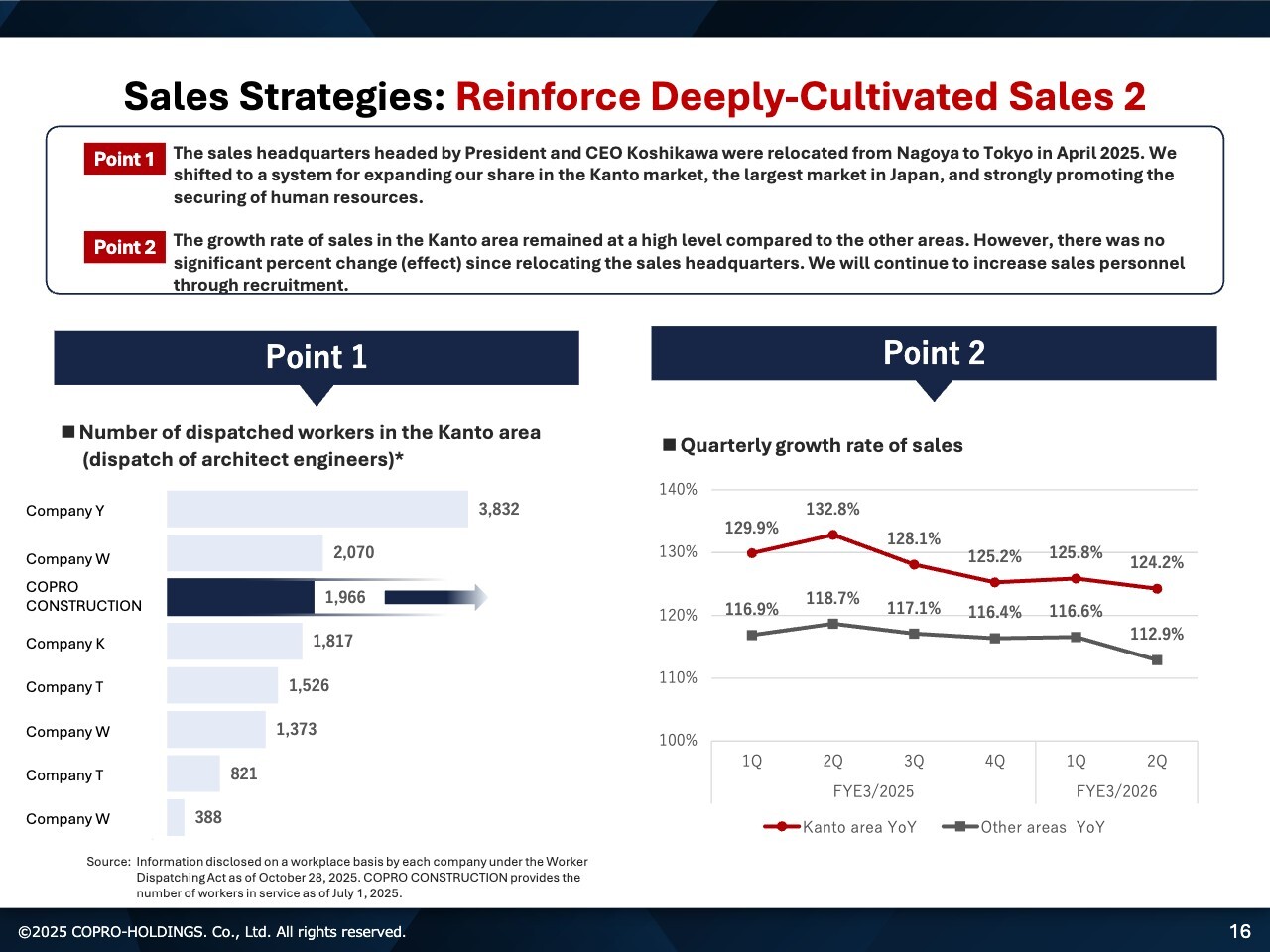

Sales Strategies: Reinforce Deeply-Cultivated Sales 2

Kiyokawa: I will explain the second measure to reinforce deeply-cultivated sales in the sales strategies. The graph in Point 1 on the left side of the slide shows the number of dispatched workers in the Kanto area. The line graph in Point 2 on the right side of the slide shows the quarterly growth rate of sales.

Among our peers, our position in the Kanto area is the third largest in the industry. In April 2025, the sales strategy unit headed by Kiyokawa, the CEO, was relocated from Nagoya to Tokyo.

Expanding our market share in the Kanto region is critically important. The region is Japan's largest market accounting for over 40% of our total sales. While significant results have not yet materialized since the April Tokyo relocation, this is undoubtedly Japan's largest market with substantial construction investment. Therefore, we want to ensure that the relocation leads to solid results.

In Point 2, quarterly growth rate of sales for the Kanto area and other areas. The red line graph for the Kanto area indicates a steep upward trend, while the regional areas also show a gradual upward trend. This represents our targeted sales growth. We will strive to deliver solid results and report them to you.

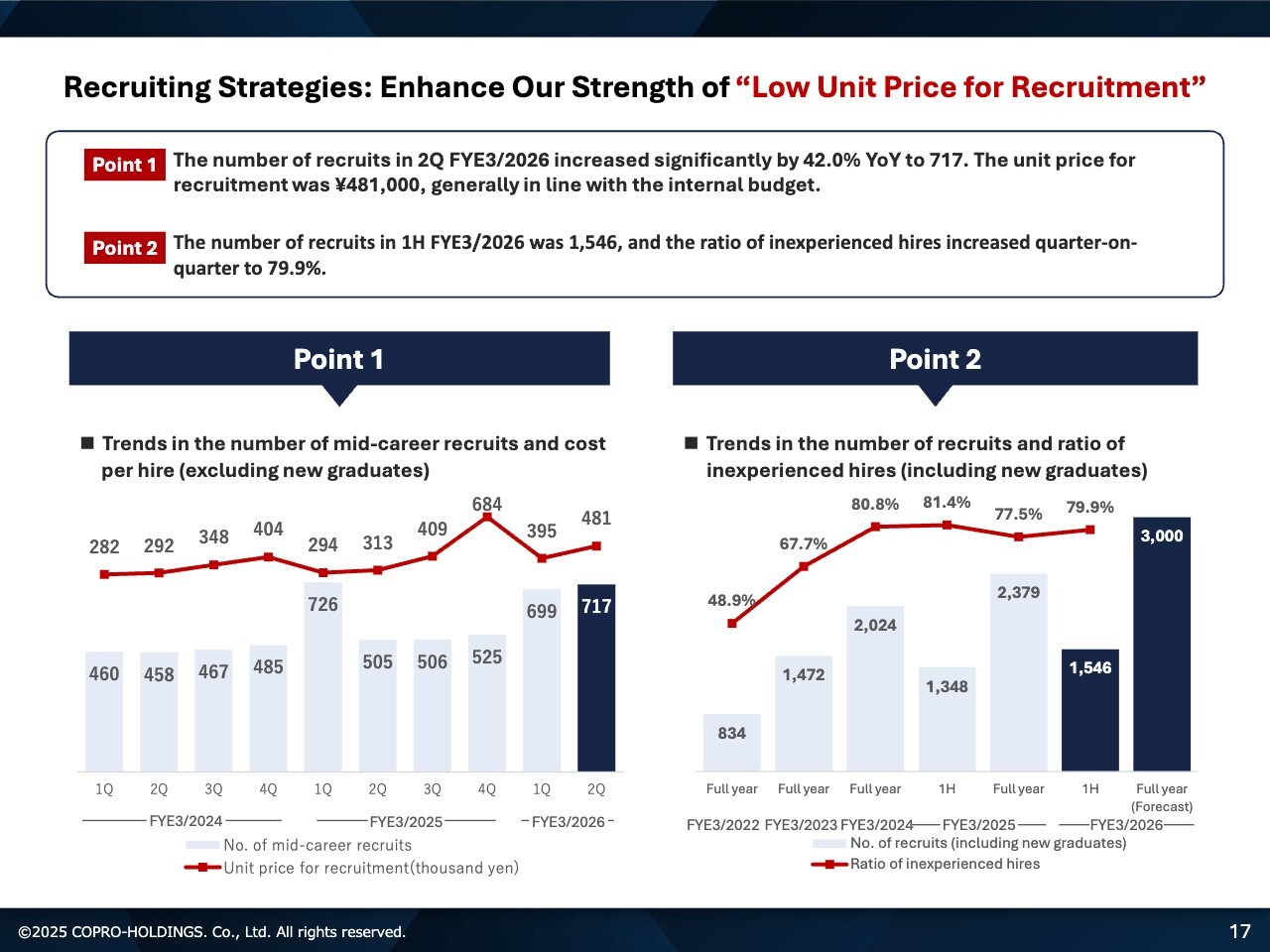

Recruiting Strategies: Enhance Our Strength of “Low Unit Price for Recruitment”

