First Half Results Highlights

Takayuki Ueda (“Ueda”): I am Takayuki Ueda, Representative Director, President & CEO of INPEX CORPORATION. Thank you for taking the time out of your busy schedule to join us today. I will begin by explaining our business activities.

Let me start with a summary of the first half (1H) of the fiscal year. Profit attributable to owners of parent (profit) increased by ¥10.9 billion year on year (YoY) to ¥223.5 billion. Despite a volatile external environment, we achieved higher profit, primarily attributable to the continued stable production of the Ichthys LNG Project (Ichthys).

In the three months from May to July 2025, we shipped 12 LNG cargoes per month. This was the first time in the Company’s history that we maintained this pace for three consecutive months.

In the second half (2H), crude oil prices (“oil prices”) and foreign exchange rates are expected to remain highly volatile, making forecasts difficult. Nevertheless, based on stable production, we have revised our full-year profit forecast upward to ¥370 billion. For Ichthys, we plan to conduct shutdown maintenance in 2H. In addition, as a significant milestone, we have decided to commence the Front-End Engineering and Design (FEED) work for the Abadi LNG Project (Abadi).

Regarding the question of how we view geopolitical risks in regions such as the United States and the Middle East, as shown in the lower section of the slide, we are currently neither operating nor exporting in the United States and therefore expect the direct impact to be very limited. Given that our portfolio is centered on Oceania and Asia, we do not anticipate a significant impact. Our projects in Abu Dhabi in the Middle East also continue to produce stably, and no major issues have arisen to date.

While oil prices remain volatile, looking back at 1H, we observed a certain degree of stability amid the instability. At the end of 1H, the average Brent oil price stood at approximately US$70/bbl, remaining higher and more stable than expected. Looking ahead, there are numerous uncertainties. As is often noted, the impact of the U.S. Trump tariffs on the global economy, along with the announcement of OPEC+ production cut relaxations, may serve as downward pressure on oil prices.

While some point out that the Asian economy remains robust, geopolitical risks, such as the war in Ukraine, continue to pose uncertainties. That said, the futures market does not indicate a sharp decline in oil prices. We expect oil prices to gradually decline, reaching around US$65/bbl by year-end.

Even under these conditions, we anticipate highly stable profits. This is underpinned by factors that will significantly transform our financial structure over the medium to long term, which I will explain in the following section.

Profit After Oil Price and Exchange Rate Adjustment Have Been Steadily Increasing (’21 Actual – ’25 Forecast)

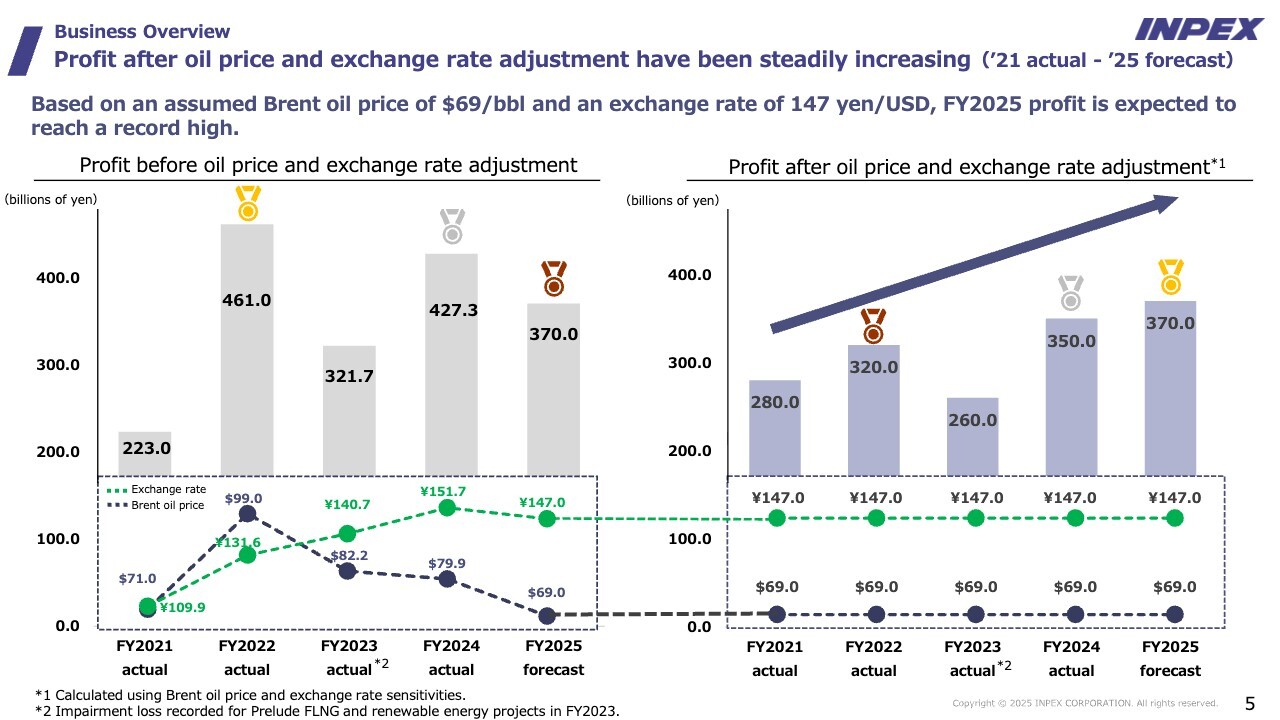

Let me now turn to our view of profit. On the left side of the slide, we display our profit in the past. The record high was approximately ¥460.0 billion in FY2022, followed by ¥420.0 billion in FY2024, and the forecast for FY2025 is ¥370.0 billion. These results reflect various conditions, including higher oil prices and a weaker yen.

As shown on the right side of the slide, we estimate the average Brent oil price for FY2025 at US$69.0/bbl, based on an average price of US$70.0/bbl in 1H and an expected decline to US$65.0/bbl in 2H. For foreign exchange, we assume a full-year average of ¥147.0/US$. Based on the oil price of US$69.0/bbl and the exchange rate of ¥147.0/US$, and using sensitivities to make a simple calculation of past profit levels, we expect FY2025 profit to reach the highest level in the Company’s history.

The lower profit of ¥260.0 billion in FY2023 was due to temporary impairment losses recorded for the Prelude FLNG Project (Prelude) and renewable energy projects. However, the overall trend remains upward. We believe the FY2025 forecast of ¥370.0 billion represents a very high level of profitability, after adjusting for oil prices and exchange rates.

