Summary

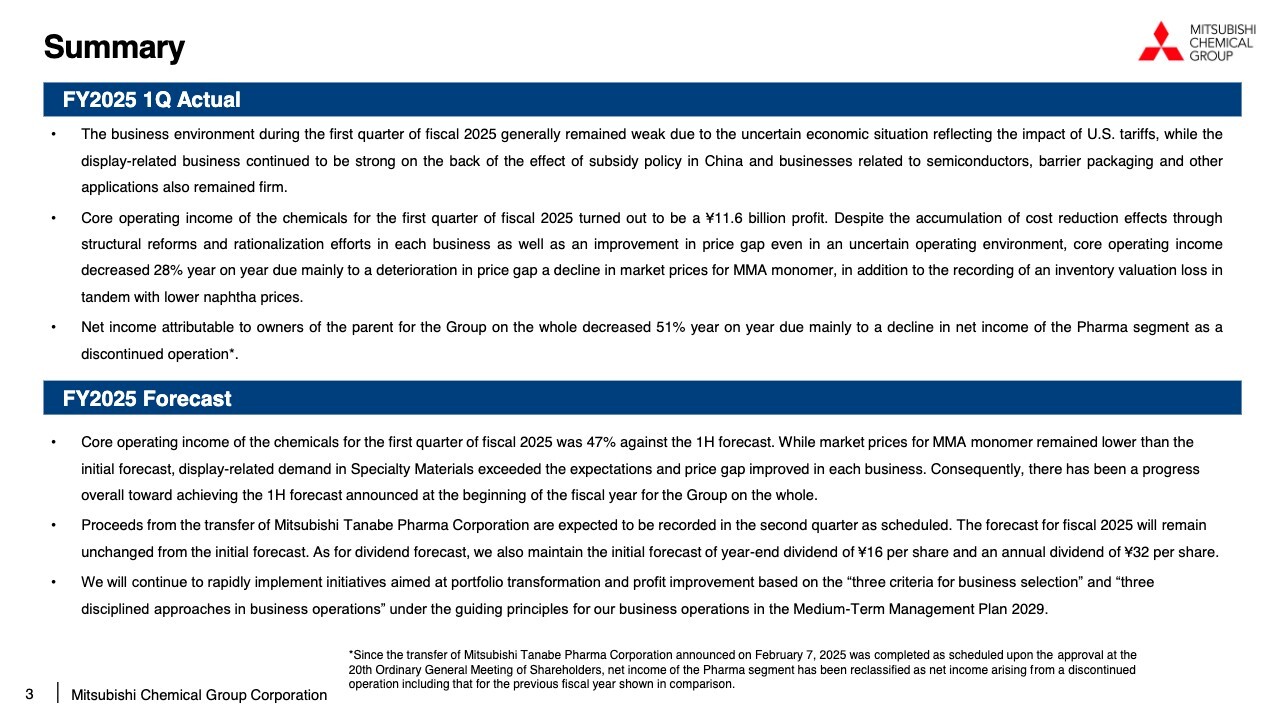

Kida: Hello, everyone. My name is Minoru Kida, CFO of the Company. I will now explain the financial results for the first quarter of the fiscal year ending March 31, 2026.

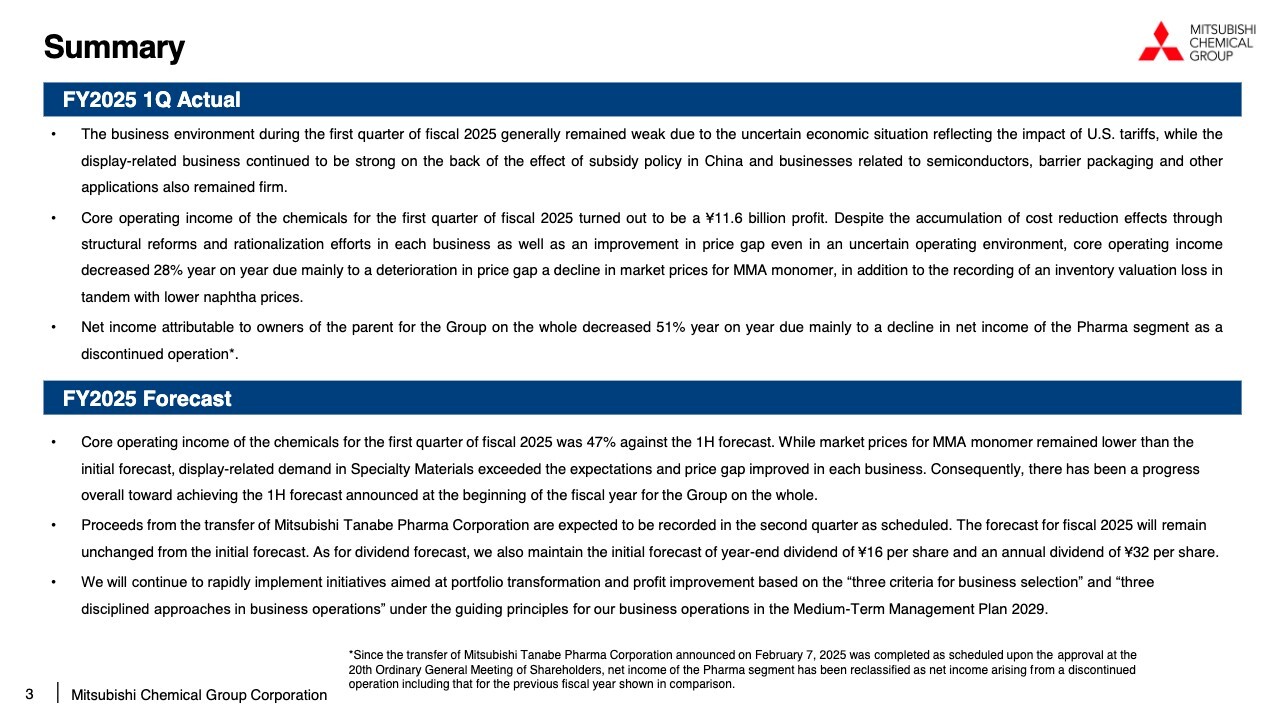

Let me begin with the summary. During 1Q, the display-related business continued to be strong on the back of the effect of subsidy policy in China. While some businesses, such as those related to semiconductors, barrier packaging and other applications also remained firm, the overall business environment was weak due to the extremely strong uncertainties in economy mainly reflecting the impact of U.S. tariffs.

Core operating income of the Chemicals for 1Q turned out to be an ¥11.6 billion profit. In addition to the accumulation of cost reduction effects through structural reforms and rationalization efforts in each business, we saw an improvement in price gap even in an uncertain operating environment.

However, core operating income decreased 28% YoY due mainly to a deterioration in price gap resulting from a decline in market prices for MMA monomer, in addition to the recording of an inventory valuation loss in tandem with lower naphtha prices. Net income attributable to owners of the parent for the Group on the whole decreased 51% YoY due mainly to a decline in net income of the Pharma segment as a discontinued operation.

Core operating income of the Chemicals for 1Q FY2025 was 47% against the 1H forecast. While market prices for MMA monomer remained lower than the initial forecast, display-related demand in Specialty Materials exceeded the expectations and price gap improved in each business. Consequently, there has been a progress overall toward achieving the 1H forecast announced at the beginning of the fiscal year for the Group on the whole.

Gain on the transfer of Mitsubishi Tanabe Pharma Corporation is expected to be recorded in 2Q as scheduled.

The forecast for FY2025 will remain unchanged from the initial forecast. As for the dividend forecast, we also maintain the initial forecast of year-end dividend of ¥16 per share and an annual dividend of ¥32 per share.

We will continue to rapidly implement initiatives aimed at portfolio transformation and profit improvement based on the “three criteria for business selection” and “three disciplined approaches in business operations” under the guiding principles for our business operations in the Medium-Term Management Plan 2029.

Consolidated Statements of Operations

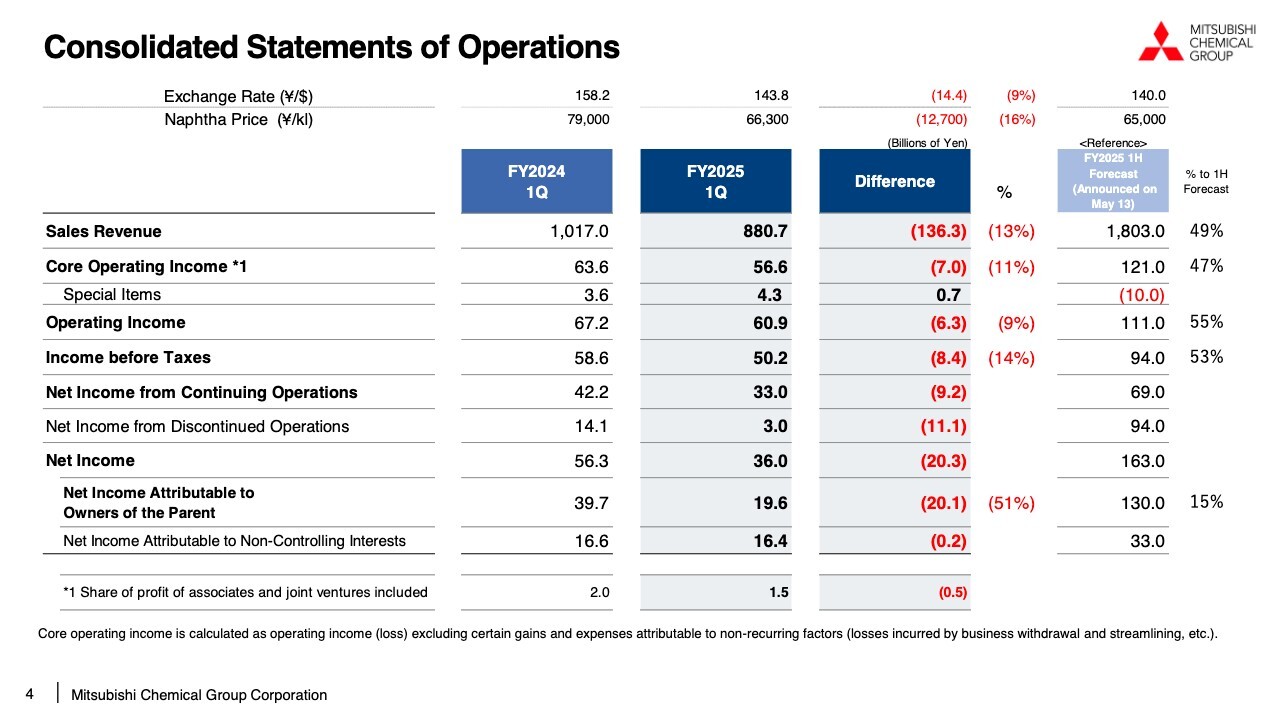

I will now explain the consolidated statements of operations for 1Q FY2025. The average exchange rate for the period was ¥143.8 to the U.S. dollar, a 9% appreciation of yen compared to the same period last year. The unit price of naphtha decreased by 16% YoY to ¥66,300/Kl. Sales revenue totaled ¥880.7 billion, a decrease of ¥136.3 billion YoY.

