Highlights Since April 2025

Takuya Yokota (hereinafter, Yokota ): My name is Takuya Yokota, General Manager of the Logistics REIT Department at Mitsubishi Jisho Investment Advisors. Thank you very much for attending today's Mitsubishi Estate Logistics REIT Investment Corporation (MEL) financial results briefing for the fiscal period ended August 2025 (the 18th fiscal period).

The briefing will follow the financial results presentation materials. I would like to start by talking about operational highlights for the fiscal period.

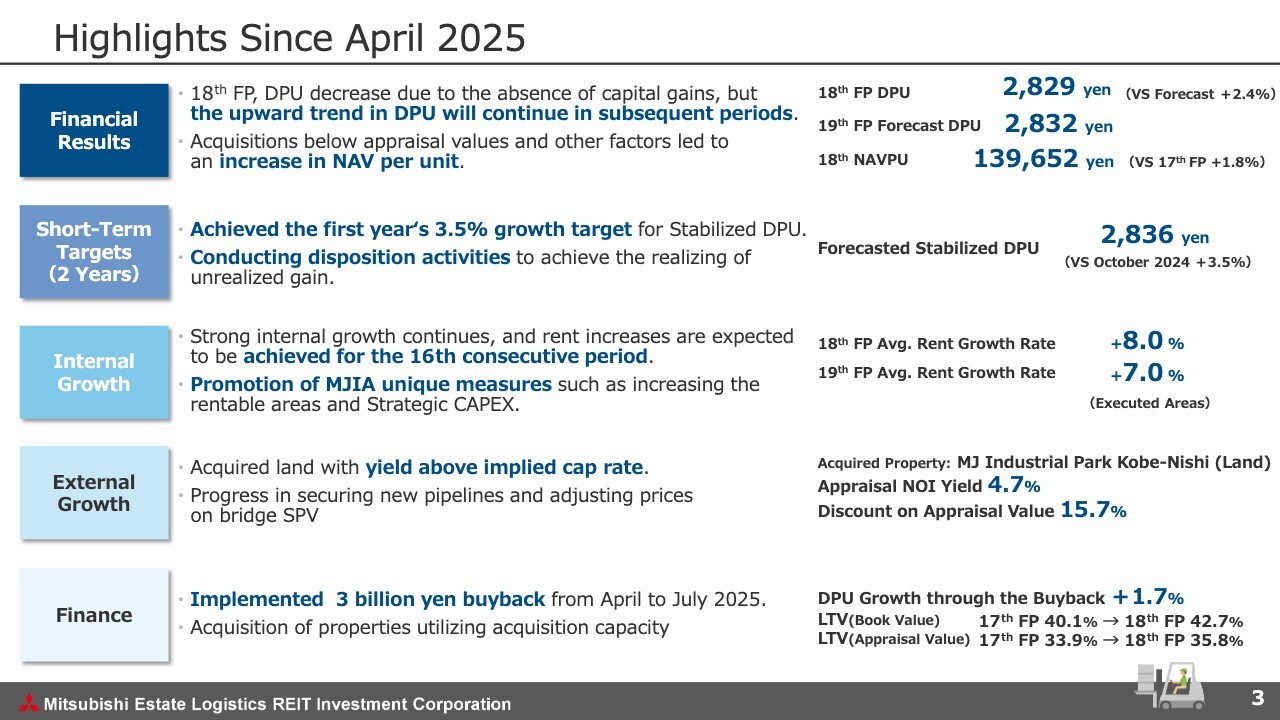

In the 18th fiscal period, distribution per unit (DPU) decreased due to the absence of gains on sales of properties obtained through the previous fiscal period. However, DPU excluding capital gains continue to increase. Additionally, NAV per unit improved due to the acquisition of properties below their appraisal value and an increase in the valuation of the existing portfolio.

Our short-term goals are stabilized DPU growth of 3.5% or more per year and the return of approximately 1 billion yen in unrealized gains per year. As of the end of the period under review, we achieved stabilized DPU growth in excess of 3.5% per year. We are also undertaking the sale of properties to achieve the return of unrealized gains.

Looking at internal growth, we expect to achieve our 16th consecutive period of rent increases, with rent increasing by 8% for the period under review. In the current 19th fiscal period, we have achieved a 7% rent increase in areas where lease agreements have already been signed, and continue to achieve strong internal growth.

Looking at external growth, MEL acquired MJ Industrial Park Kobe-Nishi at an attractive yield level. We are also making steady progress in securing a solid pipeline.

In terms of finances, we improved capital efficiency through buybacks up to the maximum of 3 billion yen during the fiscal period under review. The LTV ratio at the end of the fiscal period was 42.7% on a book value basis, staying within a healthy range. We will continue to study the acquisition of properties utilizing our acquisition capacity.

DPU Transition

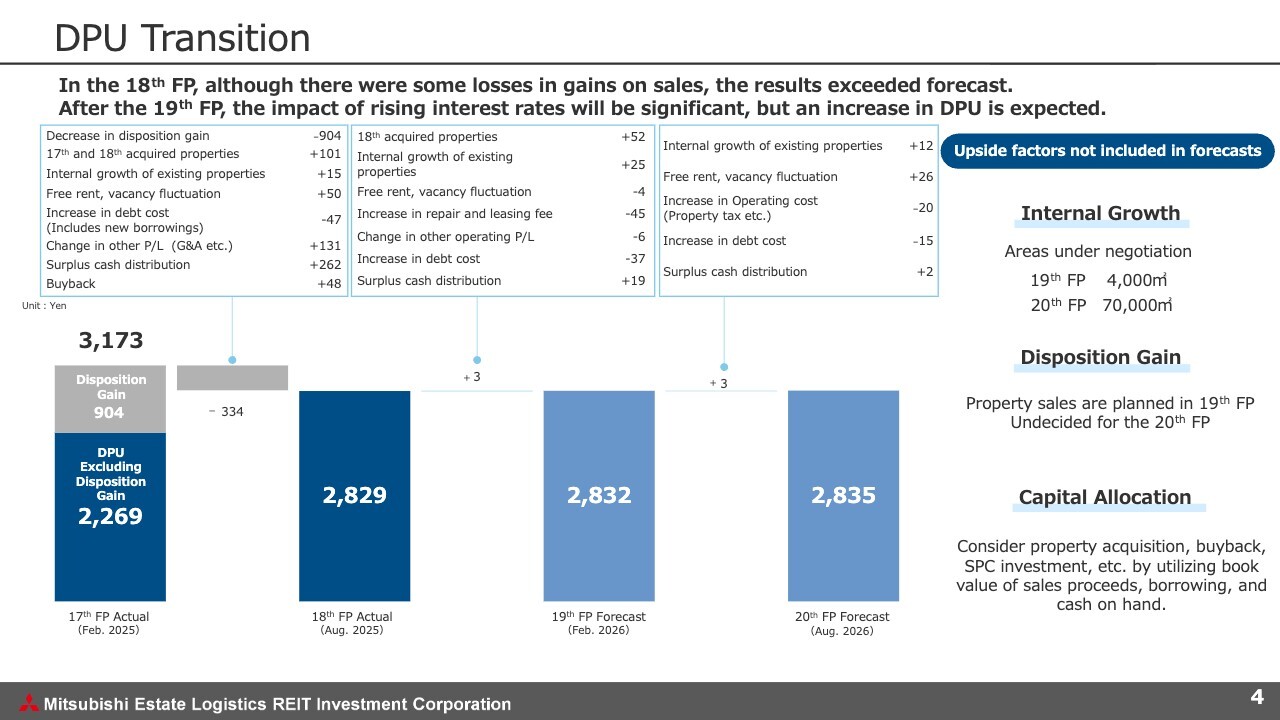

I would now like to discuss actual and forecast DPU. In the 18th fiscal period, DPU decreased from the 17th fiscal period, in which MEL recorded gains on sales. However, results exceeded forecasts due to revenue contribution from properties acquired in the 18th fiscal period, internal growth including increased rents, and buybacks. DPU excluding disposition gains is growing steadily.

From the 19th fiscal period onward, we aim to achieve further growth through internal growth related to uncontracted tenants, property sales aimed at our short-term goal of returning unrealized gains, reinvestment of proceeds from those property sales, and utilization of LTV, none of which are currently incorporated into our forecasts.

