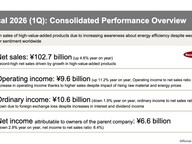

Fiscal 2026 (1Q): Consolidated Performance Overview

Takuya Ogawa (hereinafter, “Ogawa”): My name is Takuya Ogawa, Managing Executive Officer and Chief of Corporate Administration Headquarters. Thank you for joining us today despite your busy schedules. I would like to report on and explain our first-quarter results.

Here is an overview of our consolidated financial results. Although consumer sentiment remains sluggish worldwide, sales of high-value-added products grew on the back of rising energy conservation awareness. As a result, net sales increased 4.6% year on year to ¥102.7 billion, marking a record start to the fiscal year.

Operating income was affected by soaring raw material and energy prices. I will elaborate later on the global upward trend, particularly in personnel and other expenses. Despite these conditions, operating income increased 11.2% year on year, although the operating margin stayed below 10%.

Ordinary income, which had been increasing, turned to a decline due to foreign exchange losses. Last year, we recorded foreign exchange gains, but this year losses were incurred, resulting in a decline in income.

Quarterly net income was ¥6.6 billion, also down year on year.

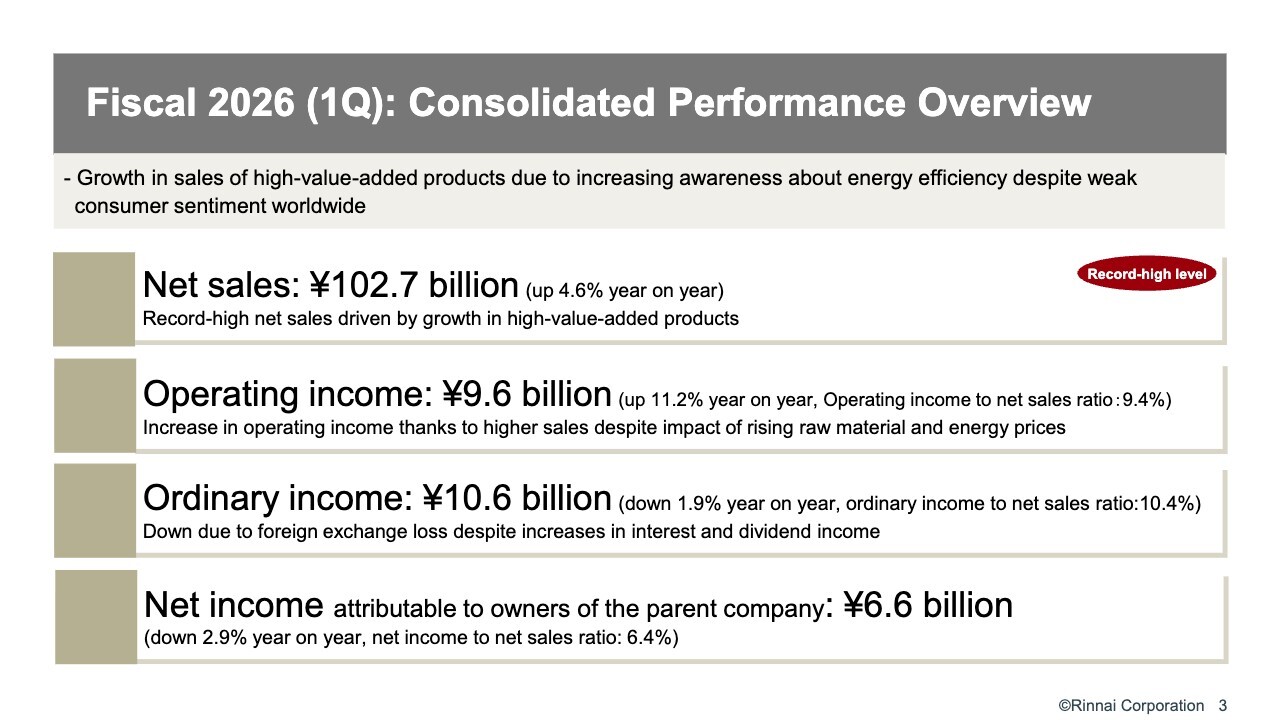

Fiscal 2026 (1Q): Consolidated Financial Results

This slide shows the trends for the first quarters. Net sales remained stable and continued to increase gradually.

Meanwhile, operating income fluctuated somewhat. In fiscal 2024, results were affected by the supply-demand balance. In particular, sales started off sluggishly due to extremely high distribution inventories in Japan.

However, operating income has recovered for two consecutive fiscal years, fiscal 2025 and fiscal 2026, and the operating margin is also on the rise.

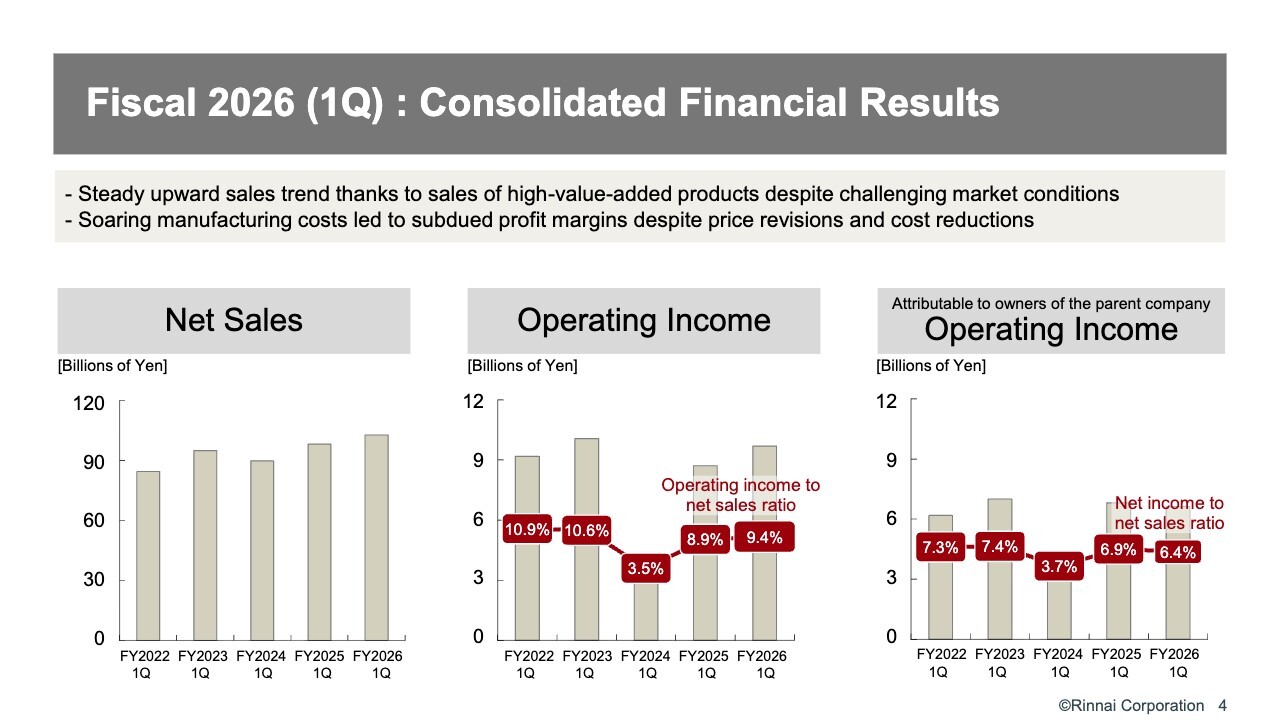

Fiscal 2026 (1Q): Net Sales by Product

This slide shows sales results by product. In fiscal 2026, “Water heater” sales increased by ¥2.86 billion. We believe this represents an extremely strong start in markets where water heaters are our core offering, excluding China.

On the other hand, “Kitchen appliance” sales were somewhat sluggish in Japan. In South Korea, specifically, sales declined due to intensified competition from KyungDong Navien Co., Ltd.—which took over the business from SK magic—advancing aggressively in the kitchen appliances sector.

Sales in “Others” increased slightly. This was driven by the inclusion of sales from Kanta-kun clothes dryer in Japan, as well as contributions from products of companies acquired last year in Australia and the United States.

