Progress on Recall of Bathroom Heater/Dryers

Hiroyasu Naito (hereinafter "Naito"): My name is Hiroyasu Naito, Representative Director and President of Rinnai Corporation. I would like to present our interim financial results for the second quarter of fiscal 2026.

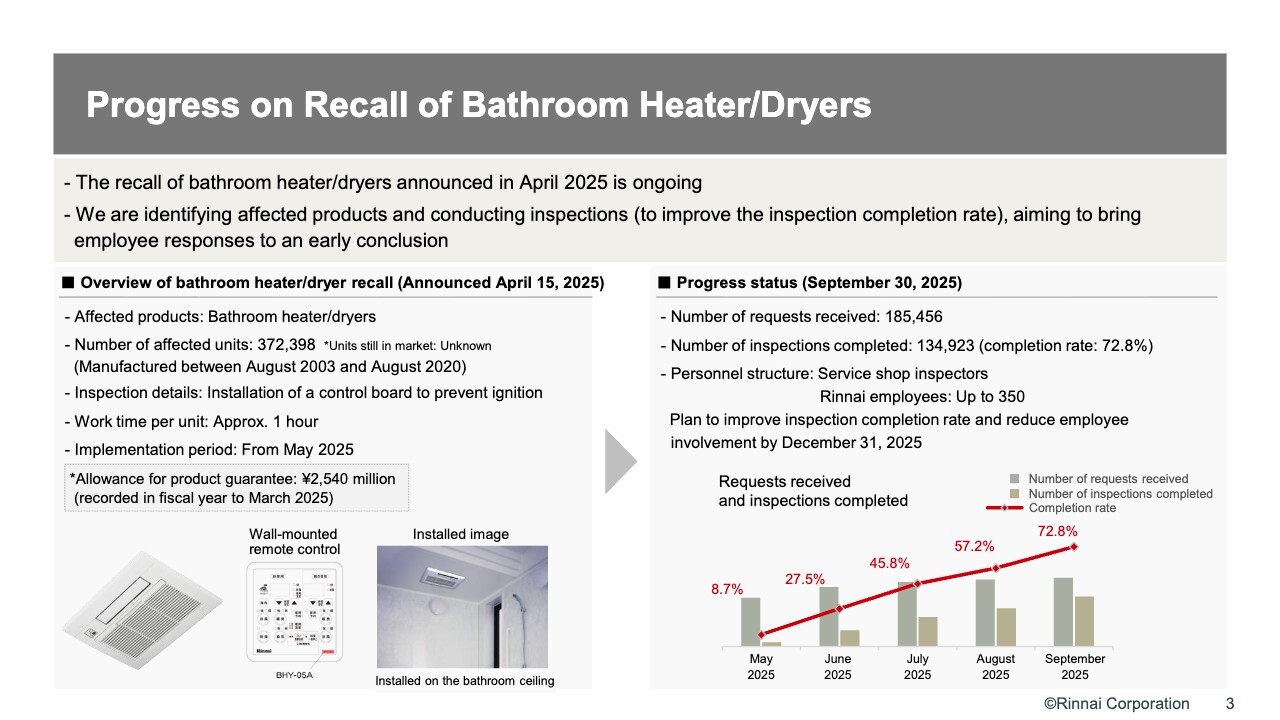

I will begin with our action in the recall of bathroom heater/dryers. The number of units covered by the recall is 372,000, with 195,813 applications received as of the end of October. This number is up from 185,456 a month ago. Of 190,000 cases, 165,500 inspections have been completed, raising the percentage of completed inspections in response to requests to 84.5%.

Our service shops and 350 Rinnai employees are engaged in inspections. Of the 180,000 requests received, we currently have completed 130,000 and hope to complete the remaining 50,000 by the end of December.

In the new year, we will downsize our current 350-person team to handle remaining cases. Currently, we see inspections as progressing well.

Fiscal 2026 (First Two Quarters/Interim): Consolidated Performance Overview

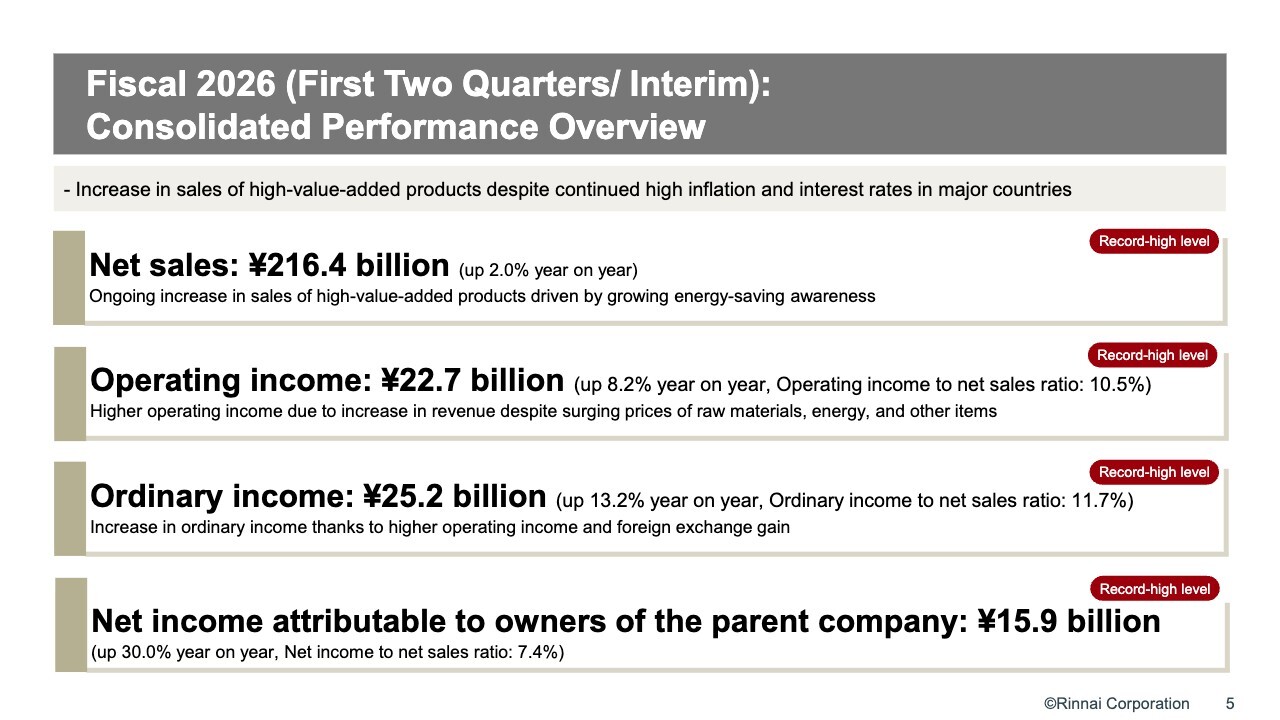

This slide shows results for the second quarter and the outlook for the full year. High value-added products grew even as prices and interest rates remained high in major countries. Net sales were ¥216.410 billion, up 2.0% year on year. This is due to the continued growth of high-value-added products under heightened energy conservation awareness.

Operating income was ¥22.72 billion, up 8.2% year on year, with an operating income to net sales ratio of 10.5%. Although raw material and energy prices and expenses soared in line with rising prices, increased sales led to higher income.

Ordinary income was ¥25.27 billion, up 13.2% year on year, with an ordinary income to net sales ratio of 11.7%. Increased operating income and conversion to foreign exchange gains contributed to the increase in income. Net income attributable to owners of the parent for the interim period was ¥15.91 billion, up 30.0% year on year, with a net income to net sales ratio of 7.4%.

As noted, net sales, operating income, ordinary income, and interim net income all reached record highs.

Fiscal 2026 (First Two Quarters/Interim): Consolidated Financial Results

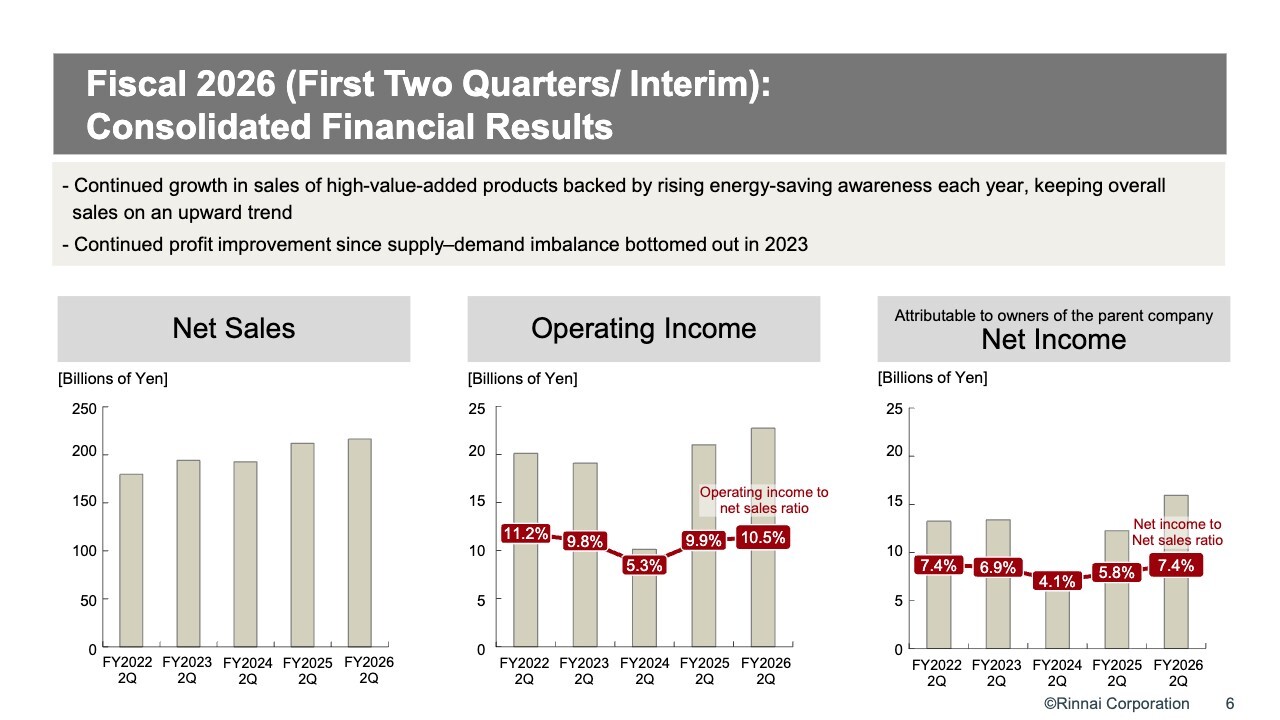

I will next discuss the trends in our consolidated financial results for the second quarter.

In 2023, supply-demand imbalance resulted in an inability to supply water heaters, inconveniencing many people. This temporarily affected the company's performance and reduced sales, but recovery has since progressed steadily. Income also continues to recover after bottoming out in 2023. The same is true for interim net income.

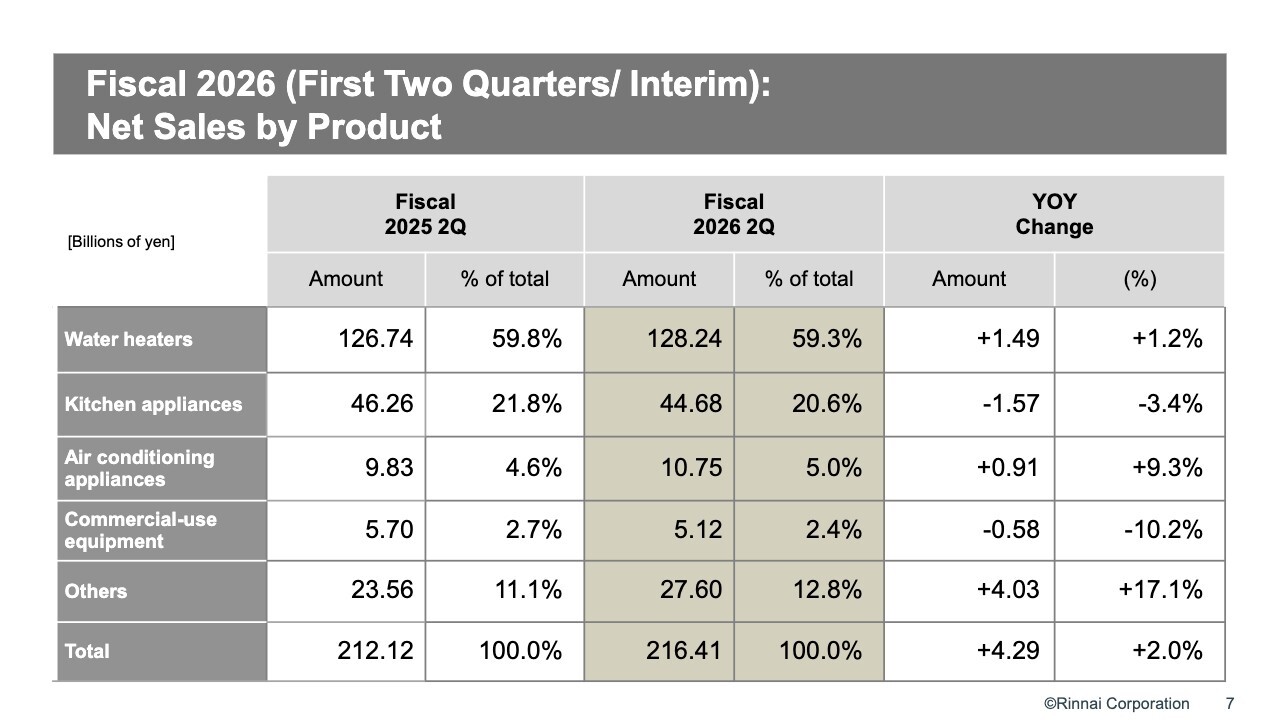

Fiscal 2026 (First Two Quarters/Interim): Net Sales by Product

This slide shows a breakdown of net sales by product. Sales of water heaters were particularly high, with sales value also increasing.