NOI Transition

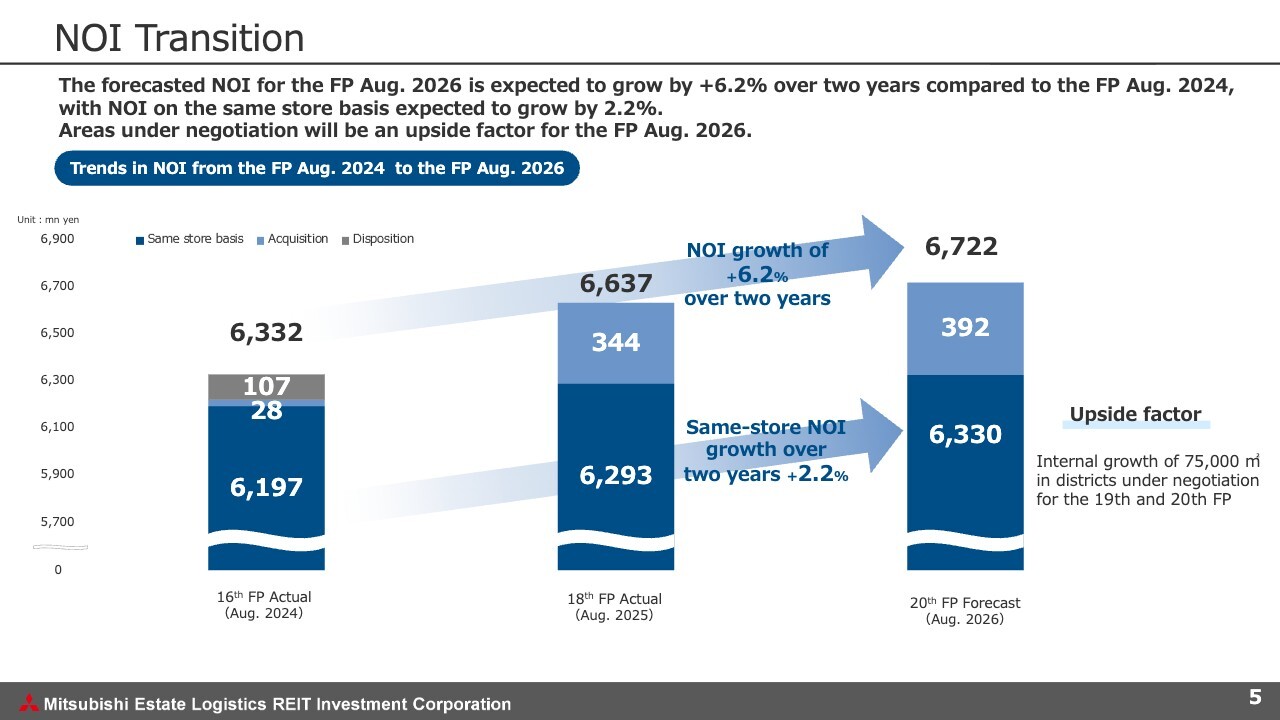

This slide concerns MEL's NOI performance and forecast. The graph shows changes in NOI by year from the 16th fiscal period.

Due to steady internal and external growth, the NOI growth rate over the two years from the 16th to 20th fiscal periods is expected to be +2.2% for existing properties and +6.2% when properties acquired after the 16th fiscal period are included.

Growth Targets Published in April 2025

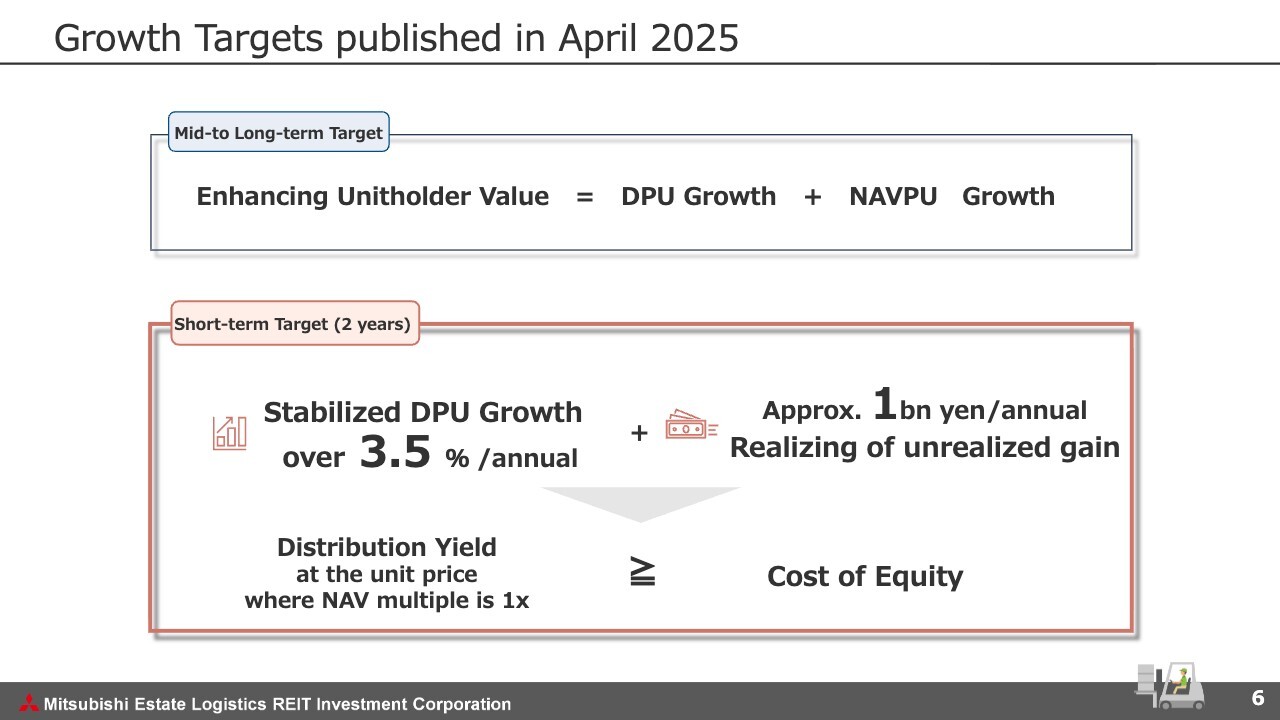

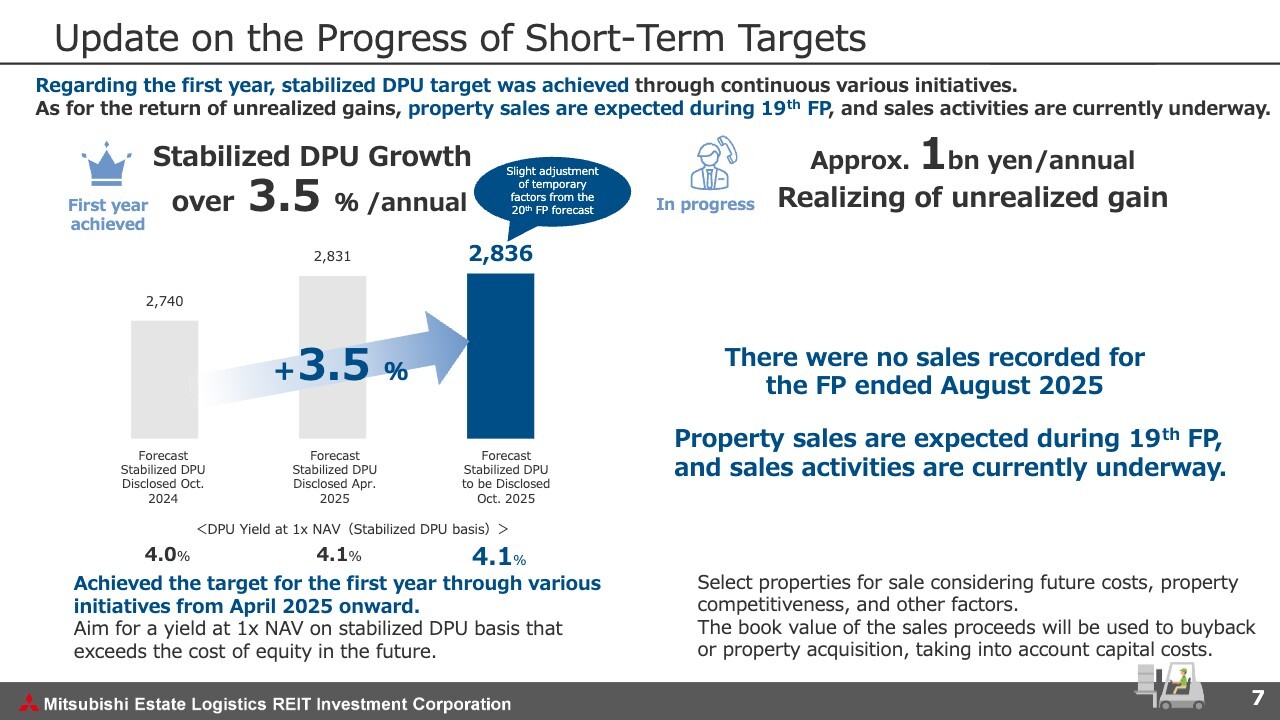

Here I would like to discuss the progress we are making toward the short-term goals we have set for April 2025. MEL has set stabilized DPU growth of 3.5% or more per year and the return of approximately 1 billion yen in unrealized gains over the next two years as short-term goals.

