Agenda

Takayuki Ueda (hereinafter Ueda): Hello everyone. My name is Takayuki Ueda, Representative Director, President & CEO of INPEX CORPORATION. I appreciate your coming today despite the bad weather. I also appreciate those of you who are taking time today to participate via Zoom.

For today's "INPEX Investor Day 2025," we have put together a program to help you better understand INPEX from multiple angles.

To begin, we would like to talk about the Ichthys LNG project from its launch to the present, and how we will transfer our knowledge and experience from that project to the subsequent Abadi LNG project. In addition, following last Friday's opening ceremony for the Blue Hydrogen project in Kashiwazaki, Niigata Prefecture, we will discuss recent developments in the low-carbon market and future investments and shareholder returns.

We will also have a Q&A session and a dialogue with two outside directors of our Company. The overall program will be short, but we hope it will help you in gaining a deeper knowledge of our Company.

The current status of the Ichthys LNG project

Miki Sumiyoshi (hereinafter Sumiyoshi): We will begin the first part of the program. We will hear from Hitoshi Okawa, Director, Senior Executive Vice President, General Administration and Oceania Projects, and Akihiro Watanabe, Managing Executive Officer, Senior Vice President, Asia Projects, on the topic "From Ichthys to Abadi: Advancing to a New Growth Stage."

First of all, could you give us an update on the Ichthys LNG project and the Abadi LNG project?

Hitoshi Okawa (hereinafter Okawa): My name is Hitoshi Okawa, Director, Senior Executive Vice President, General Administration and Oceania Projects. Let me start with a discussion of the Ichthys LNG project.

Production is progressing well, but this year the project has experienced a variety of events. Most recently, Darwin experienced a very large Category 3 cyclone that affected electric power generation and caused a degree of power shortages, which led to some production restrictions. However, we do not expect any impact on cargo. We have overcome the issue and production is proceeding smoothly at present.

Also this year, 4,600 tons of booster compressor modules were loaded onto the CPF. As you all know, this addresses the phenomenon of pressure drop as production continues. It serves to adjust the pressure difference that occurs on the fluid receiving side between the pressure drop and the CPF side, equalizing the pressure so that the fluid can flow smoothly. The equipment weighs 4,600 tons, so much that the CPF tilts when loaded.

This was a major event this year, and we wondered whether it would proceed smoothly. It did so without problem and according to schedule. Looking at the year, there are conditions by which we pinpoint specific days, and there are only two to three days per year when marine conditions are excellent. The smooth loading was an achievement.

Another event was large-scale shutdown maintenance. We initially assumed a shutdown period of about 52 days, but the work was delayed for over 20 days. As a result, production was very strong in the first half of the year and we were able to secure about three cargo loads of LNG as surplus, but the trouble resulted in the loss of just over four cargo loads.

As a result, we expect the annual LNG shipment volume to be approximately 111 cargo loads out of the initial estimate of 113. However, we believe that we may be able to recover this difference if production remains strong. The site continues to operate at full capacity and is fully engaged in production activities.

There were some reports that volatile toxic substances had been released into the atmosphere, and this was due to an error in the report from the Company to the government. We greatly regret the error in the report. The report's calculation assumed release volume under the condition of certain equipment functioning, but in reality, the equipment was not functioning properly, resulting in an increase in the volume of atmospheric release.

Regarding benzene in particular, it was confirmed that 130 times the amount listed in the report was diffused.

However, even for the carcinogen benzene, emissions were at a far lower level than the levels of environmental health standards and are judged to have no impact on health. We carefully explained to all concerned parties that despite the calculation error, no harm to health or persons resulted, and we received the parties' understanding on this point. At present, media coverage of the matter has also subsided.

Abadi LNG project entered front-end engineering design (FEED) phase from August 2025

Akihiro Watanabe: My name is Akihiro Watanabe, Managing Executive Officer, Senior Vice President, Asia Projects. As the head of the Abadi LNG project, I will report on its status today.

We are currently in the process of fully preparing for the final investment decision (FID) scheduled for 2027. Specifically, we are undertaking four initiatives.

The first involves technical aspects, specifically engineering. The project entered the front-end engineering and design work (FEED) phase in August 2025. In the Abadi LNG project, we plan to build four production facilities. The facilities called FPSO, SURF, and GEP will be offshore, and the liquefaction facility that we call OLNG will be onshore, making four packages in total.

FEED for these four packages began in September 2025 and is progressing as planned.

The second initiative is procedures related to permits and approvals. Permission from the Indonesian government is needed to secure a site for the construction of the OLNG. Environmental approvals are also necessary to carry out the project overall. The permitting procedures are on track to receive environmental approvals and secure the site.

The third initiative is commercial aspects of the project. These include financing to raise the funds to start construction following the final investment decision and marketing activities to sell LNG following the start of production. We have begun taking concrete steps to address these issues and are in discussions with financial institutions and prospective LNG buyers.

The fourth initiative is discussions with the Indonesian government. Discussions are underway to ensure the economic viability of the project, which is officially slated for implementation following the completion of FEED. Preliminary discussions are underway with the Indonesian government to consider a final investment decision soon after the completion of FEED.

As such, we are undertaking all four activities in parallel in order to reach the final investment decision in a timely manner.

Ichthys LNG – Opened Perth Office in January 1999

Sumiyoshi: From your first time as an operator overseas to the present, I imagine you must have faced many difficulties, especially in the beginning. Can you tell us about some of the challenges you faced at the Ichthys LNG project and what you learned from them?

Okawa: It would take about three days to talk about all of the difficulties, but I will summarize them in two parts. First, as you all know, we started this project in 1998. We were completely unknown in Australia at the time, which meant everyone wondered whether we could really deliver the LNG project as the operator.

I don't really want to show this picture, but my hair, which was black then, is now white after all the struggles.

What is really difficult as an unknown company is having to fight against major Western companies. Since no one had any assurance that we could carry out the project as the operator, there was a perception that working for the Company wouldn't lead to personal achievement, so it was extremely difficult to attract personnel.

However, the situation changed dramatically around January 2012, when the final investment decision was made. At that point, the impression that the project would really get underway began to grow on all parties involved, and many capable players began to come together. Around that time, we then entered the EPC phase, which involves full-scale design, procurement, and construction.

We will face many challenges as we move forward with EPC, but the outlook is that it is ultimately feasible if we use proven technologies. However, problems such as cost overruns and schedule delays also occurred. We genuinely struggled to secure human resources, a point I will touch on later.

As the second area of difficulties, I would like to mention the relationship with the head office. The decision was made to invest approximately ¥4 trillion, but we faced a challenge in that no one had experience in managing such a large-scale project.

The head office was in a constant state of worry. There was a serious risk that if this project failed, it would undoubtedly bring down the Company. Under such circumstances, the head office asked a variety of questions in rapid succession.

Usually, a major enterprise or other company that takes on such a project would have a wealth of experience accumulated within its head office. When a problem occurs, it's natural that backup is provided from the head office. That's the basic style for major oil companies.

However, we were unable to count on that and felt very isolated in the field. There's the expression "the carrot and the stick," but the background to the path leading to today was that we never received the carrot, only continuous application of the stick. In the Abadi LNG project, however, we want to leverage our experience with the Ichthys LNG project to provide strong, company-wide support to the Abadi project from headquarters. We are confident that we have created an environment for doing so.

I think we had no choice at first, but we now have a system in place for leveraging insights from the Ichthys project to solidly support the Abadi project, which I see as a major achievement.

Sumiyoshi: Do you have the impression that lessons from the Ichthys project are being applied in the Abadi project?

Watanabe: Yes. I used to be in charge of the Ichthys project and I experienced the initiatives leading to a final investment decision in Perth. To add to Mr. Okawa's explanation, at the time there was no concrete roadmap in sight for the project. But now, having experienced the road once, we can see what lies ahead, which gives us confidence.

I mentioned earlier that we will be securing a site and obtaining environmental approvals for the Abadi project. I was in charge of siting and environmental approvals in the Ichthys project. Although there are differences in the projects and their structures, I understand from my own experience what should be pushed forward. INPEX as a whole has also formed a team with such experience, so I believe that knowledge has been built up within the Company.

Watanabe: We currently have people with experience from the Ichthys project stationed and posted in Jakarta. They are in charge of FEED work for the Abadi LNG project.

