Financial Performance for Q2 FY 2026 (YoY)

Kohei Hasegawa (hereafter, Hasegawa): I am Kohei Hasegawa, Director, Managing Executive Officer, and General Manager of Administration, DAISHINKU CORP. Thank you very much for taking time out of your busy schedule to attend our financial results briefing today. I would now like to report our financial performance for Q2 FY2026 and explain our outlook for the future.

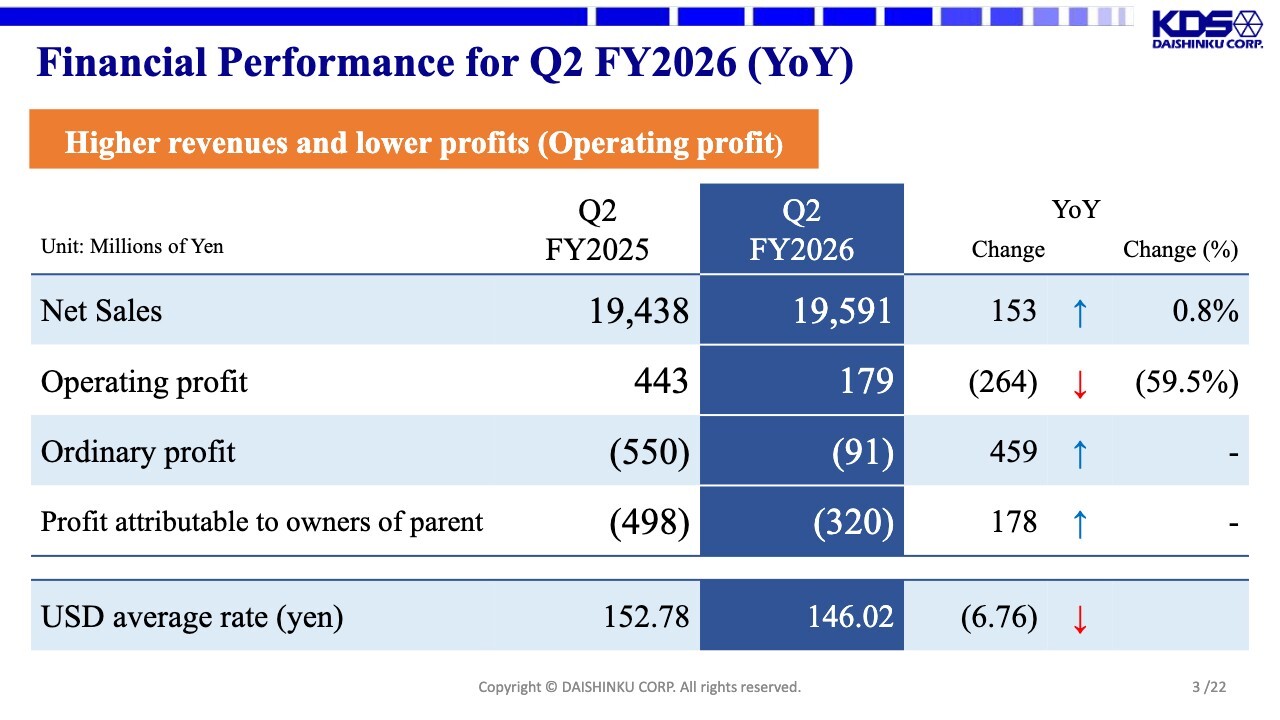

First, I would like to report the financial performance for Q2 FY2026. Net sales were 19,591 million yen, operating profit was 179 million yen, ordinary profit was minus 91 million yen, and profit attributable to owners of parent was minus 320 million yen. The results show higher revenues and lower profits YoY.

The yen appreciated to 146.02 yen per US dollar in H1 of the current fiscal year, compared to 152.78 yen per US dollar in the previous fiscal year. The main reason for the loss after the ordinary profit is the foreign exchange loss.

Sales by Market (YoY)

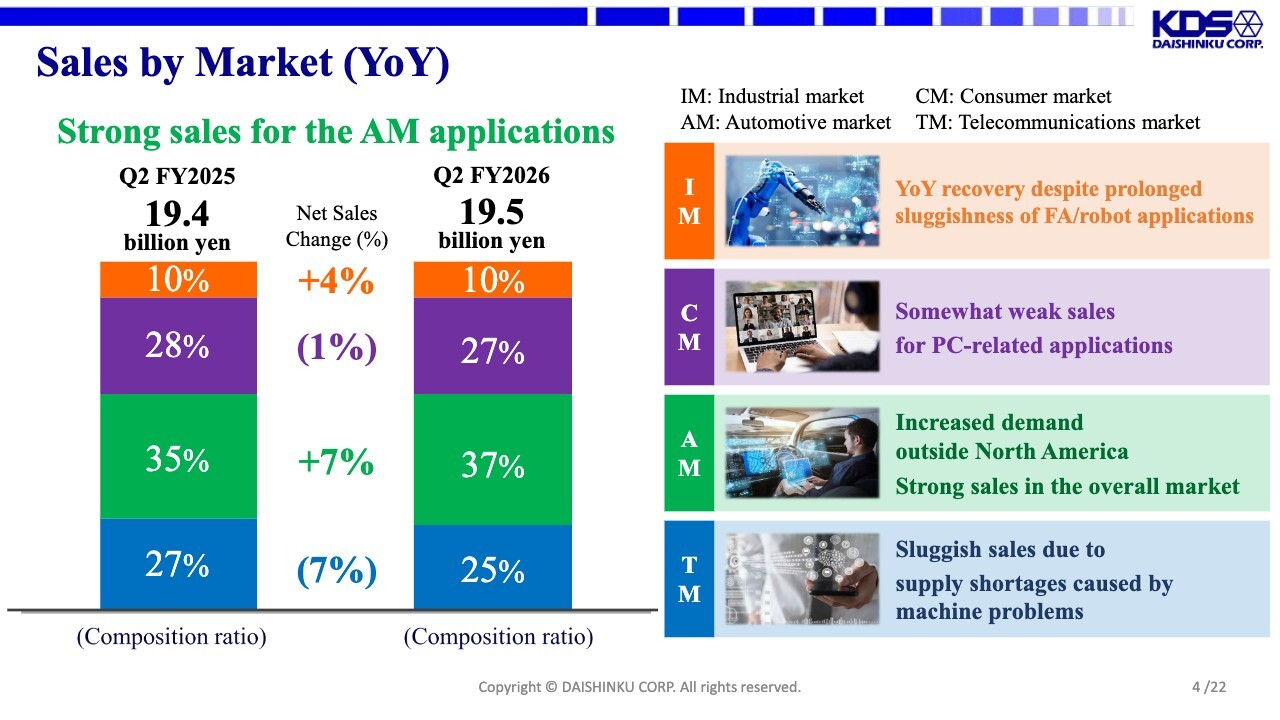

This is sales by market. They are shown YoY by market. From the bottom of the slide, the order is telecommunications, automotive, consumer, and industrial markets.

The telecommunications market declined 7% YoY. The main reason is supply shortages due to machine problems. This resulted in sluggish sales. In particular, machine problems in the photolithography field, which is our focus, were a major factor in the decline in sales.

On the other hand, the automotive market increased 7% YoY. This was mainly due to increased demand outside North America and strong sales in the overall market.

The consumer market decreased by 1%. Despite the prolonged sluggishness of FA/robot applications, we feel the industrial market is in a YoY recovery.

Operating Profit Analysis (YoY)

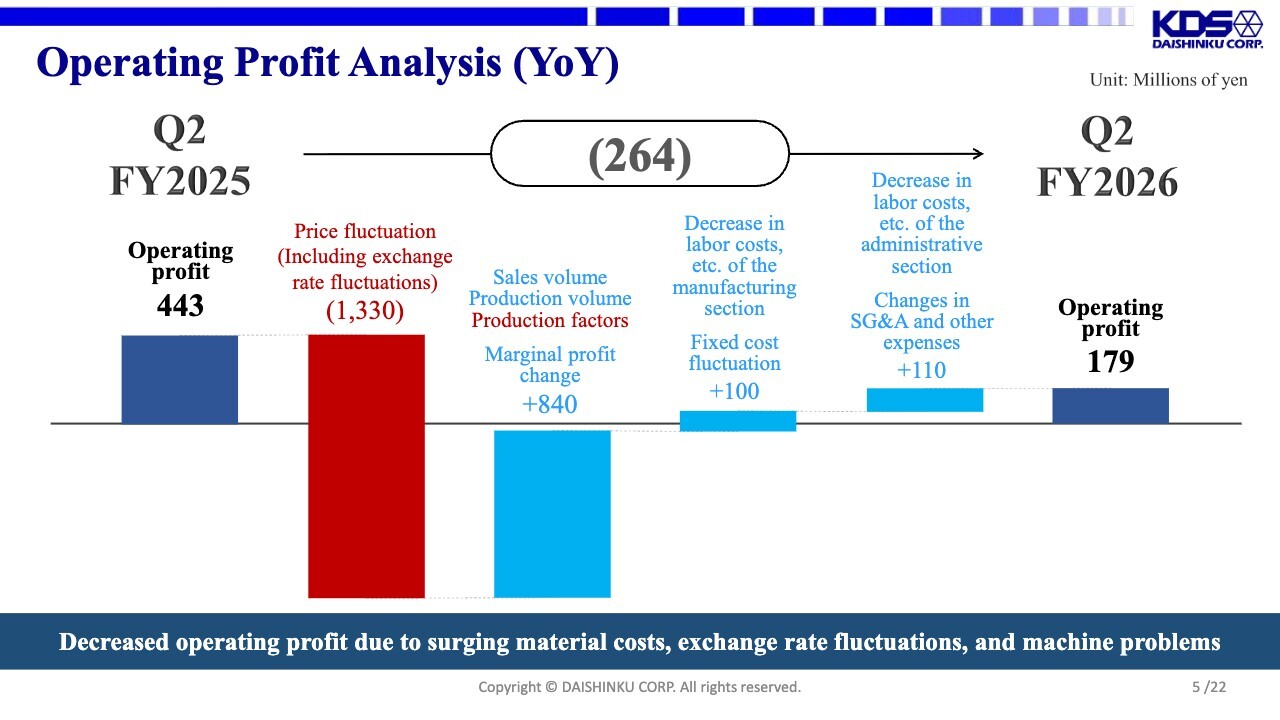

This is an analysis of changes in operating profit. The previous year’s result was 443 million yen. From there, the amount decreased by 1,330 million yen due to price fluctuations, including exchange rate fluctuations.

On the other hand, the marginal profit change increased by 840 million yen. This was mainly due to the operating profit from increased production volume. Overcoming the decreased operating profit due to surging material costs, exchange rate fluctuations, and machine problems, as shown in the lower part of the slide, led to this increase.

With regard to materials, the main factor is the sharp rise in the price of gold. Regarding exchange rate fluctuations, our Taiwanese subsidiary was significantly affected by the appreciation of the Taiwanese dollar against the U.S. dollar.

Subsequently, after a decrease in fixed costs for the manufacturing section and SG&A expenses, operating profit finished up at 179 million yen.

