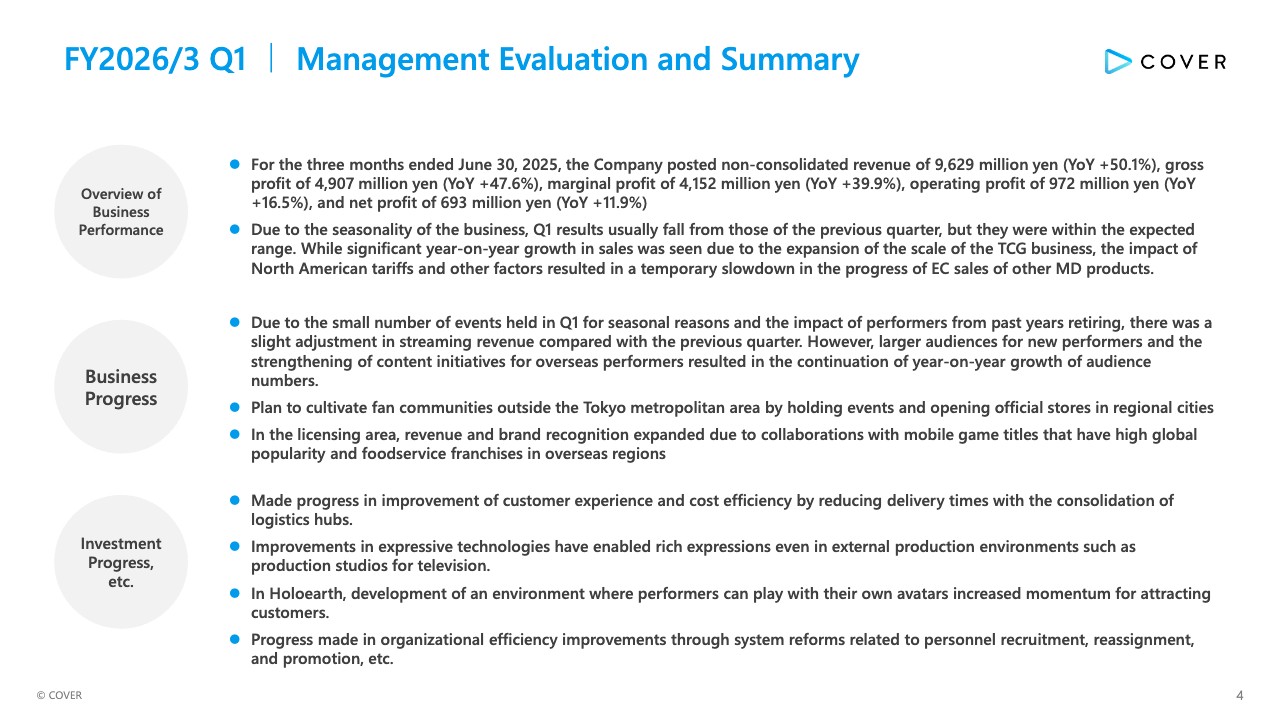

FY2026/3 Q1 |Management Evaluation and Summary

Motoaki Tanigo (hereinafter Tanigo): Thank you for joining our financial results briefing today. I will first present the overview of our financial results for FY2026/3 Q1, followed by the current status of business development by service, and finally the progress of our initiatives in the current fiscal year to achieve medium-term targets.

Revenue for FY2026/3 Q1 increased 50.1% YoY to approximately 9.6 billion yen, and operating profit increased 16.5% to nearly 1.0 billion yen. As is previous years, Q1 results declined slightly QoQ due to seasonality of the business, but we consider the outcome to be within our expected range.

Significant year-on-year sales growth was driven by the expansion of the TCG business. On the other hand, the impact of U.S. tariffs caused a temporary slowdown in EC sales of other MD products.

Regarding business progress. the limited number of events in Q1 and the impact of performers retiring in the previous fiscal year led to a slight adjustment in streaming revenue compared with the previous quarter. However, audience growth continued year on year, supported by increasing viewership of new performers and strengthened content initiatives for overseas performers.

We are fostering fan communities beyond the Tokyo metropolitan area through events in regional cities and the opening of official stores. In the licensing area, collaborations with globally popular mobile game titles and foodservice franchises overseas drove expansion both in revenue and in brand recognition.

Regarding investment progress, we are making progress in improvement of customer experience and cost efficiency by shortening delivery lead times through the consolidation of logistics hubs. In addition, advancements in expressive technologies within external production environments, such as television production studios, are enabling richer content expression.

In Holoearth, the development of an environment that enables performers to play using their own avatars has boosted audience momentum.

We are also making steady progress in organizational efficiency improvements through system reforms related to personnel recruitment, reassignment, and promotion.

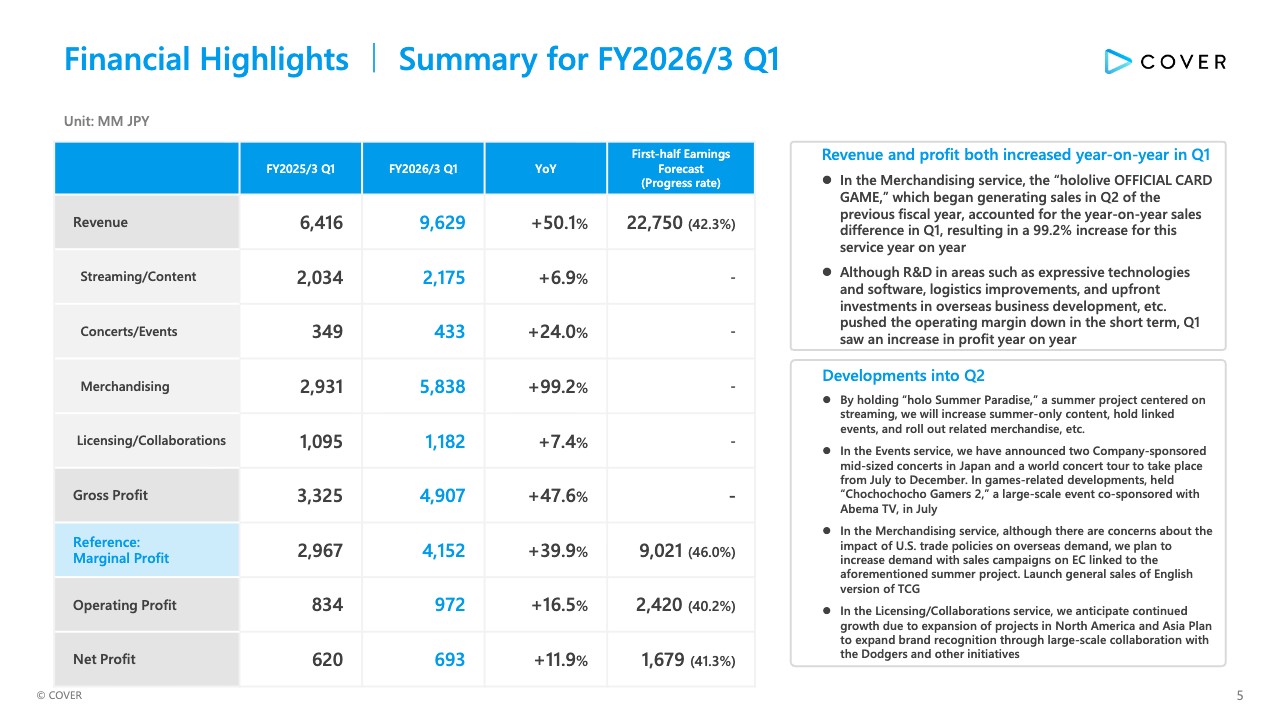

Financial Highlights |Summary for FY2026/3 Q1

Yosuke Kaneko (hereinafter Kaneko): Next, I will provide more details on our financial results. The details of Q1 financial results are as shown on the slide. In the Merchandising service, the “hololive OFFICIAL CARD GAME,” which began contributing to revenue in Q2 of the previous fiscal year, accounted for the year-on-year revenue gain in Q1, resulting in significant growth of 99.2% year on year.