Conversely, the "Kitchen appliances" segment is gradually declining in percentage of total, with sales value also lower year on year.

Looking at the "Air-conditioning appliances" segment, sales increased from ¥9.8 billion to ¥10.7 billion. This segment includes relatively small-scale products such as FF stoves, but these are extremely profitable on a per-unit basis and should not be ignored. We intend to continue to place a high value on these profitable products.

Sales of commercial-use equipment declined. Conversely, the "Others" segment, which includes the Kanta-kun clothes dryer, performed strongly, adding ¥4.2 billion to overall sales. The situation remains favorable.

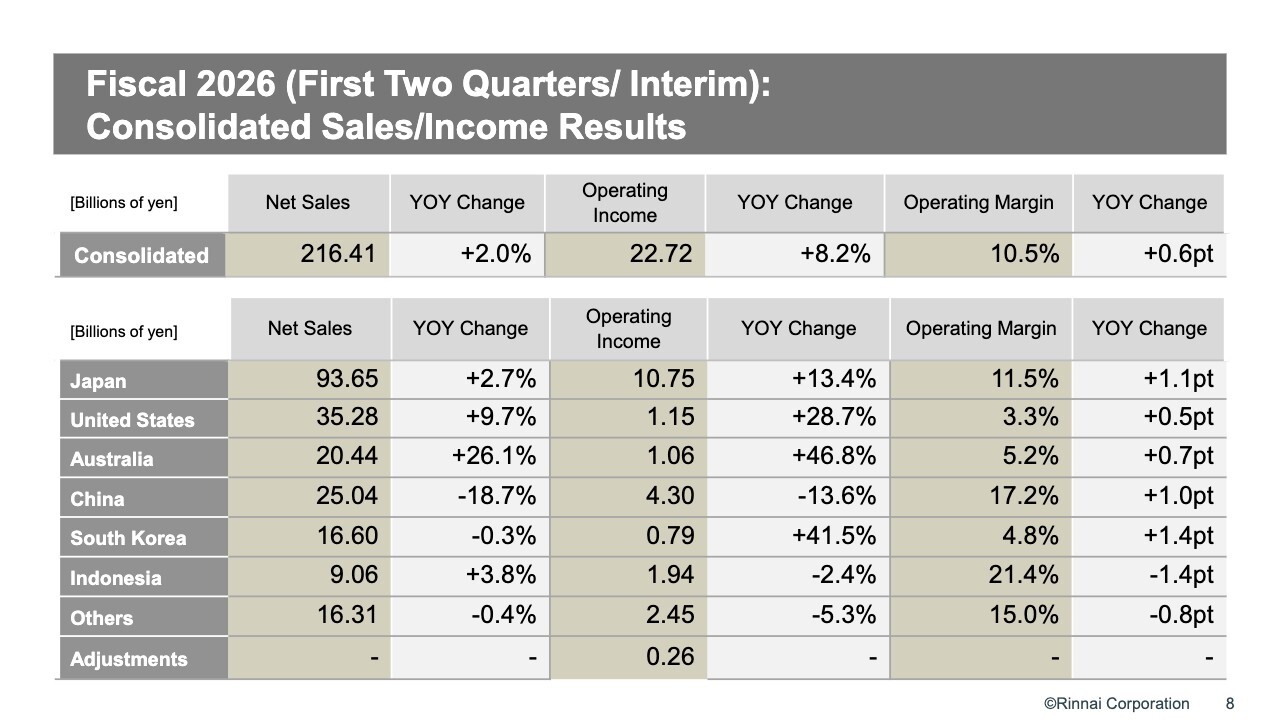

Fiscal 2026 (First Two Quarters/Interim): Consolidated Sales/Income Results

This slide presents a breakdown of income and loss results by consolidated segment. On a consolidated basis, operating income was ¥22.7 billion. In Japan, sales increased by 2.7% to ¥93.6 billion and profit increased by 13.4%, with an operating income to net sales ratio of 11.5%.

In the United States segment, operating income was ¥1.1 billion on sales of ¥35.2 billion, with an operating income to net sales ratio of 3.3%. We are not satisfied with this ratio.

In the Australia segment, sales were ¥20.4 billion, while operating income was ¥1.06 billion and operating income to net sales ratio was 5.2%. The business has been comparatively strong.

Next, in the China segment, net sales were ¥25 billion and operating income was ¥4.3 billion. China is in a very bad economic situation and sales down 18.7%. Continuing from the previous poor year, the economy remains sluggish.

What is redeeming, however, is that despite a nearly 20% decline in sales, income declined only 13.6%. Normally, a sales decline of this magnitude can be expected to slash income by more than half, but this maintenance of income resulted from the sale of high-value-added products.

Furthermore, the operating income to net sales ratio was 17.2%, a number that indicates good performance given the difficult circumstances.

In the South Korea segment, we are seeing a slight recovery from the previously sluggish situation. However, operating income to net sales ratio has yet to reach a satisfactory level.

In the Indonesia segment, operating income to net sales ratio was very high. Net sales totaled ¥9.06 billion, up 3.8% year on year. Income, on the other hand, declined slightly to ¥1.94 billion. Despite this, we maintain an operating income to net sales ratio of 21.4%.

As seen from this, in Indonesia we are selling products with a high income to net sales ratio and very high added value, specifically tabletop cookers.

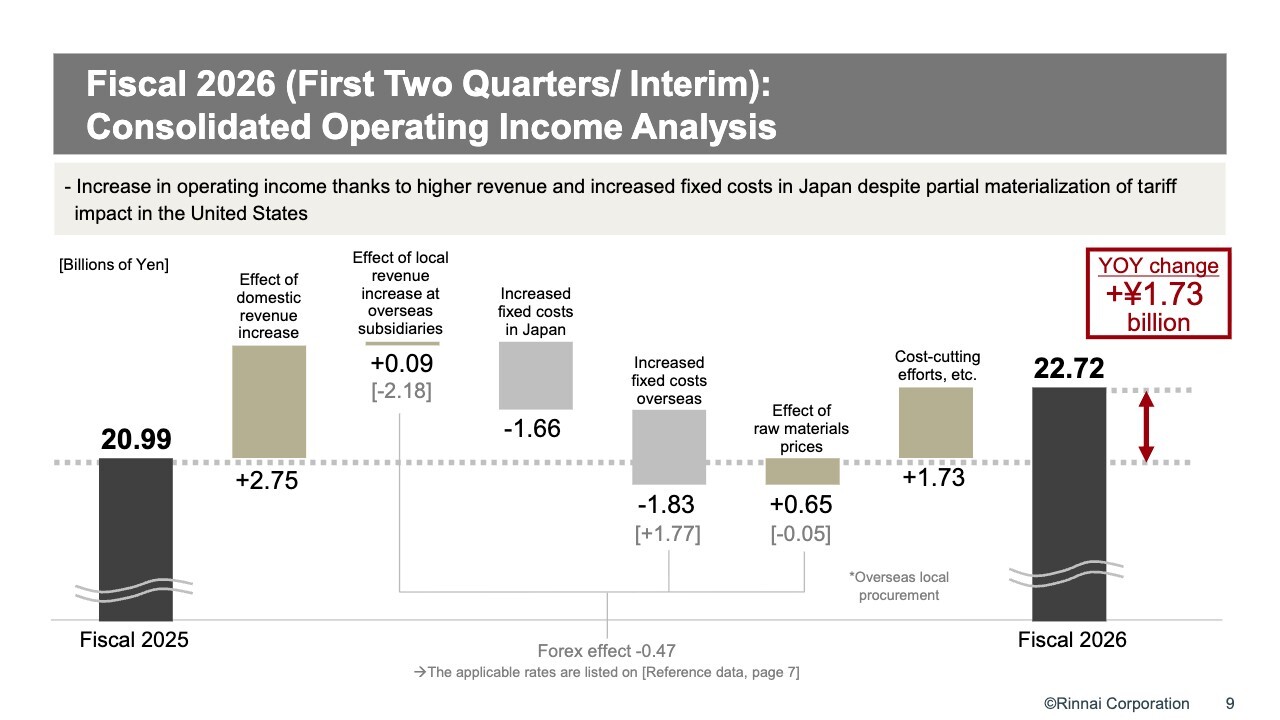

Fiscal 2026 (First Two Quarters/Interim): Consolidated Operating Income Analysis

This section presents factors that contributed to the increase in income to ¥22.7 billion. The effect of domestic revenue increase was ¥2.75 billion and the effect of local revenue increase at overseas subsidiaries was ¥0.09 billion. At the same time, higher fixed costs in Japan were a negative income factor of ¥1.66 billion. Higher fixed costs overseas were a negative income factor of ¥1.83 billion.

Looking at the impact of raw material costs, a slight decrease in raw material prices resulted in a positive income factor of ¥0.65 billion. Cost reduction and streamlining efforts added ¥1.73 billion. Consolidated operating income totaled ¥22.72 billion.

