Contents

Muneyuki Hashimoto (hereinafter Hashimoto): Thank you for joining our earnings results presentation today. I am Muneyuki Hashimoto, CFO of the Company. I will begin by outlining our full-year results for the fiscal year ended May 31, 2025 and our medium-term financial policy.

Highlights of FY2024 Results

Let me begin with highlights of our financial results for the fiscal year ended May 31, 2025.

First, net sales increased 27.5% YoY, remaining within the forecast range and demonstrating solid growth. As of May 2025, annual recurring revenue (ARR) exceeded ¥41.5 billion.

Second, adjusted operating profit increased significantly by 108.0% YoY.

Third, regarding Sansan, our sales DX solution, the growth pace of recurring sales accelerated compared to the previous year due to enhancements to our sales structure, and the business continued to grow steadily.

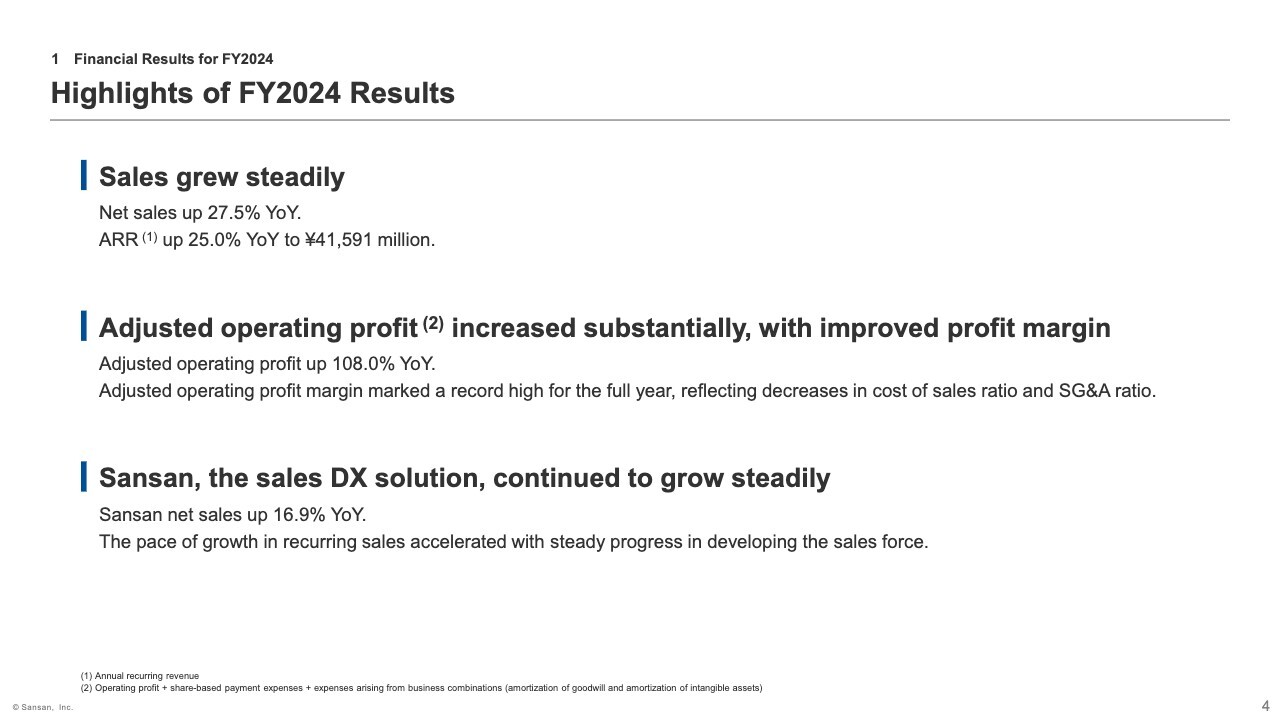

Overview of Financial Results

Group-wide financial results are shown on the slide. Net sales increased 27.5% YoY. Gross profit margin rose 1.5 percentage points. YoY, primarily due to improved profitability in Bill One driven by improved data digitization operations.