The members of the Jakarta office appear in the photo on the slide. The team is diverse, consisting of people who have moved from the Ichthys project team to the Abadi project team, people who have been posted from Tokyo, and local Indonesian staff. With this, we have a system in place to share project experience throughout INPEX.

The person at right in the photo is Jarrad Blinco. He moved from the Ichthys project team to the Abadi project team, which he heads locally as Executive Project Director (EPD).

Thus, we are in a situation in which we have a system in place, both as an organization and as individuals, to deploy experienced people from the Ichthys project directly in the Abadi project.

Sumiyoshi: Mr. Okawa noted that he gained some confidence in the project in 2012, but that was over 10 years since the project started in 1998. I was very surprised to hear that it would take 18 to 20 years before the project could actually be called complete.

I felt that we were engaged in a task like raising a human being from birth to adulthood. It's not until around past the adolescent age of 14 years that there's a sense of the person becoming an adult. It takes a long-term commitment.

This kind of work would be difficult to accomplish unless all of us, as business persons, approach the project as our life's work. Now, at the stage of moving on to executing the Abadi project, I am truly impressed with the way everyone has continued tackling the project, leveraging their experience and never giving up.

As a business person, do you find it challenging and rewarding to stay with the project?

Okawa: At first, everyone felt that there was no way we could do this project. Japanese companies had no track record here, so we were told it couldn't be done by Japanese companies or people. I couldn't let those words pass, and undertook the work partly out of pride in showing those words to be wrong.

Upon doing so, though, it was extremely difficult. The final investment decision in the project was merely a transit point; beyond that, many problems lay ahead. My original plan was to return home after making the final investment decision, but I ended up not returning to Japan anytime soon and found myself there for 18 years.

As you say, this job is exactly the same as raising children. It's something that gets into bad moods. When that happens, it is important to know how to restore that mood. If that response isn't made quickly, critical problems will grow rapidly.

What I realize as we proceed with the project, and what I would like to share with you, is that steadily completing the tasks in front of us one by one yields a great sense of fulfillment. In a way, just like raising children, there is no time to rest or sleep. I feel the project is something like that.

Sumiyoshi: Considering that, the Abadi project perhaps feels like the start of raising a second child. I believe that the question of how to apply the lessons learned is of great interest to all of you. Could you share with us how you're making the most of lessons learnt, perhaps with reference to specific happenings?

Okawa: I can speak a bit. I still feel that there were some holes in our agreements with contractors, or in our contract strategy, due to lack of experience during the Ichthys project years.

Specifically, as you all know, there was a lack of clarity in the boundary between the lump sum portion of the contract and the reimbursement portion for which expenses can be claimed, which led to a major dispute and a sharp increase in costs.

Accordingly, it is important to have a solid contract strategy in the contracting phase and to ensure that contractual details are properly arranged. Also, because costs of labor and materials and equipment are forecasted to rise, we believe that how to anticipate these costs and reflect them in contracts is very important.

At the time, we were moving forward without addressing such critical points, resulting in a schedule 22 months behind original plans and a cost overrun of 23%. However, drawing on this experience, we are able to make improvements based on specific examples.

I believe that in the Abadi project, we are drawing on our experience from the Ichthys project to digest these things, and are able to formulate a strategy to prevent and deal with similar problems.

Sumiyoshi: Leveraging experience from the Ichthys project, is it possible for the Abadi project to achieve the Company's investment discipline of a mid-10% range IRR?

Watanabe: In discussing experience obtained from the Ichthys project, contracting strategy and schedule management came up.

In the Abadi project, we are carefully reviewing contracting strategies based on our experience with the Ichthys project. In Indonesia, however, we cannot execute on these without the understanding and approval of the government, so we are developing proprietary strategy while obtaining governmental consent.

Specifically, we are trying to move forward with FEED and with future EPC based on our experience with the Ichthys project, but taking a different approach. Also, to avoid misunderstandings in relationships with contractors, I and others are communicating closely with top management of contractor companies as we move forward.

Preliminary discussions with the Indonesian government are underway to ensure economic viability. In these, we are leveraging our experience with the Ichthys project to communicate a goal of IRR in the mid-10% range for the Abadi project. Although there are many points of difficulty in negotiations with the government, we have gained a certain level of understanding from the Indonesian government and are conducting discussions along the lines of what the government can do to support INPEX in aiming for IRR in the mid-10% range, and what INPEX can do through its efforts. Although we still have a long way to go, we have a shared understanding with the government and are discussing what both sides should do to achieve the goals.

Initiatives in the Low-Carbon Solutions Business

Sumiyoshi: Next, Shoichi Kaganoi, Managing Executive Officer, Senior Vice President, Low Carbon Solutions, will speak on the topic of "Initiatives in the Low-Carbon Solutions Business." This year, under the Trump administration, there have been major shifts in climate change and clean energy policies globally.

Shoichi Kaganoi (hereinafter Kaganoi): My name is Shoichi Kaganoi, Managing Executive Officer, Senior Vice President, Low Carbon Solutions.

Our external environment can be described as one of headwinds. As an example, we participate in a conference for major oil and gas-related companies in Abu Dhabi every November. The year before last, the hydrogen-related sessions were packed from morning to night, and there was a great deal of energy.

Last year I participated in a panel discussion, but the seats were not filled and it was largely empty. This year, hydrogen-related sessions have only been held sporadically. As seen in this, we recognize that new low-carbon businesses have fallen somewhat in priority.

At the same time, our Company is promoting natural gas as a major means of achieving both stable energy supply and decarbonization. The low-carbon trend that had briefly boomed has been coolly reevaluated, partly in the wake of the Ukrainian invasion.

However, Japan is now experiencing record-high summer temperatures every year. With changes to the ecosystem, fish catches are changing and animals that do not normally appear in cities are doing so. There is even some talk of the possibility of the country being submerged and disappearing. Despite these headwinds, we believe that we must grit our teeth to overcome the ups and downs of the situation and continue our efforts.

Sumiyoshi: Citizens feel that strongly, too. There is concern about what will happen in the future when a large number of people think "enough already." Citizens looking at society feel the same, I believe. However, it appears that an increasing number of low-carbon-related projects are being suspended or cancelled overseas. What exactly is the Company's internal policy from here on?

Kaganoi: We have two main policies for future low-carbon projects within the Company. The first policy is our efforts in areas such as hydrogen and ammonia, which do not emit CO2 even when combusted. We call this "pre-combustion action," which refers to the pre-combustion phase. However, this area is likely to take longer than anticipated.

At the same time, we are also focusing on technology for carbon dioxide capture and storage (CCS) underground. Regarding the hydrogen and ammonia in the first part, as Japan will not be connected to foreign countries by pipelines or electric lines in the future, it will be necessary to receive supplies from somewhere, which will require action in the future.

Furthermore, as a company that handles fossil fuels, we have to consider efficient ways to utilize fossil fuels and alternative energy sources. We believe our original vision of realization by 2030 will probably be difficult to achieve and that we will have to take a longer-term perspective.

The second policy is in the area of post-combustion, in which generated CO2 is captured and processed. This will be an area where we can take advantage of our specialized technologies. We own 1,500 kilometers of high-pressure pipelines in Japan, which we use to supply natural gas to our customers. Our experience and technology in designing and laying this pipeline in-house can be applied to our post-combustion efforts.

We also plan to undertake underground storage of CO2, with efforts to ensure stability and safety. Our past expertise in underground storage of natural gas can be directly applied. We are proud that our technology for drilling holes in the ground, storing CO2 underground, and monitoring its stability is a field in which we are uniquely qualified. We view CCS as a mission of ours, particularly because there are few companies that can handle it.

Kashiwazaki Hydrogen Park

Sumiyoshi: Can you introduce some specific examples of your efforts?

