Executive Summary

Masataka Fujiwara: I am Masataka Fujiwara, President of Osaka Gas. Thank you for joining us for this briefing on the financial results for the second quarter of the fiscal year ending March 2026 (FY2026.3). We greatly appreciate your continued support and understanding as we pursue our business objectives.

I will be referencing the slides from the Financial Report for the Second Quarter of FY2026.3, which are available on our website.

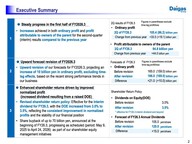

Please turn to page 2. I would like to highlight three key points.

First, regarding our second-quarter financial results: The positive momentum from the first quarter has carried through, with ordinary profit increasing by 33.5 billion yen to reach a total of 105.4 billion. Additionally, ordinary profit excluding time-lag gains and losses also saw an increase, rising by 19.1 billion yen to 86.2 billion. We view these results as an indicator of our relatively strong performance.

Second, we have revised our full-year earnings forecast upward. Alongside the robust performance in the second quarter, we anticipate that this positive trend will extend into the second half of the fiscal year. Consequently, we have raised our full-year ordinary profit forecast by 21 billion yen, from 165 billion to 186 billion. Similarly, the forecast for ordinary profit excluding time-lag effects has been revised upward by 10 billion yen, from 159 billion to 169 billion.

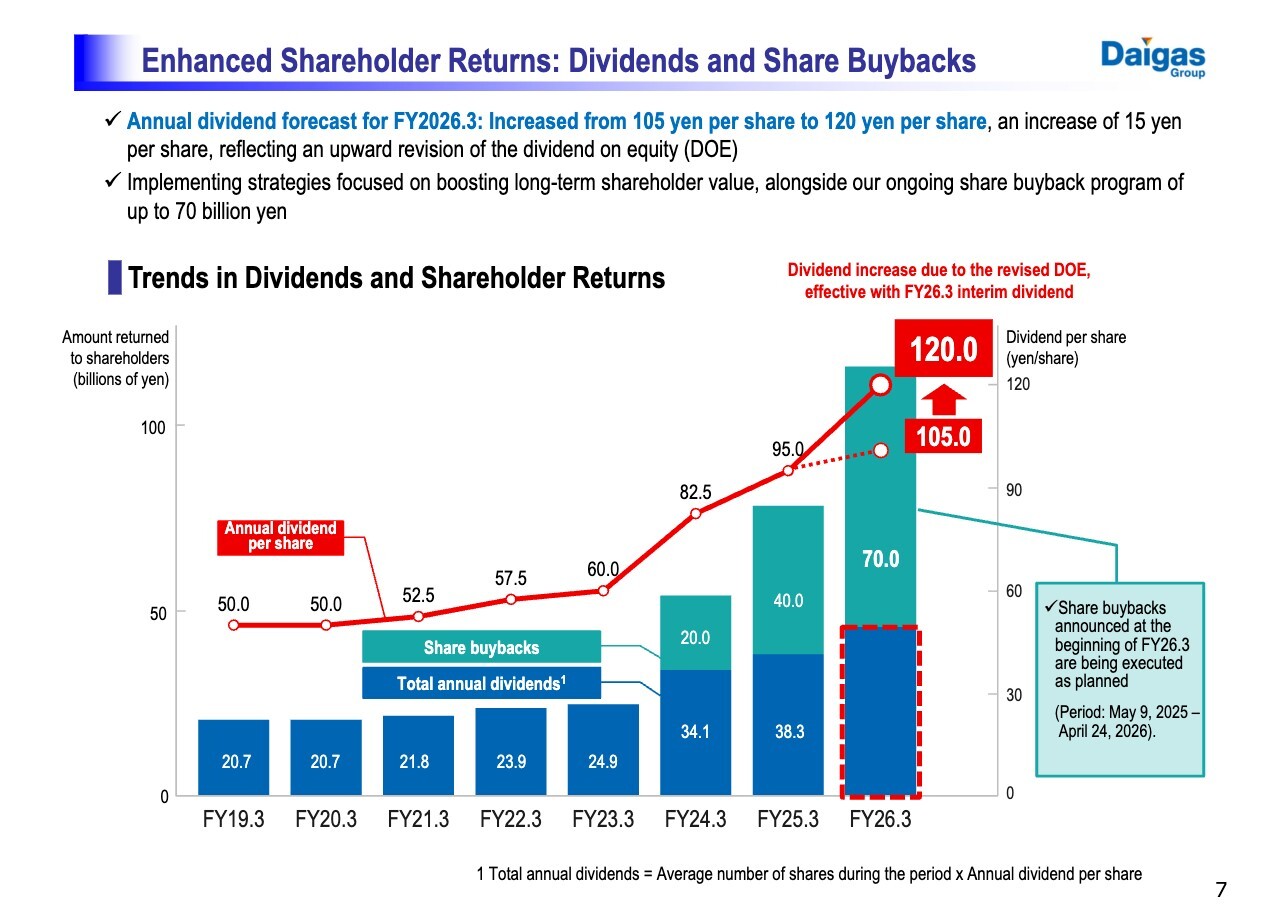

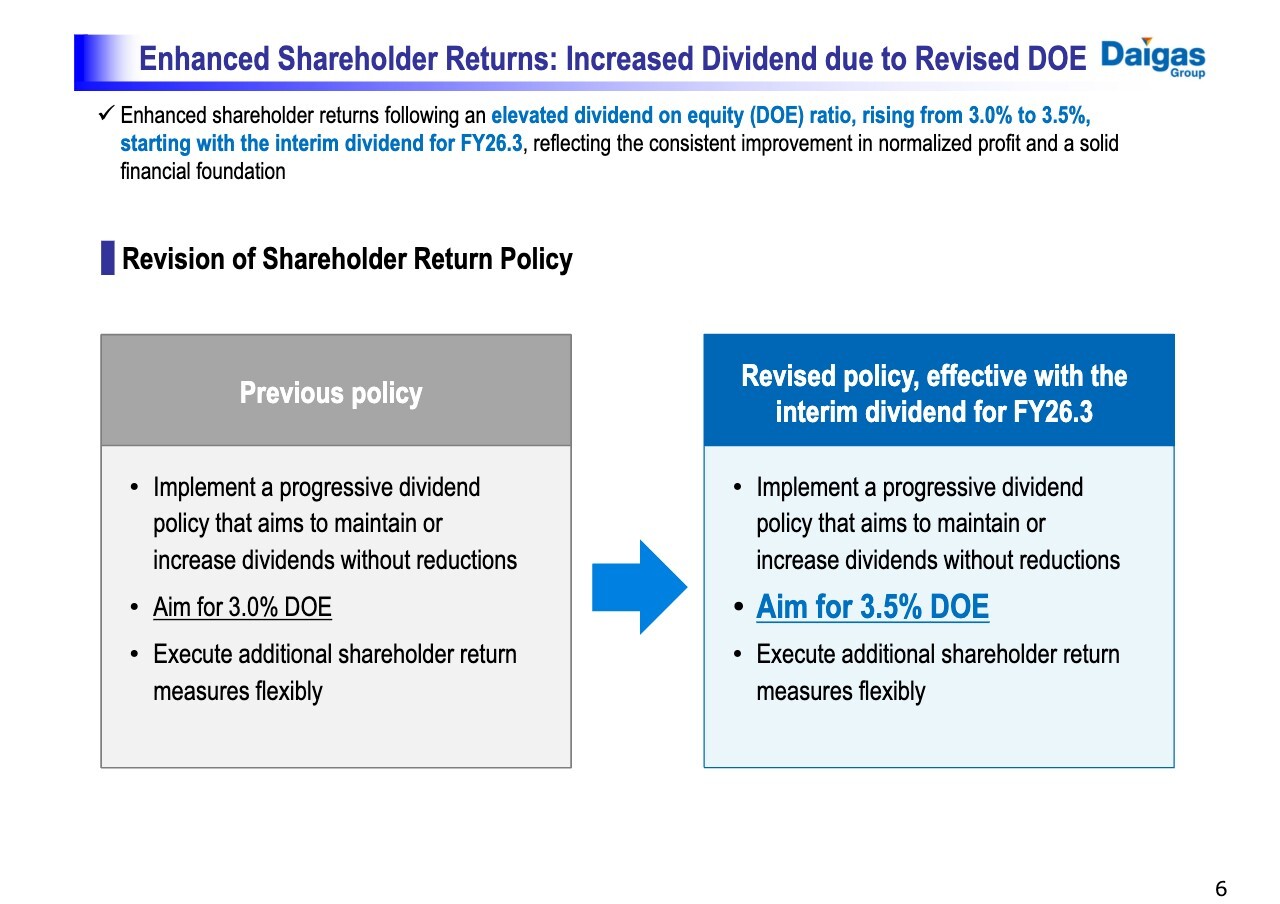

Third, we conducted a thorough review of our profit trends and future business outlook. This assessment was conducted in light of our strong ongoing performance since last fiscal year and our current position halfway through our three-year Medium-Term Management Plan. Based on this analysis, we believe that normalized profit is steadily improving. Considering this, we have increased the dividend on equity (DOE) from 3.0% to 3.5% under our shareholder return policy, beginning with the interim dividend for FY2026.3. Additionally, we have raised our annual dividend forecast from ¥105 to ¥120 per share for the current fiscal year.

Next, I will outline the initiatives we are implementing to enhance our corporate value, which played a key role in our decision to revise our shareholder return policy.