The breakdown of the decrease in sales revenue is as follows: ¥38.0 billion due to foreign exchange factors, ¥23.0 billion from selling prices, and ¥19.0 billion from volume. In addition, the largest factor was ¥56.0 billion resulting primarily from business restructuring.

Core operating income totaled ¥56.6 billion, a decrease of ¥7.0 billion YoY. This represents 47% progress against the forecast for 1H announced in May. I will explain the details later.

Special items amounted to a positive ¥4.3 billion, an increase of ¥0.7 billion YoY. Operating income was ¥60.9billion, income before taxes was ¥50.2 billion, and net income attributable to owners of the parent was ¥19.6 billion, a decrease of ¥20.1 billion YoY.

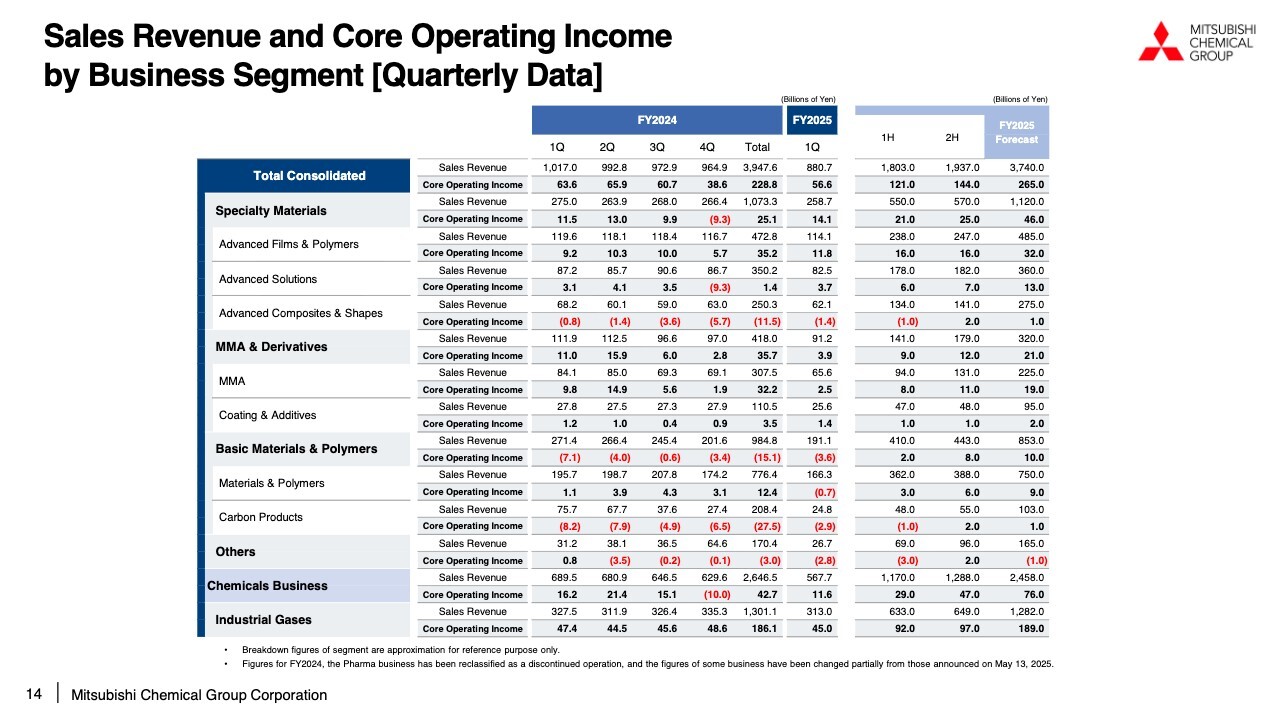

Sales Revenue and Core Operating Income by Business Segment

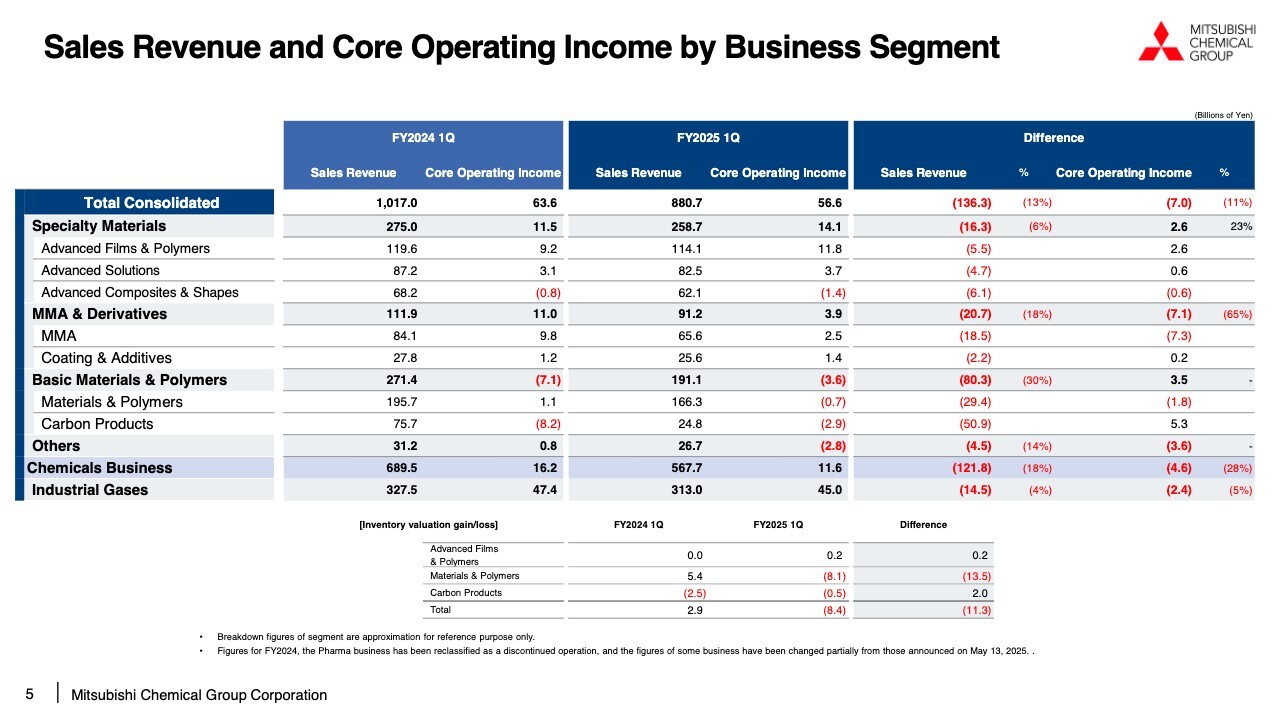

We will now present sales revenue and core operating income by business segment. Specialty Materials saw a 6% decline YoY in sales revenue, but a 23% increase YoY in core operating income.

Sales revenues decreased by ¥16.3 billion yen YoY, mainly due to the transfer of business as a result of steady progress in structural reforms, in addition to the decline in raw material prices. Meanwhile, core operating income increased by ¥2.6 billion yen YoY.

Advanced Films & Polymers and Advanced Solutions are off to a good start, thanks to relatively strong demand for display-related applications, semiconductor-related materials, and barrier packaging material applications. As for Advanced Composites & Shapes, we are expediting the structural improvement of the loss-making carbon fiber business.

MMA & Derivatives reported an 18% decrease YoY in sales revenue and a 65% decrease YoY in core operating income. Revenue and income declined due to the drop in MMA monomer market prices since 2H of the previous fiscal year.

Basic Materials & Polymers saw a 30% decrease YoY in sales revenue while its core operating loss narrowed by ¥3.5 billion YoY. Materials & Polymers experienced a significant decrease in sales revenue partly affected by the transfer of terephthalic acid business in Indonesia in the previous fiscal year in addition to the decline in price of raw material naphtha, but we managed to limit the decrease in core operating income to ¥1.8 billion.

Carbon Products experienced a significant revenue decrease of ¥50.9 billion YoY, due to a decline in raw material coal prices and the transfer of shares of Kansai Coke and Chemicals Company, Limited conducted in the previous fiscal year. Meanwhile, the loss has diminished by ¥5.3 billion due to an improvement of inventory valuation gains and losses by ¥2.0 billion YoY, as well as the effects of structural reforms.

The Chemicals business saw a YoY decreases of 18% in sales revenue and 28% in core operating income. While Carbon Products and Specialty Materials showed steady improvement, the overall performance of the Chemicals business unfortunately deteriorated due to a decline in MMA monomer market conditions.

Industrial Gases saw YoY declines of 4% in sales revenue and 5% in core operating income.