Update on the Progress of Short-term Targets

As of today, we expect a DPU of 2,836 yen, representing a growth of approximately 3.5% from the 2,740 yen announced in October 2024 and achieving our first-year target. We believe this is the result of proactive management, including buybacks, the realization of greater-than-expected internal growth, and the acquisition of high-yield properties utilizing LTV.

We have begun working to achieve our other short-term goal of returning unrealized gains during the 19th fiscal year. Together with this return, we plan to reinvest the proceeds from sales, taking the cost of capital into account.

Future Initiatives to Achieve the Second-year Stabilized DPU Target

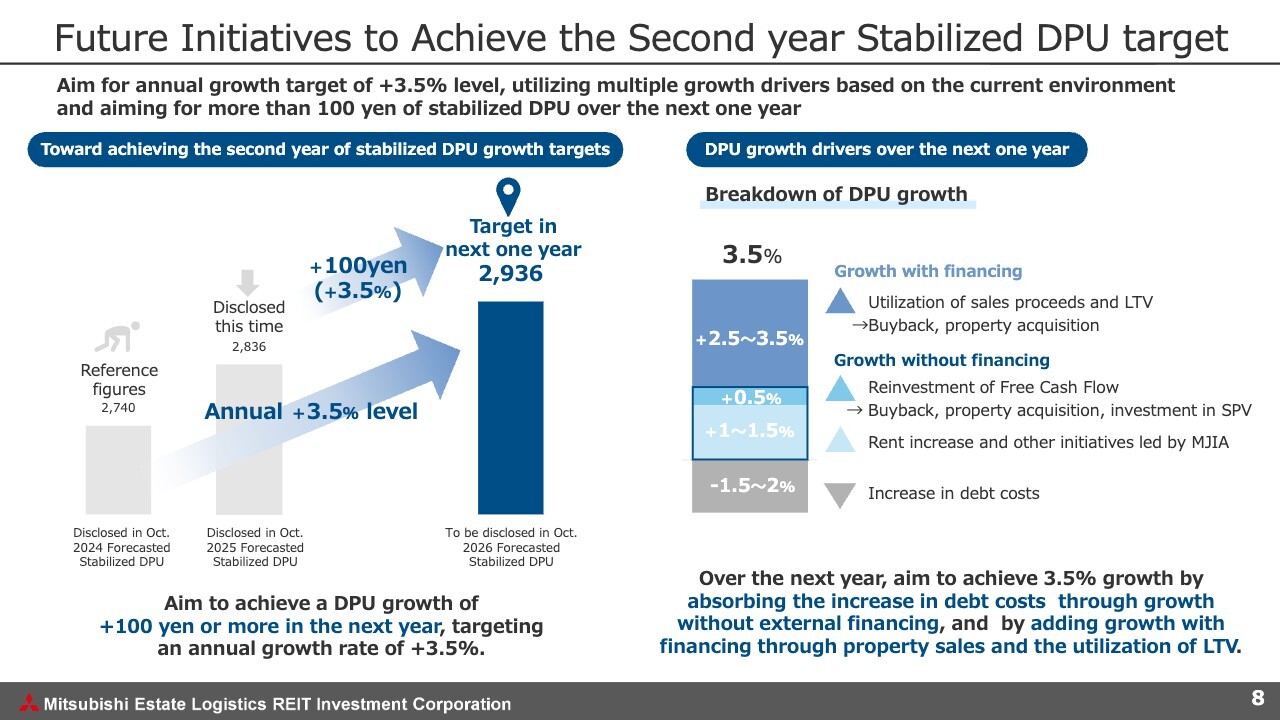

I will now discuss the second year of stabilized DPU growth. To achieve its second-year target, MEL aims to achieve stabilized DPU growth of 100 yen or more over the next year. Specifically, the target for the stabilized DPU that will be announced one year from now is set at 2,936 yen or higher.

MEL operates within an environment of a unit price below 1x NAV, making financing through public offering difficult. However, MEL has steadily achieved internal growth, primarily through rent increases, and the real estate sales market for high-quality properties is also favorable. On the other hand, rising policy interest rates have led to rising cost of debt, which has become a significant issue.

Under this environment, MEL has drawn up a vision that divides future growth into growth with financing and growth without financing. For growth with financing, we plan to utilize proceeds from sales and LTV to achieve growth through property replacement and buybacks.

For growth without fundraising, we plan to reinvest free cash flow equivalent to depreciation, continue rent increases, and implement internal growth through proprietary initiatives. Acting along these two growth axes, we aim to achieve stabilized DPU growth over the next year.

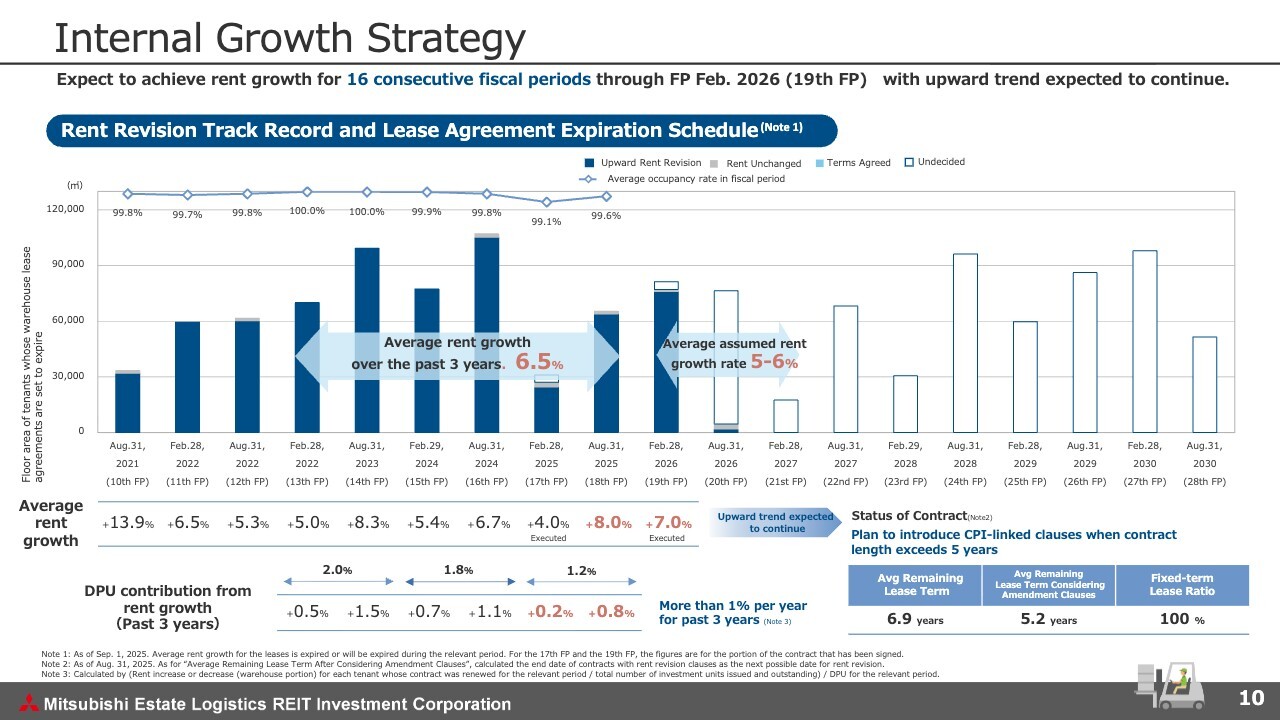

Internal Growth Strategy

I will now discuss our efforts to increase unit price, beginning with internal growth.

MEL forecasts rent increases during the current 19th fiscal period and is on track to achieve the 16th consecutive period of rent increases. Specifically, we achieved an 8% increase in the 18th fiscal period and are achieving 7% in the 19th fiscal period based on already concluded contracts.