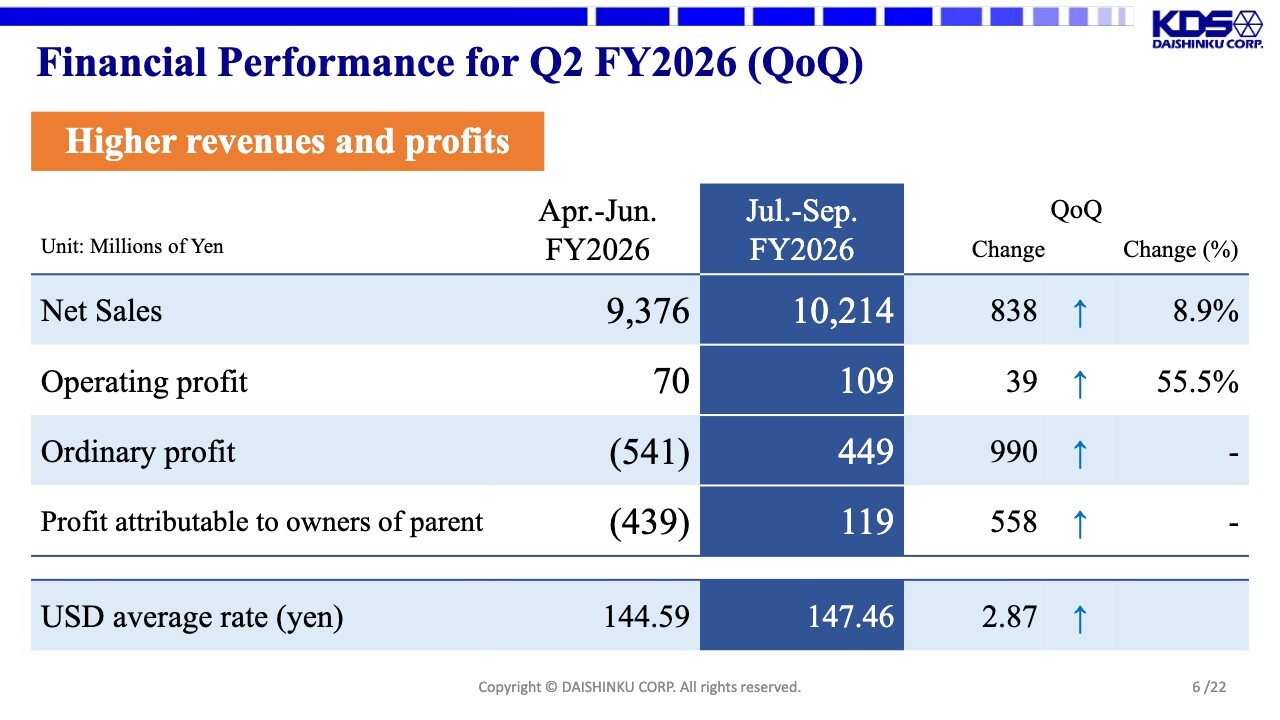

Financial Performance for Q2 FY2026 (QoQ)

This is a QoQ comparison of Q2 financial performance. Net sales were 10,214 million yen, operating profit was 109 million yen, and ordinary profit was 449 million yen. This increase is due to the impact of foreign exchange gains, contrary to the decrease in operating profit explained earlier. As a result of the QoQ growth, profit attributable to owners of parent was 119 million yen.

The assumed USD average rate for Q2 was 147.46 yen, up from 144.59 yen in Q1, reflecting the depreciation of the yen.

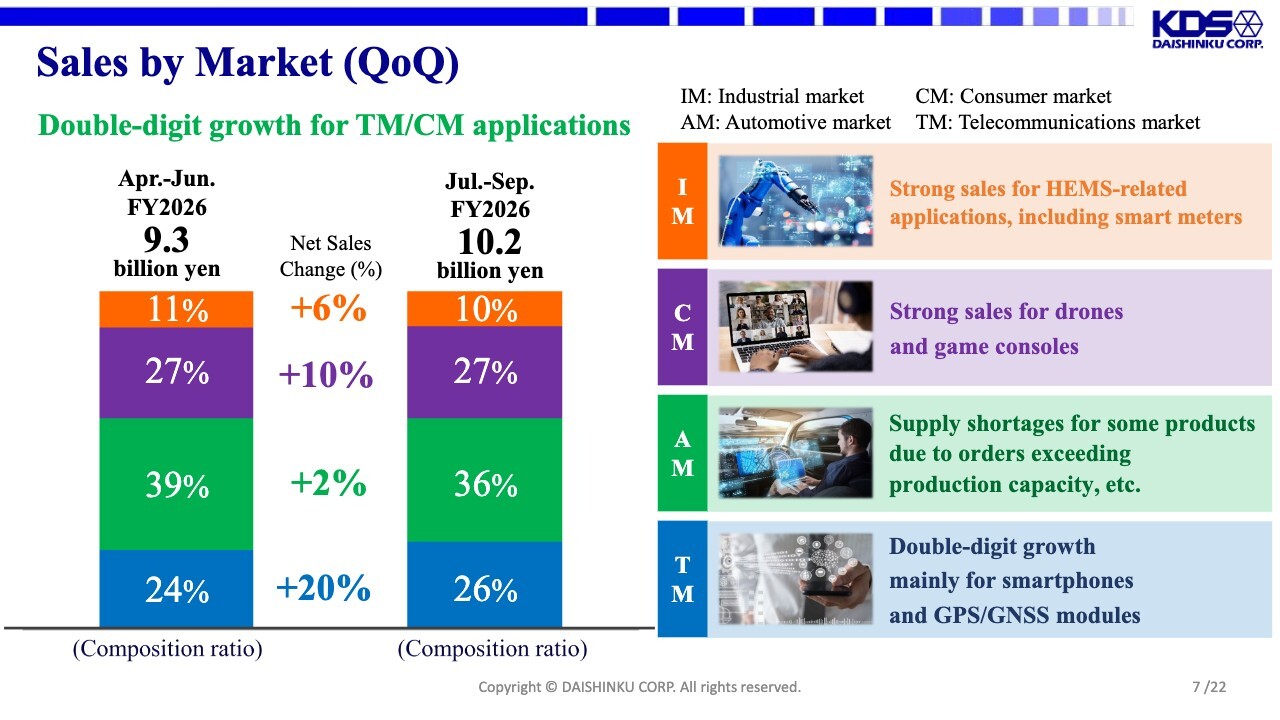

Sales by Market (QoQ)

Sales by market are shown QoQ. The composition is the same as on page 4. There was a large increase in the telecommunications market at the bottom of the list, up 20%. This is mainly due to seasonal factors, but the market could have grown even more had it not been for the ongoing effects of the machine problems we discussed earlier.

The automotive market grew steadily, increasing by 2%. However, because we were unable to respond to orders for some products that exceeded our production capacity, this is another area where we could have grown further. The consumer and industrial markets are also basically affected by seasonal factors.

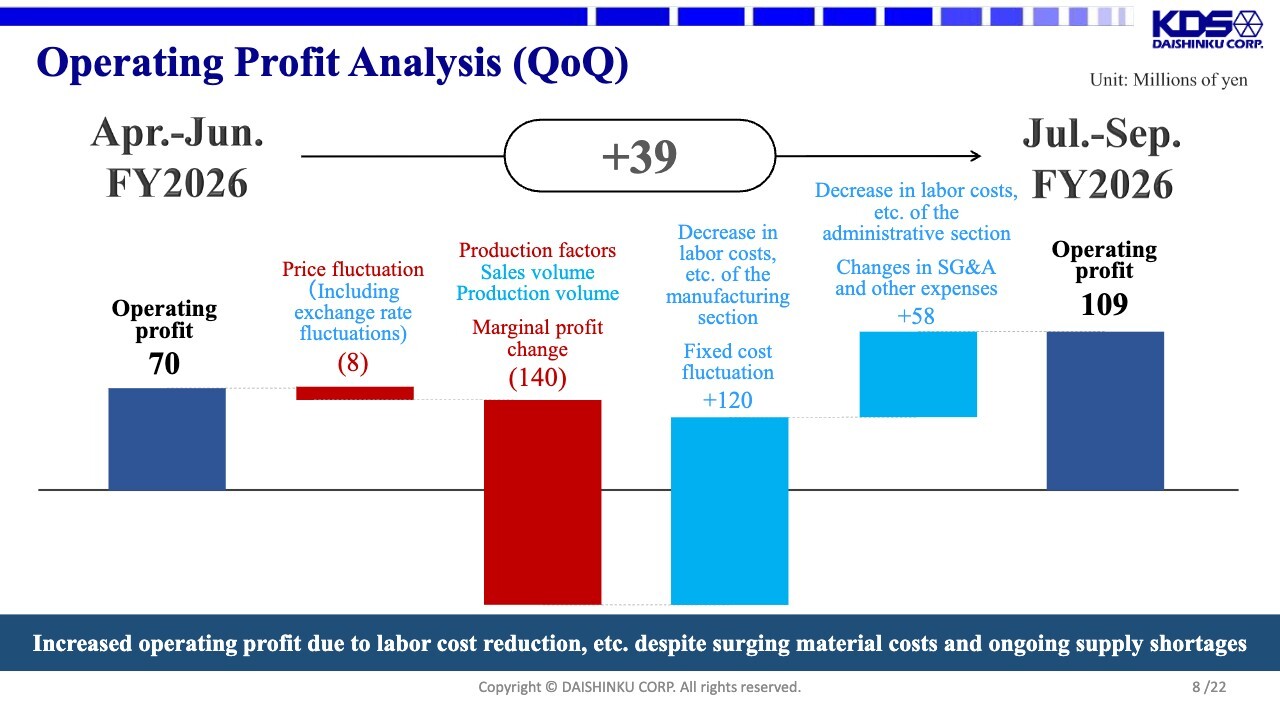

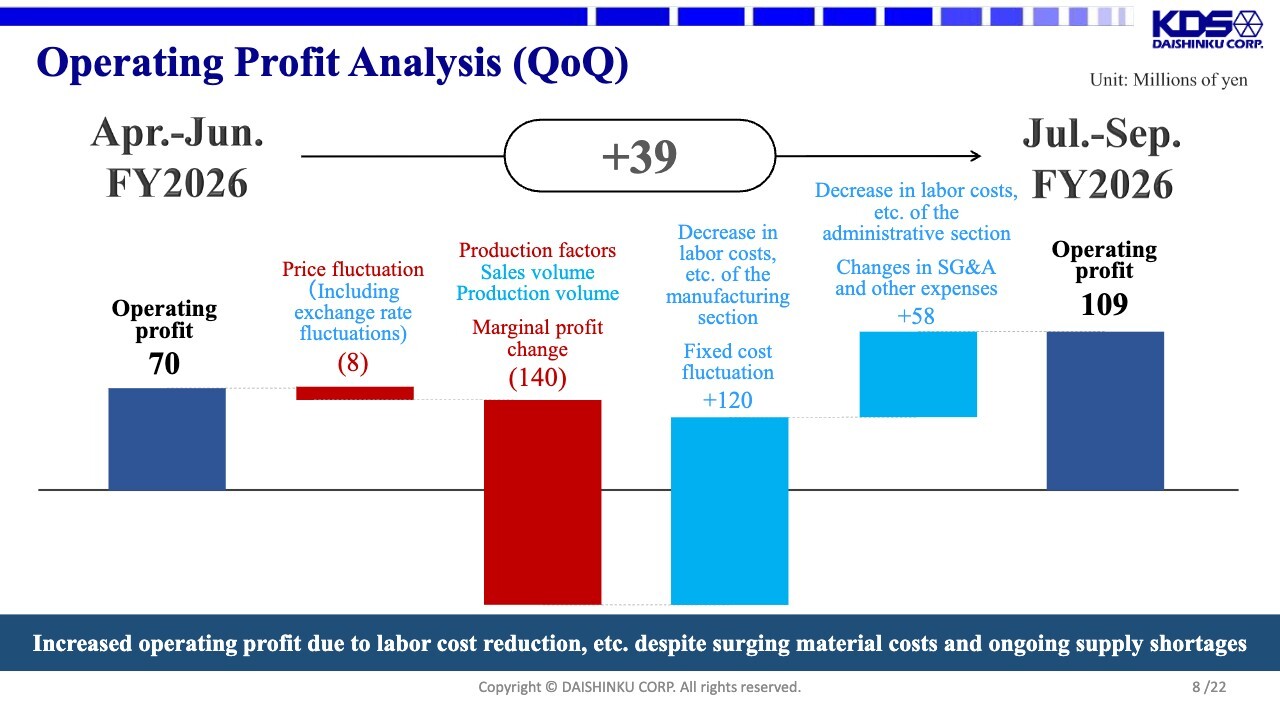

Operating Profit Analysis (QoQ)

This is an analysis of changes in operating profit. This is a QoQ comparison. The operating profit for Q1 was 70 million yen, but decreased by 8 million yen due to price fluctuations, including exchange rate fluctuations. However, the exchange rate fluctuations themselves were positive.