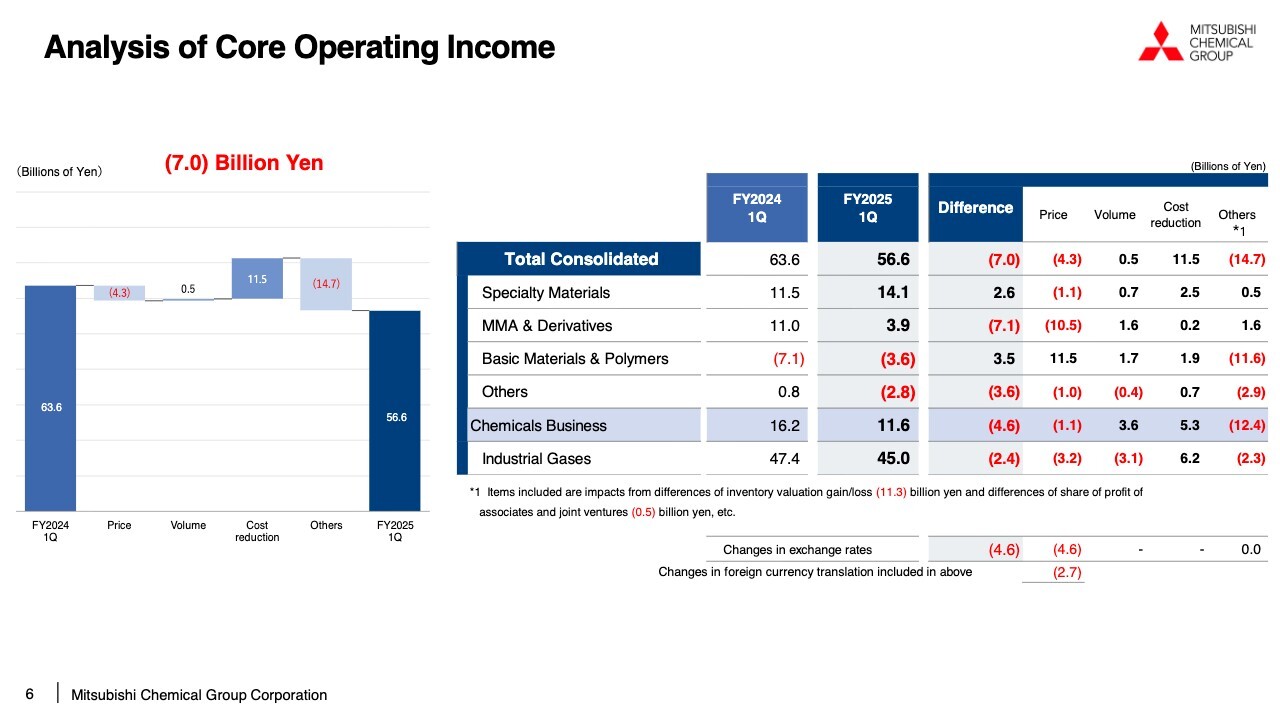

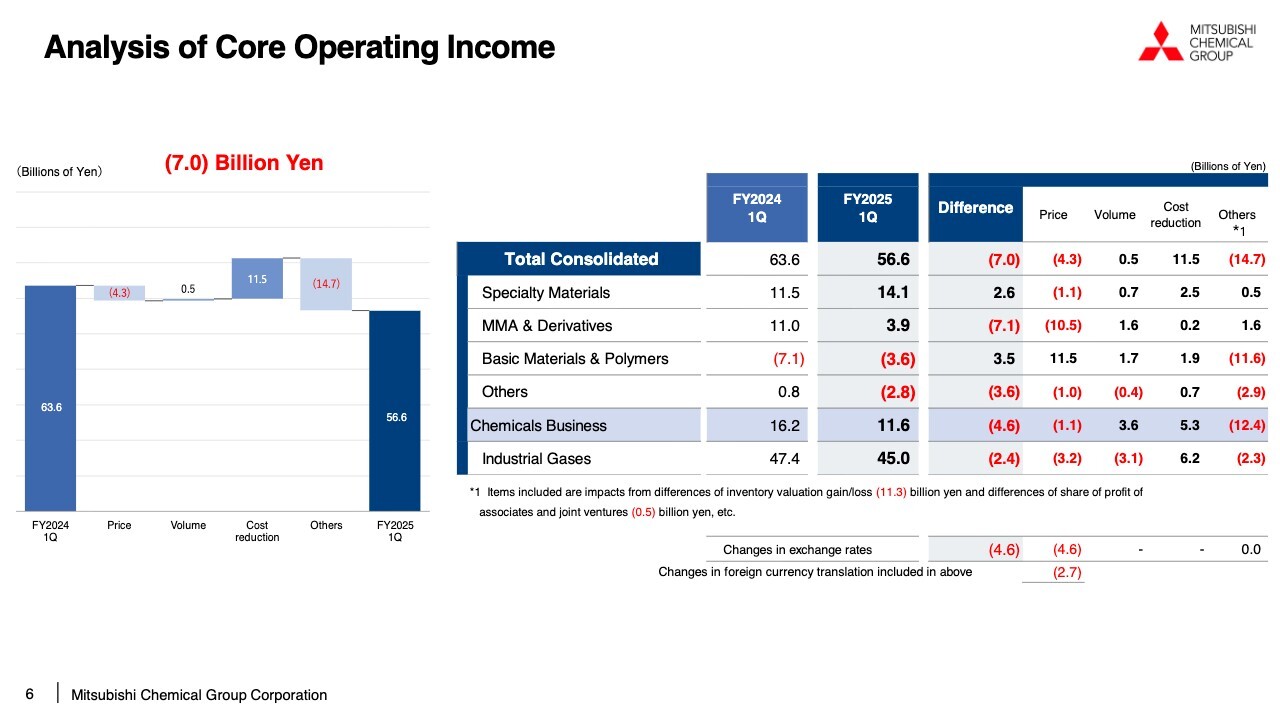

Analysis of Core Operating Income

The slide shows the breakdown of the YoY decrease of ¥7.0 billion in core operating income. The price gap brought a negative ¥4.3 billion. Of this, foreign exchange effects contributed to a negative ¥4.6 billion.

Without considering foreign exchange effects, MMA & Derivatives experienced a deterioration in price gap due to a decline in market prices, while Basic Materials & Polymers saw improvement in price gap for polyolefin.

The volume gap resulted in a positive ¥0.5 billion. While Industrial Gases saw a negative growth YoY, the Chemicals business saw a positive results. Basic Materials & Polymers and MMA & Derivatives benefited from scaled-down scheduled maintenance.

Cost reduction had a positive impact of ¥11.5 billion, with positive effects accumulating mainly in Industrial Gases and the Chemicals business.

Other factors had a negative impact of ¥14.7 billion. Of this, inventory valuation losses contributed to the deterioration of negative ¥11.3, mainly in Basic Materials & Polymers, due to the decline in the prices of raw material naphtha.