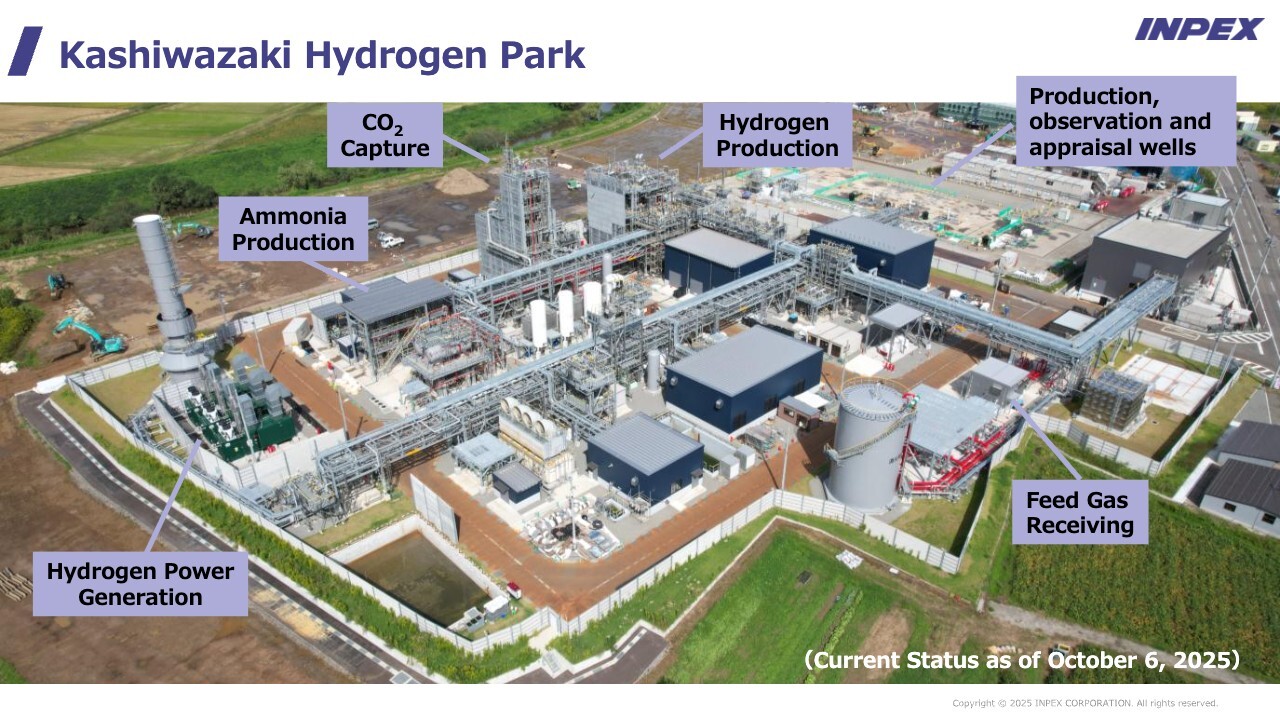

Kaganoi: This photo shows the Kashiwazaki Hydrogen Park, which held its opening ceremony last Friday. Our natural gas pipeline runs very close to this location, and we use that gas to produce our own hydrogen. The CO2 generated as a byproduct of the hydrogen production process is captured and stored in the well drilled by the Company, which can be seen at upper right.

The plan is to use clean hydrogen and ammonia, partly for electric power generation and partly for ammonia production, in this limited area in a self-contained manner.

This underground area is also a gas field where we used to produce natural gas. We are working to return CO2 to the underground and to systematically implement new low-carbon technologies at this one location. This is currently in the test operation phase and is scheduled to become operational soon. At that time we hope to provide you with an opportunity to see it, and will keep you informed.

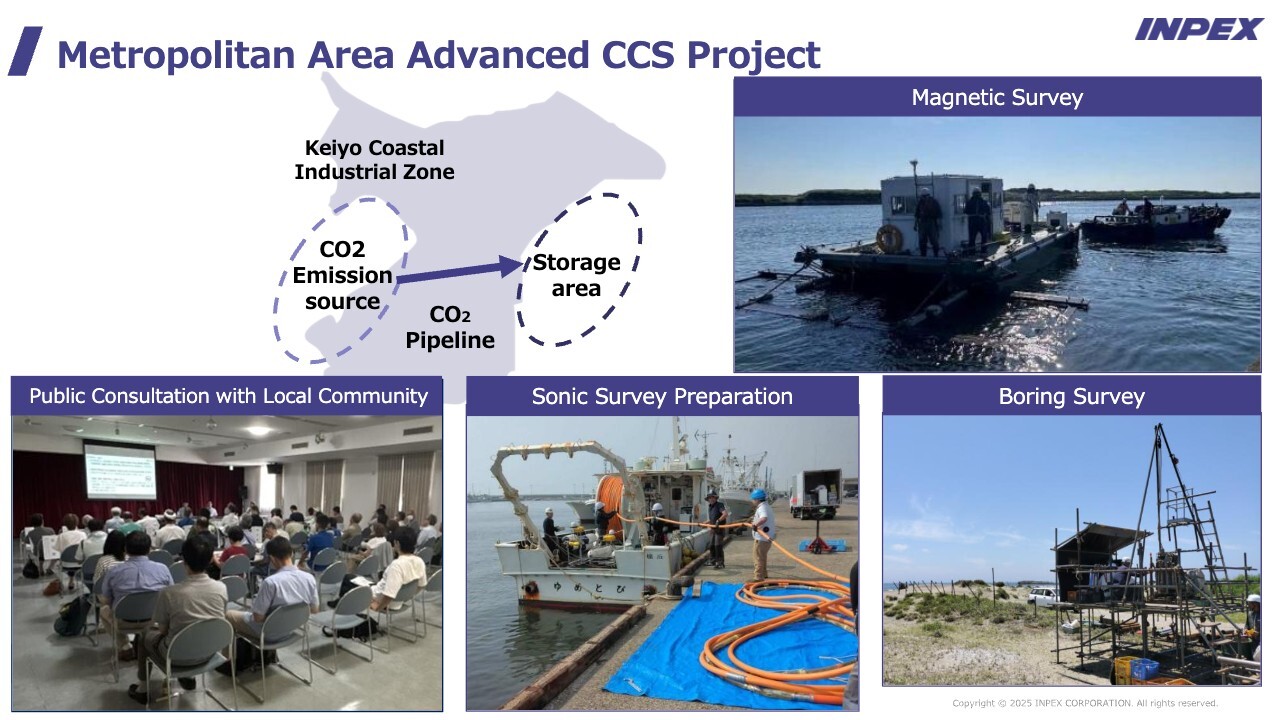

Metropolitan Area Advanced CCS Project

Kaganoi: Moving on from discussion of hydrogen, I would like to talk about CCS. These photos are related to the Tokyo Metropolitan Area Advanced CCS Project. Chiba Prefecture has one of the highest CO₂ emissions in Japan. CO2 emitted from Tokyo Bay, mainly from the Keiyo Industrial Zone, is transported through our own pipelines and stored offshore underground in Kujukuri, on the other side of the Boso Peninsula. The storage is not at the seafloor surface, but deeper underground. This initiative is being carried out as a government-commissioned project.

This is also a completely new and untested field. Although there are some similarities to the case of zero- experience in the Ichthys project discussed earlier, we are still in the process of finding a safe way to proceed.

To gain understanding, we are holding explanatory meetings for residents, investigating the underground and seafloor conditions, and conducting a borehole survey of the area where the pipeline will be installed. Regarding CO2 from Chiba Prefecture, some people argue that it's all the same atmosphere, so it doesn't matter where the CO2 is emitted. However, we want to advance CCS in a form similar to local production for local consumption.