In addition, the marginal profit change decreased by 140 million yen. Although production had an operating profit effect, it was negatively affected by the production factors shown in the upper part of the slide. The production factors are largely due to the soaring cost of gold as a material cost, as I explained earlier.

Including a decrease in fixed costs in the manufacturing section and SG&A expenses, the final figure landed at 109 million yen.

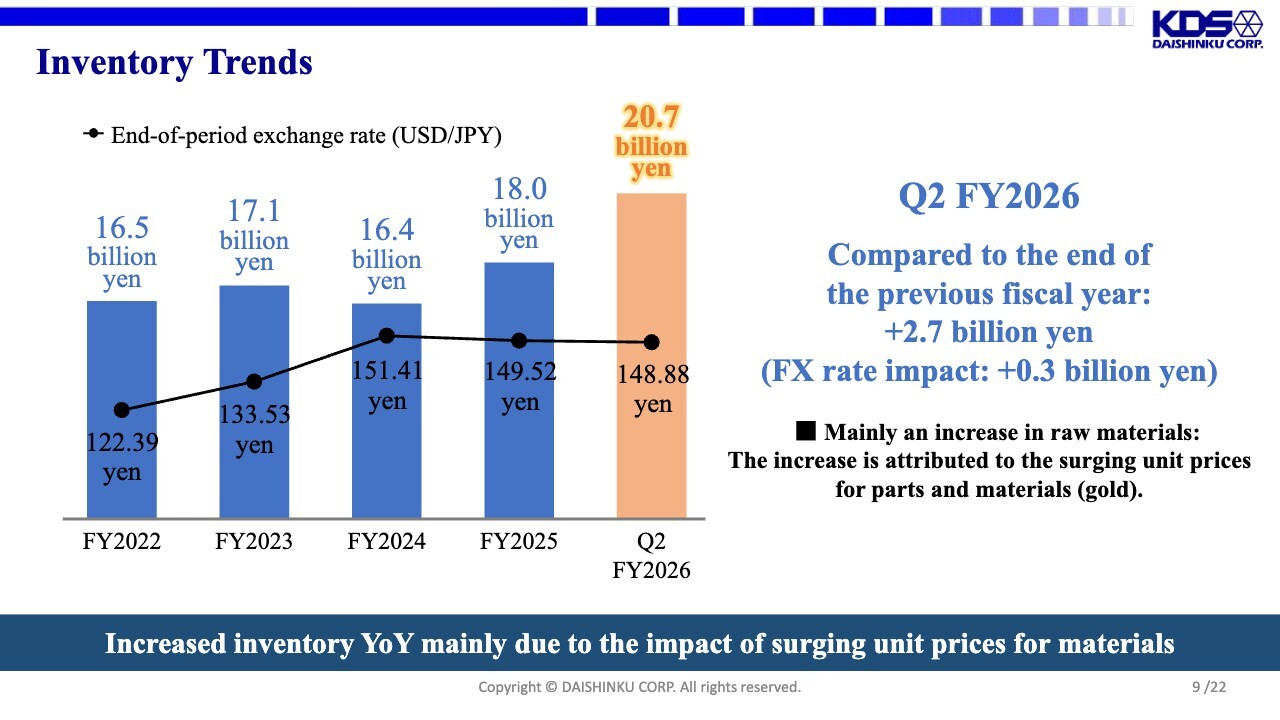

Inventory Trends

This shows inventory trends. Inventories at the end of H1 FY2026 were 20.7 billion yen, an increase of 2.7 billion yen from the end of the previous fiscal year. Of this amount, 0.3 billion yen was due to exchange rate fluctuations.

Finished goods and merchandise have decreased slightly and basically have not increased. On the other hand, the main reason for the increased inventory was an increase in raw materials. This is largely due to the surging prices of parts and materials (gold), which we have been telling you about for some time.

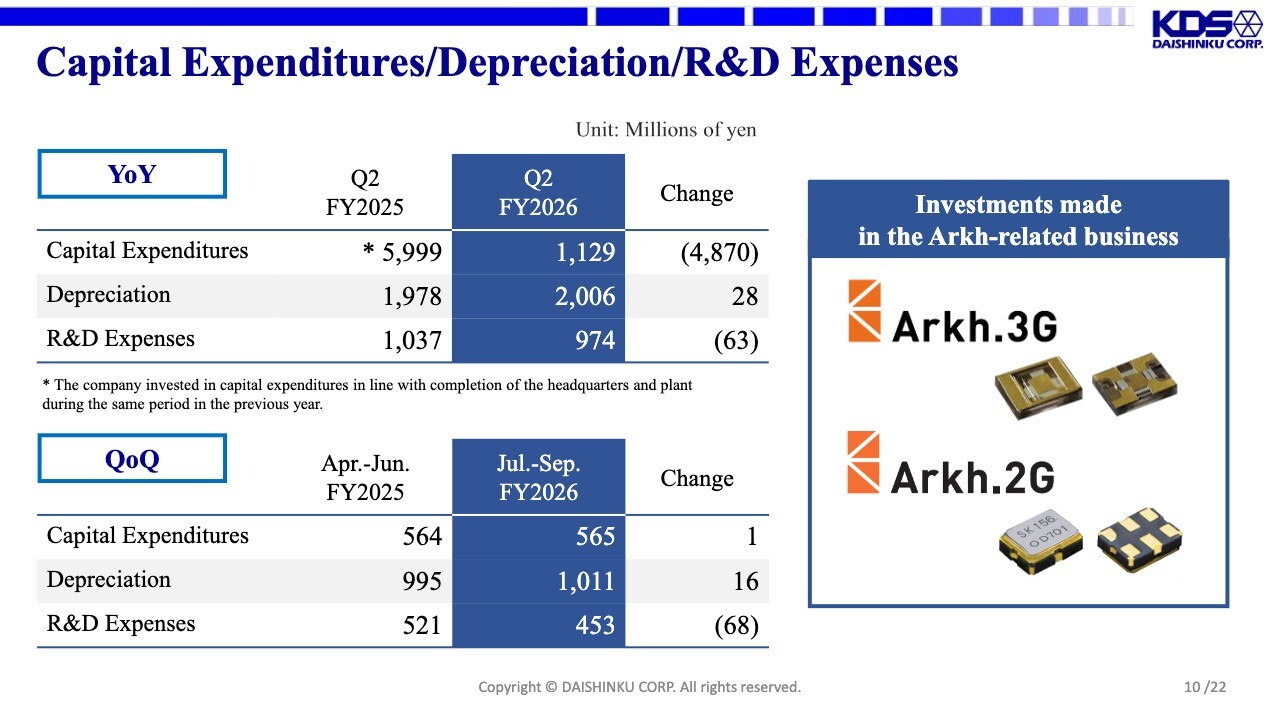

Capital Expenditures/Depreciation/R&D Expenses

These are the results of capital expenditures, depreciation, and R&D expenses. Capital expenditures for Q2 totaled 1,129 million yen, down 4,870 million yen YoY. This was a special factor due to the capital expenditures associated with the completion of the new headquarters in the previous fiscal year. Depreciation was 2,006 million yen, and R&D expenses were 974 million yen.

On a quarterly basis, capital expenditures totaled 565 million yen, depreciation totaled 1,011 million yen, and R&D expenses totaled 453 million yen.