With rent increases averaging 6.5% over the past three years, we are continuing the upward trend. Furthermore, the contribution of rent growth to DPU has remained in excess of 1% per year.

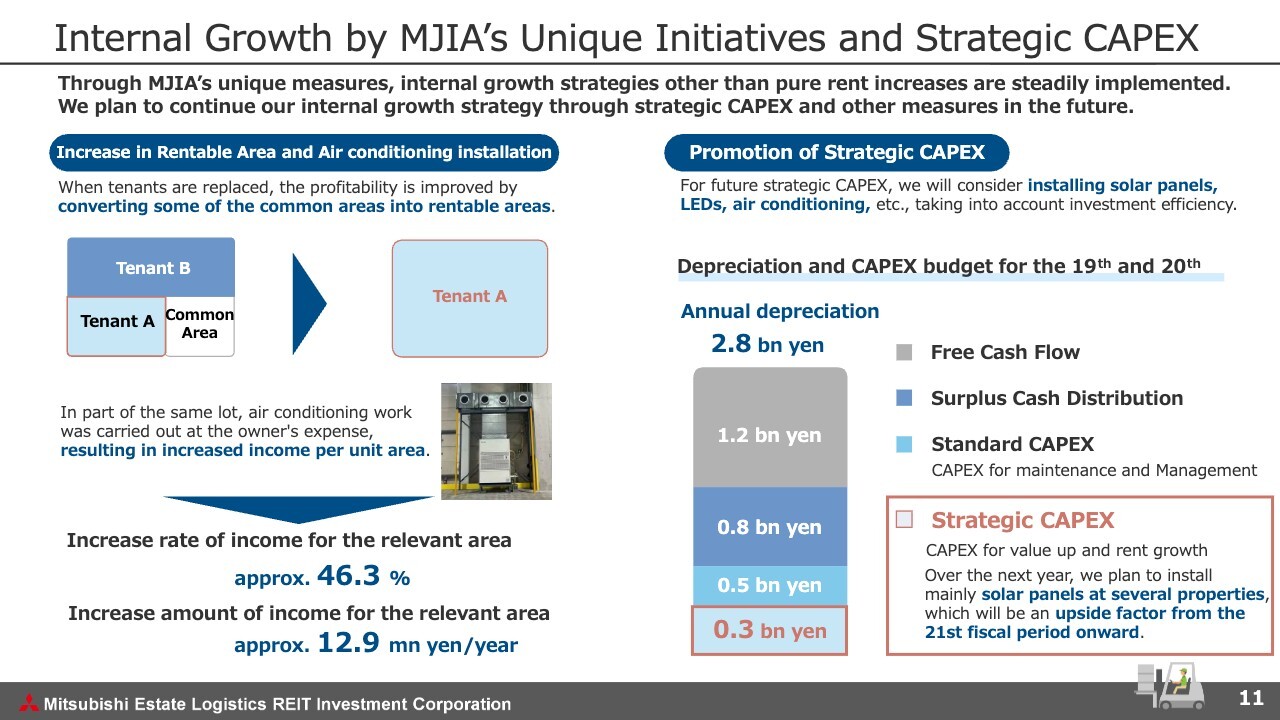

Internal Growth by MJIA's Unique Initiatives and Strategic CAPEX

Here I would like to discuss internal growth specific to MJIA. The left side of the slide shows an example of a solution we implemented during renewal of a contract with a tenant. By combining the tenant's desire to move out with the need for expansion within the building and by partitioning space into optimal areas, we were able to convert a portion of the common area space into a private area, thereby increasing the rentable ratio.

Additionally, through owner-borne investment in air conditioning equipment requested by the tenant, we achieved an additional increase in revenue. As a result, income from the target area increased by 46.3%.

As shown on the right side of the slide, MEL is considering a further focus on the active utilization of free cash flow. In particular, we aim to increase revenue through strategic CAPEX that includes solar panels and air conditioning equipment.

The increase in revenue from strategic CAPEX is not reflected in the current forecast but is expected to be a future upside factor.

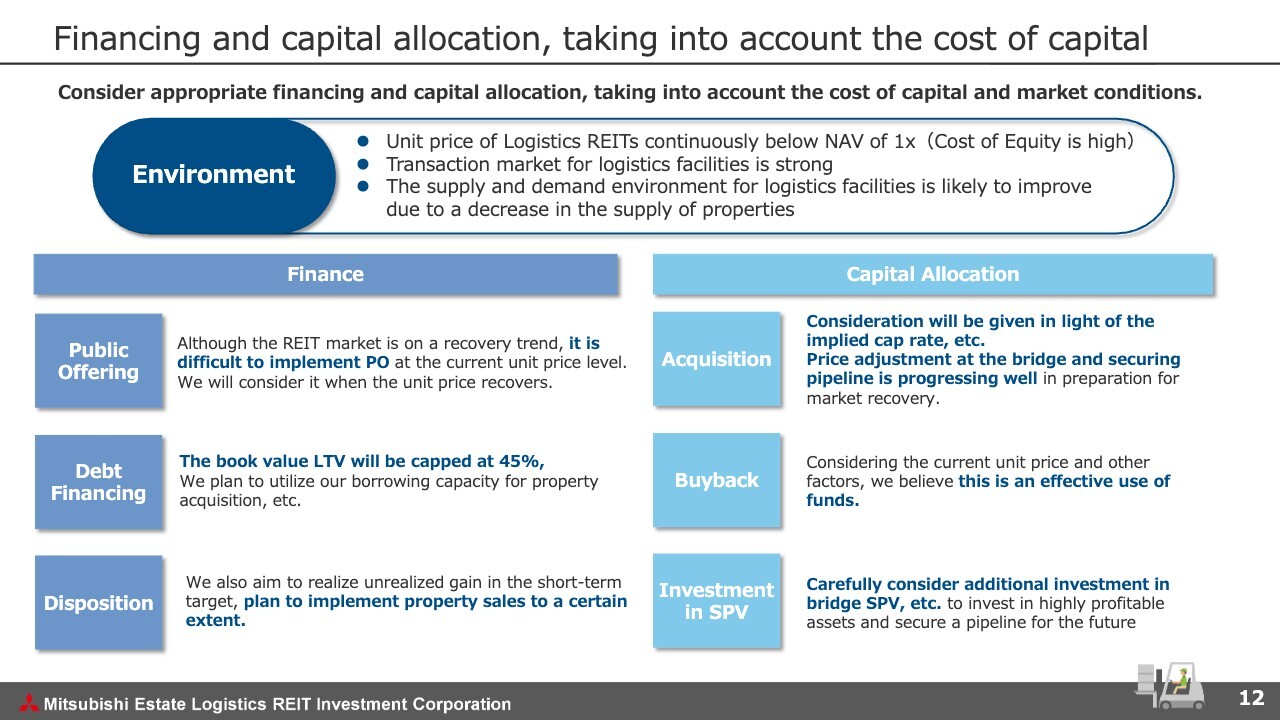

Financing and Capital Allocation, Taking into Account the Cost of Capital

I will move on to financing and capital allocation. Financing methods available to MEL and capital allocation options utilizing those funds are as shown in the slide.

Given MEL's current unfavorable unit price level, MEL will focus on financing through the utilization of LTV and property sales rather than through public offering. We plan to allocate the funds to policies that include property acquisition and buybacks, keeping the cost of capital in mind.