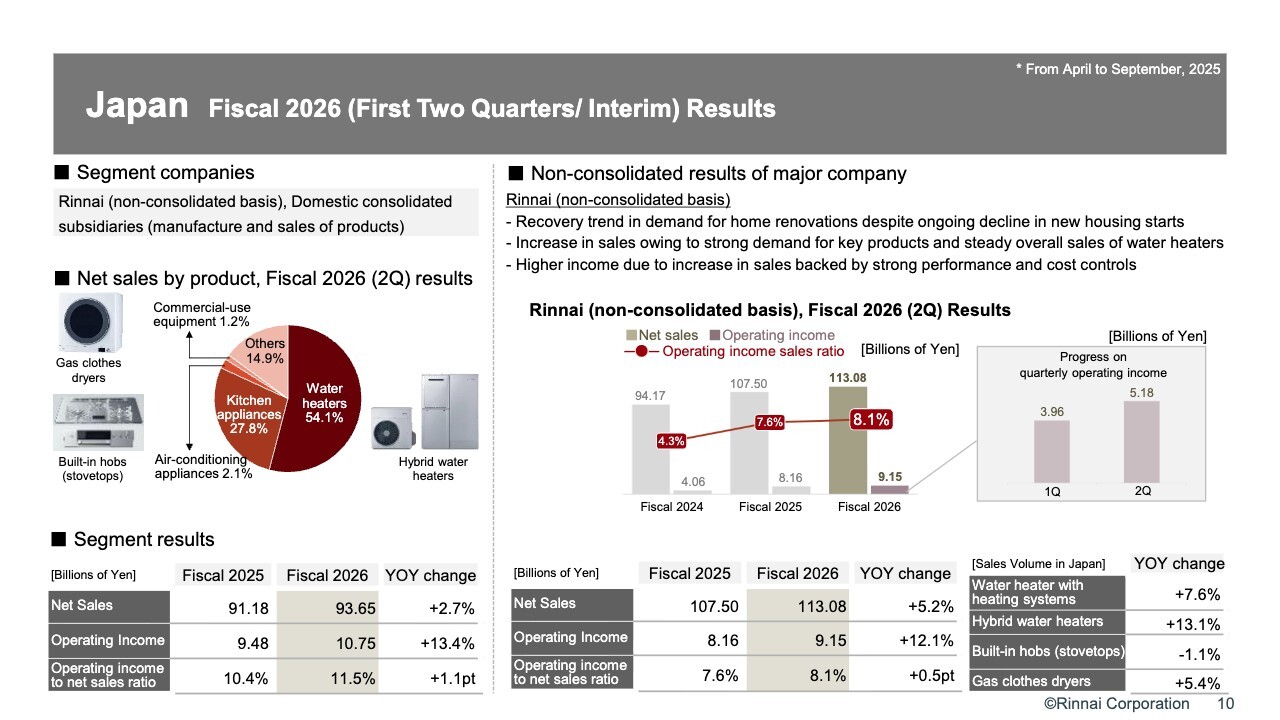

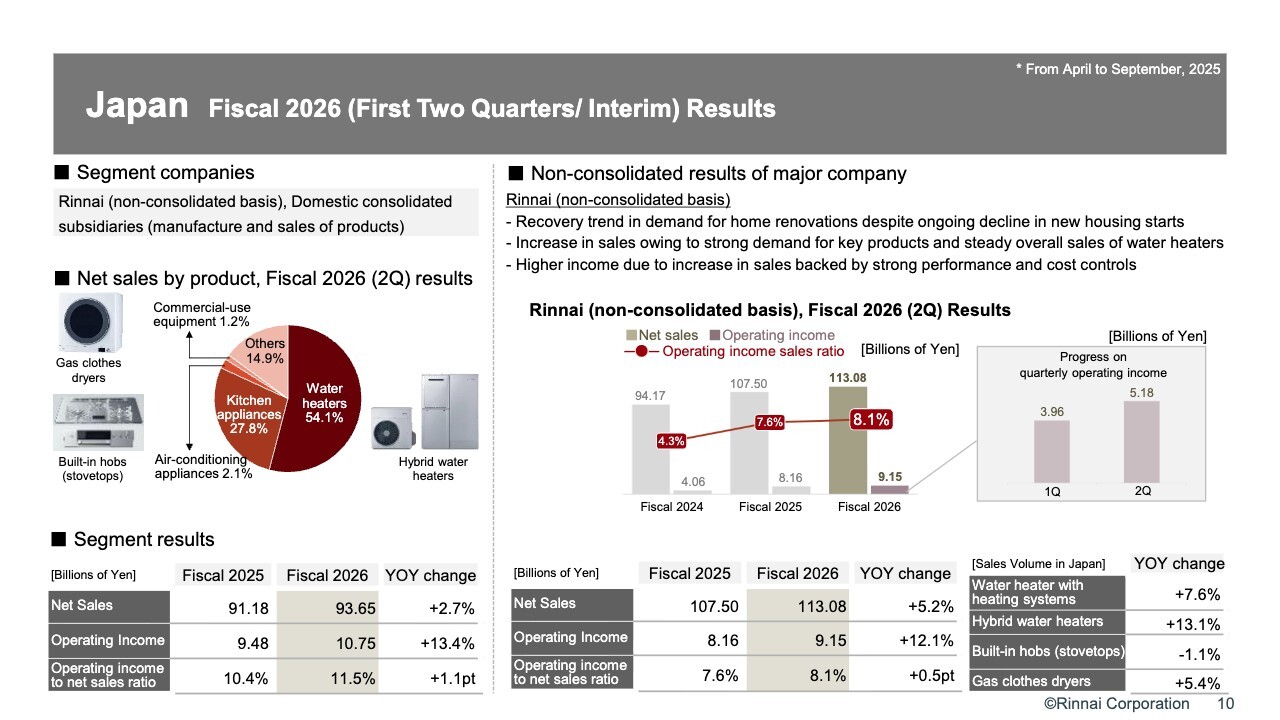

Japan: Fiscal 2026 (First Two Quarters/Interim) Results

From here, I will discuss the results by segment. The left side shows segment results by region, but to make this easier to understand, I will discuss non-consolidated results of a major company in each regional segment, shown on the right side. First, let me cover the results of Rinnai on a non-consolidated basis.

New housing starts continue to decline, while demand for home renovations is on the road to recovery. Sales of key products were strong as were overall sales of water heaters, resulting in an increase in sales.

Increased revenue from strong sales and cost containment resulted in a return to profit growth. Rinnai's non-consolidated second quarter operating income to net sales ratio has improved over the past three years from 4.3% in 2023 and 7.6% in 2024 to 8.1% in 2025.

Income for the first half of fiscal 2026 was ¥9.15 billion. Income was ¥3.96 billion in the first quarter and increased to ¥5.18 billion in the second quarter.

Hybrid water heaters recorded double-digit growth. Built-in stovetops struggled slightly, declining by 1%.

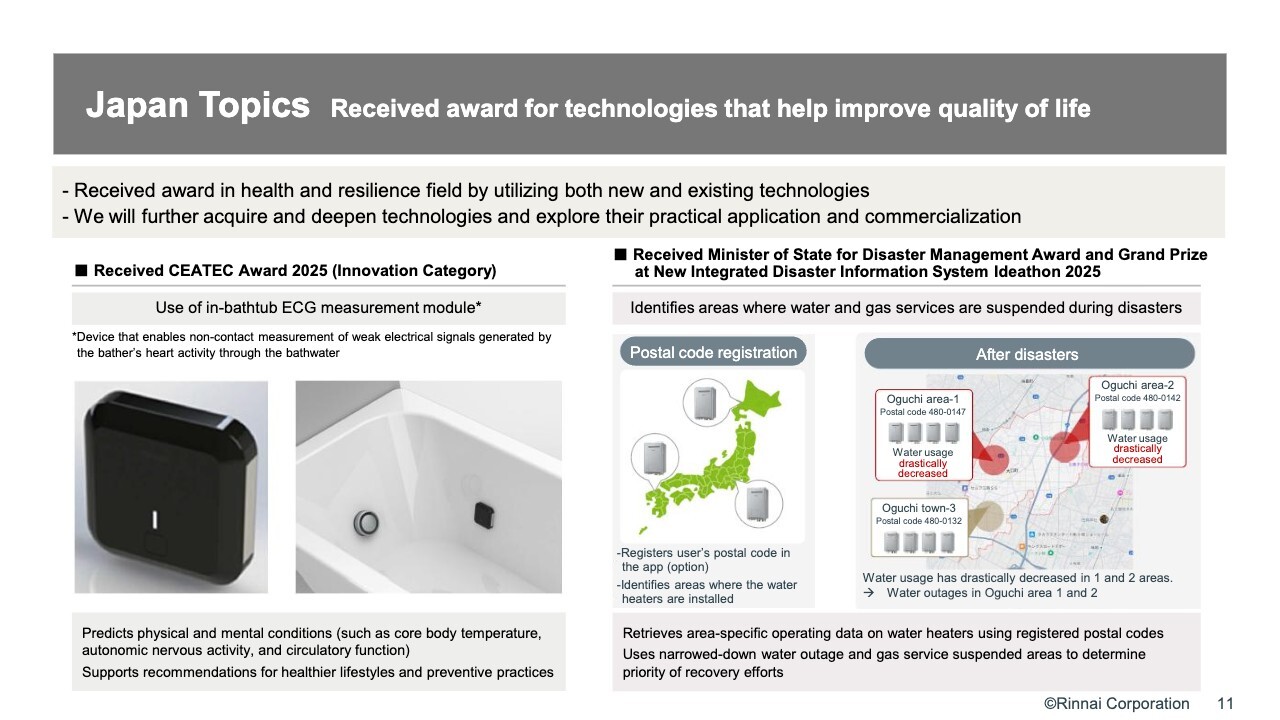

Japan Topics: Received award for technologies that help improve quality of life

Looking next at topics in Japan, we are working in the areas of health and resilience, utilizing new and existing technologies. In this field, we are undertaking the development of technology to measure heart rate and other parameters through a measurement module installed in the bathtub.

This initiative won an award in the innovation category at CEATEC AWARD 2025.

We believe that this technology will enable prediction of physical and mental states including deep body temperature, the autonomic nervous system, and circulatory functions, and enable suggestions for lifestyle improvements and preventive measures.

In addition, our "New Comprehensive Disaster Prevention Information System Ideathon 2025" won the Minister of State for Disaster Management Award Grand Prize. The idea involves registration of postal code when water heaters are installed so that both operational status of the water heaters and location information can be aggregated.

This will allow identification of areas experiencing water or gas outages after a disaster, based on water heater operating status.

The idea to use information on the identified water and gas outage areas to prioritize restoration activities was commended, receiving the Minister of State for Disaster Management Award Grand Prize.

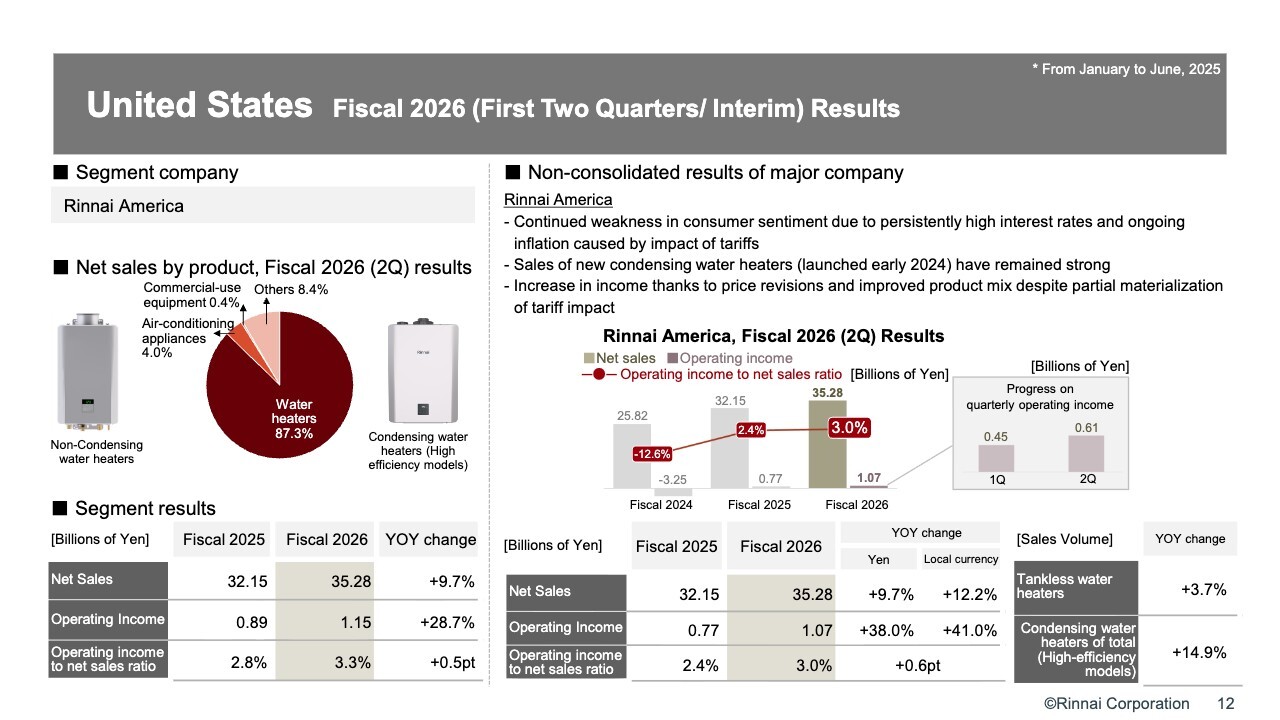

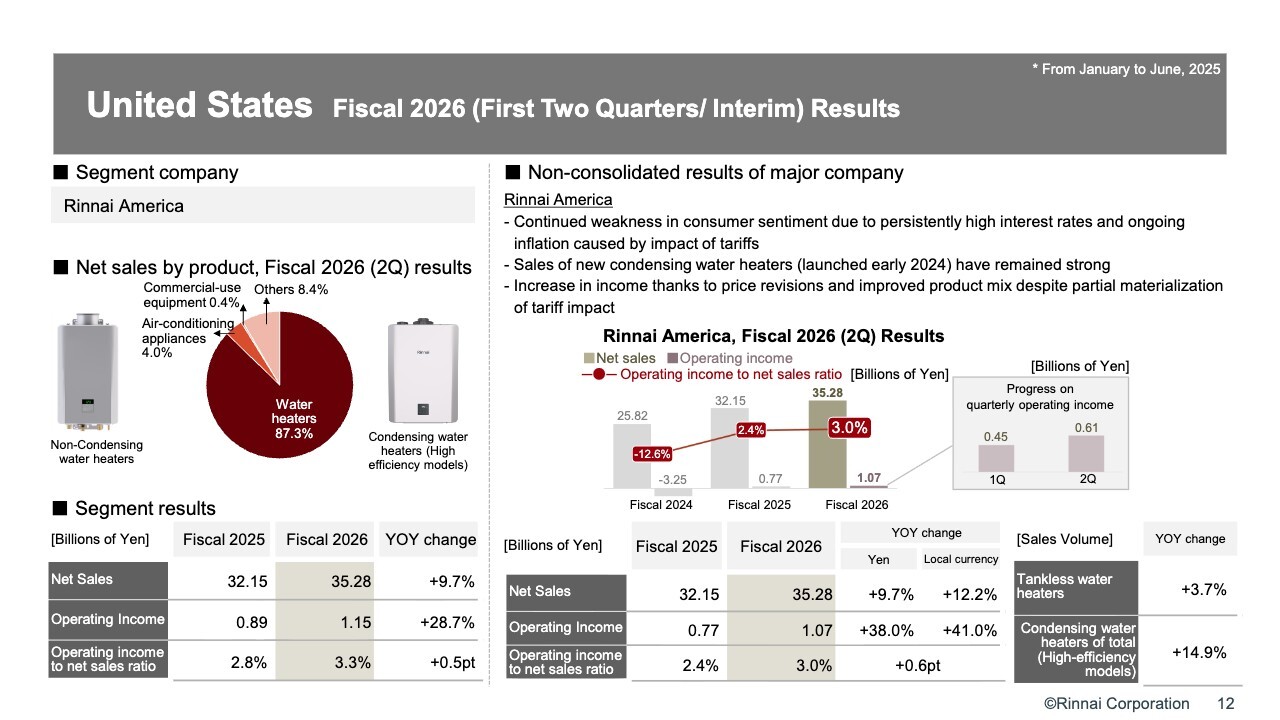

United States: Fiscal 2026 (First Two Quarters/Interim) Results

This slide concerns results in the United States segment. Consumer confidence remains weak in the U.S. due to high interest rates and inflation caused by tariffs.

Sales of the new condensing water heaters launched at the beginning of last year remain strong. Although the impact of tariffs has become apparent in some areas, we have absorbed this through price revisions and an improved product mix, resulting in an increase in income. Net sales were ¥35.28 billion, operating income was ¥1.07 billion, and operating income to net sales ratio was 3.0%.

However, we believe that this operating income to net sales ratio is not yet at a satisfactory level, and aim to achieve a ratio of 10% or higher.

The ratio was in the red in fiscal 2024, 2.4% last year in fiscal 2025, and 3.0% in the current fiscal year. The year has been hectic due to tariffs, but the numbers are relatively good despite that.