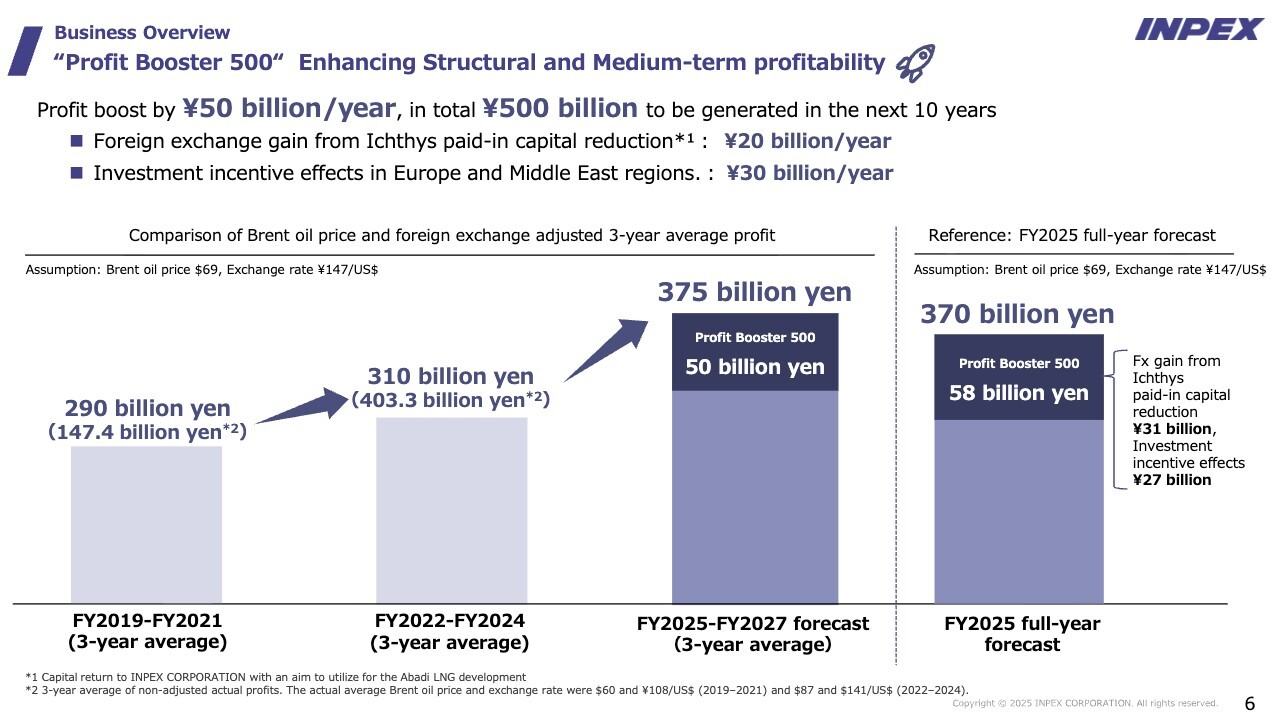

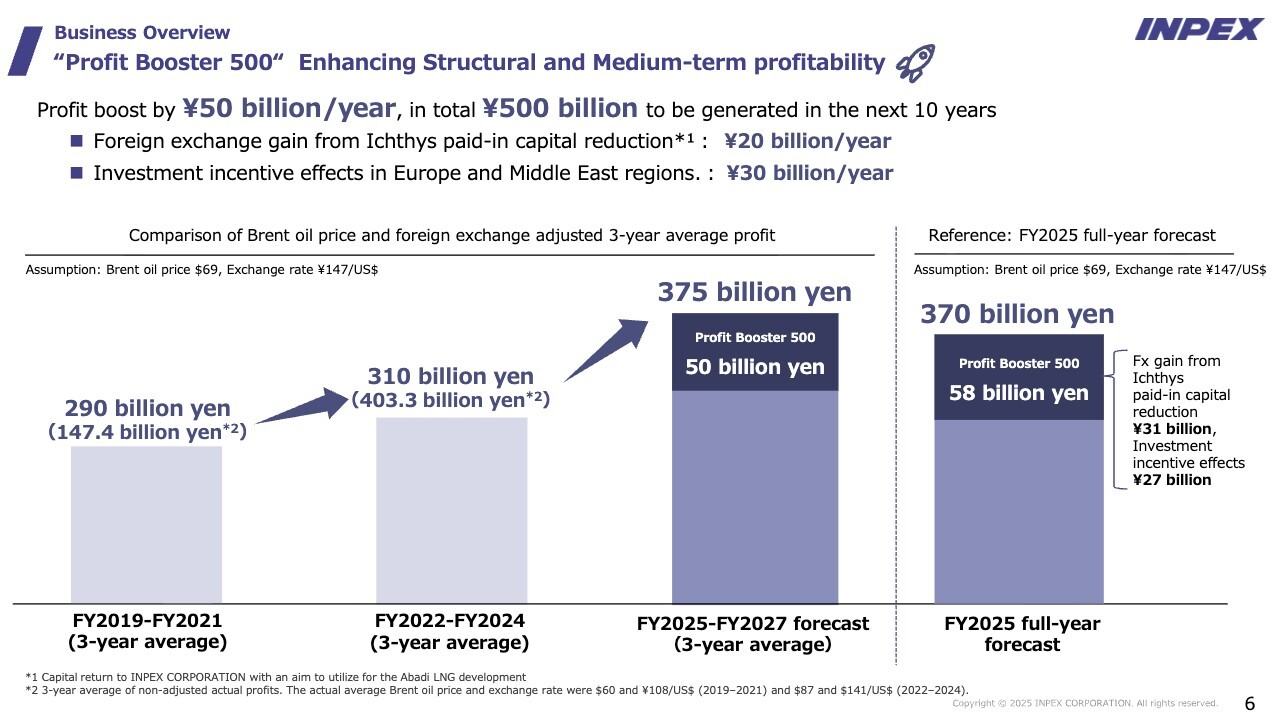

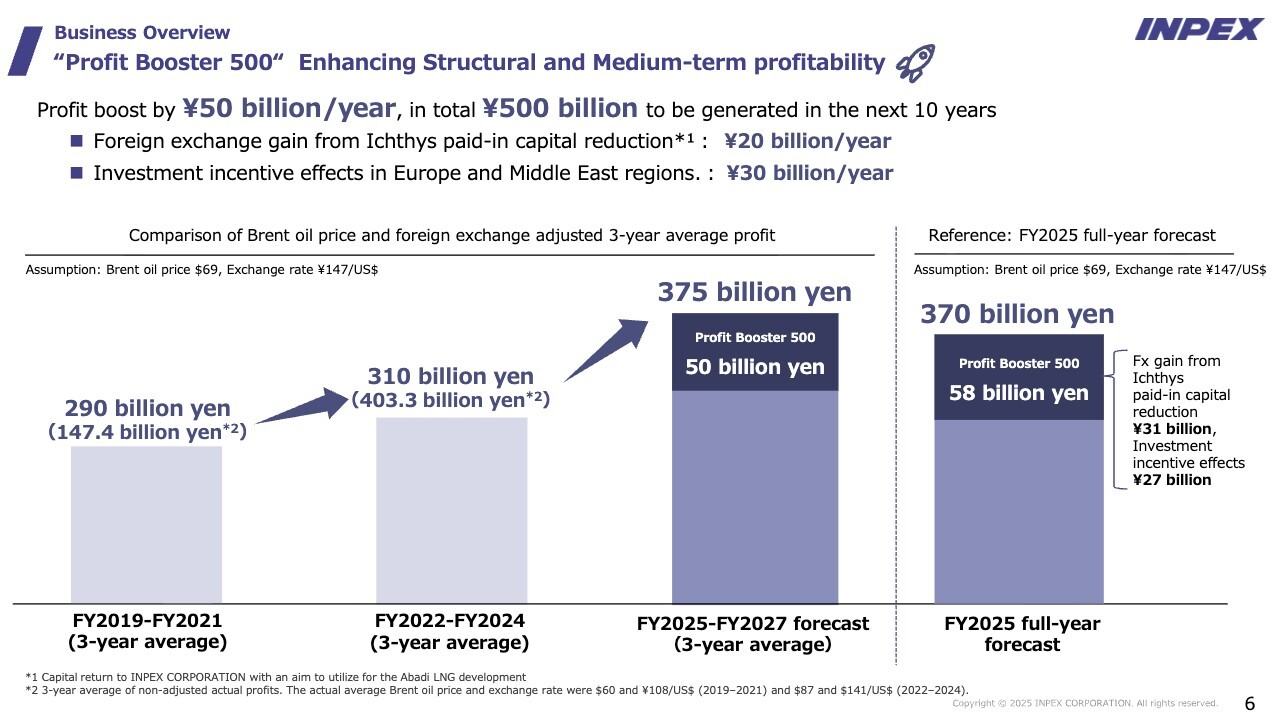

“Profit Booster 500” Enhancing Structural and Medium-Term Profitability

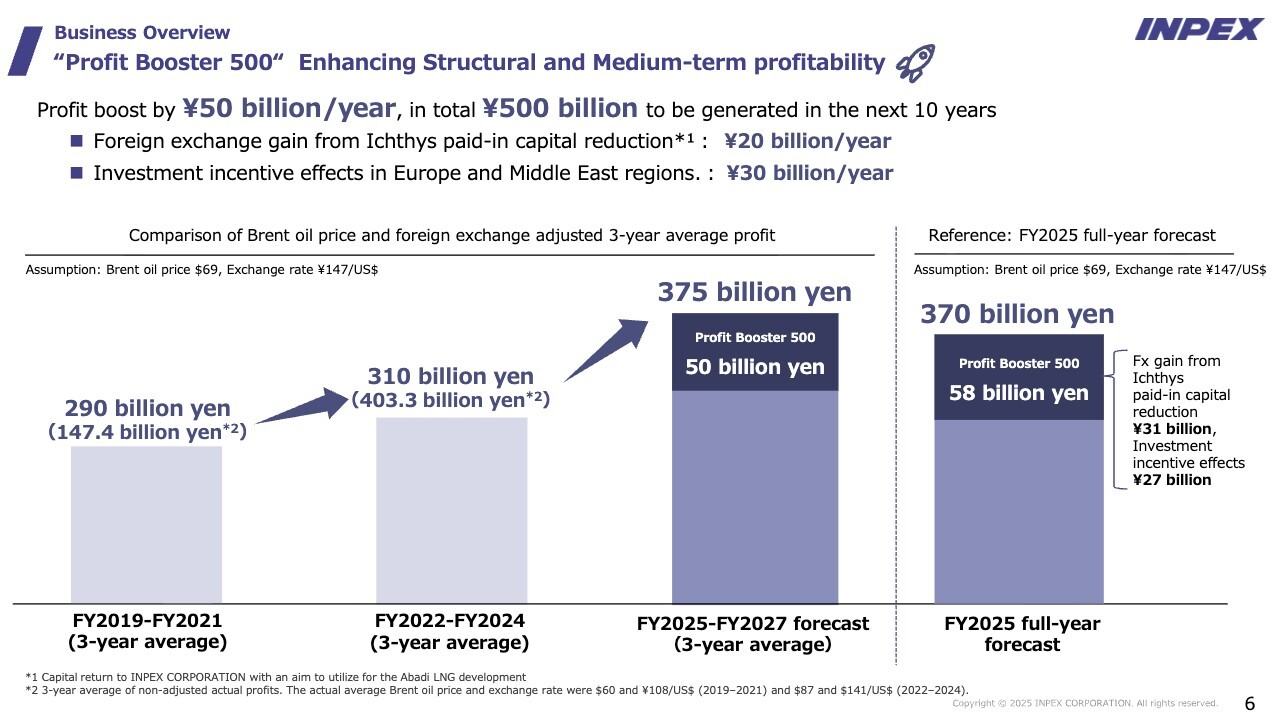

Underlying this is the “Profit Booster 500” initiative to enhance structural and medium-term profitability, with an expected profit boost of approximately ¥50 billion per year, or about ¥500 billion over the next ten years.

There are two main factors. The first is a foreign exchange gain associated with a paid-in capital reduction of Ichthys. As you are aware, Ichthys has now achieved stable operations, and the equity invested in the Australian entity in the past has entered the recovery phase. In addition, given that FEED for Abadi is scheduled to commence and the likelihood of investment in two years has increased, we decided to accumulate preparatory funds. Accordingly, we decided to conduct a capital reduction, transferring part of the equity from the Australian entity to INPEX CORPORATION in Tokyo.

While this transfer of funds does not affect consolidated cash flows, the foreign exchange gains resulting from past investments are recognized in the P/L. Although the amount will fluctuate depending on exchange rates and other factors, we expect approximately ¥20 billion per year, and plan to continue this over the long term.

The second is incentive effects, mainly from projects in Europe and the Middle East. While we are unable to disclose details due to contractual obligations with our counterparties, we expect around ¥30 billion per year in the incentive effects. Since the adjustments with the auditors were only finalized earlier this year, the paid-in capital reduction related to Ichthys was not incorporated into our Medium-term Business Plan. By contrast, part of the incentive effects, mainly from Europe and the Middle East, have already been included in it.

Taken together, we expect a profit boost of approximately ¥50 billion per year over the next ten years. In FY2025, of the full-year profit forecast of ¥370 billion, ¥58 billion is expected to come from these initiatives.

“Profit Booster 500” Building Resilience Against Low Oil Prices & Yen Appreciation

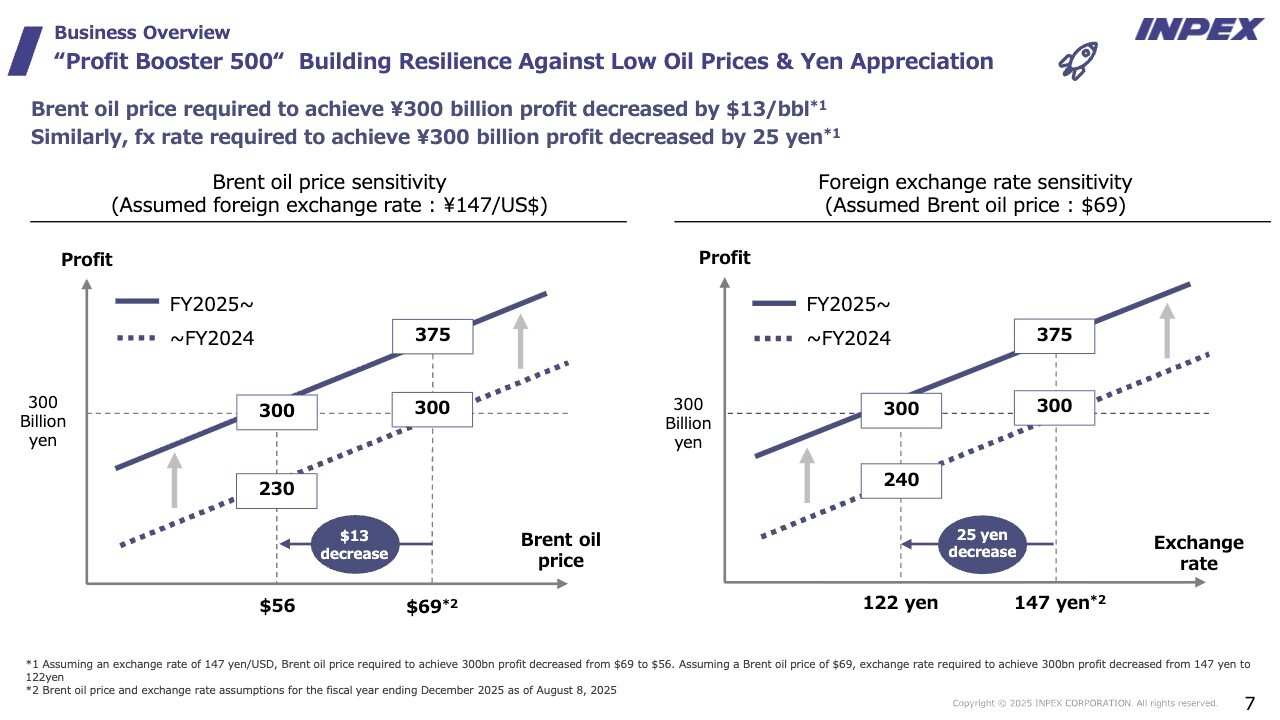

To explain this from another perspective, our earning capacity, or our resilience to fluctuations in oil prices and foreign exchange rates, has improved.