Bonaparte CCS Project

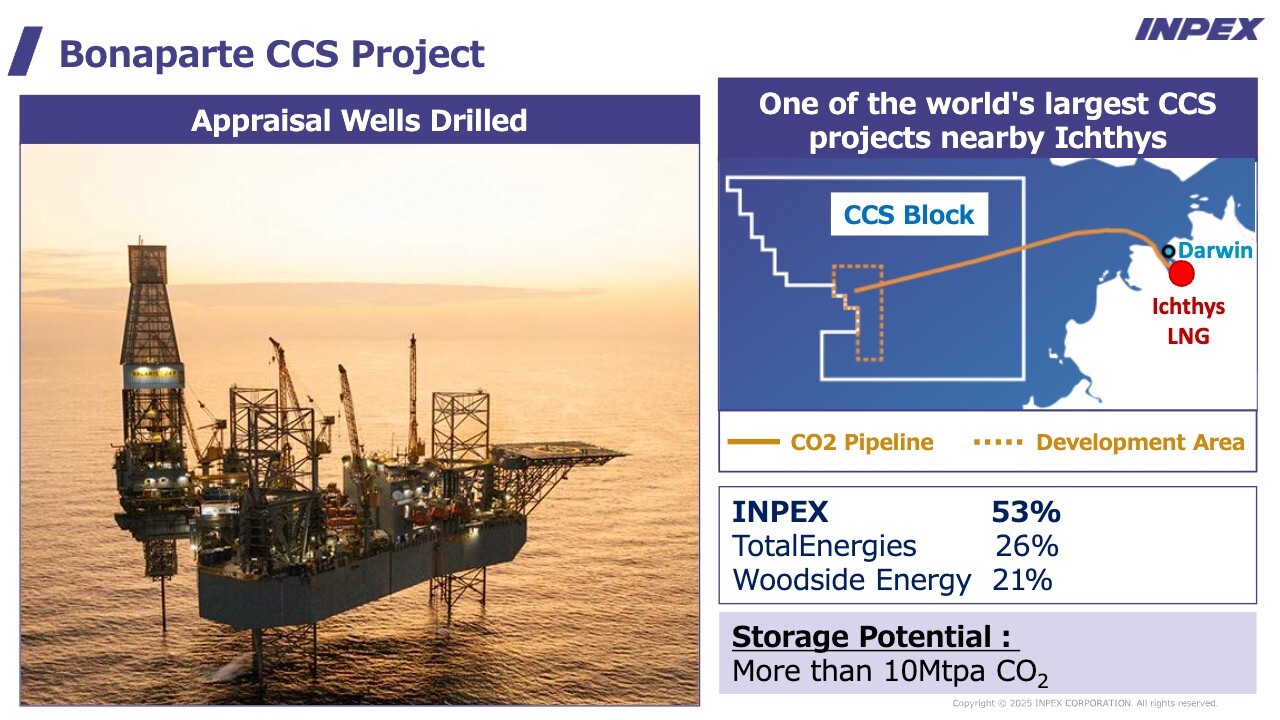

Kaganoi: This picture is from a CCS project related to the Ichthys project. Ichthys' LNG comes via pipeline from a gas field about 900 kilometers to the west. Areas along that path are targeted by the project. The area enclosed by the orange dotted line is about 200 to 250 kilometers to the west. We have acquired a concession here to engage in CCS and are conducting a survey.

Last year, we drilled two wells and conducted simple tests. The results confirmed that a significant amount of CO2 can be sequestered.

Preliminary front end engineering design (pre-FEED) began in the first half of this year, and the project has been granted major project status by the Australian government, indicating its importance within the country. We obtained the same status during Ichthys project development.

As such, although the project involves a Japanese company, it is also a CCS project recognized by Australia. We will first focus efforts on CCS, then advance hydrogen and ammonia initiatives without interruption.

Sumiyoshi: Have the technology and approach received considerable attention and recognition worldwide?

Kaganoi: There have been a number of positive comments, but also questions of whether it is truly safe. However, we believe it is important that we continue this effort, which we expect will likely become one of the world's leading CCS projects. We invite you to keep an eye on our efforts.

Sumiyoshi: I asked the question out of sense that the time will eventually come when the project earns high regard and is appreciated by the earth.

Shareholder Value Created through Investment and Shareholder Returns

Sumiyoshi: Next, Daisuke Yamada, Director, Senior Managing Executive Officer, Executive Vice President, Finance & Accounting, will speak on the topic of "Shareholder Value Created through Investment and Shareholder Returns."

Profit After Oil Price and Exchange Rate Adjustment Has Been Steadily Increasing

Daisuke Yamada (hereinafter Yamada): My name is Daisuke Yamada, Director, Senior Managing Executive Officer, Executive Vice President, Finance & Accounting.

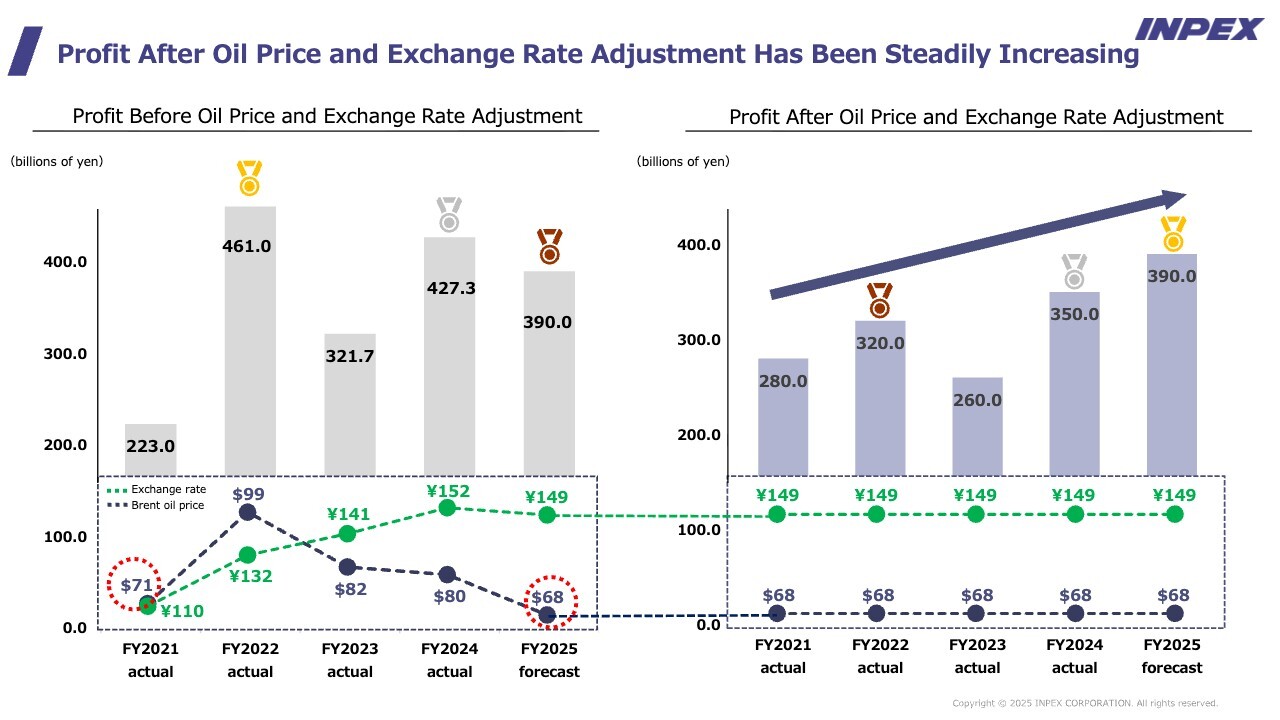

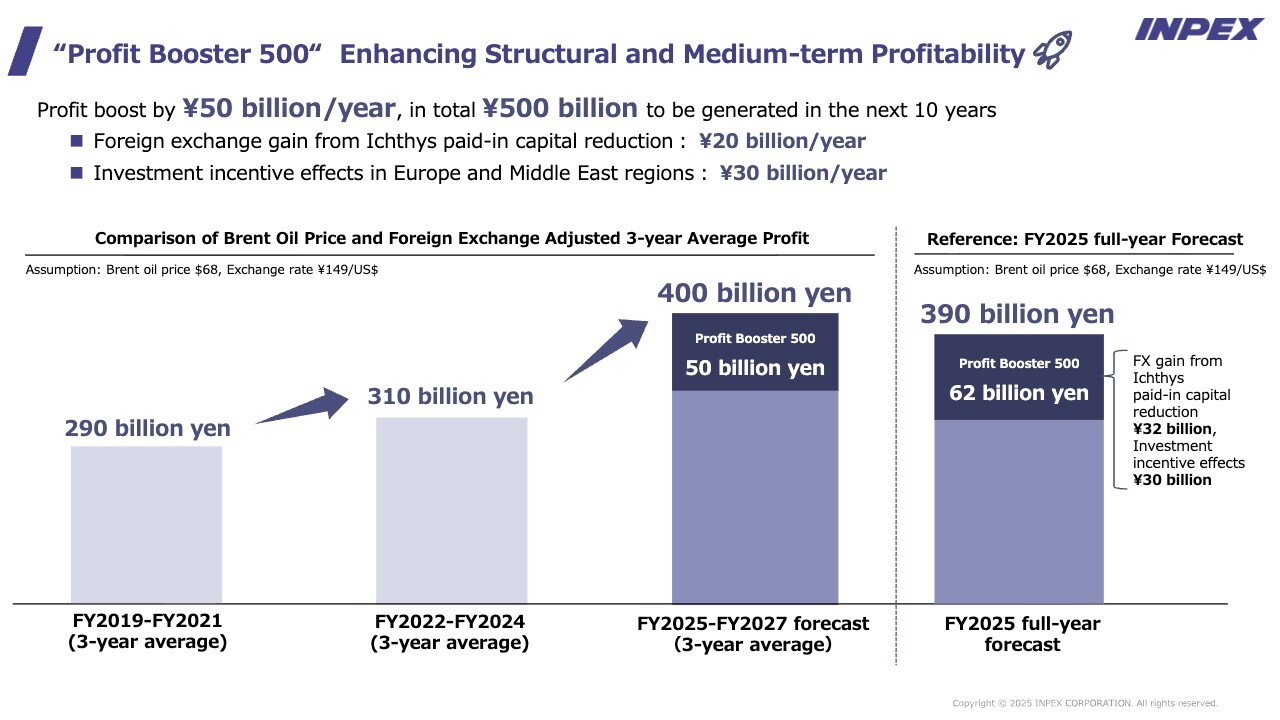

Sumiyoshi: Third quarter financial results were released on November 13. In that context, please tell us your assessment of the upward revision of the profit forecast for FY2025 to ¥390 billion, and the profit forecast for the period of the Mid-term Business Plan covering 2025 to 2027.