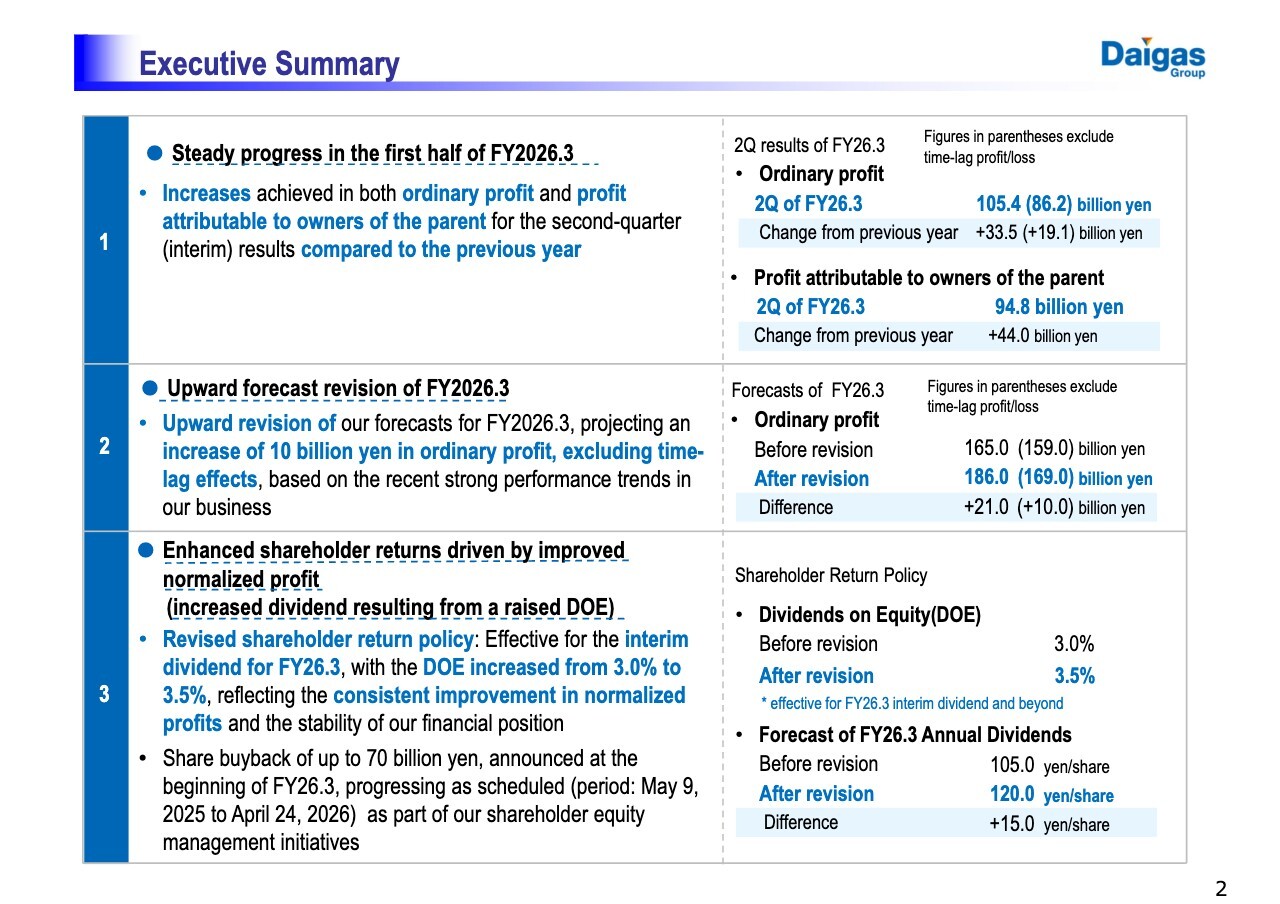

Improved Normalized Profit during the Current Medium-Term Plan

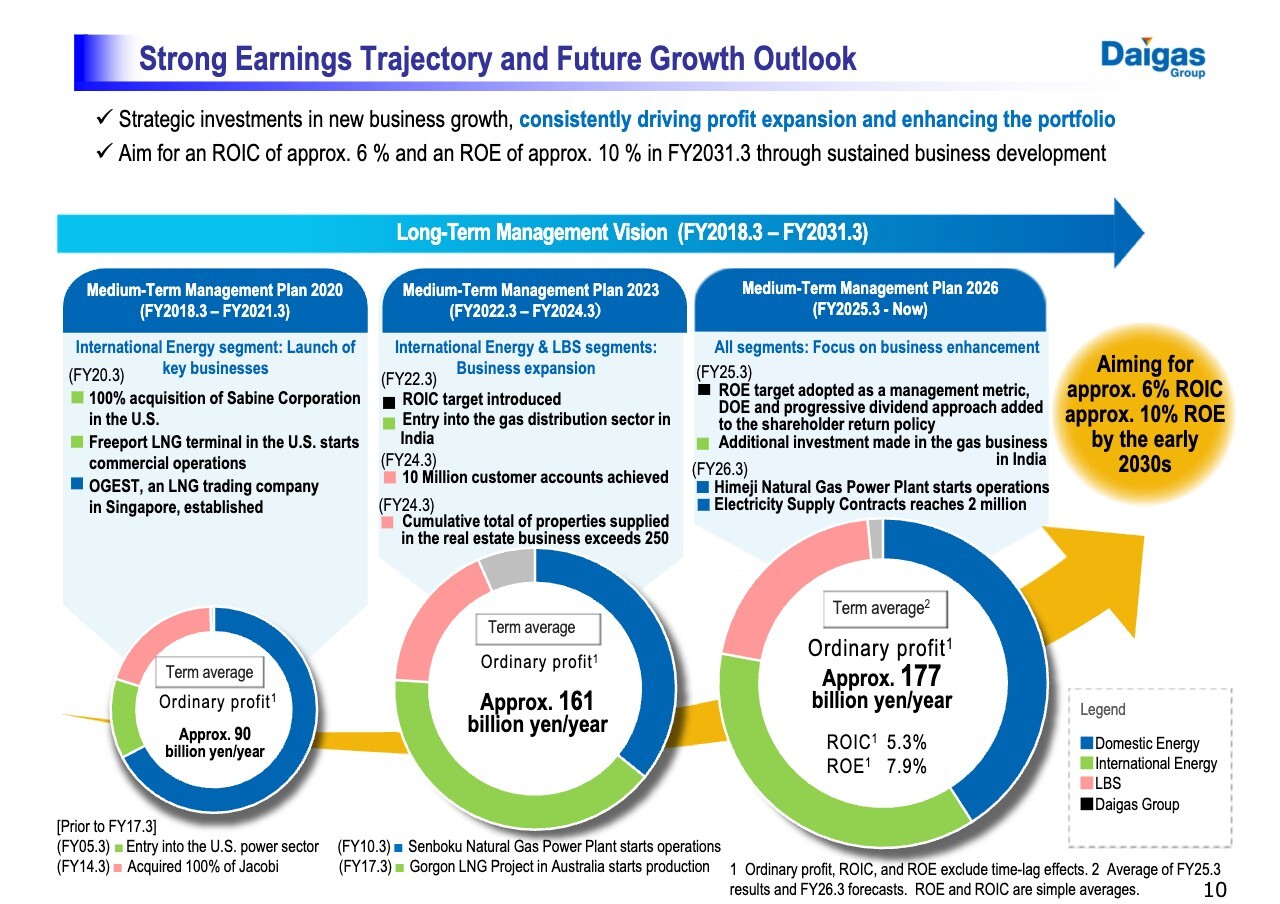

We are focused on enhancing our profits and managing shareholders’ equity. As part of our current Medium-Term Management Plan, we have set ambitious targets: achieving a return on invested capital (ROIC) of 5% and a return on equity (ROE) of 8% by the fiscal year ending March 2027 (FY2027.3), alongside an ordinary profit goal of 200 billion yen by the fiscal year ending March 2031 (FY2031.3).

To meet the objectives of the Medium-Term Management Plan by FY2027.3, we recognize the need to increase profits beyond our initial projections, given our current level of shareholders’ equity. Further details and a visual representation of this strategy can be found on the following page.

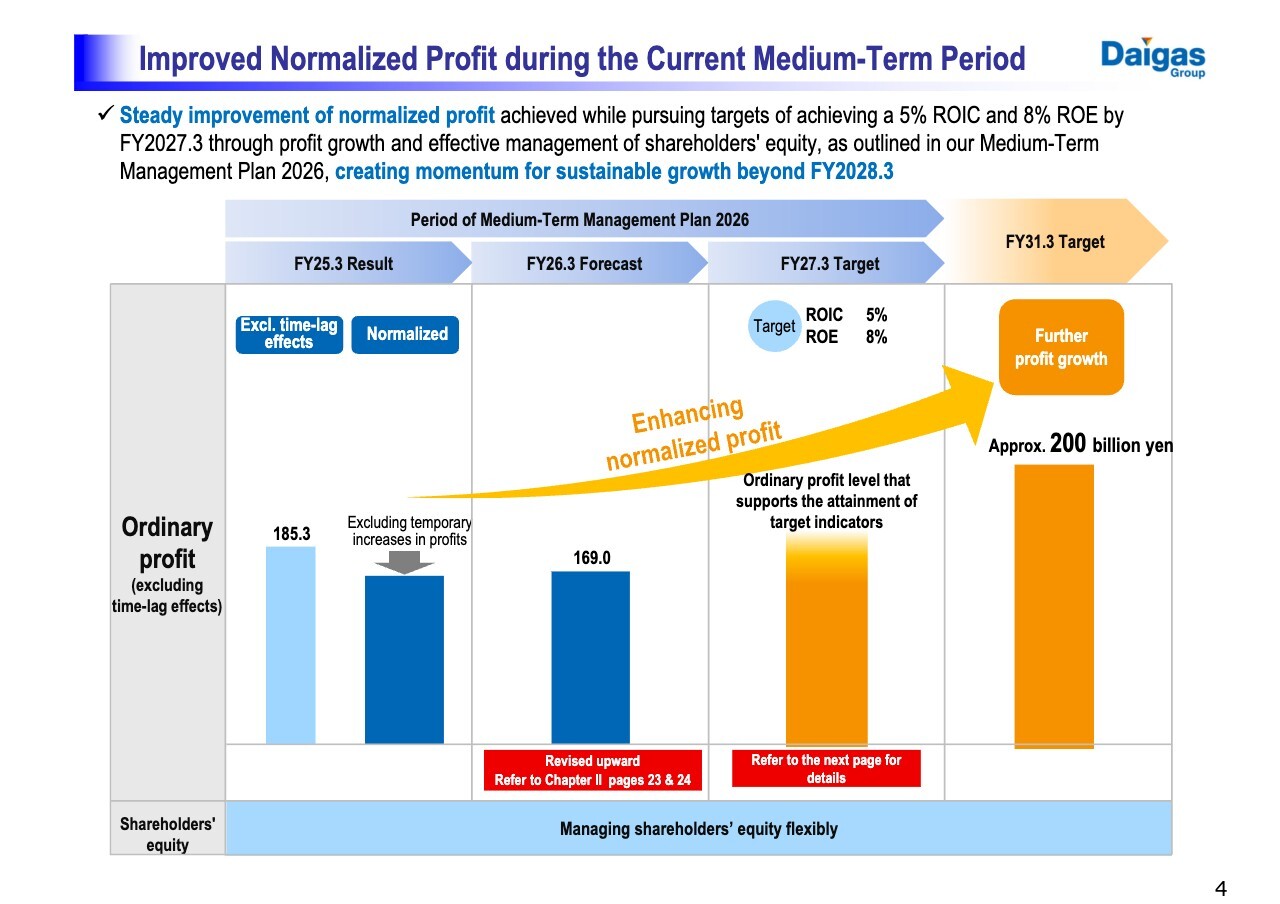

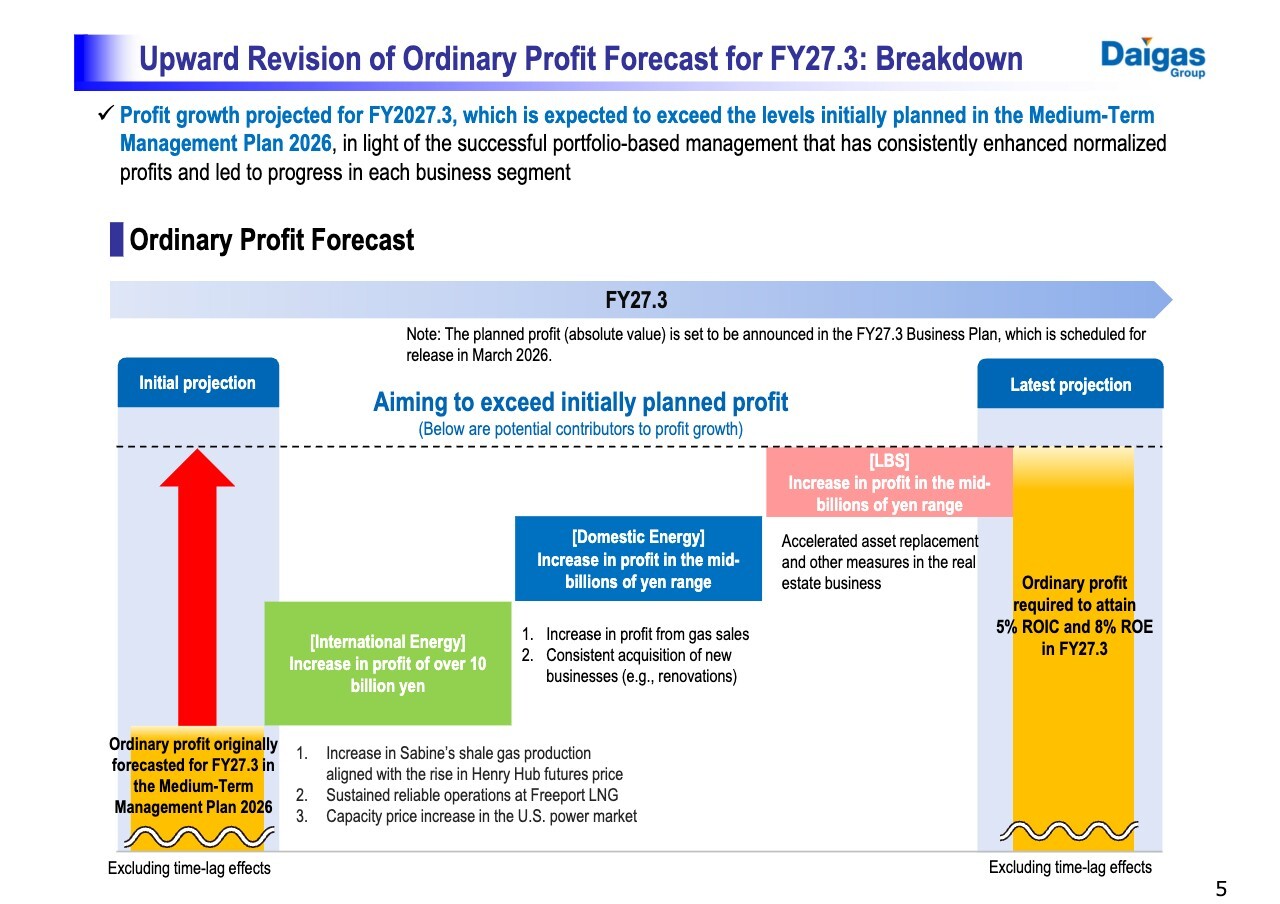

Upward Revision of Ordinary Profit Forecast for FY27.3: Breakdown

As illustrated in the graph on the slide, we aim to achieve profit growth across each segment that surpasses our initial projections outlined in the Medium-Term Management Plan.

In the International Energy segment, Sabine is ramping up production in its shale gas operations, taking advantage of the recovery in Henry Hub futures prices. Furthermore, Freeport LNG has reached a stable operational status following its recent recovery to normal state. In July, the capacity price in the U.S. PJM market increased by roughly 20% compared to last year's levels, which will positively affect our results for the second half of FY2027.3.

If the current market and operating conditions persist, we anticipate that profits in our U.S. businesses could rise by over 10 billion yen.

Additionally, our businesses in both Domestic Energy and LBS segments are expected to contribute significantly to profit growth, each adding mid-billion-yen increases. In the Domestic Energy segment, we foresee an increase in profits from gas sales and a steady acquisition of new ventures. Meanwhile, the LBS business is expected to experience accelerated asset replacement within the real estate sector.

Through these strategic initiatives, we are committed to achieving the objectives set forth in our Medium-Term Management Plan and sustainably enhancing corporate value in alignment with the medium- to long-term growth scenarios, which we will detail later.