The graph on the left side of the slide shows the oil price required to generate a profit of ¥300 billion, assuming a fixed exchange rate and varying oil prices. Until last year, an oil price of US$69/bbl was necessary to generate a profit of ¥300 billion at an exchange rate of ¥147/US$. However, under current conditions, we can achieve a profit of around ¥300 billion even with an annual average oil price of US$56/bbl.

The graph on the right side of the slide shows the required exchange rate to generate a profit of ¥300 billion, assuming a fixed oil price. Based on an oil price of ¥69/bbl, an exchange rate of ¥147/US$ was required until last year, but going forward, we can achieve a profit of ¥300 billion even at ¥122/US$. This demonstrates that, even in a low oil price or strong yen environment, we have strengthened our earning capacity without depending excessively on oil prices or foreign exchange. We believe this capacity is not temporary but will be sustained over the long term.

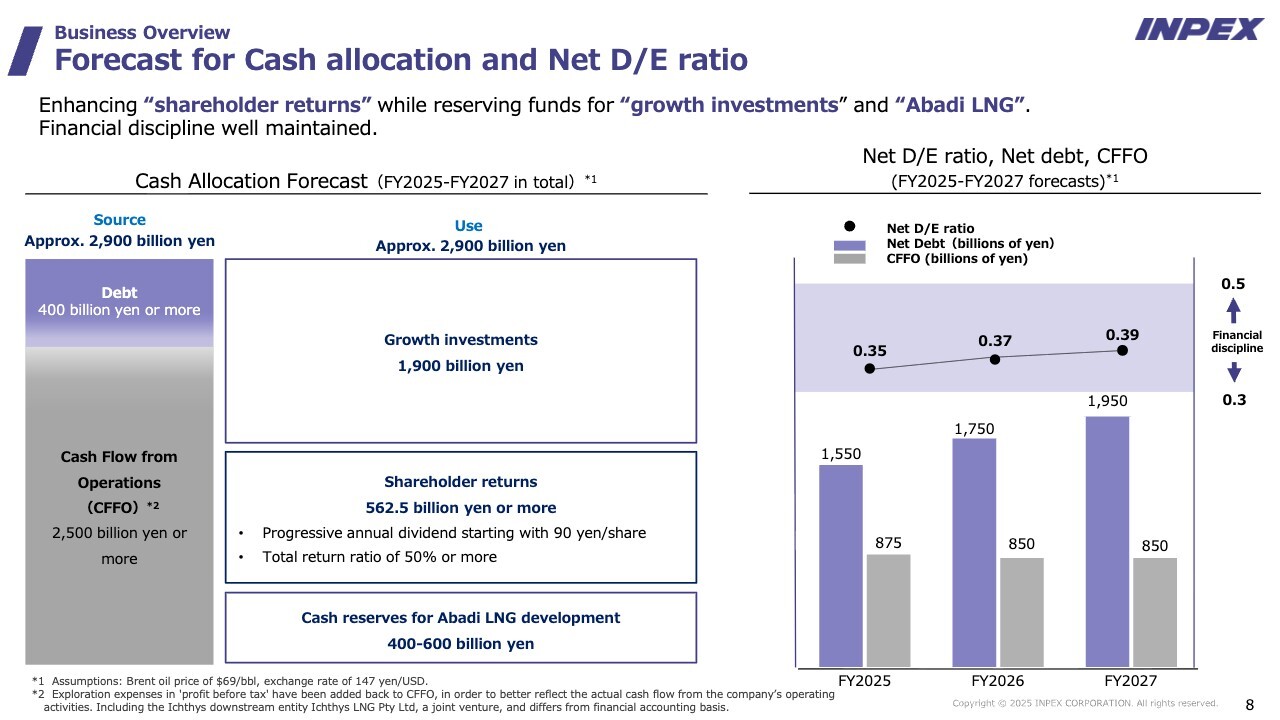

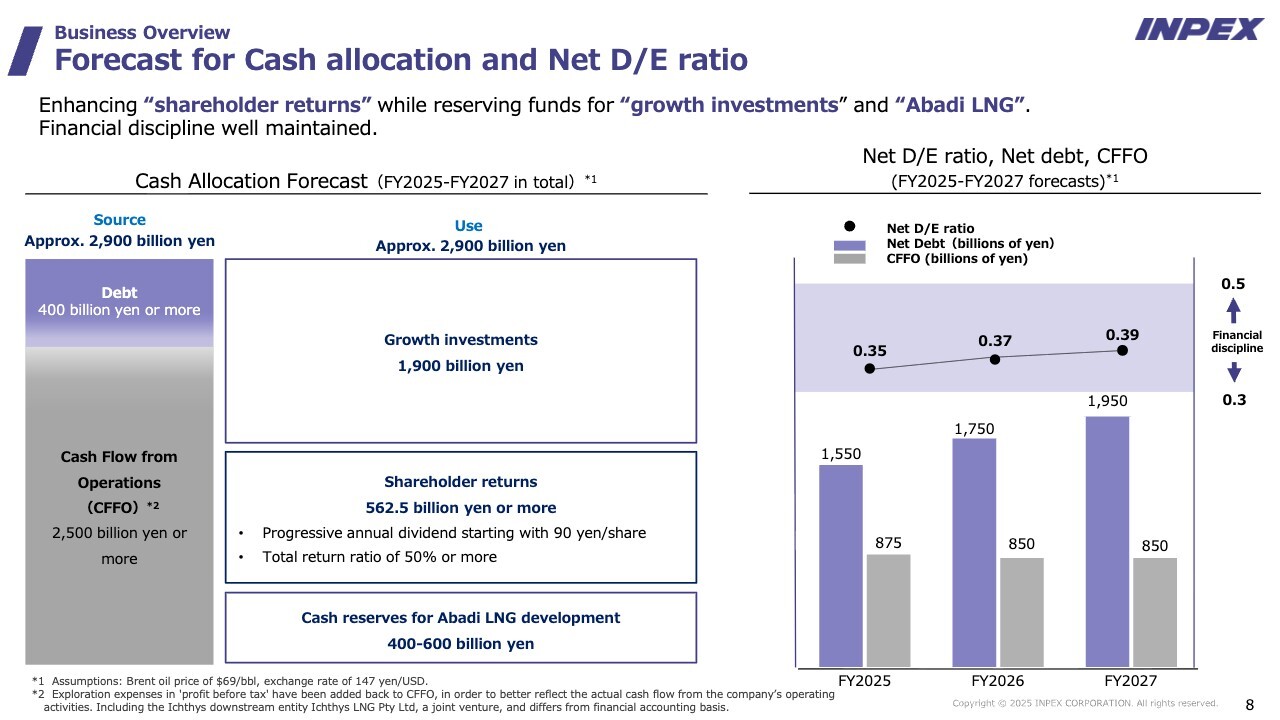

Forecast for Cash Allocation and Net D/E Ratio

Turning to cash allocation. In our Medium-term Business Plan, we explained that we would place emphasis on shareholder returns and growth investments. On this slide, based on assumptions of a US$69/bbl oil price and an exchange rate of ¥147/US$, we present our cash inflows and outflows for the next three years.

In the Medium-term Business Plan, cash flow from operations before exploration investments was estimated at ¥2,200 billion, assuming a US$70/bbl oil price and an exchange rate of ¥135/US$. However, based on this year’s average oil price and exchange rate, we now expect approximately ¥2,500 billion. Adding assumed borrowings of around ¥400 billion, cash inflows for the next three years are expected to total about ¥2,900 billion.

Of this, we plan to allocate ¥1,900 billion to growth investments. At the time of the Medium-term Business Plan, we had assumed ¥1,800 billion, or ¥600 billion per year three times, but our current outlook is approximately ¥1,900 billion. For shareholder returns, we now expect more than ¥562.5 billion, compared to more than ¥400 billion assumed under the Medium-term Business Plan.

We also regard cash reserves for Abadi as highly important in relation to FEED. With the Final Investment Decision (FID) in view, we aim to prepare approximately ¥400 to ¥600 billion. Currently, we expect the balance of marketable securities with maturities of over three months to be around ¥400 billion as of the end of this year.

As noted on the right side of the slide, even with these allocations, we expect to maintain a net D/E ratio of slightly below 0.40. We do not anticipate any significant deterioration in the net D/E ratio over the next three years.

Although not shown on the slide, we assume that these cash reserves will be deployed once the Abadi development commences. While the amount of borrowings will ultimately depend on the total cost of Abadi, and we cannot specify a precise figure at this stage, we expect that a considerable reduction in borrowings will be achievable.

In this way, we have strong confidence in our financial structure over the medium to long term. We are steadily developing into a company capable of achieving stable growth while ensuring shareholder returns.

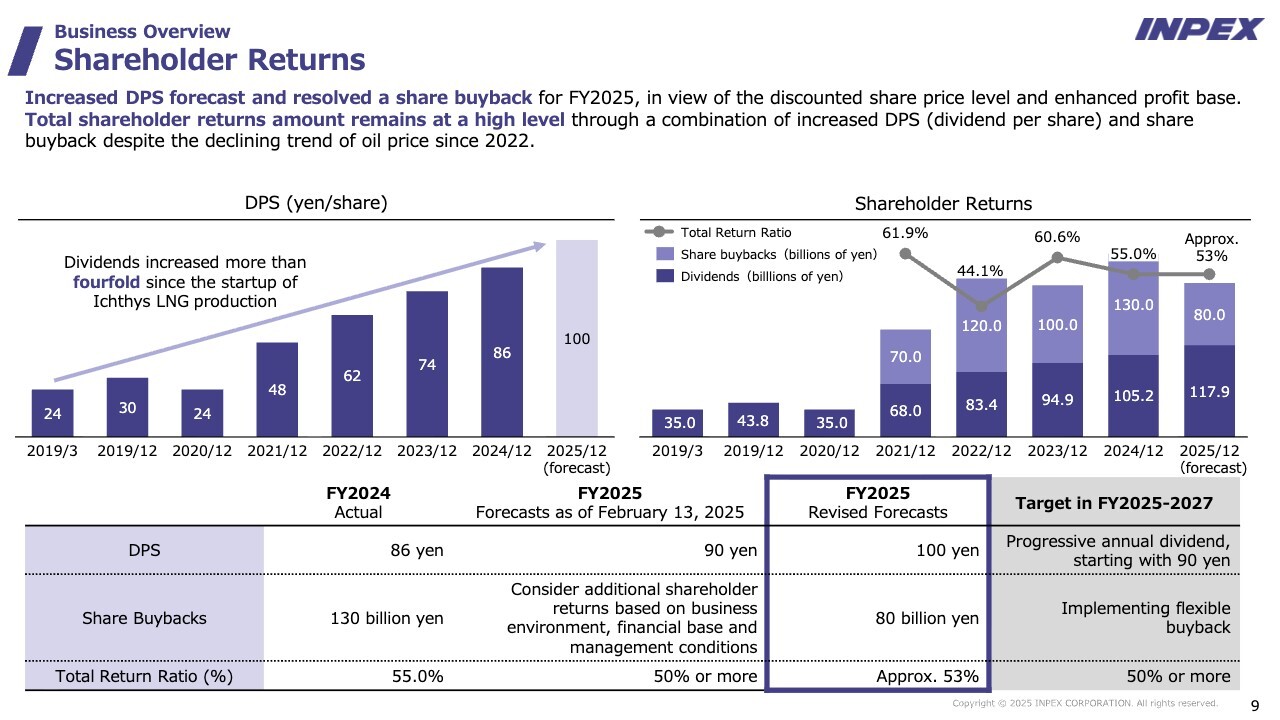

Shareholder Returns

Regarding shareholder returns, as mentioned earlier, we plan to raise the dividend from ¥90/share as set forth in the Medium-term Business Plan to ¥100/share, on the basis of a progressive dividend policy. In addition, we will implement a share buyback of approximately ¥80 billion.