Kiyokawa: As a strategy for recruitment, I'd like to discuss one of our company's strengths: low unit price for recruitment.

Point 1. The number of recruits was 699 and 717 people for 1Q and 2Q FYE3/2026, respectively. The unit price for recruitment was ¥395,000 in 1Q and rose slightly to ¥481,000 in 2Q. This figure is driven by the recruitment budget allocated as an investment and the number of recruits achieved.

In our recruitment process, we have in-house metrics for yield: how many candidates we gather, how many we engage with, and how many we ultimately hire. We need to further refine our daily actions. We must instantly detect errors in various areas and find ways to eliminate them at their source. Additionally, the interviewing skills of career hiring interviewers, who are the most critical factor, are extremely important.

We also have internal targets for how much to invest and how large a talent pool to build. By consistently meeting these targets, we aim to improve our hiring yield and control the unit price for recruitment.

Here is Point 2: the number of recruits and the ratio of inexperienced hires. While focusing on hiring experienced hires, we also want to thoroughly recruit inexperienced candidates, including new graduates. We plan to level up our approach by training these individuals at our in-house training center before dispatching them to clients.

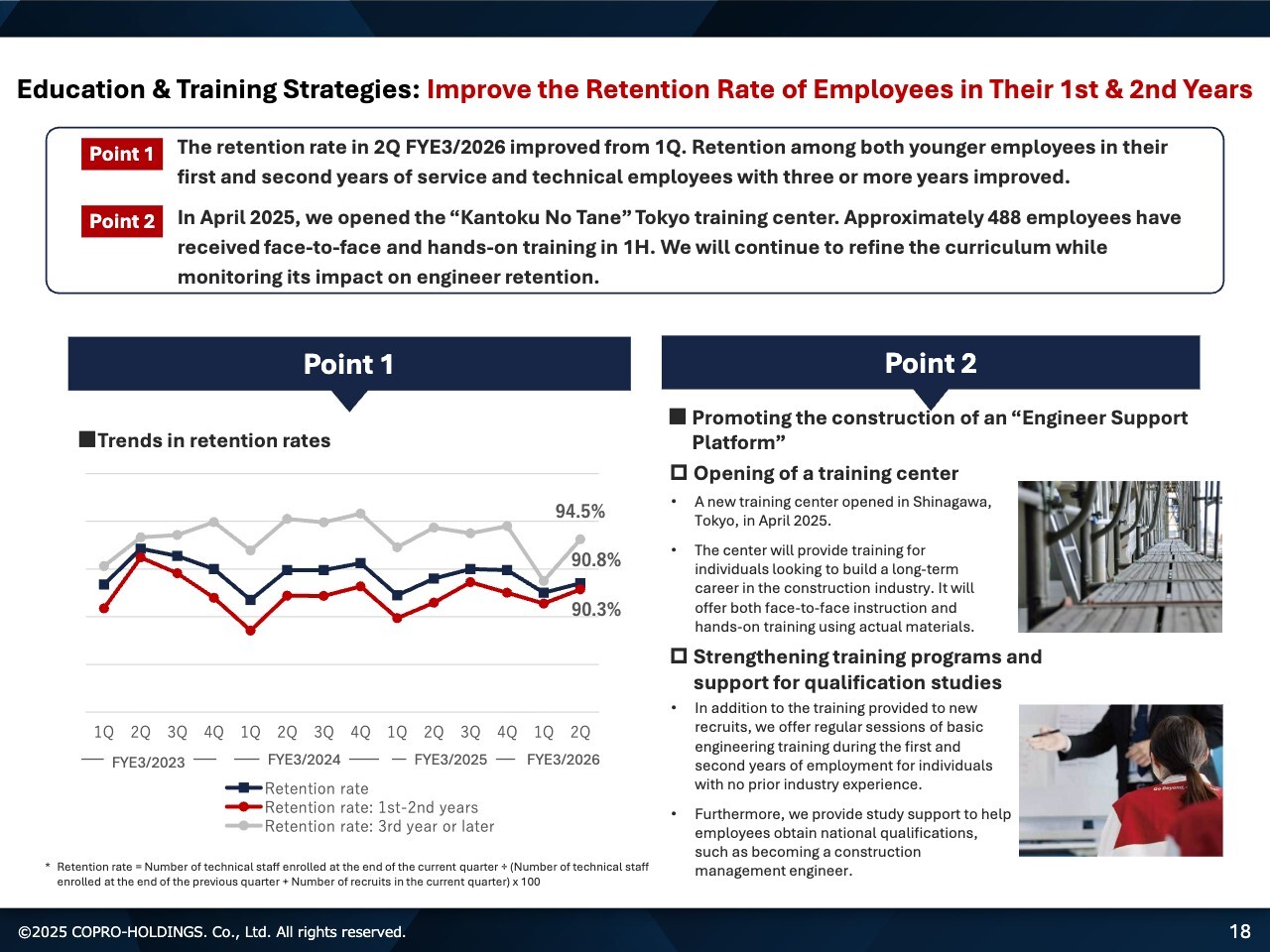

Education & Training Strategies: Improve the Retention Rate of Employees in Their 1st & 2nd Years

Kiyokawa: Here is the education & training strategies. Two points are key to our approach to improve retention rates of employees in their first and second years of service, a longstanding challenge.

Point 1. In 2Q FYE3/2026, the retention rate improved from 1Q for both younger employees in their first to second year and technical employees in their third year and beyond.

Point 2. In April 2025, we opened the “Kantoku No Tane” Tokyo training center. We conducted face-to-face and hands-on training for a total of 488 employees in 1H.

We will continue to refine the curriculum while monitoring its impact on engineer retention. This effort includes determining what types of training lead to retention and enable inexperienced individuals to advance their careers as engineers. We aim to further elevate the level of our Tokyo-based training center.