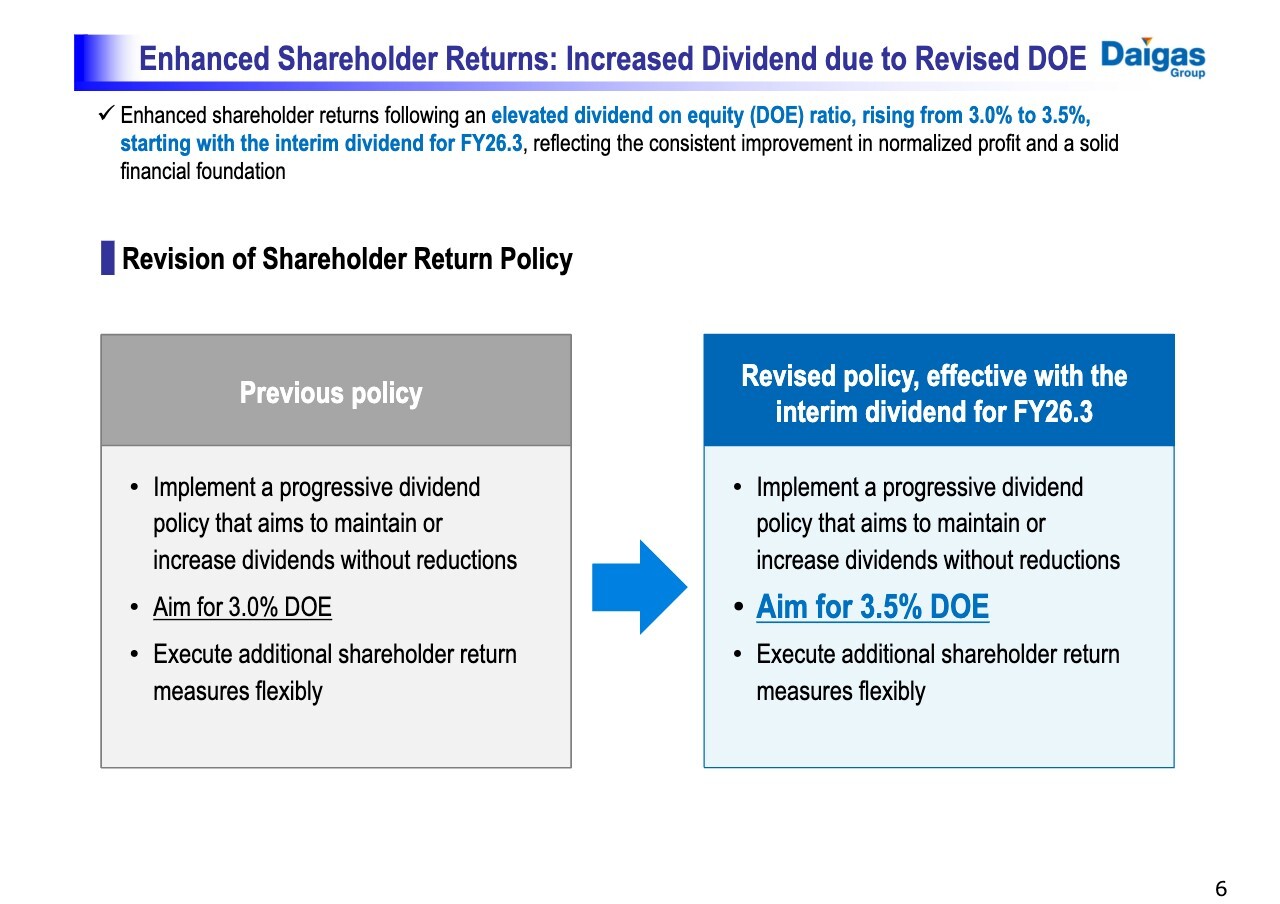

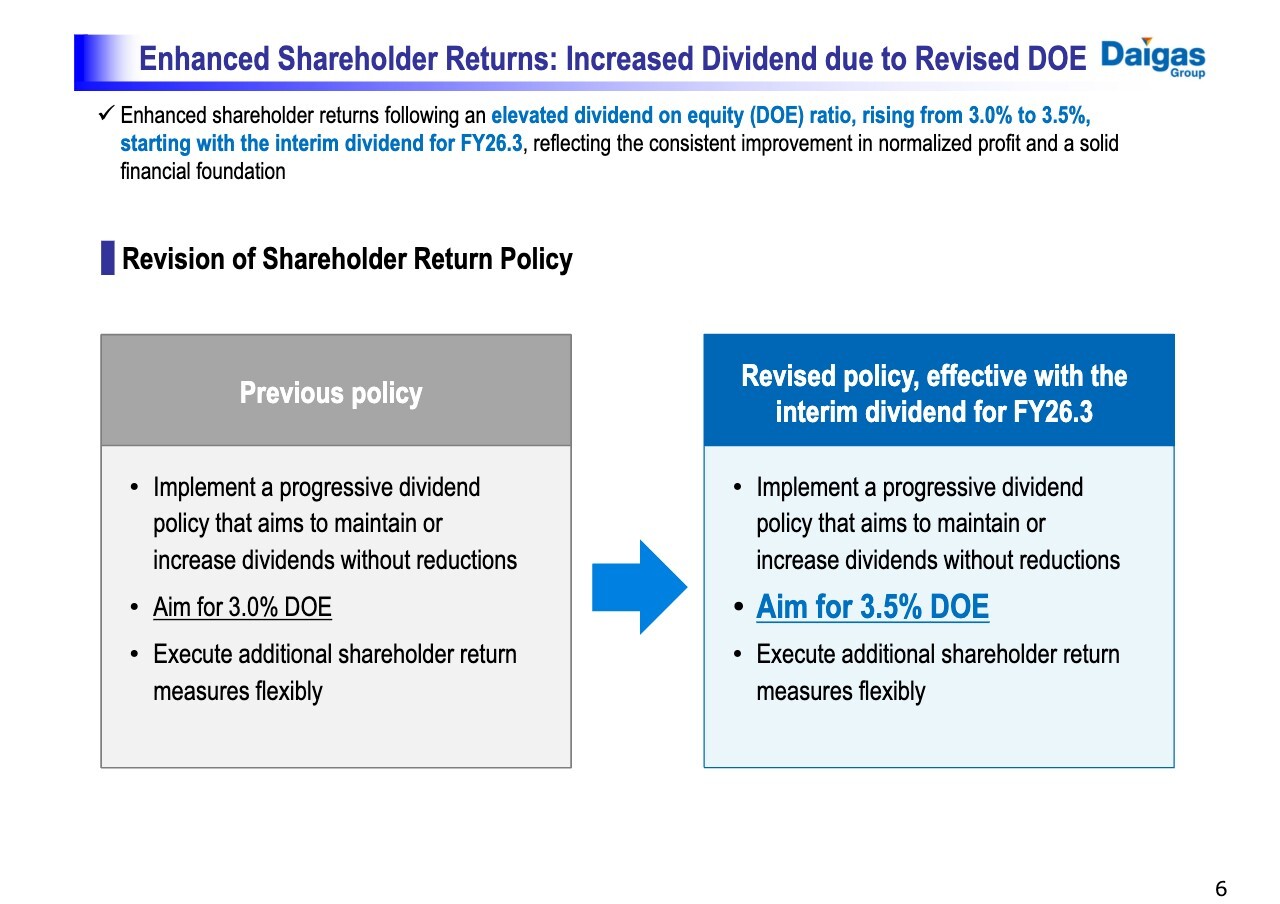

Enhanced Shareholder Returns: Increased Dividend due to Revised DOE

In light of our continued improvement in profitability and the stability of our financial foundation, we have made the decision to increase DOE from 3 percent to 3.5 percent, starting with the interim dividend for FY2026.3.

Enhanced Shareholder Returns: Dividends and Share Buybacks

As a result of the increased DOE, we have revised our annual dividend forecast for the current fiscal year upward by 15 yen, raising it from the previous estimate of 105 yen to 120 yen.

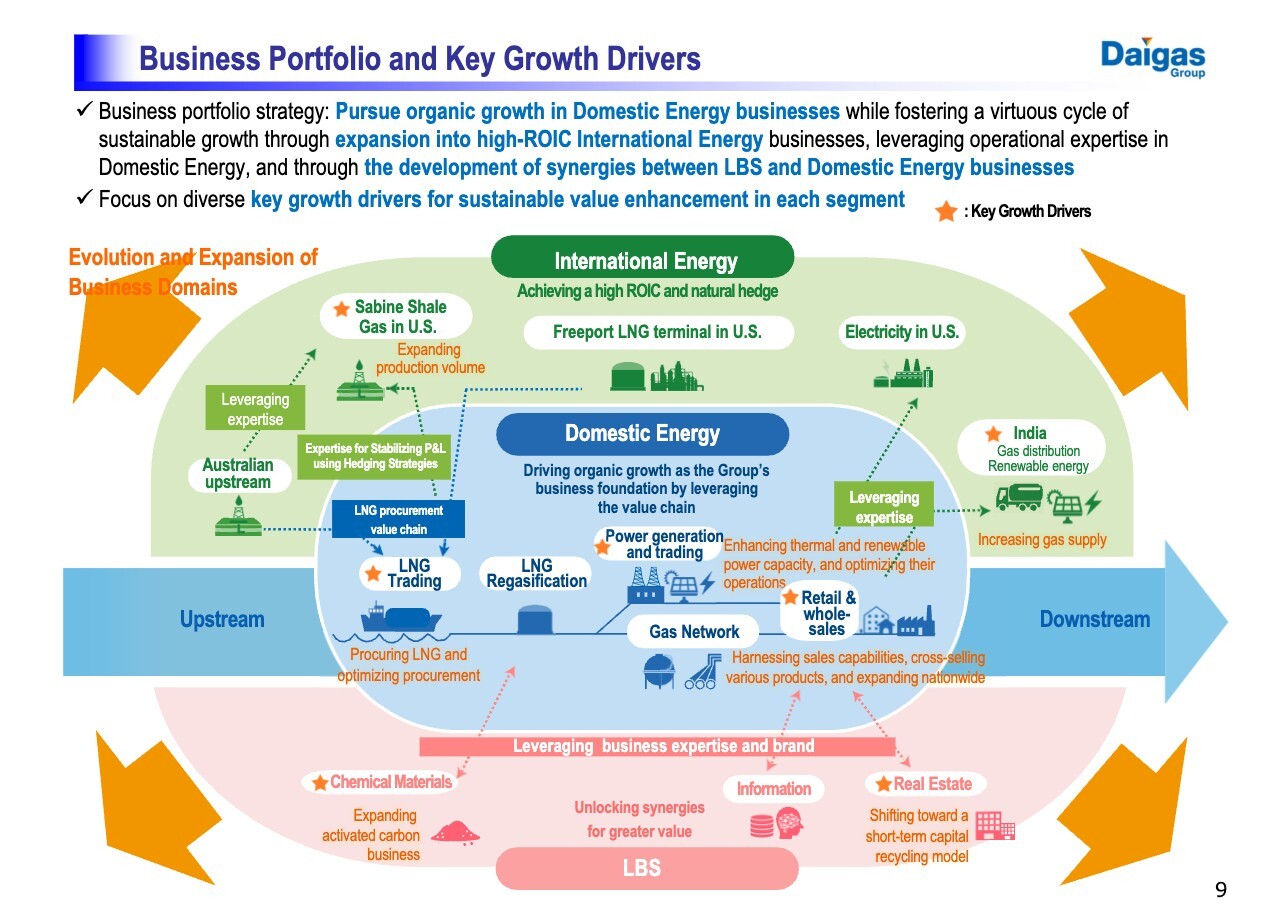

Business Portfolio and Key Growth Drivers

Starting from page 8, we will delve into our medium- to long-term growth scenarios.

Unlike some manufacturers who can easily expand globally with signature products, our energy and related businesses face a more complex situation if we aim for growth. Due to the diversification of our operations, it has become essential to articulate the distinct qualities of our various businesses, as there may be concerns about our ability to clearly convey our strengths and potential growth trajectories.

To address this, I will outline the positioning of each segment and business, the market environments we operate in, and our business strengths and synergies in a more cohesive manner.

Please turn to page 9, which offers an overview of our business portfolio. While we engage in a diverse range of operations, our business expansion is not random; rather, we are strategically leveraging the infrastructure, brand strength, expertise, and human networks of our existing businesses.

We have focused on markets with anticipated growth, exploring neighboring businesses and adjacent areas, which have enabled us to enhance our capabilities and market presence through a process of trial and error. This approach remains a cornerstone of our strategy.

For instance, in our domestic power business, we are creating a competitive value chain that fully utilizes our synergies, such as LNG trading, gas-fired power generation near LNG regas terminals, and our customer retail touchpoints. Additionally, we pursue opportunities in renewable energy and storage battery solutions. Our domestic power business positions us to aim for organic growth.

Our LBS businesses may seem disconnected from our energy operations, but they originated from our previous gas business. We established a real estate business using unused land, a materials business utilizing gasworks technologies, and an IT business from our billing system development. By leveraging our brand and network for sales channel expansion, along with our financial strength for strategic M&A, we now have three core operations in the LBS segment, each generating profits of around ¥10 billion.

In the International Energy segment, we leverage the expertise developed within our Domestic Energy businesses. Through rigorous training, we have cultivated international business talent, which has enhanced our presence in various countries. As our roster of global professionals and group companies has expanded, the International Energy segment has become a significant contributor to our overall profitability.

Our diverse business growth has enabled us to implement effective strategies that reinforce the Group’s operational stability. This includes a comprehensive optimization of power and LNG procurement, as well as capitalizing on natural hedging between our overseas upstream gas operations and domestic energy businesses. Furthermore, the expansion of our business domains has opened up opportunities for sharing best practices, cultivating interdepartmental collaboration, pursuing joint proposals for customers, and cross-selling products and services across the Group.

We have fostered our growth in a manner that encourages cooperation across the entire Group while allowing each business to thrive autonomously, ensuring that we succeed through synergies among the Group’s various operations.

On the next page, we will present the evolution of profits as we propel these growth initiatives forward.

Strong Earnings Trajectory and Future Growth Outlook

As we expand our business domains, we have embraced management indicators such as ROIC and ROE to guide our investments for growth and fortify our business foundation. This strategic approach has proven effective, providing us with a strong outlook for achieving consistent growth in ordinary profit, excluding time-lag gains and losses, throughout the current Medium-Term Management Plan period.

Domestic Energy—Retail and Wholesale: Residential, Commercial, and Industrial Sectors