Recognizing that investor expectations for dividends are particularly strong, we have adopted a return policy that places greater emphasis on dividends.

Business Activities – Oil and Gas Business –

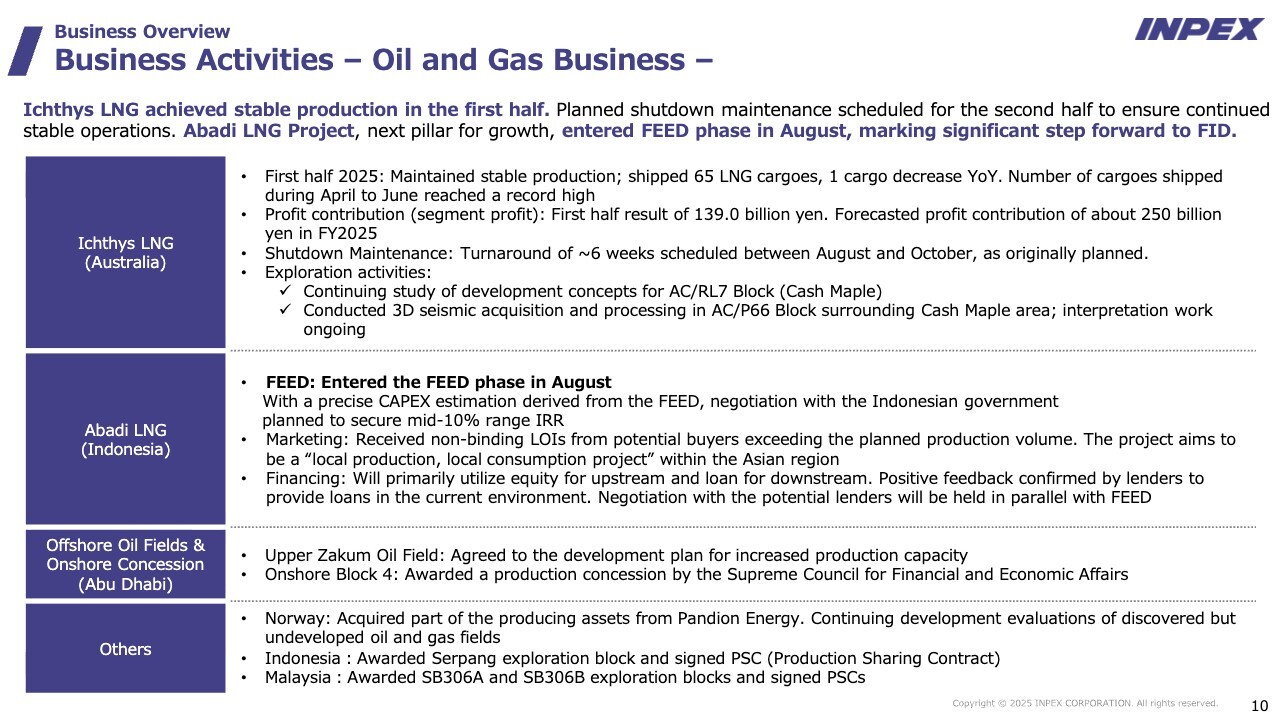

Now I turn to business activity topics. As you are aware, Ichthys is currently performing very well. Scheduled shutdown maintenance will be conducted from mid-August for approximately one and a half months, during which all equipment will be shut down and opened for inspection. In addition, as exploration activities, we continue studying development concepts and conducting interpretation work, including the AC/RL7 Block (Cash Maple).

For Abadi, the most significant topic in the interim period is the transition to the FEED phase. FEED refers to the basic design, and this work is a massive undertaking. The overall cost, including overhead and other expenses, is expected to be around US$1 billion on a 100% project basis, equivalent to approximately ¥140–150 billion.

Although this is design work, it requires substantial investment and will be carried out across four areas: (1) onshore LNG facilities, (2) a subsea pipeline (Gas Export Pipeline, or GEP), (3) a Floating Production, Storage and Offloading (FPSO) facility, and (4) subsea wells and related facilities, collectively referred to as Subsea Umbilicals, Risers, and Flowlines (SURF).

The FSPO and onshore LNG facilities will adopt a dual FEED approach, with two consortia competing. The consortium that delivers superior results at FEED will then be awarded the subsequent Engineering, Procurement, and Construction (EPC). Accordingly, there will be two FEEDs each for the onshore LNG and FPSO, and one FEED for SURF and GEP, totaling six FEEDs to be carried out in parallel. As noted earlier, the cost is extremely large at US$10 billion, with our share alone amounting to approximately ¥100 billion for the massive design work.

In parallel with FEED work, we will also move forward with two major initiatives. The first is marketing, where we are already in discussions with a number of potential customers. As one of the large-scale LNG projects in Asia, Abadi has attracted considerable attention, and although at the non-binding stage, demand already exceeds the project’s production capacity. As FEED progresses, we intend to move these non-binding purchase contracts into binding long-term contracts.

The second initiative is financing. There are both upstream and downstream components. For the downstream onshore LNG facilities, we plan to rely on loans, while the upstream portion will be funded through equity contributions. We have received very positive evaluations from banks and other financial institutions.

Last week, I visited Jakarta and obtained agreement from Indonesia’s Minister of Energy on the application of the cost recovery system to the start of FEED. We have also secured the cooperation of the Indonesian government in advancing FEED. With Indonesia expected to face future energy shortages, expectations for Abadi are rising sharply, and in fact, we have been urged to proceed as quickly as possible.

Over the next two years, we will fully implement design work while examining the structure of marketing and financing. Based on securing an appropriate level of economic viability, we plan to move forward toward a final investment decision in two years.

As for projects in Abu Dhabi, an expansion plan for production capacity has already been announced. We are aligned with this plan, and although mid-term investment will be required, we expect it will become a major source of earnings through increased production.

In the near term, we have acquired assets in Norway and also secured a block in Indonesia. In short, while advancing such initiatives, we will continue to establish a solid foundation over the medium term.

Business Activities – Lower-Carbon Solutions, Energy and Resources Fields –

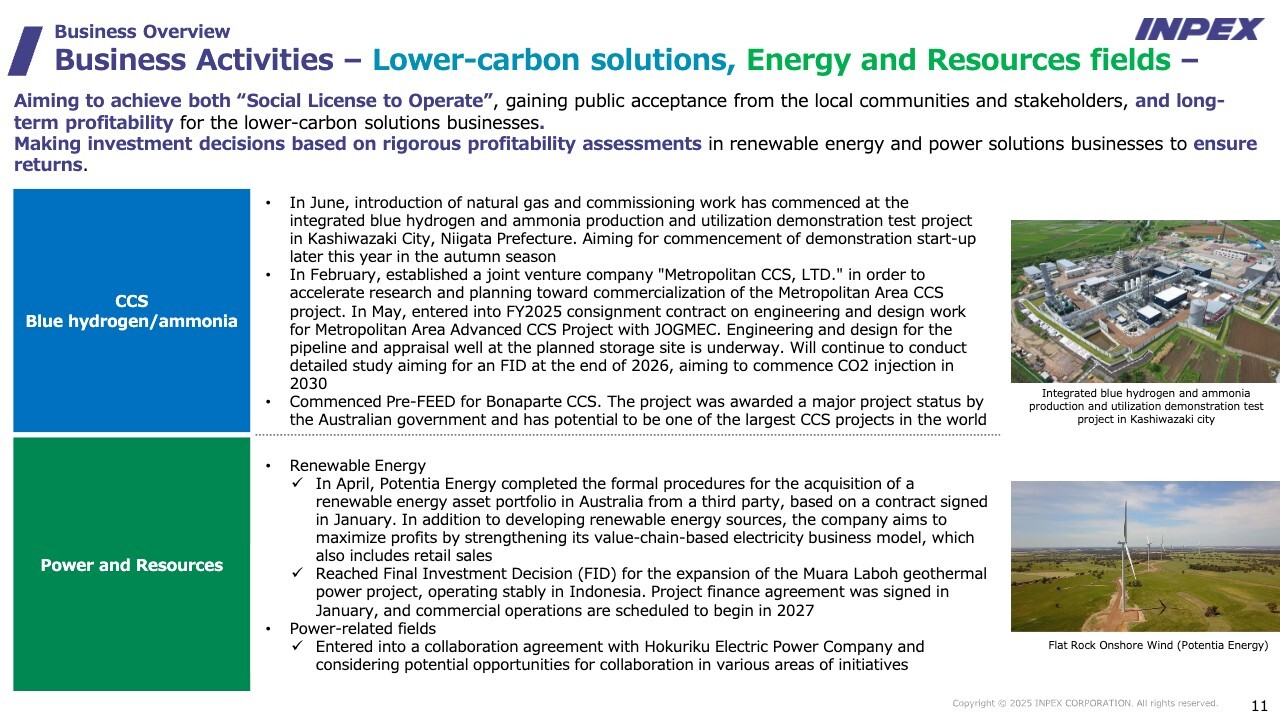

We have seen several major developments in our lower-carbon solutions and energy and resources initiatives.

The first relates to hydrogen. In Kashiwazaki City, Niigata Prefecture, we are constructing a demonstration plant for the production of blue hydrogen and ammonia. The plant has already entered the test-run stage, and we aim to commence operations this autumn.

As for Carbon Capture and Storage (CCS), we are advancing the Metropolitan Area CCS project, which had previously been selected as an advanced CCS project. Together with Kanto Natural Gas Development Co., Ltd., we established Metropolitan CCS, LTD. to drive this project. The project will be fully funded by the government, and over the next year, we plan to carry out Pre-FEED and FEED, followed by well drilling.

In addition, near the Ichthys area in Australia, we are pursuing a CCS project called Bonaparte CCS. While its primary purpose is to store CO2 from Ichthys, based on the results of well drilling, we expect it to have the potential to become a world-class CCS project in the future.

Recently, this project was awarded a Major Project Status by the Australian government, signifying its recognition as a project of national importance for Australia’s economic development. CCS projects in Australia require around 140 approvals and permits, and we expect this recognition to significantly streamline the process.

In power-related fields (related to renewable energy and power), we established Potentia Energy Pty Ltd. in Australia, and the business is expanding steadily. We have recently acquired an additional asset, bringing our total net generation capacity to approximately 800 megawatts.

These are the latest developments in our projects.

Our profit base has improved considerably, and we feel that our earning capacity has been strengthened. The most significant milestone during the interim period is FEED of Abadi. Following this process, which will continue for about two years, we aim to reach FID.