On the other hand, upfront investments in research and development, including expressive technologies and software, logistics improvements, and overseas business development temporarily pressured the operating profit margin. However, overall, Q1 still delivered year-on-year profit growth.

Developments for Q2 are shown in the lower right section of the slide. Through the summer project “holo Summer Paradise,” which is centered on streaming, we plan to increase summer-only content, hold linked events, and roll out associated merchandise.

In the Events business, we have announced two company-sponsored mid-sized concerts in Japan, as well as a world concert tour scheduled from July to December.

In games-related developments, we held “Cho-Cho-Cho-Cho GAMERS 2,” a large-scale event co-sponsored with AbemaTV, in July.

In the Merchandising service, although concerns remain regarding the impact of U.S. tariffs on our overseas operations, we are working to expand demand through EC sales and campaigns linked to the summer project.

We will launch general sales of the English version of TCG.

In the Licensing/Collaborations service, we expect continued growth driven by the expansion of projects in North America and Asia. Furthermore, we aim to expand brand recognition through a large-scale collaboration with the Dodgers.

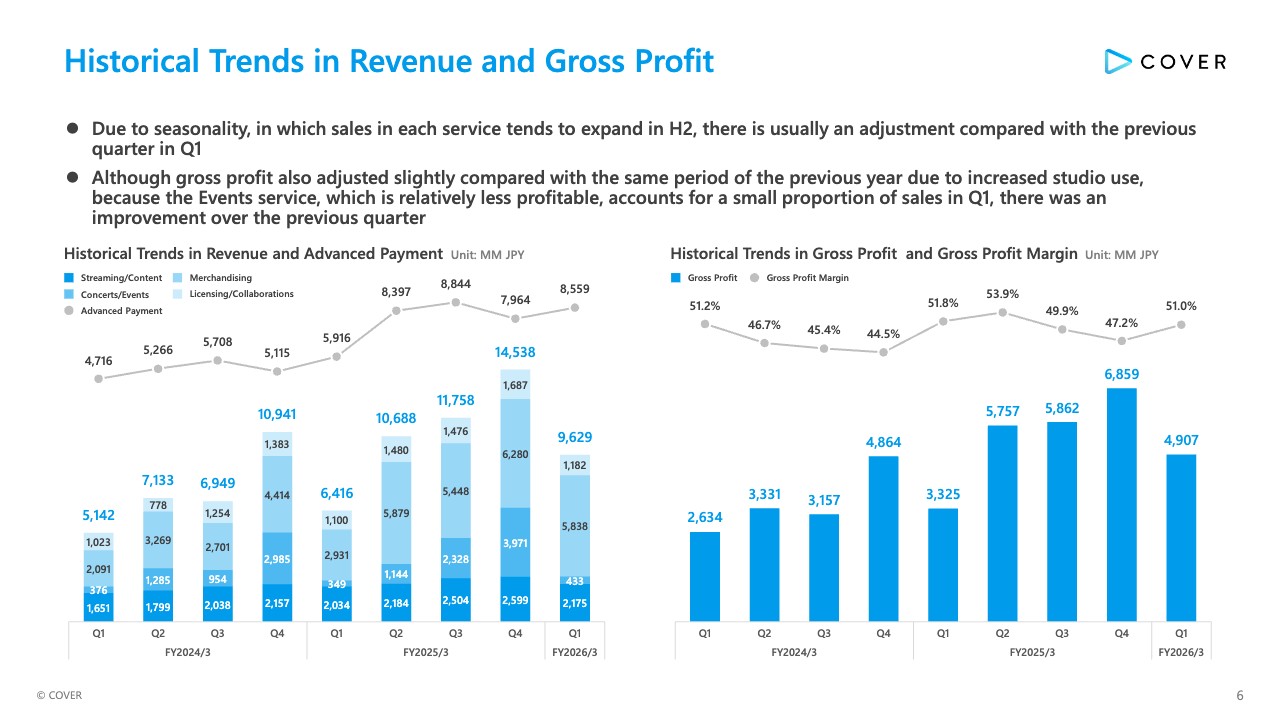

Historical Trends in Revenue and Gross Profit

Each business tends to exhibit seasonality, with revenue generally expanding in H2 of the fiscal year. As a result, Q1 typically shows an adjustment compared with the previous quarter.

Although gross profit was also adjusted slightly compared with the same period of the previous year primarily due to the expansion of studio operations, gross profit improved QoQ, as the share of the Events service—which is relatively less profitable—declined in Q1.

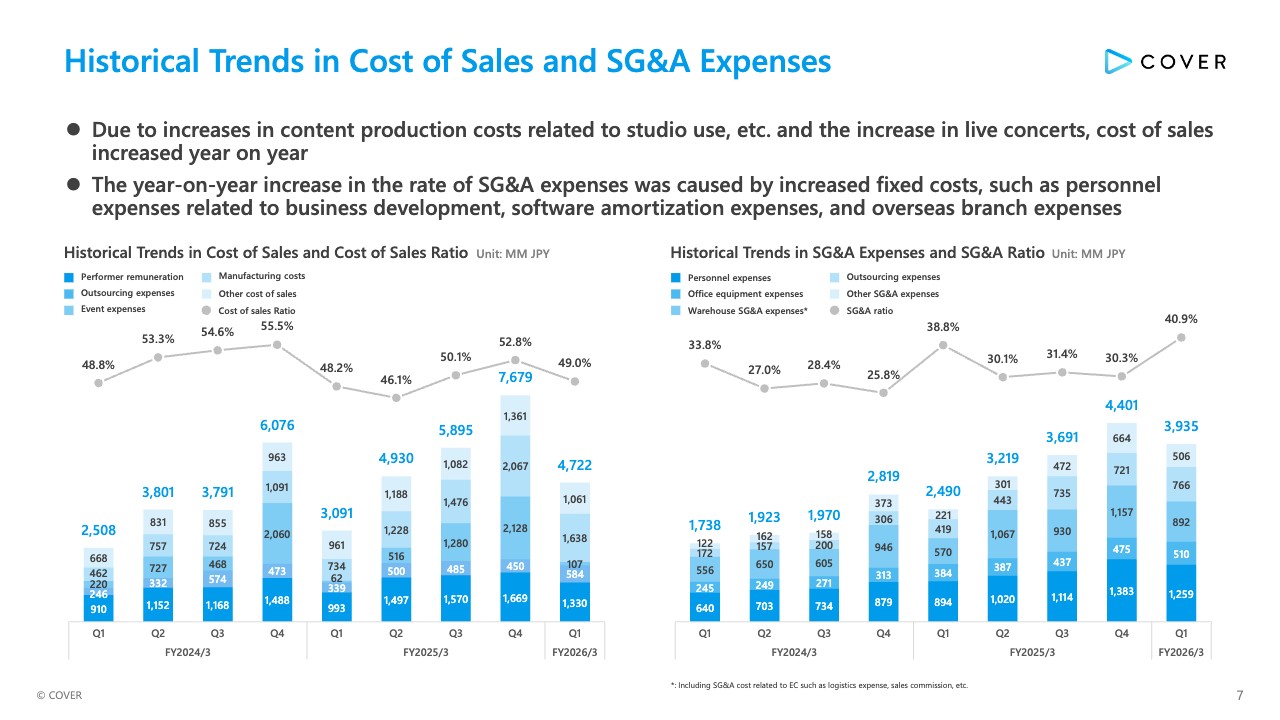

Historical Trends in Cost of Sales and SG&A Expenses

Historical trends in cost of sales and SG&A expenses are shown in the slide. Cost of sales increased YoY due to higher content production costs associated with expanded studio operations and an increase in live concerts.

The YoY increase in the SG&A expense ratio was driven by higher fixed costs, including personnel expenses related to business development, software amortization, and overseas office expenses.