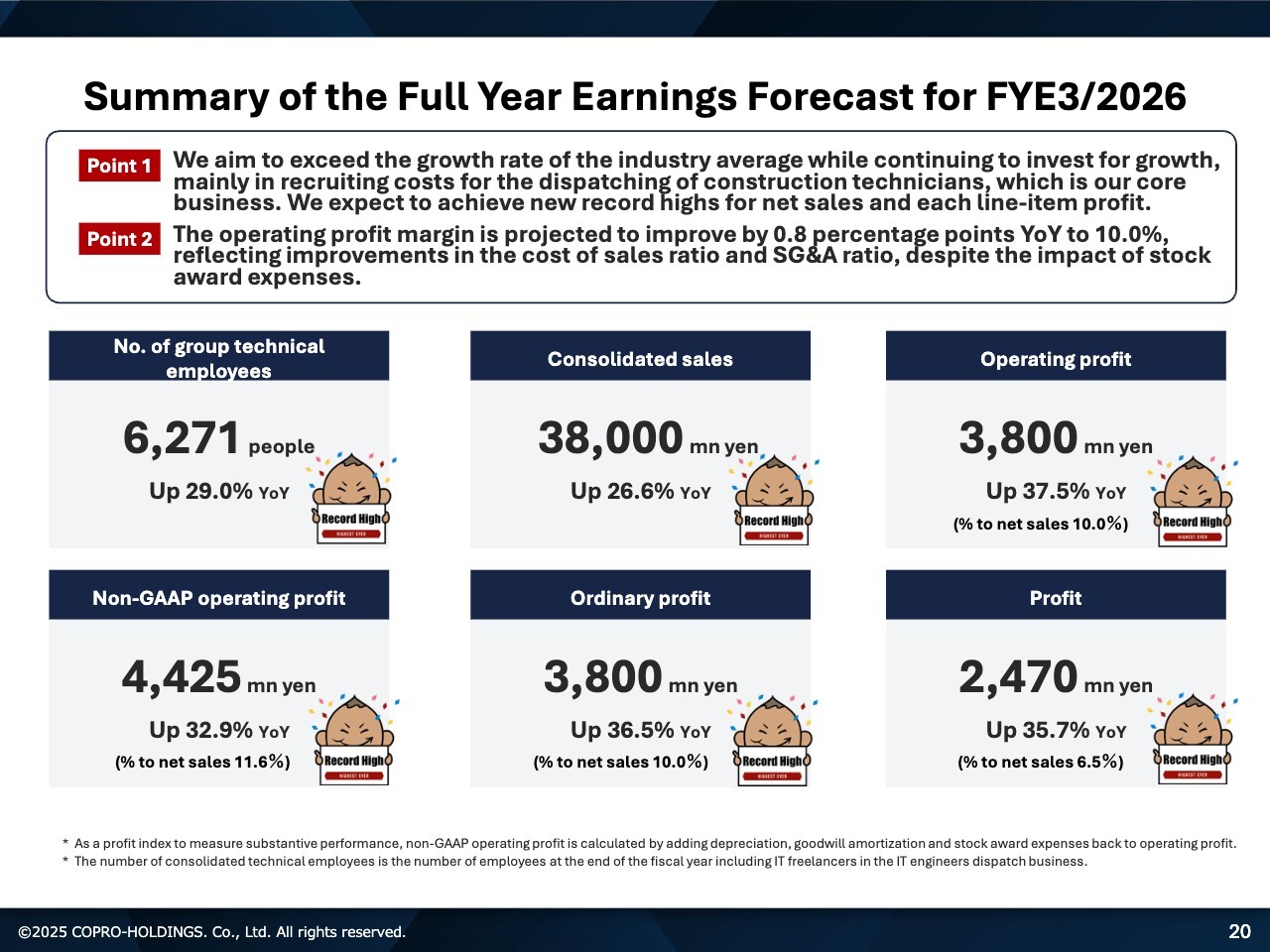

Summary of the Full Year Earnings Forecast for FYE3/2026

Kiyokawa: In Section 4, I will explain the performance and dividend forecast for FYE3/2026. Here is the summary of the full-year earnings forecast for FYE3/2026. I will describe the figures for the six highly important categories.

We forecast the number of group technical employees to increase by 29% YoY to 6,271 people, consolidated sales to increase by 26.6% YoY to ¥38,000 million, and operating profit to increase by 37.5% YoY to ¥3,800 million.

Non-GAAP operating profit is projected to increase by 32.9% YoY to ¥4,425 million, ordinary profit by 36.5% YoY to ¥3,800 million, and profit by 35.7% YoY to ¥2,470 million.

The full-year earnings forecast remains unchanged. We anticipate setting new all-time highs across all categories.

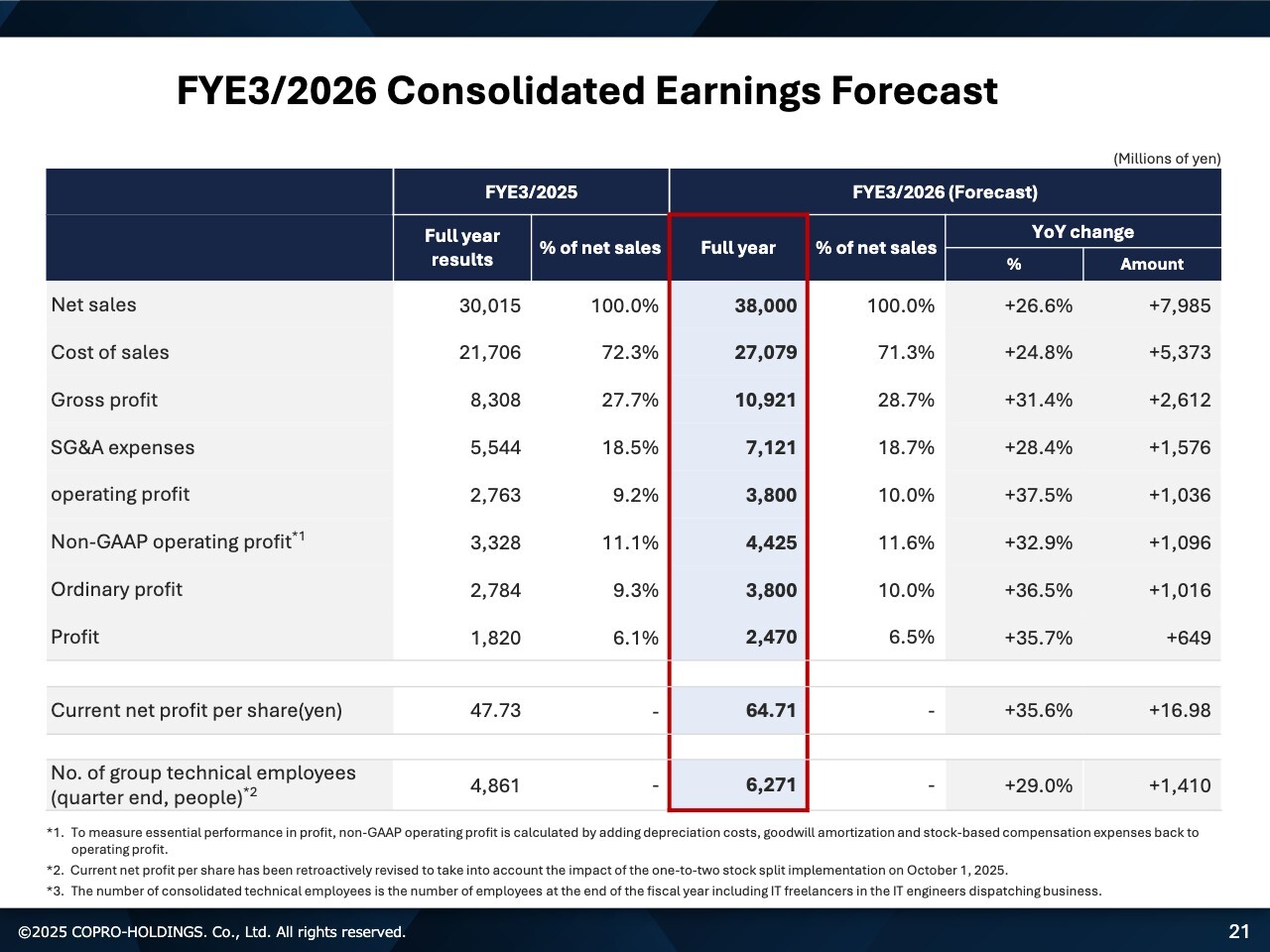

FYE3/2026 Consolidated Earnings Forecast

Kiyokawa: Please refer to the slide for the P/L in the full-year earnings forecast.