We are sometimes asked: “We understand Abadi, but how will you grow earnings in the meantime?” One answer is the “Profit Booster 500” initiative I mentioned earlier. Another is enhancing profitability from projects in Abu Dhabi by investing in line with its production capacity expansion plan. Furthermore, we will continue to increase production at other bases in Indonesia, Malaysia, and Norway.

Through this structure, we will realize stable profit growth over the three years of the Medium-term Business Plan. Once Abadi commences production, it will serve as a major booster, driving further growth. This is our current growth story, and it is the key message I hope you will take away today. That concludes my presentation.

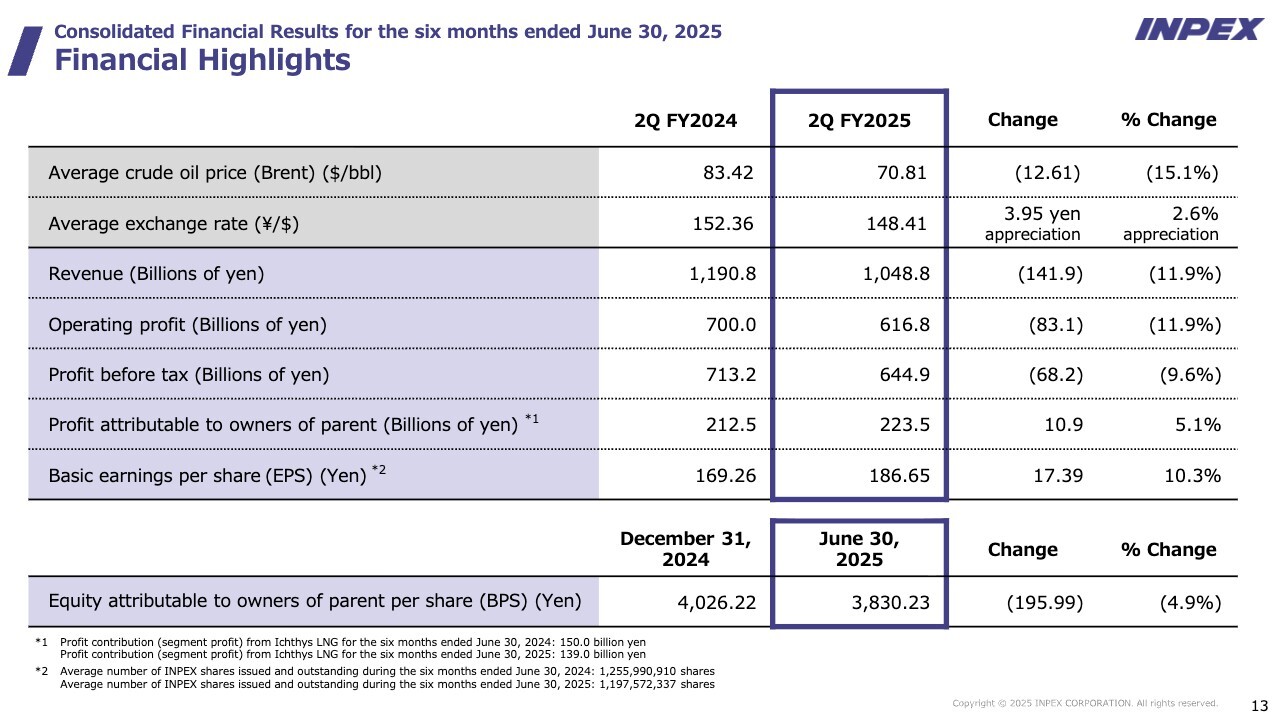

Financial Highlights

Daisuke Yamada (“Yamada”): As President Ueda mentioned, we are confident that we have been able to strengthen our earnings base over the medium to long term.

Today, I will focus on the current situation in 1H. As you can see, the oil price declined by US$12/bbl YoY. Despite the appreciation of yen, profit increased by ¥10 billion YoY to ¥223.5 billion.

While the absolute figure peaked in FY2022, this was the second-highest level for 1H, and we believe the results were reasonably solid.

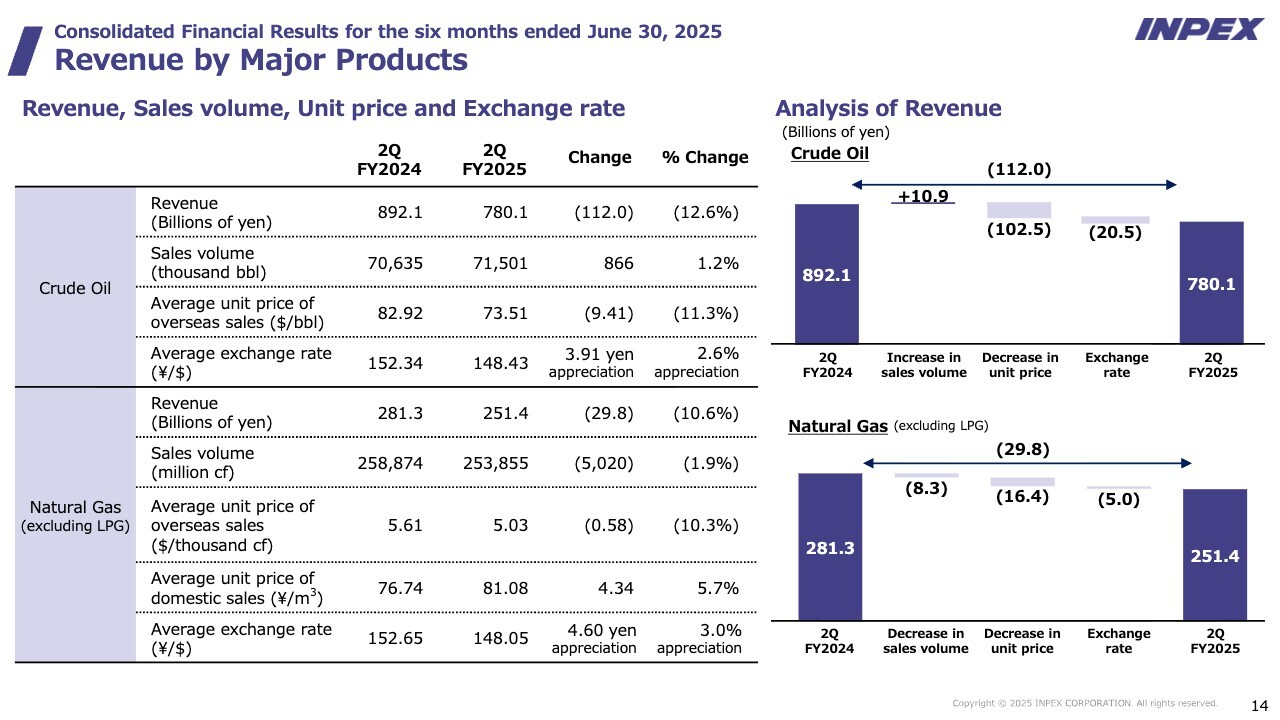

Revenue by Major Products

Now I turn to revenue. Revenue declined YoY, primarily due to lower crude oil revenue, which fell from ¥892.1 billion to ¥780.1 billion, and lower natural gas revenue, which fell from ¥281.3 billion to ¥251.4 billion.

Although sales volume remained largely unchanged, the lower average unit price of sales due to a decline in oil prices and natural gas prices, combined with the impact of the appreciation of the yen, resulted in a decrease in revenue.

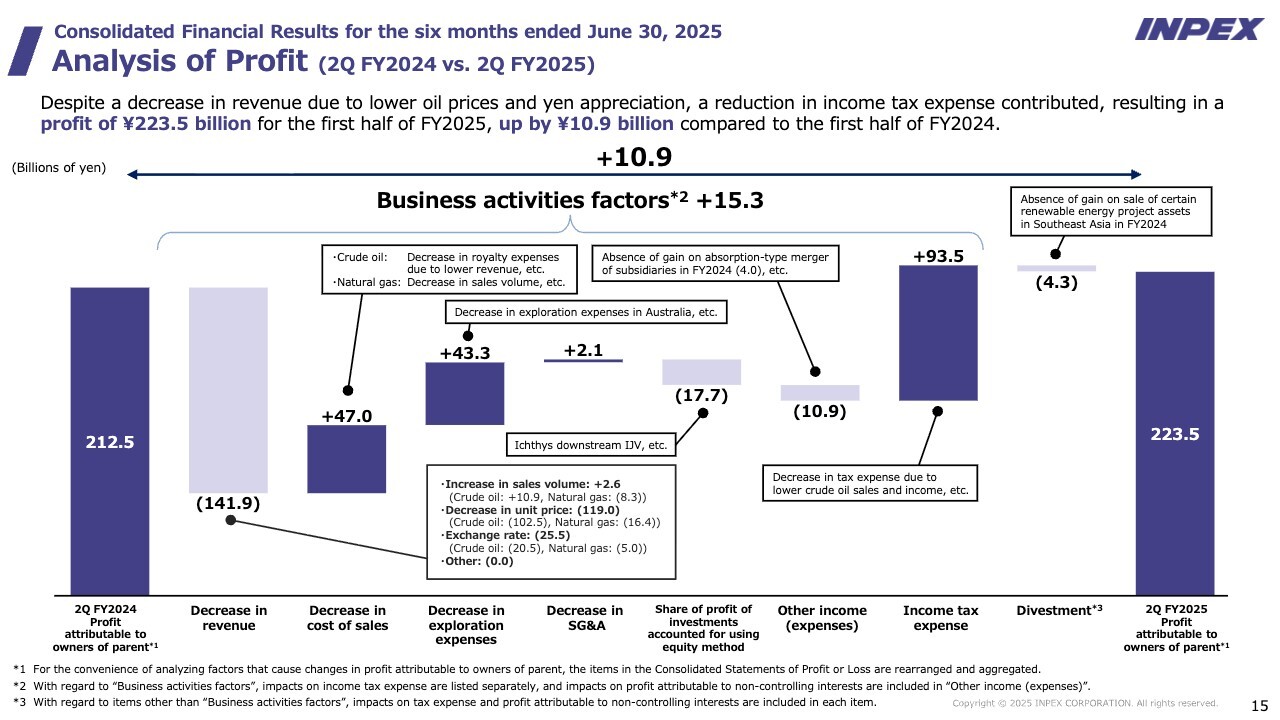

Analysis of Profit (2Q FY2024 vs. 2Q FY2025)

Please look at the left-hand side of the waterfall chart. Profit increased from ¥212.5 billion in 2Q FY2024 to ¥223.5 billion in 2Q FY2025. I mentioned earlier regarding the decrease in revenue. Regarding the cost of sales, royalty expenses slightly decreased.

The most significant factor was exploration expenses. Last year, we recorded the effect of a dry hole at Bassett Deep, and that effect was reversed in the current period. In addition, the share of profit of investments accounted for using the equity method was slightly negative, due to the lower unit price of sales in the downstream business of Ichthys.

As for income tax expenses, there was a tax benefit difference (delta) of ¥93.5 billion. Of this amount, approximately ¥70.0 billion was profit-linked, while about ¥20.0 billion was attributable to factors not directly linked to profit, such as tax effects on retained earnings of subsidiaries etc,and the utilization of foreign tax credits.