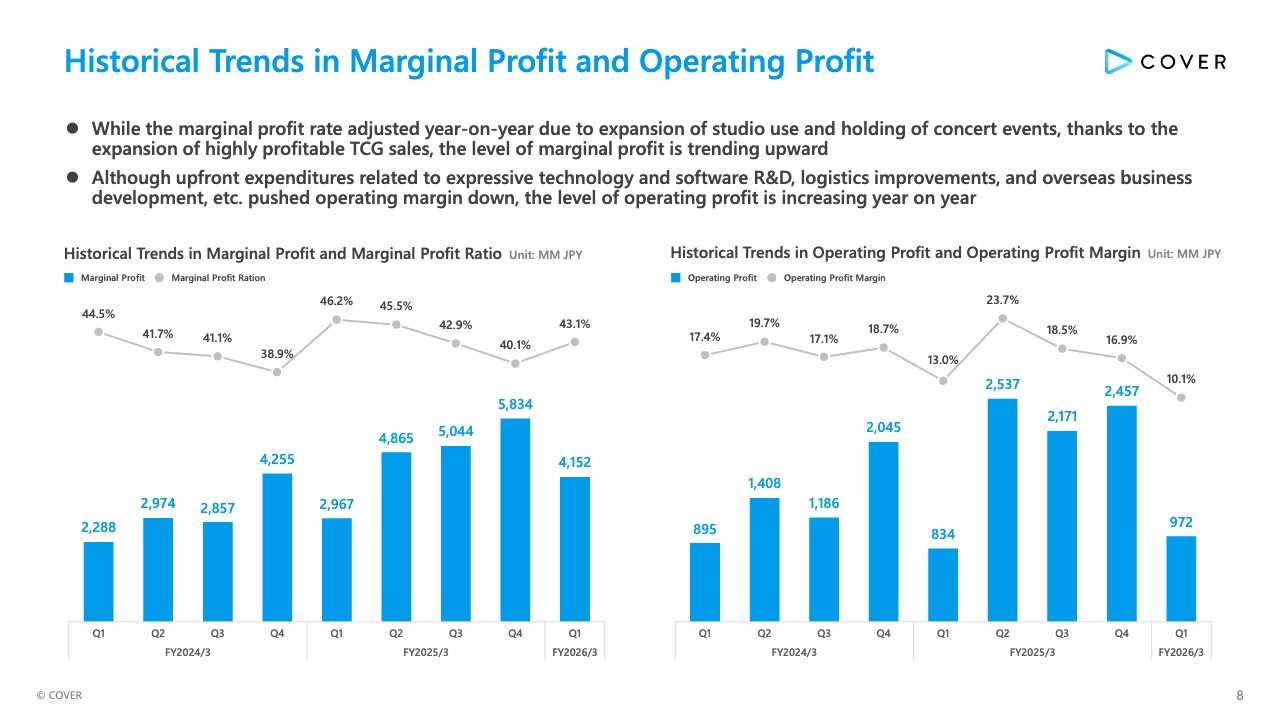

Historical Trends in Marginal Profit and Operating Profit

Historical trends in marginal profit and operating profit are shown in the slide. The marginal profit margin was adjusted YoY due to expanded studio operations and concert events. However, supported by the growth of the highly profitable TCG, the level of marginal profit continued on an upward trend.

Although upfront investments in areas such as expressive technologies and software R&D, logistics improvements, and overseas business development weighed on the operating profit margin, operating profit itself increased YoY.

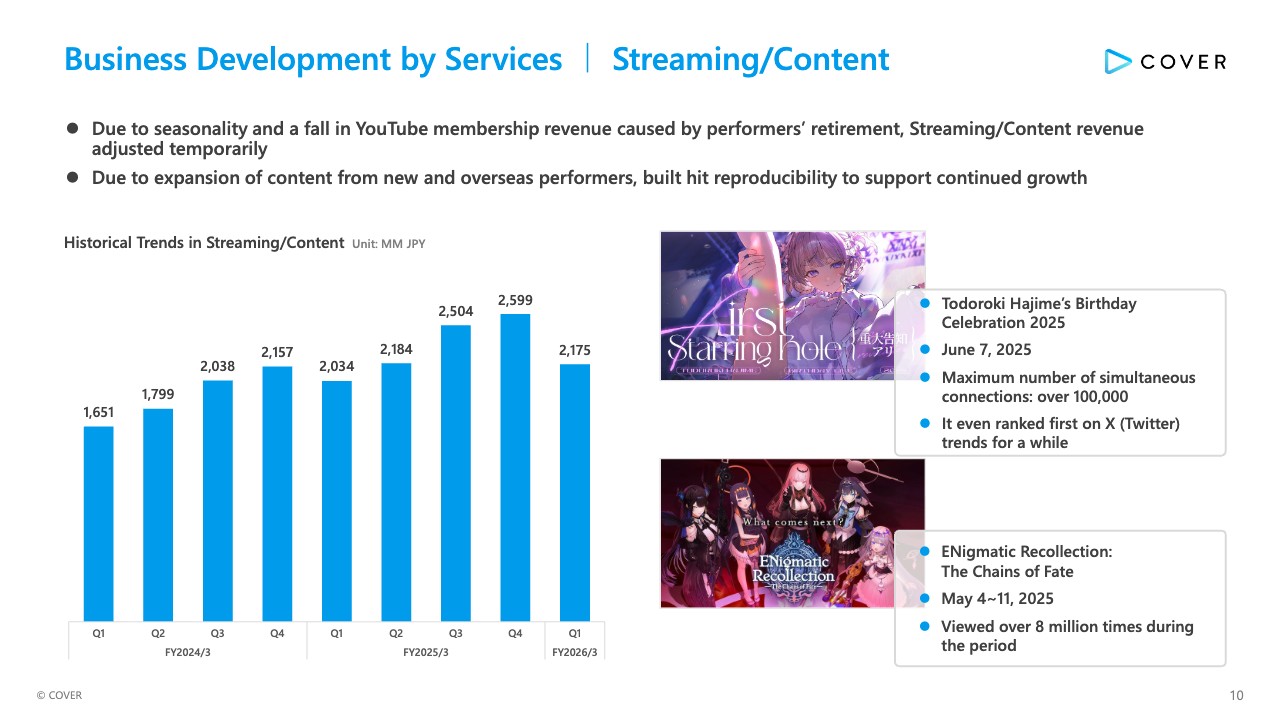

Business Development by Services|Streaming/Content

Tanigo: I will now explain the current status of business development by service, beginning with the Streaming/Content service. Due to seasonality and a fall in YouTube membership revenue caused by performers’ retirement, Streaming/Content revenue faced a temporary adjustment.

At the same time, we are expanding content from new and overseas performers while focusing on building the reproducibility of hits to support sustained growth.

As shown on the right side of the slide, an online live concert, Todoroki Hajime’s Birthday Celebration 2025, and a large-scale story event, ENigmatic Recollection: The Chains of Fat were held on YouTube. Both events recorded large numbers of simultaneous connections and generated a strong buzz on social media. Going forward, we expect continued expansion of the fan community and stronger engagement.