Yamada: This is a question I have been expecting.

Please see the ¥390 billion figure in the graph at right on the slide. Our financial results tend to be very closely linked to oil prices and exchange rates. Adjusted for past profit based on this year's oil prices and exchange rates, this year's figure of ¥390 billion is the highest in the Company's history.

If you look at the left side, profit for FY2021 is listed at ¥223 billion. At that time, we were very pleased to have exceeded ¥200 billion for the first time. The oil price then was $70 per barrel.

Although the oil price this year is $68 per barrel, profit has increased by ¥170 billion despite the unchanged oil price. The first factor behind this is exchange rates, with depreciation of the yen making a significant contribution. The start of operations at the Ichthys project was also a major factor in the increase in earnings. Another factor is profit contribution from the Abu Dhabi business.

I think another major factor is that we are now able to engage in balance sheet control.

To explain what balance sheet control is, each item on a balance sheet has inherent tax and accounting gains and losses, which fluctuate with conditions. How we combine these, within the rules for accounting and taxation, now allows us to derive the Company's profit and loss as they should be.

"Profit Booster 500" Enhancing Structural and Medium-term Profitability

Yamada: As an example, the "FX gain from Ichthys paid-in capital reduction" shown on the slide is related to TA recycling (the impact of reclassifying translation adjustments of foreign operating activities from equity to profit due to capital reduction). This has been incorporated into financial statements from this fiscal year.

In other words, we made a huge investment in the Ichthys project when the exchange rate was 80 or 90 yen to the dollar. The current exchange rate is in the 150-yen range, resulting in significant unrealized gains. This means that adjustments were made on how to reflect this unrealized profit from the balance sheet to profit and loss, and were incorporated into this fiscal year's financial results. This was made possible through deep insight and knowledge concerning the balance sheet.

In addition, taking into account the incentive effects in Europe and the Middle East, as shown at right on the slide, we project profit of approximately ¥390 billion this year. Approximately ¥60 billion of this is profit from balance sheet control.

We expect that this is not a one-time event but one that could continue for 10 years. During the three years of the Mid-term Management Plan, we expect profit of approximately ¥400 billion per year from this.

We envision an outlook for financial results that rise powerfully on the engine of increased profit, like the "Profit Booster 500" rocket flying depicted at the top of the slide.

Forecast for Cash Allocation and Net D/E Ratio ('25-'27)

Sumiyoshi: I would like to ask about cash allocation, which I believe is of great interest to investors. What is your approach to cash allocation during the period of the Mid-term Business Plan?

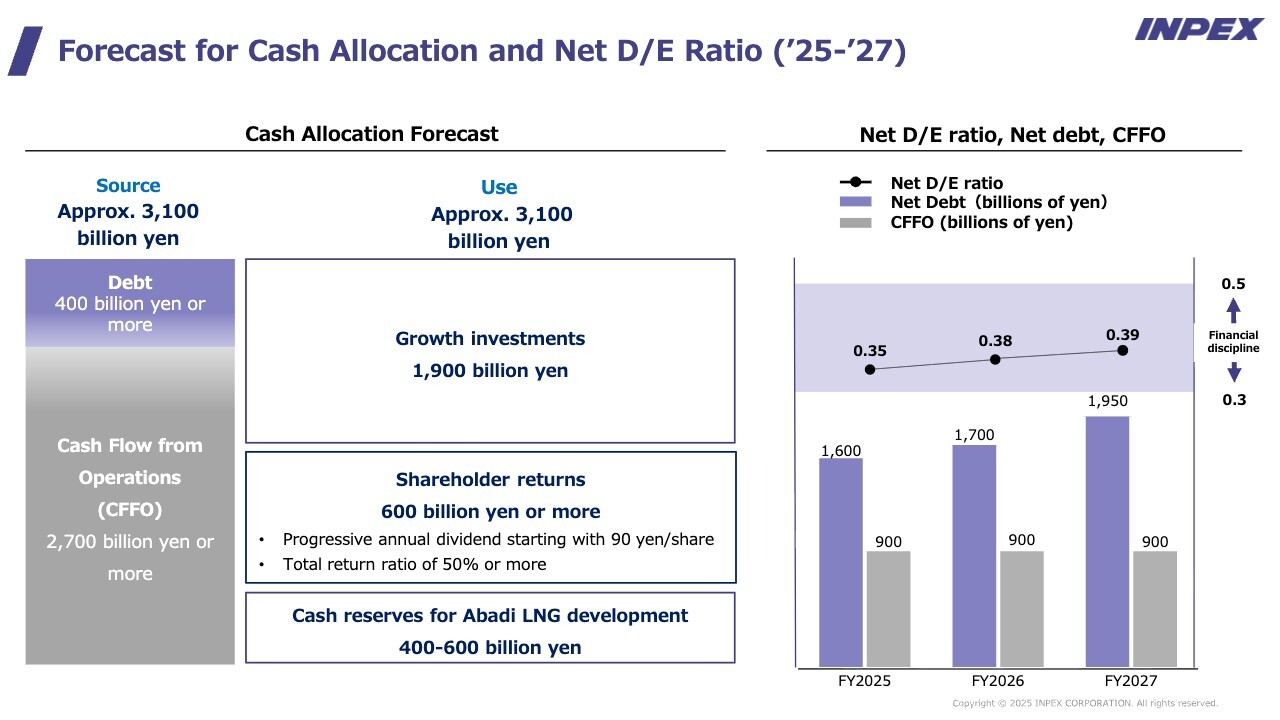

Yamada: Given the large investment in the Abadi project, some of you may be concerned about what that means for cash allocation and for returns. We plan to be aggressive about returns, with the outlook as shown here.

During the period of the Mid-term Business Plan, we plan to invest a total of ¥1.9 trillion at a pace of approximately ¥600 billion per year, and plan returns of ¥600 billion. This return is intended to be a progressive dividend, with a total payout ratio of 50 percent or more. About ¥600 billion will be set aside as cash reserves for the upstream of Abadi project.

In the case of the Ichthys LNG project, we carried out a ¥500 billion public offering before the final investment decision was made. This time around, the Company is able to invest in the Abadi project using its own cash flow.

Thanks to the Ichthys project, we are now in a position to secure such large development preparation reserves in-house, a situation that I believe is very different from the previous project.

Please look at the right side of the slide. Even under these investments and returns, the D/E ratio, which indicates financial discipline, is 0.39. I believe our situation is one in which financial discipline is not a problem at all.