The larger decline in revenue in high-tax jurisdictions also had an impact, resulting in a sizable tax benefit difference (delta).

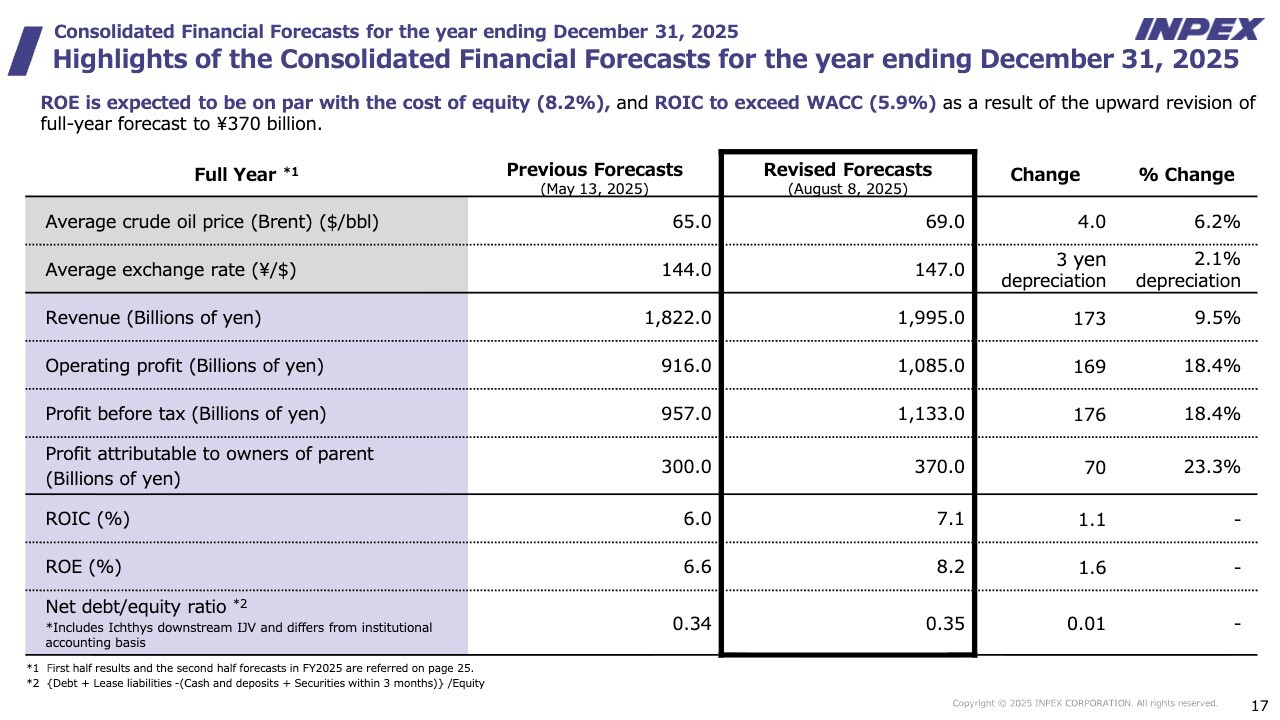

Highlights of the Consolidated Financial Forecasts for the Year Ending December 31, 2025

Now I turn to financial forecasts. As President Ueda also mentioned, we assume an oil price of US$69.0/bbl and an exchange rate of ¥147.0/US$.

Revenue is projected to be approximately ¥2,000.0 billion, operating profit is expected to exceed ¥1,000.0 billion, and profit is forecast at ¥370.0 billion. Compared to our May forecast of ¥300.0 billion, this represents an upward revision of ¥70.0 billion, or a 23.3% increase. As shown in the earlier slide, after adjusting for oil prices and foreign exchange rates, this figure reaches a record high. This underpins our confidence going forward.

Additionally, ROIC is projected at 7.1%, above our WACC. With respect to ROE, as we committed in our Medium-term Business Plan to exceed the cost of equity, we expect to achieve 8.2% in the first year.

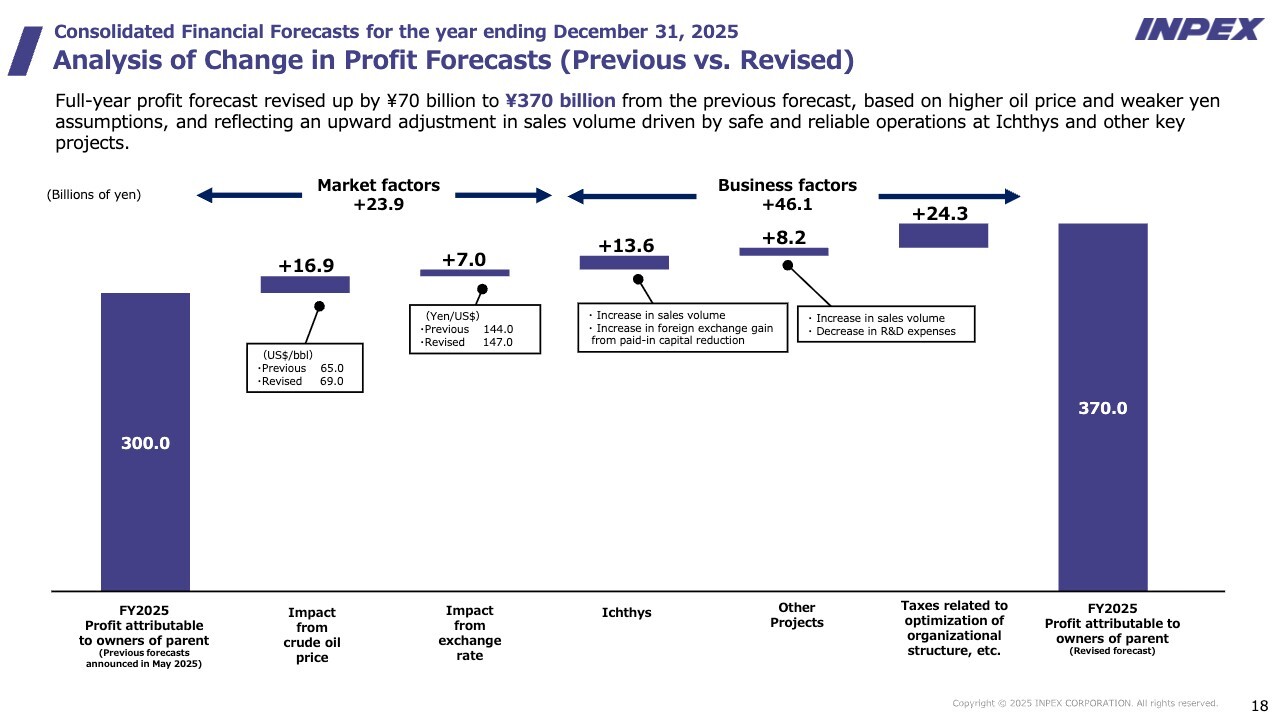

Analysis of Change in Profit Forecasts (Previous vs. Revised)

This slide shows the analysis of factors behind changes in profit for the current fiscal year. Market factors represent a positive ¥23.9 billion, reflecting upward revisions in oil price and exchange rate assumptions compared to the May forecast.

Ichthys includes an increase in sales volume as well as an increase in foreign exchange gain from paid-in capital reduction. As mentioned earlier, the foreign exchange gain associated with the paid-in capital reduction is expected to be ¥30.0 billion for the full year, and this analysis reflects the difference (delta) from the May forecast at ¥23.0 billion. In addition, regarding the effects of investment incentives, the difference between the May forecast and the August forecast is also included in business factors.

R&D expenses decreased slightly. On the far right of the slide, you can see the item, “taxes related to optimization of organizational structure, etc.” This reflects the reorganization in which we spun off an Australian exploration company and consolidated the blocks slated for withdrawal under a single entity.

Since the Japanese parent company owns 100% of that entity, a tax loss will be recognized in Japan upon its dissolution, resulting in a reduction of tax burden. Last year, we recognized a tax loss in Australia due to unsuccessful exploration activities, whereas this year, we plan to recognize a tax loss in Japan. This effect is included in the ¥24.3 billion shown here.

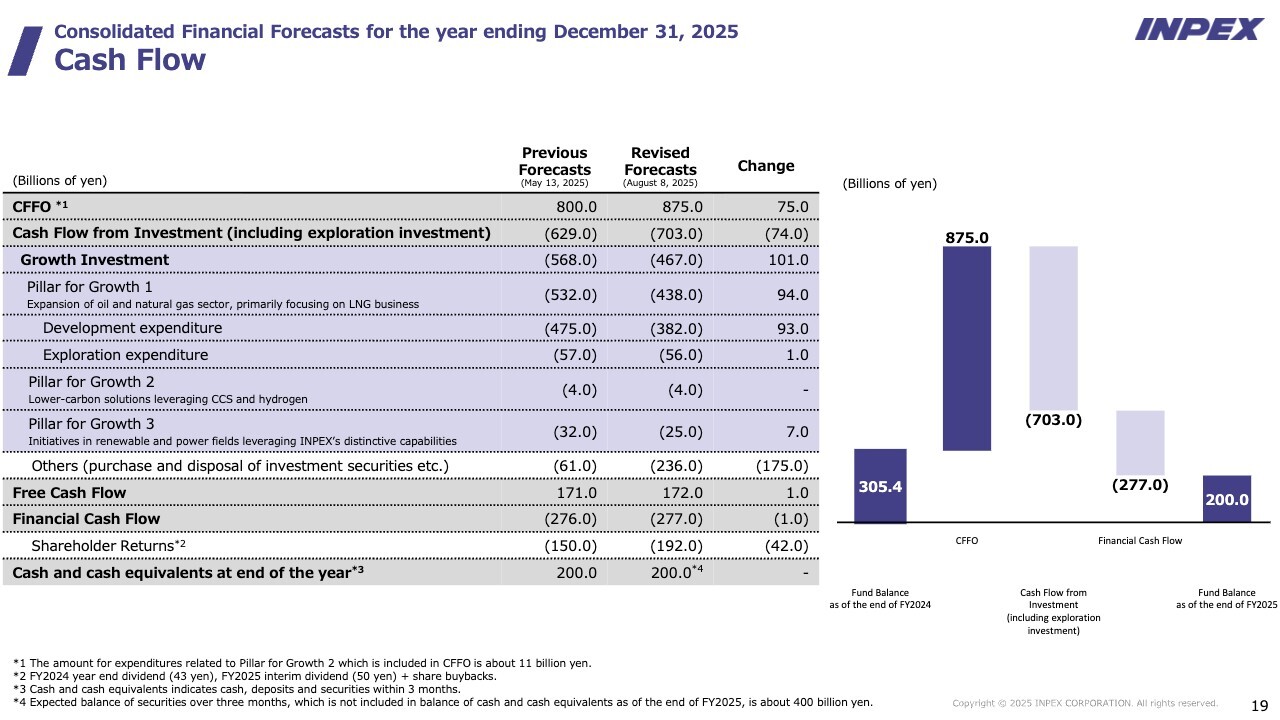

Cash Flow

Now I turn to the breakdown of cash flow. CFFO is ¥875.0 billion. Cash flow from investment is ¥703.0 billion, of which ¥467.0 billion is allocated to growth investment. The remaining ¥236.0 billion is invested in marketable securities with maturities of over three months, to be reserved as standby funds for the future Abadi.

