Corporate Governance: Dialogue with Outside Directors

Miki Sumiyoshi (hereinafter Sumiyoshi): The last part of the program today is "Corporate Governance: Dialogue with Outside Directors."

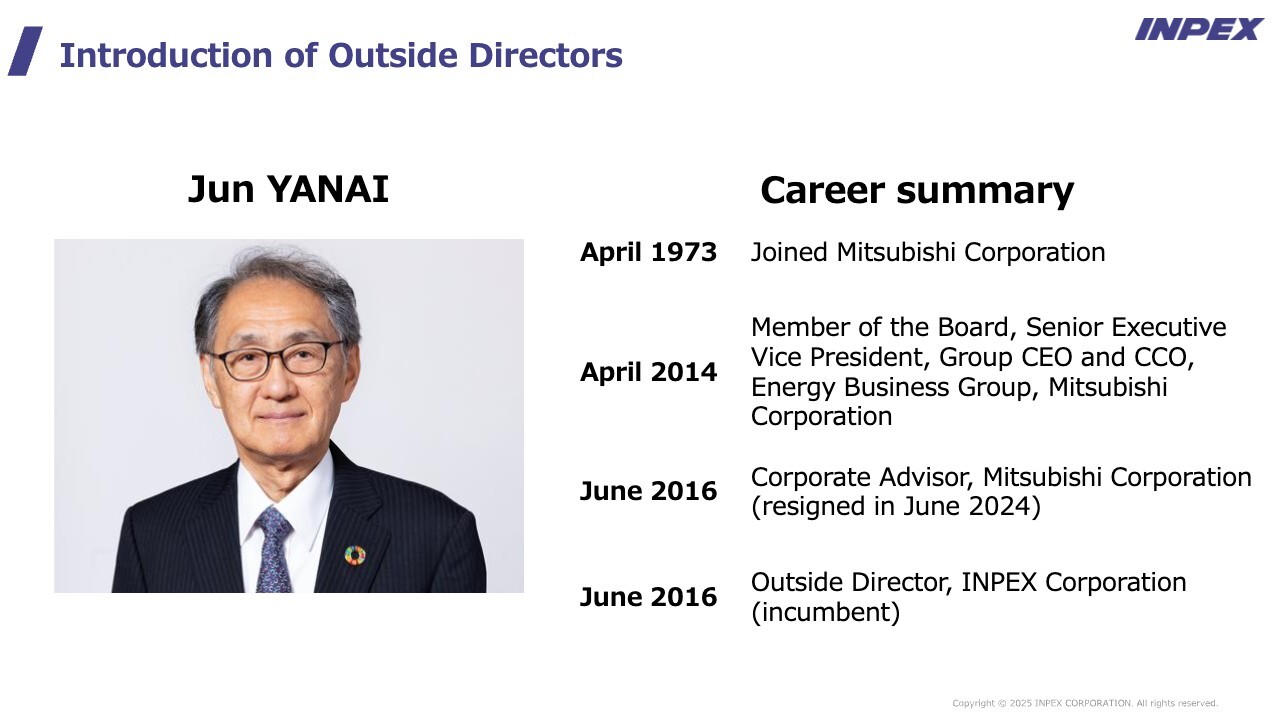

In the first half of the session, outside directors Jun Yanai and Hideka Morimoto will talk about the roles they have played in governance and their expectations for INPEX's future growth. In the second half, we will take questions.

Mr. Yanai has served as an outside director of INPEX since 2016 and Mr. Morimoto since 2022. I would like to ask about the roles they have played and how they prepared themselves for their duties. Let us begin with you, Mr. Yanai.

Introduction of Outside Directors, Jun Yanai

Jun Yanai (hereinafter Yanai): My name is Jun Yanai. As you can see on the slide, I served as the head of the Mitsubishi Corporation Energy Business Group for about five years. During that time, many outside directors were present at the Board of Directors meetings I attended. My impression, frankly speaking, was "what a bothersome bunch of people."

After resigning, I was approached by INPEX to serve as an outside director. I accepted the position thinking that I would avoid becoming such a bothersome person. Upon actually serving on the Board of Directors, however, I realized that only a bothersome person can serve as an outside director.

I believe that it is not the place of outside directors to say only what is easy to hear. When I joined in 2016, many of the outside directors here were persons with involvement in the industry. Since then, however, attention has turned to diversity, and persons involved in the industry are little seen.

For my part, I was prepared to make some use of my own industry knowledge to offer candid opinions on a variety of matters as they came up.