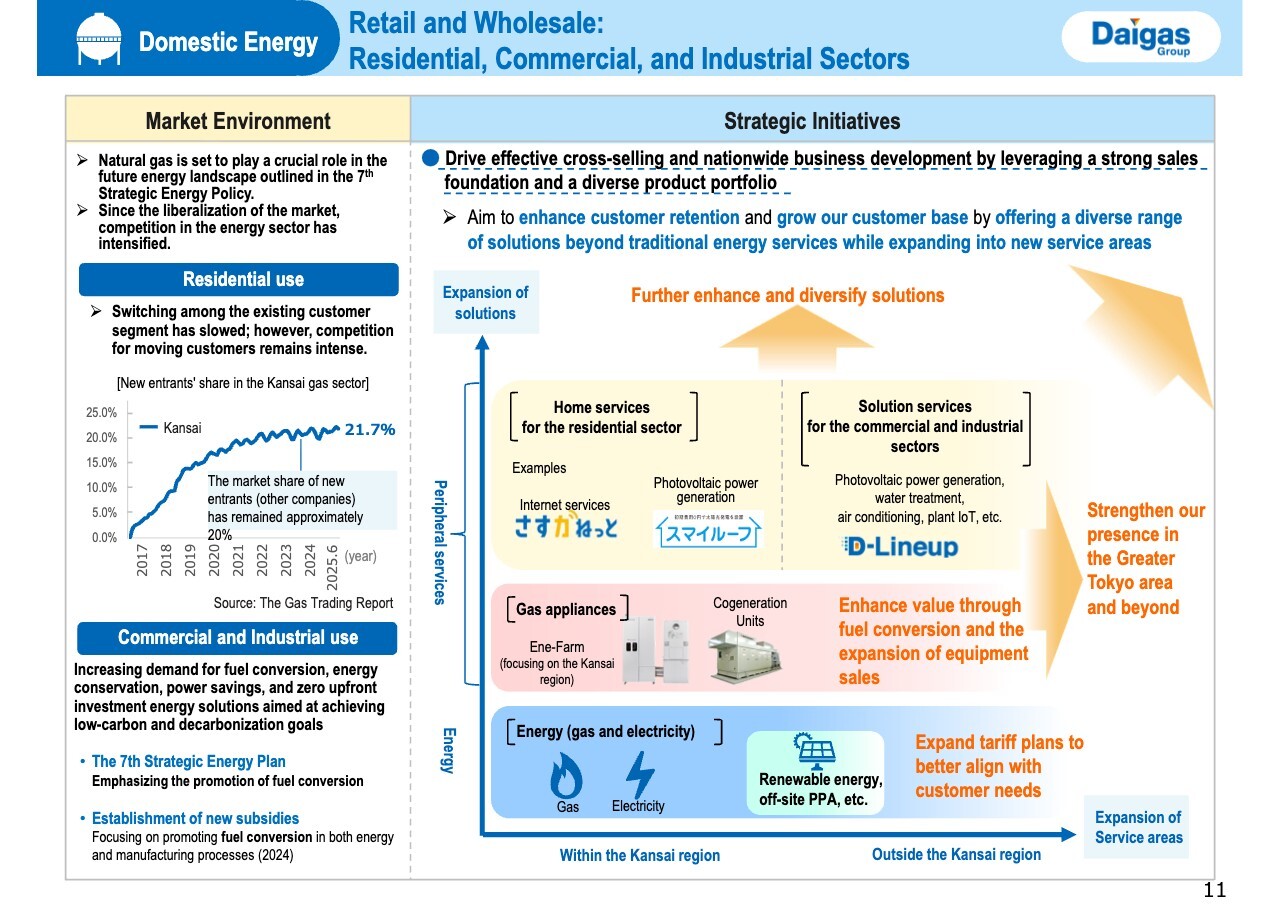

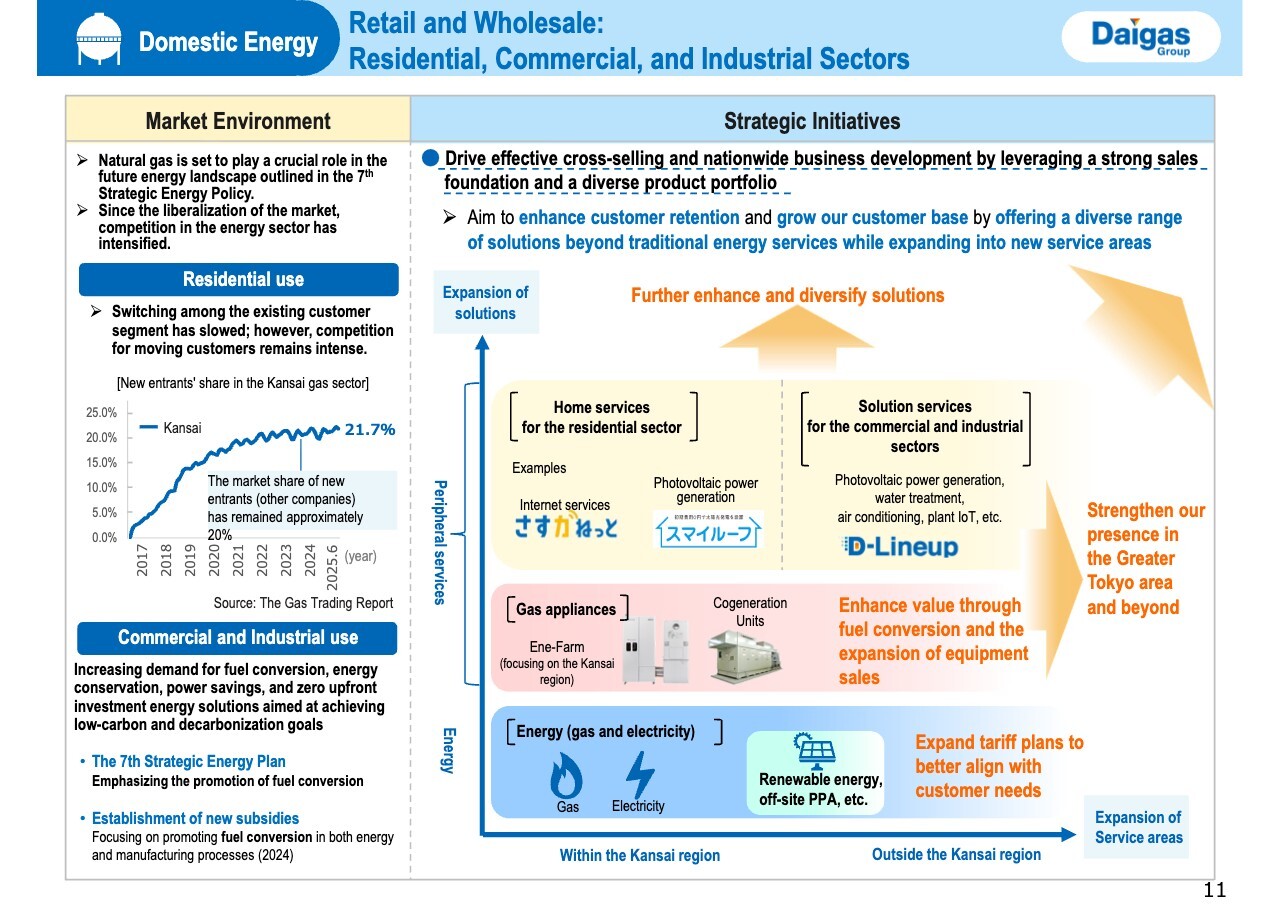

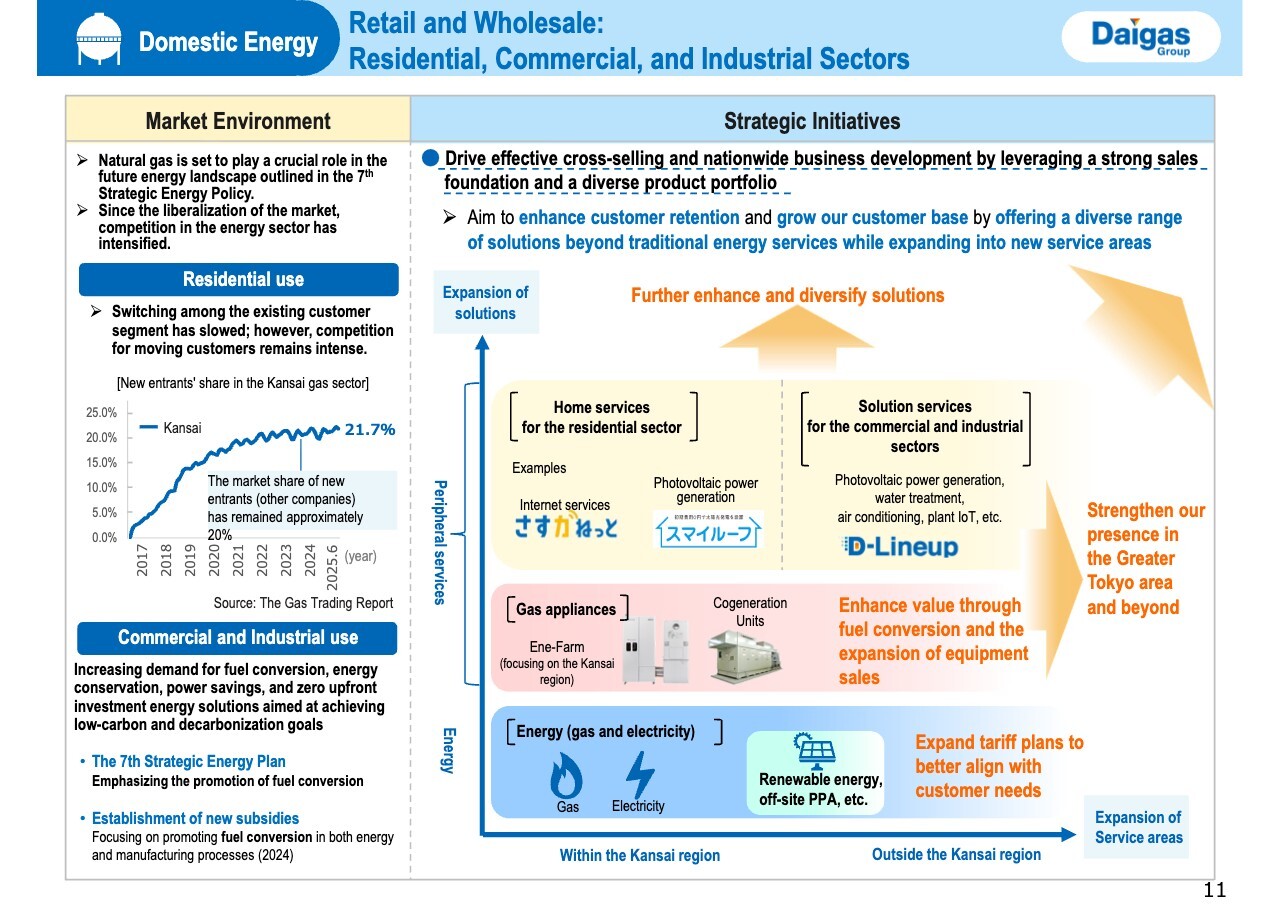

On page 11, we will discuss the key growth drivers for each segment, as indicated with stars, in relation to our business structure outlined on page 9, focusing on the market environment and our strategic initiatives for each driver.

First, let's explore the Domestic Energy business. In alignment with the Seventh Basic Energy Plan that recognizes natural gas as a crucial energy source for the future, we are focused on the gas business by capitalizing on our robust sales base and diverse product offerings to enhance cross-selling opportunities and extend our reach nationwide.

In the residential sector, the primary focus is maximizing our existing customer base. We are leveraging our advantage of regular engagement with customers to introduce a variety of home services beyond gas and electricity. This approach aims to strengthen customer contract retention and grow our overall customer count.

In the commercial and industrial sectors, we strive to provide higher added value by delivering low-carbon and decarbonization solutions, as well as labor-saving innovations and other services to customers.

Additionally, we are expanding our area coverage into the Greater Tokyo area and other regions to drive further business growth.

Domestic Energy—Power Generation, Power Trading, and LNG Trading

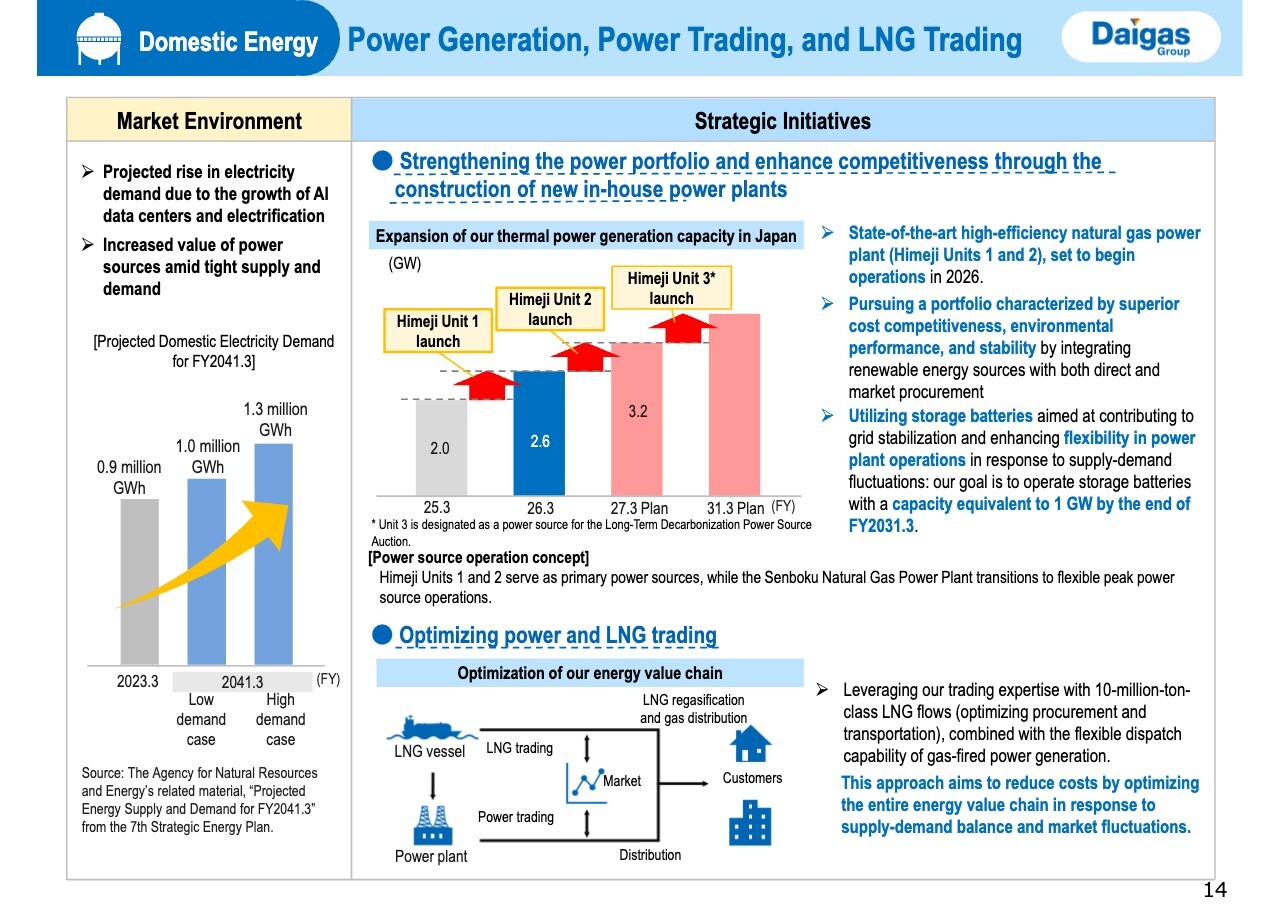

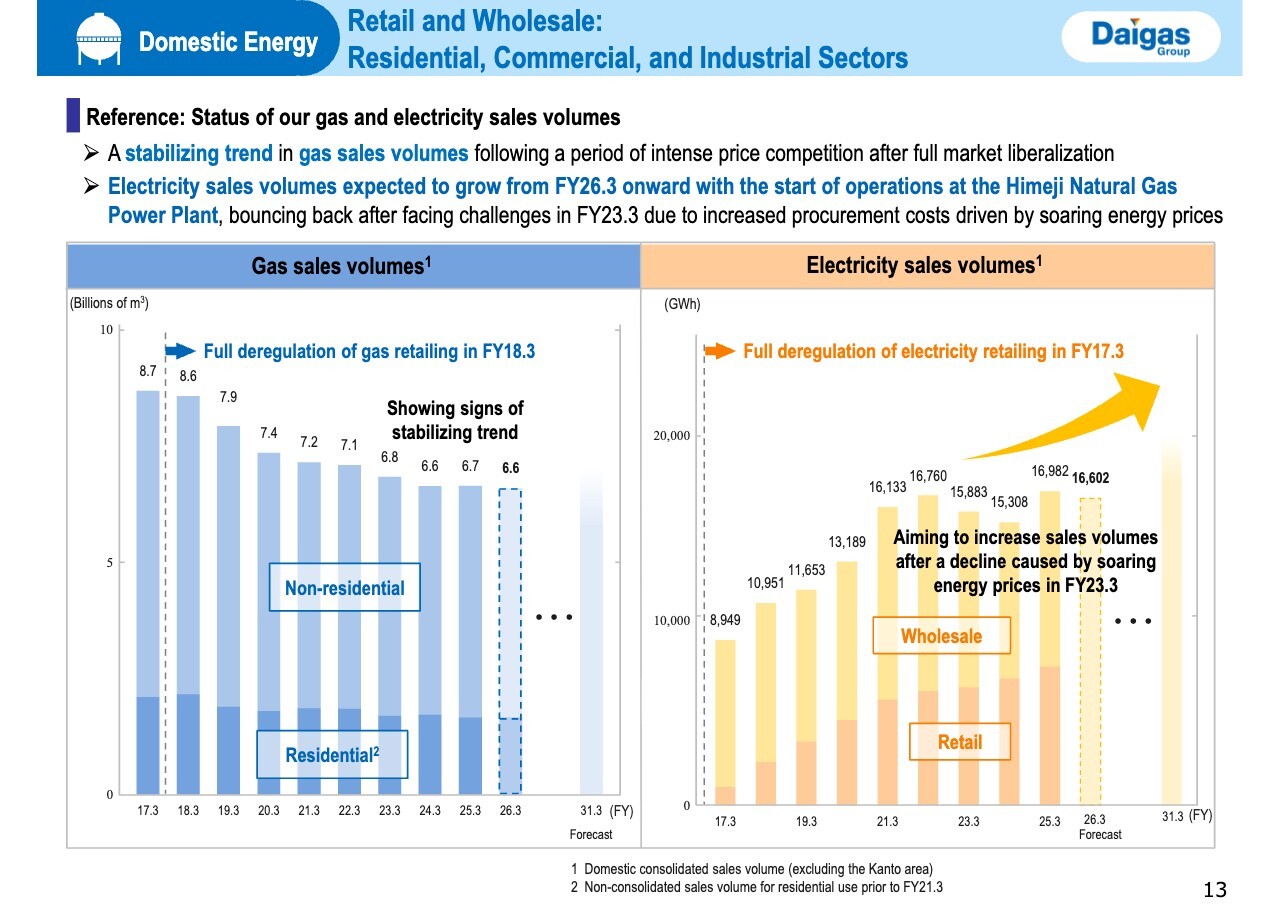

Following our overview of the gas business, I would like to discuss our electricity business, which has increasingly become a key pillar in the Domestic Energy segment. Domestic electricity demand is on the rise, driven by the growth of AI data centers and the expanding trend of electrification.