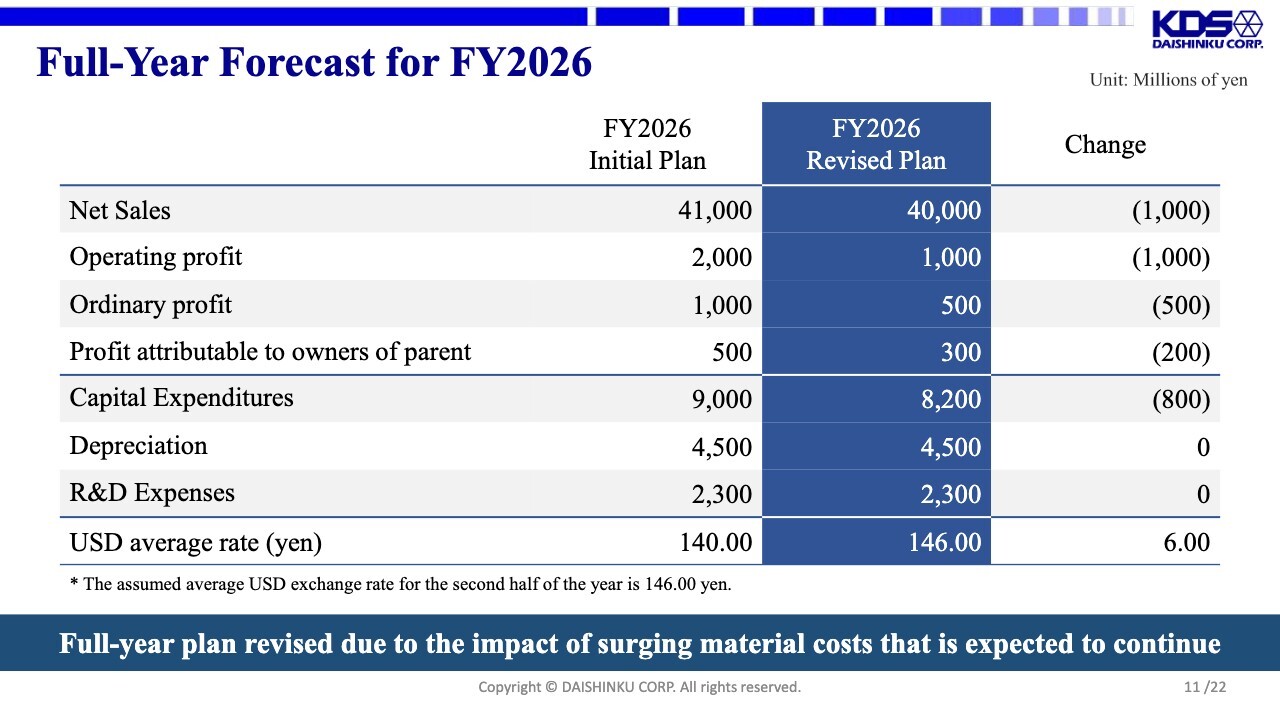

Full-Year Forecast for FY2026

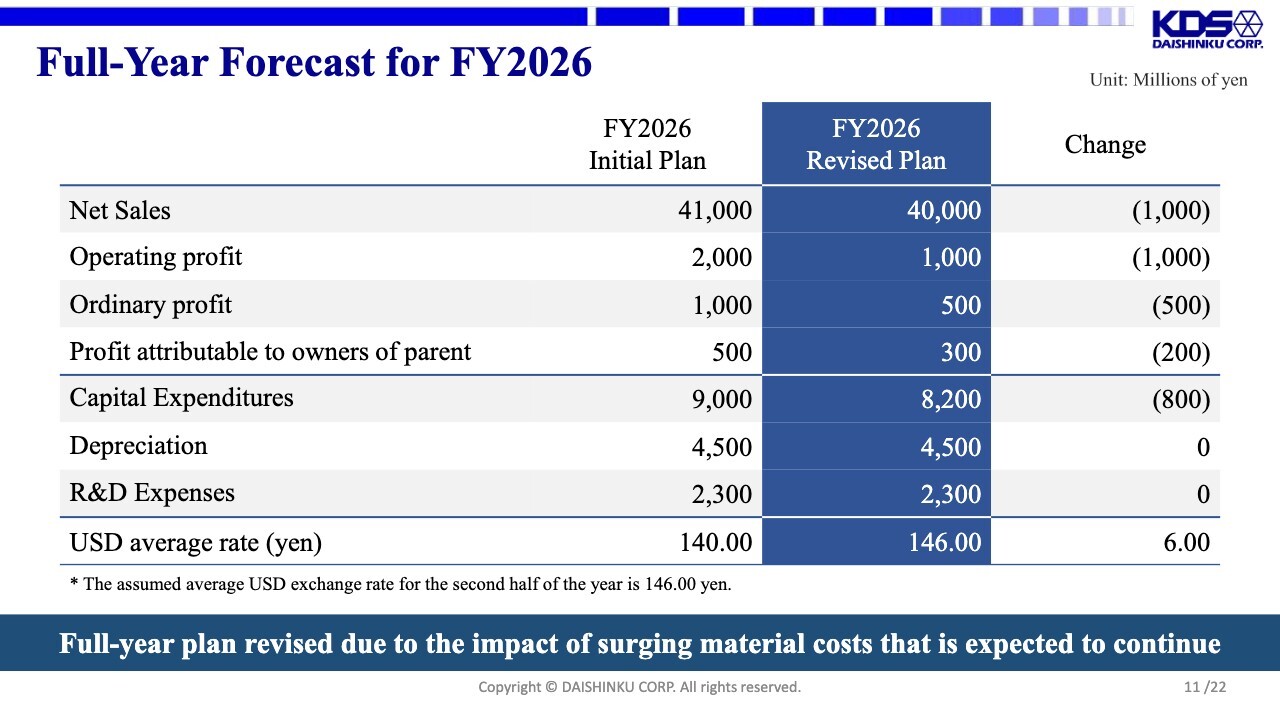

In conjunction with this financial results presentation, the company also announced a revision to its full-year forecast. We will inform you of the modifications.

Net sales are 40,000 million yen, down 1,000 million yen from the initial plan; operating profit is 1,000 million yen, down 1,000 million yen from the initial plan; ordinary profit is 500 million yen, down 500 million yen from the initial plan; and profit attributable to owners of parent is 300 million yen, down 200 million yen from the initial plan.

Capital expenditures, originally projected at 9,000 million yen in the initial plan, were partially revised and reduced by 800 million yen to 8,200 million yen. There are no revisions to depreciation and R&D expenses.

In conjunction with this revision announcement, the USD average rate has been revised from 140.00 yen in the initial plan to 146.00 yen, reflecting the current market environment.

The background to this revision is the impact of surging material costs in H1 of the fiscal year. Furthermore, we expect this trend of surging costs to continue in H2, leading us to revise our full-year forecast.

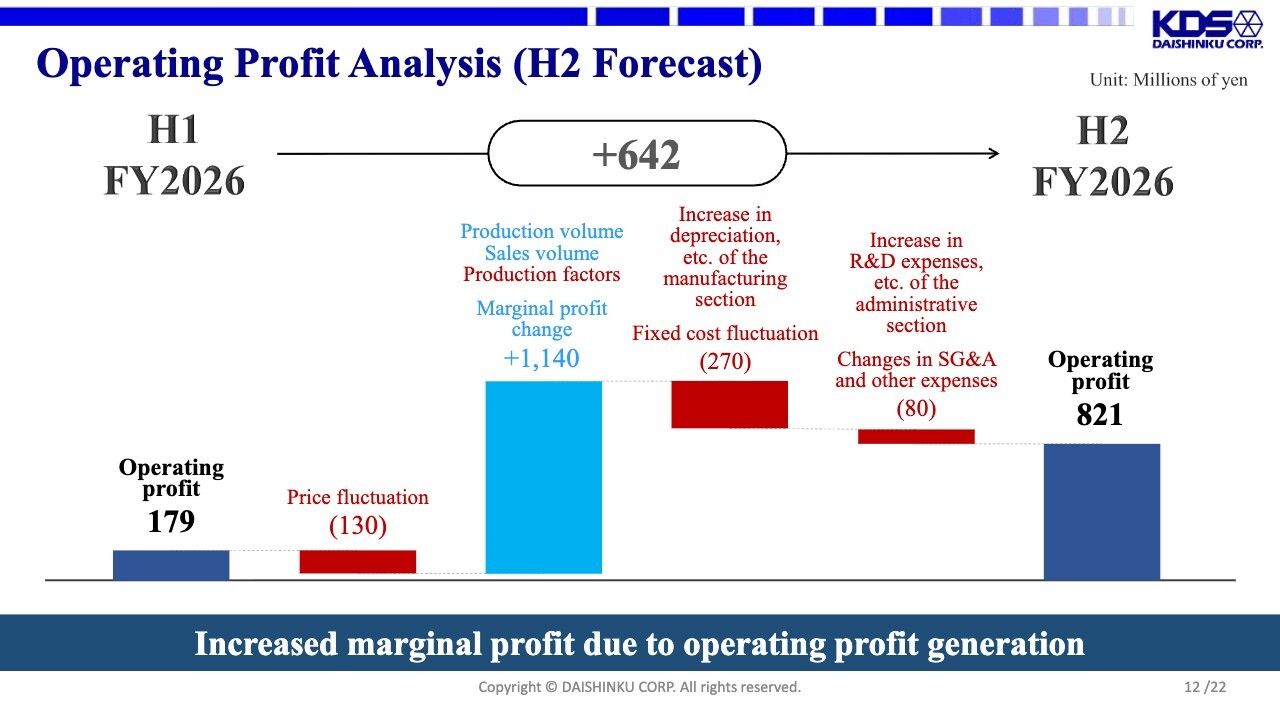

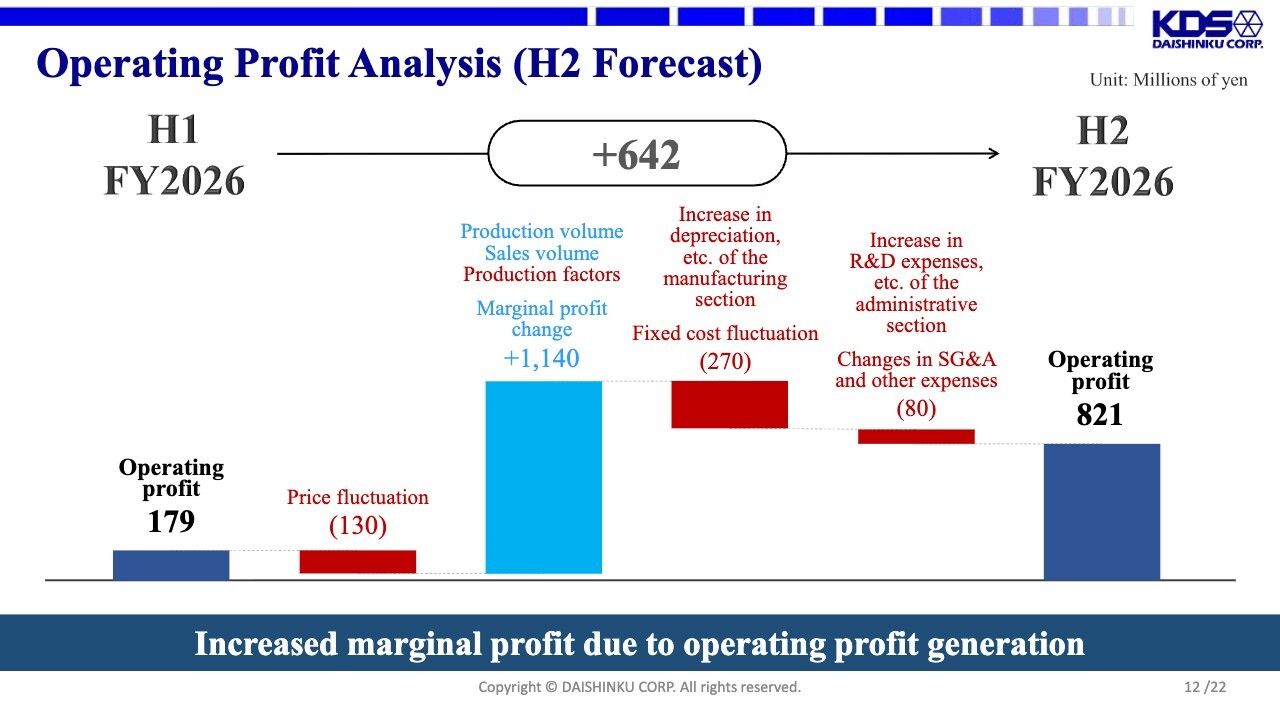

Operating Profit Analysis (H2 Forecast)

Forecasts for operating profit changes in H1 and H2 of the year. Operating profit for H1 FY2026 was 179 million yen. The exchange rate is assumed to be 146.00 yen per US dollar, and there is no foreign exchange impact. Since the price fluctuation is about the same, we expect a pure price fluctuation of negative 130 million yen.

In addition, we expect a marginal profit change of positive 1,140 million yen. Against this backdrop, we expect material prices to continue to rise in H2 of the year.

On the other hand, machine problems that occurred in H1 were resolved in H2. This is expected to reduce yield loss and increase shipments of photolithographic products by eliminating problems in the photolithographic process. As a result, product mix and cost ratio are expected to improve.

Considering the increase in fixed costs in the manufacturing section and the increase in expenses in the SG&A section, operating profit for H2 is expected to be 821 million yen. Combined with H1, operating profit for the full year is expected to be 1,000 million yen.