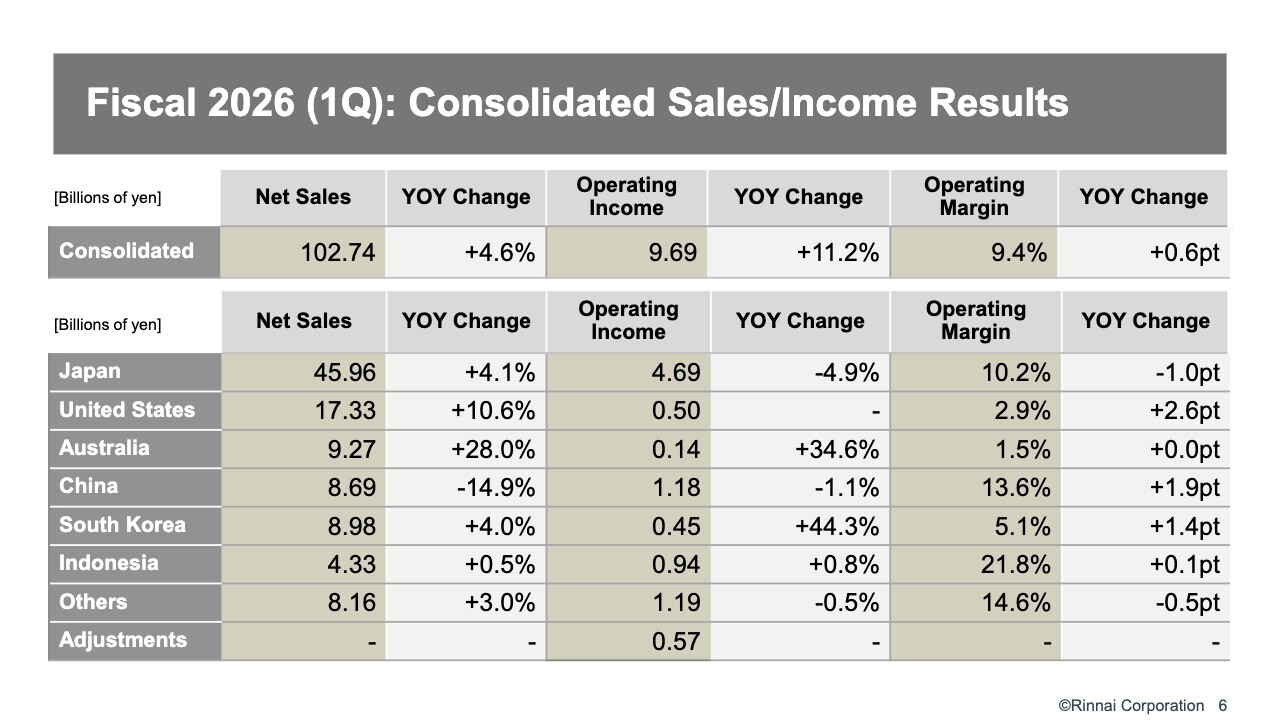

Fiscal 2026 (1Q): Consolidated Sales/Income Results

This slide shows the status of each segment. I will elaborate on the major countries later, but looking at the overall picture, income in the Japan segment has declined and remains below expectations.

In the China segment, although income has been achieved to some extent, sales remain a key challenge. The impact of last year’s significant market downturn appears to have carried over into the first quarter of fiscal 2026.

In this environment, the United States and Australia segments delivered relatively strong performance, which I will also explain later.

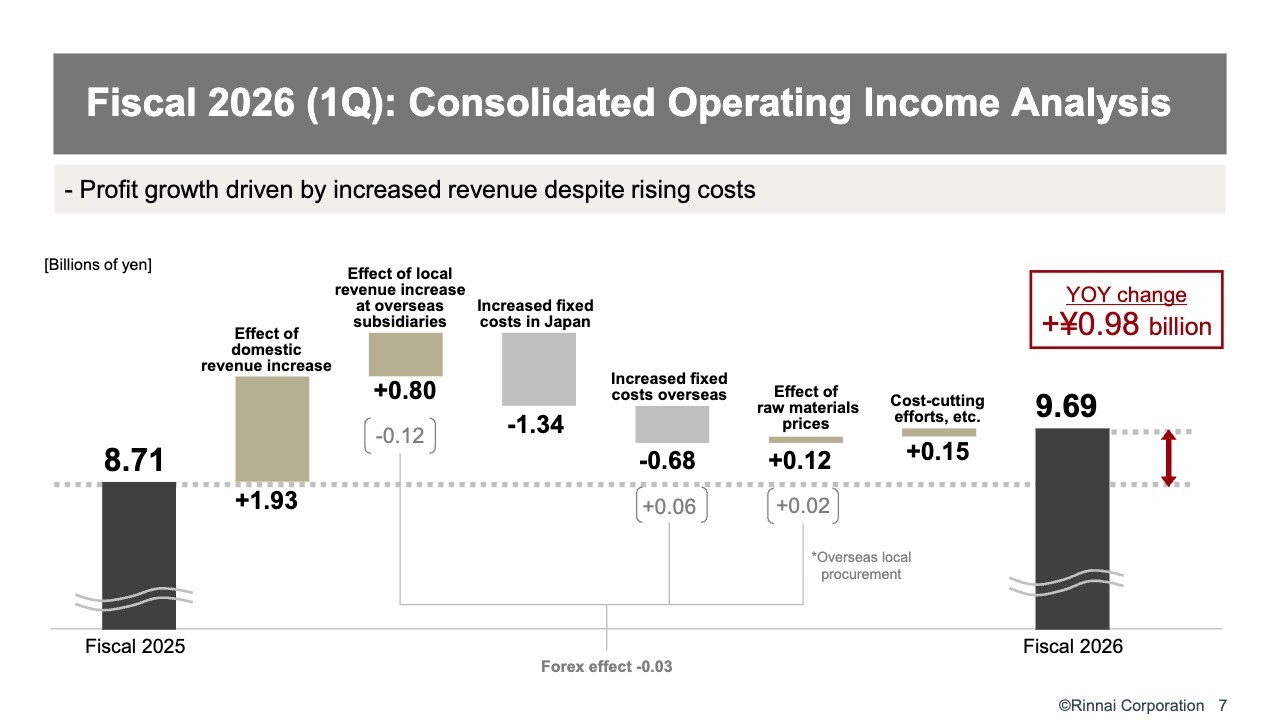

Fiscal 2026 (1Q): Consolidated Operating Income Analysis

This slide shows the analysis of changes in consolidated operating income. As you can see, operating income increased due to higher sales both in Japan and overseas. However, labor and other expenses also increased in both Japan and overseas. In particular, higher fixed costs in Japan had a negative impact on income.

Raw material prices were included in the annual earnings forecast as a factor expected to push down income. However, as of the first quarter, they remained stable and had a slightly positive impact on income.

The most disappointing area was “cost-cutting efforts, etc.” Although it is difficult to evaluate this area in the first quarter, since it accounts for only a small portion of full-year results, initiatives in Japan remain a particular challenge.

Currently, more than 300 employees have been assigned to respond to the recall of bathroom heater/dryers since May. The actual expenses incurred in this process were provisioned in the previous fiscal year; there will be no direct impact on this fiscal year’s income.

However, there is a possibility of opportunity loss, as 300 employees are unable to perform their regular duties. These factors have contributed to the disappointment. Overall, operating income still increased by ¥0.98 billion year on year.