Continued Enhancement of Shareholder Returns

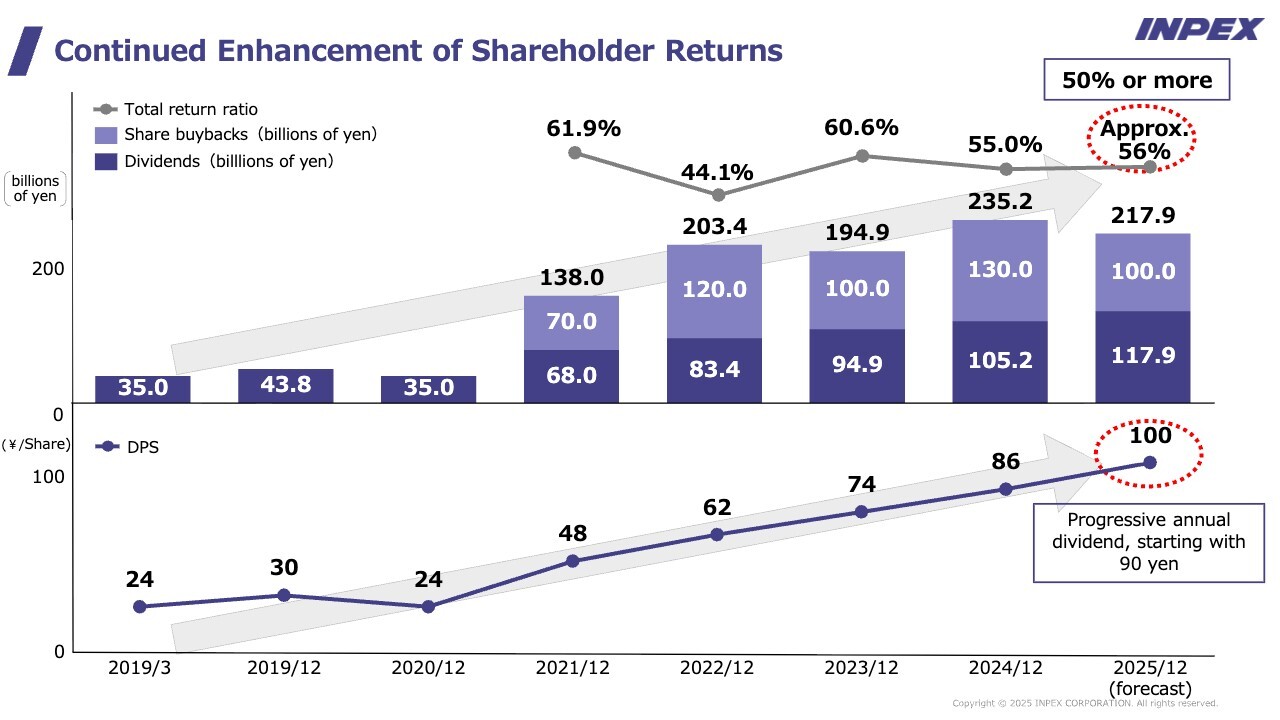

Sumiyoshi: Next, please tell us about the Company's history of enhancing shareholder returns.

Yamada: As we announced recently, the dividend for this fiscal year is ¥100 per share. We raised share buybacks from ¥80 billion to ¥100 billion. The total return ratio is approximately 56 percent, and we remain committed to progressive dividends and a total return ratio of 50 percent or more. We are increasingly confident about shareholder returns.

Sumiyoshi: From that, I can understand that the Company has built capacity for growth while ensuring adequate shareholder returns.

Declining Correlation Between Oil Prices and Our Share Price

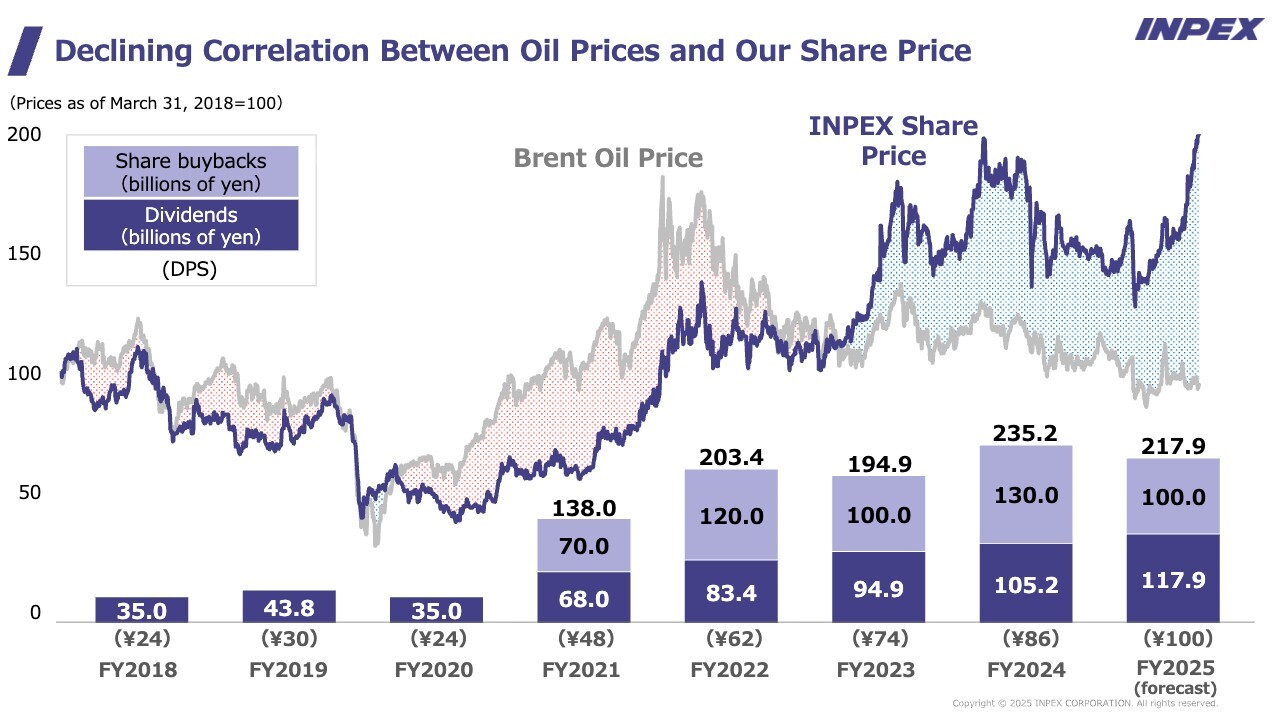

Sumiyoshi: There is a general image that INPEX's performance and share price are linked to the Brent oil price. Please tell us about the impact of oil prices on performance and your perception of the current share price.

Yamada: I myself was surprised to see the share price rise from ¥2,000 to ¥3,000 over the three months since August.

Our stock has been referred to as an "oil price-linked stock," meaning that the share price rises and falls alongside oil prices. However, that link has now been broken, and the share price is rising despite flat oil prices.

The reason why the share price has risen so much is, of course, due to our shareholder returns and our stable performance. Despite the increase, however, our P/B is still around 0.83, and we cannot afford to be complacent. This is not a time to get carried away.

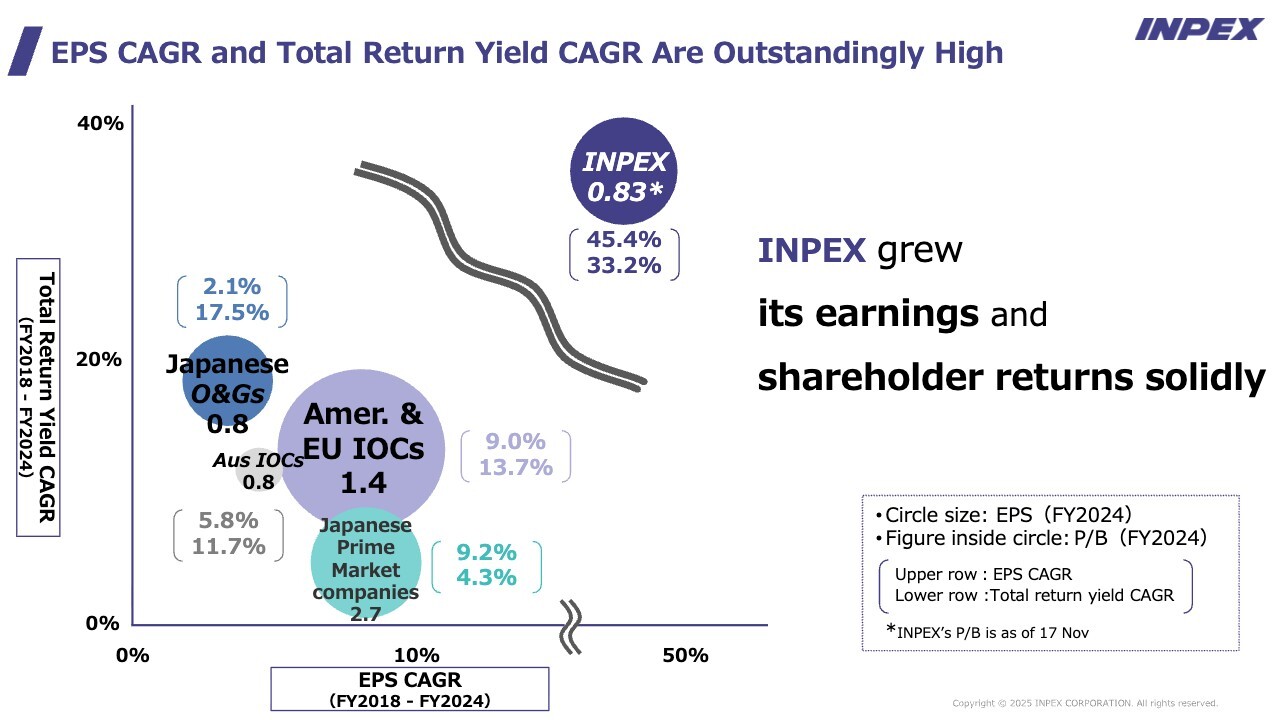

EPS CAGR and Total Return Yield CAGR Are Outstandingly High

Yamada: In terms of how much we are implementing shareholder returns and how much our EPS is growing, I would like to show you this graph.