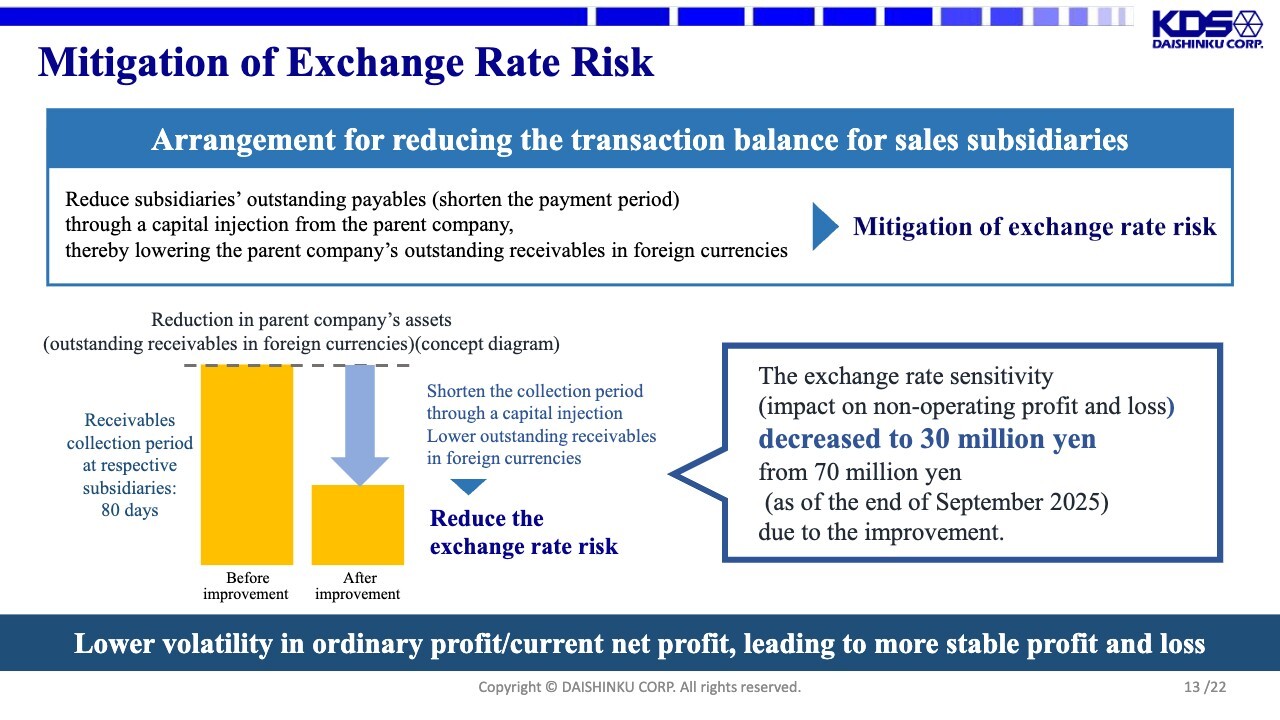

Mitigation of Exchange Rate Risk

This is an effort to mitigate the exchange rate risk. We have traditionally recognized the issue of extremely high non-operating foreign exchange sensitivity relative to the size of our business. To eliminate this problem, efforts to reduce sensitivity are underway in H2 of this fiscal year based on the arrangement described on the slide.

The main reason for the high foreign exchange sensitivity is that accounts receivable and outstanding receivables in foreign currencies from the Japan side (the headquarters) are subject to exchange rate effects between the Japan side and the overseas sales subsidiaries. This significantly boosts the consolidated foreign exchange sensitivity.

This time, the headquarters will provide funds to the sales subsidiaries in the form of a capital increase, which will be used to pay their obligations to the parent company. In other words, shortening the accounts payable payment period reduces foreign exchange sensitivity. Previously, non-operating foreign exchange sensitivity was approximately 70 million yen per yen, but this is expected to be decreased to approximately 30 million yen due to this improvement.

We believe this will lower the volatility in ordinary profit and current net profit, leading to more stable profit and loss.

These are the results of the settlement of accounts. From here, I would like to talk about our future prospects.

Focus Domain: Differential Oscillators for Optical Transceivers

This is the progress of the “Arkh” series, which we have positioned as the core of our growth strategy. We are finally in the full-scale operation phase and would like to share the details with you.

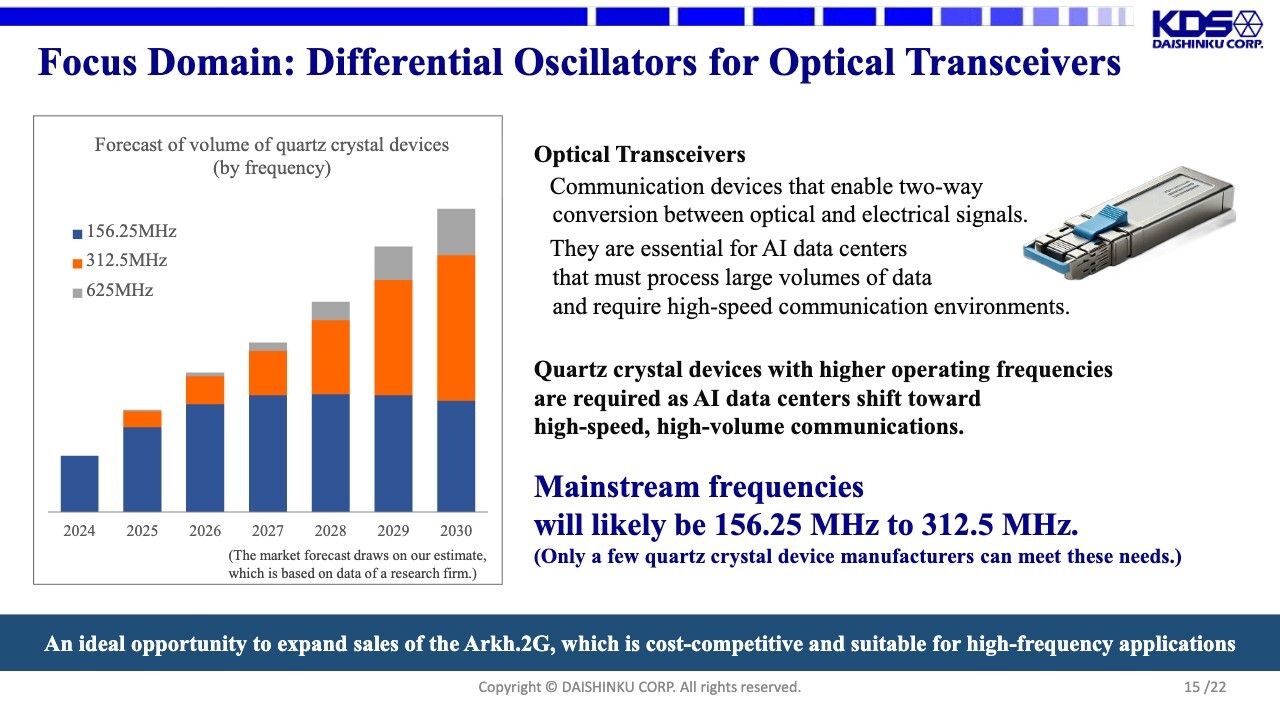

First of all, the focus domain we have set for the “Arkh” series is differential oscillators for optical transceivers, as described in the slide.

Conventionally, differential oscillators for optical transceivers have used 156.25 MHz high-frequency oscillators. At this point, the number of quartz crystal manufacturers that could support this technology was quite limited, but as shown in the graph on the left side of the slide, the market for 312.5 MHz, which is double the frequency, is emerging starting in 2025. We see this becoming mainstream going forward.

At 312.5 MHz, the number of suppliers that can meet these needs is even more limited. In this market environment, we see an ideal opportunity to expand sales of the “Arkh.2G”, which is cost-competitive and suitable for high-frequency applications. The advantages of “Arkh.2G” are explained on the next page and beyond.

Cost Advantages of the Arkh.2G in Ultra-High Frequency Bands

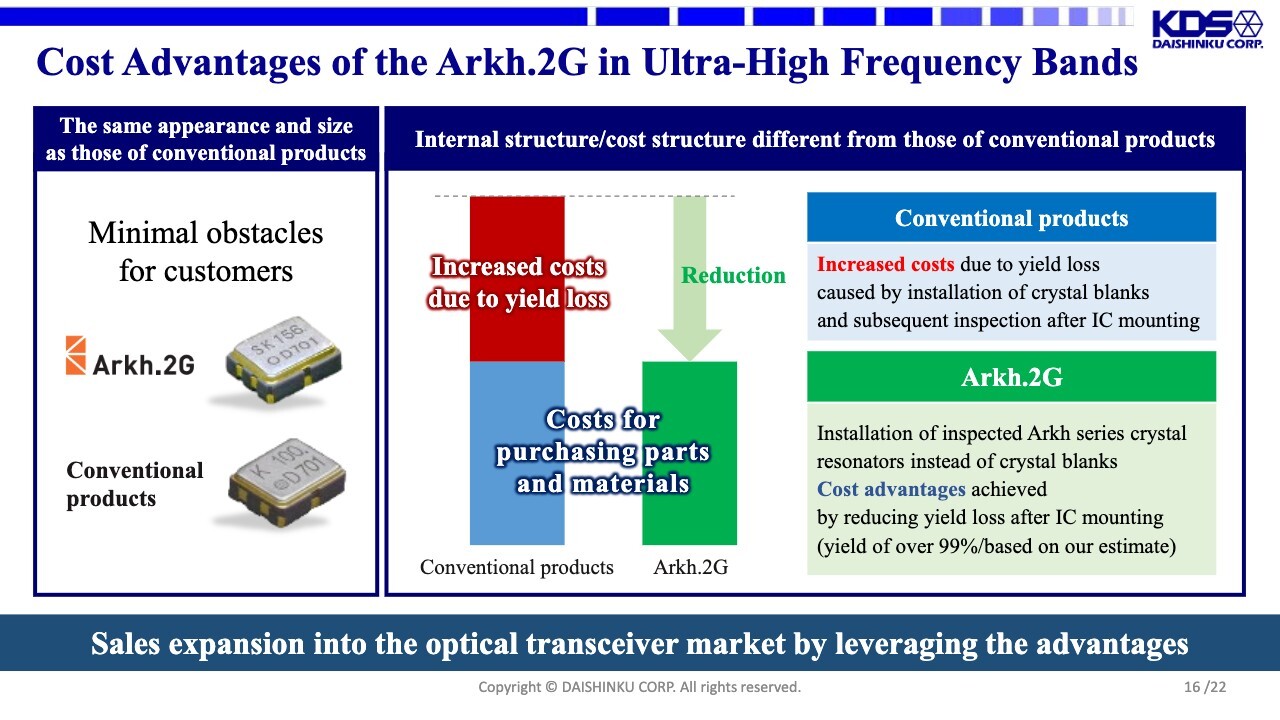

Cost advantages of the “Arkh.2G” are seen in the ultra-high-frequency bands such as 156.25 and 312.5 MHz.

The figure on the left side of the slide shows the cost structure. The process for conventional oscillator products includes, after IC mounting, installing crystal blanks, performing frequency tuning, hermetically packaging, performing subsequent inspection, and shipping. However, the higher the frequency, the greater the difficulty in adjusting the crystal frequency and installing crystal blanks, and the yield tends to deteriorate significantly.

We procure high-frequency differential oscillator ICs externally, which are very expensive devices. In such a material composition, the yield due to crystals is affected, resulting in large losses, which is a cost characteristic of conventional oscillators.

On the other hand, the “Arkh.2G” uses high-quality, inspected crystal resonators called “Arkh.3G” instead of crystal blanks. Furthermore, since the frequency adjustment has been completed, there is basically no yield loss after IC mounting, and a yield of 99% or more can be secured based on our estimate.

This avoids material loss due to crystal factors yield, which has occurred with conventional products, and ensures cost advantages over competitors’ products. We will promote sales expansion into the optical transceiver market by leveraging the advantages.