Next, I would like to discuss income for the first and second quarters. Income was ¥0.45 billion in the first quarter and ¥0.61 billion in the second quarter. This is due to the growth in sales of condensing, or high-efficiency, water heaters.

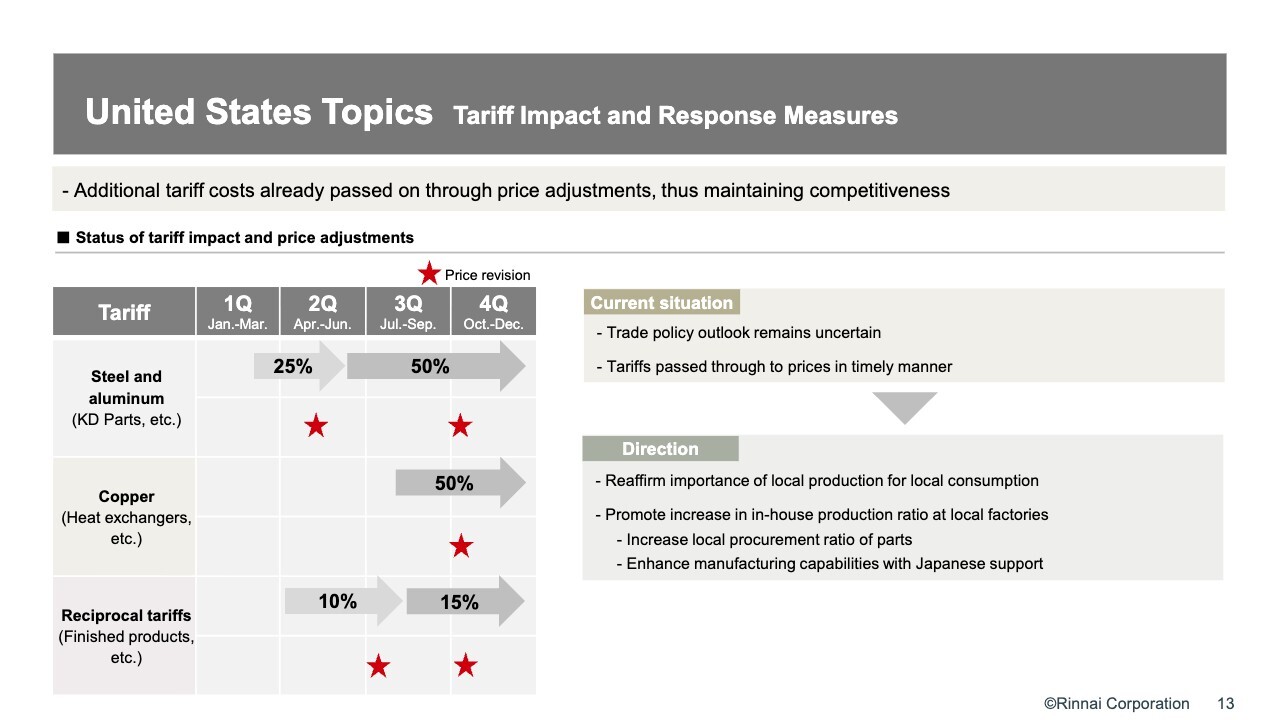

United States Topics: Tariff Impact and Response Measures

Although we are experiencing anxiety over the Trump tariffs, we have passed on the additional costs of tariffs to prices. We recognize that we have been able to maintain market competitiveness even after the cost pass-through.

While the Trump tariffs have not been devastating at this point, the future remains uncertain. As noted, for tariffs that have already been executed, we have promptly passed added costs on to prices, and cost pass-through is complete at this stage. However, we will continue to closely watch market trends.

For the water heaters sold in the U.S., roughly 60% of sales come from units manufactured in and exported from Japan, while the remaining 40% are from products manufactured locally in the U.S. For production in the U.S., critical components are shipped from Japan, and tariffs imposed on those components could make costs very high.

In response to the idea that importing assembly products from abroad might be more advantageous overall, we conducted a number of studies. However, after repeated calculations we concluded that local production and local sales remain the most advantageous. Through this, we have reaffirmed the importance of local production and local sales.

Going forward, we intend to increase the ratio of locally procured components at our overseas factories. We currently send critical parts from Japan but will increase the local procurement ratio and raise the level of manufacturing capabilities with support from Japan.

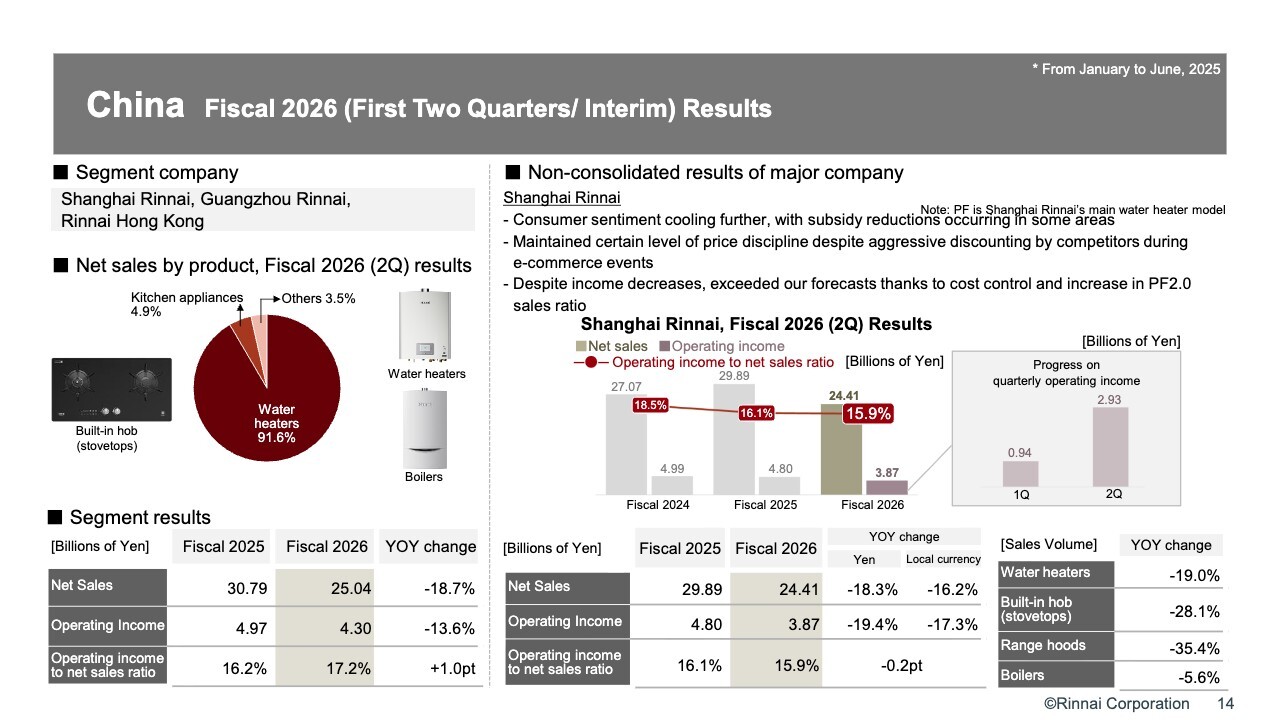

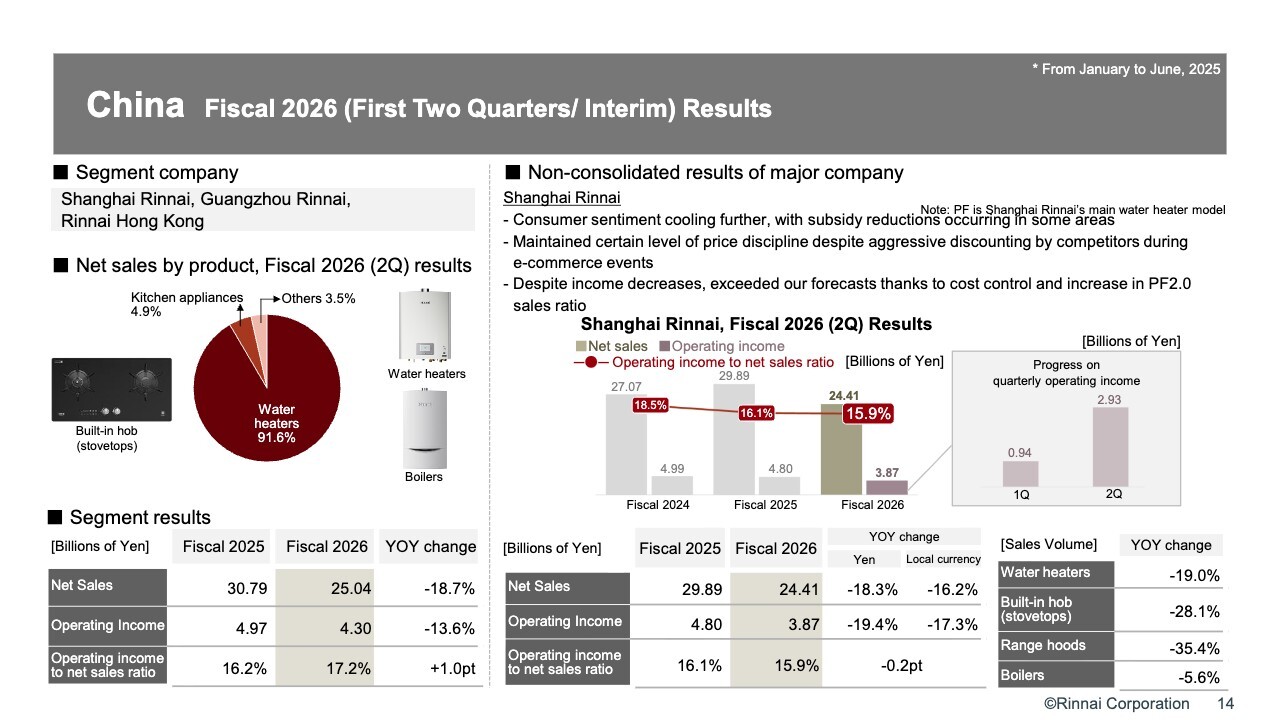

China: Fiscal 2026 (First Two Quarters/Interim) Results

This slide concerns the China segment market. Consumer sentiment has weakened further, partly due to subsidy reduction in certain regions.

At EC events, there have been noticeable price discounting offensives by competitors, as seen in June 18 (618 shopping festival) and November 11 (W11) events. Our policy is to ensure income while maintaining a certain level of price discipline.

Although income decreased, it exceeded original plans due to cost containment and increased adoption of Platform 2.0 (hereinafter "PF2.0"). This term refers to a significantly streamlined water heater design that results in very high added value.

Net sales were ¥27 billion in the first half of fiscal 2024, increased to ¥29.8 billion in the previous fiscal year, and were ¥24.4 billion in the current fiscal year.

Income, however, was ¥4.99 billion, ¥4.80 billion, and ¥3.87 billion in those same three years.

Quarterly income was ¥0.94 billion in the first quarter and ¥2.93 billion in the second quarter.

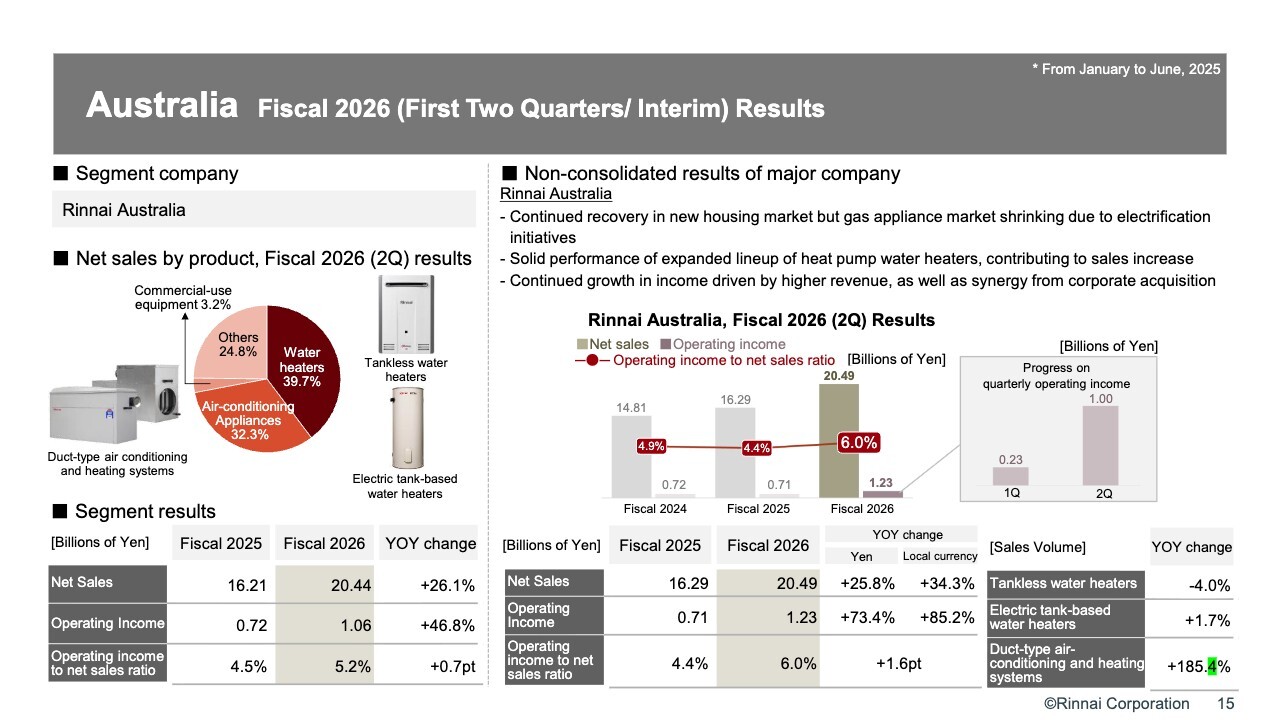

Australia: Fiscal 2026 (First Two Quarters/Interim) Results

In Australia, recovery continues in the new housing market but strict laws have been enacted prohibiting the connection of gas piping to new homes. This has led to electrification measures and a shrinking market for gas appliances, though the market is not shrinking significantly due in part to replacement demand.