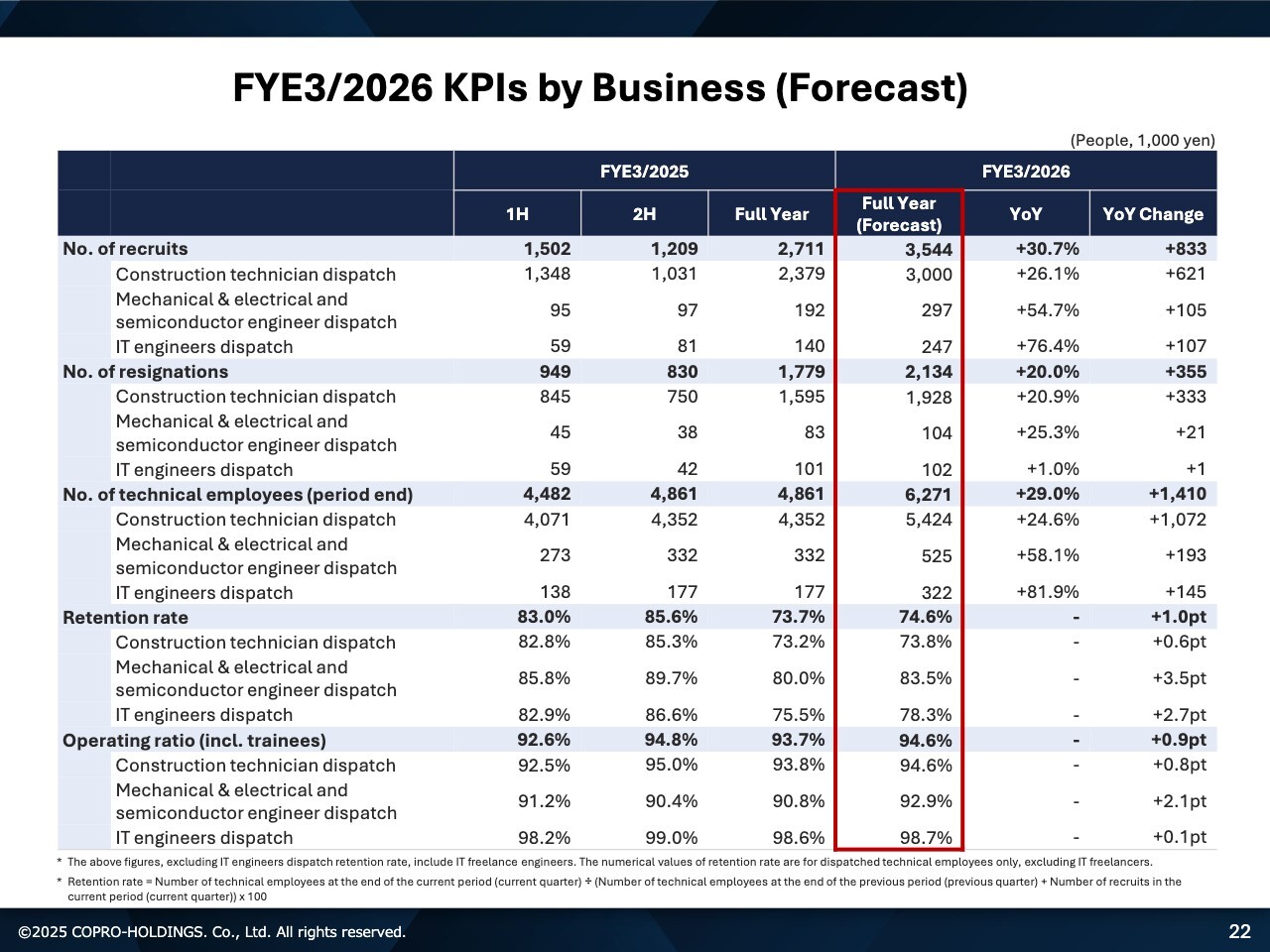

FYE3/2026 KPIs by Business (Forecast)

Kiyokawa: Here are the forecasts for KPIs by business. While the number of recruits fell slightly behind in 1H, we want to make a strong recovery in 2H.

Furthermore, implementing measures to effectively control the number of resignations is critically important. We intend to rigorously pursue this approach to further improve the retention rate, increase operating ratio, and ensure we achieve our full-year earnings forecast.

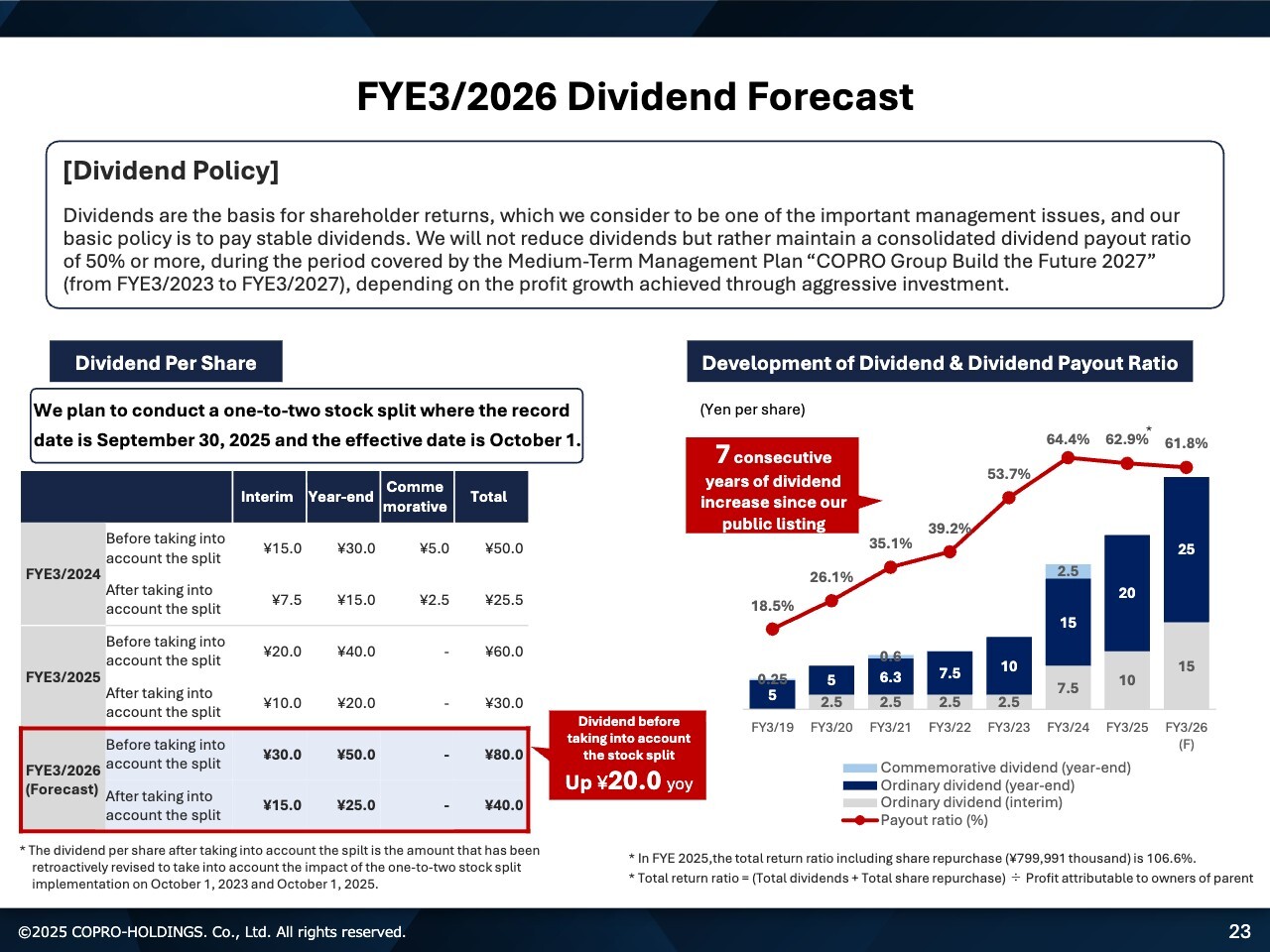

FYE3/2026 Dividend Forecast

Kiyokawa: This concerns the dividend forecast for FYE3/2026. Let me first reiterate our dividend policy. Dividends are the basis for shareholder returns, which we consider to be one of the important management issues.