Additionally, adjusted operating profit and ordinary profit increased substantially, up 108.0% and 124.1% YoY, respectively, reflecting a lower SG&A ratio and other factors.

Profit attributable to owners of parent decreased 55.5% YoY, due to an extraordinary loss of approximately ¥2.3 billion recorded in connection with a series of transactions involving shares of Unipos Inc., as announced on May 22, 2025.

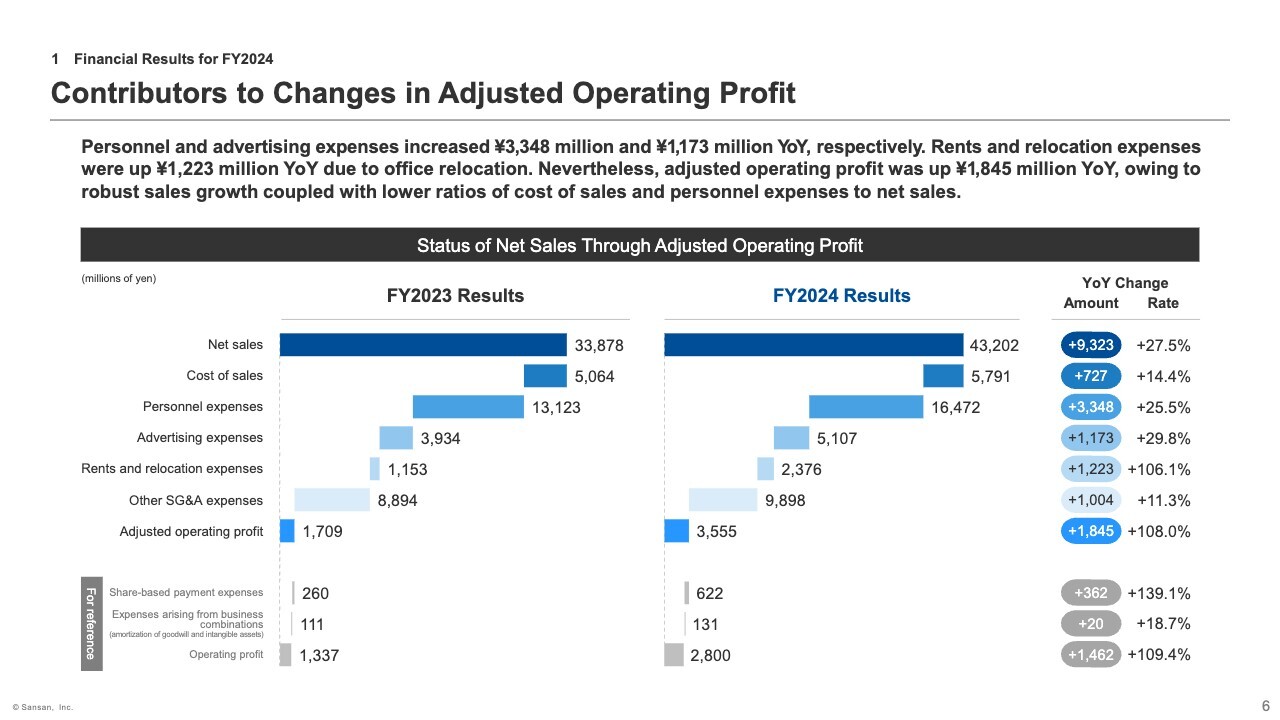

Contributors to Changes in Adjusted Operating Profit

Let me explain the factors behind changes in adjusted operating profit. Net sales increased 27.5% YoY, resulting in solid top-line growth. The cost of sales ratio declined by 1.5 percentage points, leading to an improvement in gross profit margin.