Performance Advantages of the Arkh.2G Structure

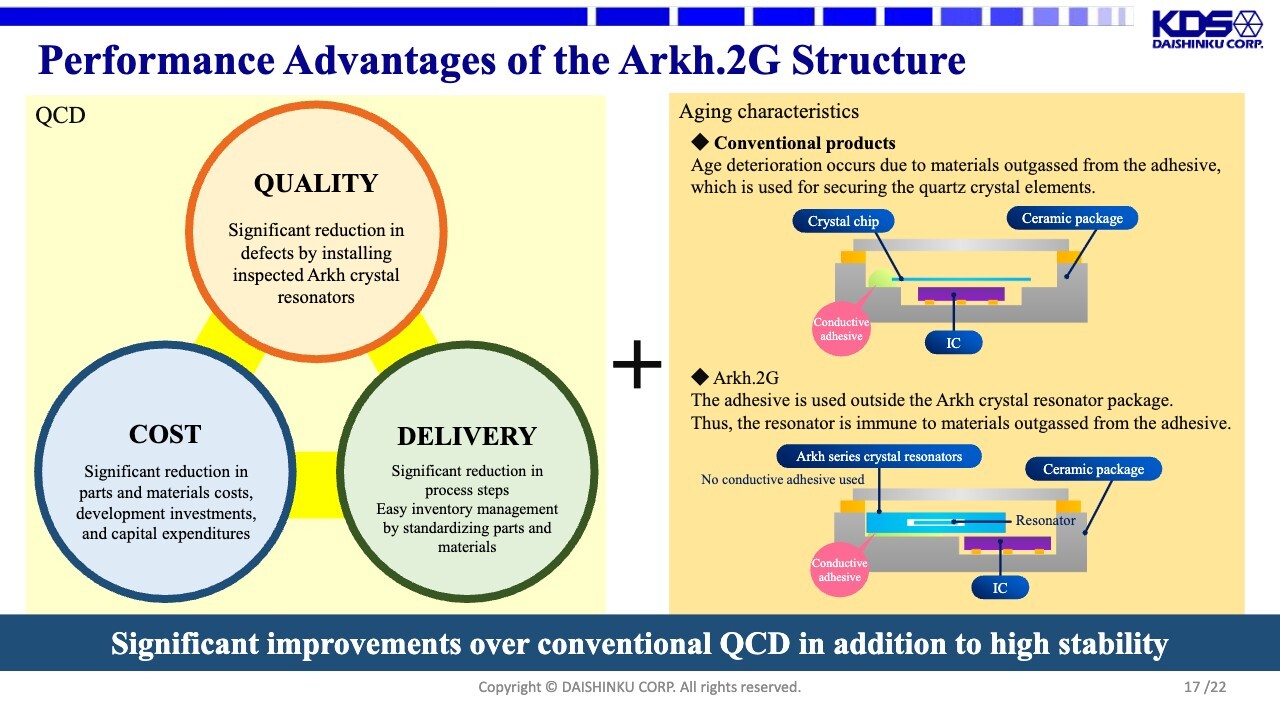

This slide shows performance advantages other than cost. First, with regard to Quality, Cost, and Delivery (QCD), which are fundamental values for devices, there is a structure-induced advantage for each element. The right side of the slide also describes a performance advantage called aging characteristics.

Conventional products contain a bare crystal element inside the package. In this mounting process, organic conductive adhesives are used, but gases are generated over time. The gas adhered to the bare crystal element, resulting in a frequency drop due to mass fluctuations.

On the other hand, the “Arkh.2G” structure incorporates a crystal resonator in a completely hermetic package, so it is not affected by outgassing even when mounted with conductive adhesive. We believe this could be the only solution in terms of cost, general QCD, and performance requirements.

Driving Adoption of the Arkh Differential Oscillators

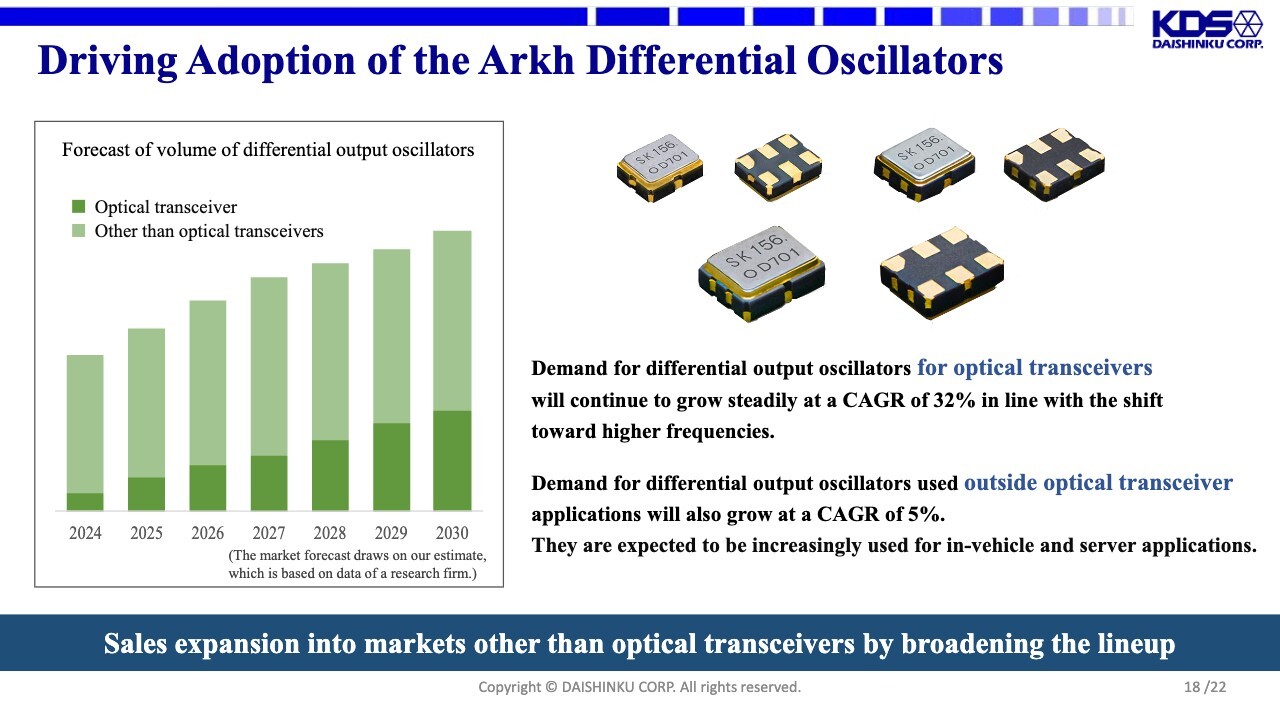

I explained differential oscillators for optical transceivers. But the percentage of differential oscillators for optical transceivers remains low in the overall market. However, optical transceivers themselves are expected to grow at a very high CAGR of 32%. Considering the overall market, we also position differential oscillators for optical transceivers as a very promising market.

In the future, while focusing on the optical transceiver market as the entry point, we intend to expand sales and increase our market share in differential oscillator markets outside optical transceiver applications by leveraging the advantages of “Arkh.2G.”

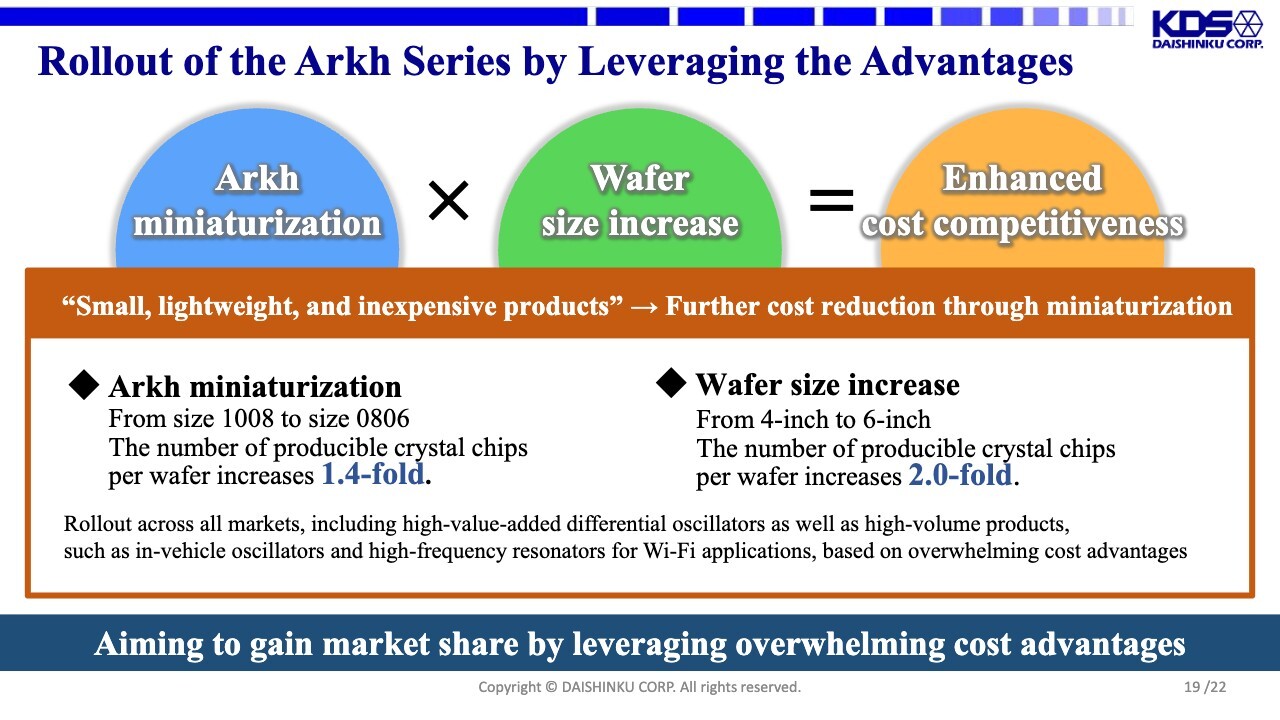

Rollout of the Arkh Series by Leveraging the Advantages

I would like to supplement the future rollout of the “Arkh” series. First, quartz crystal devices in conventional products follow a cost curve in which cost increases as devices become smaller. The reasons for this are that the smaller the product, the worse the yield, and the price of direct materials purchased from outside tends to rise. Against this background, the cost curve is inevitable.

On the other hand, the crystal resonators we call “Arkh.3G” are manufactured at the wafer level, allowing us to draw a cost curve different from that of conventional products. Specifically, the number of producible crystal chips per wafer can be increased by downsizing the product. Currently, we have a product lineup of size 1008, but we plan to miniaturize to size 0806 in the future. This expands the number of producible crystal chips per wafer 1.4-fold.

In addition, we promote increasing the wafer size. Currently, we use a 4-inch process, but shifting to a 6-inch process increases the number of producible crystal chips per wafer 2.0-fold. The combination of miniaturization and wafer size increase enables a cost reduction of approximately 2.8-fold, or a multiplicative cost reduction.

Because of these product characteristics, we intend to continue to invest resources in technological innovation to make it a reality. Based on the overwhelming cost advantage we have achieved, we believe we can demonstrate sufficient competitiveness and expand our market share not only in the very high value-added differential oscillators I mentioned earlier, but also in high-volume products, such as automotive oscillators and high-frequency resonators.