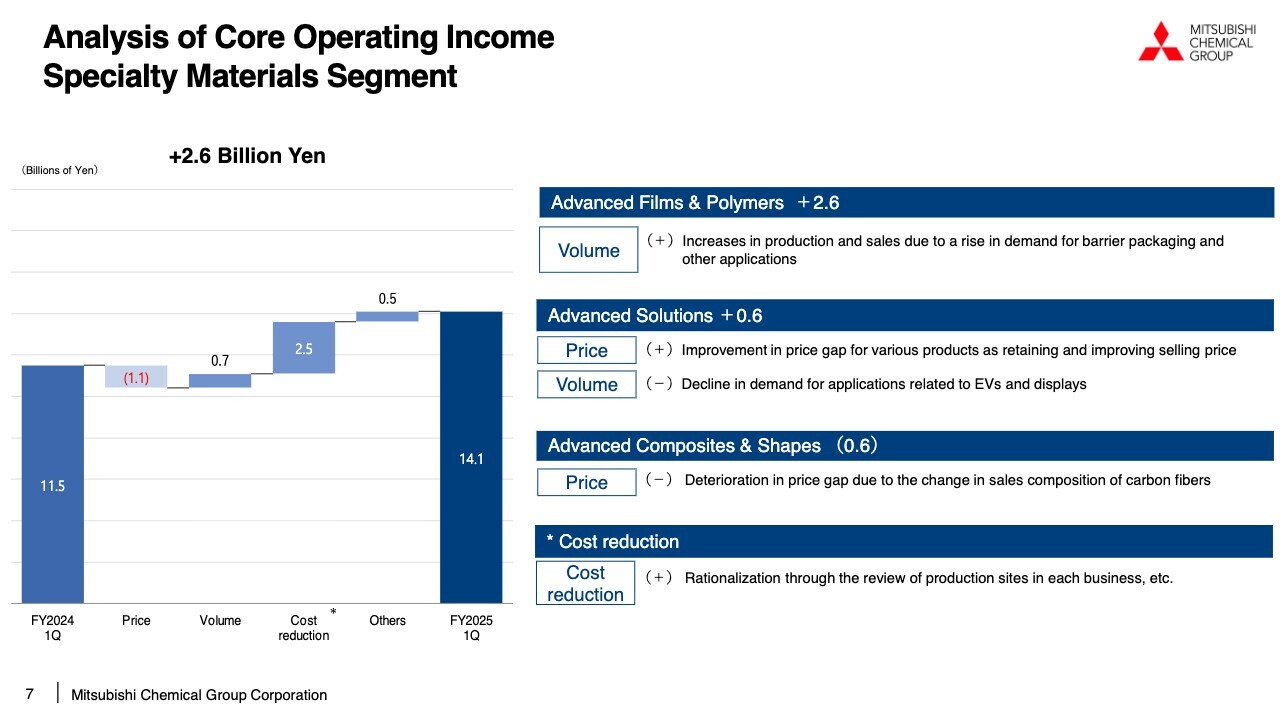

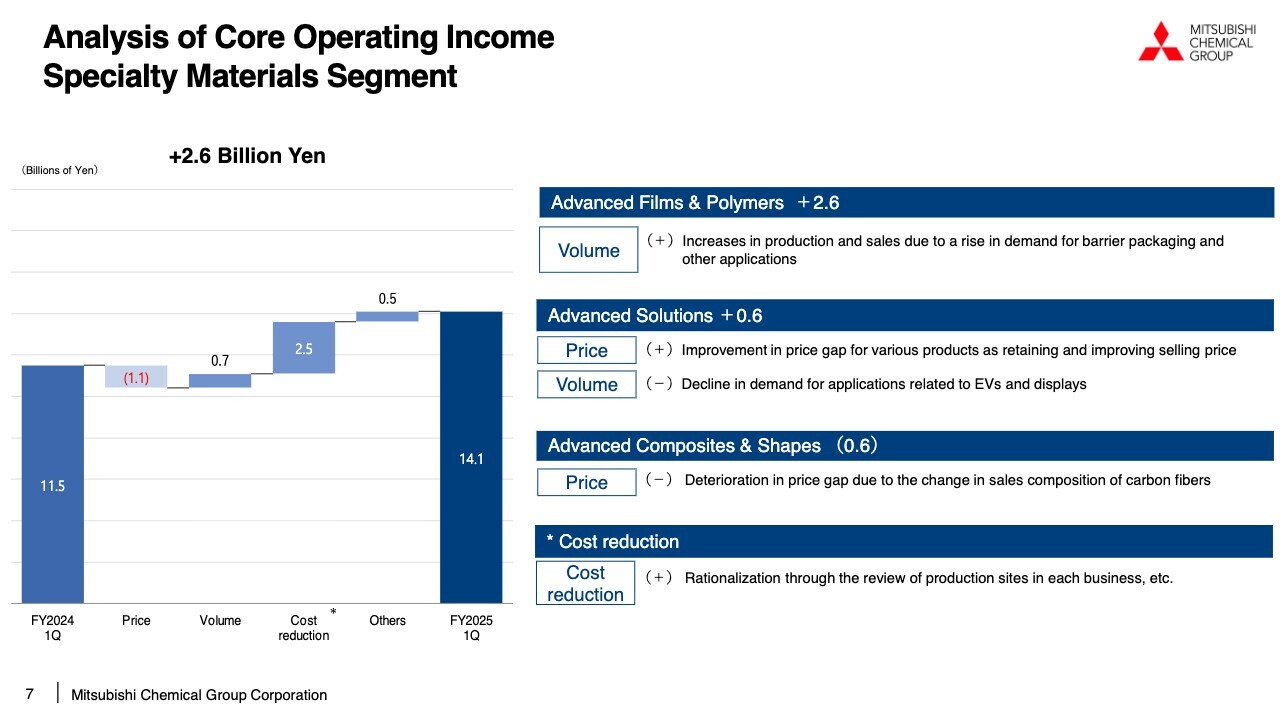

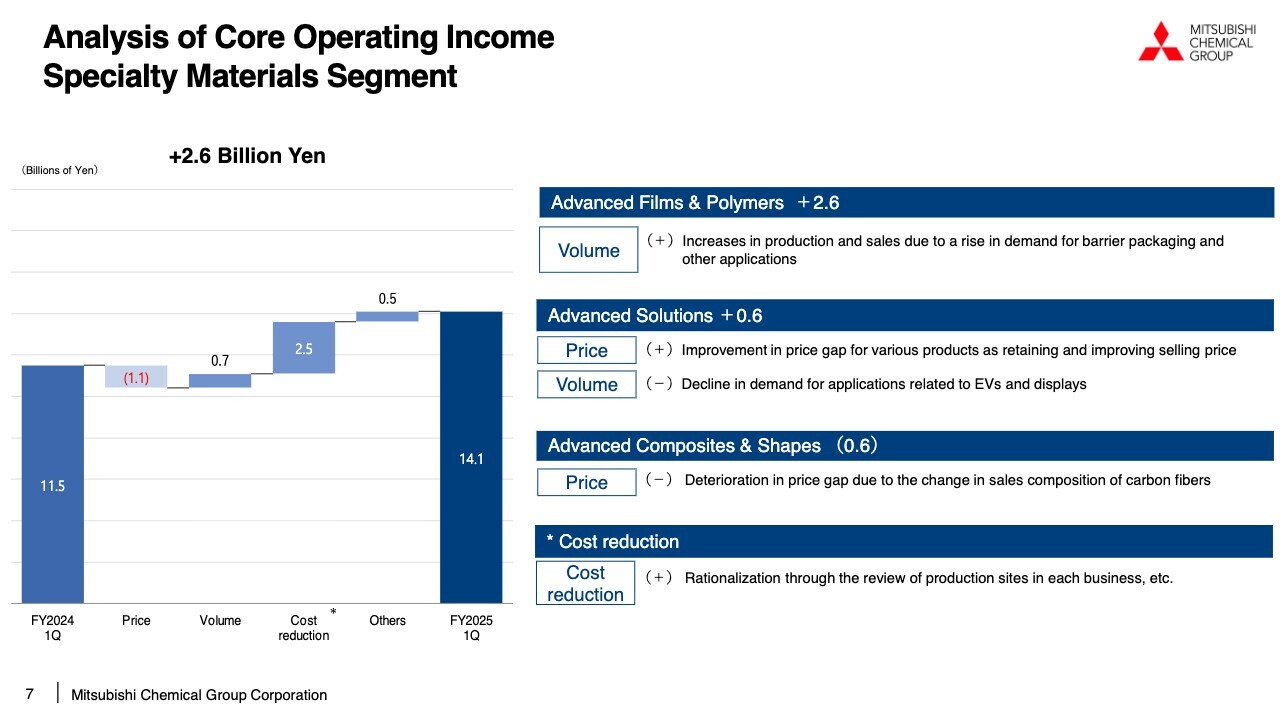

Analysis of Core Operating Income: Specialty Materials Segment

Let me explain the details by segment. Specialty Materials saw an increase of ¥2.6 billion YoY in core operating income. The price gap contributed a negative ¥1.1 billion.

In Advanced Solutions, price gap improved for various products including semiconductor-related products as a result of maintaining and improving selling prices.

In Advanced Composites & Shapes, the carbon fiber business saw a decline affected by the sales mix resulting from the deterioration of the competitive environment for pressure vessels and other products, which continued from the previous fiscal year. The volume gap resulted in a positive ¥0.7 billion.

In Advanced Films & Polymers, volume gap improved mainly due to YoY increases in capacity utilization and sales of barrier packaging application Soarnol. Demand for polyester films and OPL films remained solid as customers’ high operations continued from the previous fiscal year supported mainly by subsidy policies in China.

In Advanced Solutions, volume gap worsened due to lower demand for electrolytes for EVs, mainly in Europe and the U.S., and lower sales volume of some display-related materials.

In Advanced Composites & Shapes, the volume remains flat from 1Q of previous year. The carbon fiber and composites business posted a loss for FY2024, with a core operating income of negative ¥10.2 billion.

To improve profitability, we are expeditiously reviewing the production system and sales portfolio. Decisions were made to suspend operations of the large tow production facility in Hiroshima Prefecture and to scale back production at the regular tow production facility in the United States in 2025. In connection with these decisions, an impairment loss was recorded for the previous fiscal year.

We will steadily improve profits by cutting back on manufacturing and sales of products for wind turbines and pressure vessels, whose profitability has been deteriorating, and focusing on high-value-added applications such as high-end sports, aircraft and defense applications, and business for next-generation mobility by CPC SRL, an Italian manufacturer of carbon fiber composite components.

Cost reductions contributed to a positive ¥2.5 billion, driven by effect of rationalization through the promotion of structural reforms and the review of production sites in each business.

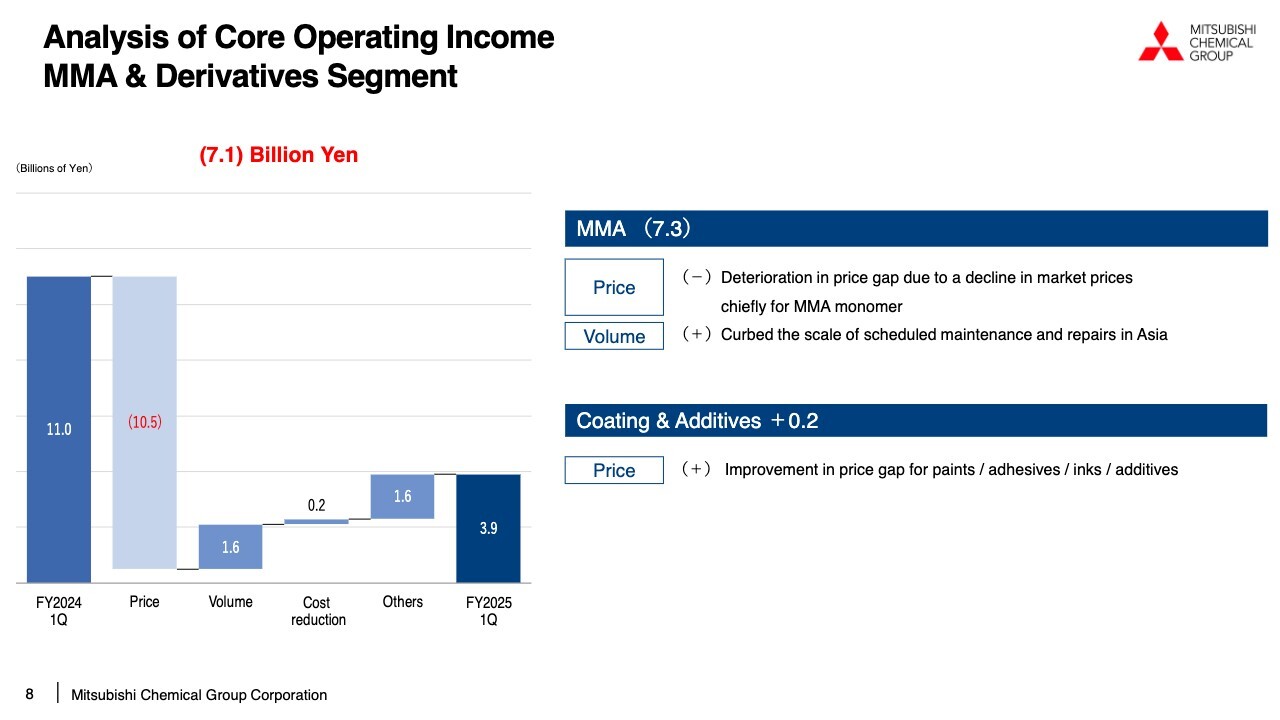

Analysis of Core Operating Income: MMA & Derivatives Segment

MMA & Derivatives saw a YoY decrease of ¥7.1 billion in core operating income. The price gap has a negative impact by ¥10.5 billion.

While price gap improved in Coating & Additives business, market price for MMA monomer declined significantly YoY, narrowing the spread. The volume gap improved slightly YoY to a positive ¥1.6 billion due to the diminished impact of scheduled maintenance and repairs on MMA monomer in the Asian region.