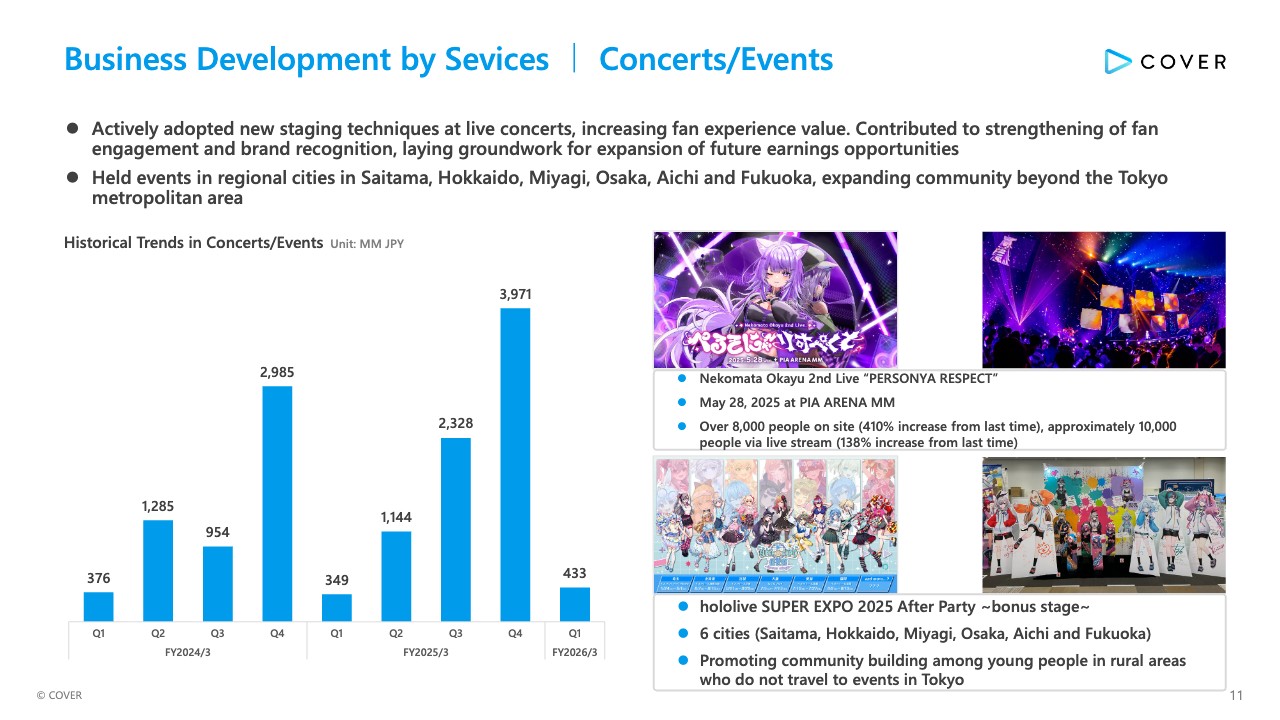

Business Development by Services|Concerts/Events

This is business development of the Concerts/Events service. We are actively adopting new staging techniques at live concerts to increase fan experience value. Through these efforts, we aim to strengthen fan engagement and brand recognition to expand future earnings opportunities.

Nekomata Okayu 2nd Live “PERSONYA RESPECT” that was held in May attracted over 8,000 people on site and approximately 10,000 people via live stream. This represented significant growth compared with the performer’s first live concert, with on-site attendance increasing 410% and online attendance 138%.

With the aim of fostering communities beyond the Tokyo metropolitan area, we held “hololive SUPER EXPO 2025 After Party –bonus stage–” in six cities: Hokkaido, Miyagi, Saitama, Aichi, Osaka, and Fukuoka.

These initiatives are promoting community building among young people in rural areas who find it difficult to travel to events in Tokyo.

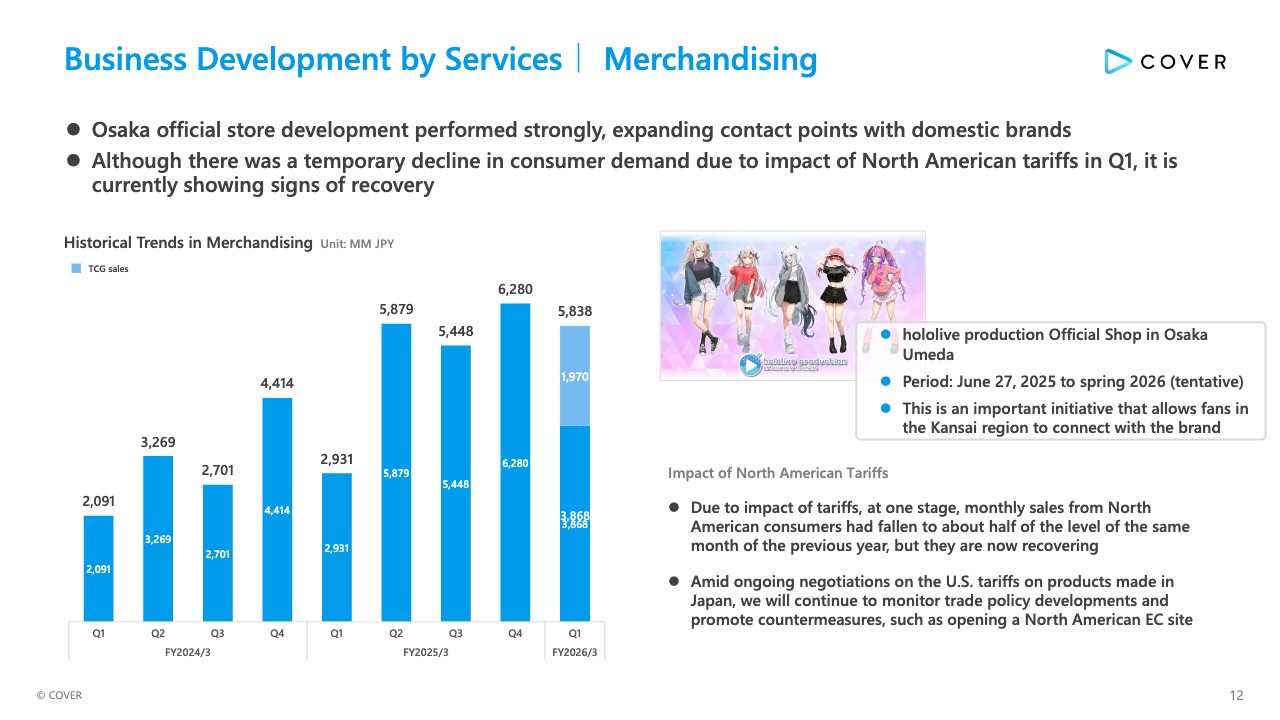

Business Development by Services|Merchandising

This is business development in the Merchandising service. We have launched the hololive production Official Shop in Osaka Umeda for a limited period from June 2025 to spring 2026. We are strengthening real-life engagement with fans in the Kansai region, and have received a highly positive response.

On the other hand, monthly EC sales from North American consumers had temporarily fallen to about half of the level of the same month of the previous year due to impact of the U.S. tariffs. Although they are now recovering, the situation still requires careful monitoring going forward.

Overall merchandising sales remained at a high level QoQ, as shown in the graph, thanks to the continued contribution of TCG. We will continue to monitor developments in trade policy and consider measures for sustainable business growth, such as opening an EC site for North America.