However, we believe that in the long term, demand is on the decline. We are strengthening our handling of heat pump water heaters and expanding our lineup in Australia, which is contributing to increased revenue.

Income continued to increase due to strong sales as well as the acquisition of Smart Energy and the realization of synergies.

Unit sales of gas tankless water heaters, which had been selling in the market, declined by 4% year on year, while unit sales of electric tank-based water heaters increased by 1.7%.

Sales of high-efficiency heat pump water heaters grew by 185.4%. We believe this will be a mainstay of the business in the future.

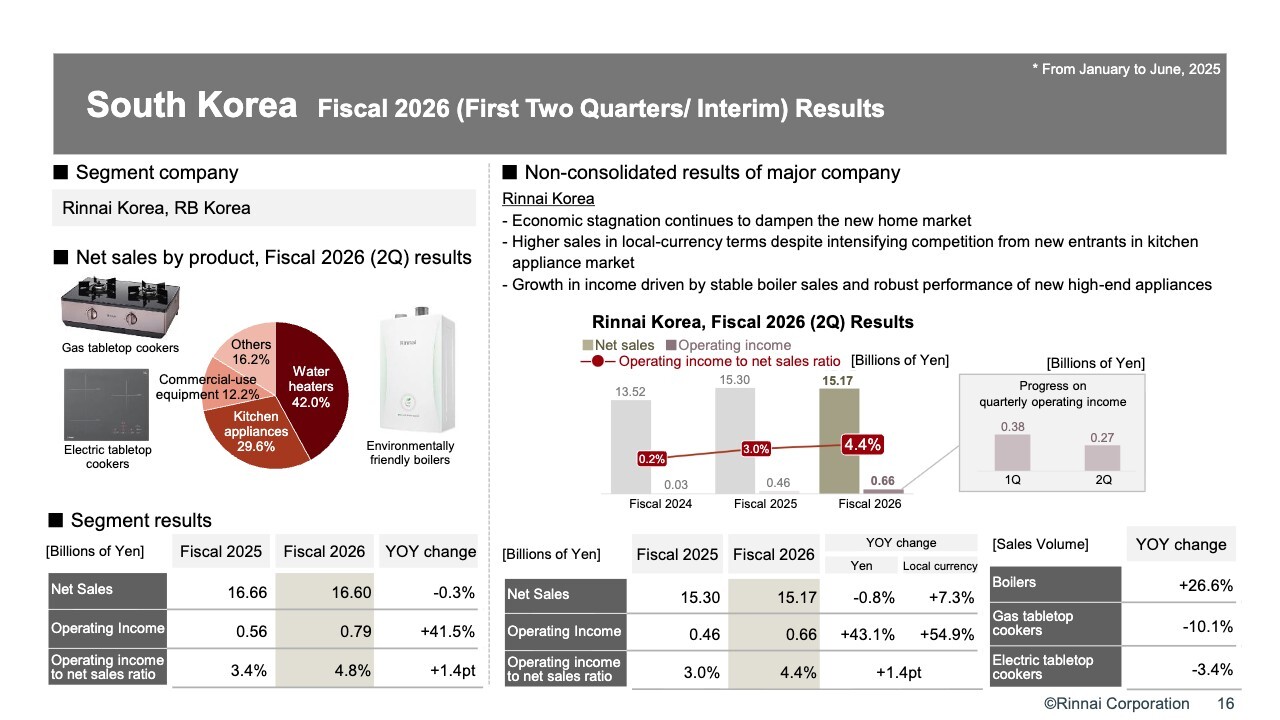

South Korea: Fiscal 2026 (First Two Quarters/Interim) Results

In South Korea, the new housing market remains weak due to the stagnant economy. In addition, competition has intensified with new entrants in the Kitchen appliance market. Nevertheless, Rinnai Korea achieved revenue growth on a local-currency basis.

Strong boiler sales and new high-priced kitchen appliance products contributed to increased incomes. Rinnai Korea has been on a downward trend but is beginning to show signs of stepping up.

However, the operating income to net sales ratio remains unsatisfactory at 4.4%. The second quarter was somewhat slower than the first quarter; the third and fourth quarters will be key. Demand for boilers, in particular, is expected to increase as the weather turns colder.

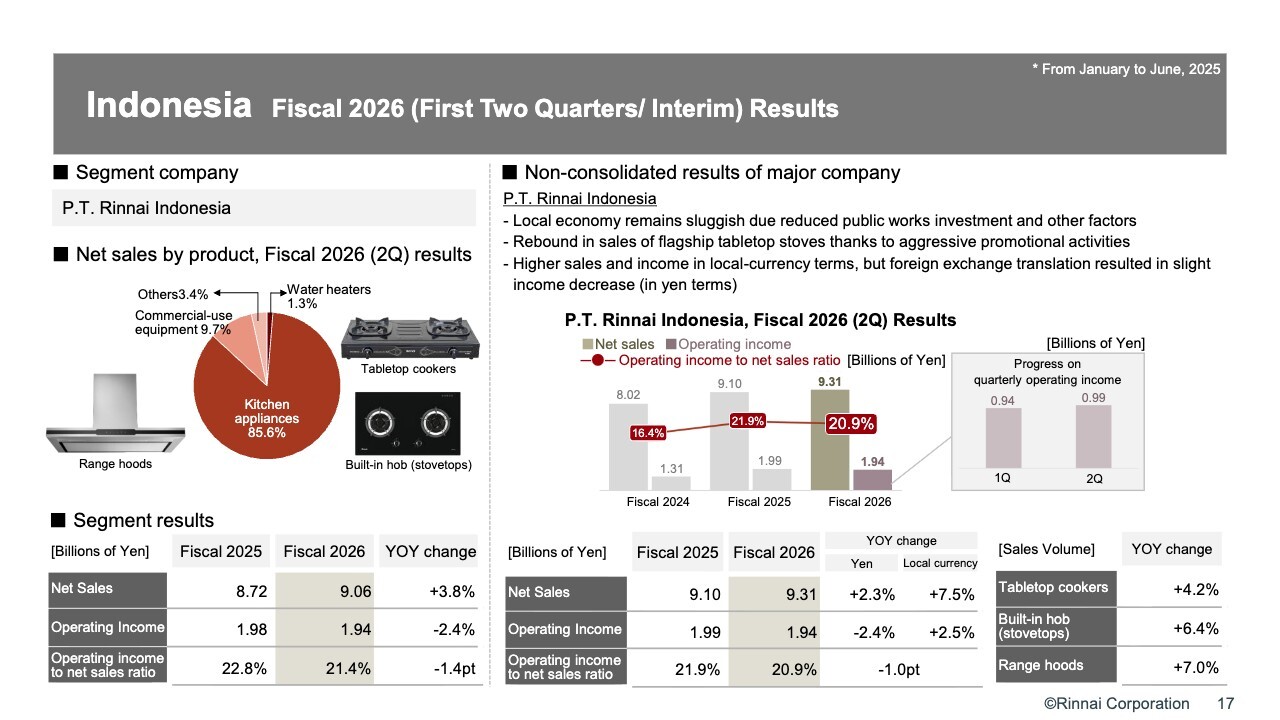

Indonesia: Fiscal 2026 (First Two Quarters/Interim) Results

The Indonesia segment is a market that generates considerable income. Although the local economy remains sluggish due to reductions in public works investment and other factors, aggressive sales promotion activities have resulted in a recovery in sales of tabletop cookers, our mainstay products, which had been stagnant.

Although both sales and income increased on a local-currency basis, the effect of currency translation resulted in a slight decrease in income. However, profitability remains very strong, with the operating income to net sales ratio at levels high enough to exceed 20%, allowing the business to continue generating solid earnings.

In the first half alone, the segment posted operating income of approximately ¥2 billion. As a result, we expect income of about ¥4 billion for the full year.

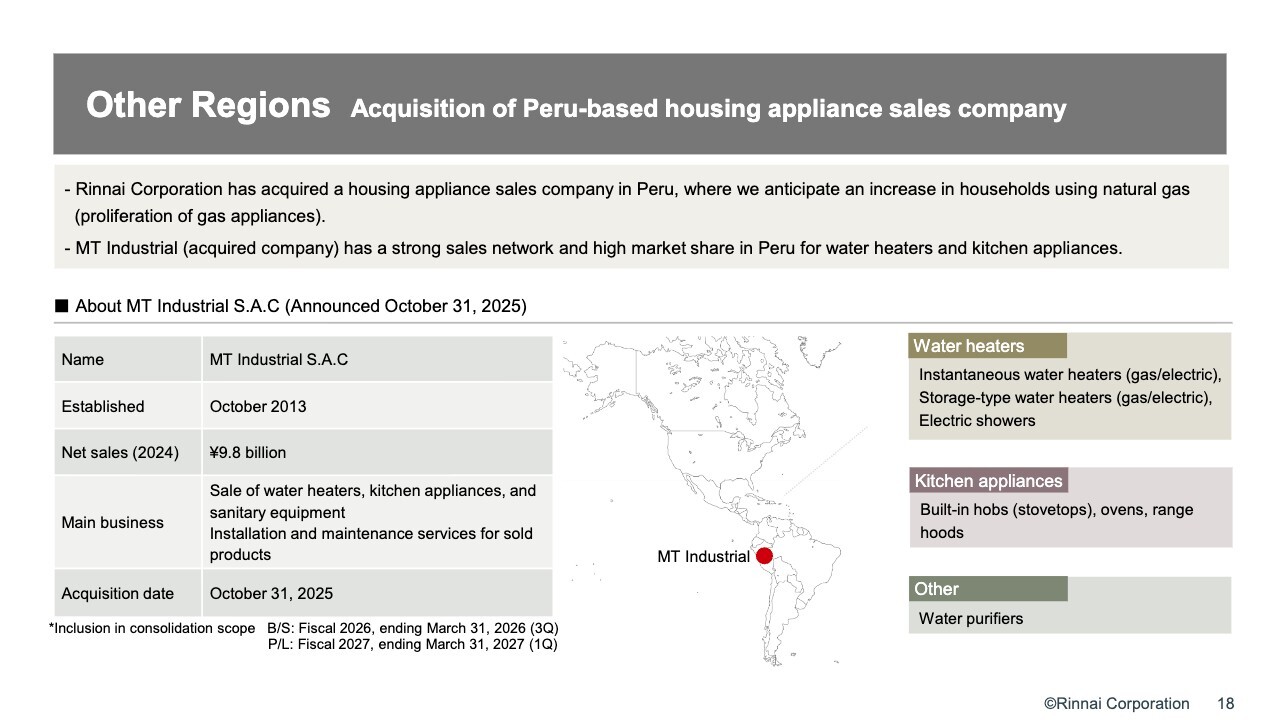

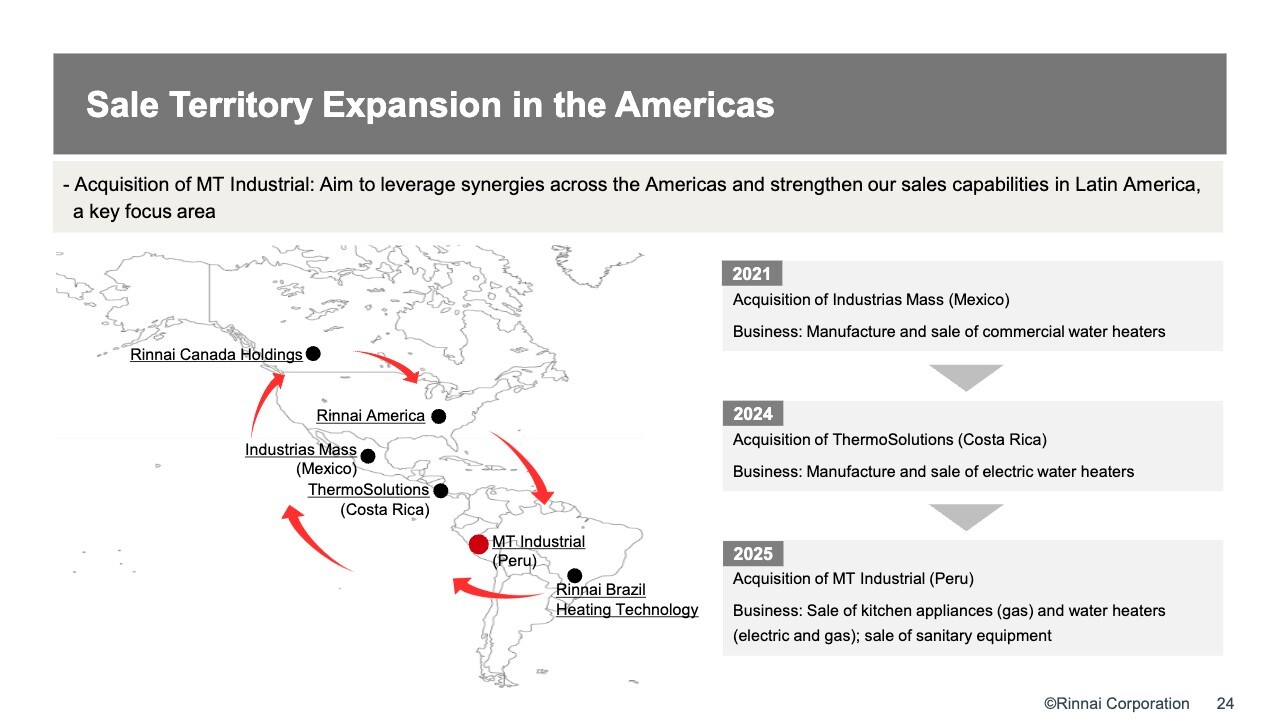

Other Regions: Acquisition of Peru-based housing appliance sales company

In other regional topics, I would like to report on our recently announced acquisition of MT Industrial, a Peru-based housing appliance sales company.