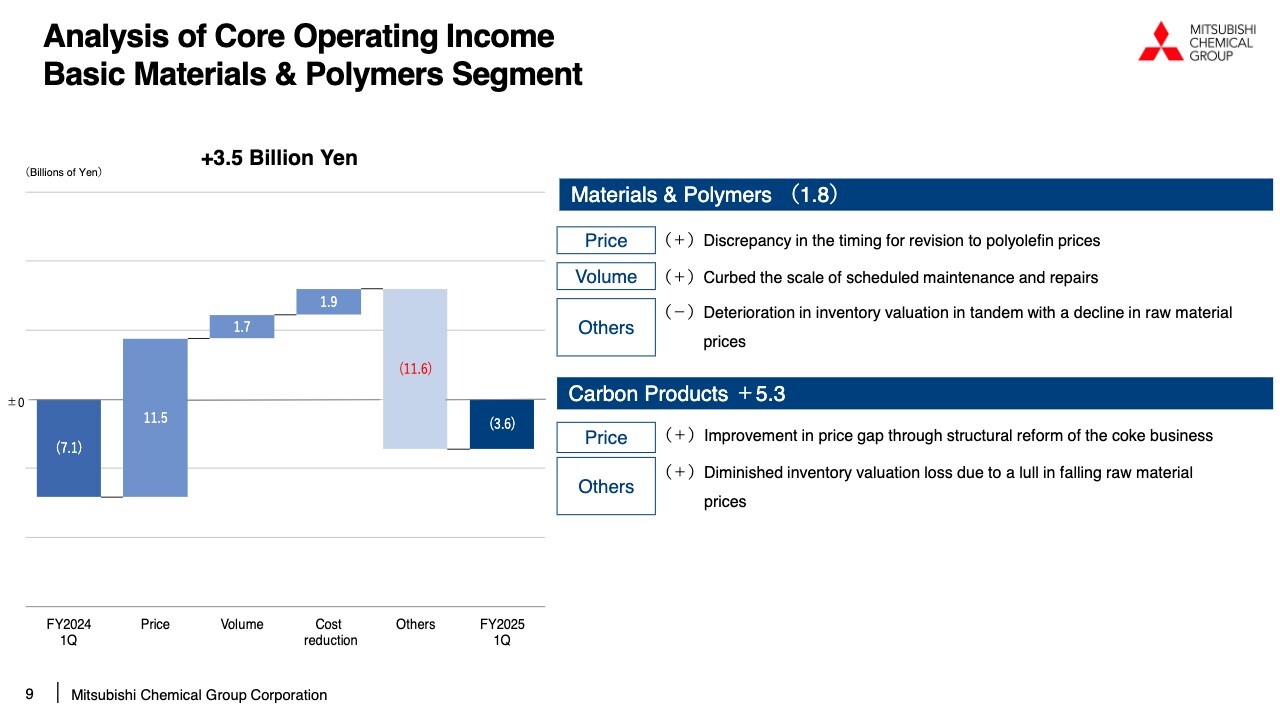

Analysis of Core Operating Income: Basic Materials & Polymers Segment

Basic Materials & Polymers reduced its core operating loss by ¥3.5 billion YoY. The price gap had a positive impact by ¥11.5 billion.

Materials & Polymers contributed to improved profit as a result of the impact of discrepancy in the timing for revision to polyolefin selling prices and the selling prices remaining at relatively high levels despite falling naphtha prices.

In Carbon Products, price gap improved YoY due to the completion of capacity reduction at Kagawa Prefecture and the reduction of market price-based loss-making transactions.

The volume gap added ¥1.7 billion mainly due to diminished impact of scheduled maintenance in Materials & Polymers. Cost reduction had a positive impact of ¥1.9 billion, adding up the effects of fixed cost reductions in Materials & Polymers and the production capacity reduction in Carbon Products. Other factors with a negative impact of ¥11.6 billion include a negative ¥11.5 billion resulting from deterioration in inventory valuation gains and losses.

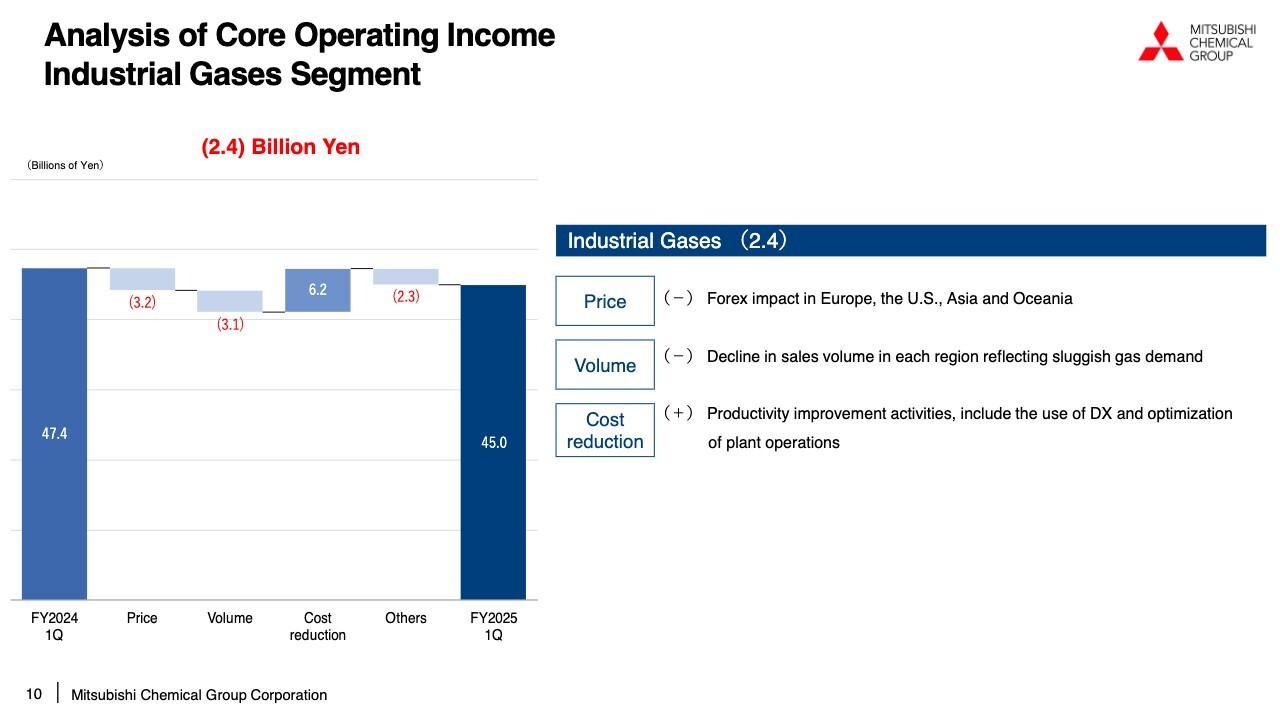

Analysis of Core Operating Income: Industrial Gases Segment

Industrial Gases saw a decrease of ¥2.4 billion YoY in core operating income. The YoY decrease was attributable to foreign exchange impact and deterioration in the volume gap, although cost reduction effects from ongoing productivity improvement activities and other initiatives across various regions continued to deliver results.

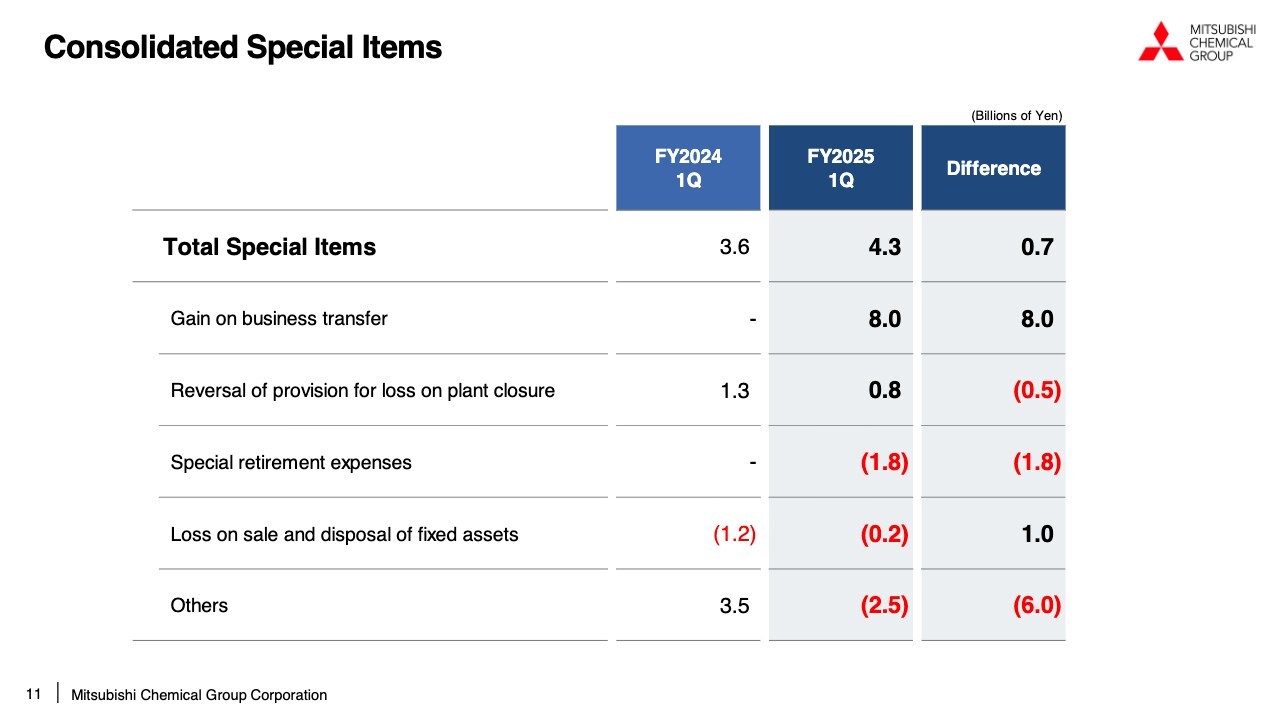

Consolidated Special Items

This slide shows consolidated special items. They came in at a positive ¥4.3 billion in 1Q, largely on par with the same period last year. We recorded a gain on the business transfer of ¥8.0 billion as a result of the transfer of the real estate business and the real estate holdings of Dia Rix Corporation, our service subsidiary, to a non-group company.

On the other hand, we recorded a loss of ¥1.8 billion yen in special retirement expenses due to structural reforms, including those related to the carbon fiber business. Others include a negative ¥1.0 billion in expenses related to the transfer of the real estate business, as well as expenses related to the shutdown of common facilities.