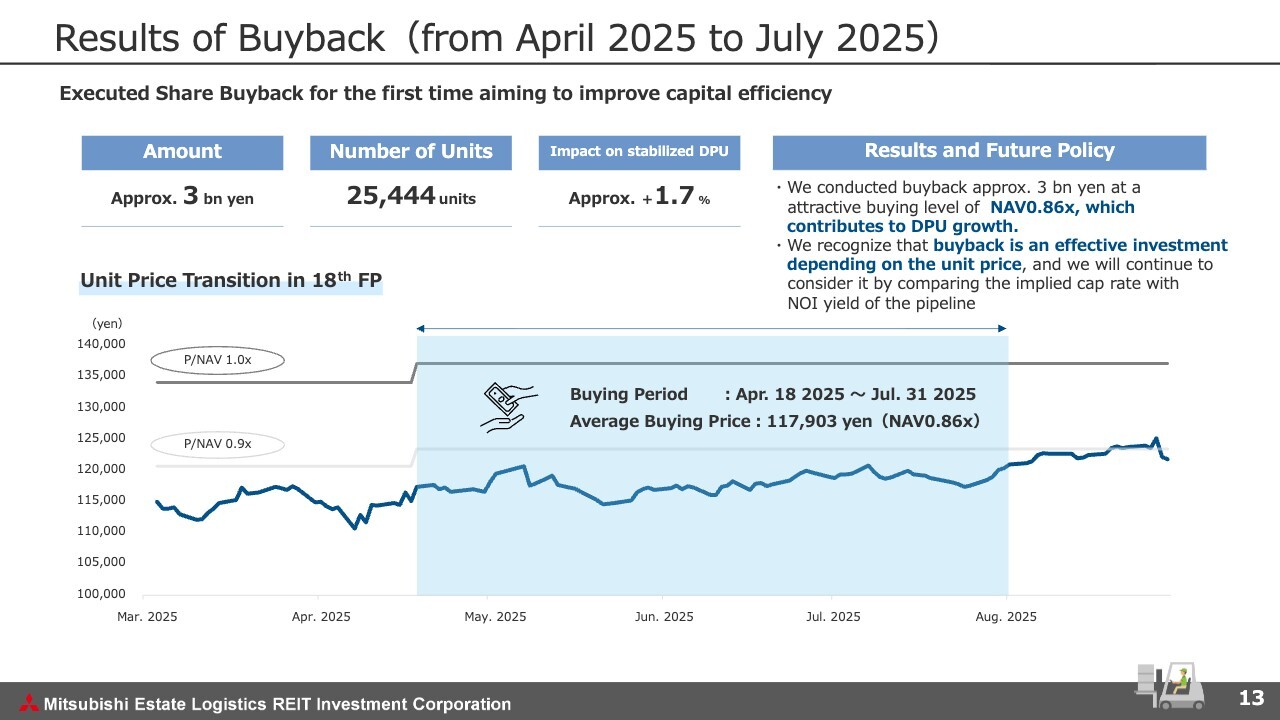

Results of Buybacks (from April 2025 to July 2025)

I will next look at the most recent operational highlights, beginning with the results of buybacks. Between April and July 2025, MEL conducted buybacks of 25,444 units totaling approximately 3 billion yen in value, and retired the units during the fiscal period under review.

Purchases made during the period were at a level of 0.86 times NAV, which had an impact of 1.7% on stabilized DPU. We believe that this action also contributed to enhancing the value of units from a capital efficiency standpoint.

We will continue to examine MEL's unit price and implied cap rate through comparison with the NOI yield of the pipeline.

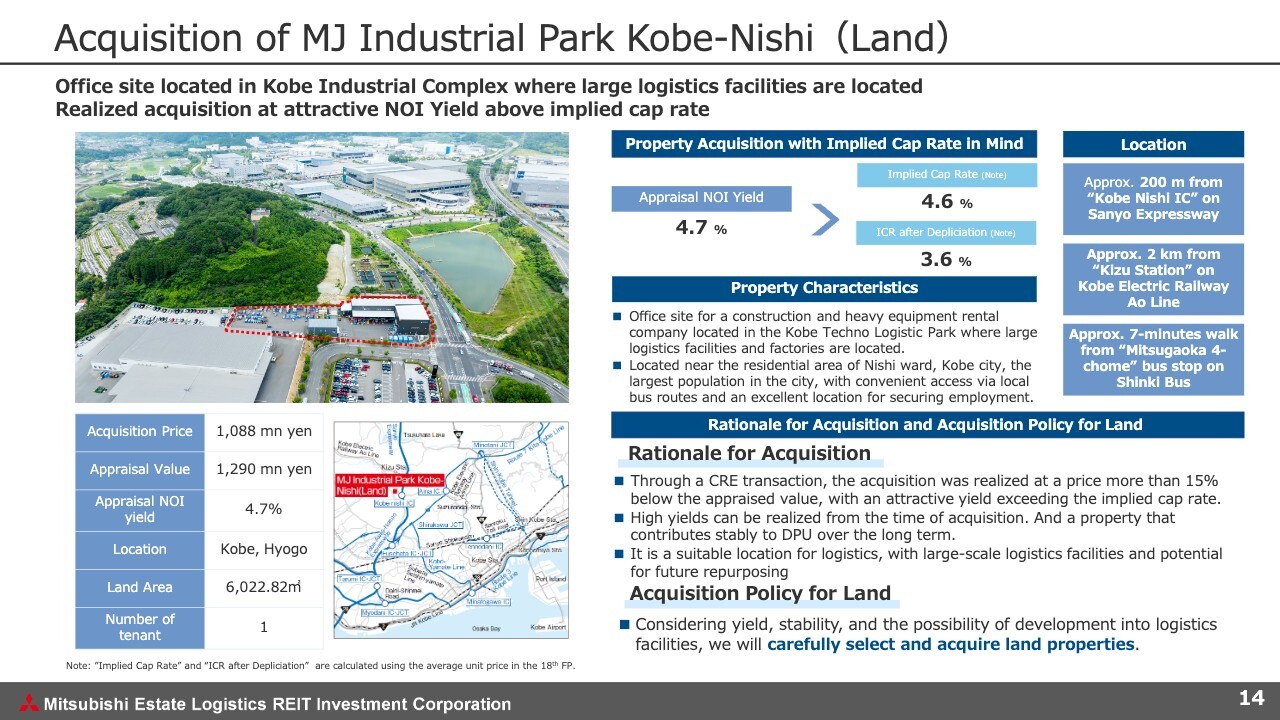

Acquisition of MJ Industrial Park Kobe-Nishi (Land)

During the fiscal period under review, MEL acquired MJ Industrial Park Kobe-Nishi. The property is located close to the Kobe-Nishi Interchange on the Sanyo Expressway on land within the Kobe Industrial Complex.

The property was acquired at a price more than 15% below appraisal value. As the appraisal NOI yield is a relatively high 4.7%. MEL made the acquisition after determining that the property will steadily contribute to both NAV and DPU.

While land is an asset that can generate stable income over the long term and enhance the stability of our portfolio, we also recognize that we are living under an ongoing inflationary environment. We plan to continue careful selection and acquisition of properties based on factors including yield and potential for future development of logistics facilities.

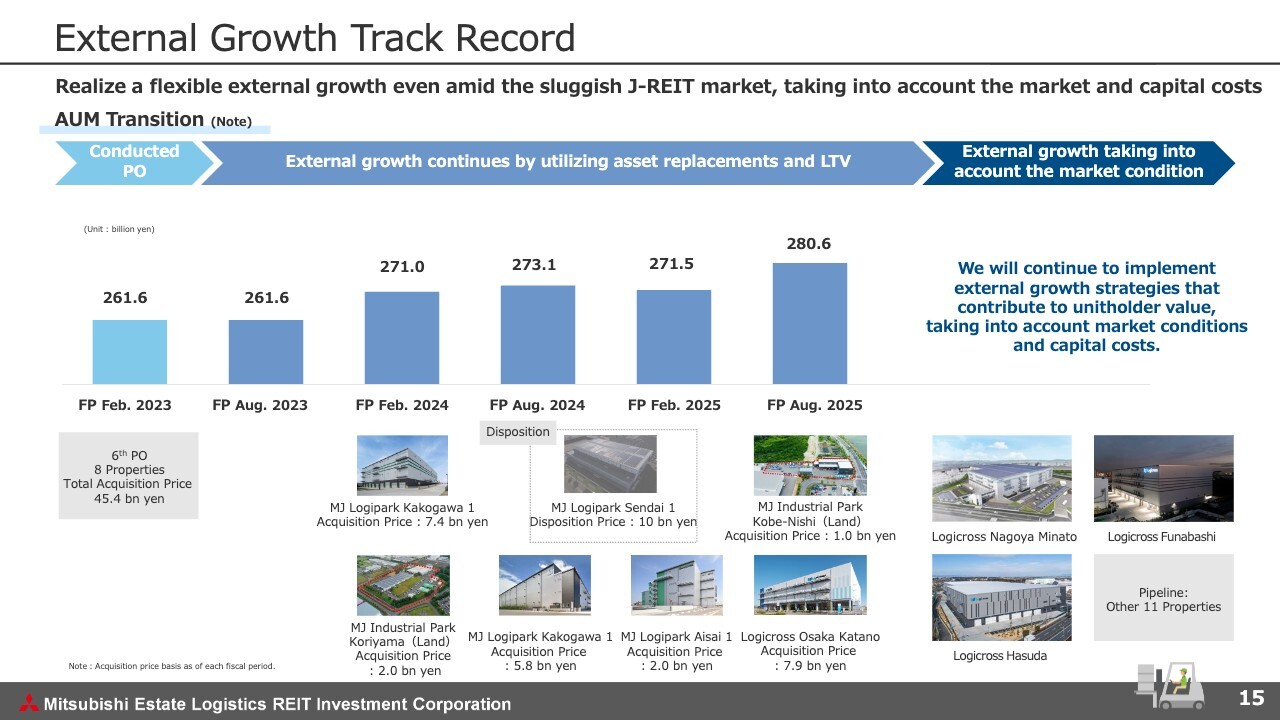

External Growth Track Record

This slide shows MEL's external growth track record from fiscal 2023. Through the fiscal year ended February 2023, the unit prices of logistics REITs remained relatively high, and we were able to acquire large-scale properties through public offerings.