During the period of the Medium-Term Management Plan, “Copro Group Build the Future 2027,” we will not reduce dividends. While aiming for a consolidated dividend payout ratio of at least 50%, our basic policy is to provide stable dividends in line with profit growth achieved through proactive investment.

First, we conducted a two-for-one stock split with the record date of September 30, 2025 and the effective date of October 1. For this reason, the dividend structure may be slightly confusing.

For FYE3/2026, highlighted in red on the slide, we will pay an interim dividend of ¥30 on a pre-split basis. The year-end dividend was previously projected at ¥50 on a pre-split basis. However, owing to the two-for-one stock split, the year-end dividend on a post-split basis will be ¥25.

Therefore, on a pre-split basis, the year-end dividend is projected to be ¥80, representing a ¥20 increase YoY. On a post-split basis, the interim dividend of ¥30 will be ¥15, and the year-end dividend of ¥50 will be ¥25, resulting in the year-end dividend of ¥40. However, the dividend forecast remains unchanged.

The right side of the slide shows a graph of dividend trends since listing. Since the stock listing, we have achieved seven consecutive years of dividend increases. We will continue to carefully consider the dividend policy to ensure the stock remains attractive to you, our shareholders.

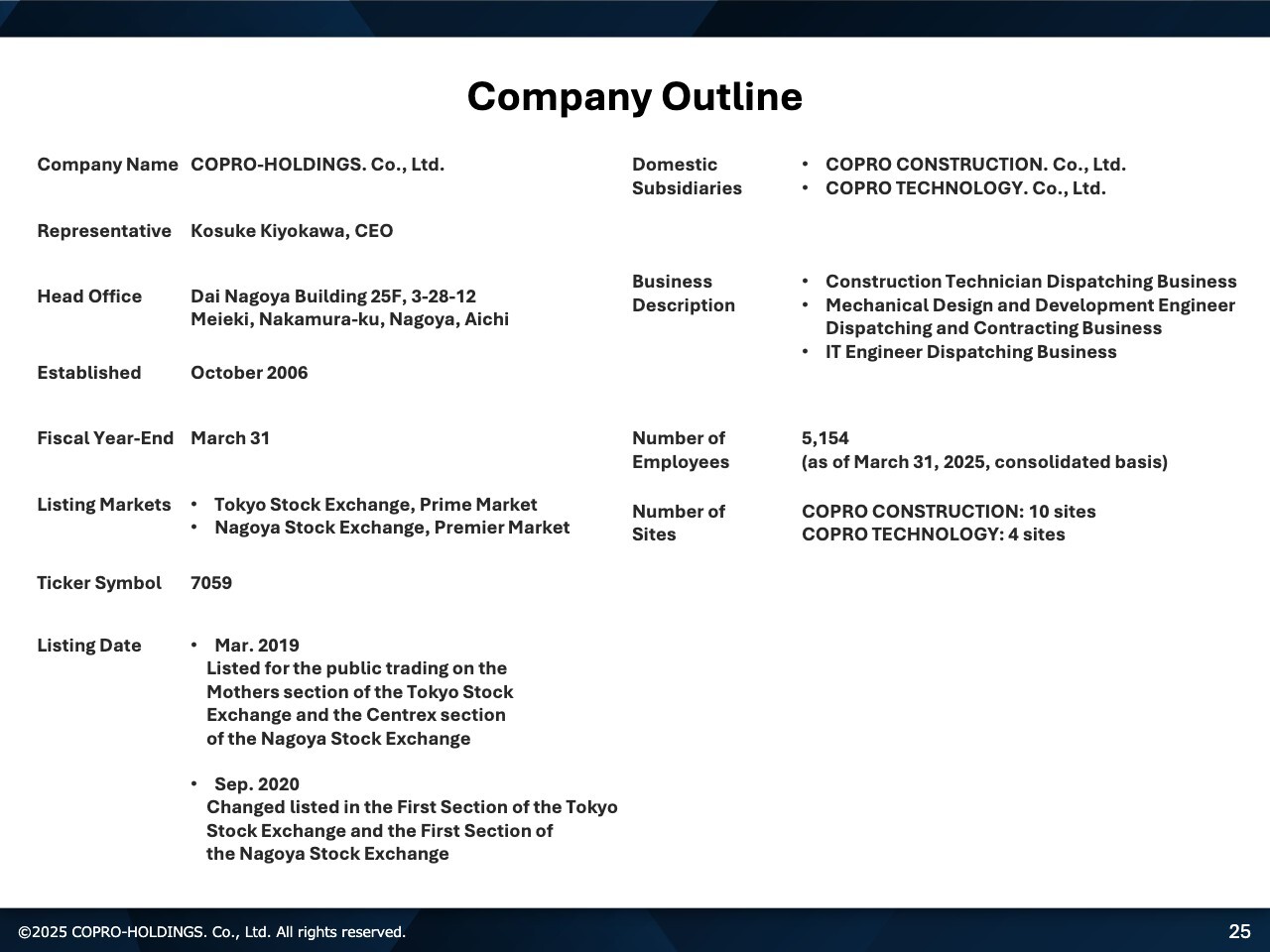

Company Outline

Kiyokawa: Section 5 covers the company outline and the business outline.