Financial cash flow is ¥277.0 billion, of which ¥192.0 billion is allocated to shareholder returns.

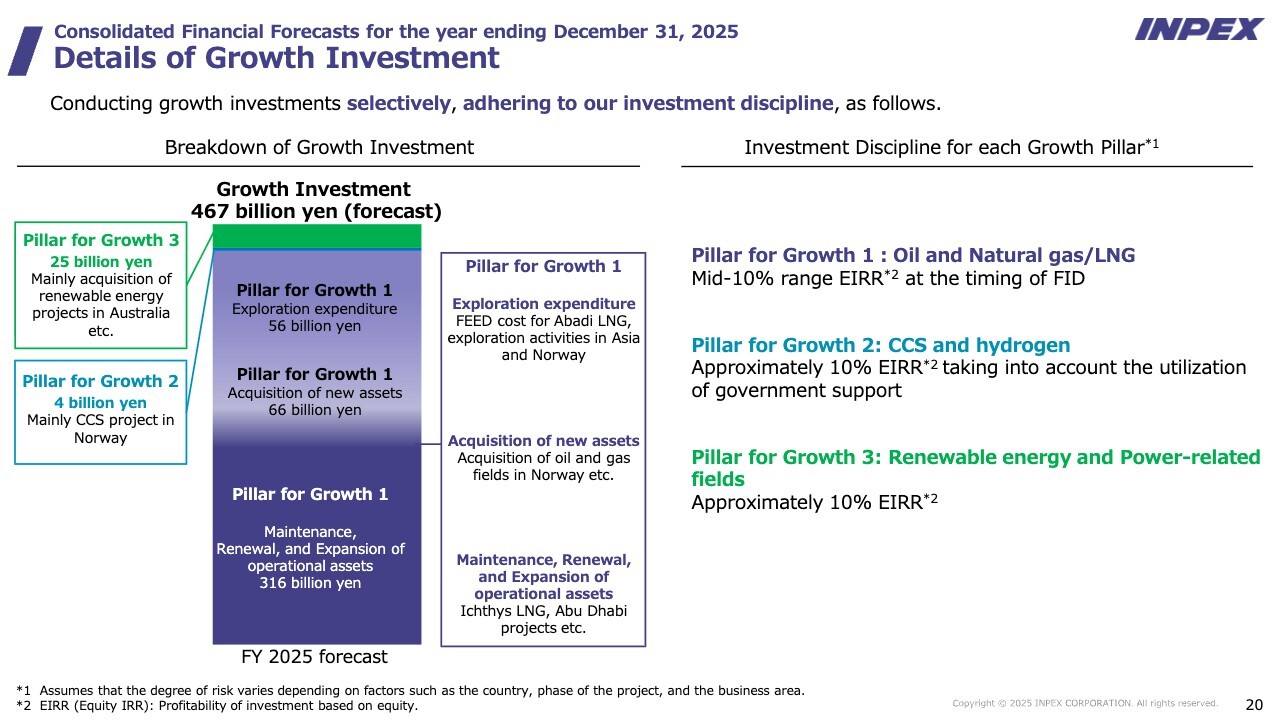

Details of Growth Investment

Now I explain the breakdown of the growth investment of ¥467 billion. The Pillar for Growth 1 focuses on maintaining and expanding the oil and natural gas business, particularly LNG. We will invest ¥56 billion in exploration, and ¥66 billion in new project acquisitions, such as the acquisition of oil and gas fields in Norway. The largest portion, approximately ¥316 billion, will be allocated to the maintenance, renewal, and expansion of existing operational assets, including Ichthys and Abu Dhabi projects.

The Pillar for Growth 2 is a lower-carbon solution, centered on CCS and hydrogen, with an investment of ¥4 billion in CCS projects. The Pillar for Growth 3 is the renewable energy and power-related fields, where we plan to invest approximately ¥25 billion.

As stated in the Medium-term Business Plan, growth investments will be conducted selectively and in strict adherence to our investment discipline. In the oil and natural gas projects, our investment criterion is an Equity IRR (EIRR) in the mid-10% (mid-teens) range, while for CSS and renewable energy projects, the criterion is an EIRR of around 10%. Projects that do not meet these thresholds will not be pursued.

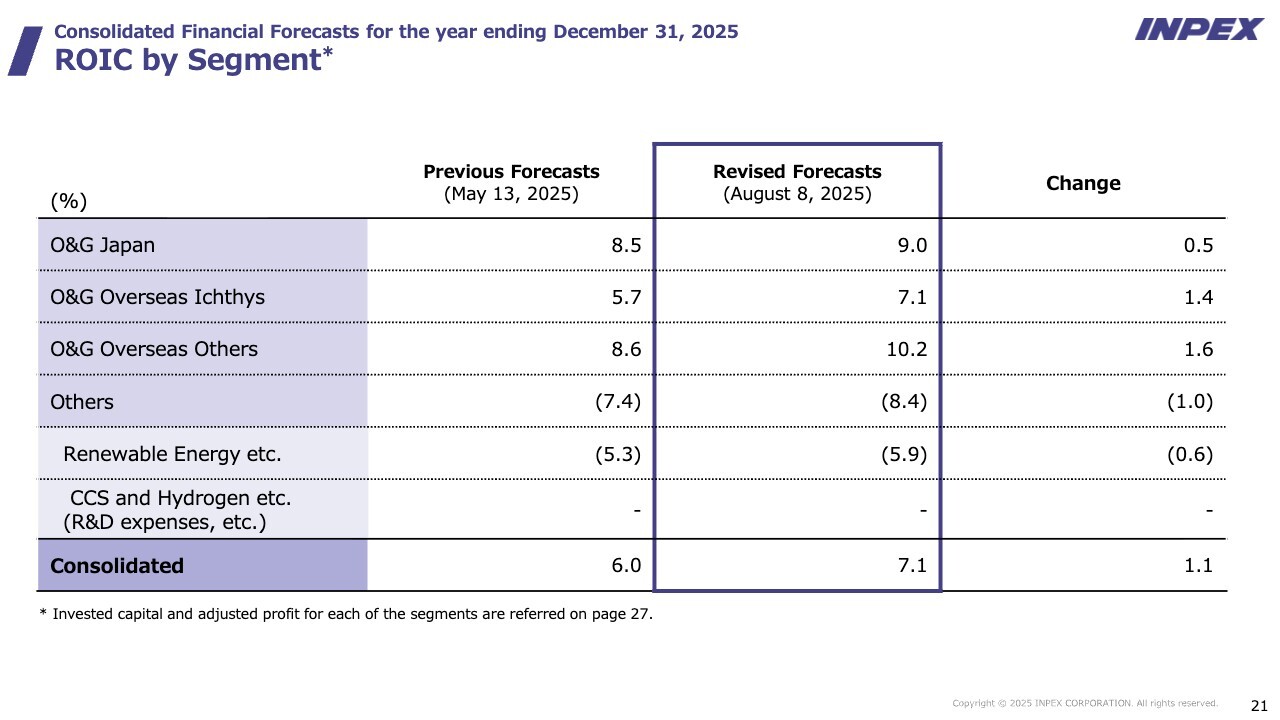

ROIC by Segment

The ROIC of 7.1% on a consolidated basis exceeds our WACC. This represents an improvement of approximately one percentage point compared to the forecast announced in May.

We disclose these figures with respect to ROIC, although consolidated ROIC is ultimately influenced by the ROIC of Ichthys. That concludes my presentation.

Q&A: Progress of the Abadi Project

Q: I have a question regarding the progress of the Abadi Project. According to your previous remarks, you are currently considering financing and marketing strategies as you proceed with FEED. One key concern among investors is the status of communication with the Indonesian government. I believe this is a critical issue to address when evaluating Abadi.

Over the next two years or so, as you work toward FID, what do you consider the most significant hurdles in realizing the project? Specifically, I would like to hear your thoughts on the challenges related to marketing, financing, and communication with the government, including discussions regarding a framework to ensure adequate returns. In your view, which aspects are likely to require the most difficult negotiations at this stage?

Ueda: I believe that the biggest challenge is maintaining relationships with the Indonesian government and local governments. The Abadi Project is a greenfield project located in a remote area, and given the relatively high level of risk, we are seeking a correspondingly high EIRR (mid-10% range).

A concern for the future is that Abadi’s costs may rise in the current market environment. The extent of the increase is unclear at this point, but I believe that it is inevitable.

We have established a process whereby, if the IRR declines, we will re-negotiate the project’s financial viability with the Indonesian government and receive additional incentives as necessary. The specific details will be determined through future negotiations, but we expect the process of adjusting financial viability to be fairly tough. The Indonesian government has requested that we proceed with Abadi as quickly as possible. This is because domestic energy demand is growing significantly, and with a production decline expected at other gas fields, such as Tangguh, the nation needs natural gas from Abadi. Despite these challenges, we remain fundamentally optimistic. Abadi’s natural gas is in high demand among a very large number of people. Asian gas is more attractive compared to gas from the Middle East and the United States due to its lower geopolitical risk and proximity to Japan. It is also an important resource for Indonesia. As long as there are people who need gas and those who want to produce it, I believe that there will always be a compromise. I believe that we will be able to work something out in the end.

Q&A: Approach to capital allocation

Q: I have a question regarding the allocation of cash flow after Profit Booster 500. The uses are categorized as “growth investment,” “shareholder returns,” and “cash reserves for Abadi LNG development.” I find this categorization very clear.

Regarding the range of ¥400 billion to ¥600 billion established as cash reserves for Abadi LNG development, it was mentioned that ¥400 billion could be reserved this fiscal year. Could you please explain the background and intent behind this range? Could you also tell us, to the extent possible, how much you plan to invest?

Additionally, growth investment is set at ¥1.9 trillion, while shareholder returns are targeted at ¥562.5 billion or more. Is it correct to understand that growth investment will be kept within this range, whereas shareholder returns may increase depending on earnings?

Ueda: There were news reports saying, for example, that the cost of Abadi was approximately $20 billion as of 2018. However, with the addition of CCS and other cost escalations, the total is expected to rise by several dozen percent.

The financing of Abadi is broadly divided into upstream and downstream portions. The upstream portion is funded through capital contributions from participating companies, including us, and is expected to account for just under half of the total project cost. The downstream refers to the LNG terminals (liquefaction facilities), which make up slightly more than half of the overall cost. For the downstream facilities, we plan to adopt a financing method known as “trustee borrowing.”

Our participating interest is currently at 65%. However, under an agreement with the Indonesian government, 10% will be transferred to domestic Indonesian companies designated by the government. As a result, we expect our final interest to be around 50%.

Based on the above, the total amount of cash we need will be limited. We have set a range of ¥400 billion to ¥600 billion to cover part of this amount.

Q&A: Profit Booster 500

Q: I have a question about Profit Booster 500. There was mention of a foreign exchange gain of ¥20 billion associated with Ichthys’ paid-in capital reduction. While the amount may fluctuate, it was stated that the cumulative total over the next ten years would be ¥500 billion. Is it correct to understand that this will continue for at least ten years? Or is there a plan to continue this for ten years or longer?

Additionally, the investment incentive effects are substantial, at ¥30 billion. Could you provide more specific details?

Yamada: As we have been explaining since last year, we have reached an agreement with our audit firm on the accounting treatment for the paid-in capital reduction. Therefore, we have formally incorporated it. This means that the amount, which was zero until last year, will be recorded starting this year.