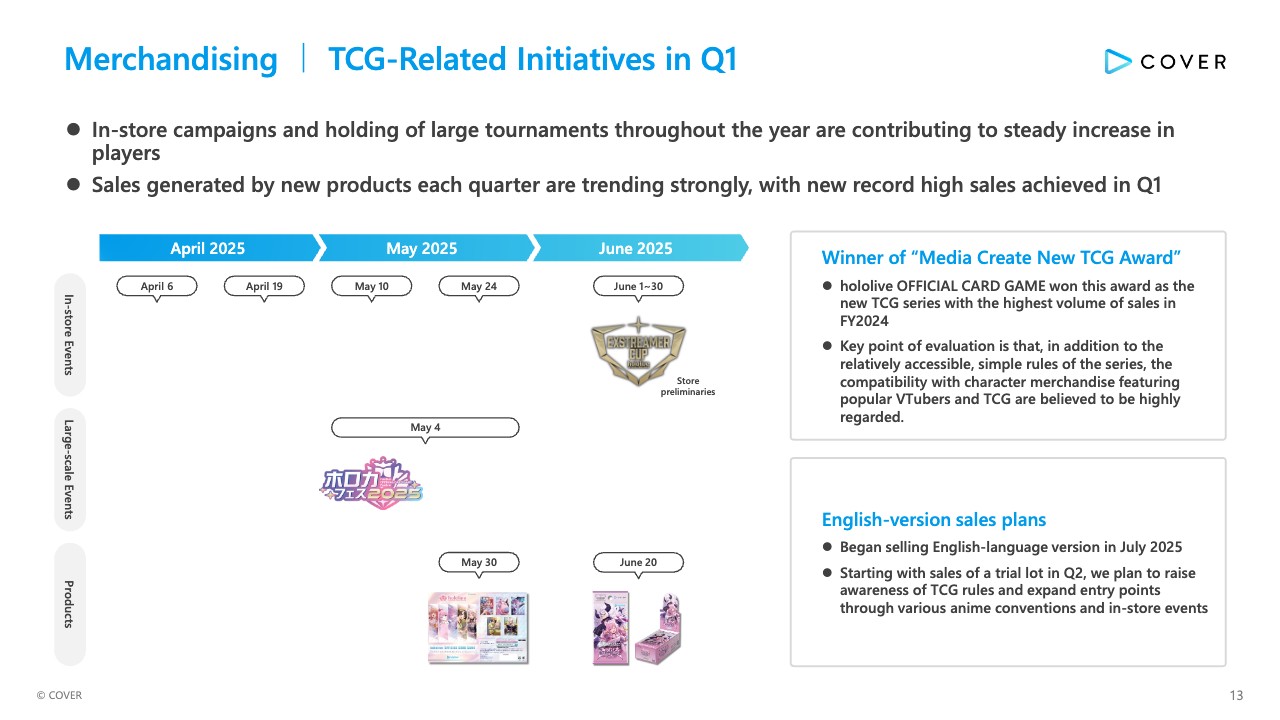

Merchandising |TCG-Related Initiatives in Q1

I will explain TCG-related initiatives. In-store campaigns and holding of large tournaments throughout the year are contributing to steady increase in players.

Sales generated by new products are trending strongly in Q1, with new record high quarterly sales in the TCG service.

From April to June, we held multiple in-store events and large-scale tournaments such as “hololive Official Card Game Festival 2025” and “World Grand Prix 2025” to expand participation opportunities for users.

Hololive OFFICIAL CARD GAME won the Media Create New TCG Award as the new TCG series with the highest volume of sales in FY2024. Key point of evaluation is that, in addition to the relatively accessible, simple rules of the series, the compatibility with character merchandise featuring popular VTubers and TCG are believed to be highly regarded.

We began selling English-language version in July, and are fully expanding into overseas markets, mainly North America. We expect further growth through overseas events in Q2 and beyond.

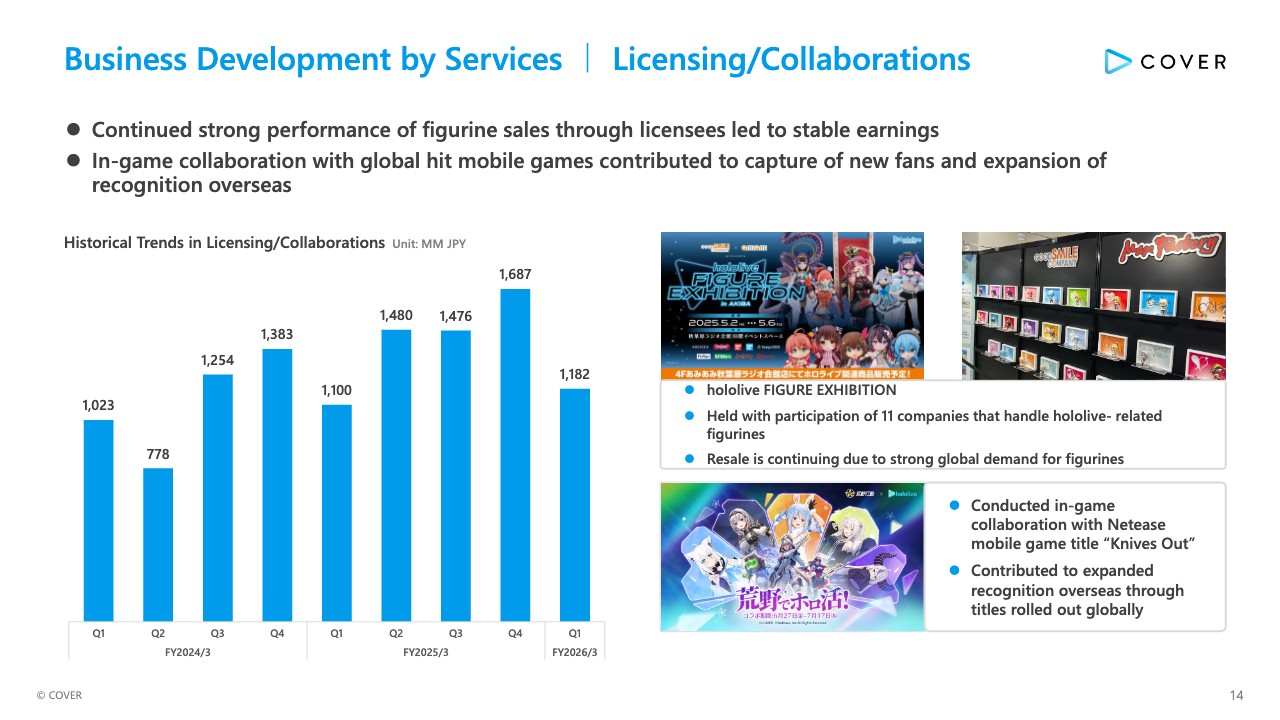

Business Development by Services|Licensing/Collaborations

I will explain business development in the Licensing/Collaborations service. In this service, figurine sales through licensees remained strong. Resale is continuing due to strong global demand for figurines, which contributes to stable earnings. Hololive FIGURE EXHIBITION was held with participation of 11 licensees, leading to sustained strong sales.

We are conducting in-game collaboration with Netease mobile game, “Knives Out” as a measure to expand recognition overseas. Collaboration with titles rolled out globally contributes to acquiring new fans and increasing brand awareness overseas.

Looking at historical trends, revenue in Q1 was 1,180 million yen, which was adjusted due to seasonality compared with the previous quarter, but remained at a high level YoY. Stable growth is expected to continue through domestic and overseas collaboration initiatives.

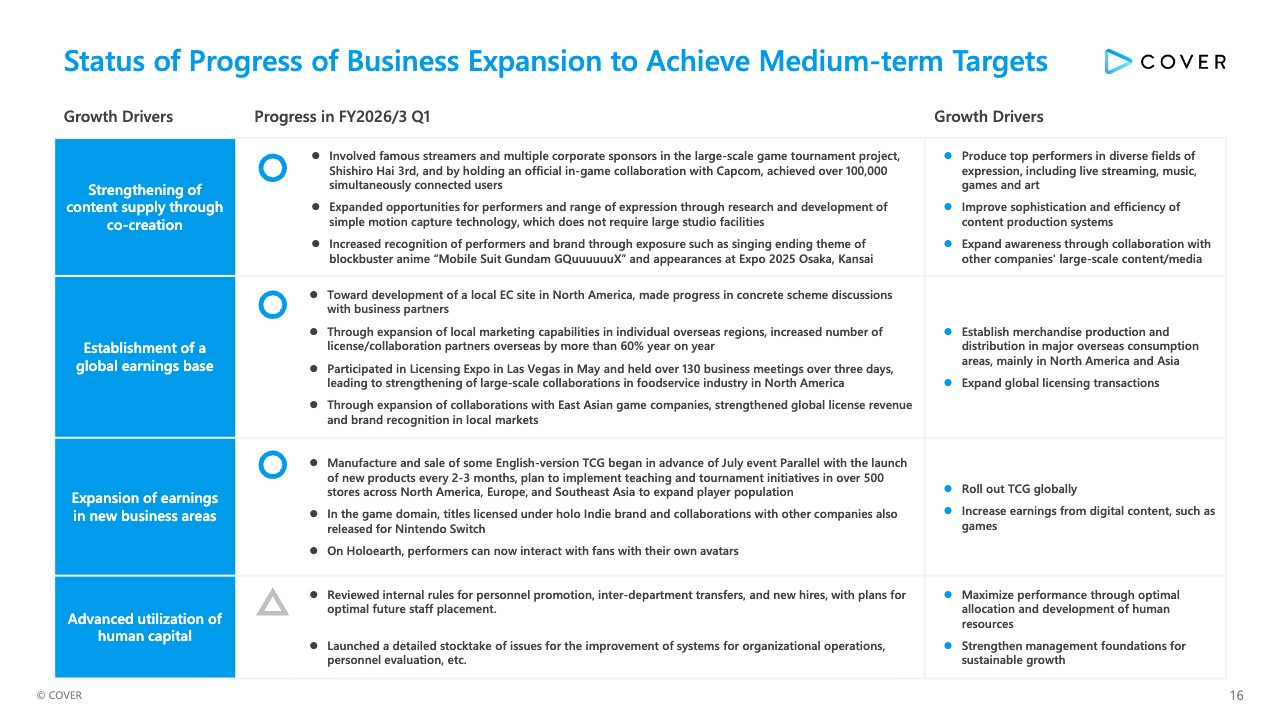

Status of Progress of Business Expansion to Achieve Medium-term Targets

I will explain the progress of initiatives in current fiscal year to achieve medium-term targets. This slide summarizes the status of progress toward the medium-term targets by growth driver.