On the other hands, unit prices have remained sluggish since the August 2023 period. Even under this environment, however, we have continued to grow through LTV utilization and the replacement of properties. We will continue to advance external growth strategies that take into account the market and the cost of capital.

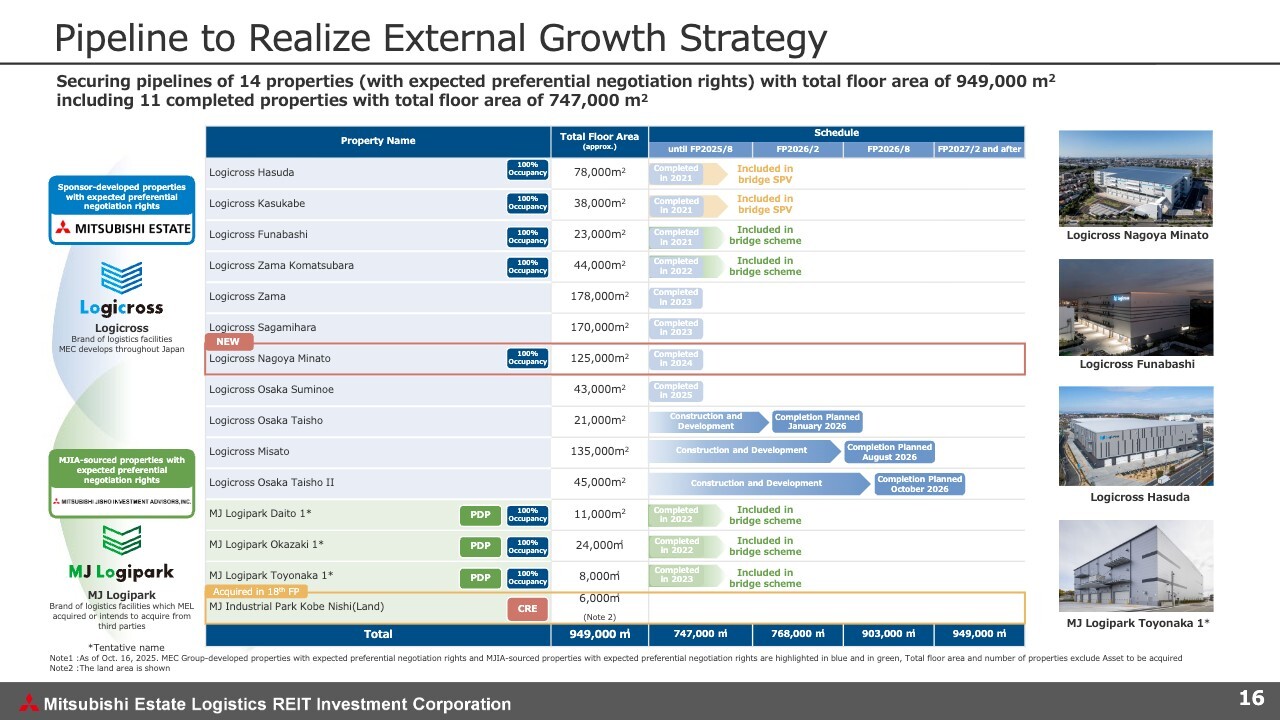

Pipeline to Realize External Growth Strategy

This next slide takes a look at the pipeline. As of today, we have secured a pipeline of 14 properties totaling approximately 940,000 square meters.

During the fiscal period under review, we acquired land in MJ Industrial Park Kobe-Nishi. With the addition of Logicross Nagoya Minato, our pipeline has been further strengthened. While taking the market environment into account, we will utilize these properties to achieve external growth that contributes to enhancing our unit price.

Utilizing Bridge SPV and Progress of Securitization Scheme with LLR

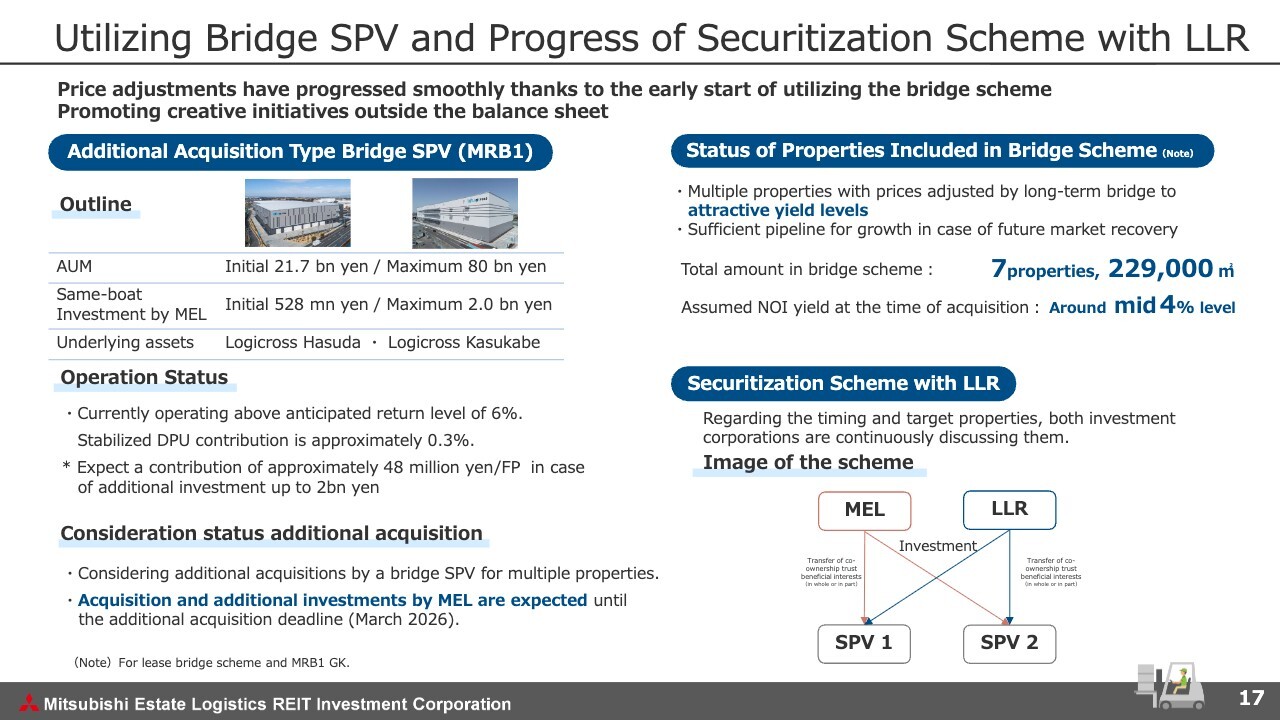

I would now like to explain the bridge scheme being used by MEL and the scheme involving an SPV that we are considering.

As shown on the left side of the slide, as announced in March 2025, we have begun operating a bridge SPV aimed at diversifying our bridge methods. This SPV, which has the potential to expand its scale to 80 billion yen, currently manages two Logicross properties acquired by the SPV at the start of operations, with a total value of approximately 21.7 billion yen.

MEL has also invested in this SPV. The impact of dividend income from this SPV on MEL's DPU is approximately 0.3% on a stabilized DPU basis. If the SPV reaches its maximum size, the impact on MEL's revenue is expected to be approximately 48 million yen per period.

The SPV is permitted to acquire additional properties until March 2026 and will continue to study acquisitions.

At top right, the slide shows the status of properties that have been incorporated into the third-party bridge, in addition to the SPV. As of today, a total of seven properties have been incorporated into the bridge. If these are acquired by MEL, the expected NOI yield is in the mid- 4% range. This is an attractive yield compared to the current real estate transaction market. We will consider acquiring the properties with the future of the J-REIT market and MEL's implied cap rate taken into consideration.

As explained in our previous financial report, we continue to advance discussions with LaSalle LOGIPORT REIT regarding the collaborative scheme.