To meet this demand, we plan to commence operations at the Himeji Natural Gas Thermal Power Plant Unit 1 in January 2026, followed by Unit 2 in May. This development is expected to enhance our domestic power supply capacity by 1.2 GW, allowing us to significantly increase our electricity sales.

Moreover, as part of our strategy to manage the entire electricity and gas value chain, we will actively engage in electricity and LNG trading according to supply-demand dynamics as well as market prices to maximize profits. We aim to capitalize on price differentials in the electricity and gas markets to drive effective monetization.

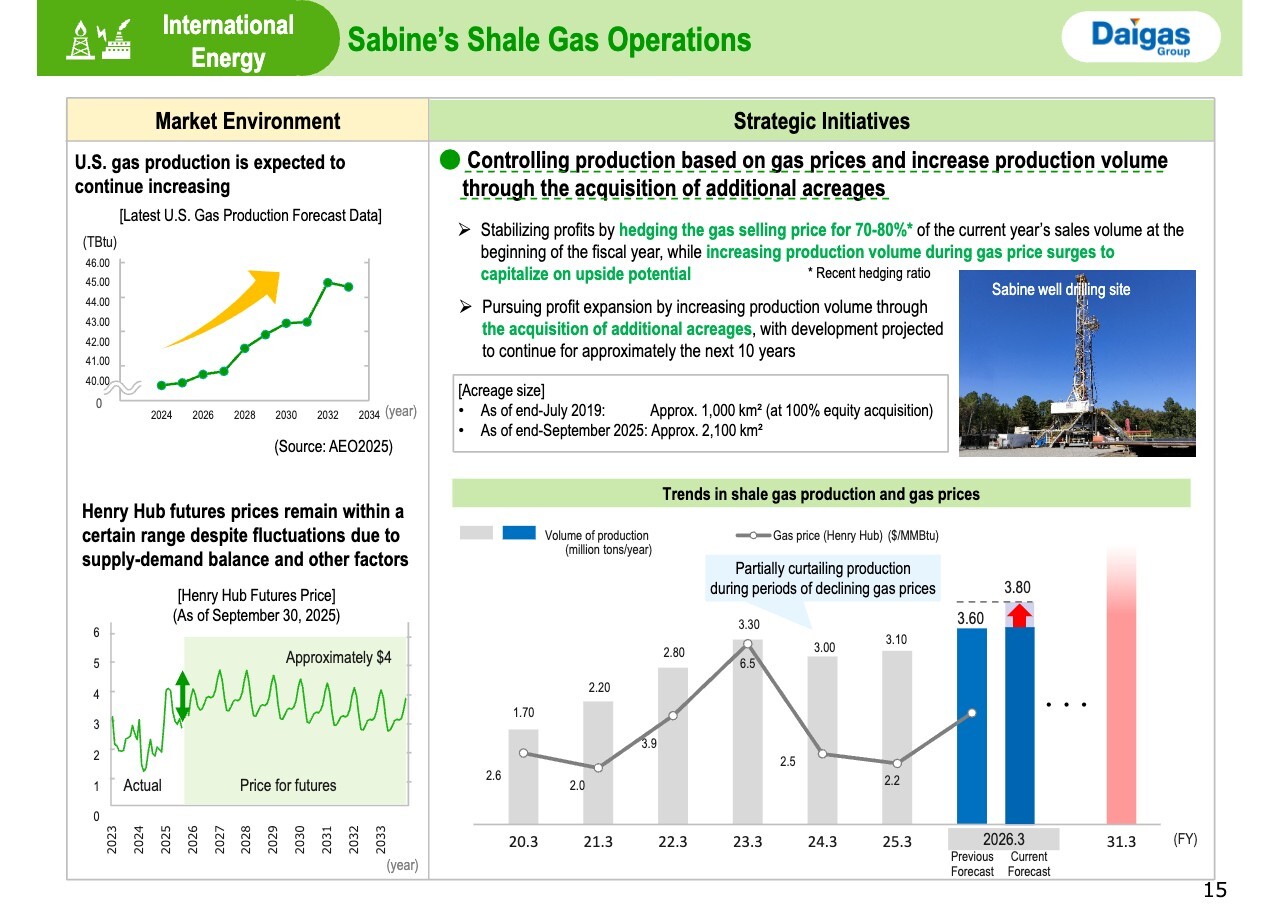

International Energy—Sabine’s Shale Gas Operations

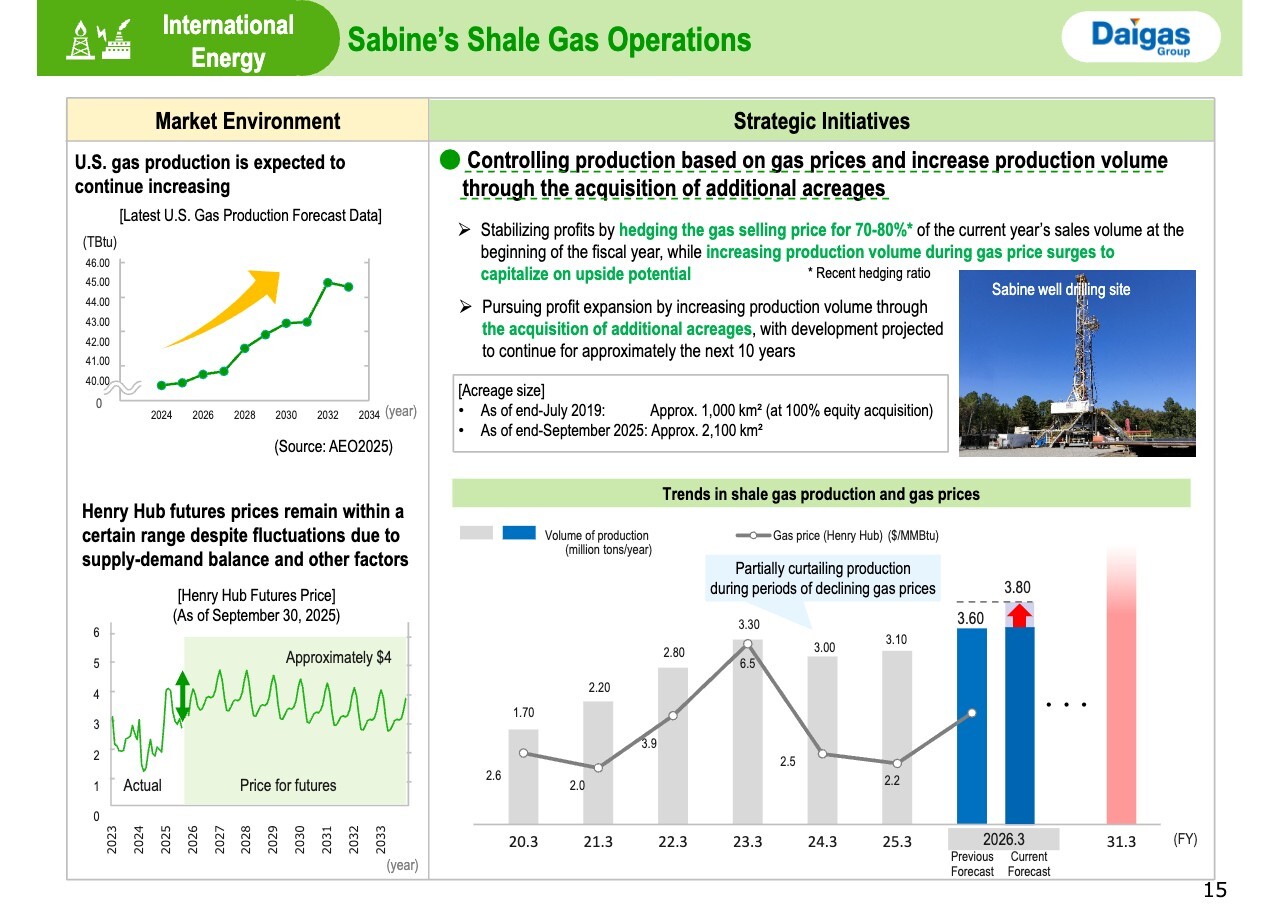

Next, I would like to discuss our International Energy business, which is continuously expanding. In the United States, we anticipate sustained high demand for natural gas, driven by growing LNG exports and rising electricity consumption.

In our shale gas operations, Sabine has successfully implemented hedging strategies that fix selling prices, enabling us to secure stable cash flow even during periods of low Henry Hub prices.

Additionally, we are optimizing the use of our valuable shale gas acreage assets by strategically managing production, reducing output when Henry Hub prices are low and ramping it up when prices rise. Looking ahead, we plan to enhance our production capacity by acquiring additional acreage, further driving the expansion of our business.

International Energy— Electricity in U.S.: Thermal Power

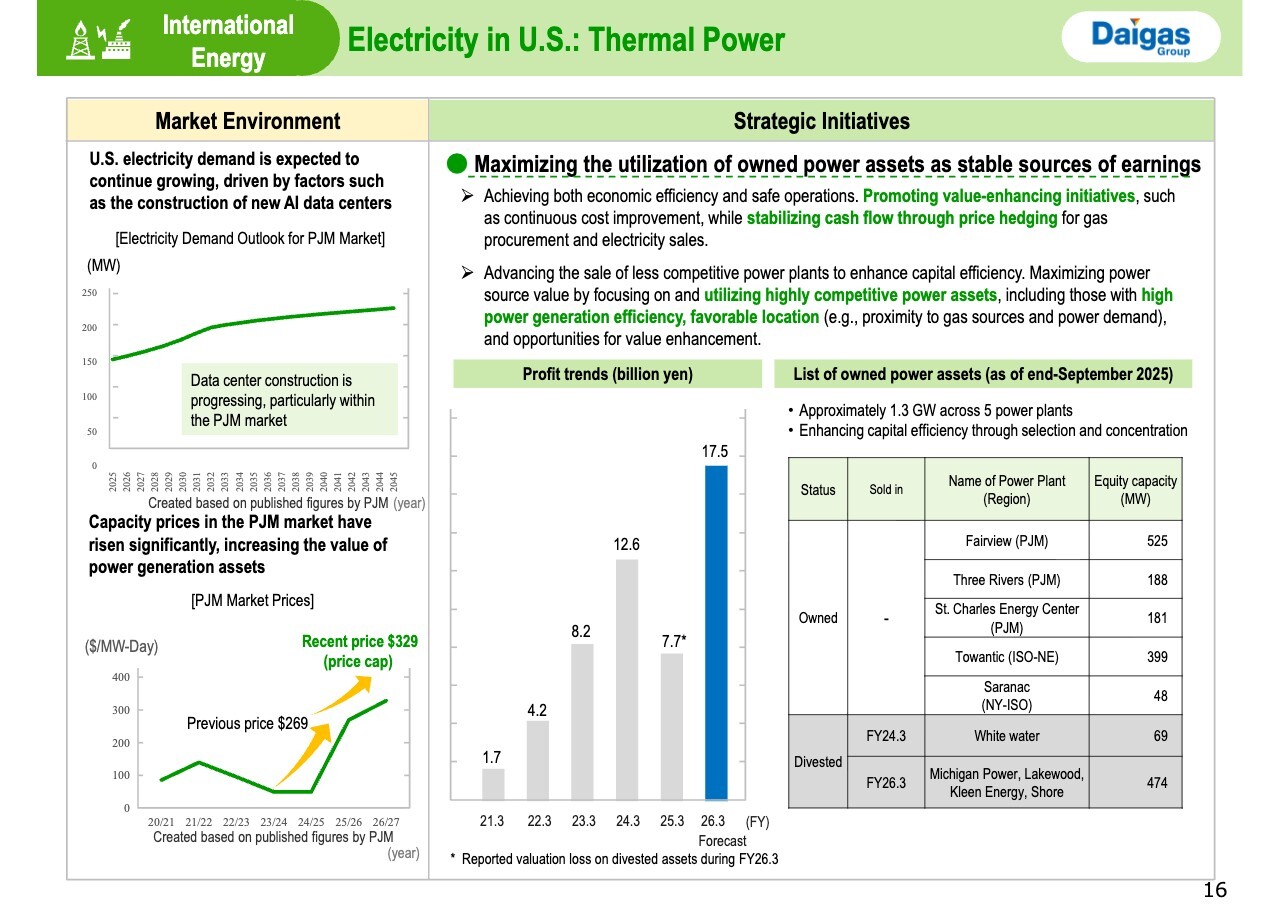

With electricity demand rapidly growing in in the United States, the U.S. power sector is gaining significant attention. Notably, capacity prices in the PJM market, where we focus our Independent Power Producer (IPP) business, have risen considerably due to this heightened demand.

Given the challenges associated with quickly building power plants and increasing supply capacity, our five gas-fired power plants, with a total equity capacity of 1.3 GW, play a vital role in meeting the electricity needs across the U.S.

By leveraging our expertise in domestic power plant operations, we aim to enhance the value of our power generation assets and explore additional opportunities for value creation, including potential asset replacements.