A blue circle stating "INPEX 0.83" is shown at upper right. Below that, in parentheses, "45.4" appears in the top row and "33.2" in the bottom row.

The 45.4 indicates how much EPS grew annually between 2018 and 2024, meaning growth of 45.4 percent. The 33.2 represents the average annual growth rate of the overall shareholder return yield, which increased by 33.2 percent.

Below the wavy line in the lower left corner, "IOC" and "Prime" are noted, but as you can see, there is a large disparity. Despite growing earnings and consistent payout of shareholder returns, our P/B is 0.83x, compared to the Prime P/B of 2.7x.

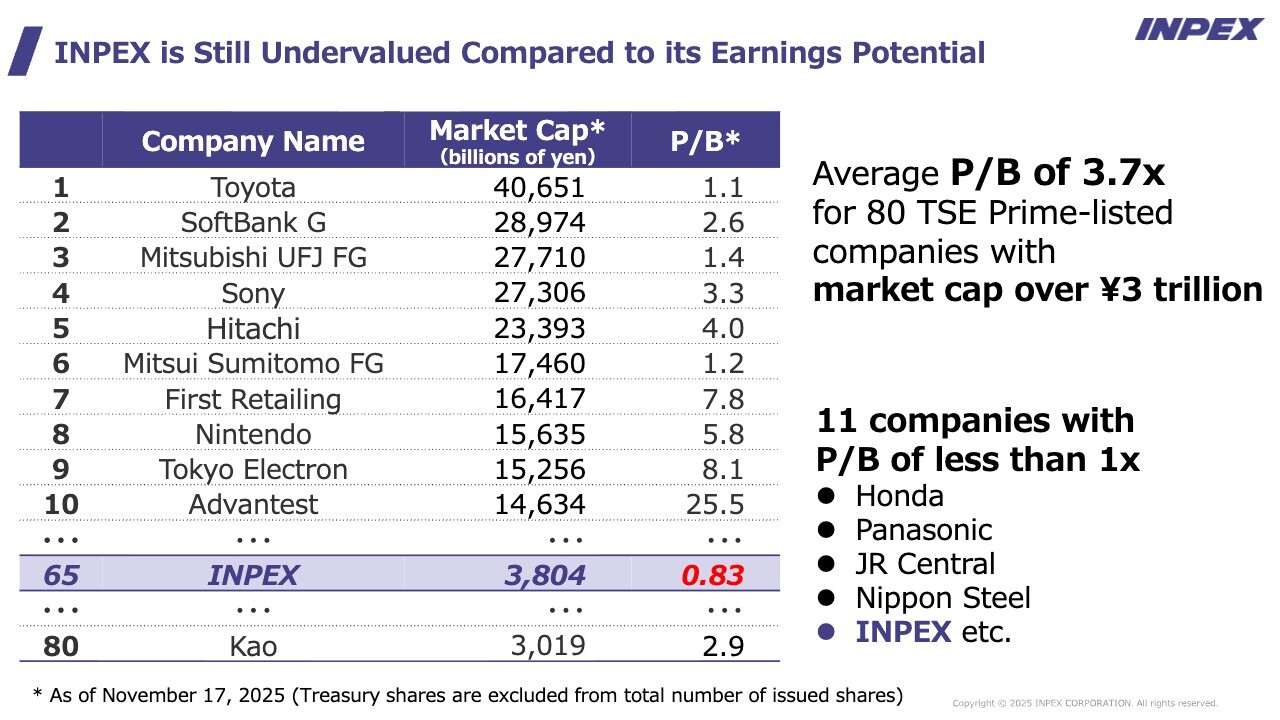

INPEX is Still Undervalued Compared to its Earning Potential

Yamada: This table shows companies with market capitalization over ¥3 trillion. INPEX currently has a market capitalization of approximately ¥3.8 trillion and a P/B of 0.83x.

The average P/B of companies listed on the Prime market with market capitalization of over ¥3 trillion is 3.7x. By contrast, ours is 0.83x, less than 1x. Only about 10 such companies exist. Of course, we are very pleased with the rising share price, but we believe it is still undervalued.

Although our share price has grown thanks to our investors, we recognize that it is still in the process of growing.

Sumiyoshi: Is it correct to recognize that performance and oil prices are no longer linked?

Yamada: Our presence among investors has increased to the point that the share price is not so greatly affected by oil prices. However, this does not mean that if oil prices rise in the future, our share price will not rise. I believe that as oil prices rise, our business performance will improve and share prices will rise accordingly, but the situation has changed a bit and the dimensions of our share price level may be shifting.

Q&A: Profitability of the Abadi Project and handling of risk

Questioner: Is the Abadi project expected to contribute to profit? You earlier mentioned a figure in the mid-10% range, which I assume refers to equity IRR. I heard that the Company is aiming for this range, but I'd like to ask you to comment on risks in the Abadi project, especially country risk.

I believe that LNG supply and demand and inflation are also major risks. I believe there was some mention in your earlier explanation, but which risk do you consider to be the greatest at present? How do you plan to manage that? As country risk includes areas that are difficult to see from the outside, please explain in detail how you will manage that risk, and the prospects for achieving the mid-10% goal.

Watanabe: You mentioned country risk, risks related to marketing, and risks related to inflation and costs. These are all important risks, and we are taking steps to address each of them. However, marketing and inflation risks are common to all projects we are involved in, and are not a challenge unique to the Abadi project.

Here, I would like to discuss our response to country risk, particularly as it relates to our relationship with the Indonesian government. The project in Indonesia is based on the country's petroleum laws, and we need to move forward with the consent and approval of the Indonesian government. We believe this could lead to country risk.

However, we also believe that if we can build a good relationship with the government, many things will go smoothly. We engage in close communication with the government on a daily basis.

In our dialogue with the Indonesian government, we also use the term "FID Requirements" in connection with our final investment decision. Specifically, we have repeatedly explained that we are aiming for the mid-10% range on an equity IRR basis as our economic bar to cross, and we have also communicated our need to meet the expectations of our shareholders and investors.

We believe that maintaining a good relationship with the Indonesian government and obtaining its maximum support while gaining its understanding is the best way to deal with country risk. I also have opportunities to meet with senior officials of the Indonesian government, and have always received messages that the Indonesian government fully supports the project and that the Abadi project is important to Indonesia. Accordingly, we intend to continue to address country risk through building, maintaining, and strengthening good relationships.

Q&A: Profitability in the low-carbon solutions business and the business potential of CCS

Questioner: I have a question about the Company's commitment to low-carbon solution projects. I understand that there are continuing headwinds in the decarbonization business, and in connection to this, you discussed hydrogen/ammonia and CCS. I believe the situation is particularly difficult for hydrogen/ammonia, but I would also like to ask whether there is any change in the business potential of CCS.

Given that this is an area of expertise of the Company and that the project is progressing, please let me ask whether we can assume that the certainty of profitability has increased or whether the situation is largely unchanged.

Kaganoi: Concerning profitability, the situation remains less than optimistic. The same is true for hydrogen and ammonia, which need to be reasonably competitive in order to replace new energy sources with conventional ones amid rising costs. Currently, this is not possible without government subsidies.

This is also true for CCS. Our initiative is one to build new facilities to recover what had previously been discharged directly into the atmosphere. This inevitably incurs costs that someone has to bear.