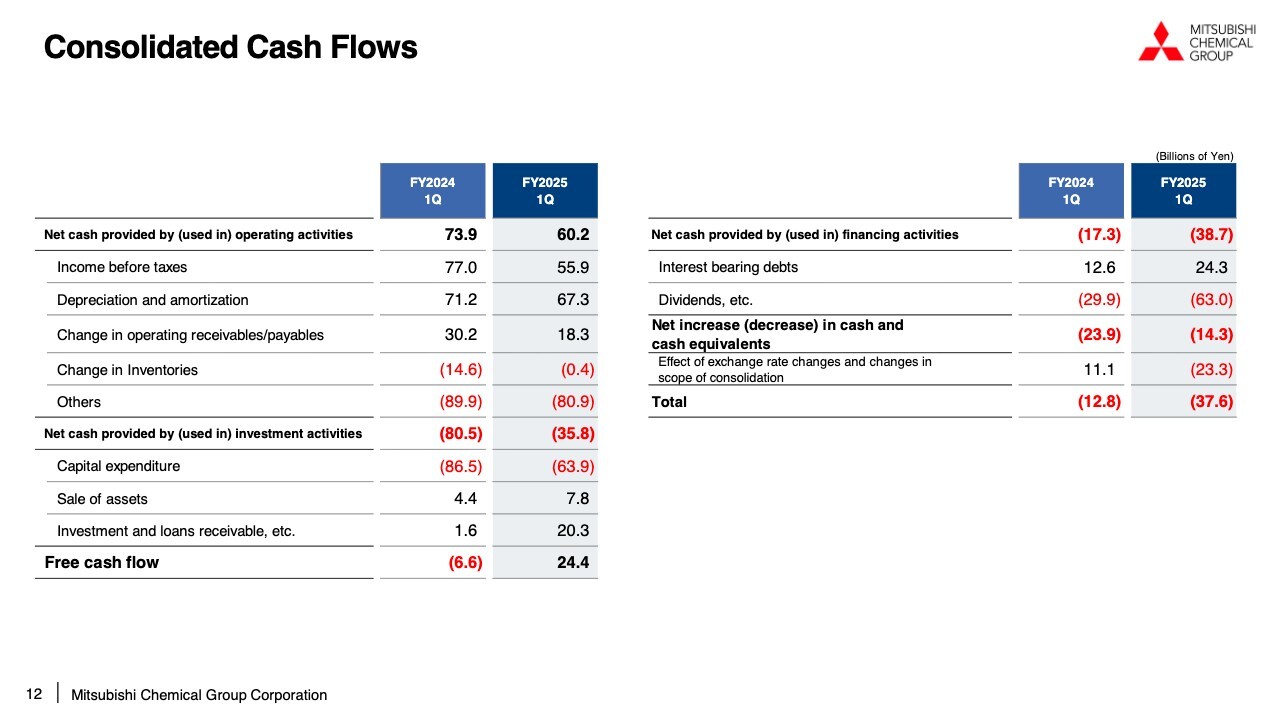

Consolidated Cash Flows

Now I will explain the consolidated statements of cash flows. Net cash provided by operating activities was ¥60.2 billion. Change in trade receivables or payables resulted in a cash inflow of ¥18.3 billion, and change in inventories resulted in a cash outflow of ¥0.4 billion. As a result, total working capital resulted in a cash inflow of ¥17.9 billion. We continue to work to enhance the working capital management, aiming to improve ROIC in each of our businesses.

Net cash used in investing activities was ¥35.8 billion. Capital expenditure resulted in a cash outflow of ¥63.9 billion, reflecting steady progress of growth investments in Specialty Materials, including the expansion of production capacity at CPC in Italy and expansion of production capacity for barrier packaging material application Soarnol in the U.K.

Cash inflow from sale of assets was ¥7.8 billion, and investment and loans receivables provided ¥20.3 billion. We recorded proceeds from the transfer of non-core businesses including the real estate-related business of Dia Rix, as well as disposal of cross shareholdings and non-essential assets. As a result, free cash flow totaled an inflow of ¥24.4 billion, and net cash used in financing activities was ¥38.7 billion.

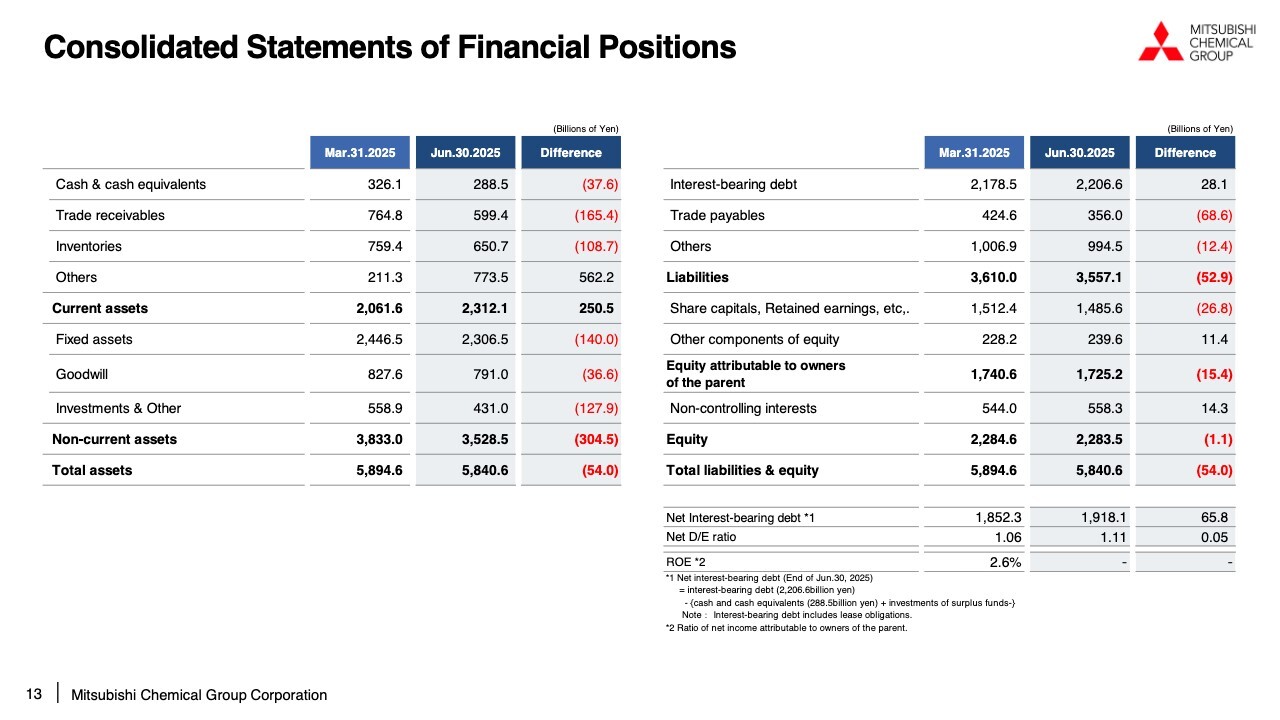

Consolidated Statements of Financial Positions

Next, I will explain the consolidated statements of financial position. Total assets were ¥5,840.6 billion, a decrease of ¥54.0 billion from the end of FY2024. Compared to March 31, 2025, the yen depreciated against the euro, resulting in an increase of approximately ¥34.0 billion due to the impact of foreign exchange rate.

Meanwhile, trade receivables decreased by approximately ¥56.0 billion due to the decline in market prices of raw material naphtha and the implementation of scheduled maintenance in 1Q, and fixed assets and other assets decreased by approximately ¥13.0 billion due to the effect of sales of businesses including the sale of Kansai Coke and Chemicals Company, Limited.

Net interest-bearing debt increased by ¥65.8 billion from the end of FY2024. The net debt-to-equity (D/E) ratio deteriorated by 0.05 times from 1.06 at the end of FY2024 to 1.11, due in part to a decrease in the balance of equity resulting from purchase of treasury stock. Since the proceeds from the transfer of Mitsubishi Tanabe Pharma Corporation are coming in during 2Q as scheduled, we expect a significant improvement in our cash position toward the end of 2Q.

Sales Revenue and Core Operating Income by Business Segment [Quarterly Data]

I will now provide supplemental information on the changes in core operating income from 4Q FY2024 to 1Q FY2025, as well as the outlook toward 2Q.

Core operating income for 1Q FY2025 was ¥56.6 billion, an increase of ¥18.0 billion from 4Q FY2024. The forecast of core operating income for 1H, which we announced in May, is ¥121.0 billion, and the progress against this forecast at the 1Q-end is 47%.

Although the market prices for MMA monomer have been weaker than initially expected, the progress of the Group as a whole is broadly in line with the plan to achieve ¥121.0 billion in 1H, thanks mainly to better-than-expected demand for display-related products in Specialty Materials and improved price gap in each business.

Specialty Materials recorded core operating income of ¥14.1 billion in 1Q FY2025, an improvement of ¥23.4 billion from a loss of ¥9.3 billion in 4Q FY2024. The figure for 4Q FY2024 included one-time loss of approximately ¥16.0 billion, which was partly attributable to an impairment loss of ¥12.9 billion yen in Advanced Solutions and the impact from the fiscal year-end closing adjustment in Advanced Composites & Shapes.

In addition to the resolution of these one-off factors at the fiscal year-end, demand for polyester films and OPL films for display applications remained strong in 1Q, and cost reductions effects achieved through progress in structural reforms in each business, including carbon fibers, contributed to the significant improvement.

For 2Q, we expect the demand for our display-related products, including polyester films and OPL films, to soften as the display market has entered an adjustment phase in reaction to high utilization rates by panel manufacturers that have continued since the previous fiscal year.

In addition, demand in the automotive sector has somewhat softened mainly due to the impact of the U.S. trade policy. Consequently, the profit levels, especially in Advanced Films & Polymers, are expected to be weaker than the 1Q level.

MMA & Derivatives saw an increase of ¥1.1 billion in core operating income, from ¥2.8 billion in 4Q FY2024 to ¥3.9 billion in 1Q FY2025. The Asian MMA monomer market declined from $1,582/ton in 4Q FY2024 to $1,430/ton in 1Q FY2025.

However, 1Q saw a slight increase in income, partly because the price gap did not deteriorate as much as the apparent market decline, mainly due to remaining transactions that reflected the previous year’s market price, as well as the scaling down of scheduled maintenance.

Core operating income in the Coatings & Additives for 1Q FY2025 remained on par with 4Q FY2024, with some variations among applications. For 2Q, we expect a decline in income to be inevitable, given the weak market conditions for MMA monomer.

However, compared to past market declines, the market fluctuations are expected to be supported to a certain level by the effect of the pricing policy of ongoing expansion of cost-linked formulas.

In Basic Materials & Polymers, core operating income remained largely flat QoQ, from negative ¥3.4 billion in 4Q FY2024 to negative ¥3.6 billion in 1Q FY2025.