I have experienced my fair share of failures during my working years and thought it might be helpful to share my experiences of failure. To the best of my recollection, on three occasions I shared opinions based on personal experiences with failure, prefaced with, "I'm embarrassed to say this, but…"

In doing so, my comments were particularly grounded in the matter of risk. Regarding such risk, outside directors are in a position of having far less information than divisions concerned.

In my experience, when a matter is put forth from the position of top management, if I feel something is out of place and ask questions to the division in charge, the division studies the matter in depth and delivers responses to all of the questions. Accordingly, it can be difficult to oppose as a position of top management.

Based on this experience, I have made it my policy to trust my instincts and put forth my opinions at the start of any project or matter that I feel is at risk.

As for other points in preparing myself for the role, as one of few people involved in the industry, I always study and have kept myself updated on the current state of the energy industry.

Sumiyoshi: How do you evaluate INPEX from the perspective of your involvement?

Yanai: Governance was mentioned at the outset, so let me address that first. In the nine years and five months that I have been an outside director of INPEX, the Company has changed so dramatically in terms of governance that it's like a different company.

Specifically, the composition of the Board of Directors has become more diverse and prior briefings to outside directors on agenda items have become very detailed.

Another very positive aspect is that there is a culture of openness and acceptance of opinions that are difficult to hear. I find it quite wonderful that an attitude has taken root of not paying excess heed to opinions that are comforting.

Introduction of Outside Directors, Hideka Morimoto

Sumiyoshi: I would now like to ask you, Mr. Morimoto. First, please tell us about your preparations and about the role you have been assigned.

Hideka Morimoto (hereinafter Morimoto): I joined the Environment Agency, as it was then called, and have about 40 years of experience in government administration. Basically, my background is work in environmental administration. However, following the Great East Japan Earthquake, nuclear issues arose and I was transferred to the Cabinet Secretariat to oversee the launch of an organization for nuclear regulation.

Later, I was transferred to the Nuclear Regulation Authority that I worked to create, and had the opportunity to study energy in depth.

After I returned to the Ministry of the Environment, the issue of climate change became a very big issue. In particular, Prime Minister Suga's 2020 declaration on carbon neutrality spurred major changes in economic and social structures.

The climate change issue and energy stabilization strategy are essentially two sides of the same coin. Accordingly, I worked closely with the Ministry of Economy, Trade and Industry and the Agency for Natural Resources and Energy.

I joined INPEX in 2022 and have now been with the Company for a little over three years. What first impressed me most was that by carrying out such large and long-term projects, the Company is achieving a stable energy supply and has carried out a major role in the country. This impressed me greatly.

I believe the Company gained much experience in the course of its projects, and when I joined the board as an outside director, I wondered how I could contribute to projects.

In particular, the Pillar for Growth 1, "Expand natural gas and LNG supply" entails a number of risks in ensuring a stable supply of natural gas.

In the Abadi project, as mentioned regarding an earlier question, there are country risks. How the Company will address these is important.

Outside directors are in a position to offer opinions from a variety of perspectives, based on which we consider risk. Furthermore, in light of those risks, I believe we need to consider risk-taking.

The Pillar for Growth 2 is "Provide lower-carbon solutions leveraging CCS and hydrogen" and the Pillar for Growth 3 is "Drive initiatives in the energy and resources fields by leveraging INPEX’s distinctive capabilities."

Social conditions are definitely changing, and we are currently facing headwinds. From a long-term perspective, however, I believe this is something that will naturally progress.

In terms of my perspective as an outside director, I have a background in public administration and have worked in such fields for a long time. With regard to low-carbon solutions in particular, it is the government's job to engage in dialogue and to consider how we can build the market through subsidies or regulatory measures.

I think it is important that we think about our role as outside directors with a view to interacting with the government.

Sumiyoshi: How do you evaluate INPEX from the perspective of your own experiences with the Ministry of the Environment and issues such as nuclear power and climate change?

Morimoto: We are currently in a period of transition, during which I believe the role of natural gas is very important.

I believe that the role of natural gas is vital because of the need to achieve both transition and stable supply, not only thinking about the decarbonization of energy. I think the first thing to do is to emphasize that perspective from the standpoint of climate change considerations.

There is also a long-term perspective. INPEX has a mission to supply diverse energy sources from a long-term perspective, looking at 2030, 2040, and 2050.

I believe it is important to think about and communicate how to work toward that goal, while advancing dialogue with the government on low-carbon solutions.

Human Resource Development and Greater Name Recognition as Future Expectations for INPEX

Sumiyoshi: Moving on, I would like to ask about your expectations for INPEX's executive team in achieving further growth, and how you hope to contribute from the standpoint of an outside director. How about you, Mr. Yanai?