If a company is able to pass the cost on to its products, this may not be a great problem. Otherwise, the public may have to bear the burden through taxes. Both hydrogen/ammonia and CCS, particularly CCS, are at the stage of attempting to turn what has been nearly costless into a business. It is very difficult at this point to guarantee profitability.

Accordingly, we believe that we need to seek ways to improve economic efficiency by collaborating with those in the industry who can easily realize some kind of pass-on pricing, or by adding something to CCS to create "CCS Plus."

As a first step, however, we believe it is most important to steadily finish the projects we are currently working on. Once a company has a proven track record, its communications with others in the business world change greatly.

As an example, referring back to the photo of Kashiwazaki Hydrogen Park, we are involved in this project in the belief that we can be called upon in the future when parties are looking for partners to pursue hydrogen and ammonia projects.

Similarly, we will first complete the CCS initiative, and while it faces financial difficulties for the time being, we believe it will add to our track record and serve as preparation for future developments.

Q&A: How the field perceives the Ichthys project's paid-in capital reduction

Questioner: My question is for Mr. Okawa. We believe that Ichthys is a major driver of profits, with strong production and paid-in capital reduction. From the perspective of those in the field, I would appreciate it if you could explain how you view the Ichthys project's paid-in capital reduction.

While this is important from the perspective of controlling equity and improving capital efficiency, I think it is also necessary to secure investment capital and financial soundness for Train 3. Please explain how you perceive the situation, such as whether you seek more of a buffer or whether you want to proceed with a sense of urgency to improve capital efficiency.

Okawa: We fully understand that the project needs to contribute to capital efficiency in the field. However, whether the topic of paid-in capital reduction is actually at the center of the conversation in the field is a matter for the corporate side. When I speak with people in the field, I talk about goals to request actions that have specific effects. Although the people understand the policies of the head office, their focus is above all on how to continue stable operations.

Accordingly, head office corporate divisions will take the lead on this matter, addressing the current situation and the prospects for future paid-in capital reductions.

We are making every effort to gain the cooperation of people in the field in discussing what lies ahead in terms of paid-in capital reduction. However, as for whether this is a central topic of conversation among people in the field, the reality is that they face many issues on which they are concentrating.

Q&A: The LNG supply/demand outlook and strategy, and the outlook for the Ichthys and Abadi projects

Questioner: Regarding LNG, what is the current five- to ten-year supply and demand outlook and what are your strategies based on that?

You mentioned marketing of the Abadi project. I believe that LNG supply and demand will have a significant impact not only on the Abadi project's marketing but also on the Ichthys project's price review and contract renewal after 15 years. It is often said that LNG supply and demand balance will worsen, but I would like to know the Company's view on this.

On the assumption that this balance will deteriorate, how will the Ichthys and Abadi projects address that? For example, are you considering measures that assume that your strengths will weather the conditions, or measures viewing the market as difficult to predict like oil prices, with the assumption of negative effect on performance if certain conditions occur? In that context, how do you see supply and demand, how will you address it, and how should we as investors prepare?

Ueda: I will answer this question due to its wide-ranging nature. First, regarding LNG supply and demand, there is a general belief that there will be oversupply from 2026 to around 2030.

One reason for this is that, as you know, numerous LNG projects based on shale gas have been launched in the U.S. and will begin production. During the period, oversupply is predicted despite growth in LNG demand. As a result, the general view is that the price will also decline. We share that view.

However, it is also commonly expected that the supply-demand balance will become tight after 2030, resulting in a supply shortage.

Regarding natural gas/LNG, we believe that there is a near global consensus that LNG will play a very important role during the immediate transition period, despite the existence of other energy sources.

In concrete figures, current global LNG production and transaction volume is approximately 400 million tons per year, a volume expected to double to 700 to 800 million tons around 2040. Demand for LNG is so great that, although the oversupply situation will continue until the early 2030s, it is expected to subsequently reverse to a situation of LNG shortage.

Also, regarding recent global debates over energy, prior to the war in Ukraine, the emphasis was on energy transition. Since then, however, the focus has been on energy security, that is, stable supply. Recently, the term "energy addition" is increasingly heard worldwide.

In reality, power demand has grown significantly, especially for AI data centers. Demand for LNG is also forecasted to double, while demand for oil is expected to peak in the 2030s and then remain at a plateau without sharp decline.

Thus, as overall energy demand grows worldwide, the challenge is to secure supply to meet it, and the discussion of "energy addition" is gaining attention. This could even be called the global buzzword of the year. Stable demand for LNG is expected through the 2040s and even into the 2050s.

Regarding the Ichthys and Abadi projects, even if LNG prices temporarily decline in the early 2030s, we expect conditions to stabilize thereafter. This is a strength of the projects. In the course of marketing for the Abadi project, we have found that buyers have very high expectations for LNG in the Asian market. While the U.S. LNG supply is expanding and LNG supplies also exist in Qatar and elsewhere in the Middle East, large scale LNG supply projects in Asia are very attractive.

In particular, buyers are demanding diversification of sources of supply, and it is important to supply from Asia rather than to rely solely on the U.S. and the Middle East. In addition, the geographical characteristics of the Asian region as the center of demand also offer the advantage of relatively low transportation costs for LNG supplied from Asia.

Against this background, we feel that the expectations of customers for the Abadi project are much higher than we had imagined.

In particular, the Ichthys Train 3 and Abadi LNG projects are forecasted to begin production in the early 2030s. LNG supply and demand are expected to be tighter during this period, and we expect Asian LNG demand to be even stronger in the future. Therefore, we believe that the Ichthys Train 3 and Abadi projects will continue to demonstrate the strength of LNG in Asia.

Q&A: Ichthys and Abadi project strategies and points for improvement

Questioner: I am grateful for the rise in the share price. I believe that the market is taking note of the Company's commitment to profit. Regarding guidance for next year, I would ask that you not be too conservative and disappoint the market's expectations.

Yamada: We are not obsessed with profit; rather, it is a result of our considering what our balance sheet and our profit and loss should be. For example, we are considering whether accumulating as much as ¥1 trillion on our balance sheet for the exchange differences on translation of foreign operations is really an appropriate profit and loss item for the Company. We believe that if there are unrealized losses on fixed assets, they should be impaired, and if there are unrealized losses for tax purposes, they should be reflected firmly in the figures.

Our basic policy is not to try to force earnings on the statement of profit and loss, but rather to provide investors with information on our appropriate balance sheet and statement of profit and loss at that point in time to enable fair evaluation of our share price. I would like you to understand that our financial policy is not to be conservative but to proceed in a proper manner.

Questioner: What you have said so far has been very informative. I think it is really wonderful that you were able to launch the Ichthys project from nothing. However, current equity IRR for the project does not seem to have reached the mid-10% range.

This may have been influenced by the many difficulties encountered during the start-up process. As for the subsequent Abadi project, I think there is a mid-double-digit goal, i.e., the mid-10% range. Looking back at the Ichthys project, I would like to ask about this gap and whether there were areas with room for improvement, such as in contract strategy.

Specifically, if such improvement measures had been implemented, is it possible that the mid-10% range could have been achieved at the Ichthys project? I would like to know whether any such know-how and lessons can be reflected in the Abadi project, speaking from your experience.

Okawa: Ichthys was our first project as operator, and to be honest, it was difficult to formulate strategy given our lack of experience.

Looking back, there are many areas for improvement, but I think contract strategy is particularly important – that is, how to manage contractors and how to structure contracts with them. This is the first key element.

The second element is stakeholder management. There is a huge number of parties involved in onshore development projects and in creating LNG development infrastructure, as in the Abadi project. Without the agreement of those involved, we cannot advance the projects.

Any delay in schedule will result in new costs. Although things went smoothly in the latest project, I have some regrets that we should have established relationships with potential stakeholders a little earlier in the process with the Ichthys project.

The third element is the issue of yards. As the various facilities are built, it is important to know how much capacity contractors actually have at the time. During the Ichthys project, there were many competitors.

Because Chevron and Shell projects were launched at about the same time, contractors naturally gave priority to supporting the big name projects. As a result, there was a time when our project was put on the back burner. We fell into a situation in which the longer the delay, the more costs rose and the further the schedule was delayed. Therefore, with the Abadi project, we feel we need to reassess the situation of contractors and the market as a whole.

With a correct assessment of the market situation, we know the key points we need to hold down. To ensure that contractor management does not lag, we will continue to assess the situation and ensure that we hold down what we need to hold down and push what we need to push. There are several other points, but these are the ones that I experienced and feel are important.