While developed countries promote carbon neutrality, emerging countries are using natural gas and will be expanding their demand for it.

Peru is a prime example, as is Bangladesh. There is a trend toward expanding the use of natural gas, developing pipelines to homes, and increasing consumption.

The company we acquired, MT Industrial, has a strong sales network and a high market share for water heaters and kitchen appliances in the Peruvian market.

With sales of approximately ¥10 billion, the company has a number of commercial offerings in water heaters, kitchen appliances, home appliances, and sanitary equipment that have secured market shares of over 50% in some products. Through the acquisition, we expect to expand our sales network.

MT Industrial develops its own brands, but these are mass-market products, whereas the Rinnai brand is positioned in the mid- to high-end price range. We intend to focus on targeting products including gas water heaters and storage-type gas and electric water heaters, and foresee an income to net sales ratio of approximately 10%.

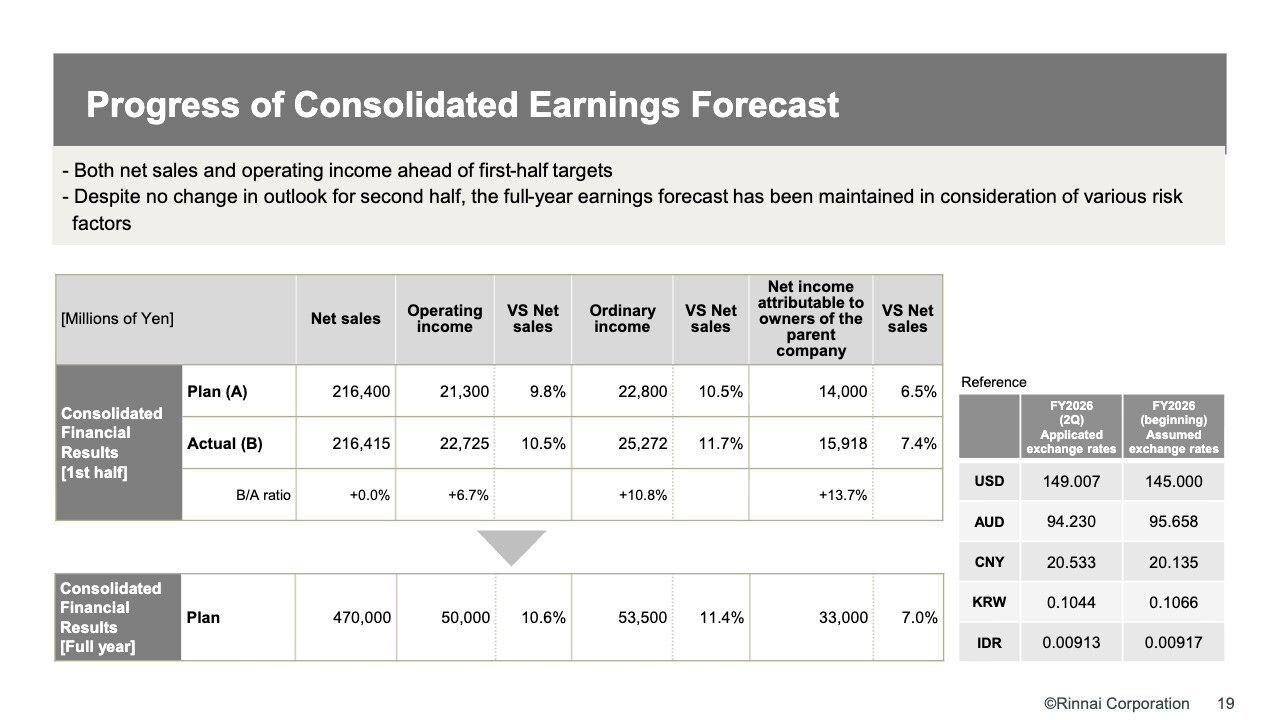

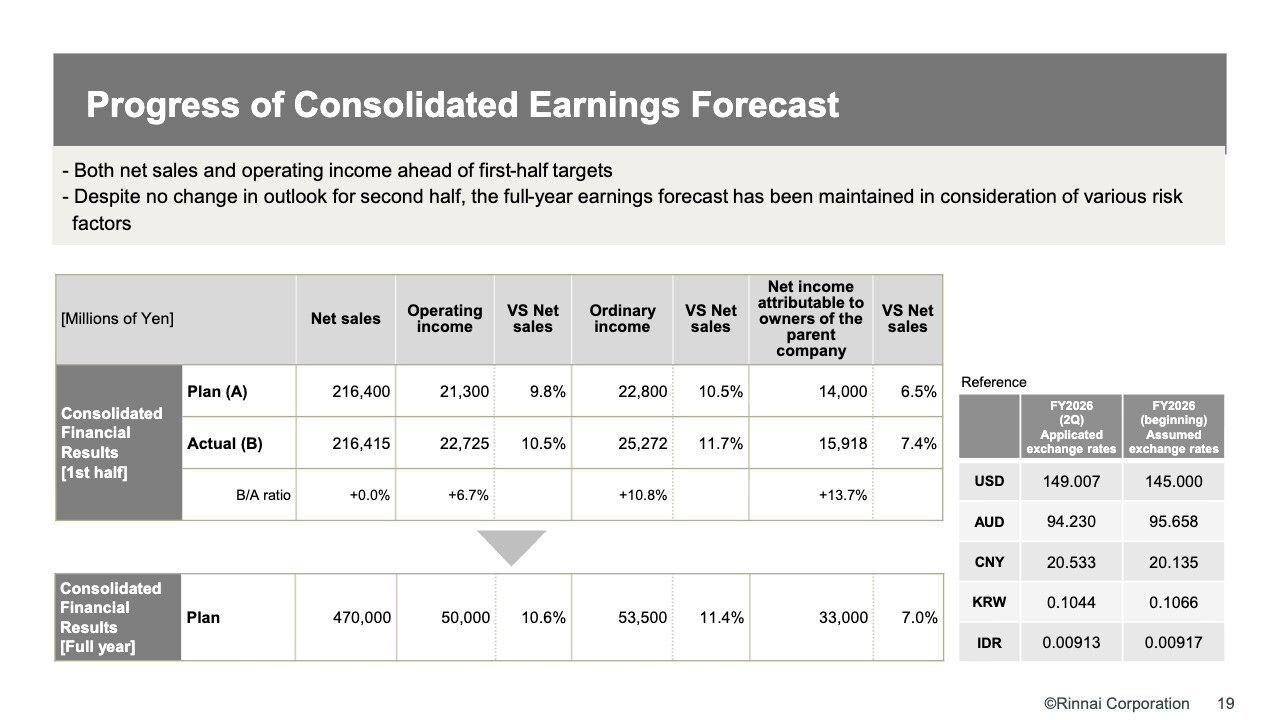

Progress of Consolidated Earnings Forecast

This slide shows our progress toward our consolidated earnings forecast. Both sales and income exceed our plans for the first half and are progressing well. The outlook for the second half remains unchanged, but in consideration of various risk factors, we have decided to leave our full-year forecast unchanged.

We are determined to achieve sales of ¥470,000 million, operating income of ¥50,000 million, ordinary income of ¥53,500 million, and net income of ¥33,000 million.

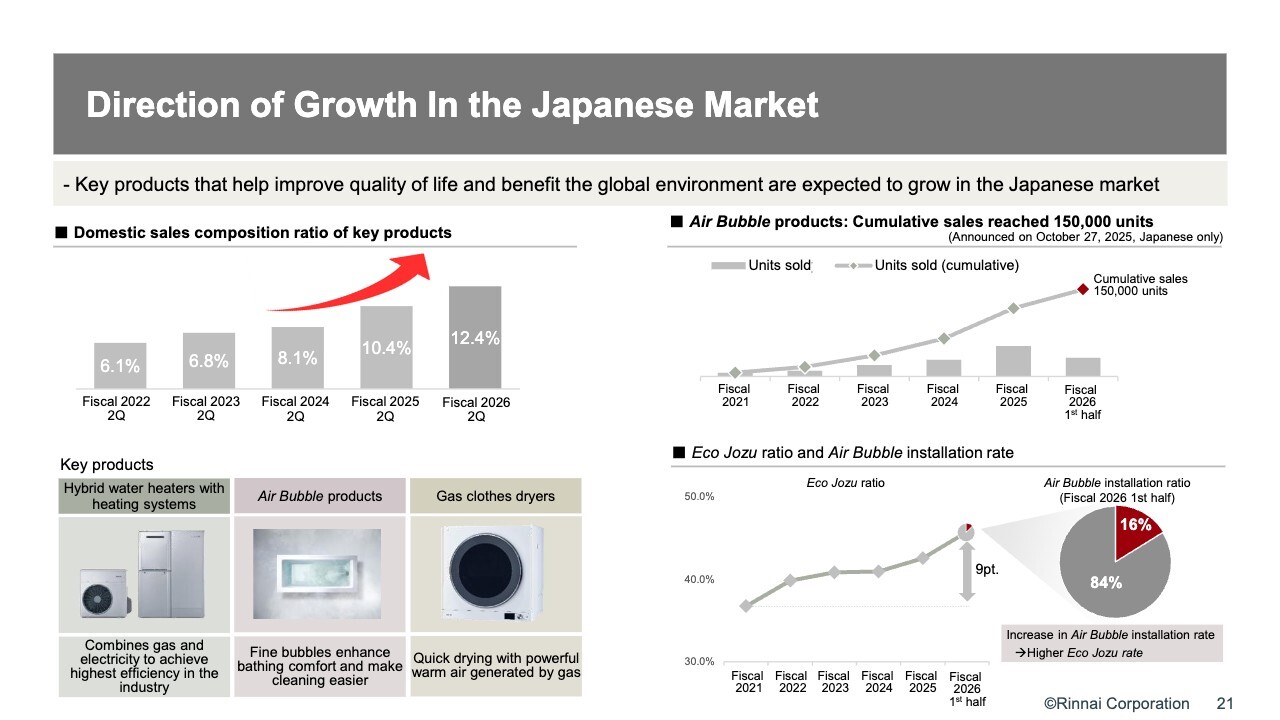

Direction of Growth in the Japanese Market

Next, I would like to discuss the direction of our management. As the growth direction in the Japanese market, we forecast growth in key products that help improve quality of life and benefit the global environment. Such products already contribute to sales and income at present, for which we are grateful.

Sales of key products related to these areas as a percentage of total sales doubled from 6.1% in fiscal 2022 to 12.4% in the second quarter of the current fiscal year. Because net sales overall have increased, the actual increase exceeds 12.4%.

Within these key products are Air Bubble products, which consist of Ultra Fine Bubble water heaters and the Micro Bubble Bath Unit.

Unit sales of Ultra Fine Bubble in particular are high, reaching a cumulative total of 150,000 units in combination with the Micro Bubble Bath Unit. The bubbles of Ultra Fine Bubble are invisible to the eye but extremely gentle to the skin. They also create a clearly visible effect on hair when dried with a dryer after washing.

Sales have been growing even more recently due to recognition of the product's high cleaning effectiveness.

Air Bubble products are available only in our high-efficiency Eco Jozu water heaters.

As shown here, a higher Air Bubble installation ratio equates to a higher Eco Jozu ratio. The graph at lower right shows the ratio of Eco-Jozu units, which previously ranged from 35% to 36% and has now increased to 44% to 45%.

Of our Eco Jozu water heaters sold, the ratio with Air Bubble installed has increased to 16%. If this can be further extended, we expect it to achieve very high added value and contribute to the business.