The first growth driver, “Strengthening of content supply through co-creation,” includes holding the large-scale game tournament project, “Shishiro Hai 3rd,” which has become an annual event. This time, by involving famous streamers and multiple corporate sponsors and through an official collaboration with Capcom, we achieved over 100,000 simultaneously connected users.

Research and development of simple motion capture technology is progressing, advancing technologies that enable diversification of performers’ activities without being constrained by studio capacity.

Brand recognition is rapidly expanding through exposure such as singing ending theme of TV anime “Mobile Suit Gundam GQuuuuuuX” and appearances at Expo 2025 Osaka, Kansai.

The second growth driver, “Establishment of a global earnings base,” involves the ongoing establishment of a collaborative scheme for the development of a local EC site in North America. In addition, the number of license/collaboration partners overseas increased by more than 60% year on year through expansion of marketing capabilities in overseas regions.

We participated in Licensing Expo in Las Vegas in May and held over 130 business meetings over three days, leading to large-scale collaborations in foodservice industry in North America.

Through expansion of collaborations with East Asian game companies, we are also making progress in expanding brand recognition in local markets.

The third growth driver, “Expansion of earnings in new business areas,” has seen the start of manufacturing and distribution of products for the July general release of the English version of TCG. Going forward, we will launch new products every two to three months and aim to expand player population in Europe, the U.S., and Asia through teaching events and tournament initiatives.

In the game domain, titles licensed under holo Indie brand and collaborations with other companies also started to be released for Nintendo Switch.

On Holoearth, the experience value is improving, allowing performers interact with fans with their own avatars.

The fourth growth driver, “Advanced utilization of human capital,” involves reviewing internal rules regarding enhanced hiring, inter-departmental transfers, and new hires. In addition, a detailed stock take of issues and the optimal medium- to long-term staff placement are being carried out for reviewing systems for organizational operations and personnel evaluation.

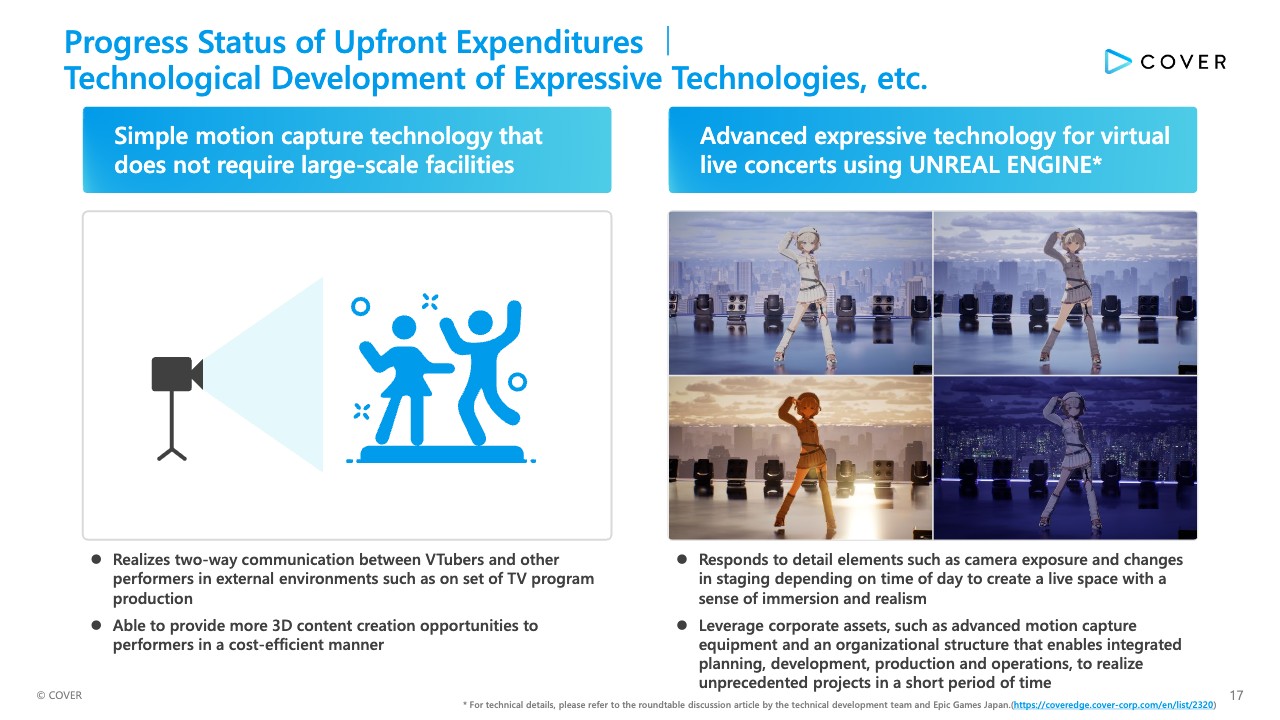

Progress Status of Upfront Expenditures |Technological Development of Expressive Technologies, etc.

I will explain the progress of upfront investments in the Expressive Technologies service. First, the use of simple motion capture technology that does not require large-scale facilities is advancing. This has enabled VTubers support and two-way communication between VTubers and other performers in external environments such as on set of TV program production.

By enabling recording or streaming sessions with simple equipment without being constrained by studio capacity, it is possible to provide more 3D content creation opportunities to performers in a cost-efficient manner.

In parallel, we are continuing research into advanced expressive technology for virtual live concerts using UNREAL ENGINE. This technology enables real-time reflection of camera exposure and changes in staging depending on time of day to create a virtual live space with a sense of immersion and realism.

By leveraging corporate assets, such as advanced motion capture equipment and an organizational structure that enables integrated planning, development, production and operations, it is possible to realize unprecedented projects like this in a short period of time.

Progress Status of Upfront Expenditures|Logistics Related

I will explain the progress status of upfront investments in logistics area. With the cooperation of transcosmos inc., full-scale operations began at the new logistics center in June.

This consolidation of previously dispersed warehouse sites will be an important turning point in our response to the increasing volume and diversification of products handled associated with the growing popularity of VTubers. This initiative will improve flexibility of inventory management and inbound and outbound operations and promote simplification and visualization of data and product flows.

As a result, streamlining the entire supply chain and strengthening quality control will enable us to strengthen foundations and reduce costs in preparation for future business growth.

Progress Status of Upfront Expenditures |Holoearth

This slide explains the progress status of upfront investment in Holoearth. From late June 2025, we conducted a project whereby performers could log in to Holoearth with their own avatars.

This provides an experience where users and performers can interact directly in the same 3D space, functioning as unique fan engagement initiatives that are not available on other platforms.

This initiative promotes an increase in the creation of UGC by users and contributes to improving the quality of the user experience. As a result, a structure is being formed that increases the enthusiasm of the entire community and motivation for continued participation.

We will go on developing and implementing Holoearth as a place to further enhance the value of experience created by performers and fans together.