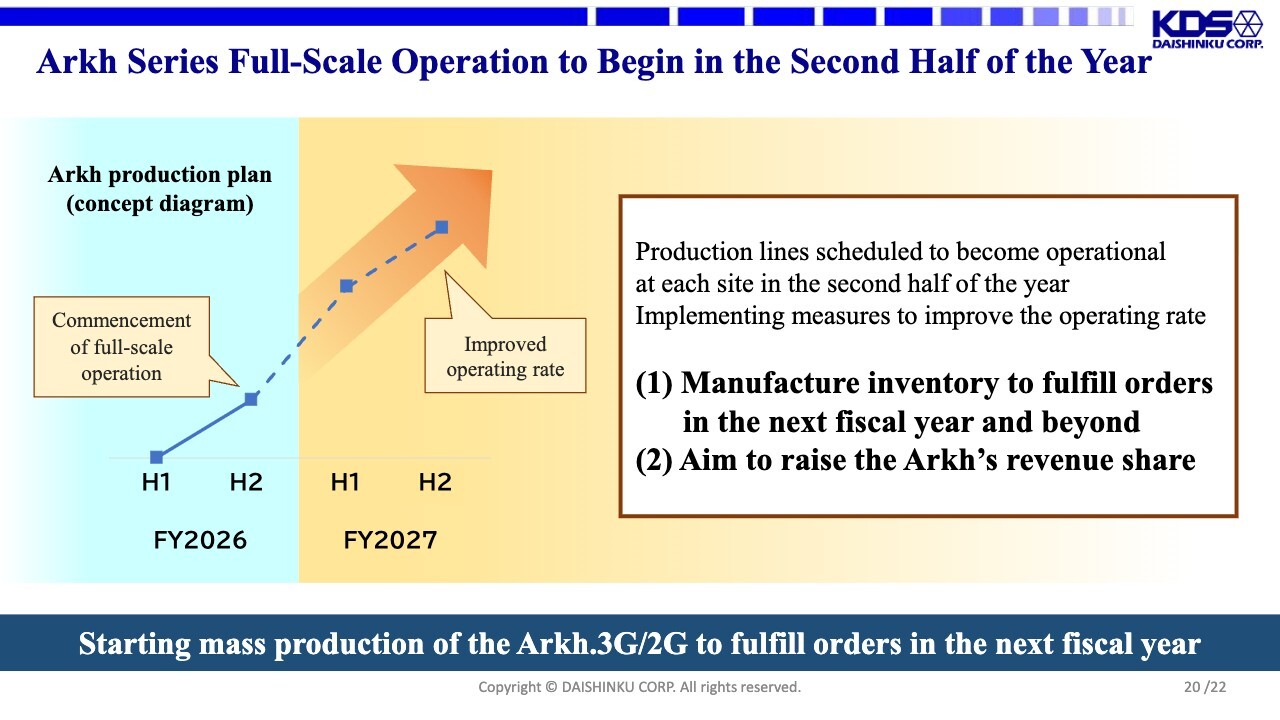

Arkh Series Full-Scale Operation to Begin in the Second Half of the Year

The “Arkh” series we introduced is finally entering full-scale mass production, as we reported at the beginning. We are already moving forward with mass production, but we also expect this to be a major point of change as the market moves into the volume zone. Production will start in the second half of this fiscal year, although large orders are expected in the next fiscal year and beyond.

As background, we have not yet achieved mass production in the 312.5 MHz field I described earlier. Therefore, by working in advance, we hope to utilize the experience curve to reduce costs and stabilize production. Production is expected to start in the second half of this fiscal year, with sales contribution in the next fiscal year and beyond.

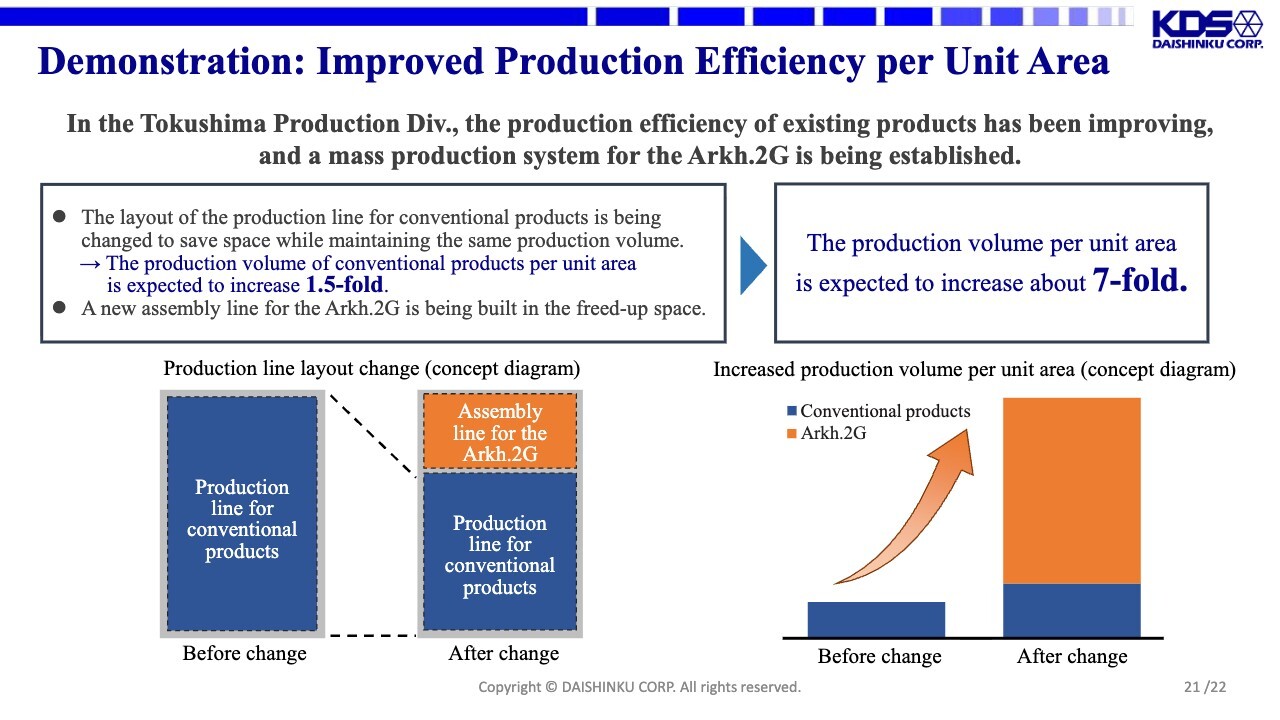

Demonstration: Improved Production Efficiency per Unit Area

We are currently building the “Arkh.2G” production line at the Tokushima Production Div. While there is a line of existing products, the layout was partially changed, and a new line for the “Arkh.2G” was introduced. As a result, the production volume per unit area at the Tokushima Production Div. has increased about 7-fold.

Improving productivity per unit area in the “Arkh” series has been a very important goal of ours from the beginning. The reason this improvement is important is that the quartz market tends to continue to expand on a volume basis.

For example, building one new plant when production volume doubles will significantly increase fixed costs. In addition, overhead and infrastructure costs will also increase. With fixed costs rising significantly, orders will not necessarily increase proportionally, and we believe that a situation in which increased production will worsen profit and loss is inevitable.

However, by dramatically increasing production volume per unit area to this level, we don’t need to build a new plant and can meet market demand while avoiding a significant increase in fixed costs. We believe this is an increasingly effective solution for the future expansion phase of the crystal market.

That concludes our financial results briefing for Q2 FY2026, including future prospects. Thank you for your attention.

Q&A: Causes of machine problems and status of resolution

Participant: You said the machine trouble started around the first half of last fiscal year, but is it true that it has already been going on for about a year and a half?

If I remember correctly, you explained at last fall’s briefing that the problem would improve in the second half of the year, and at this year’s spring briefing, you said that the problem would be resolved starting this fiscal year. I think the trouble has changed, but what exactly was going on?

Also, you mentioned earlier that “no problems will arise in this second half of the year.” How can we be sure of that statement, and what is your rationale?

Hasegawa: As far as I recall, it was not until the second half of last year that we were informed of the impact of the machine trouble. The machine trouble that has been occurring this quarter is also an event in the same photolithography process, but the details are different. Therefore, there is no continuity of last year’s problem.

Machine problems for the current fiscal year have already been resolved in the first half. After that, the crystal chip fabrication process, photolithography, was improved, and the problem was resolved at the stage where these crystal chips were input into the assembly process after November. We have confirmed this as our track record.

Participant: I remember you saying there was a problem with the exposure machine. You said at the time that you were aware of the problem and could solve it, but why couldn’t you solve it, even though you told us so this past spring?

Hasegawa: It means that the event that occurred was a different problem than we had anticipated.

Participant: Let me review the current situation again. Is it correct that it is working normally and the yield is back to normal?

Hasegawa: That is correct.

Participant: When did that start?

Hasegawa: Assembly yields have returned to normal levels since November.

Participant: Am I correct in understanding that although there was still some impact in October, there is no problem with the input from November?

Hasegawa: You are right. The October input was affected by the remaining input of chip portions manufactured in the first half of the year.

Q&A: Business opportunities and competitive advantages in the optical transceiver market and generative AI server sector

Participant: You mentioned optical transceivers, and I felt that growth is very promising. Do you have any visions, for example, showing the impact on your company’s sales for the current fiscal year and how much it will increase in the next fiscal year?

In addition, what business opportunities do you see other than optical transceivers in the rise of generative AI servers, and what potential do they have compared to optical transceivers?

Hasegawa: As we may have mentioned a little last year, our market share in the optical transceiver and differential oscillator markets is low. Therefore, we believe its contribution to current sales is very limited. However, a design-in for 312.5 MHz is underway, and customer evaluations are progressing very well there.

Regarding the sales contribution to the field of generative AI, our market share is not high, especially for the use of crystal devices in servers. However, since the products are available, we are currently expanding sales.

Jun Mizui (Mizui): I am Mizui from the Marketing & Sales Division. I will provide an additional explanation. As Hasegawa explained earlier, to be honest, sales of optical transceivers are not very high this fiscal year. The current main frequency is 156.25 MHz. To expand the range to 800 GHz to 1.6 THz for next-generation optical transceivers, we have completed development of 312.5 MHz and are expanding sales of this frequency. We believe that the sales contribution will begin in the next fiscal year and will grow significantly thereafter.

Participant: You mentioned that the MEMS process part is competitive. Can you introduce any strengths of your company or those of quartz crystal in this area?

Hasegawa: Regarding MEMS, I understand that they are basically products that generate frequencies using a technology called PLL. In the process of frequency generation by this PLL, our jitter performance, or so-called noise saving performance, is very good. This market is very sensitive to these performance metrics due to increasingly higher frequencies and customers’ desire to reduce jitter noise.

Therefore, our jitter performance advantage is solid for MEMS. However, as frequency increases, some areas will be difficult to handle with crystals.

Specifically, which frequency bands and above will become more difficult will depend on future development trends at our company and in the industry as a whole. However, we believe that users are gaining a better understanding of these crystal issues while they consider component selection and future directions.

In the current frequency bands of 156.25 MHz and 312.5 MHz, only a limited number of players can respond, but this is not an area where crystals cannot respond at all. Therefore, we believe that the crystal with purely superior performance will ultimately be selected.

Q&A: Fields where “Arkh”’s utilization rate and its market are expected to be enhanced

Participant: You mentioned that the “Arkh” facility is being expanded in the second half of this fiscal year and that the utilization rate will increase in the next fiscal year. You explained earlier that the market has been relatively small to date, and I understand that you have specific orders for market expansion and expansion of your company’s customer base as a result of the facility expansion. If you don’t mind my asking, please tell me in which areas the product will be used and will increase sales.

Hasegawa: I will refrain from discussing specific customers or applications, but first of all, we consider the 312.5 MHz optical transceiver I mentioned earlier to be one of our solid products.

In other areas, many design-ins are currently underway. In the volume zone, we are seeing orders of 1 million units per month for devices in the consumer market.