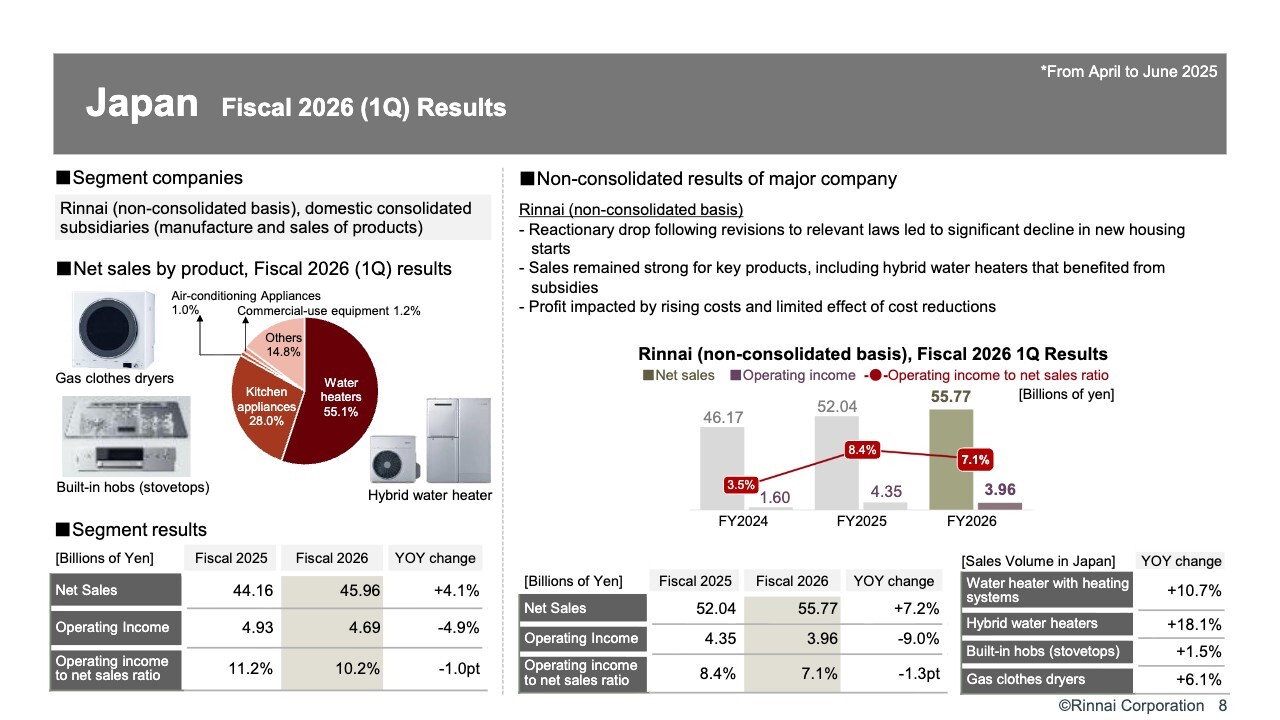

Japan: Fiscal 2026 (1Q) Results

From this slide, I will explain the topics by country. The left side shows results for each country segment, while the right side shows results for the major company within that segment. This format applies to both the Japan and overseas segments. Next, I will explain the major companies shown on the right.

First, in the Japan segment, results are shown for Rinnai on a non-consolidated basis. In the market, new housing starts declined significantly due to a reactionary drop following revisions to relevant laws and regulations. The revisions led to a rush of demand in March, followed by a reactionary decline from April onward.

Subsidies contributed to our sales. The subsidy policy of ¥150,000 per “hybrid water heater” continued under the same conditions as last year. Our efforts to expand sales of “hybrid water heaters” in cooperation with distributors were very successful. As a result, volume increased 18.1% year on year as shown at the bottom right.

However, income decreased. As I mentioned earlier, the main factor was higher costs. In addition, the effects of cost-reduction initiatives in Japan were limited.

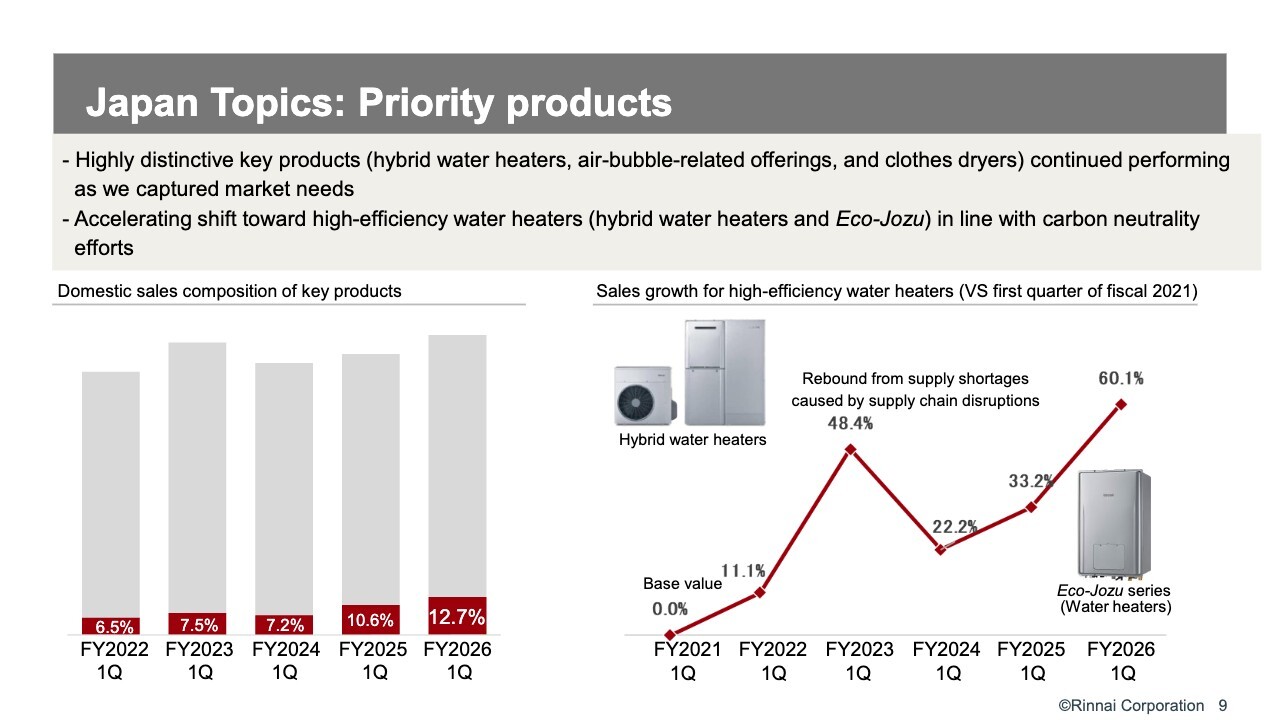

Japan Topics: Priority products

Let me talk about topics in the Japan segment. As we have emphasized since last year, priority products—“hybrid water heaters,” “air-bubble-related offerings,” and “clothes dryers”—have remained very strong. Their share of total sales has also increased.

The common feature of these three priority products is that they not only boost sales but also contribute significantly to income due to their high added value.

This situation remained largely unchanged in the first quarter. The effect is continuing to a certain extent. As for water heaters shown on the right side, high-efficiency models—namely “hybrid water heaters” and “Eco-Jozu”—are eligible for subsidies for replacement in rental properties. Partly as a result, their growth rate—measured on a year-on-year basis—has been very strong over the past five years.

Using fiscal 2021 as the base year, volume in the first quarter of fiscal 2026 increased 60%. This demonstrates that the percentage of high-efficiency water heaters is rising significantly.

Looking ahead, we expect water heaters in Japan to become even more efficient. In other words, raising the percentage of “Eco-Jozu” products will be the key to future growth.