Progress in Management Structure Reforms and Other Matters

This slide reports on the main initiatives related to management structure reforms, etc. as of Q1. First, as “Review of personnel and organizational systems,” we restructured our organization with the objective of strengthening interdepartmental cooperation under the new executive officer structure from April. In addition, we are strengthening our human capital strategy including the improvement of evaluation systems, and the flow of hiring, promotion, and transfer.

In terms of “Strengthening of performer support,” we continue to hold individual interviews, group interviews, and town hall meetings, and are promoting efforts to establish a support system based on communication with performers, resolve issues, and improve operations.

In terms of “Cost optimization,” we have achieved reductions of around 25 million yen as of Q1 by taking inventory of SaaS and PC equipment and optimizing costs, and expect an annual improvement effect on a scale of 70 million yen. By strengthening the flow of order management, we will work to optimize procurement and manufacturing costs.

In terms of “Strengthening of project governance,” we will work to strengthen the progress management system for each project and to build a system aimed at flexible reallocation of resources in line with the progress of the strategy.

Q&A: Progress of profits and status of utilization of upfront investments

Question: I have a question about profit progress. You mentioned that the Q1 results were within the expected range. However, when subtracting the Q1 results from the H1 plan, the projection implies about a 40% decline in profits for Q2. Given the number of events scheduled in Q2, I feel that the plan appears somewhat conservative. Could you explain whether this conservative projection reflect risks such as the impact of U.S. tariffs?

Also, regarding upfront investments, you mentioned that the budget for this fiscal year is 3.1 billion yen. If possible, could you share the utilization rate?

Kaneko: Thank you for your question. As mentioned in our financial results briefing, we referred to trade policies, including U.S. tariffs. However, since the trends of the Merchandising service are difficult to predict in the short term, we do not believe that our guidance can be described as overly conservative.

Regarding the 3.1 billion yen budget for upfront investments, while there are seasonal factors such as the increased inflow of labor into the Japanese market in April, a significant portion of the upfront investments consists of software amortization expenses. As a result, expenditures are progressing evenly on a quarterly basis, and we consider that roughly one-fourth of the 3.1 billion yen has been utilized to date.

Q&A: Supply and demand balance for trading cards

Question: I would like to ask you about the situation with trading cards. Revenue reached nearly 2.0 billion yen this quarter, which represents an increase of approximately 40% compared with the previous Q4. I believe this indicates very solid performance.

With resales and other initiatives, it has become easier for customers to purchase the cards. Could you share your views on the current supply-demand balance and prospects for further sales expansion? In particular, is there room to further increase production volume given the current demand environment? Also, the English version has now been released; to the extent possible, could you provide some indication of its scale?

Kaneko: Currently, supply is being gradually increased to meet demand, and we believe that expansion is progressing. However, as the TCG series has been on the market for only about one year, we have not yet made the decision to significantly increase supply in the short term. Our policy is to proceed cautiously while monitoring the increase in players and the spread of the product.

For the overseas version, we are gradually rolling out campaigns similar to those for the Japanese version, with the aim of expanding the overseas player base. For example, in July we held trial play sessions at anime conventions in North America as part of phased promotional efforts. At present, however, the distribution lots for the overseas version remain limited and are still at a trial level.

Q&A: Effects and challenges of strengthening performer support

Question: I have a question about the effects of strengthening support for performers. Several months have passed since President Tanigo began improving communication with performers. Could you tell us about any challenges that have emerged, the positive effects on performers’ activities, and any feedback you have received?

Since the start of this fiscal year, performers have had more solo live performances. I believe this is a result of incorporating their feedback. Could you share any outcomes or results?

Tanigo: We support performers in their use of studios and daily streaming activities. As we strengthen our support for these main activities, we are currently making minor improvements such as relaxing unnecessary rules.

Q&A: Impact of North American tariffs

Question: Could you comment on the impact of tariffs on the Merchandising business in North America? If available, could you provide an estimate of the actual impact?

Should we understand that the impact was reflected in sales from April through June, or that it was recorded as advances received at the end of June and will continue to affect sales from July through September? Any additional clarification on this impact would be appreciated.

Kaneko: In May, when the outlook for tariffs was uncertain, we saw a noticeable slowdown in purchasing activity. As a result, monthly sales in North America were reduced by half in certain months.

We estimate the impact to be several hundred million yen, though it differs depending on product characteristics. Specifically, the impact was observed both in products with short lead times that could be delivered quickly, and in made-to-order products that take three to six months to be recognized as sales.

Currently, the outlook for tariffs has improved slightly, and the situation is gradually recovering. However, we expect that a certain impact will remain in Q2 and beyond, so we will continue to monitor the situation closely.

Question: Would it be correct to say that the impact from April through June was in the low hundreds of millions of yen?

Kaneko: That is correct. That is my understanding as well.

Q&A: Growth pace of revenue in the Streaming/Content and trends in capturing new fans

Question: Could you please tell us about the growth pace of revenue in Streaming/Content? You mentioned that the Q1 results were affected by the retirement of some performers. Excluding that factor, has there been any change in momentum? In particular, please confirm whether there has been a change in the trend of capturing new fans.

Kaneko: The number of active viewers is good, as indicated by year-on-year comparisons and market share data from third-party surveys.

New and overseas performers are also growing steadily. In order to build growth for this fiscal year and beyond, we should focus on ensuring the reproducibility of hits.

It is also necessary to continue closely monitoring the short-term impact of performers’ retirement and the growth process of new performers.

Q&A: Updates on the mobile app game DREAMS

Question: I have a question about the current updates to the mobile app game DREAMS. Will there be any changes to the launch schedule? And what are your expectations for expanding the fan base?

Kaneko: We cannot make a hard commitment regarding the release timing of DREAMS, but our goal remains to launch it next fiscal year.

The gaming business is drawing significant attention, supported by large-scale events, the phased release of holo Indie, and development projects with mid-sized licensing-based game developers being ported and released on Nintendo Switch.

Given these developments, we continue to hold high expectations for the strong customer acquisition power of hololive performers in the gaming medium. We also believe that, through exposure to games, consumers will be guided back toward hololive performers, creating a positive cycle of engagement.

Q&A: Factors contributing to revenue growth

Question: Revenue increased by nearly 50%. Could you explain how this growth breaks down in terms of customer numbers, average spending per customer, and purchase frequency?

Kaneko: The overall number of customers continues to increase, driven by the expansion of retail stores, the growth of card games, and the diversification of sales channels and product offerings.

Average spending per customer has not shown significant fluctuations. However, overseas sales have been volatile recently due to external factors such as tariffs and foreign exchange movements.

We believe that purchase frequency is on an upward trend, supported by the diversification of sales channels and product offerings.

Q&A: Status of overseas sales ratio

Question: What is the current overseas sales ratio?

Kaneko: Overseas sales originally accounted for about 30% of total EC sales, but from April through June, the ratio declined slightly due to trade policy effects.

Q&A: Trends in customer attributes

Question: I would like to ask you about customer attributes. Are there any particular demographics, such as gender or age, that are growing or showing distinctive characteristics?

Kaneko: At present, the customer base is expanding across all age groups, from younger consumers to relatively older segments within the entertainment market.

In particular, some emerging performers have been particularly successful in attracting female and younger audiences, enabling us to reach fan segments that did not previously exist.

Q&A: Annual sales forecast and growth potential for trading cards

Question: Trading card sales reached nearly 2.0 billion yen in Q1. Simply multiplying this figure by four would bring it to 8.0 billion yen, and adding overseas sales would increase it to 10.0 billion yen on a full-year basis. Please provide your forecast for annual trading card sales and growth potential for the next fiscal year and beyond.

Kaneko: Originally, at the beginning of the fiscal year, we set a budget based on an estimated sales figure of 4 to 5 billion yen. However, it now appears that actual sales may exceed this figure. While sales of expansion packs are increasing, the Q1 figures also include shipments of starter decks and the overseas version. Therefore, sales may not necessarily continue at this pace. Taking into account the previous response, we plan to slightly increase the initial budget while monitoring player growth and the supply-demand balance at retail stores.