And, of course, design-ins are underway in other areas as well. However, it is difficult to provide a specific level of final order probability at this time, as we are currently preparing our business plan for the next fiscal year. However, our feeling is that work is progressing on significantly high-volume products for these two applications.

Q&A: Lowering of operating profit

Participant: I have a question about figures. Operating profit was lowered from 2,000 million yen to 1,000 million yen, while the exchange rate was revised from 140.00 yen to 146.00 yen. Please let us know if there is any part of your quantitative explanation, including foreign exchange sensitivity, such as “this much positive impact due to exchange rate” or “this much negative impact due to gold price increase.”

Hasegawa: We believe that foreign exchange sensitivity is about 150 million yen per yen per year on a sales basis. Since the exchange rate is 146.00 yen, up from 140.00 yen in the initial plan, the company is receiving a significant tailwind by nature.

On the other hand, the most significant factor is the impact of the rising material prices, especially gold. Although it is difficult to quantify the impact today, it is safe to say that the majority of this decrease in profit, or 1,000 million yen of the decrease from the initial plan, is due to this rise in material prices.

Participant: Just to confirm, you mentioned the sales sensitivity per yen, but could you also share the operating profit sensitivity?

Hasegawa: Operating profit sensitivity is 50 million yen per yen per year. As for the non-operating portion, as explained earlier, we currently expect 70 million yen, which is expected to decrease in the second half of the year.

Q&A: Background of the fluctuations in marginal profit

Participant: I have a question regarding the analysis of the changes in profit in the top and bottom on page 12 of the briefing material. I feel that the change in marginal profit of 1,140 million yen is relatively large. In particular, I understand that you are trying to increase profits by increasing production volume. Please tell us the inventory level forecast at the end of the fiscal year and how much the increase in production volume accounts for this 1,140 million yen increase. Can you also tell us about your specific vision for production?

Hasegawa: Regarding the background of the 1,140 million yen increase in marginal profit, the second half of the year will be affected by the same material price hikes as the first half. Therefore, the first point to be made is that, in real terms, the effect of the utilization rate is greater than this 1,140 million yen increase. Improvements in not only the utilization rate but also the cost ratio are progressing. One reason is that there were machine problems in photolithography during the first half of the year.

This trouble resulted in a significant yield loss in the assembly process. As a result of the decline in yield, the utilization ratio also declined, which was a factor in the decrease in profit. However, this situation will be improved in the second half. Therefore, the revenue loss factor due to lower yield and utilization rates is expected to return as a positive factor. The cost ratio is also expected to improve due to an improved ratio of photolithography products and product mix compared to the first half of the year.

As for the remainder, as you noted, we believe the most significant impact will come from increased production. On a sales basis, growth of about 800 million yen is expected in the first and second halves, one of the factors being the increase in marginal profit. In addition, as you have indicated, we intend to build up inventory in the second half of the year and into the next fiscal year.

Although we refrain from discussing inventory levels in specific monetary terms, we do not intend to build excess inventory, but we aim to bring the current tight inventory situation back to an appropriate level. In photolithography products, we believe that a certain level of inventory increase is unavoidable as we correct the shortage of TCXOs, crystal resonators with thermistors, tuning-fork oscillators, and other products, and adjust to appropriate inventory levels. The effect on the utilization rate associated with this increase in production is also taken into account.

Q&A: Market development and competition of oscillators for optical transceivers

Participant: I believe that both “Arkh” and the optical transceiver area are where several Japanese crystal manufacturers, including your company, are competing. At the competitor’s briefing, they mentioned that some semiconductor manufacturers have given their approval for 312.5 MHz oscillators. In contrast, please tell us about the current progress and pace of obtaining approvals in your company.

I would also like to know more specifically your company’s expected share of the crystal oscillator market for optical transceivers in the next fiscal year, as well as the expected contribution of these products to your business performance in the next fiscal year.

Hasegawa: Regarding the current adoption status, Mizui, who is in charge of sales, will answer.

Mizui: Regarding optical transceivers, our competitors have indeed obtained chip approval. We are likewise expanding sales to manufacturers of chipsets and modules used in our main optical transceivers as required. As for 312.5 MHz, we have provided samples to make them evaluated. At this time, approval has not been finalized, but we believe we are moving very close.

We are unable to provide specific figures on the market share of optical transceivers. However, for the next fiscal year and the year after that, we, as a challenger, are currently developing products with a competitive advantage utilizing the “Arkh.2G” technology, as Hasegawa explained earlier. Based on this product, we believe we can expand the 312.5 MHz market.

Also, as mentioned in earlier questions, we are working to expand sales in the MEMS market and other areas where other companies are ahead of us, as we believe our “Arkh.2G” technology will be sufficient to compete with them.

Q&A: Progress of the medium-term business plan and the certainty of the plan for the next fiscal year

Participant: I have a question regarding your perspective on the current medium-term business plan. The next fiscal year is the final year of your medium-term business plan. We recognize that the plan is somewhat aggressive, with net sales of 53 billion yen and operating profit of 5.5 billion yen, assuming the exchange rate of 135.00 yen per dollar.

Do you envision continuing to be aggressive without changing your focus despite this downward revision? As for the next fiscal year, I remember that you explained at the briefing at the beginning of the fiscal year that you have already seen about 9 billion yen of the planned 13 billion yen increase in profit. Can you comment on the likelihood of the profit amount increasing in the next fiscal year at this time and the base that can be expected?

Hasegawa: I think your question is about the rate of progress against the medium-term business plan. As I mentioned earlier, we are making steady progress on our medium- and long-term growth strategies. Unfortunately, however, there is undeniably some delay with respect to single-year figures. One of the reasons for this is that the timing of the full-scale launch of the “Arkh” series was very late.

As a result, market penetration has not progressed as much as originally envisioned when the medium-term plan was first formulated. One factor was a partial delay in development. While it is difficult to quantify the prospects for the next fiscal year, we feel that at this point, there is a delay of approximately one year. We are in the process of compiling the figures and will be able to provide some clarity at the next financial results briefing.

Q&A: Current orders and sales trends

Participant: Can you explain the current order situation and sales trends by application, if possible? Also, please tell us whether that is in line with your sales plan for the second half of the year, whether it is strong or delayed, and your overall feel for it.

Hasegawa: The current order situation is very firm. We will first inform you of this point before comparing it with the revised plan. Excluding the impact of foreign exchange rates, net sales have increased approximately 7% YoY against the revised plan for the current fiscal year of 40,000 million yen.

Almost all of the sales composition in the current fiscal year came from conventional products. We believe the market environment is such that we can see so much growth in markets outside the core of our growth strategy.

We can only tell you at this time that the current variation against the revised plan is the planned line. Mizui will add some notable points by field.

Mizui: Based on what Hasegawa just told you, I would like to discuss our second-half forecast. We expect the telecommunications market to remain very strong. In addition, the machine trouble we discussed earlier is on its way to being resolved, and as production is restored, we expect to meet market demands and continue to perform well.

As for the automotive market, the market as a whole has recovered and remained firm, and stable orders continue to be received. There are regional variations, but overall, the market is very solid. In the consumer market, orders are also strong for significantly growing applications, although there is some variation by application.

As for the industrial market, the adjustment phase has ended, and it is heading toward recovery. The overall picture is very solid, but we are still behind our original plan. However, we expect growth in the second half of the year and into the next fiscal year to be in line with our plans.

Q&A: Factors behind the increase in sales in Q2 and the impact of machine problems

Participant: This is about the factor analysis in the comparison between Q1 and Q2. Regarding page 8 of the document, given that sales in Q2 increased by 800 to 900 million yen QoQ, I think you are well-positioned to see some positive marginal profit as well. However, looking at the current situation, I estimate there may have been a negative factor of 500 to 600 million yen.

In your earlier explanation, you said that most of the impact was due to the rise in gold prices. Would you say that, on a half-yearly basis, the negative impact would be in the range of 400 to 500 million yen? Or are machine problems having a bit more of an impact? Can you tell us more about the degree of impact and nuance?

Hasegawa: I think that is a very astute confirmation of your point about the impact amount. However, the real amount has not reached that level. The impact is not as large as 400 to 500 million yen in half a year, but the material impact is close to that amount.

Participant: In that sense, do you mean that the impact of the machine trouble was also on the scale of several hundred million yen?

Hasegawa: The yield dropped significantly, which was a very significant factor in the decrease in profit.

Participant: A related question. How does a defect in the photolithography process cause a yield loss in assembly?

Hasegawa: From the photolithography process through the assembly process, the “Arkh.2G” configuration determines whether the product is good or defective at that point and dispenses only good products. However, the chips in the photolithography process are simple bare chips, which are then processed, so the process is not designed to inspect all chips at the time of dispensing.

Therefore, if chips that differ from the targeted dimensions are dispensed to the subsequent process, the only way to remove defective chips is through inspection in the subsequent process. The result is a situation in which yields are greatly reduced and direct material costs increase accordingly.

Q&A: Progress of “Arkh” and changes in orders

Participant: About “Arkh.” You mentioned that the company will enter the volume zone in the second half of the year and also mentioned a change point, but I am a little concerned about whether there is any actual change in orders or design-in actual progress to support this.

I know this is very important for setting your company’s direction for the next few years, but is progress actually being made steadily? Even if there is some margin of error, please let us know if you are seeing changes that you can watch with anticipation for an upward direction for the next fiscal year.

Hasegawa: Due to the nature of electronic components, we believe it would be difficult for the mix to change significantly in the next fiscal year and have a sudden impact on sales. In other words, I don’t think we are in a situation where the sales percentage would suddenly rise to double digits. On the other hand, we have certainly seen a significant increase in the number of projects and cases being evaluated by our customers.

We do not yet have a firm order for the next fiscal year, i.e., six months into the future. We recognize that this is only a situation where customers are making progress in their evaluations, and that the numbers are coming out on a forecast basis. We are in a situation where projects are emerging.

Q&A: Current and possible future dividend policy

Participant: I would like to ask about dividends. I have the impression that your company pays a stable dividend. Is there any possibility that your dividend policy will change in the current or next fiscal year and beyond because of changes in presidents? Or will you proceed with the policy of “continue to pay 28 yen”?

Hasegawa: Regarding the dividend policy, as you mentioned, the bottom line is set at 2.8% based on the DOE standard during the current medium-term business plan period.

In the next fiscal year, which is the final year of the plan, the company has announced its policy to aim for 3%. At this time, there are no plans to change the dividend policy in this medium-term business plan.

However, the company is still discussing whether the current dividend policy remains appropriate going forward. As an option, we are not considering lowering shareholder returns, and we believe there is room to discuss the details in the future.

In other words, we should discuss whether it is better to implement all the shareholder returns through dividends or through stock buybacks, based on the world and the company’s own situation. However, at this time, the dividend policy for the next medium-term business plan has not yet been clearly defined.

Participant: In the next medium-term business plan, is the idea that a reduction in dividends will be an option if profits are not generated?

Hasegawa: We are aiming for a return to growth, with last year as the bottom. Although the dividend payout ratio is currently very high, we are discussing what dividend policy and shareholder return policy would be appropriate in the future when our business performance changes, so we are not discussing dividend cuts at this time.

Participant: When profits start to recover, is there an option to not only reward them with dividends, but also with share buybacks and the like? I have the impression that the stock price has not fallen as much as it might have because the dividend is protected. Is the nuance that you are considering 28 yen as some sort of protection level for the next fiscal year and beyond?

Hasegawa: The dividend policy for the next fiscal year is naturally within the scope of this medium-term business plan, and we have no intention of revising it at this time.