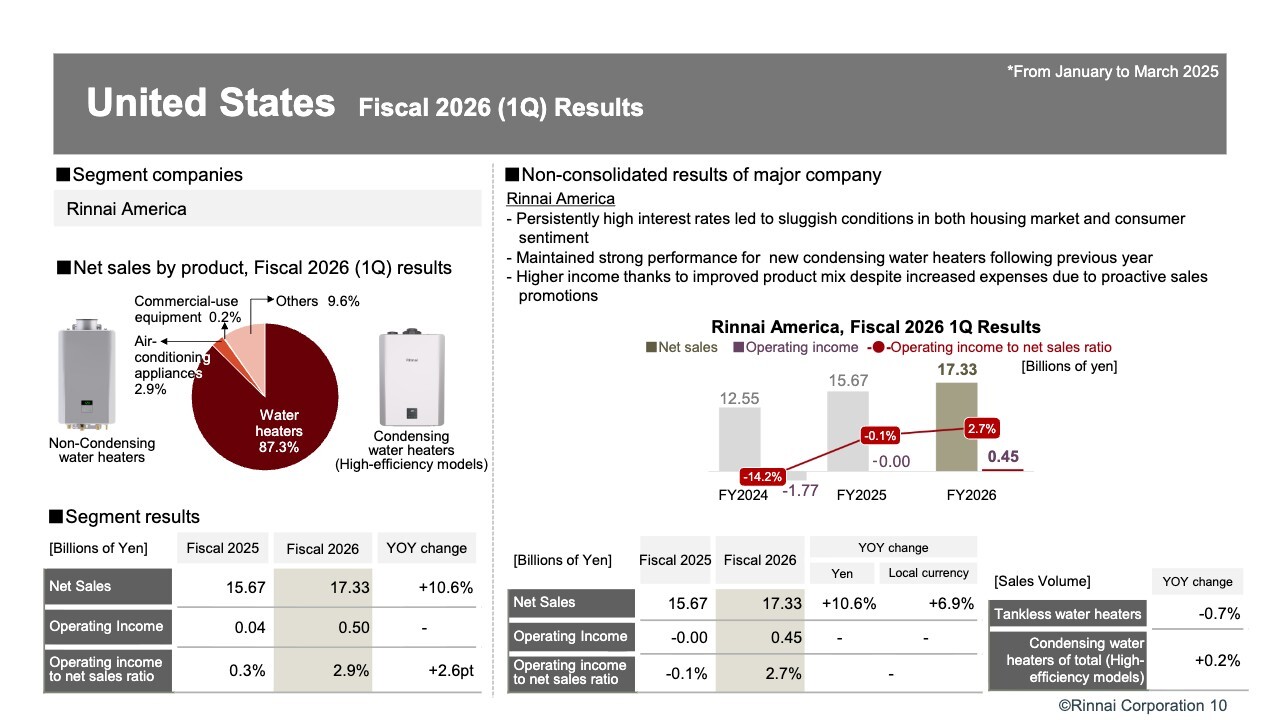

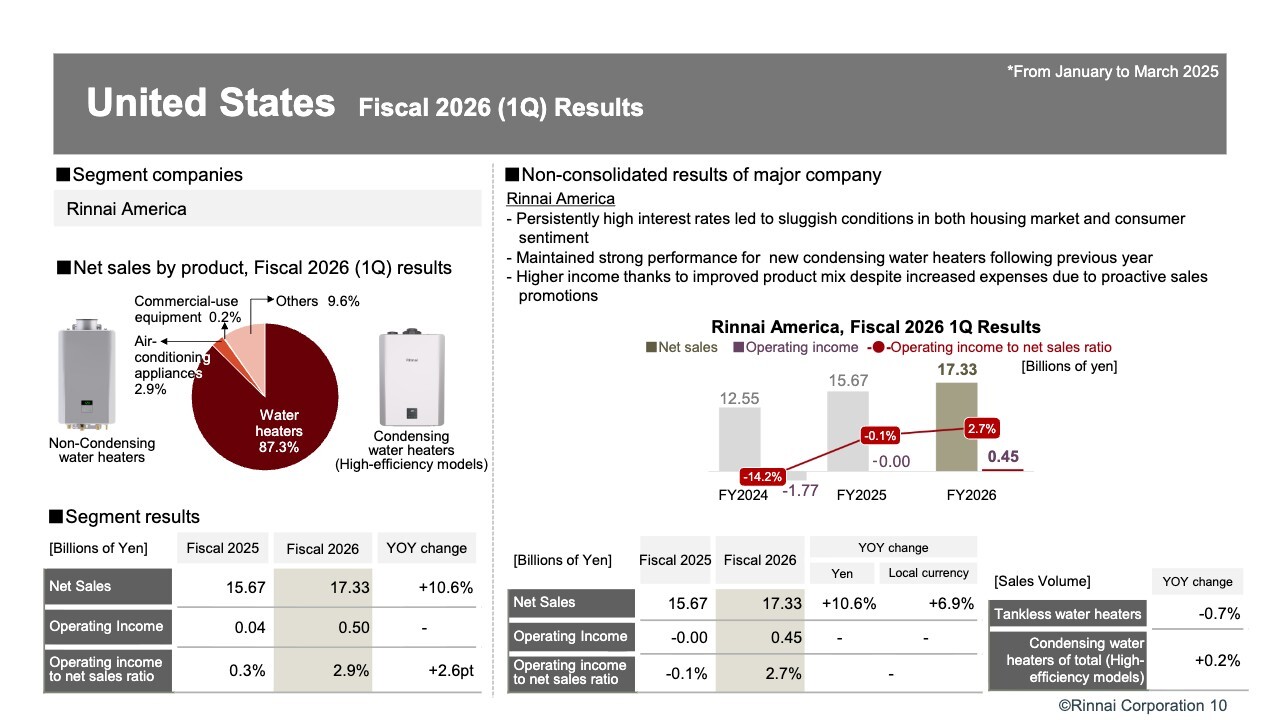

United States: Fiscal 2026 (1Q) Results

This slide shows the results for the United States segment. Rinnai America is facing a sluggish housing market and weak consumer sentiment due to persistently high interest rates. Against this backdrop, we launched a new high-efficiency condensing water heater in the first quarter of the previous fiscal year, and sales of this product have remained strong. Although sales volume of the condensing water heaters has not increased significantly, sales are growing due to the favorable product-mix effect, or price effect.

Expenses increased due to aggressive sales-promotion measures. However, with the higher ratio of condensing to non-condensing water heaters, income—flat at the start of last year—began at ¥0.45 billion this year, and ¥0.50 billion for the entire segment shown on the left side.