Materials & Polymers saw a decrease of ¥3.8 billion in core operating income due to deterioration in inventory valuation losses and the impact of scheduled maintenance in Okayama Prefecture in 1Q, despite an improvement in price gap for polyolefins and the elimination of the effect of year-end cost concentration in 4Q FY2024.

Carbon Products saw an increase of ¥3.6 billion in core operating income, mainly due to a reduction in loss-making transactions and cost reduction effects resulting from the cutback of production capacity. For 2Q, we expect further profit improvement due to a diminished impact of scheduled maintenance in Materials & Polymers and the effect of further improvement in price gap in Carbon Products.

In Industrial Gases, core operating income decreased by ¥3.6 billion to ¥45.0 billion in 1Q FY2025 from ¥48.6 billion in 4Q FY2024, which was affected by foreign exchange effects as well as lower sales volume in the U.S. We expect solid performance for 2Q.

Q&A: Outlook for the Specialty Materials Segment

Questioner: I get the impression that Specialty Materials has recovered better than I expected. I think the results were above the forecast, and if we subtract them from the previous plan for 1H, 2Q profits will be down 50% QoQ.

While there are some businesses I am concerned about, such as optical films and automotive-related businesses, I don’t expect the results of Specialty Materials to deteriorate that much. Will you please give us some additional information on the prospects for these three sub-segments?

Kida: We are somewhat relieved to hear your comments. Specialty Materials is on a path to full-fledged recovery. Though still weak, we feel that the business has entered a growth trajectory.

From 1Q to 2Q, I believe that Specialty Materials will remain relatively firm. That said, it is clear, as I mentioned earlier, that display applications have entered an adjustment phase.

For example, inventory of panels has risen to very high levels. In addition, slow movement of goods is becoming more and more clearly visible in some areas. In our budget at the beginning of the year, we anticipated to some extent that displays would enter an adjustment phase, and I think the 1Q results were above that forecasted level.

Specialty Materials as a whole is expected to remain broadly in line with the budget. In particular, we expect that the two sub-segments, Advanced Films & Polymers and Advanced Solutions, will continue to perform in line with our forecast at the beginning of the fiscal year.

For carbon fiber composite materials, the effects of rationalization and other measures have materialized in some areas since 1Q. As shown in the slide, we have yet to see a correction in prices. We are taking various measures, including what I discussed earlier, about properly matching upstream production or production capacity to the balance in the downstream.

To increase prices, we also have to improve the price mix. Therefore, we are going to shift further to higher-end products.

Q&A: Prospects for Achieving Profitability in Carbon Products and the Measures to be Taken

Questioner: I would like to hear again the reason why Carbon Products has almost halved its deficit from 4Q FY2024 to 1Q FY2025. 2Q results will be in the black when factoring a results from the 1H forecast. Please let us know how you are confident about achieving this, and also any further actions that you are planning to take to achieve a profit.

Kida: Looking at the Carbon Products alone, the improvement from 4Q to 1Q was approximately ¥3.6 billion; of this, ¥0.4 billion was impact from inventory valuation gain/loss. Excluding the negative ¥0.4 billion impact from inventory valuation gain/loss, the improvement would have been ¥4.0 billion.

As I explained earlier, the YoY improvement is ¥5.3 billion, and ¥3.3 billion after excluding the impact from inventory valuation gain/loss. So far, we are seeing positive signs that our measures are yielding definite results.

We announced the reduction of coke ovens after 1Q last year, but the coke oven reduction takes a fairly long time. In April this year, we have just closed down 100 coke ovens, and we expect to see clear effects of cost rationalization from 2H of the current fiscal year.

So, we view the improvements on an underlying basis of ¥40 billion QoQ and a little over ¥33 billion YoY of as the result of our efforts to improve trade terms.

From the beginning, we believe it is important to secure an appropriate processing margin — in other words, a tolling fee added on top of the cost of coking coal, rather than selling at coke market prices. However, in reality, we have not been able to get the full amount we expect as a result of our approach.

The carbon business is extremely difficult: because of the large volume of shipments per vessel, it is difficult to quickly start or stop supply. For instance, if a customer cancels an order at short notice, we need to sell the products at the market price. In fact, we experienced a similar situation in 1Q.

So, although we are not getting the full amount we hope for, we are getting prices at very close to the level, or seeing the effect of changing formulas. We hope to continue this trend going forward.

We do not expect to achieve profitability in 2Q. Currently, we are aiming for profitability in 4Q, or ideally in 3Q.

Q&A: Market Conditions for MMA Monomer

Questioner: You have explained that the market price of MMA monomer has not dropped because of the market prices prevailing from the previous quarter. I think, previously, the ICIS price in Asia and quarterly profit or loss were trending similarly. Does this suggest that your link formula is starting to produce a considerable impact?

And what are your views on the scheduled maintenance that you mentioned as a factor contributing to QoQ profit growth, as well as on the MMA monomer market prices , which continue to drop?

Kida: About whether the cost-linked formula has a significant impact, frankly, I don’t believe, unfortunately, it has reached that level.

As you know, the gap between ICIS prices and quarterly profits and losses is one factor. If we look at MMA monomer on a YoY basis, for example, the ICIS prices in Asia were around $2,040/ton in 1Q last year. In 1Q this year, I think the ICIS price level in Asia was probably be around $1,430/ton. Unfortunately, we feel that the effect of the cost-linked formula is probably about a modest ¥1.0 billion. We still decide the prices based on the ICIS prices in Asia.

Or, in China, due to the business practice of negotiating prices on a case-by-case basis, rather than using ICIS prices, it is difficult to penetrate the cost-linked formula in China. One key point going forward is how far we can extend cost-linked formula to customers in Asia outside of China, or how high we can set a certain floor even if we use ICIS-based formula.

Another point, we feel that prospects for market conditions are very severe. Based on our own experience, we have noticed some changes in the behavior of our competitors in China, including those supplying petrochemicals products. Last year, MMA manufacturers often started running plants when prices went up and stopped operations when prices dropped as a result of oversupply of goods.

However, we feel fewer Chinese manufacturers are suspending their operations these days. This trend is also seen in other goods such as phenol, for example, as well as for MMA monomers. I personally suspect that they look at the whole picture of operations from the refinery, even naphtha crackers, and are very conscious of the need to protect those operations.

Given this background, I think the market prices are unlikely to recover. So, what we need to do as a short-term measures is to steadily increase sales in markets that are still relatively attractive to us, such as North America and India, by optimizing global allocation, or in other words, by making sure that we can keep the ball rolling across the world.

Questioner: Are you saying that under the current market conditions, a loss is inevitable for 2Q?

Kida: We cannot say for sure if a loss is inevitable. It is difficult to make definite estimates, but we do expect a decline in profits in 2Q compared to 1Q.

Questioner: Materials & Polymers is also improving much better, if inventories effects are excluded. Does this mean that the spread for polyolefins has improved? Are there any other factors in particular?

Kida: I think it is better to say that we have been able to maintain the improved spread of polyolefin, rather than the spread has improved comparatively.

Questioner: What are your prospects for 2Q and beyond?

Kida: In that sense, we expect the utilization capacity to rise comparatively, as our plant in Okayama is currently undergoing a scheduled maintenance.

However, in Basic Materials & Polymers, we are aware that demand for petrochemical products other than polyolefins in particular, such as C2 and C3 derivatives, is quite soft, as I mentioned earlier with regard to MMA monomers.

We are also considering various measures in this area. For example, while working to reduce the capacity of phenol next year, one key point is how long or how well we can sustain polyolefin at this level.

Questioner: You just mentioned China. Given the government’s anti-involution drive, what is the view of your company?

Kida: This issue is quite challenging, and we have been making various approaches to the government. The tide is turning, and we feel that doing the same thing as before is not effective. Therefore, we have been thinking about what action we can take with a different approach.

More than ever, we are developing our plans with a strong awareness that we should take action quickly, not just think about it, based on a belief that the faster we act, the smaller the damage will be.

Q&A: Causes for Uncertainty for Profit Growth in 2Q

Questioner: In the section on Materials & Polymers, you mentioned that in 2Q, where the negative impact from inventory valuation gain/loss decreases significantly, the profit growth will not be as strong as it should be. Please tell us if there are any other causes for concern other than the impact of the formula for polyolefins and the assumption that C2 and C3 derivatives will remain weak.

In addition, you mentioned the possibility that the Carbon Products may fall short of the initial forecast. Looking at Basic Materials & Polymers as a whole, is it correct to assume the results will be in line with the initial forecast due to the solid performance of Materials & Polymers? Please elaborate a bit more on your perspective.

Kida: I feel Basic Materials & Polymers has not yet reached the level we can say we are on the right track. We have taken actions steadily on Carbon Products, which are proving to be effective at a reasonably high rate.

However, one of our major goals is to achieve profitability by the end of this fiscal year, which we consider to be, in a sense, a prerequisite for our survival. We are closely monitoring the timeframe as it progresses from 2Q to 3Q, and if we do not see a prospect of turnaround by the end of this year, we will need to take a step further to achieve the goal.

In Basic Materials & Polymers, polyolefins are performing relatively well, and we expect them to remain solid in the future. The question is to what extent demand will recover for the C2 and C3 derivatives I mentioned earlier, specifically ethylene oxide, and oxo, acrylate and nitrile in the case of C3. Currently, due in part to the situations of crackers in China I mentioned earlier, we are seeing more inflows driven by derivatives than domestic demand. If this is the case, we need to take it a step further.

For 2H, we expect profit growth to be a bit weak at this point, and it will be important how firmly we can take measures for recovery. In terms of cost control in particular, we are currently considering from the viewpoint of, for example, production capacity and production methods. This is a general picture of our business climate.

Questioner: Even assuming that the situation remains the same for C2 and C3 derivatives, etc., I think there will be a positive impact of about ¥4.0 billion from 1Q through to 2Q, as negative impact from inventory valuation gain/loss of ¥8.1 billion was reflected in Materials & Polymers in 1Q, and half of it will be offset due to the timing difference in formulas.

If so, it seems to me that we don’t have to worry so much if market conditions remain flat. Please let me confirm that there is no further cause for concern beyond what you have already mentioned.

Kida: We do not think there is much to worry about. We expect to see a decent buildup of profits, as the impact of the scheduled maintenance will diminish in Materials & Polymers from 1Q through to 2Q.

Q&A: Effective Date of Sale of Mitsubishi Tanabe Pharma Corporation

Questioner: I thought the date of sale of Mitsubishi Tanabe Pharma Corporation was June 30, but was it July 1?