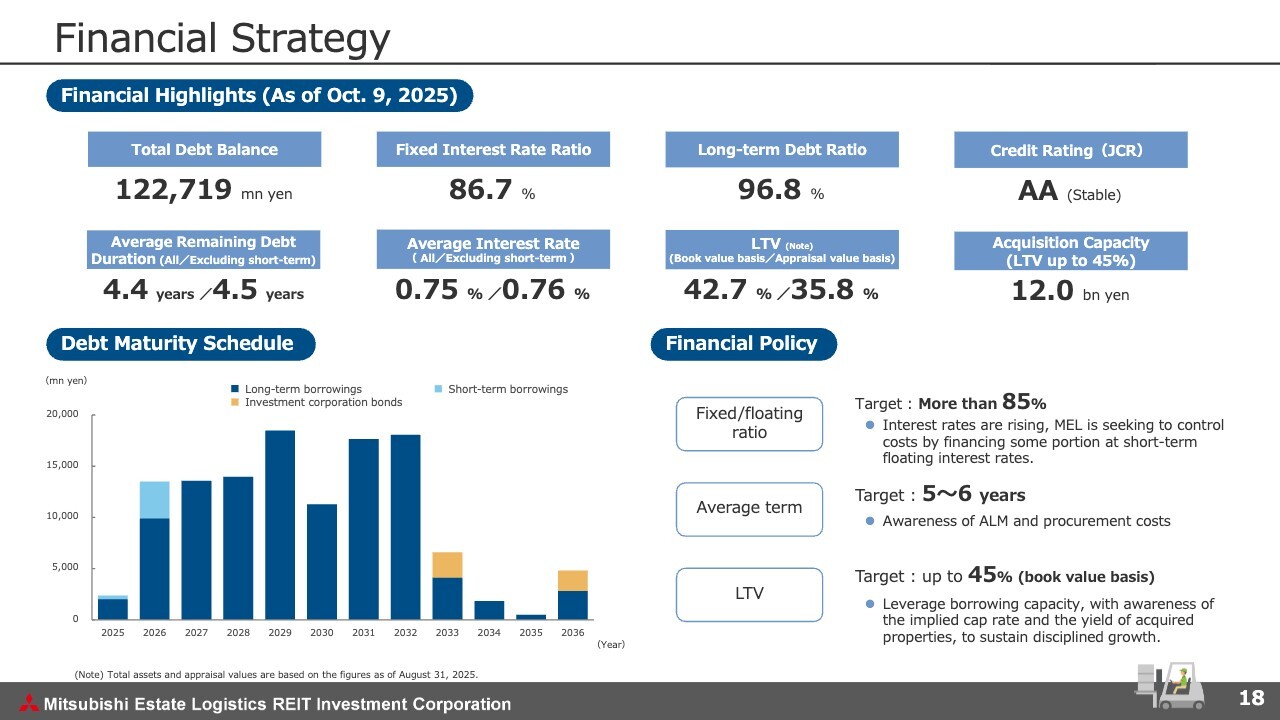

Financial Strategy

This slide concerns our financial strategy. We continue to utilize the strong creditworthiness of the Mitsubishi Estate Group to ensure stable financial management.

As shown at bottom right, we intend to strike a balance between stability and cost control by aiming for a fixed ratio of 85% or more and an average financing period of 5 to 6 years for future financing, taking interest rate trends into consideration. We aim to achieve disciplined external growth by utilizing our borrowing capacity, with an LTV upper limit of approximately 45% on a book value basis for the time being.

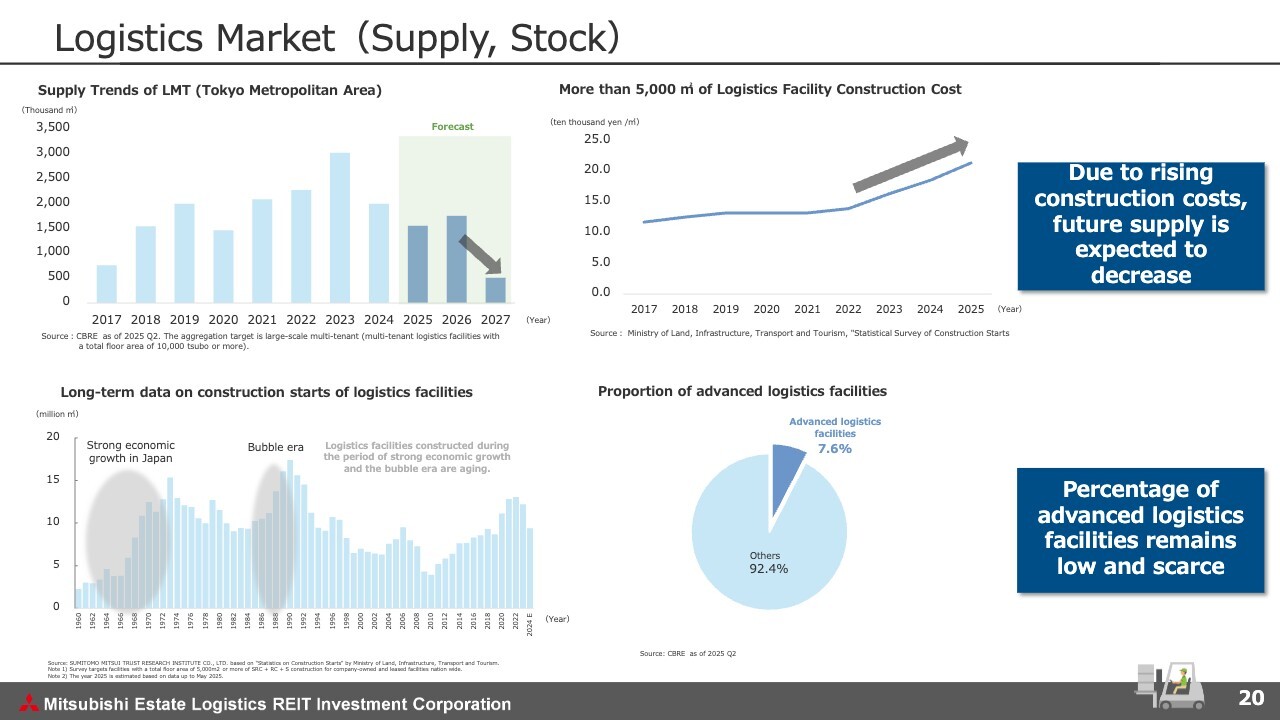

Logistics Market (Supply, Stock)

Here I will discuss trends in the supply of logistics facilities. Due to rising labor costs and building material prices, construction costs are rising and the development of logistics facilities is becoming more difficult. As shown in the graph at upper left, the expected supply of logistics facilities is on a downward trend.

On the other hand, as the graphs at bottom show, while supply has increased in recent years as the stock of logistics facilities ages, the proportion of advanced logistics facilities remains low at less than 10%. For this reason, we recognize that the portfolio held by MEL has high scarcity value.