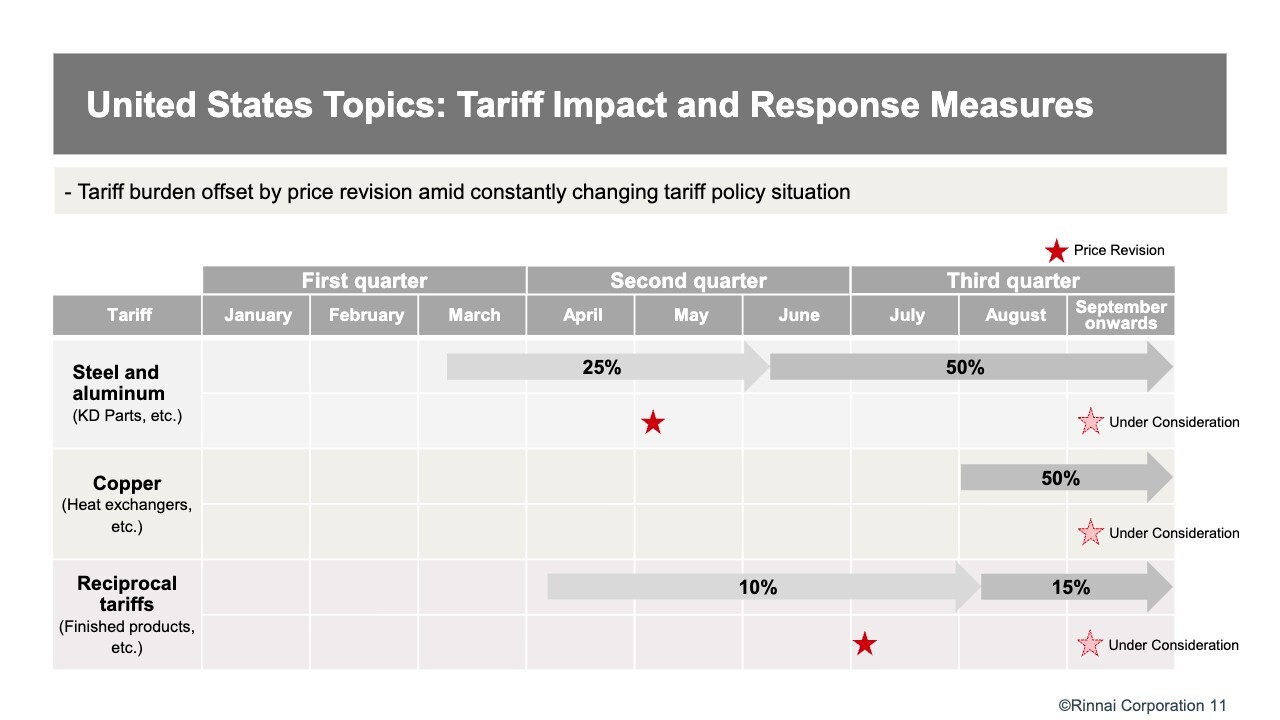

United States Topics: Tariff Impact and Response Measures

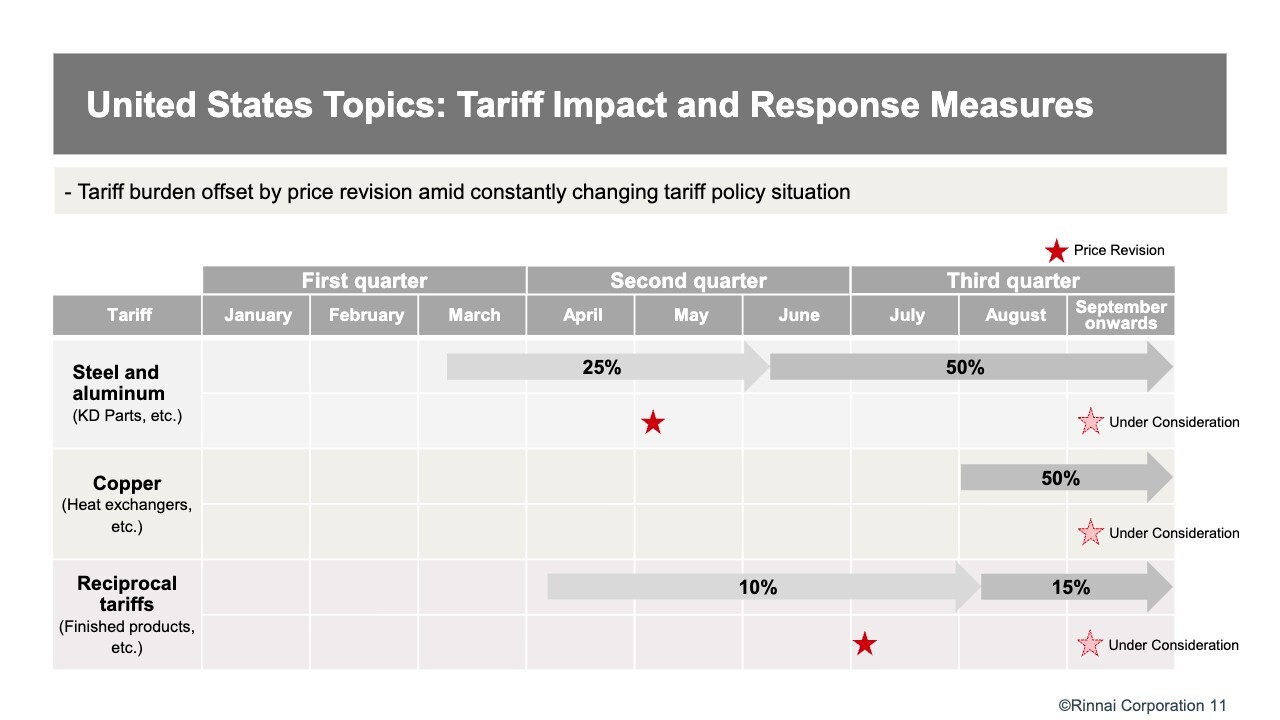

The biggest concern in the United States segment is the impact of tariffs. This slide explains our response.

First, regarding the so-called Trump Tariffs: tariffs of 25% had been imposed on materials such as steel and aluminum since March, but these were raised to 50% in mid-June. Furthermore, tariffs of 50% were imposed on copper beginning in August.

The so-called reciprocal tariffs, imposed in Japan at a rate of 10% starting in April, have been confirmed to increase to 15% in early August, according to recent reports.

We raised prices in May to offset the tariffs on steel and aluminum. In particular, we revised the prices of non-condensing water heaters—our main products—because they are manufactured at our U.S. plant and are affected by tariffs on materials.

Furthermore, as a measure to address the 10% reciprocal tariffs, we revised the prices of condensing water heaters from July, as these are manufactured in Japan and supplied to the United States.

As shown on the right side of the slide, we are currently considering additional price increases for the remaining portion of the tariff impact. A decision will be made and implemented as soon as possible, while carefully monitoring the actions of our competitors.

We have raised prices twice so far and are considering additional increases, which has led to concerns about a potential decline in competitiveness—specifically, a shift away from tankless gas water heaters. However, based on the announced results for the first quarter in the United States segment and the current situation in the second quarter, we have not seen any decline in competitiveness due to these price increases. At this point, we believe the positive trend will continue.

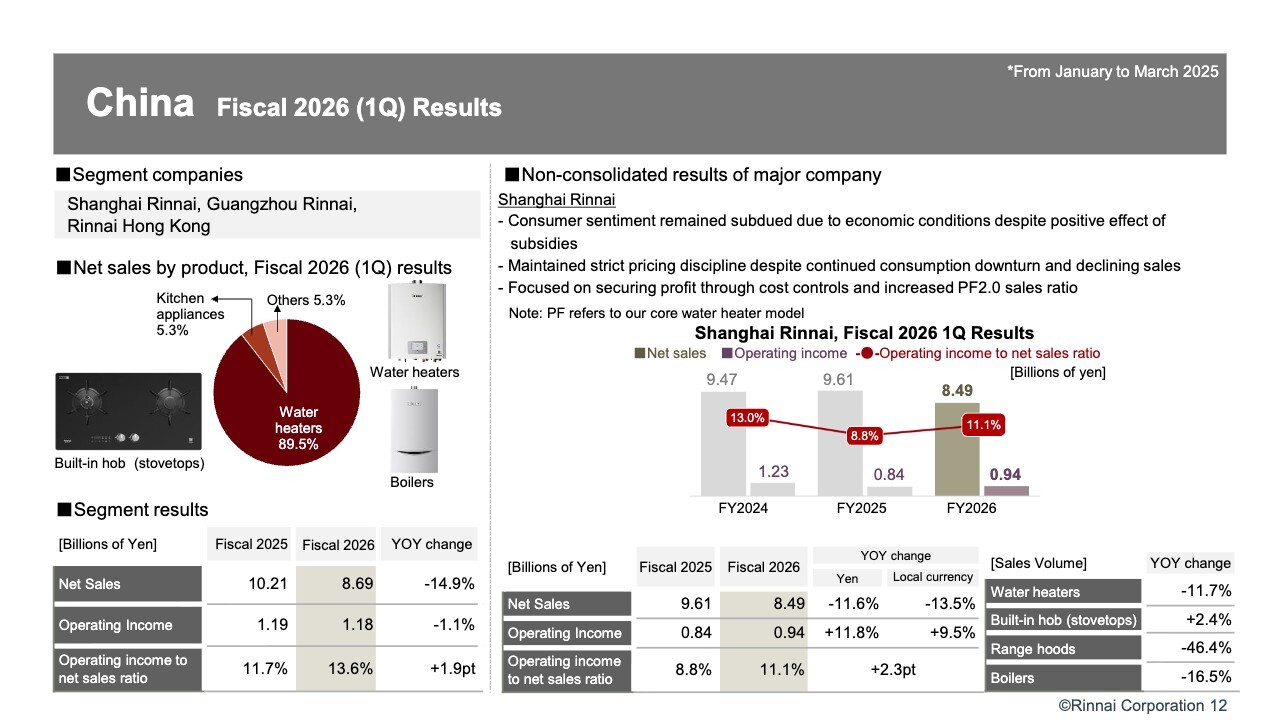

China: Fiscal 2026 (1Q) Results

This slide shows the results for the China segment. At the start of this fiscal year, our biggest concern was the situation in the Chinese market. Despite the effect of subsidies, consumer sentiment remains dampened by economic factors, and the downturn continues.

Under these circumstances, Shanghai Rinnai is facing intensifying competition along with accelerated consumer down-trading. Competitors are cutting prices at an unprecedented pace, making the environment even more severe. In this environment, Shanghai Rinnai is implementing disciplined pricing aligned with the market, with a policy of prioritizing income over sales. This does not mean we will avoid price reductions entirely, but we will not cut prices as deeply as our competitors.

We are also working to secure income by controlling expenses and increasing the share of sales from our high-margin water heaters, “Platform 2.0 (PF2.0).” As a result of these measures, although income in the first quarter was small, it increased year on year, enabling us to get off to a good start.