Kida: The date of sale of Mitsubishi Tanabe Pharma Corporation is July 1. As I indicated in the section on the consolidated statements of cash flows, the consideration for the transfer of ¥510.0 billion was not yet received as of June 30, and it will be recorded in 2Q.

Q&A: 1H Plan for Advanced Composites & Shapes

Questioner: Regarding Advanced Composites & Shapes, the operating loss for 1Q exceeded my expectation. Please let me confirm whether the 1H plan is sufficiently achievable by, for example, streamlining the production capacity of carbon fiber composite materials you mentioned earlier, further expanding sales of CPC, and expanding the business.

Kida: For carbon fibers, we have seen considerable effects of rationalization in the upstream of our operations during the current fiscal year. In addition to the operational shutdown of the large tow production facility at the Hiroshima Plant in Otake, which I explained earlier, we are about to completely shut down one of our regular tow production facilities in the U.S., among the four lines at two locations. We are also partly suspending lines at the other facility.

If you carefully read our annual securities report, it actually says in the notes that we have recorded an impairment loss for the facilities in the U.S.

These initiatives have already had an effect of about ¥1.0 billion in 1Q, mainly through reduced fixed costs. Since it was only recently that we decided to shut down the plant in Otake and communicated the decision to our employees, the large tow production facility will continue to operate for some time in the current fiscal year.

However, the facility in the U.S. has already stopped, and we have already seen some effect of fixed cost reductions in 1Q. We expect to see a larger effect with 2Q and 3Q combined.

We expect we will be able to achieve solid results in such areas because we can take tangible measures. On the other hand, in terms of business, currently, the business for luxury cars has been slow for some manufacturers as explained in the case of CPC, as well as what we presented in the past.

Although we cannot give you specific names, we have experienced some cases in which manufacturers placed orders with us in the volume they wanted, but those models and series did not sell as expected. I think a key is how much recovery we see in this area. In other words, the CPC is currently exposing the weakness of the existing business.

Questioner: I expect results in the medium to long term. Thank you for your confirmation.

Q&A: Management Initiatives and Price Gap in Each Business

Questioner: In relation to management measures, you explained three months ago that you expect an increase in profit of ¥56.0 billion for FY2025 as a result of measures based on the “three disciplined approaches in business operations.” Of this, ¥29.0 billion would come from pricing policy and ¥27.0 billion from asset optimization.

According to your explanation earlier, I don’t think we are yet to see that much results in 1Q. I would like to check the progress you are making toward this plan, and whether you have any particular areas lagging behind the plan, especially in MMA monomer, carbon products, and carbon fiber businesses.

Also, the slide explained the improvement in price gap in each business as a contributing factor to the achievement of the earnings forecast, despite the downward fluctuation in the MMA monomer market price. Does this mean that the improvement of price gap in each business is progressing better than initially planned, and if so, can you tell us which products are showing better-than-planned progress?

Kida: First , you mentioned the numbers ¥27.0 billion and ¥29.0 billion, and let me start with the effects of cost reductions. At the beginning of the fiscal year and at the business strategy briefing, I mentioned ¥27.0 billion for asset optimization, which includes cost reductions.

As presented in the waterfall graph in my earlier explanation, the overall improvement in cost reductions is ¥11.5 billion. Of this, improvement of about ¥5.0 billion is from the Chemicals business. I think we have made solid progress in 1Q toward our full-year target of ¥27.0 billion.

As for the prices, on the other hand, our full-year target is ¥29.0 billion, of which, I feel our results in 1Q is approximately ¥5.0 billion if we add up the effect of the expansion of cost-linked formula for MMA, revision of sales portfolio for Carbon Products, and other effects in each business.

Although this has not reached a quarter of the ¥29.0 billion, we will continue to put our efforts into it, as I mentioned earlier that we will steadily expand the area related to cost-linked formula.

About the ¥5.0 billion, this may sound like an excuse, but on the waterfall graph I showed you earlier, the price gap is actually negative in all business segments. However, there are various compounding factors, which resulted in, for example, a price gap of about negative ¥1.1 billion in Specialty Materials.

The negative impact of foreign exchange rates is also included here. Also, the selling price of carbon fiber in 1Q last year had not declined to the current level. If we make a YoY comparison of 1Q, we can see that the impact of the falling price of carbon fibers has actually remained strong. That is an impact of over ¥1.0 billion level.

Therefore, we see negative impacts in various areas other than the effects of price correction. The foreign exchange rate has a particularly large impact, and the graph does not properly illustrate the results of our price correction efforts. I apologize for the lack of clarity.

I hope you understand that I have answered your questions as directly and quantitatively as possible.

Questioner: How do you evaluate the progress of the pricing policy of ¥5.0 billion in 1Q against the initial estimate?

Kida: Honestly, the figure is difficult to evaluate, but we had hoped to make a little more progress. However, we have not been able to make as much progress as we had expected, especially in changing the formula for MMA. We will remain focused on this area.

We would also like to reach out and appeal to customers who have not yet fully recognized the value of our non-MMA products, especially those specialty materials products offering high added value.

Questioner: I think MMA is a downside factor. Meanwhile, will the demand for display-related products be a upside factor, and in addition, will this improved price gap serve as an upside factor for the 1H plan?

Kida: Yes, I think their progress has been largely in line with our projections. On the other hand, in the case of Specialty Materials, the price of raw materials has been falling, and this has led to an improvement in the price gap.

In other words, we have lowered the raw material prices , without lowering the selling prices. This is also part of the improvement in price gap. In many ways, we feel that we are relatively on track with what we expected, except for MMA.

Q&A: Shareholder Return

Questioner: With regard to shareholder returns, the transfer of Mitsubishi Tanabe Pharma Corporation was successfully completed, and I assume, by end of July, you have almost completed the ¥50.0 billion treasury stock purchase that was announced at the time of the 4Q FY2024 financial results presentation. Will you please explain again whether you have any plans to use the proceeds from the transfer of business to make additional purchases of treasury stock in the future, and to further increase shareholder returns?

Kida: This is something we have consistently communicated, and we have not changed our view that investment in growth is important for enhancing corporate value.

That said, we must properly recognize the shareholder value in total. Particularly, it is not a good idea at all, to accumulate more cash and deposits than actual demand when large sum of money comes in. We recognize that this is wrong and something that we should not be doing.

We will seek to enhance shareholder returns while balancing various aspects of our operations.

Q&A: Situation of Semiconductor Materials

Questioner: Please tell us about the situation of semiconductor materials in 1Q on a YoY and QoQ basis. Also, please share with us your outlook for 2Q.

Kida: First , if we look at overall indicators on a YoY basis, the previous high inventory levels of some components in the entire semiconductor supply chain have started to normalize.

As you all know, AI-related business has been performing extremely well, and I feel the automotive and industrial applications have bottomed out as well. First of all, in the area of semiconductor-related products alone, I believe that the profit of our company has nearly doubled YoY.

Also on a QoQ basis, leaving aside the detailed figures, the demand has recovered in line with our expectations, and profit has improved favorably.

I expect that the current market situation will continue into 2Q. Although it is difficult to forecast the semiconductor market, I hope to see some upward fluctuations.

Q&A: Increasing Demand for Barrier Packaging Applications

Questioner: In the explanation on Advanced Films & Polymers, you mentioned a rise in demand for barrier packaging applications. Please tell us quantitatively, if possible, the level of improvement.

Regarding terms of trade, I think conditions were quite severe last year. How have the things turned out so far this year?

Also, please give us some additional information on the outlook for 2H and beyond, particularly with regard to the tightening of recycling regulations in Europe and the increase in demand in the U.S.

Kida: Demand for barrier packaging materials seems to have bottomed out, especially in Europe. However, if asked whether we are seeing a return of robust demand and a sharp increase in sales volume, we have not yet reached that level. On a YoY basis, the rate of increase has been in the range of 5% to 10%.

It may sound like we are experiencing growth, but there are various other factors involved. For example, we were unable to deliver products in Europe due to some problems in the same period last year, which we recovered this year.

With these factors included, the growth is at the rate I have just mentioned. The market appears to have reached the bottom, and we recognize that our business is now starting to recover. Therefore, I am not talking about a strong demand returned in 1Q, but expect demand to recover slightly after bottoming out in 2Q and beyond.

Questioner: What about the terms of trade and price increases? Is there any such momentum building up, or is it a little further down the road?

Kida: We are currently negotiating raise in prices with our customers, due to the increased cost of production. For Soarnol and other barrier packaging materials, however, we raised the price substantially well in advance of other businesses, due to our own circumstances. So, it may be somewhat challenging to further raise prices in this year.

Q&A: Effects of Measures in Carbon Fibers

Questioner: You have just mentioned measures taken in upstream of carbon fibers in the U.S. and in Otake, Hiroshima. How much effect do you expect from these measures for the full year FY2025 or for FY2026? I think it will be hard to fully cover the negative ¥15.0 billion by the restructuring effect. Do you have any promising prospects for plans like CPC or the aviation and aerospace areas?

Kida: It is impossible to offset the negative ¥15.0 billion only through improvements in fixed costs. While we cannot give you an exact number, the effect should be somewhere in the low tens of billions of yen. That will be the level of effects from monetization, fixed cost reductions, among other factors.

After all, we need to change the sales mix. Again, I cannot give you specifics, but we have been receiving various inquiries for aviation and defense applications.

Because of the various restrictions imposed on such applications, customers cannot always choose products made by Chinese or Korean manufacturers, no matter how inexpensive they may be in relation to their quality. Therefore, we hope to see some opportunities in these areas.

Questioner: You mean defense-related companies, right?

Kida: Yes, mainly in defense areas, although obviously there is also aviation involved. Defense has an extremely broad range of applications.

Questioner: We are looking forward to the developments over the long term.

Greetings from Mr. Kida

Kida: As always, thank you for your questions on a variety of topics. I would also like to thank you again for taking time out of your busy schedules to attend our financial results briefing today.

Although our business environment is far from perfect due to the lingering economic uncertainties, we are gradually starting to see the effects of the structural reforms for which we have been accelerating our decision-making process since last year. As I have been discussing since last year, our immediate task is to complete major structural reforms in FY2024 and FY2025. We are speeding up our efforts with a sense of urgency toward achieving this goal.

Through company-wide efforts, we strive to meet the expectations of our stakeholders more quickly and to a greater extent by accelerating the implementation of initiatives. We look forward to your continued support. Thank you very much for your time today.