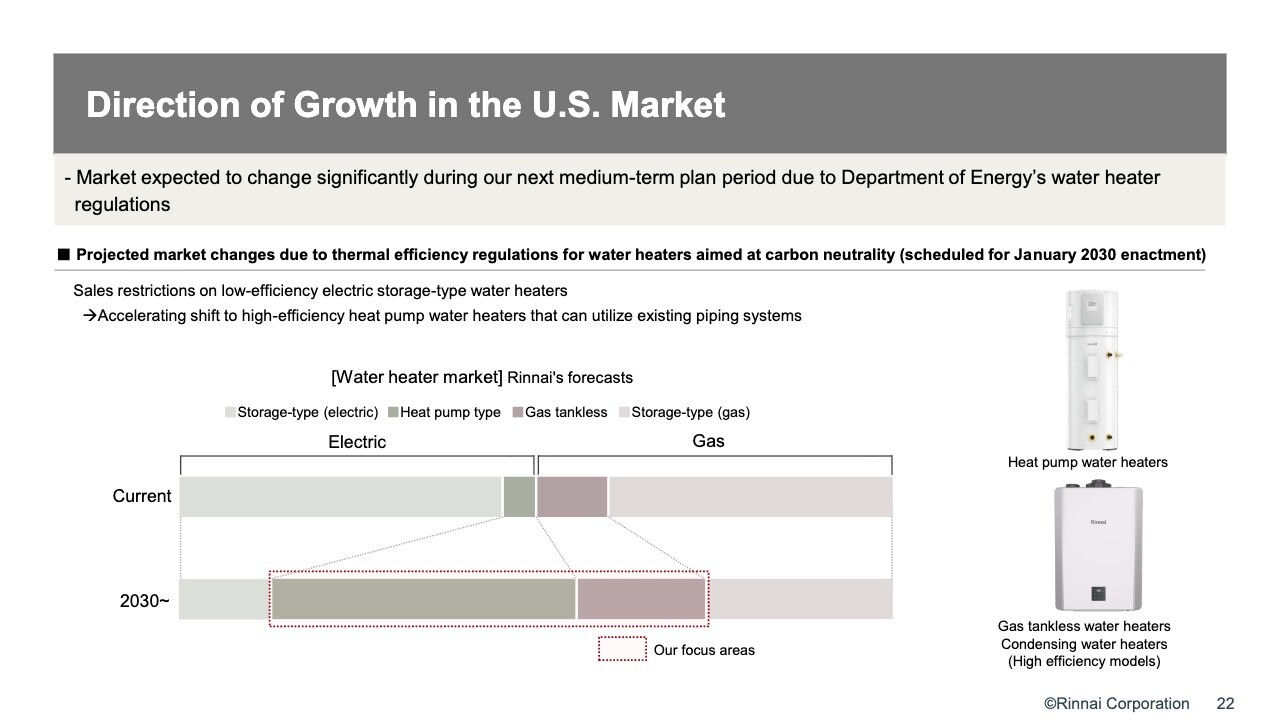

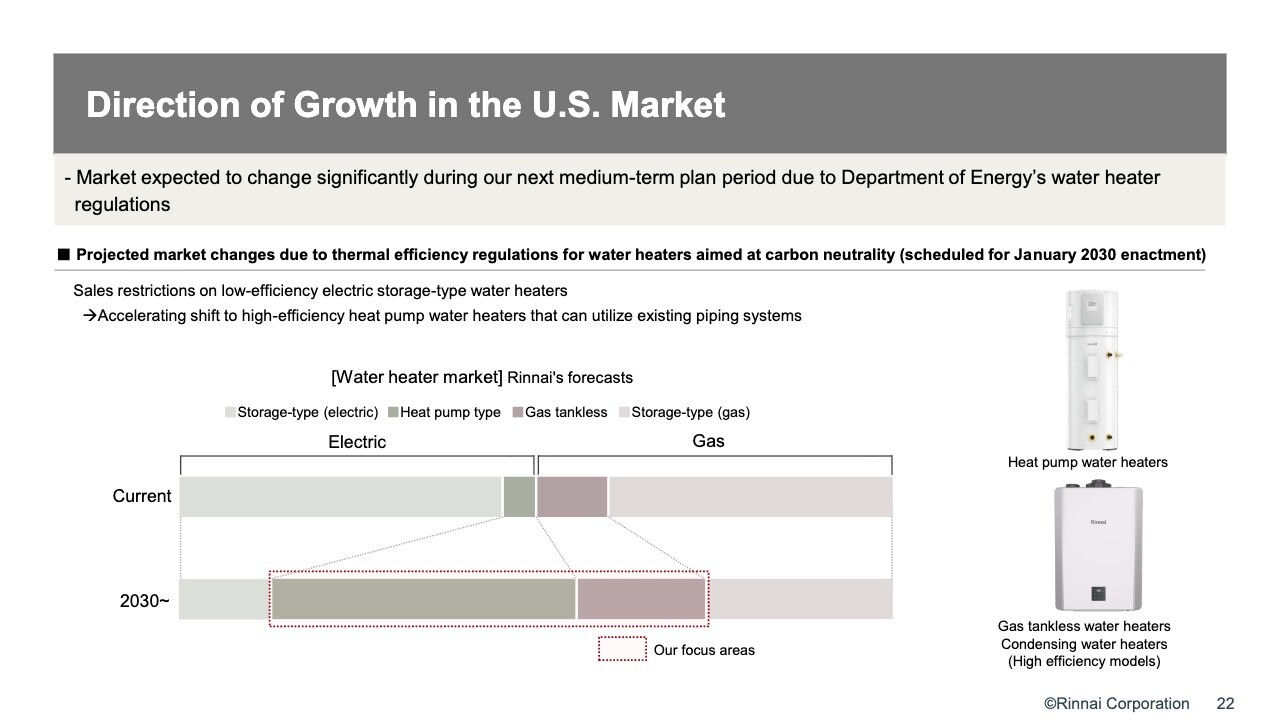

Direction of Growth in the U.S. Market

This slide concerns the direction of growth in the U.S. market. We expect the market to change significantly during the next medium-term business plan period due to carbon neutrality-related water heater regulation by the Department of Energy.

Specifically, the sale of electric storage-type water heaters with low thermal efficiency will be prohibited in about four years.

Under directives to instead produce high-efficiency storage-type water heaters using heat pumps, we expect a sudden shift in that direction in three to four years' time. This is a tremendous opportunity for our company.

Next, I would like to discuss the water heater market. The current market size is approximately 10 million units per year, with gas and electric water heaters each accounting for almost 50% of the market.

In the bar graph on the slide, the light green area is electric storage-type water heaters. This is currently the type with the greatest number of units. Heat pump water heaters have been growing a bit recently, but their share is still only that shown in dark green.

With regard to gas, light gray indicates a gas storage-type hot water heaters. Our company is focusing on the gas tankless water heaters, shown to the left of storage-type.

Currently, in the electric water heater market we sell heat pump water heaters supplied on an OEM basis. The market is still small, but we expect it to expand in the future and will focus on it.

In short, our areas of focus are gas tankless and heat pump water heaters. We confidently predict that in the future, almost 100% of the electric water heater market will be heat pump water heaters. In any case, with this opportunity at hand, we intend to do our utmost in this area.

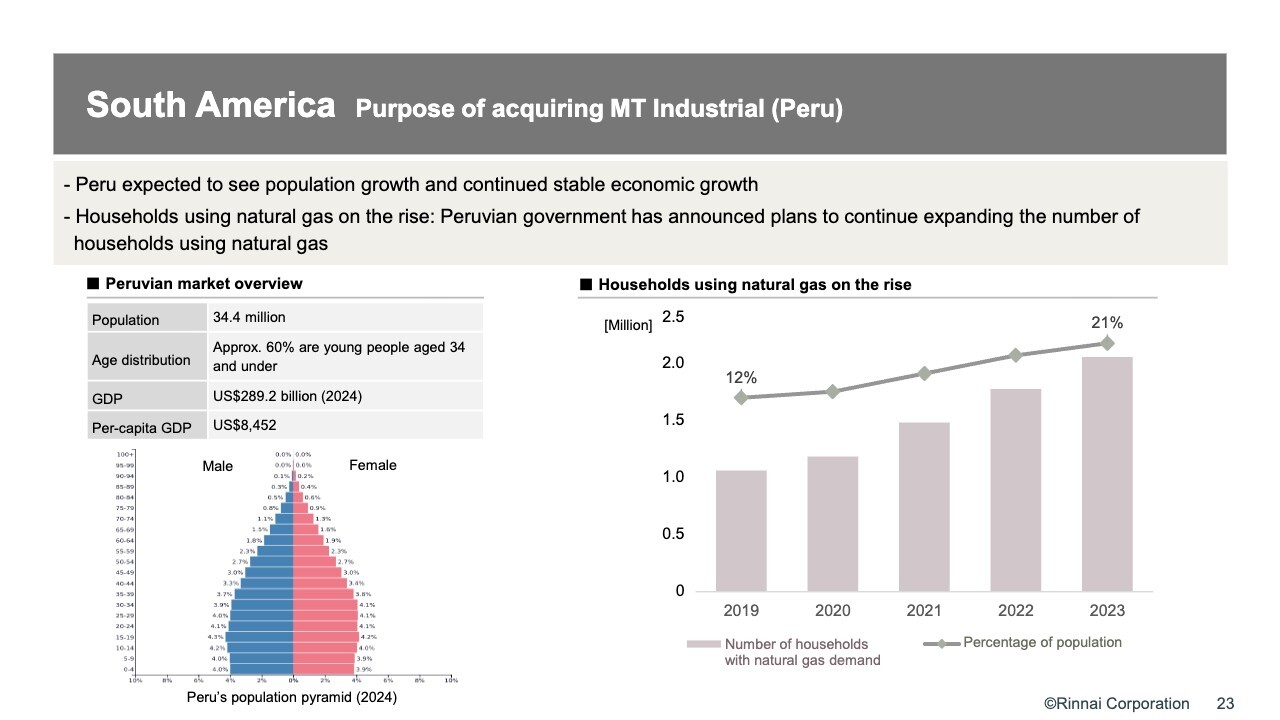

South America: Purpose of acquiring MT Industrial (Peru)

I would like to discuss the purpose of our acquisition of MT Industrial in Peru. As mentioned earlier, the number of households using natural gas is increasing in Peru.

When I was in charge of overseas affairs at the Chamber of Commerce and Industry, I met with the Peruvian ambassador when he came to Japan. At that time, the ambassador told me that Peru has only 100,000 households were connected to gas pipelines, despite the fact that the country has natural gas resources. He enthusiastically asserted that the country would expand this number to one million over the next decade, which surprised me. Peru can be expected to develop further in the future.

The Peruvian government has also announced plans to expand the number of households using natural gas.

Peru's political situation is relatively stable, making it an attractive market in this regard. The population has been gradually increasing beyond 34 million and is expected to surpass 40 million in the near future. Per-capita GDP is less than $10,000 but is expected to surpass $10,000 and even $20,000 in the future.

The number of households using natural gas is shown in the graph on the right. I believe it was prior to 2019 that I spoke with the Ambassador, but the number then had not yet reached 1 million. It has since increased rapidly, and today 21% of all households have connected gas lines. We believe this is a very promising market.

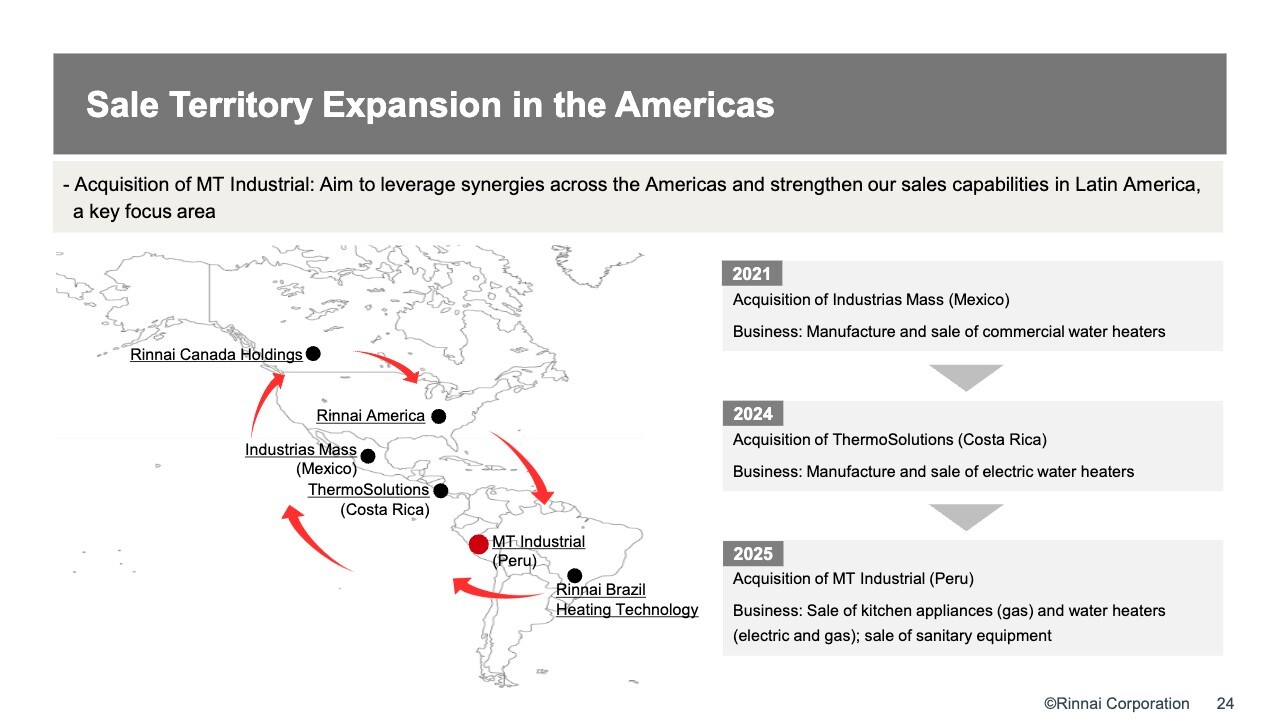

Sale Territory Expansion in the Americas

We aim to create synergies across North America and South America, as well as the Americas with Central America included, and to strengthen our sales capabilities in the priority markets of Central and South America.