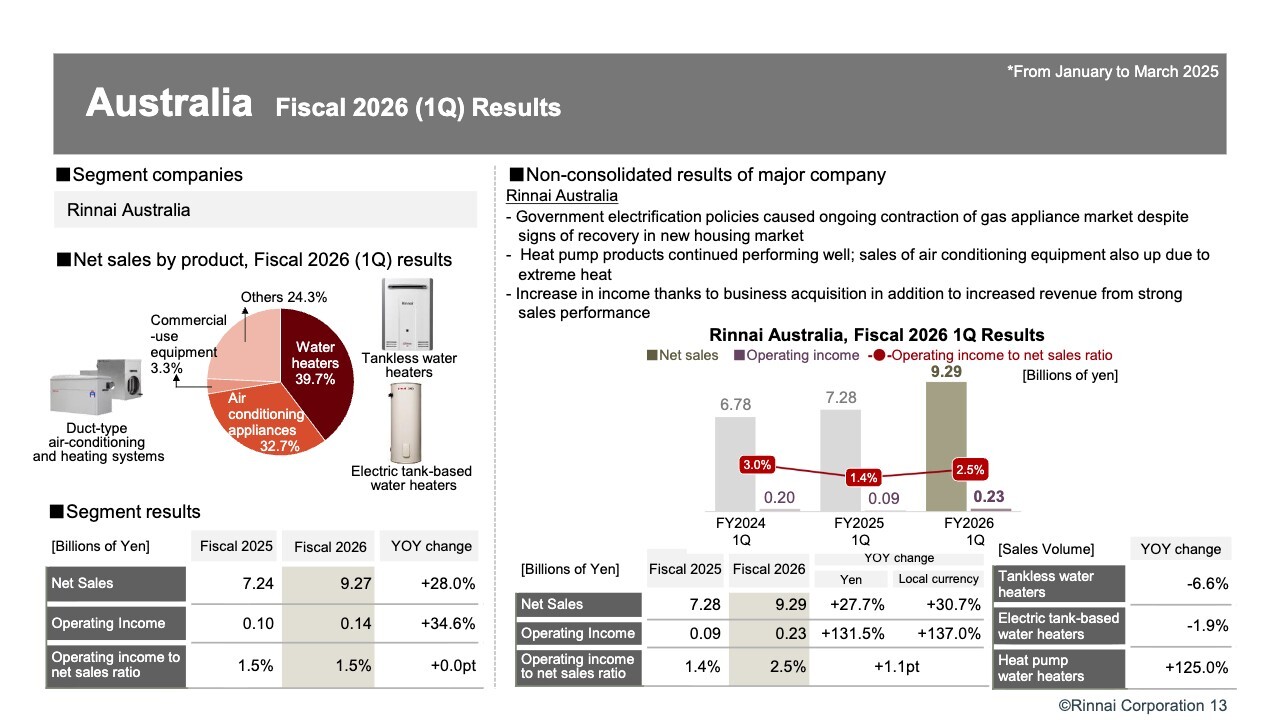

Australia: Fiscal 2026 (1Q) Results

This slide shows the results for the Australia segment. We achieved very strong results in this segment, particularly in sales.

As explained previously, the main drivers of this growth were the expansion of heat pump water heaters amid a challenging gas market and the positive impact by Smart Energy acquisition, which was consolidated into our results in August last year. As a result, sales grew significantly, followed by income. However, margins remain low.

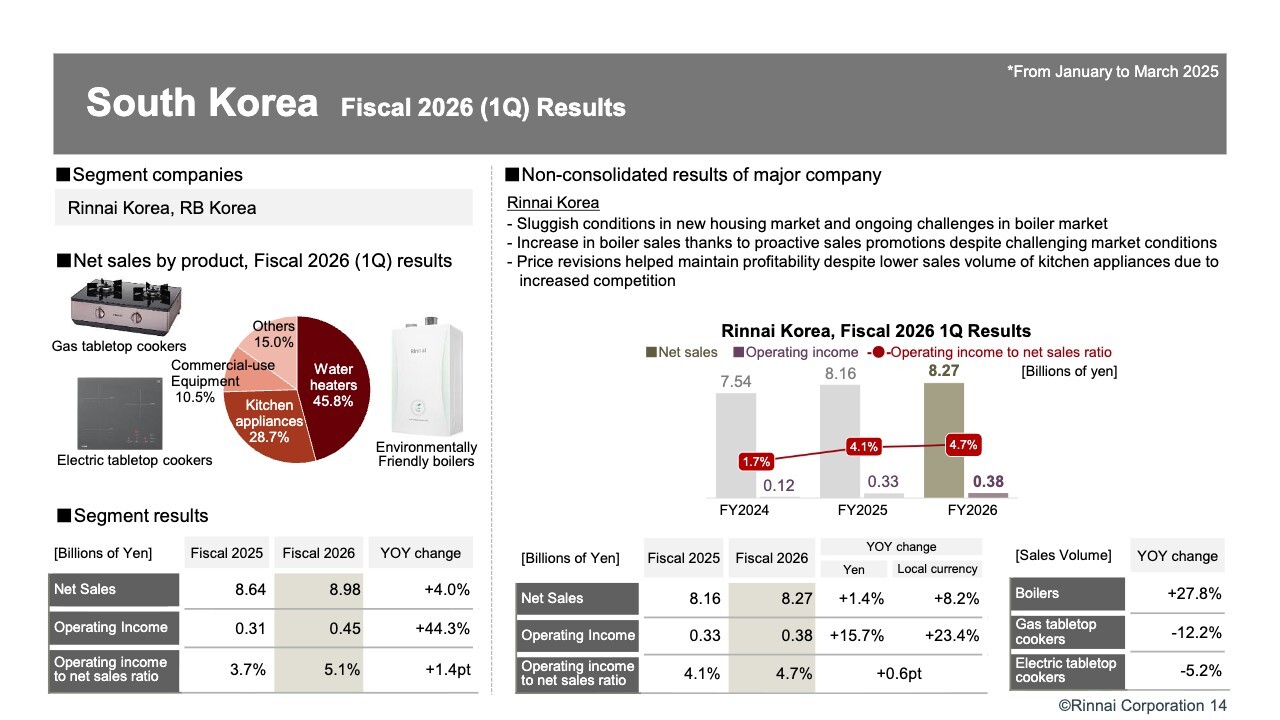

South Korea: Fiscal 2026 (1Q) Results

This slide shows the results for the South Korea segment. The South Korean market remains sluggish, particularly in new construction, and the boiler market continues to be challenging. However, Rinnai Korea achieved to reverse the trend in the first quarter in the boiler market, where it had struggled for a long time. Our market share is actually rising.

Meanwhile, as mentioned earlier, Navien Magic launched an expected offensive in the gas tabletop cooker market. We had increased our market share significantly last year when Navien Magic had certain vulnerabilities. However, once Navien Magic launched its offensive, our market share in gas tabletop cookers declined slightly, as anticipated. The same trend is also seen in electrical tabletop cookers.

Despite price revisions and other factors, we began this fiscal year with higher sales and income, even in a challenging market environment.