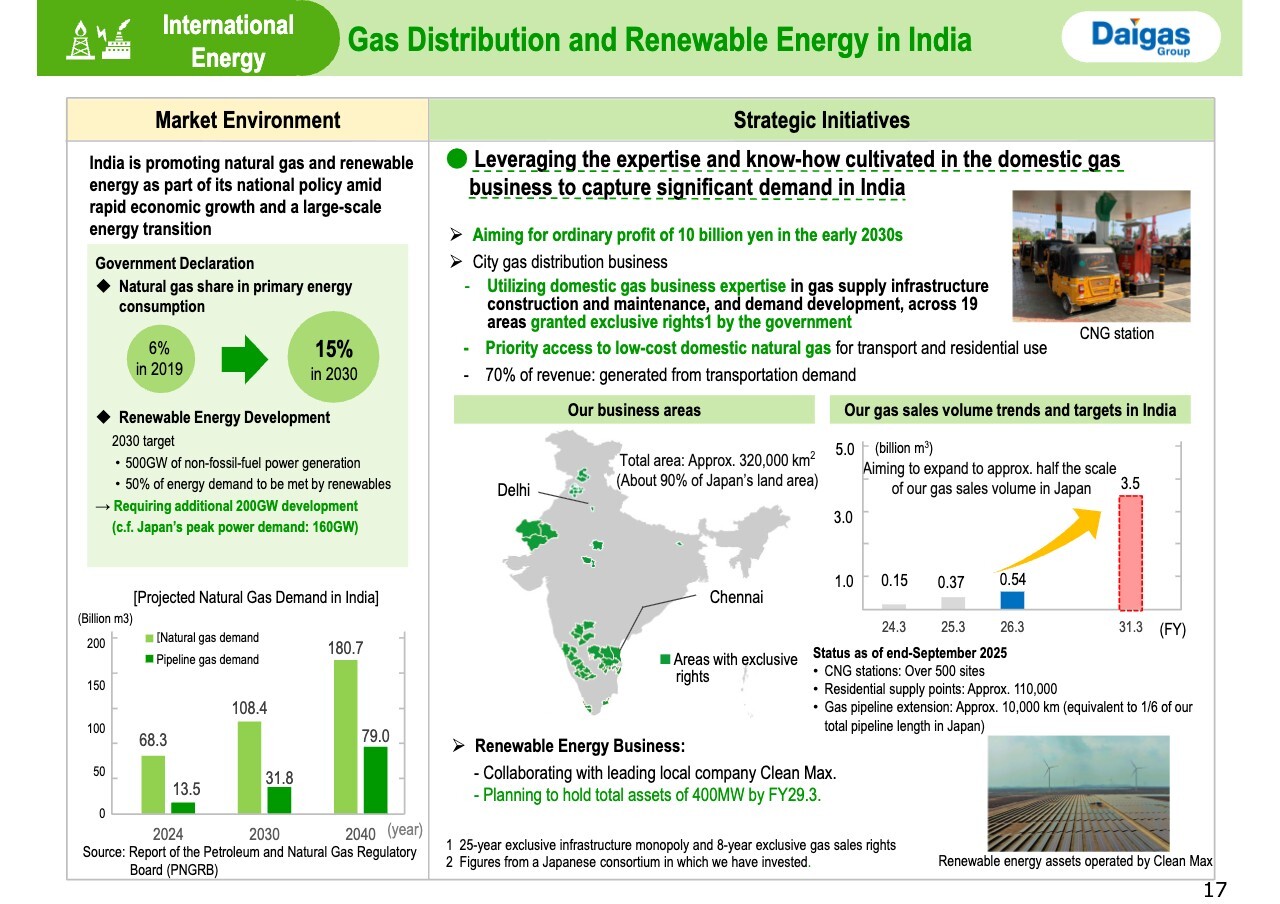

International Energy—Gas Distribution and Renewable Energy in India

We are also actively pursuing opportunities in the rapidly growing gas distribution and renewable energy sectors in India.

The Indian government is promoting natural gas and renewable energy as part of its national policy, leading to a significant increase in demand for these resources. In our gas distribution business, we are operating in 19 areas where we have obtained exclusive rights from the government, leveraging our expertise from the domestic gas sector. Our goal is to expand our sales volume to 3.5 billion cubic meters by FY2031.3, which would be nearly a tenfold increase from our current volume in India and approximately half of our current volume in Japan.

In the renewable energy sector, we have formed a capital and business alliance with Clean Max, a leading local company in this field, to enhance our asset base. Through these initiatives, we are targeting an ordinary profit of 10 billion yen in India by the first half of the 2030s.

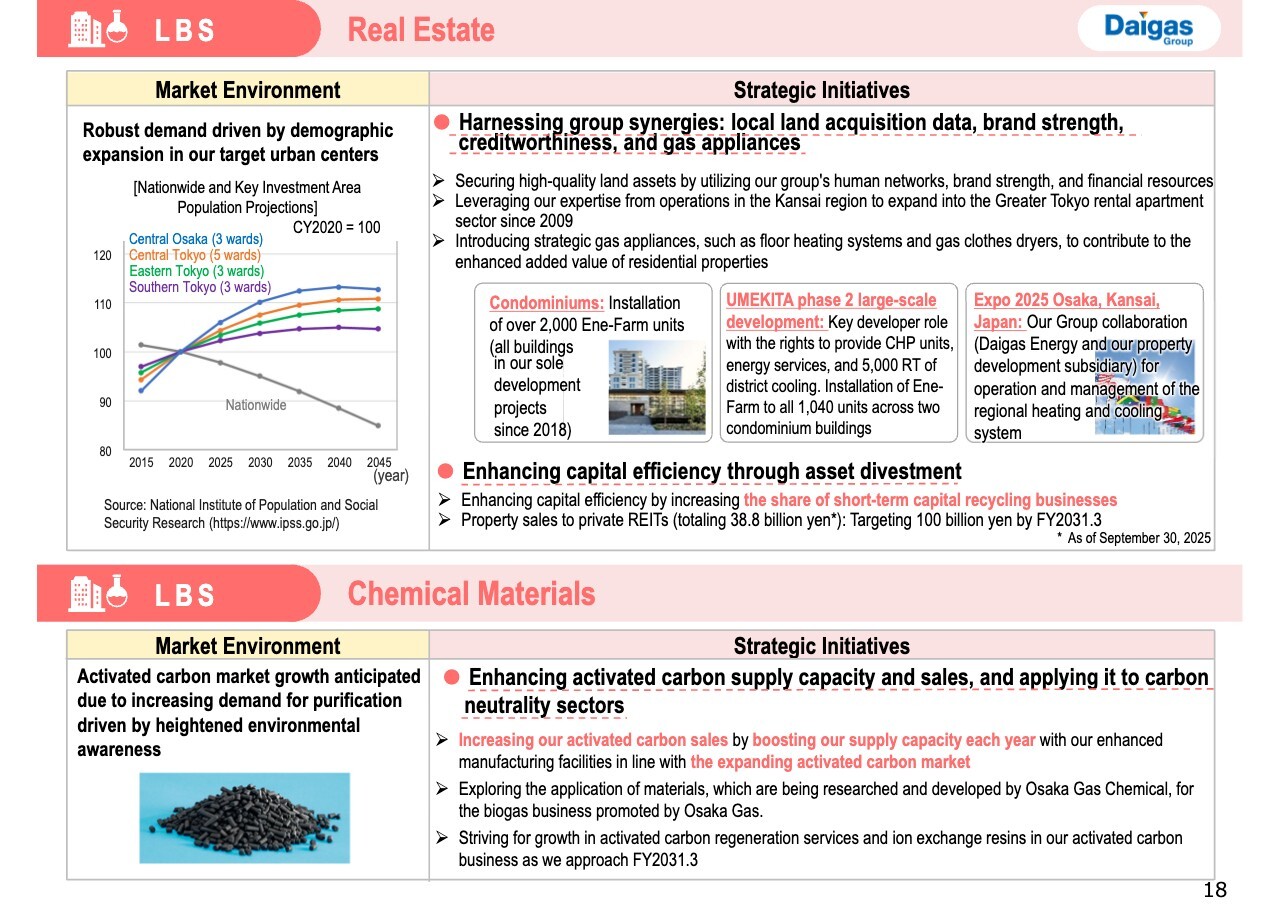

LBS—Real Estate and Chemical Materials

Next, let’s look at our real estate and materials businesses, which are key growth drivers for our LBS segment. In the real estate sector, our strategy targets urban areas projected to continue experiencing population growth. We are enhancing the value of our residential real estate assets by leveraging our brand strength and integrating gas strategy products. Additionally, to improve capital efficiency, we aim to increase the proportion of our capital recycling businesses over the medium to long term. By FY2031.3, we plan to achieve a cumulative total of sales to private REITs of approximately 100 billion yen.

In terms of our materials business, we anticipate growth in the activated carbon market as living standards rise. To capitalize on this opportunity to expand our sales volume, we are focused on enhancing our supply capacity by increasing our manufacturing facilities.

By fostering growth across multiple businesses rather than relying on a single entity, we are strategically leveraging the combined market growth potential with the strengths and positions of each business within the Group. We believe that this collaborative approach will drive the overall growth of the entire Group.

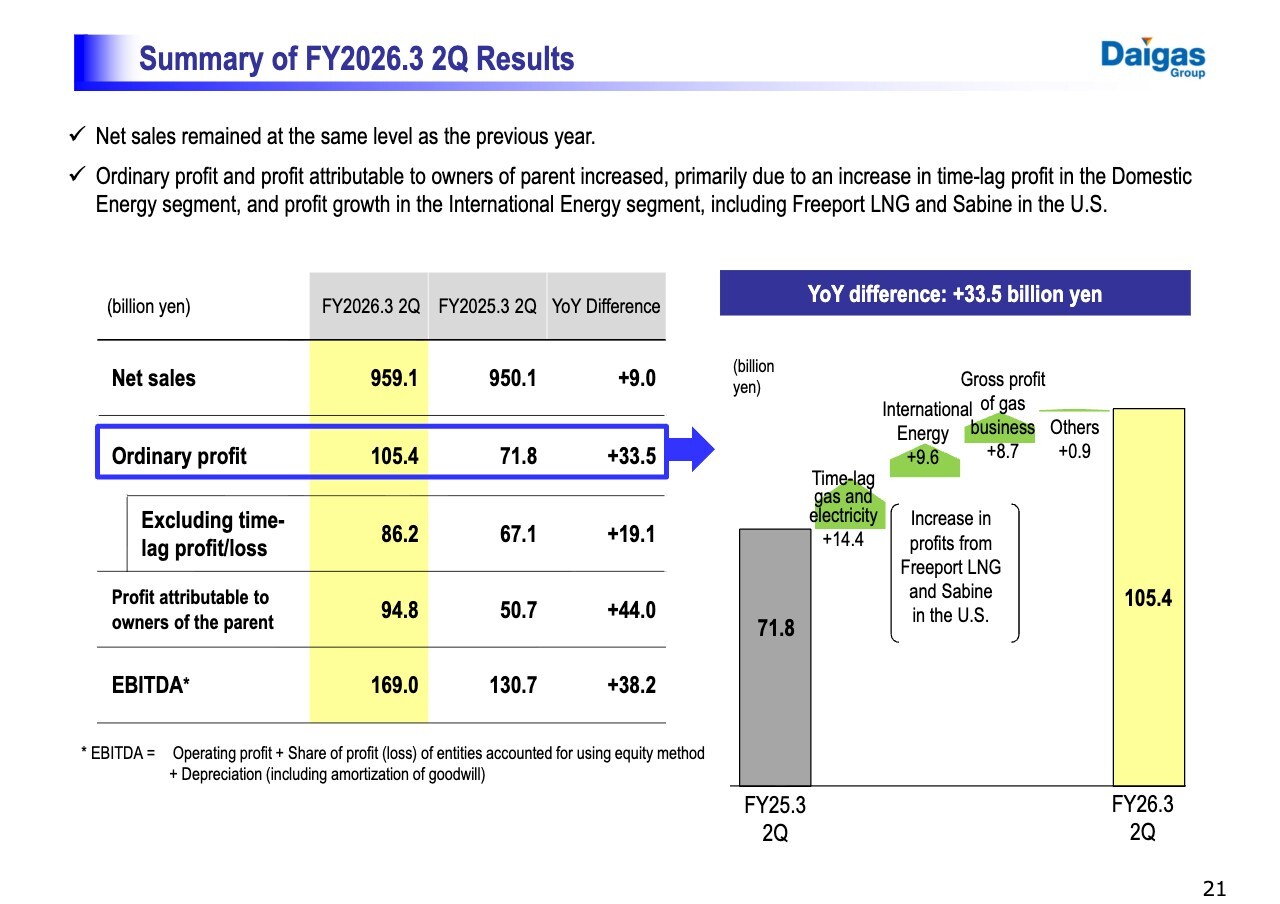

Summary of FY2026.3 2Q Results

Next, I will provide an overview of the second quarter financial results and the revisions to our forecasts. Please refer to page 21 for the key highlights of the financial results for the second quarter of FY2026.3.

Net sales remained consistent with the previous year, while ordinary profit saw a notable increase of 33.5 billion yen, reaching 105.4 billion yen, largely due to the growth in time-lag profit. Excluding time-lag profit/loss, ordinary profit stood at 86.2 billion yen. Additionally, net income attributable to owners of the parent increased by 44.0 billion yen from the previous year, totaling 94.8 billion yen.

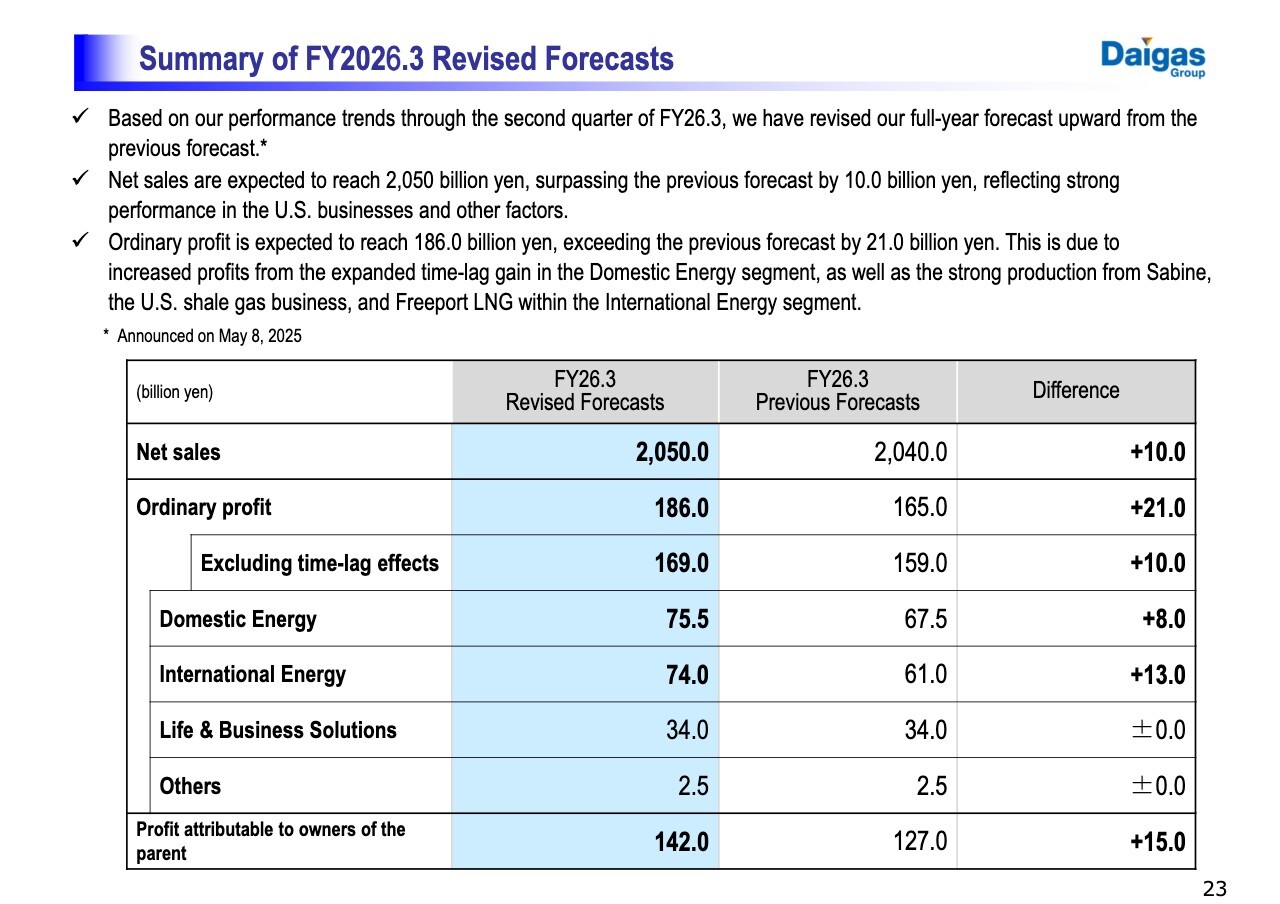

Summary of FY2026.3 Revised Forecasts

Now, let's discuss the revision of our full-year forecasts based on the performance trends observed in the first half of the year. Net sales are projected to surpass the previous forecast by 10 billion yen, primarily driven by the robust performance of our U.S. business.