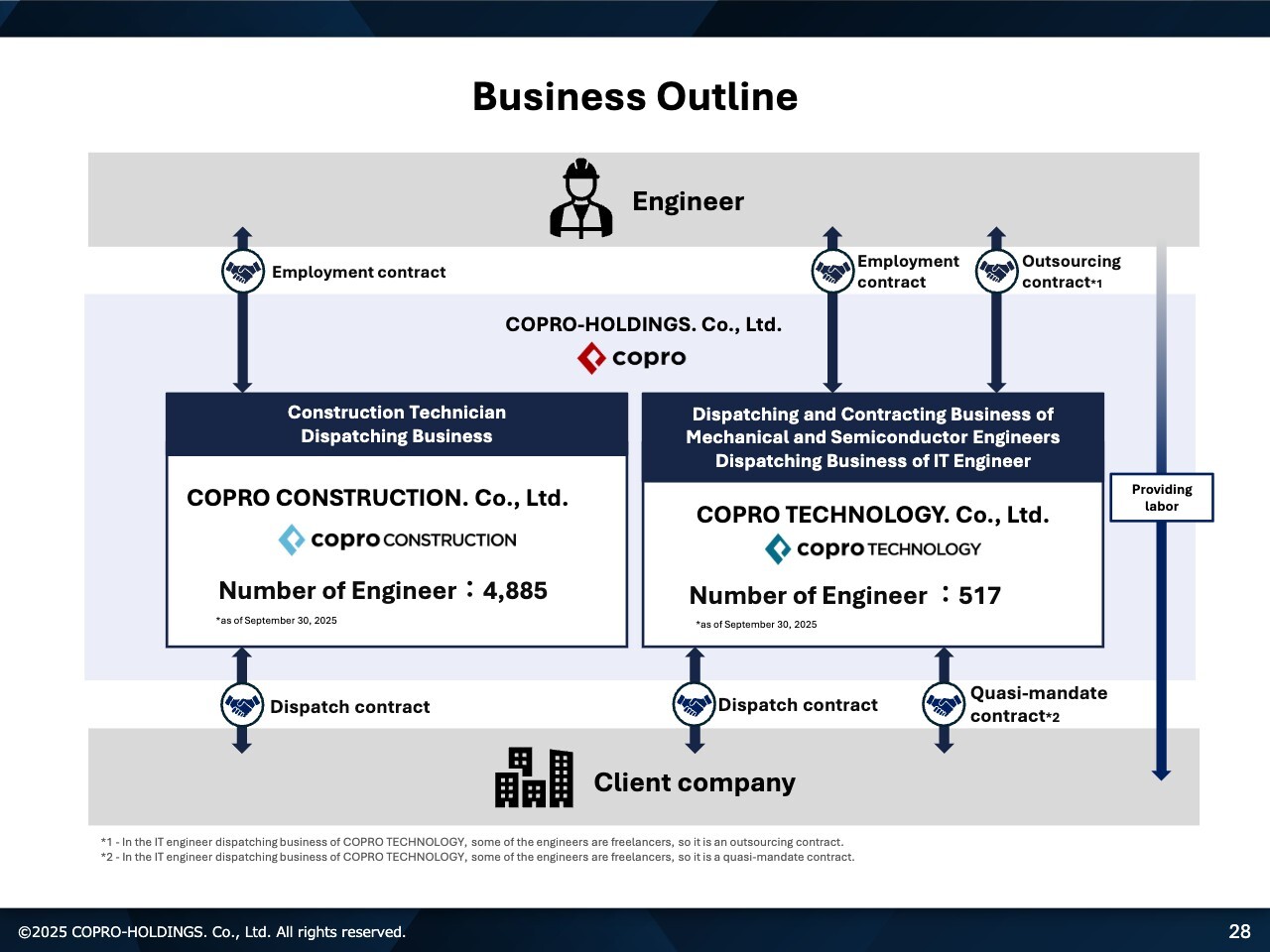

Business Outline

Kiyokawa: Please refer to this slide as reference materials.

Q&A Session: Dividends if performance targets are not achieved

Saori Arai (hereinafter “Arai”): The question is: “The 1H forecast was not achieved. If the full-year earnings forecast falls short of your projections, will the dividend forecast also be revised?”

Kiyokawa: We have resolved to pay the interim dividend as planned at ¥30 per share. Even if the full-year earnings forecast is below the forecast, we will not reduce dividends during this Medium-Term Management Plan period. Given the current level of retained earnings, we have no intention of lowering the planned year-end dividend of ¥50 per share before taking into account the stock split, or ¥25 per share after taking into account the stock split.

Q&A Session: Hiring Projection

Arai: The question is: “Given the current increasing trend of the number of technical employees, it seems highly likely you may miss the current fiscal year’s target.”

Kiyokawa: As you pointed out, the number of engineers in 1H was slightly below the planned figure. However, we have thoroughly identified the factors behind this as issues within our organization.

Of course, it remains crucial to continue accelerating our hiring efforts. Simultaneously, we will put in place measures to help new hires settle in and reduce turnover, thereby contributing to a higher retention rate.

Although you pointed out concerns about the annual earnings being challenging, we expect to be able to make up for it in 2H. Looking ahead to the end of the fiscal year, we intend to go full throttle.

Q&A Session: Reasons for stagnant growth in the number of engineers

Arai: The question is: “The number of engineers in the mechanical & electrical and semiconductor sectors has barely increased, and the number of IT engineers has even decreased MoM at times. Why is this happening?”

Kiyokawa: We recognize that the construction field continues to grow significantly. On the other hand, the mechanical & electrical, semiconductor, and IT sectors are currently stagnating.

It is extremely important that we actively advance the sales know-how, recruitment processes, and personnel redeployment we have cultivated in the construction segment. This is to promote the mechanical & electrical, semiconductor, and IT sectors as the second pillar of growth.

We admit that we were unable to achieve significant growth in 1H. However, given the room for further growth, we intend to address the issue.

Q&A Session: Results of the Kanto expansion and operating expenses

Arai: The question is: “Following the headquarters relocation, it appears that the growth rate of sales in the Kanto region has not seen a significant change. Where do you perceive the challenges in expanding into the Kanto region? Also, will it lead to an increase in operating expenses in the future?”

Kiyokawa: One challenge in expanding into the Kanto region is that our competitors prioritize there. In a market with many rival companies, the key point is how we differentiate ourselves and enhance our added value as a service.

Furthermore, we consider it quite difficult to achieve significant growth in the Kanto region unless we can offer unique COPRO advantages such as providing higher salaries than the competitors in recruitment.

Nevertheless, we recognize the Kanto region, with its overwhelming market share, is undoubtedly an area requiring our full commitment. We will dedicate substantial resources there.

We view productivity as one of the criteria for sales costs. Monitoring metrics like how much revenue each salesperson or employee generates, we reinforce staffing accordingly. Declining productivity, we reassign personnel to other areas. We will exercise such controls rigorously.

Moving forward, we aim to build solid results from our Tokyo relocation and report them to you. We kindly ask for your patience for a little while longer.

Q&A Session: Acquisition of a Competitor by Blackstone Inc. (“Blackstone”)

Arai: The question is: “A few months ago, Blackstone acquired a competitor. How do you view this acquisition from an industry perspective? Could this signal industry consolidation?”

Kiyokawa: We are aware that the industry is in the midst of the industry consolidation. Funds with such huge capital resources continue to acquire technology staffing companies. Companies run solely by founding owners like mine—where I serve as both the owner and the manager—are becoming fewer.

Amidst this industry consolidation, we must not only keep our antennae up and gather information diligently to position ourselves as a major player, but also become a company capable of effectively leading this industry restructuring.

Simultaneously, bringing companies under an umbrella through M&A is not the end goal. What is critically important is how we then integrate synergies and steer them towards organic growth. We are confident in our strengths within construction, mechanical & electrical, semiconductor, and IT sectors. We will manage our operations diligently to ensure our continued independence amid the current wave of industry consolidation.

Q&A Session: Competitors experiencing slow growth

Arai: The question is: “How do you interpret the fact that competitors' growth is slowing? Do you see a possibility that COPRO-HOLDINGS. could also experience a similar slowdown in growth momentum in the future?”

Kiyokawa: We recognize that for any industry, not just our human resources business, there are inevitable plateaus when pursuing organic growth. Currently, Japan faces major challenges: an extremely low birthrate and an aging population, coupled with a labor shortage. Within our industry, the shortage of engineers and skilled workers is a critical issue.

Against this backdrop, we recognize that the source of a company's competitiveness will be how effectively it strengthens its recruiting capability, how much investment it commits, and how much it invests in hired personnel by providing learning and training opportunities. To sustain organic growth without halting progress, we must strengthen our recruiting capability.

Furthermore, we believe effectively leveraging M&A amid industry consolidation will sustain significant growth. We want to pursue a hybrid approach combining organic growth and M&A.

Q&A Session: Efforts to gain investor support

Arai: The question is: “You mentioned record profits. What efforts do you think are necessary to continue gaining investor support from now on?”

Kiyokawa: I believe the key to gaining greater investor support and turning them into fans lies entirely in how attractive COPRO becomes as a company and how much we enhance our corporate value.

Looking more closely at the worksite, I understand that our customers will not feel satisfied unless we provide services with added value. I also recognize that creating a truly attractive company will be difficult unless we communicate the industry's appeal and COPRO charm to the new workers joining us.

Therefore, to become an attractive stock for investors, we must take a multifaceted approach encompassing shareholder returns, dividends, earnings, and a company where employees can feel happy. We aim to build a company with higher corporate value by solving various challenges and pursuing these approaches.

Q&A Session: Reasons for earnings below initial forecast

Arai: The question is: “Would you please explain again why earnings were below the initial forecast?”

Kiyokawa: We set our budget with the earnings target as an absolute must-achieve figure for the year. However, we consider those forecasts somewhat ambitious.