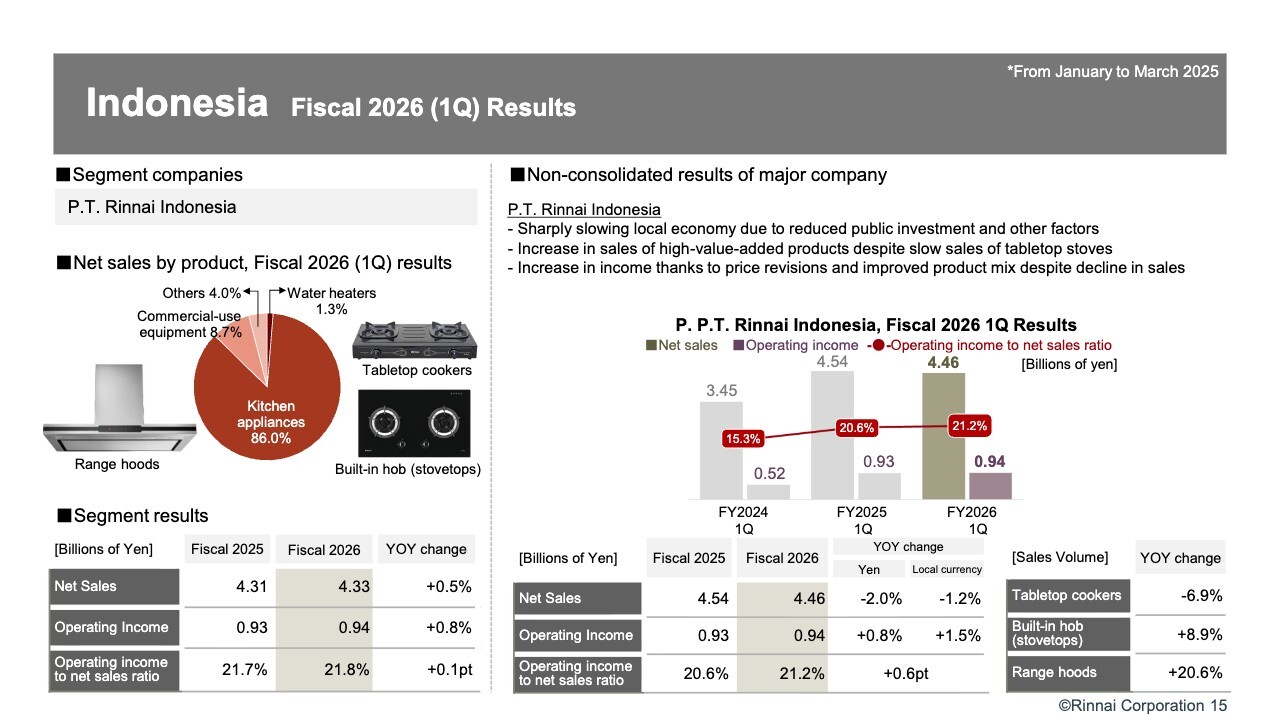

Indonesia: Fiscal 2026 (1Q) Results

This slide shows the results for the Indonesia segment. Amid a sharp economic downturn in the Indonesian market, sales volume of tabletop cookers—our main product—declined, resulting in a slight impact. However, in built-in hobs (stovetops) and range hoods, where growth potential in Indonesia is expected over the medium to long term, growth in high-value-added products was achieved in the first quarter, which we view as a reasonable result.

Income increased due to price revisions and improvements in the product mix, despite the decline in sales. The high income margin of 21% is a major factor contributing to consolidated income.

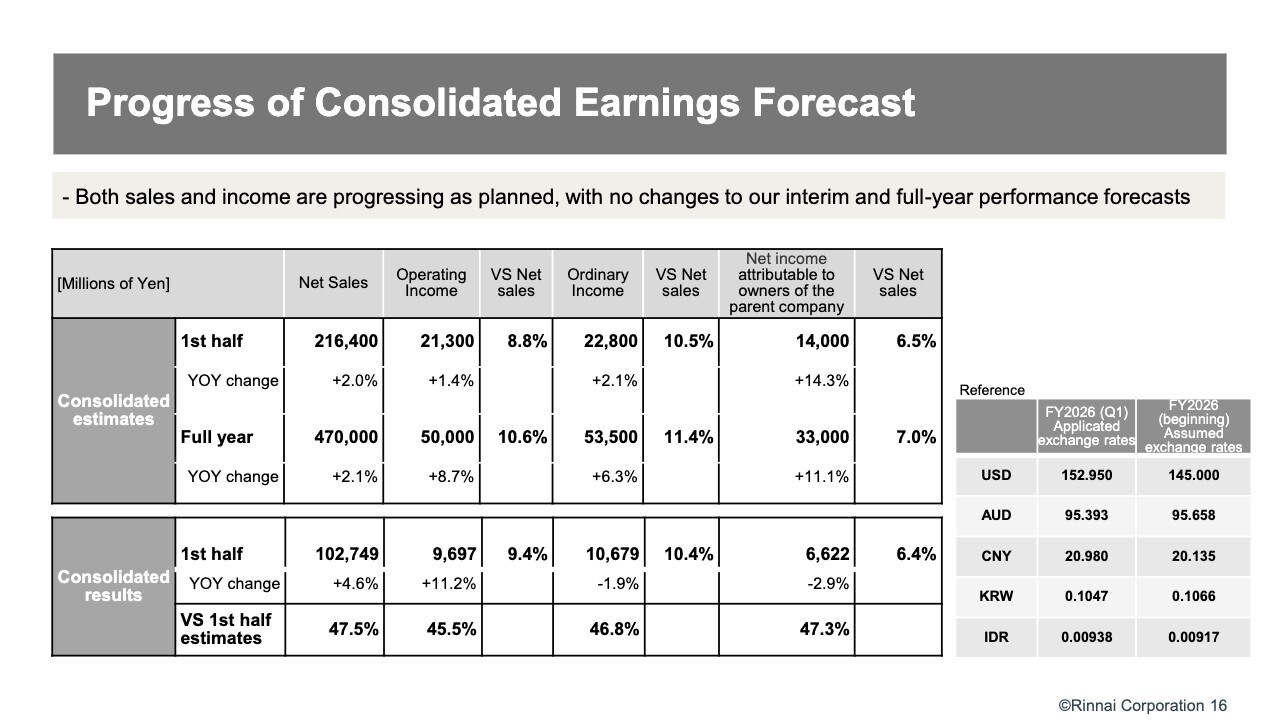

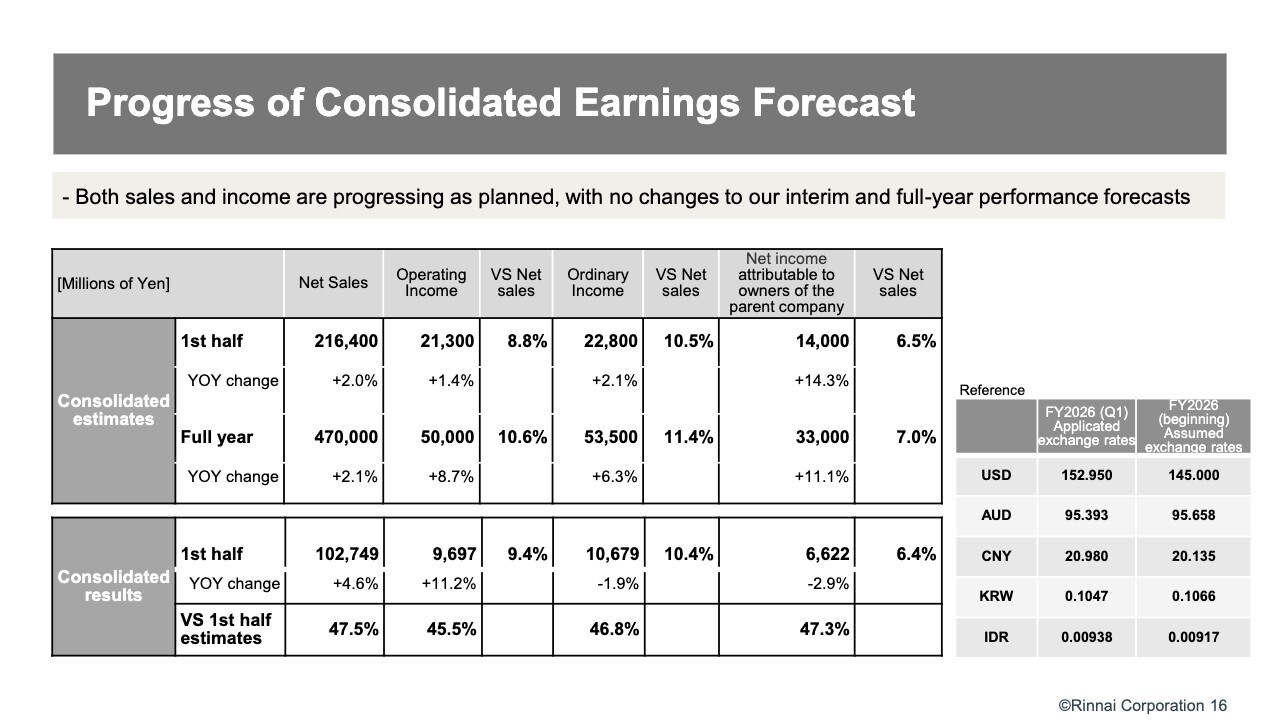

Progress of Consolidated Earnings Forecast

Overall, consolidated results for the first quarter were solid in both sales and income. We believe progress was made largely as planned. Therefore, at this point, there are no changes to our earnings forecasts for the first half or the full year.