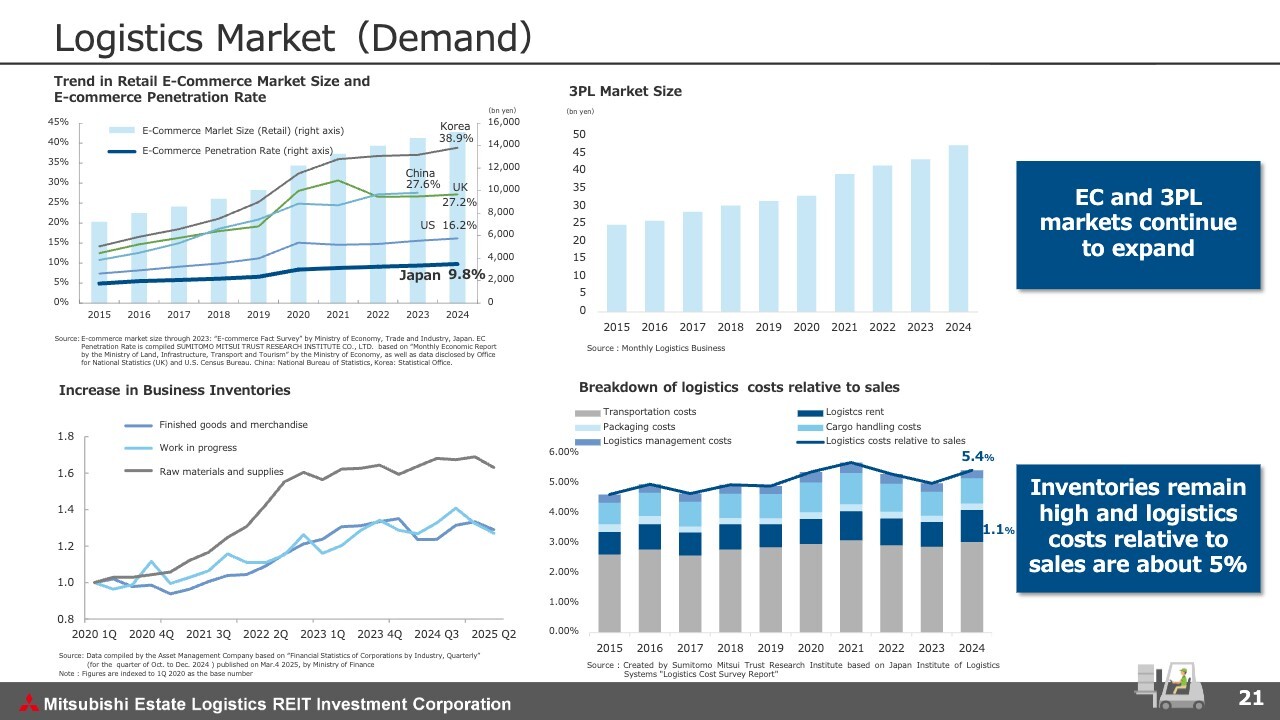

Logistics Market (Demand)

This slide looks at the demand trend for logistics facilities. Due to the increasing global adoption of e-commerce and the expansion of logistics outsourcing by business operators, we expect solid demand for efficiently usable logistics facilities for lease.

Under active corporate economic activity, corporate inventories remain high and logistics costs as a percentage of corporate sales are being kept at around 5%. Based on this, we expect stable demand to continue.

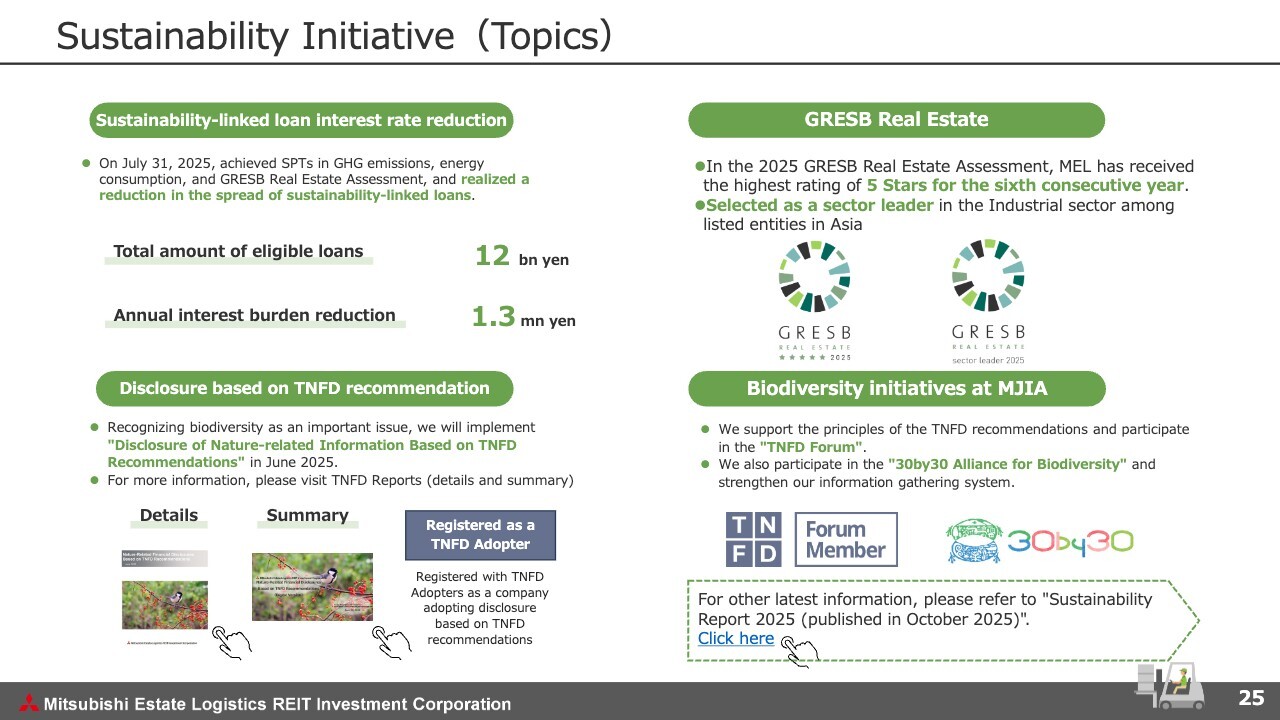

Sustainability Initiatives (Topics)

I would now like to take a look at our sustainability initiatives. As shown at upper left, we have achieved the environmental targets set for existing sustainability-linked loans as of the reference date, and are reducing the applicable spread. For the seven target loans, we achieved a total annual interest burden reduction of 1.3 million yen.

As shown at upper right, in the 2025 GRESB Real Estate Assessment, MEL received the highest rating of 5 Stars for the sixth consecutive year. MEL was also selected as a sector leader in the logistics and industrial sector among listed entities in Asia, demonstrating its proactive approach to sustainability.

That concludes today's presentation. Thank you very much for your attention.

Q&A: The Momentum of Rent Increases

Questioner: Regarding rent increases, MEL has achieved high increases in rent from the past three years, with an increase of 8% in the August 2025 period and an increase of 7% in the February 2026 period. Is there a clear sense that momentum is improving, or are there some special factors at play? I believe that the coming decrease in supply will lead to increased momentum, but what are your thoughts on the accelerating rate of increase in rents?

Yokota: Rent revisions taking advantage of rent gaps are continuing, and we feel that momentum is building. However, as differences in volume of rent renewals and rent gaps in target rents inevitably occur from period to period, we believe that there will be some fluctuations in the future.

Q&A: Capital Allocation Prioritization

Questioner: I would like to ask about capital allocation with an awareness of the cost of capital. Regarding property acquisition and buybacks, taking into account the use of cash on hand and debt, have the MEL's priorities changed from six months ago? For example, do you currently believe that property acquisitions contribute more to improved profitability per unit than do buybacks, or do you continue to see buybacks as important?

Yokota: We have so far not set particular priorities but have allocated funds in the most optimal way at the time, taking into account stock price levels, the yield and the sense of size of properties in the pipeline, and so on. As of now, there are no major changes.

Q&A: Introduction of CPI-linked Clauses

Questioner: The financial results presentation materials note a policy of introducing CPI-linked clauses when a contract term exceeds five years. Should this be understood to mean that such clauses will not be actively introduced for contracts of less than five years?

Yokota: As a guideline, CPI is presented during negotiations with parties wishing to renew or enter into a new long-term contract of over five years. Conversely, for contracts of less than five years, if the rent gap can be firmly realized at the time of contract renewal, CPI may not be incorporated, taking into account the opportunity for further negotiation. However, if the expected rent gap is not reached, CPI may be proposed as a bargaining chip.

Q&A: Collaborative Scheme with LaSalle LOGIPORT REIT

Questioner: Regarding the collaborative scheme with LaSalle LOGIPORT REIT, how should we view the timing of a start?

Yokota: We view the collaborative scheme with LaSalle LOGIPORT REIT as one way to return unrealized gains, and are currently engaged in discussions along those lines. With regard to the return and sale of the unrealized gains, we are also considering the possibility of external sales of not only properties jointly owned with MEL and LLR but also properties that MEL wholly own. We are currently proceeding on both fronts.

We will provide further progress updates at the appropriate time for publication.

Q&A: LTV policy

Questioner: Regarding LTV, the upper limit for the time being is 45% on a book value basis. Is there a future possibility that the standard will be changed to a market value basis as is the case with other REITs, and that leverage will be further increased?

Yokota: Regarding LTV, we are proceeding with a policy of 45% on a book value basis, but as you note, we are aware that there is a trend to assess market value. In particular, the longer the investment period, the greater the discrepancy between book value and market value. Therefore, we plan to continue studying which option is more appropriate, keeping market value in mind.

Remarks from Mr. Yokota

Thank you for taking the time to attend today's Mitsubishi Estate Logistics REIT Investment Corporation's financial results briefing for the fiscal period ending August 2025 (18th fiscal period). As we endeavor to manage the fund in a way that meets the expectations of our investors, we appreciate your continued support.