Of course, getting through the plan is important. However, we achieved increases in revenue and earnings, with sales growth of nearly 20%. We recognize that we have made solid progress, amidst a situation where most competitors are treading water. Against the premise of the above, the parts where we fell short of the plan were due in part to setting quite challenging, high-bar targets. Against the premise of the above, the parts where we fell short of the plan were due in part to setting quite ambitious, difficult-to-achieve targets.

Additionally, we struggled to match customer demand with the workforce we hired, leading to an increase in standby employees and a decline in operating ratio. Thoroughly identifying and understanding this as an issue, we aim to make a strong recovery in 2H and achieve our full-year earnings targets.

Q&A Session: Company Size in Five Years

Arai: The question is: “Please tell us about the company size in five years and areas that may change.”

Kiyokawa: We are currently advancing a medium-term management plan with FYE3/2027 as its final year. First, we will fully achieve the plan. We have also entered the preparatory stage to announce the next medium-term management plan.

We prefer not to provide specific figures for sales or headcount in five years. However, qualitatively speaking, we aim to become an overwhelming No.1 position in the industry in the construction market by then. We aspire to build a company with such brand strength that customers, employees, and job applicants looking for new opportunities will say, “When it comes to construction technician dispatching, it’s COPRO.”

Q&A Session: Confidence in 2H

Arai: The question is: “I will simply ask. Can we trust your 2H forecast?”

Kiyokawa: I will answer simply. Trust us. I have not given up.

Q&A Session: Impact of adopting IT and artificial intelligence (“AI”)

Arai: The question is: “Recently, IT and AI are topics in every industry. Could IT and AI adoption reduce demand for temporary staffing at construction sites going forward?”

Kiyokawa: We've received numerous questions on this. First, the domains of IT, AI, and construction DX exist to boost productivity and help alleviate the labor shortage, even if only partially.

Furthermore, with overtime regulations now in effect in the construction field, the industry must evolve to leverage IT, AI, construction DX, drones, and similar technologies—and we recognize it already is.

On the other hand, unlike the manufacturing industry, the construction industry does not operate on processes suited for mass production. It is an industry where each building and civil engineering domain has unique shapes and structures, such as buildings, condominiums, commercial facilities, arenas, and schools. I personally recognize that it is not an industry where repetitive actions can be handled by robots monitoring or AI replacing human workers.

Accordingly, we must thoroughly promote the adoption of IT, AI, and DX to enhance productivity. However, I see no reason why this would eliminate the need for worker dispatching.

Q&A Session: Entering the IT sector through M&A

Arai: The question is, “Do you ever think entering the IT sector through M&A was a wrong decision?”

Does adopting IT technology yield immediate results?

Kiyokawa: Judging that we could extend what we cultivated in construction, we acquired an IT sector through M&A and are currently nurturing it. However, it is true that we have not yet seen significant results. Nevertheless, I have absolutely no regrets about the acquisitions made through M&A.

How to grow within the IT sector is our major challenge. While the figures have not followed yet, we intend to maximize every feasible approach going forward and achieve solid earnings in the IT sector as well.

Q&A Session: M&A Progress

Arai: The question is: “We've heard several times about M&A as a use for your substantial financial resources. Could you tell us how far along it is specifically?”

Kiyokawa: While I cannot discuss specifics at this time, we must proactively pursue M&A opportunities in our specialized construction field, driven by industry consolidation, while continuing our organic growth.

I will report progress to all of you in detail once we reach a stage where disclosure is possible.

Q&A Session: Possibility of share buybacks

Arai: The question is, “ Do you have any plans for share buybacks within the current fiscal year?”

Kiyokawa: While I cannot make a definitive statement, we, the management team, are constantly considering how best to return value to our shareholders, taking market conditions into account.

Last week, following our earnings announcement, the stock price declined slightly. We interpret it as a reaction to our results not meeting your expectations. We will continue to consider whether to conduct share buybacks in situations like this, taking shareholder returns into account.

Q&A Session: Matching inexperienced people

Arai: The question is: “You mentioned that you could not match the needs of your target companies. Does that mean they do not want people with less expertise?”

Mr. Kiyokawa's explanation did not include that. I suppose they're bringing in inexperienced people and training them, building up the mid-level workforce. However, when you want to expand the pool of workers, there needs to be a period where you first bring in a lot of inexperienced people, right?

Kiyokawa: Currently, it's becoming difficult to easily hire people with expertise in this industry. In this environment, it's extremely important to thoroughly refine our business model: making the construction industry attractive, recruiting inexperienced people and young individuals from other industries, and then sending them out after training.

The mismatch wasn't just about inexperienced people lacking skills; it also involved matching non-skill-related factors, like whether they could commute to sites with demand. We also need to enhance precision in these aspects.

Arai: The questioner seems concerned that focusing on hiring inexperienced people might undermine deeply-cultivated sales efforts to target companies, potentially preventing goal achievement.

Kiyokawa: In reality, the projects we receive from our target companies—the top five major general contractors and midsized companies—include some for workers with expertise. However, strong demand for inexperienced people also remains, with requests like “Even if they’re inexperienced, bring in as many as you can.”

The target companies are not saying they “ do not need inexperienced people.” I believe the key point is for us to fully meet the demand of the target companies with our supply capacity.

Arai: Even as inexperienced people develop, will the team dispatch model still be effective?

Kiyokawa: I suppose it will involve trial and error. Since this is an area that we have not explored before, it represents a new challenge.

When comparing two scenarios for a younger employee: one in which they go alone as a dispatched worker from COPRO to a customer site with no acquaintances, and another in which several veteran COPRO employees are already stationed there. Which is better? Undoubtedly the latter is better. We intend to build this structure properly.

Message from CEO

Kiyokawa: It’s been a pleasure having you all here today. Thank you very much.

We have received concerns from many investors on the progress made in 1H. We expect that where earnings fell short this time, we can recover and make up for it in the full-year earnings. We will not give up; we will steadily recover by spreading our strategy throughout the site.

I would be grateful if all of you, our investors and shareholders, would continue to support COPRO.

Additional questions and answers received on the day of the session

We are pleased to share answers by COPRO to questions that were received on the day but could not be addressed due to time constraints.

Please note that questions have been edited for clarity, with changes to phrasing, additions, or revisions. Additionally, answers have been grouped together where content overlaps.

<Question 1>

Question: In the construction industry, recent financial results for general contractors and subcontractors have been favorable. Does COPRO benefit from it?

Answer: We recognize that, combined with labor shortages, conditions are becoming more favorable for accepting unit price negotiations. We will further promote billing rate improve negotiations, including raising rates for inexperienced people.

<Question 2>

Question: Could a large-scale hiring initiative temporarily reduce profits?

Answer: There is a several-month lag between investing in hiring expense, conducting the selection process, and having the candidate join the company, assigning them to customer companies, and generating revenue. Therefore, if the hiring pace is suddenly accelerated, the upfront costs may impact profitability. In the current fiscal year, we are investing in hiring expenses in a planned manner.

<Question 3>

Question: To expand operating profits, please share any specific project ideas you have. Examples include AI, semiconductor center construction, national policy projects in the field of national resilience, and the Linear Chuo Shinkansen project.

Answer: We anticipate that demand for personnel will remain robust going forward. Large-scale projects such as the Linear Chuo Shinkansen and an integrated resort, along with related peripheral construction work.

<Question 4>

Question: Please provide specific details on what you are currently investing in and when such investments are expected to yield profit growth.

Answer: Unlike businesses requiring fixed asset investments, our operations are built on human resources. To secure superior talent, we are actively investing in hiring expense while continually reviewing our sales and recruiting process. This includes not only hiring industry veterans but also strengthening our recruitment of inexperienced people and new graduates.