Ordinary profit is also projected to exceed the prior forecast by 21 billion yen. This revision takes into account the growth in time-lag profit within the Domestic Energy segment and the increased profits stemming from strong production levels in our U.S. shale gas operations as well as Freeport LNG in the International Energy segment.

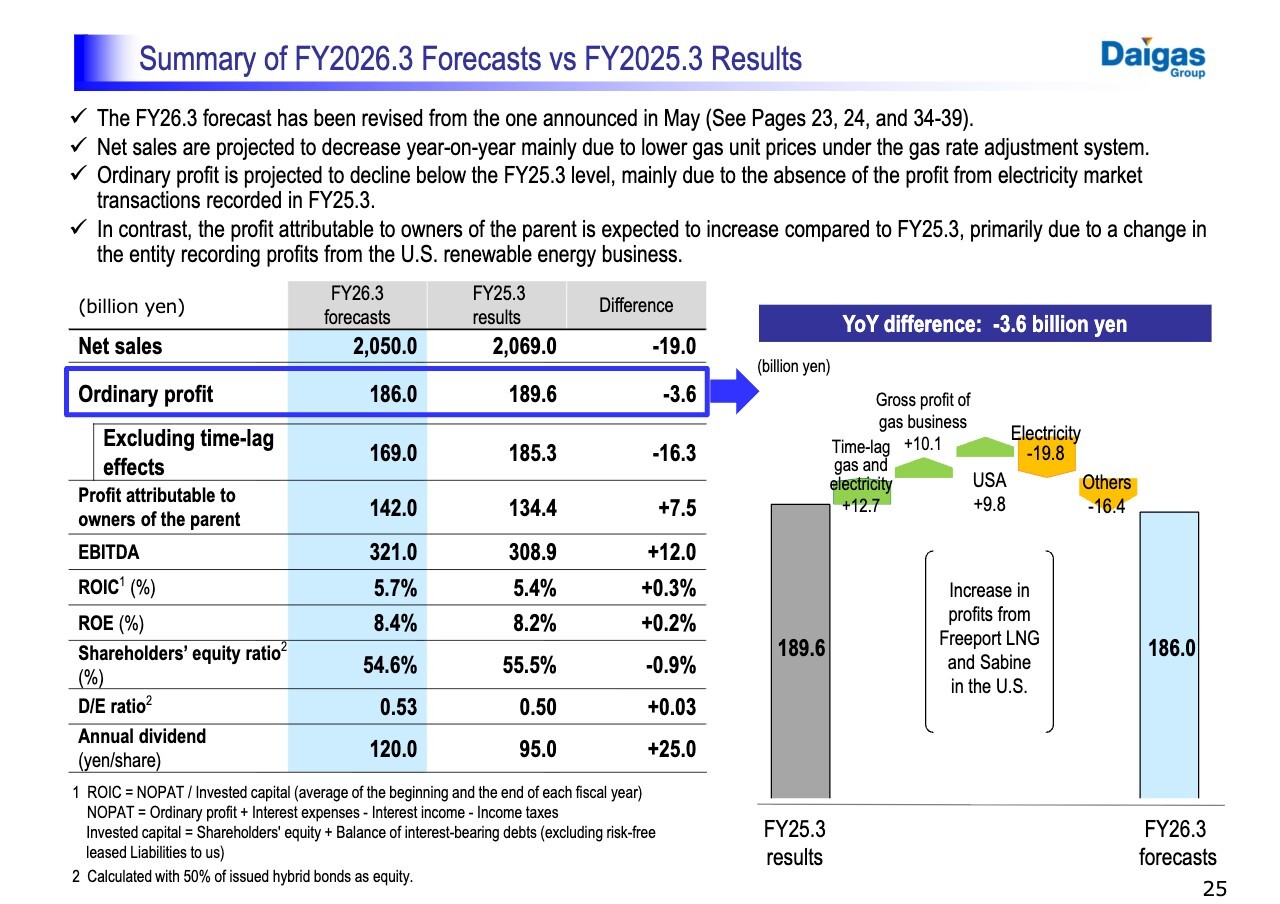

Summary of FY2026.3 Forecasts vs FY2025.3 Results

Next, let’s focus on the key elements of the full-year forecasts. We anticipate that net sales will decrease by 19.0 billion yen compared to the previous year, primarily due to a decline in gas sales prices in the Domestic Energy business.

Ordinary profit is expected to decline by 3.6 billion yen from last year’s level, while ordinary profit excluding time-lag profit/loss is projected to decrease by 16.3 billion yen. This decline is primarily attributed to the absence of the temporary increase in profits we experienced last year, which was largely driven by electricity market transactions.

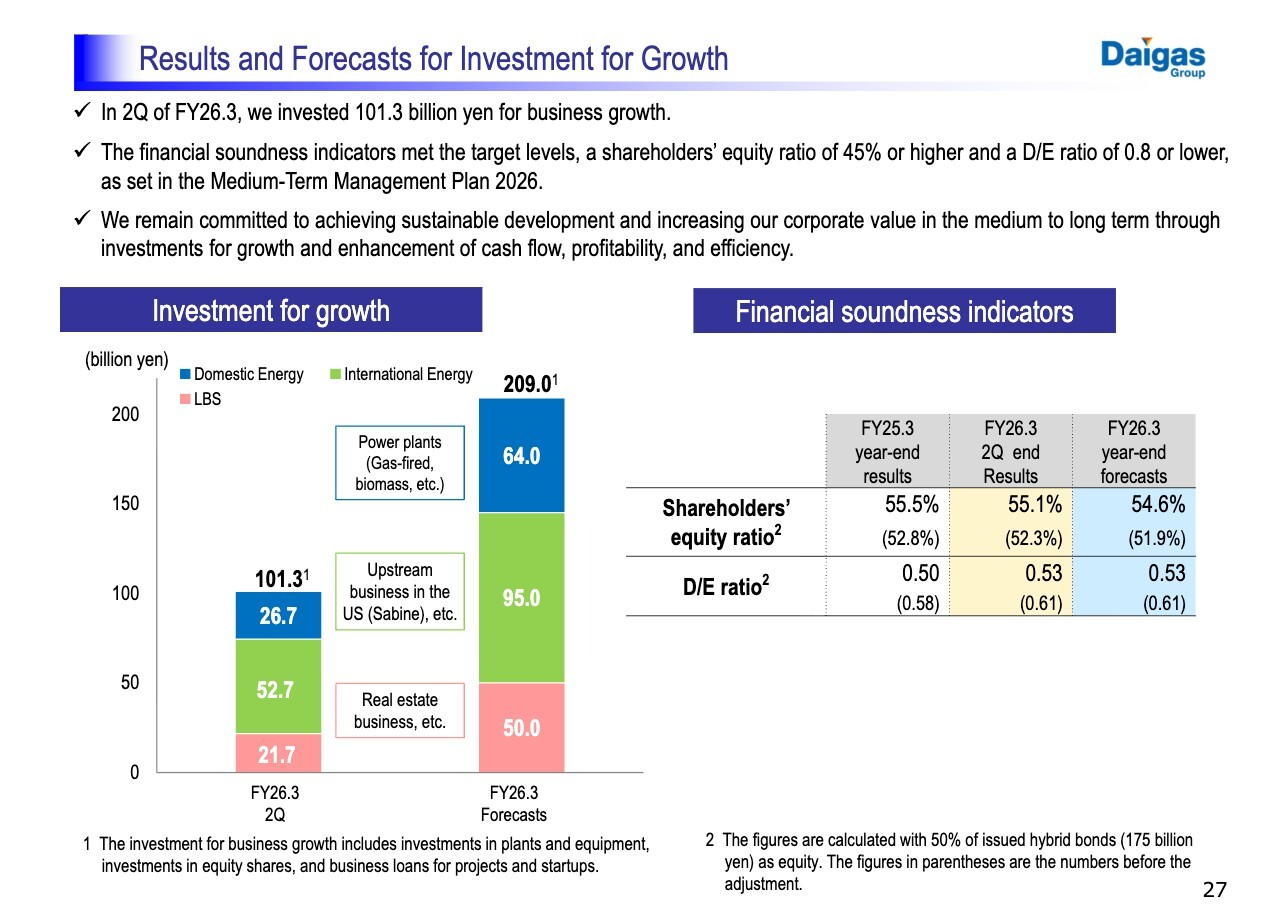

Results and Forecasts for Investment for Growth

Now, let’s discuss our investment for growth and financial soundness. In the second quarter of FY2026.3, we achieved cumulative investments for growth, totaling 101.3 billion yen, which represents 48% of our annual target and indicates strong progress.

As of the end of the second quarter, we have successfully maintained a shareholders’ equity ratio of 45% or higher and a debt-to-equity (D/E) ratio of 0.8 or lower, aligning with the goals set in our Medium-Term Management Plan 2026.

I will forego the following detailed explanations, but I encourage you to review the subsequent sections. Starting on page 28, you will find a comparison of the second-quarter results with the same period last year, followed by a comparison of the full-year forecasts with previous projections on page 34, and a comparison with last year’s results on page 40. Additionally, from page 46 onward, supplementary information includes sales volume and profit sensitivity to external factors, , time-lag effects, foreign currency translation adjustments in the balance sheet, and a list of IR reference materials.

This concludes my presentation. Thank you for your attention.

Q&A: Profit Growth Potential of U.S. Business

Inquirer: I would like to inquire about the future profit growth potential of the U.S. business.

In the U.S. business, we have already achieved a profit scale of nearly 70 billion yen this fiscal year, establishing it as a backbone of our operations. Can we expect further expansion during the current Medium-Term Management Plan period and the next? If so, could you provide insights on which business fields have growth potential? I would appreciate it if you could share the expected profit levels for thosegrowing business fields.

Masataka Fujiwara: We have effectively grasped the profit trajectory of our International Energy businesses for this fiscal year.. In the medium term, we plan to focus on three key areas:

First is the shale gas business. Our approach involves efficient investment strategies to expand our acreage, where we prioritize small-scale, targeted investments at reasonable prices rather than making large-scale investments. We are also committed to enhancing the efficiency and productivity of our drilling and well development.

Second is Freeport LNG. This fiscal year has shown promising improvements after experiencing a significant setback from an incident that occurred in FY2023.3. We have since faced challenges from power outages caused by external factors, which prompted us to implement enhanced safety measures.

Third is the U.S. electricity business. There has been growing attention to the rising capacity prices in the PJM market, which is the largest grid operator market in the United States. With major players like GAFA rapidly expanding their data centers, the capacity market is currently operating at over $300 per MW. We aim to further expand our assets in this area and pursue profit growth.

While these opportunities will not yield immediate results, we are taking a medium- to long-term perspective and believe there is substantial potential for growth ahead.

Q&A: Revised Shareholder Return Policy

Inquirer: Regarding the shareholder return policy, you mentioned that you will increase the DOE to 3.5 percent, which took me by surprise given the timing during the current Medium-Term Management Plan period. Could you share the reasoning behind this positive decision, including the internal atmosphere and any relevant discussions within the company?

Masataka Fujiwara: We have engaged in extensive discussions internally about our DOE standards. Focusing on the capital market, we have actively listened to feedback from our investors.

Prior to October 2023, when share buybacks were not common practice for us, there were opinions within the company suggesting that we should prioritize investments for growth over share buybacks. However, we ultimately agreed that after making a total investment of approximately 300 billion yen for growth and quality improvements, it would be appropriate to return equity capital to our shareholders if a significant amount continues to accumulate.

This fiscal year, we recognized that there is a strong likelihood of robust performance. Given these positive projections, we felt it would be inappropriate to adjust our forecasts without revising our shareholder return policy. Consequently, we reached a consensus to take this positive step and enhance our shareholder return.

Q&A: Outlook for Expansion in Domestic Energy Business toward FY2031.3

Inquirer: I would like to ask about the normalized profit growth potential of the Domestic Energy segment. Could you provide the insights into the increase in profits from gas sales and the consistent acquisition of new businesses, such as renovations, as mentioned on page 5? Additionally, what is the outlook for FY2030?

Tadasu Yano: I am Tadasu Yano, Senior General Manager of the Corporate Strategy Department. In terms of gas business profit growth, a key factor is the renewal of large contracts. As these contracts are renewed, we have consistently observed improvements in contracted gas prices, particularly in the Kansai market, where optimizing prices was previously challenging due to severe competition.

In the realm of new businesses, particularly in renovations, we are experiencing positive momentum thanks to the booming real estate market and rising property prices. Our subsidiaries focus on acquiring second-hand properties and renovating them to a condition that rivals new constructions before reselling. This approach has proven highly successful, especially as potential buyers find it increasingly challenging to purchase new properties.

Masataka Fujiwara: I’d like to share additional insights into Domestic Energy. The graph showing the market share of new entrants on the left side of slide 11 highlights the diminishing impact of increased competition, indicating a slowdown in the trend of customers switching to our competitors.