Yanai: First of all, I think it is important that the Company solidly move forward with projects coming after Ichthys, a pillar of its earnings.

In terms of growth, I believe that the development of human resources is the most important factor. It is vital that all employees are motivated and work toward the same shared goals.

"INPEX Vision 2035" is a particularly important guide created with the participation of young employees. It is important that employees share this information and move forward with greater motivation.

I believe that the management team also needs to focus on human resource development. Although I am the one speaking today, all of the outside directors believe that human resource development is of paramount importance in terms of growth.

This may be a bit off topic, but from the standpoint of growth, I feel that boosting recognition of INPEX is an issue. INPEX is a very influential company.

As an example, when the situation in the Ukraine invasion broke out, INPEX stably supplied LNG to Japan at long-term contract prices. Without this contract, Japan would have been in a very difficult situation if it had procured LNG at spot prices. Despite the Company's impact, however, its visibility is still far from sufficient.

The current lack of recognition of the Company, even though it plays a role on par with or greater than companies such as Nippon Steel Corporation and Toyota Motor Corporation, may hinder growth in terms of employee motivation or future M&A. I would like to see the Company work on improving this.

One way to do so is through the policy on return of profits to shareholders. As seen in its high recognition within NISA (Nippon Individual Savings Account), INPEX is gaining recognition among investors. The importance of the Company needs to become recognized by industry as a whole, and even by the nation as a whole.

In doing so, it is important to take concrete next steps as well as to establish post-Ichthys business and to address environmental issues. As a company that deals in hydrocarbons, it is clear that INPEX faces strong environmental scrutiny and must respond to that.

The Company also needs to tackle M&A. As the Company moves forward with numerous things in the future, I hope it can do so under strong name recognition. I believe this is one of the keys to growth.

Sumiyoshi: How about you, Mr. Morimoto?

Morimoto: I agree with what was just said. First, despite its scale, INPEX is actually not very well known.

I am a lecturer at Waseda University, which is undertaking a very unique initiative. Current students invite their alumni grandfathers and grandmothers to Waseda for an event called Homecoming Day.

The wonderful thing about this initiative is that grandfathers and grandmothers come together with their grandchildren. I feel that this initiative, which lets grandparents say "This is the university I went to," connects tradition and is a wonderful endeavor.

I toured the Ichthys project and INPEX's Niigata terminal, and felt that a lot of people would become fans of the Company if they could actually observe these sites. Actually, I hear that when the Company sends out invitations to shareholders to tour sites, many applications come back. This should be valued as a very important initiative.

I think this is a measure that attracts new supporters by showing something concrete and real.

In addition, I believe that the Ichthys project has a variety of assets, some tangible and also some intangible. Tangible assets include terminals and gas field.

Another advantage is approximately 4,000 "lessons learnt" through the Ichthys project. The Company also owns 1,500 kilometers of pipeline in Japan and has very good partnerships with Australia and the UAE.

I believe that sharing these tangible and intangible assets, leveraging them in the Abadi project and in further steps, will lead to growth.

I also believe that the 1,500 kilometers of pipeline will be useful in supplying the Japanese market.

Q&A: Challenges and opportunities for INPEX as seen from the Nomination and Compensation Advisory Committee

Questioner: Mr. Yanai, I understand that you are the chairman of the Nomination and Compensation Advisory Committee. From that perspective, what are your thoughts on the challenges and opportunities facing INPEX?

Yanai: Regarding issues for the Nominating and Compensation Advisory Committee, you probably have succession planning in mind.

The current president has already served for seven years and is of course managing the Company very well, but the situation is not permanent.

For that reason, succession planning has been under discussion in a closed-circle format by the Nominating and Compensation Advisory Committee for over a year. I will refrain from noting specific names here, though they are mentioned in discussions.

The main issue under discussion is what sort of person should stand at the forefront of the Company to ensure its smooth operation.

Who will be the president is a very big message, the most significant message for employees and all stakeholders as well as a very serious matter with implications for the future. Large-scale investments are of course important, but I recognize that the question of who will be president is also a critical topic.

Members of the Nominating and Compensation Advisory Committee are now engaged in discussions very seriously.

Starting this year, I am chairing the Nominating and Compensation Advisory Committee, a majority of the members of which are from outside the Company.

As in other companies, within the committee we use all manner of skill matrices to meticulously discuss what the most important elements are in succession planning.