<Question 5>

Question: What factors do you see as having pushed down the stock price in this earnings report? Do you have any points that you believe should be properly valued but are not, or that may be causing misunderstanding?

Answer: We recognize that the reason for the stock price decline is the delay in progress toward our full-year earnings targets, and sincerely accept the stock market's assessment. While results have fallen short of the 1H forecast, as stated on page 4 of the briefing materials, both net sales and each type of profit below operating profit reached record highs. Furthermore, compared to competitors, we have achieved growth exceeding the industry average. We will address the challenges identified in 1H and focus on making up for the delayed progress against the published forecast in 2H.

<Question 6>

Question: Do you set the dividend yield around 4 % as a target?

Answer: We do not have a specific dividend yield policy. You can find our policy on shareholder returns on the IR website below.

https://www.copro-h.co.jp/en/ir/stockbond/stocks.html

<Question 7>

Question: What potential benefits might the headquarters relocation offer to shareholders?

Answer: The headquarters relocation scheduled for April 2026 aims to consolidate the bases of three group companies currently scattered throughout Nagoya City. This consolidation will promote active communication across company and departmental boundaries, strengthening collaboration within the group. Additionally, the new office will include an expansion of our in-house training facility, “Kantoku No Tane” Nagoya training center. Following the training center opened in Shinagawa, Tokyo in April 2025, this will serve as another practical training facility, creating an environment where more engineers can deepen their skills and industry understanding.

<Question 8>

Question: Sales for 2Q alone increased, but operating profit remained at the same level as the previous quarter. I think achieving the full-year forecast is quite challenging, and the stock price has also declined. Were the 2Q results as expected?

Answer: The 2Q results fell slightly short of our expectations. While customer demand remains exceptionally high, operating ratios struggled to improve. The main reason was a shortage of sales personnel, leading to delayed assignments and an increase in standby engineers. We regret that sales staff recruitment has not kept pace with business growth. In 2H, we will increase headcount through new hires to improve both the number of active engineers and operating ratios.

<Question 9>

Question: Please share your thoughts on the dividend outlook for the next fiscal year.

Answer: Please await the dividend forecast for the next fiscal year until the announcement of the earnings forecast for FYE3/2027, scheduled in May 2026. Please note that our shareholder returns policy states that, for the period up to the final year of the Medium-Term Management Plan ending March 2027, we will not reduce dividends and aim for a consolidated dividend payout ratio of 50% or more.

<Question 10>

Question: What makes your company attractive to job seekers?

Answer: We place particular emphasis on selecting the initial placement company and worksite. This is to ensure we can meet job seekers' requests by securing a wide range of opportunities, and to realize our core value proposition: a human resource development. We focus placements primarily on target companies, mainly large general contractors and subcontractors where stable assignments are expected. Additionally, we actively promote team dispatch, assigning multiple engineers from our company to an assignment at the same site. Additionally, we actively promote team dispatch, assigning multiple engineers from our company to an assignment at the same site.

Furthermore, we are advancing our “Engineer Support Platform” to proactively assist engineers in building their careers. In April 2025, we opened the “Kantoku No Tane” Tokyo training center in Shinagawa, Tokyo. We have begun talent development through face-to-face instruction and hands-on training using actual materials. We also offer regular sessions of basic engineering training for new recruits with no industry expertise in their first and second years of employment for individuals with no prior industry experience and provide study support to help employees obtain national qualifications such as becoming a construction management engineer.

<Question 11>

Question: What kind of company do you envision becoming in 10 years?

Answer: While we haven't set a definite deadline, we seek an overwhelming No.1 position in the Industry in the construction technical staffing domain, both in terms of scale and quality, so that we are chosen by both engineers and client companies.

<Question 12>

Question: What does “organic” growth mean?

Answer: While we actively explore inorganic growth methods such as partnerships and acquisitions through M&A, we understand that these non-linear growth means can only be realized when grounded in organic growth leveraging our internal resources. We prioritize self-sustained growth by refining our sales and recruiting processes.

<Question 13>

Question: What are the main reasons construction engineers leave their jobs?

Answer: Most resignations are attributable to engineers hired with no prior experience. Many resign after finding a gap between their expectations and the actual duties of construction management.

<Question 14>

Question: You have accumulated a significant amount of net cash. What effective utilization are you considering?

Answer: We are examining its use for M&A. We will also consider shareholder returns as appropriate.

<Question 15>

Question: Can hiring foreign workers amid labor deregulation expand business opportunities?

Answer: With the inevitable prospect of a tighter labor market in the future, we understand that utilizing overseas human resources could be an option to address the labor shortage in the construction industry, particularly the shortage of construction managers to whom we provide staffing services. However, the role of construction manager inherently requires communication skills in Japanese to manage project progress and safety. Accordingly, challenges such as teaching Japanese language must be overcome, and the hurdles are by no means low.

<Question 16>

Question: Are you still aiming for the ¥100.0 billion market capitalization mentioned in past earnings briefings?

Answer: As a manager, we are of course aiming for a market capitalization of ¥100.0 billion because it is also a good milestone target. To achieve it, we intend to achieve solid earnings in the near term, sow the seeds for growth in the next fiscal year and beyond. Then, we plan to steadily step up, first achieving a market capitalization of ¥50.0 billion, then ¥60.0 billion, and ¥70.0 billion.

<Question 17>

Question: While you fell short of the 1H forecast, can you achieve the Medium-Term Management Plan?

Answer: We recognize that the targets set in the Medium-Term Management Plan are by no means easy to achieve. We will strive to achieve the Medium-Term Management Plan. To that end, we will repeatedly refine further the recruitment and sales processes we have built up to date, enhance the reproducibility of revenue growth, and actively invest resources.

<Question 18>

Question: If you successfully achieve your Medium-Term Management Plan, will you continue the progressive dividend policy into the next Medium-Term Management Plan?

Answer: Thank you for your valuable feedback. We will consider the dividend policy for the next Medium-Term Management Plan moving forward.

<Question 19>

Question: The growth in the number of technical employees on the payroll as of the end of October 2025 has slowed. What is the reason for this?

Answer: The reason is that as the number of technical employees on the payroll increases, the number of resignations is also increasing. We will work to curb the number of resignations not only by raising the number of recruits, but also by tightening assignment rules for non-target companies and promoting assignments at the same site and team dispatch.

<Question 20>

Question: Do you consider any large-scale M&A for business expansion?

Answer: We actively examine M&A opportunities if they lead to increase the corporate value.

<Question 21>

Question: You should be able to achieve a PER of over 20 times, but it appears stagnant due to a weak growth strategy. How about improving it? You have many growth drivers, so I hope you can depict them effectively.

Answer: Our PER is actually not low compared to other companies in the same industry providing construction technician dispatching. However, we believe our growing potential remains at a higher level within the industry. The potential is driven by our sales capability and recruiting capability in a favorable business environment. There is a possibility we have not sufficiently communicated such appeal to the capital markets.

PER is a measure reflecting the overall sentiment of the capital markets, making it difficult for us to improve it directly. Nevertheless, we expect that the stock price will rise if EPS expands steadily. Moreover, PER represents the capital market's expectation of EPS growth. Therefore, we will continuously enhance communication with the capital market while pursuing continuous growth, particularly in our core construction technician dispatching business. This is to ensure that investors in the capital markets understand and have confidence in our ability to sustainably grow EPS.

<Question 22>

Question: I was unable to attend the shareholders' meeting held in Nagoya. Were the shareholders generally enthusiastic? I would like to hear about the atmosphere.

Answer: Attendance at the 19th Annual General Meeting of Shareholders was 31 people, an increase from the previous meeting.

We also received numerous questions that clearly demonstrated the high level of interest our shareholders have in our business. This made the entire management team feel a renewed sense of responsibility. The Annual General Meeting is also live-streamed online so you can watch from home or elsewhere. We would be delighted if you could make use of this service.