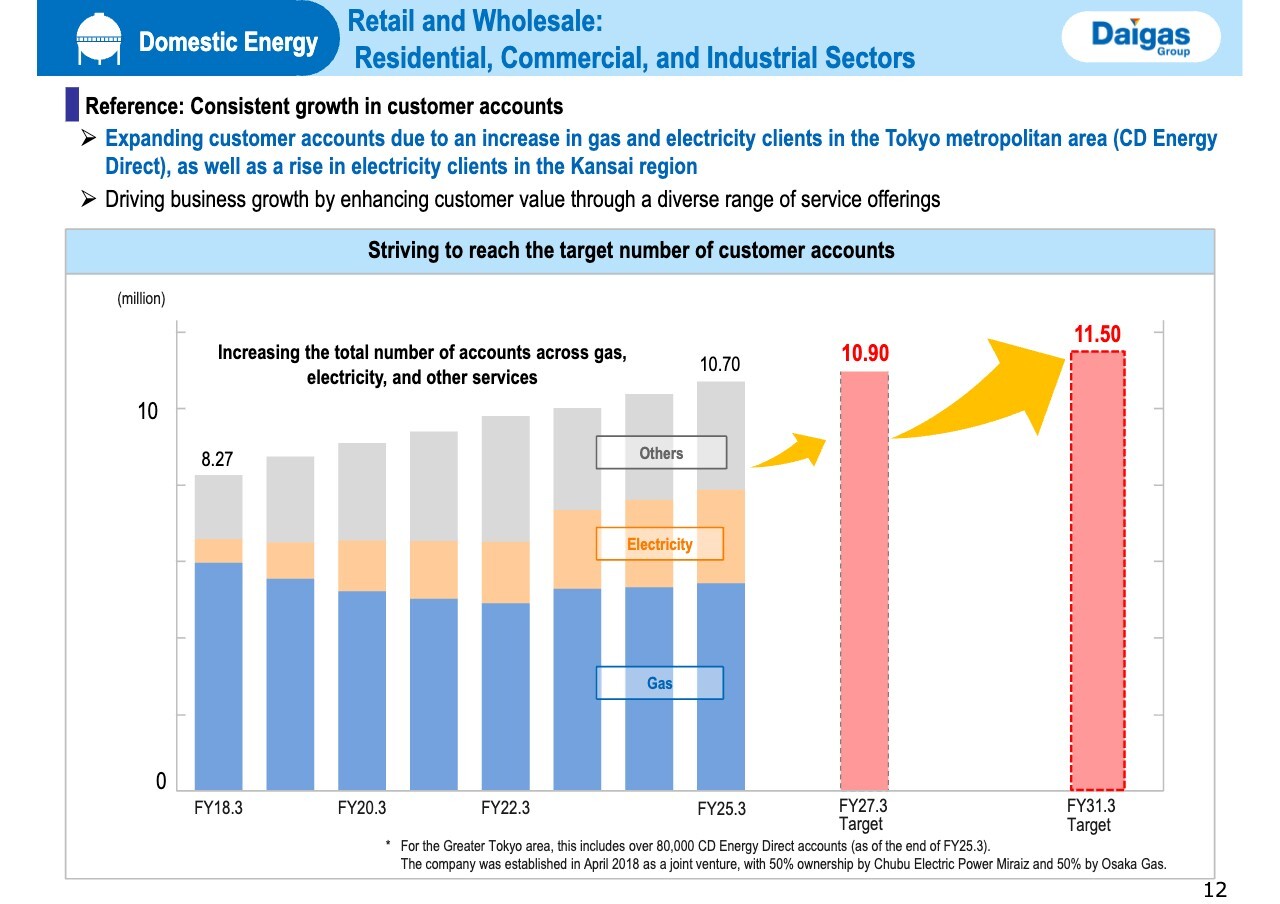

In the Greater Tokyo area, we aim to steadily increase the number of energy supply points through our operations, including CD Energy Direct, as outlined on page 12 of the slides. Our focus is on further expanding this business while enhancing our gas and electricity supply volumes.

Furthermore, the Himeji Natural Gas Power Plant Units 1 and 2 are scheduled to commence operations in January and May of next year, respectively. This development offers substantial growth potential for our power business, with a total generation capacity of 1.2 GW. The Ministry of Economy, Trade and Industry predicts an energy supply and demand of 1,200 TWh by FY2040, positioning us to consistently generate profits in regions with high electricity demand.

Regarding the competitive landscape, we are pleased to report that the decline in gas sales volume has slowed. In the past, supply point fluctuated by approximately 400,000 annually; however, we are now witnessing a reduction in lost gas contracts due to decreased customer switching, which has unfortunately also contributed to a slowdown in acquiring new electricity contracts. Overall, after nearly a decade of full liberalization, these recent market conditions have enhanced our visibility and strategic positioning.

Additionally, we are capitalizing on cross-selling opportunities by leveraging our comprehensive range of home services, which includes our fixed-line telecommunications business. This strategy has led to improved customer retention and enhanced sales margins per account, ultimately boosting our profitability.

For the commercial and industrial sectors, we expect only modest growth; however, the ongoing transition towards decarbonization and low-carbon solutions, despite some recent slowdown, still holds promise, particularly in the Chugoku and Shikoku regions of western Japan. These areas are home to many heavy chemical industries that currently rely on coal boiler turbine generators. By converting these systems to a combined cycle using natural gas, we can unlock significant opportunities for increasing the utilization of natural gas.

Also, we are prioritizing our bunkering business, having launched our shore-to-ship LNG supply service in April 2025. We anticipate a growing trend in natural gas consumption within the maritime industry. In light of the unexpectedly strong demand, we plan to expand our offerings to include ship-to-ship bunkering, building on the success of our initial shore-to-ship initiatives.

Although we recognize that demand for natural gas in the Kansai region, our primary market,may decline due to population shrinkage and reduced industrial activity in specific areas, we are committed to expanding our sales by forging diverse partnerships across the country.

Q&A: DOE Strategy for Improving ROE

Inquirer: I would like to inquire about dividends and DOE. The recent increase in DOE, driven by rising profits, is certainly a positive development. While it may still be a bit too early to address this, as ROE continues to grow, it seems the dividend payout ratio could inevitably decline unless DOE is adjusted upward accordingly. Could you share the company's perspective on this?

Tadasu Yano: At this point, we have not made a definitive decision regarding DOE. That said, as you noted, we intend to explore our path forward, as DOE is calculated as payout ratio multiplied by ROE.

Masataka Fujiwara: As Yano mentioned, we are indeed aware of the significance of the payout ratio. Additionally, we recognize the importance of the total return ratio in maintaining an appropriate level of shareholder equity. We will prioritize investments in growth and quality improvements while remaining flexible in our payout strategy as circumstances evolve.

Q&A: Factors for the success of the U.S. business

Inquirer: How do you assess the factors that contributed to the revenue growth in the U.S. business? It seems you've successfully generated profits not only from shale gas but also from thermal power generation and Freeport LNG. What factors contributing to the achievements in the U.S. do you believe can be applied to driving success in the Indian market and future expansion in the United States?

Masataka Fujiwara: Our journey has faced significant challenges, and we have encountered setbacks along the way. As an early mover in the energy sector, we experienced the reality of project failures, costing us over 30 billion yen.

These experiences taught us a vital lesson: while venturing into entirely new areas with no production history can lead to high rewards if successful, it also entails substantial risks. Consequently, we recalibrated our strategy to focus on acquiring companies and operating areas that were already in development. This shift led to our successful acquisition of Sabine, which was available at a relatively low cost at the time. It allowed us to effectively implement our “start small and grow big” strategy.

More than a decade ago, we entered the U.S. Independent Power Producer (IPP) market, aiming to capitalize on the challenging capacity market when prices were around $50. Since then, several favorable conditions, such as the retirement of coal plants, the policies of the Trump administration, and growing demand for data centers, have contributed to our growth and enhanced our value.

Over the past 30 years, we have emphasized the development of our human resources through trial and error, which has sharpened our ability to identify promising projects and make sound judgments.

In India, we are moving forward with our business operations while ensuring compliance. While our experiences in the U.S. may not directly transfer, we benefit from applying the knowledge and practices we've cultivated over our 120 years of operation.

Q&A: Liquidation of Domestic Energy assets

Inquirer: What is your perspective on the current landscape for liquidating your energy assets in Japan, including power plants and gas businesses? Osaka Gas announced plans to build the Unit 3 of the Himeji Thermal Power Plant this year without taking a majority stake. Should we interpret this as a special case due to the long-term decarbonization power auction?

Masataka Fujiwara: In line with our asset-light strategy, we are focused on enhancing the adoption of renewable energy within our electricity business. Currently, we have achieved a renewable energy generation capacity of 3.99 GW. Our objective is to reduce our asset base while increasing off-take volumes, allowing us to secure electricity from renewable sources without relying solely on ownership of these assets. We are actively exploring avenues for expansion that do not burden our balance sheet, and this approach is also reflected in the development of Unit 3 at the Himeji Thermal Power Plant.

Tadasu Yano: We aim to establish a commercial flow particularly in the renewable energy sector and are actively working to reduce our equity share wherever possible and utilize project financing. That said, we intend to retain some assets on our balance sheet, including the Senboku Natural Gas Power Plant, which generate stable cash flow and are operated directly by our company; we consider them akin to in-house factories in the manufacturing industry.

Q&A: Current Status of Shareholders’ Equity Ratio

Inquirer: The revised shareholders’ equity ratio is projected to be 51.9% by the end of March 2026, which is higher than the initial forecast of 51.2%. While this exceeds the original goal of 45%, it seems there’s still a slight distance from that target. What are your thoughts on this?

Masataka Fujiwara: Currently, we do not consider the shareholders’equity ratio as a specific management target. When we faced the full liberalization of electricity and gas retail in 2016 and 2017, we were entering uncharted territory, which prompted a more cautious approach since our shareholders’equity ratio was below 50% at that time. In hindsight, particularly in light of the subsequent Freeport LNG incident, maintaining a robust capital base has proven to be a prudent decision.

We acknowledge that our shareholders’ equity is increasing as our profits continue to grow. It is important to strike a balance by returning value to shareholders while also pursuing growth and investing in quality improvements. At this stage, we view a shareholders’ equity ratio of 45% as acceptable from a risk management standpoint. Furthermore, with the anticipated changes to lease accounting standards in 2027, we will need to thoroughly assess their potential impact on our financial metrics.

Q&A: Development of Energy Business in India

Inquirer: I’d like to inquire about the current status of your business in India. Ultimately, you aim to achieve an ordinary profit of 10 billion yen in the first half of the 2030s. What steps are you taking to reach this goal?

Masataka Fujiwara: Before entering the Indian market, we experienced significant challenges in Southeast Asia, mainly because the energy sector is intricately linked to the fundamental aspects each country and is heavily influenced by local political dynamics. The licensing systems tend to be rigid and often move at a slower pace compared to Japan.

In contrast, the Indian market presents significant promise. The government is designating specific business areas to operators, which allows for eight years of sales exclusivity in each area, along with 25 years of exclusive ownership of the associated infrastructure.

Currently, we procure gas produced domestically in India. However, if the wholesale price of domestic gas rises due to economic growth, it may become difficult to secure the profits we initially projected. That said, the presence of several government-backed gas supply companies, along with foreign firms like ours, helps mitigate the risk of abrupt policy changes, and we are actively working to expand our operations in this environment.

Moreover, India's renewable energy sector is gaining momentum, propelled by government initiatives aimed at increasing the availability of affordable renewable energy. These initiatives are not only about environmental sustainability but also focus on managing trade deficits. I believe this creates significant growth opportunities for our business as we move forward.

Q&A: Possibility of share buybacks due to changes in stock liquidity

Inquirer: I was impressed by the recent change in DOE and commend your company for taking this important initiative. I have a question regarding equity management: with stock prices rising and strong results being achieved, is there room to consider increasing the scale of share buybacks from a liquidity standpoint?

Masataka Fujiwara: While we acknowledge that temporarily increasing share buybacks could provide a boost to stock prices, we are concerned that this impact might not be sustainable over the long term. Thus, we prefer to maintain the current level of daily repurchases to pursue an appropriate balance between supply and demand.

Ultimately, our primary focus is on enhancing our ROE. The energy sector poses unique challenges due to its infrastructure- and labor-intensive nature. Improving ROE won't be easy, but we are dedicated to continuously pursuing this goal.

Q&A: Improvement of ROIC in the Domestic Energy business

Inquirer: I was impressed to see the latest projection of achieving an ROE of 8% for FY2027.3. However, it is important to enhance ROIC further in light of the target of 10% for the first half of the 2030s.

In my view, it would be more compelling to communicate to overseas investors the potential for improvement in the Domestic Energy business rather than solely emphasizing growth in the International Energy sector. In addition to enhancing the numerator through improvements in Domestic Energy, how will you manage the denominator?

Masataka Fujiwara: Regarding the status of the Domestic Energy business, the stringent monitoring period, during which transitional rates were introduced following full deregulation, has concluded, as increased market competition was confirmed due to sufficient customer switching. While the current regulatory frameworks do not prevent rate increases, our immediate focus is to set appropriate levels for fee s and other charges.

Currently, three-quarters of our sales volume is derived from commercial and industrial customers, and since the initial deregulation in 1996, we have faced intense competition with Kansai Electric. While there have been instances where fees were temporarily reduced, we have actively optimized our pricing strategy, which has significantly increased the numerator. Furthermore, we anticipate that the demand for gas and electricity outside our core market will continue to rise steadily in the future.

Our next challenge involves addressing the denominator. We have already implemented substantial measures, but we recognize the need to continue our efforts to decrease it further. However, seeking quick fixes to lower the denominator may not be realistic under the current circumstances. Ultimately, it comes down to the diligence and care we apply to overcoming this challenge.

Q&A: Free Cash Flow–Driven Management Approach

Inquirer: Could you share the company’s approach to future free cash flow? Is it primarily centered on a commitment to achieving positive cash flow or expanding cash flow? Or, is there no specific focus on increasing free cash flow, with reliance instead on the progress in growth projects?

Masataka Fujiwara: While actively pursuing positive free cash flow (FCF) is a fundamental aspect of FCF-driven management strategy, we must also recognize that significant investments can lead to a marked increase in investment cash flow. During periods of heavy investment, operating cash flow may not rise as quickly, which can result in negative cash flow. It’s crucial that we do not restrict our investments in growth and quality improvements. Nevertheless, we remain mindful of a FCF-driven management approach and intend to maintain this focus consistently.

Akira Kuriyama: I am Kuriyama, Senior General Manager of the Finance Department. Corporate value is fundamentally assessed based on the accumulation of free cash flow. Although we may occasionally experience negative cash flow, this is indicative of our commitment to positioning ourselves for future growth. We are dedicated to expanding our business while simultaneously focusing on building positive free cash flow over the medium to long term.