I will refrain from going into specifics, but one thing that is noteworthy about INPEX compared to other companies is that it is engaged in a very large energy business, and therefore typically deals with major oil and gas producing countries and with high-ranking government officials.

As a result, the Company has a need for human resources who have sufficient knowledge, character, and a high degree of common sense to deal with such counterparts. These qualities go beyond skills to include more multifaceted aspects.

I also know from experience that not only textbook-like items such as skill matrices but also personality and human sensibility are ultimately critical. In fact, I know of many companies in which these factors have led to poor decisions and failures. Therefore, I believe that such points are important factors in final decision-making.

Q&A: Investment policy in response to the anti-ESG movement in the U.S. and other changes in the external environment

Questioner: You have both mentioned the need to firmly address environment-related headwinds from a long-term view.

I believe this makes sense with regard to the external environment, but I also think that the anti-ESG movement in the U.S. could undergo change as a risk under a change of administration.

What are your thoughts concerning the Company's reduction of its amount of decarbonization investments from the amount already set in investment plans?

Also, what situations might arise in the future that would allow putting forth suggestions when changes are made in decision-making, or what thoughts do you have on previous decision-making?

Additionally, would you care to share your thoughts on the flexibility of the Company's planning?

Morimoto: First, the Board of Directors spent a year discussing the vision and Mid-term Business Plan. Outside of Board of Directors meetings, we held active discussions at venues such as advance briefings and work briefings.

To respond to the environmental changes mentioned, such as addressing the issue of decarbonization, I believe INPEX needs to act with full consideration of its strengths and resources.

Regarding the Pillar for Growth 2 and the Pillar for Growth 3, we first engaged in "selection and concentration" on the Pillar for Growth 2. The Pillar for Growth 3 is a new pillar.

We also held discussions on whether INPEX should be a part of addressing a likely enormous increase in electricity demand in the future. We discussed in considerable depth how INPEX will position itself amidst the multitude of players in the power-related sector.

As a result, INPEX shored up its policy of specializing in unique businesses such as iodine utilization and lithium extraction from brine.

In a nutshell, this means that, taking into account environmental changes, we consolidated our discussions in the direction of leveraging INPEX's strengths and special capabilities when examining how to address the decarbonization field.

Yanai: That largely answers the questions, but I will say a bit more. In a company that mainly engages in hydrocarbons, how and when the world might change is always an unknown.

At this point, the Trump administration has taken two or three steps backward, and we cannot predict at all how things will turn out. I also believe that there is a possibility that European-led actions will be revived.

Accordingly, the Company needs to be well prepared for such future risks and changes in the environment. In doing so, however, I am opposed to the Company making major investments in areas in which it has little knowledge just because they address a cost.

The Company is now casting nets in a number of areas, including CCS, blue hydrogen, and the iodine mentioned earlier, which I believe have potential to stimulate demand in the future.

In short, the presence of demand means money will follow, and the Company should to some extent sow seeds and make preparations in such areas.

Q&A: Change of president and changes over the past 10 years

Questioner: My question is for Outside Director Yanai. I believe you have experienced a change of presidents during your tenure.

You mentioned earlier that governance has changed dramatically. From the perspective of the stock market, my impression is that INPEX has changed a lot in less than 10 years, not only in its shareholder return policy and its stance on capital efficiency but also in each of its disclosures.

What background do you think is behind such changes? Have they been affected by major events such as changes of president, or by changes of discussion in the world, or are changes in the Board of Directors involved?

What are your thoughts on changes that have taken place over the past 10 years, even changes that you have caused?

Yanai: I think changes have resulted from a combination of the three factors you mentioned. The previous president was by no means backward-looking; these movements had been accelerating since the end of that president's term.

I think what has been particularly noticeable is the revitalization of discussion among directors. One factor behind this is that all directors are asked to complete a questionnaire anonymously. This questionnaire is designed to improve the efficiency of the Board of Directors, and because it includes free-response items, some daring opinions come out.

Because the questionnaire is anonymous it receives candid opinions, and I myself am caught off guard at times by these. While we cannot feasibly adopt all of them, open-mindedly taking in a wide range of opinions has been helpful in invigorating discussion among board members.

These developments have increased the sense of tension among directors and have spurred a wider range of suggestions. I believe this has been a very significant factor. I also believe that the management team's willingness to take in such opinions as valuable has also been a major influence.

While conditions in the world are also part of the background behind major changes, the Company is now more focused than ever on shareholder returns. Most recently, its push to advance shareholder returns has raised visibility and has yielded a consensus that the approach is beneficial on many fronts.

On top of this, I feel that Investor Relations and Public Relations activities have also become much more active.