The right side of the slide lists companies we have acquired. In 2021, we acquired Industrias Mass in Mexico. This company manufactures and sells commercial water heaters. In 2024, we acquired ThermoSolutions, a Costa Rican company. This company manufactures and sells electric water heaters.

In 2025, we acquired MT Industrial in Peru. The company has very strong sales force capabilities.

Our Policy in the Increasingly Challenging Chinese Market

This slide concerns the China segment market. For the time being, we assume that consumption will remain sluggish due to economic factors. Despite the severe market environment, we have maintained our income to net sales ratio through management efforts. China remains an important market for the Group.

Our direction is to maintain and promote a high-quality brand built on Japanese technology. In addition, by consolidating our business bases, we have enabled faster decision-making, which in turn allows us to strengthen fixed-cost management. We will also continue to improve management efficiency through efficient operation of Plant 2.

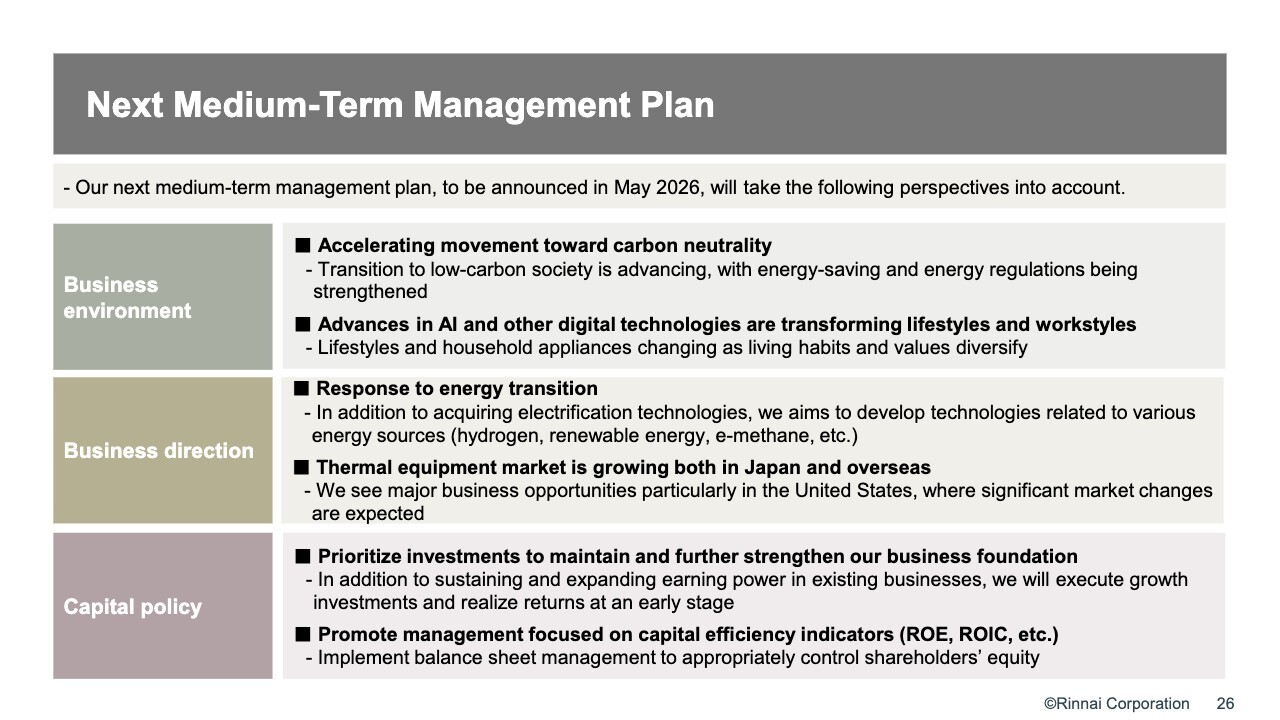

Next Medium-Term Management Plan

This slide presents our efforts as we approach the next medium-term business plan. The business environment is moving increasingly toward carbon neutrality. In developed countries and Japan, the change to a low-carbon society is progressing, and energy conservation and energy regulations are being strengthened.

The advance of AI and other digital technologies will change the way we live and work. Modes of living and values are diversifying, and lifestyles and housing equipment are changing accordingly.

Our business direction includes adaptation to changes in energy. In addition to the acquisition of electrification technologies, mainly heat pumps, we will also seek to acquire diverse energy technologies involving hydrogen, renewable energy, and e-methane.

We recognize that the thermal equipment market is expected to grow both domestically and internationally, and that the United States segment in particular represents a significant opportunity for our business, given the anticipated changes in that market.

In our capital policy, we will give priority to maintaining our business base and investing for further growth. In addition to maintaining and expanding our earning power in existing businesses, we will carry out investments for growth and seek early returns.

We will also engage in management with awareness of capital efficiency, including ROE and ROIC. We intend to implement balance sheet management and solidly control equity capital.

This concludes my presentation. Thank you for your attention.

Q&A: Improvement of income to net sales ratio in the China segment

Questioner: My question concerns the China segment. As mentioned in your presentation, net sales fell sharply by 18.7% year on year but operating income to net sales ratio improved by 1.0 points.

Regarding the composition ratio of PF2.0, what is the degree of change from the first to second quarter, and how did cost containment contribute to improvement of the income to net sales ratio?

In addition, please provide information on the current price offensive by competitors Midea and Haier.

Naito: I will first respond regarding the China segment. PF 2.0 has become quite widespread, accounting for perhaps 80% to 90% of water heaters now. This is a very high-value-added product that prevents income from falling.

A 20% drop in sales would normally cause a company to fall into the red, but PF2.0 has kept this in check. We will continue to pursue further cost reductions, and are maintaining income through such means.

On the topic of cost reductions, comparison is a little difficult as we vary and finely control items such as sales promotion expenses year to year and month to month.

In any case, we can say that the value-added effect of PF 2.0 on income improvement is considerable.

Major electrical appliance manufacturers are entering the water heater market. Their products are very inexpensive, about half our price per unit. Despite the decline in sales volume, we have been able to secure a certain level of sales and income because we are consistently generating added value.

We believe the reason for this is the strength of the brand as a high-end product. Therefore, while keeping an eye on the situation, we aim to steadily secure added value without reliance on a strategy that emphasizes volume, as is the case with major competing appliance manufacturers.

Q&A: Growth of the water heater business in the United States segment

Questioner: My question concerns the direction of growth in the U.S. market, as shown on Slide 22. The company has a large share of the gas tankless market in the U.S., together with Korean companies, and I hear that the market is promising and will grow in the future.

You noted that the company also plans to focus on electric heat pump water heaters. How large is the company’s heat pump business in the U.S. today, and how much capacity does the company have?

You mentioned that the market will expand, but I would like to hear about the company’s structure in connection to this.

Naito: First, let me address our share of the gas tankless water heater market in the United States segment. Taking the total market share of tankless water heaters to be 100%, our share is 35% to 40%.

On the other hand, the market for heat pump water heaters is still in its infancy and the market size is limited at this time. Our share of this market is still small.

Against this background, we are entering the heat pump market. We are seeking to build relationships with major distributors and volume retailers with whom we have done business in the past. We understand that some may see this as reckless, but we believe that we have a good chance of winning by offering good products.

In addition, the market is expected to grow further. The growth of the heat pump market is particularly strong in Australia, and the United States is expected to surpass that. The market is expected to expand rapidly as a result of regulations, and we assume that the expansion will be very fast.

Q&A: Impacts of the Peruvian company acquisition

Questioner: My question concerns Slides 23 and 24. You mentioned that the company has acquired a Peruvian company which has sales of approximately ¥10 billion and an income to net sales ratio of about 10%. In this connection, can you give us an idea of the size of the Mexican and Costa Rican companies that have been acquired and the pace at which they have grown since?

Naito: Regarding the acquisition in Peru, the similar name creates a complication, but Industrias Mass in Mexico engages in gas instant-type water heaters for commercial use. This is a very small company, with sales ranging from ¥1 to ¥2 billion.

The same is true for ThermoSolutions in Costa Rica.

Regarding MT Industrial in Peru, the company has sales of ¥10 billion and we believe will contribute immediately to our business. To further enhance synergies, we plan to strengthen overall relevance by promoting technological exchanges with Industrias Mass, which has water purifier and water technologies.

Q&A: Factors behind the upward swing in operating income in the first half, and conditions by region

Questioner: You have explained strategy in detail, but I would like to ask Managing Executive Officer Ogawa a numbers-related question.

Regarding operating income for the first half of the fiscal year, sales were in line with plans while income rose, which I think can be attributed to sales of high-value-added products and to cost reductions.

However, is this mainly in Japan or are there differences from plans in other regions, too?

Should this upturn in income be viewed as "savings" against the full-year plan, or is it a new cause for concern?

I would like to have these figures sorted out.

Takuya Ogawa (hereinafter "Ogawa"): My name is Takuya Ogawa, Managing Executive Officer and Chief of the Corporate Administration Headquarters. I will respond first about Japan, mainly with regard to plans in terms of income. We had a very difficult start to the first quarter, but recovered considerably in the second quarter, and as a result, income in Japan exceeded our plan.

Overseas, the Australia segment exceeded plans the most and made a considerable contribution.

In the United States segment, we had set first half plans conservatively, and results exceeded plans.

In the China segment, income was very severe compared to the previous year. However, as we had incorporated considerably severe conditions into plans at the beginning of the period, income slightly exceeded plans.

Questioner: I understood that you the full-year forecast is left unchanged due to strong performance in Japan and in other regions.

Q&A: Factors behind second quarter strong performance in Japan and the outlook for the second half and beyond

Questioner: This overlaps somewhat with the previous question, but could you reiterate the factors behind the strong second quarter in the Japan market? Also, please tell us your thoughts on the second half of the fiscal year and beyond.

Regarding the second quarter, I understand that response to the recall was still ongoing. Is it correct to understand that, despite this, fixed cost reductions had an effect in achieving solid numbers in the second quarter?

Also, please summarize your thoughts about Japan from the second half of the fiscal year to the next fiscal year, with regard to the possibility of further improvement in business performance from the second half as response to the recall reaches an end.

Naito: Regarding the details of the strong performance in the second quarter, sales in Japan were favorable. Overseas sales varied from region to region, but were slightly stronger overall. We believe that the combination of these two strong performances allowed us to generate steady income.

In addition to large markets such as the United States segment and China segment in particular, the Indonesia segment, the Taiwan segment, recently the Australia segment, and other regional segments are doing well and are earning steady income. This is a very significant factor. We believe that the combination of these factors led to the second quarter results. Is there anything else you would like to add?

Ogawa: In the first quarter, the recall put considerable pressure on income. However, in the second quarter, we reviewed our fundamental approach to the recall response and adopted a policy of streamlining and minimizing response as much as possible.

In addition, although not directly related to the recall, we implemented other emergency measures such as cost reductions throughout Japan, which we believe led to improved income in September.

Q&A: Target for operating income to net sales ratio in the United States segment

Questioner: I would like to ask you about the approach to operating income to net sales ratio in the United States segment. I remember that at a previous briefing, President Naito indicated a target along the lines of at least 5%.

At this point, taking into account the impact of tariffs and cost pass-through, to what level do you hope to raise the operating income to net sales ratio at the end of this fiscal year and in the next two fiscal years, and what is your sense of that target?

Naito: I am not satisfied with the fact that the operating income to net sales ratio in the United States segment has not reached 5%. However, the market environment in the U.S. continues to evolve rapidly.

As an example, we earlier faced a very serious problem with a water heater that we were producing in the market, which could have halted sales. This was due to very unfair counting practices in efficiency calculations.

Simply put, regulations were about to pass that would okay inefficient water heaters but disallow our regular, efficient water heaters. Regarding this matter, the transition to the Trump administration worked in our favor, enabling us to have the issues addressed.

I think the United States segment market will continue to change, and it is indeed moving in major ways. We are engaging in sales under these conditions and, while there are many unclear and uncertain points, we see the future changes in the market for heat pump water heaters as a great opportunity and are committed to results.

Meanwhile, high-efficiency gas water heaters and standard water heaters produced locally in the U.S. still have potential for growth. We intend to nurture these carefully as well.

We are aiming for a double-digit income to net sales ratio, but will first pursue 5%.

Questioner: I see. If I may ask one more question, am I correct in understanding that in Japan, response to the recall will normalize from the third quarter onward, so only positive elements will be reflected in results?

Ogawa: Currently, we have 350 employees dealing with the recall, but as President Naito mentioned, we are moving forward with plans to conclude our in-house response by the end of December. Therefore, we believe that the third quarter will be on the same scale as the second quarter, but the burden will clearly be less in the fourth quarter.

Q&A: Impacts of the deteriorating business environment in the United States segment

Questioner: Looking at the financial results of other home improvement companies, the business environment in the U.S. is deteriorating. Specifically, consumers are tightening their purse strings in remodeling and other situations. Is it correct to say that your company has not been affected so much by the deterioration in consumer sentiment, given high replacement demand?

Naito: We always hear "the market is not so good" from our U.S. subsidiary As our company’s income to net sales ratio is 2% or 3% we’re in no position to talk big, but I don’t think conditions are all that bad.

The truth is that, with question marks hanging overhead amid an uncertain outlook, we are moving forward.