There are two factors that made this accounting treatment possible. The first is that Ichthys has entered an investment recovery phase. This was recognized in discussions with our audit firm, enabling the capital to be transferred to Tokyo.

The second is that the Abadi Project has officially started with the commencement of FEED. Since it became necessary to transfer investment funds for Abadi from Australia to Japan, we carried out a paid-in capital reduction to transfer the funds from Australia to Tokyo.

The investment in Ichthys is recorded at an exchange rate of approximately ¥85 (note: changed to ¥115 at the time of voluntary IFRS application). The difference between the recorded exchange rate and the current exchange rate is recognized as a foreign exchange gain in the profit and loss statement. This year, the amount is expected to be approximately ¥31 billion.

However, this does not mean that there is no limit. First of all, the exchange rate and oil prices must remain at certain levels. The exchange rate is particularly important, and so are oil prices. This is because the mechanism involves transferring the free cash flow of upstream and downstream companies to an intermediate holding company, which carries out a paid-in capital reduction. Therefore, the amount of free cash flow is the upper limit.

For this reason, even if we attempt to carry it out at a scale of, for example, ¥300 billion per year, it would be impossible. A paid-in capital reduction can only be executed within the limits of free cash flow. Any resulting foreign exchange gains would also be confined to that range.

Considering the balance of the foreign-currency translation adjustment and the capital of the intermediate holding company, I believe there will be no problems over the next ten years. Depending on oil prices, exchange rate fluctuations, and free cash flow conditions, this situation may persist for an extended period. However, we expect to continue to have foreign exchange gains related to the paid-in capital reduction for approximately ten years. Therefore, we are projecting ¥200 billion over the next ten years. This will help strengthen our medium-term profit base. Regarding the incentive effects, certain incentives exist when we invest in Europe and the Middle East. These effects have existed for some time. We expect that the difference from the period of the previous Medium-term Business Plan (delta) will increase in the future. We estimate that the amount will reach approximately ¥30 billion annually. Please understand that we cannot provide details due to the difficulty in doing so. When combined with the actual cash flow and investment plans, we expect that this will continue for the next ten years. As a result, the amount is likely to reach approximately ¥30 billion per year, totaling ¥300 billion over ten years.

Q&A: Factors behind the increase in net production volume

Q: It appears that the net production volume has recently increased. Could you clarify whether this is due to a rise in base production or simply a result of increased offtake volume driven by lower oil prices? Please provide the latest situation.

Toshiaki Takimoto (“Takimoto”): Production in the first half was 673,000 barrels of oil equivalent per day, the highest level ever. Production for the second quarter alone reached more than 690,000 barrels. The annual average forecast is for 642,000 barrels, an increase of approximately 10,000 barrels from the previous year.

This is not due to an increase in offtake volume associated with declining oil prices. The main factors are exceptionally strong production at Ichthys up to the second quarter, along with a nationwide production increase in Abu Dhabi. This was an increase of approximately 10,000 barrels per year, but please understand that production capacity has improved.

Q&A: Discussion regarding paid-in capital reduction and taxes

Q: Regarding the paid-in capital reduction at Ichthys, I believe that it is beneficial for investors because it raises profit. However, I also believe that a paid-in capital reduction generates a profit, which in turn leads to taxation. Could you please explain the discussions surrounding the taxes?

Yamada: As you have pointed out, foreign exchange gains do result in taxes. After offsetting the two, we can expect a profit of approximately ¥30 billion.

As for the future, our tax structure is highly complex. It is difficult to forecast the extent of domestic losses because foreign tax credits are involved. However, as part of our tax management strategy for foreign exchange gains, there are several areas where we can recognize tax-deductible losses. Even so, due to foreign tax credits, mistiming the recognition of losses may result in a lower impact than anticipated. Therefore, it is essential to strategically utilize tax-deductible losses while maximizing foreign exchange gains as much as possible. The situation fluctuates significantly in response to the external environment. For this reason, it is difficult to formulate and execute a detailed plan in advance. In reality, there are aspects that require a certain degree of agility. We will continue to monitor the situation, assess potential profit, and manage our operations accordingly to minimize tax outflows to the extent possible.

Q&A: Profit Booster 500 and future strategy

Q: I have a question about Profit Booster 500. Since the results may vary depending on oil prices and exchange rates, I understand that you may not be committed to achieving ¥50 billion. However, does the title “Profit Booster 500” imply a target of ¥50 billion?

When considering foreign exchange gains from the paid-in capital reduction, I believe the amount reflected in the profit and loss statement in yen will vary depending on your approach. This could involve either targeting ¥20 billion per year by adjusting the amount of funds repatriated from Australia in line with the exchange rate or operating in dollars in such a way that you generate the equivalent of ¥20 billion based on this year’s exchange rate. Within the bounds of what you are able to share, please let us know what you intend to prioritize in your future strategy.

Yamada: Regarding the title “Profit Booster 500,” “Booster” refers to a rocket engine and implies the idea of ignition in stages. As you have pointed out, “500” refers to ¥50 billion.

Although we forecast ¥58 billion this fiscal year, there are challenges, such as the impact of exchange rates and the handling of tax-related losses. However, looking ahead over the next ten years, we believe that ¥50 billion remains achievable, assuming exchange rates and oil prices stay near the current levels.

Regarding the paid-in capital reduction, there are three main methods for transferring funds from Australia to Japan. The first is to allocate free cash flow toward the repayment of borrowings that were financed through a financial subsidiary in Singapore.

The second method is dividends, and the third is a paid-in capital reduction. The amount of earnings will vary depending on how these three approaches are combined. For example, one option is to moderate the pace of repayments and dividends and instead allocate more toward a paid-in capital reduction.

This method can be used depending on the external environment at the time, the exchange rate, the amount of free cash flow from Ichthys, and funding needs in Tokyo. Since we have set a target of ¥50 billion, we will continue to work toward that goal while remaining flexible.

Regarding upper limits, there are constraints such as oil prices and exchange rates. Also, we cannot transfer funds if Ichthys’ free cash flow is interrupted. However, as long as these conditions are maintained, we can adjust our earnings with a certain degree of discretion. We believe it is possible to carry over this year’s portion to the next, or to revise next year’s plans based on funding considerations.

Q&A: Intent behind the dividend of ¥100

Q: Could you tell us about the intent behind the dividend of ¥100? Earlier, the president mentioned that a stronger emphasis on dividends tends to receive higher evaluations from investors and that you have considered the dividend ratio. Was this decision influenced by the Profit Booster 500 benchmark, by a specific figure such as ¥370 billion, or was it based on the proportion within the overall shareholder returns?

You may argue that this decision was based on a comprehensive assessment. However, given that your company has declared a progressive dividend policy, raising the dividend to ¥100 seems to me a bold and courageous move. Please explain the reasoning behind this figure and how we should view your future dividend plans. Ueda: In response to the question as to why we set the dividend at ¥100, it ultimately comes down to a comprehensive assessment, as you mentioned. Until now, we have implemented various measures related to share buybacks and dividends. One thing we can say is that while many investors prefer share buybacks, the actual impact of share buybacks tends to be limited. Currently, we are observing a significant increase in individual shareholders. Since we have promised stable and progressive dividends, they have a strong interest in receiving higher dividends. We intend to proceed with this in mind, keeping these individual shareholders in view.

As for institutional investors, they support share buybacks in part because buybacks are not taxed. However, there are also many investors who place value on dividends. Taking all these into consideration, and with the intention of conveying various messages through dividends, we have decided to pay ¥100, an increase of ¥10, rather than the range of ¥90 to ¥95, which was one of our initial options. Under our progressive dividend policy, we will avoid reducing dividends, at least during the period covered by the Medium-term Business Plan. Based on our profit structure, we have determined that this policy is fully manageable. As a result, we have decided to place a slightly greater emphasis on dividend payments this time. We also conduct share buybacks at a scale of approximately ¥80 billion. Therefore, it is not the case that we do not conduct buybacks at all. While maintaining overall balance, we have embedded a clear message in this round of dividend payments. Q: Is it correct to understand that, while feeling the pressure of not being able to reduce dividends due to the progressive dividend policy, you still intend to prioritize dividends as much as possible over share buybacks. Ueda: We regard dividends as the foundation of shareholder returns. However, since reducing dividends is difficult, our basic policy is to use dividends as the foundation and supplement them with share buybacks when financial conditions allow. We intend to continue with this policy going forward.

Q&A: Approach to the participating interest in Abadi

Q: I would like to hear your views on your equity stake and participating interest in Abadi. In the case of Ichthys, there was a precedent where you reduced your participating interest to diversify ownership even as you maintained a majority stake. For Ichthys, you have farmed out interests to companies such as TotalEnergies. With respect to Abadi, please let me know if your approach is similar to your stance on Ichthys regarding the participating interest, excluding the 10% held by the local side. Ueda: Until recently, we and JOGMEC each held about a 50% stake in an Abadi subsidiary. However, significant funds will be required for FEED going forward, and FID will also incur costs. For this reason, the equity stake is a major issue. We cannot disclose details at this time because the matter is currently under negotiation. However, since FID brings us closer to the production phase, the risks involved differ from those of exploration. Therefore, we intend to proactively assume the necessary risks. We expect our share to increase significantly from the current 50%.

With regard to the participating interest, we currently hold 65% of the Abadi Joint Venture, while Pertamina and Petronas together hold the remaining 35%. However, under Indonesian law, 10% must be transferred to domestic companies designated by the Indonesian government, referred to as the “Indonesia Participant.” This 10% would be transferred on a pro rata basis from us, Pertamina, and Petronas.

Furthermore, as seen in the case of Ichthys, there may be instances where potential buyers show interest in acquiring upstream participation rights. In such cases, a small portion, ranging from fractions of a percent to several percent, could be transferred.

The final participating interest ratio will be determined based on factors such as our relationship with JOGMEC, the transfer to the Indonesia Participant, and the intentions of the buyers. From an investment perspective, we expect that our participating interest will ultimately be reduced to approximately half (50%).

Q&A: Increase in growth investment and a single-year timing shift

Q: Tell me about your approach to growth investment. According to the current three-year outlook, the projected amount has increased from the previous ¥1.8 trillion to ¥1.9 trillion. However, cash flow data for this fiscal year show that growth investment has decreased by approximately ¥100 billion.

I believe the increase in cumulative growth investment over the three-year period reflects the steady accumulation of projects that align with your company’s investment discipline. However, when viewed on a single-year basis, there appears to be a decrease due to a timing shift. I would appreciate a follow-up on your current approach to growth investment.

Takimoto: We have raised the amount of growth investment mainly because we revised our exchange rate assumptions. We adopted an assumed exchange rate of ¥147, instead of ¥135. For this reason, the same investment amount results in a higher figure in yen terms, which is reflected in our numbers.

Regarding the timing shift, projects originally scheduled for this fiscal year are now expected to be carried over into next year. That amount is just under ¥100 billion. Overall, we anticipate approximately ¥600 billion in growth investment per year. However, the acquisition of new oil and gas fields has been delayed, and that portion will be shifted to next year.

Over the three-year period, we plan to implement growth investment of between ¥1.8 trillion and ¥1.9 trillion, in line with our Medium-term Business Plan. Please note that this year’s growth investment is lower because of this timing shift.