This concludes my presentation. Thank you very much for your attention.

Q&A: Response to recalls in Japan segment

Questioner: Earlier, you mentioned the recall of bathroom heater/dryers in the Japan segment. Did the company have to allocate more human resources than expected for this?

Ogawa: We effectively initiated our response to the recall in May, with assigning approximately 320 employees to conduct inspections. Since the number of units subject to inspection amounts to 370,000, we are determining staffing levels based on the progress of the inspections.

We received more calls than expected, which led to a rapid increase in the capture rate—that is, the number of inspection requests. As a result, 320 employees are currently assigned, after adding about 100 employees midway through the process.

This staffing framework has continued through July and August, but we are still unable to keep up with the number of inspection requests. Therefore, we will maintain this framework until the situation stabilizes. We maintain the framework during the second quarter and expect it to stabilize around the third quarter.

Q&A: Sales Status of New Condensing Water Heaters in the United States Segment

Questioner: You said that new condensing water heaters are selling well in the United States. Could you elaborate on the specific customer attributes driving these purchases?

In addition, while condensing water heaters performed well, overall sales of tankless water heaters declined 0.7%, which may suggest a decline in sales of non-condensing models. Could you explain the background behind this?

Ogawa: First, regarding the consumer segment purchasing these products: as in Japan, because they are water heaters, we believe they are mainly purchased by general users, without particular attributes such as being limited to affluent consumers.

However, tankless (instant-type) water heaters are more expensive than the widely used tank-based (storage-type) models. In the United States, where inflation is rising, we believe that many consumers purchasing these products have relatively high purchasing power.

As you mentioned, demand for non-condensing water heaters is declining as condensing water heaters gain share. We believe this trend will likely continue.

The Republican administration in the United States may adopt policies that place some emphasis on conserving gas, but policy direction varies from state to state. California, in particular, is strongly promoting environmental measures.

Therefore, we believe the shift from non-condensing to condensing models will continue to be a major trend.

Q&A: Fixed costs in the Japan segment

Questioner: I have a question about fixed costs in the Japan segment. You mentioned earlier the additional staffing for the recall of bathroom heater/dryers. Are there any other costs increasing more than expected?

Also, regarding the increase in fixed costs from the second quarter onward, you said the costs related to the recall would settle down somewhat in the third quarter. Could you give us an indication of the kind of impact we should expect from fixed costs?

Ogawa: We had already anticipated personnel and other expenses within our fixed costs for the Japan segment.

As you know, we implemented a 5.6% salary increase in April, which is the usual timing for raises. As a result, since bonuses are calculated based on base salaries, they were also affected.

These factors have been accounted for to some extent, but expenses continue to rise across nearly all categories, particularly energy and logistics.

There is no doubt that we are in an environment where expenses are significantly higher than originally expected, and the Japan segment’s first-quarter results fell short of plan. Accordingly, we are urgently discussing countermeasures within the company and will implement various steps on an emergency basis, such as reducing non-essential and non-urgent expenses.

We expect that the response to the bathroom heater/dryer recall will peak in the second quarter, before settling down in the third quarter and beyond. For this reason, we view the first half of this fiscal year as a period of patience. In the second half, we will implement measures to recover expenses and expect to begin realizing the effects of these initiatives.

Q&A: Price revisions in the United States segment

Questioner: On slide 11, it is stated that price revisions are being considered for the United States segment from September onwards. In this section, three star symbols are shown. Could you clarify whether each of these refers to non-condensing or condensing products?

The background to my question is that results for copper were not mentioned, so it is unclear whether this applies to non-condensing or condensing products.

Ogawa: On slide 11, it says “under consideration” for steel and aluminum, copper, and reciprocal tariffs.

First, the target is non-condensing water heaters, which are manufactured locally in the United States. Copper is used in the heat exchangers of non-condensing water heaters, and that copper is sourced from outside the United States. We are currently considering how much additional price increases to apply to non-condensing water heaters, taking into account the impact from steel and aluminum, and copper.

In addition to tankless water heaters, various products—including heating systems—will also be subject to tariffs. The impact from steel and aluminum will extend to other items, but will primarily affect both non-condensing and condensing tankless water heaters.

Questioner: Are steel and aluminum, and copper primarily used in non-condensing applications?

Ogawa: That is correct.

Questioner: Am I correct in understanding that reciprocal tariffs are imposed on condensing applications?

Ogawa: That is correct.

Q&A: Demand in the Japan segment and recall response

Questioner: Regarding the Japan segment, you mentioned that the company slightly increased human resources in response to the recall.

Could you confirm your outlook for domestic demand, whether you have a framework in place to generate income as expected once the recall response settles down, and whether there are any changes to the outlook?

Ogawa: Prices are rising overall in Japan, and consumer spending appears to have slowed slightly, but we do not expect any major changes. Demand for high-efficiency water heaters is growing thanks to subsidies, and clothes dryers are also maintaining strong sales. This creates a very favorable demand environment for us.

The recall response will peak in the second quarter, but we expect it to settle down in the third quarter as we gradually reduce the number of employees currently assigned to inspections.

Although we began this fiscal year with a decline in income in Japan, the key challenge is how much we can recover in the second half. We are currently discussing measures in the second quarter and expect to provide an update when we announce our second quarter results.

Q&A: Full-year earnings forecast for fiscal 2026

Questioner: Based on the results for the first quarter, could you give us your outlook for the full fiscal year? The first quarter appears to have progressed steadily. Am I correct in understanding that the company is basically on track to achieve its targets for this fiscal year?

Ogawa: The first quarter accounts for a small weighting, with the peak coming in the third quarter. Therefore, it is difficult to comment at this point on the full-year outlook relative to the initial forecast without seeing the results for the second quarter.

We also believe that the China segment is a key factor. Although the first quarter appears to have gotten off to a decent start in terms of figures, market conditions are not favorable. In China in particular, the second and fourth quarters account for a very large proportion of sales, and online sales grow significantly due to events such as “6.18 Sale and Double Eleven (W11).” We believe that these will be important points.

Questioner: I think the domestic business outlook depends on the weight of the third quarter. Although income declined slightly in the first quarter, based on what you have said, am I correct in understanding that there are signs the company will catch up with its plan in the second quarter and beyond?

Ogawa: Rather than the second quarter and beyond, it is the third quarter and beyond. The second quarter will be the peak in terms of resources allocated to the recall response I mentioned earlier, and we expect continued patience will be required during this period. From the third quarter onward, as we advance our measures, we expect to be able to gradually reduce the resources devoted to the recall response, and we believe the financial effects of these measures will begin to materialize.

Q&A: Inventory status and impact on income

Questioner: I have a question regarding inventory. Inventory on the balance sheet has decreased. Can I assume that this is moving toward a more appropriate level?

In addition, how does this affect income? Am I correct in understanding that income is positively impacted by adjustments in the form of unrealized income? I would also appreciate it if you could provide further information, particularly regarding the inventory situation in the China and other segments.

Ogawa: Certainly, we feel somewhat relieved that inventory assets on the balance sheet have decreased, as this also has a positive impact on ROIC.

That said, the largest factor behind this decrease is foreign exchange valuation. As for inventory levels in the China segment, we do not see any particularly significant expansion of our own inventory due to the deterioration in market conditions, either in China or in other countries.

Since last year, we have been working to maintain inventory at appropriate levels with the aim of improving ROIC. The effects of these efforts are gradually beginning to appear, and favorable exchange rates have also contributed to this trend.

Questioner: Did improvements outside the major regions you mentioned have some impact on the first quarter?

Ogawa: Do you mean outside the major regional segments?

Questioner: Yes. I asked about the adjustment because it seemed that the difference was positive to a certain extent.

Ogawa: Are you referring to income, rather than inventory?

Questioner: I am referring to income.

Ogawa: We believe there was a slight increase. In fact, we recorded approximately ¥0.6 billion in unrealized income, which may have been a significant factor.