Q&A: Contribution of Holoearth to revenue

Question: Please explain how Holoearth will begin to contribute to revenue. Could you also include the outlook for the next fiscal year and beyond, as well as the impact on sales for the current fiscal year.

Kaneko: In addition to a clear increase in mentions on social media, we are gradually confirming product-market fit through initiatives such as such as introducing marketplace functionality and enabling performers to log in with their own avatars.

That said, we do not believe that we have yet reached the stage of aggressively monetizing Holoearth in the current fiscal year.

Q&A: Trends in the VTuber market

Question (for President Tanigo): How do you view recent trends in the VTuber market compared with your initial expectations? Can we understand that your company will continue to maintain its competitive advantage?

Tanigo: When we look at the global market, we recognize Japan, Southeast Asia, and North America as currently the most active regions. We are also steadily gaining viewers in North America. I attended Anime Expo and visited the doujinshi section, where I observed that, unfortunately, there was very little content from other companies in the domestic VTuber category. I believe this demonstrates our strength. Looking ahead, we also recognize that in North America there continues to be a strong market among traditional anime fans. We intend to continue advancing our business by leveraging our global expansion as a key strength.

Q&A: Trends in Streaming sales and viewing time

Question: I would like to ask about trends in Streaming sales and total viewing time. According to third-party data, seasonality may be at play, yet I feel that the recent growth in viewing time is somewhat weak. What are your thoughts on this?

Kaneko: Viewing time is affected in the short term by the number of performers streaming and the activity levels of those who are actively streaming. As you mentioned, seasonality also plays a role every year. We generally see traffic weaken somewhat from Q4, when festivals are held, to Q1, when such events are absent.

We believe the current situation is not particularly unhealthy when compared with the same period last year. However, we will continue to closely monitor consumer trends and strengthen our content supply further.

Question: Let me confirm. Is it correct to understand that we don’t need to be concerned about the slowdown in IP value growth and fan acquisition at this point?

Kaneko: Quarterly trends can be influenced by seasonality, so it is hard to evaluate them by comparing Q4 and Q1. However, based on the long-term trend, we do not consider the situation to be significantly unhealthy.

Q&A: Impact of Osaka store performance on results and timeline for North American EC expansion

Question: I have a question about Merchandising. You mentioned that the Osaka store is performing well. To what extent do you expect it to contribute to overall performance? Could you also provide an update on the timeline for North American EC expansion?

Kaneko: We have received reports from the field indicating that the Osaka store is generating sales momentum comparable to that of the pop-up shop currently operating in the basement of Tokyo Station.

Large-scale development for North American EC expansion is progressing steadily. However, we believe it will be difficult to open within this fiscal year. Accordingly, while we cannot commit to a specific timeline, we are proceeding with the goal of launching in the next fiscal year.

Q&A: Investment in expressive technologies

Question: I would like to ask about investment in expressive technologies. I feel that your company’s expressive technologies are superior to those of your competitors. However, looking at the gaming industry, it seems that once a certain level is reached, the return on investment in these technologies tends to decline somewhat. Do you view this as an area that requires continued investment, including for differentiation?

Tanigo: Rather than simply aiming for higher quality, we are focusing on building a framework that enables us to produce content with agility.

After establishing large studios, the cost per distribution increased. As our operations became more like those of a television station, the investment required to create engaging content grew substantially, resulting in a highly inefficient situation. Therefore, we are now working to establish a structure that allows us to add content more easily.

At the same time, with regard to Unreal Engine, while our goal is certainly to improve quality, our approach is also to leverage it as a means of achieving the agility to take on new challenges.

Q&A: Impact of the closure of VShojo business

Question: What impact do you expect from the closure of the VShojo business at the end of July?

Tanigo: We do not expect any material impact.

Kaneko: The North American VTuber market is characterized by a wide range of participants, primarily independent creators. Within this large market, VShojo was one of the notable players. However, we do not anticipate any significant direct numerical impact.

Q&A: Performer discovery and development strategy

Question: I have a question about your performer discovery and development strategy. Several performers have retired in the past. Please tell us about your strategy for developing new performers going forward.

Tanigo: We typically hold online auditions, select promising candidates as performer prospects, and then provide them with training before their debut. Currently, there are no significant changes to this strategy.

Q&A: Acquiring performers

Question: What is your medium- to long-term target for the number of affiliated performers? Also, do you see competition for acquiring performers intensifying?

Tanigo: We do not have a specific target for the number of affiliated performers. Considering that having too many performers could weaken our support system, we believe that maintaining a somewhat smaller number is more appropriate for sustainable growth.

At present, we do not perceive competition for acquiring performers to be intensifying.

Q&A: When will overseas sales of TCG start to contribute significantly to earnings, and what is the sales strategy for overseas TCG?

Question: You just started selling TCGs overseas. When do you expect them to start contributing significantly to earnings?

Also, do you plan to use the same strategy and schedule for overseas TCG sales as you did in Japan? In addition, please let me know if there is any possibility of a delay in overseas sales.

Kaneko: We are currently in a phase where we are gradually rolling out campaigns to increase the number of overseas TCG players. We anticipate that it will take at least six months before we see significant revenue contributions.

One example is the supply of cards in the North American card game market. Unlike in Japan, where card shops are concentrated in urban areas, players in North America enjoy cards in locations that are quite spread out.

Additionally, although the North American market is large, consumers there enjoy cards differently than Japanese consumers do. Therefore, we are increasing card supply while conducting further research.

There is a slight difference in the timing of revenue recognition for overseas card sales, but it is not significant. However, the timing of wholesale purchases differs slightly from that in Japan.

This does not pose a significant financial or IR concern, though. For instance, we held a campaign in July at an anime convention to sell English-language cards in advance. Card sales from that campaign were recorded in Q1, albeit in small amounts.

Question: Does that mean they are released a little earlier?

Kaneko: That is correct. However, the amount is minimal, so it does not significantly impact the overall situation. We are operating under this cycle.

While we regularly supply the Japanese versions every quarter, we are gradually rolling out the English versions to catch up to that pace. That is the main difference from the Japanese versions.

Q&A: Expected number of visitors and schedule for Holoearth

Question: I would like to ask about Holoearth. I understand the sales figures, but could you explain how the actual visitor numbers and timeline differ from your initial plan?

Kaneko: Financial results have slightly exceeded our projections. However, in terms of long-term product-market fit indicators for customer acquisition, our internal stretch goals are set at a pace more consistent with expectations for next year or the following year, rather than with this year’s KPIs. Therefore, we do not yet view the current figures as satisfactory.

Q&A: Key focus areas in the overseas TCG market

Question: I have a question about the key focus areas in the overseas TCG market. Are the tipping points quantitative factors such as KPIs, or qualitative factors such as user enthusiasm? Please explain.

Kaneko: The most important factor is player population. We believe it is important to create a situation in which many people actively play the English versions. For example, we observe the number of participants in tournaments.

However, it is difficult to accurately grasp the number of end consumers in the industry electronically. Therefore, third-party reports on trading card games commonly estimate this by dividing the growth market volume by the consumer unit price. Our TCG is still in the market formation phase, so it is difficult to make such estimates at this stage.

Q&A: Changes in the impact of tariffs from Q1 to Q2 and beyond

Question: I would like to ask about the impact of tariffs in Q1. The tariff rates have changed in Q2 and beyond. Could you provide any guidance on this point?

Kaneko: At one point, significantly higher tariffs were being considered for Chinese products exported to the U.S. As a result, some figure manufacturers temporarily suspended exports to North America, and we also saw a short-term slowdown in customer purchases around spring.

Compared to that period, the tariffs currently imposed on Chinese-produced goods have been considerably eased. That said, tariffs remain somewhat higher than they were one to two years ago, including those on exports of domestically produced goods to the U.S. Therefore, I believe that we are still in a phase where it is necessary to monitor how customers will respond. Although we are seeing a gradual recovery, the situation remains unpredictable.

Question: So, even though the tariff rates have been somewhat reduced, is it correct to understand that the impact is still lingering at present?

Kaneko: That is correct.