Among SG&A expenses, personnel expenses increased approximately ¥3,348 million YoY. However, the ratio of personnel expenses to net sales declined by 0.6 percentage points. On the other hand, advertising expenses rose by approximately ¥1,173 million, mainly due to a large-scale promotion in Q4, and the ratio to net sales increased by 0.2 percentage points.

As a result, adjusted operating profit increased approximately ¥1,845 million YoY, and adjusted operating profit margin improved by 3.2 percentage points.

Of the approximately ¥1.2 billion increase in rent and other expenses related to office relocation, approximately ¥550 million was a one-off expense recorded only in the fiscal year under review.

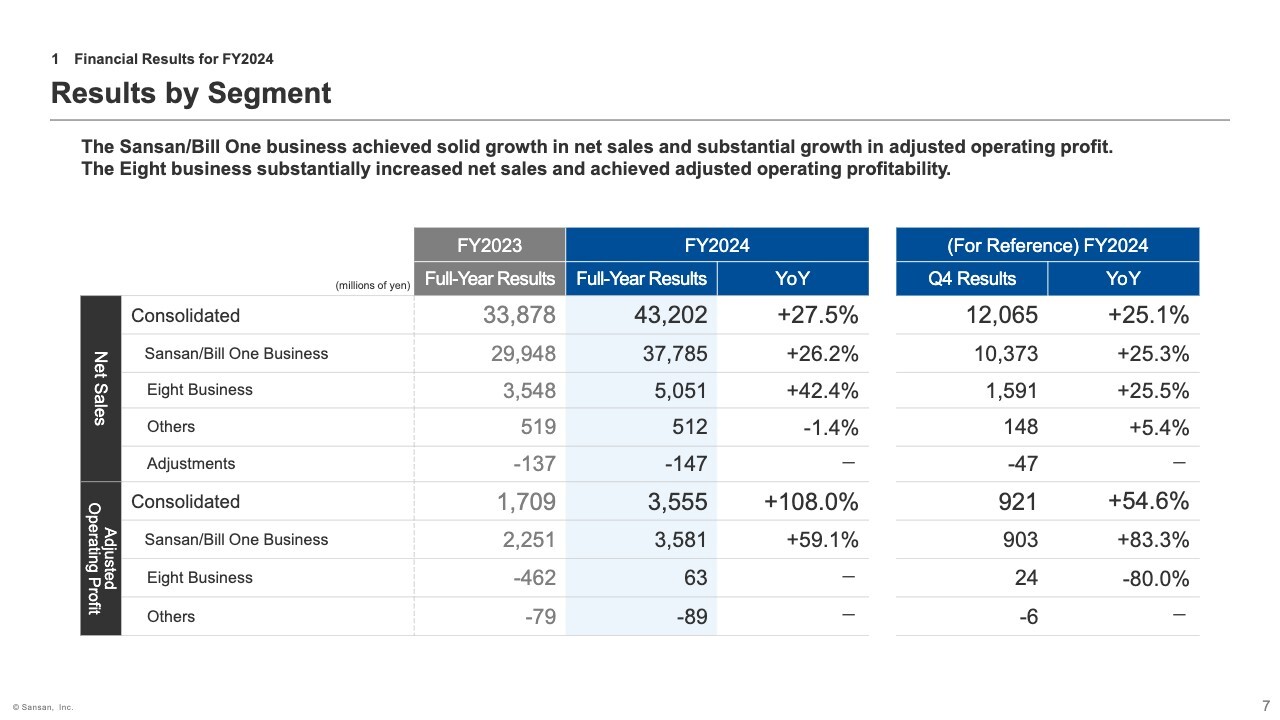

Results by Segment

Let me now discuss results by segment.

The Sansan/Bill One Business achieved solid growth in net sales and a substantial increase in adjusted operating profit.

The Eight Business also posted significant net sales growth. While head office expenses and other costs have been allocated to segments from the fiscal year under review, the business achieved full-year profitability in adjusted operating profit even on this new basis.

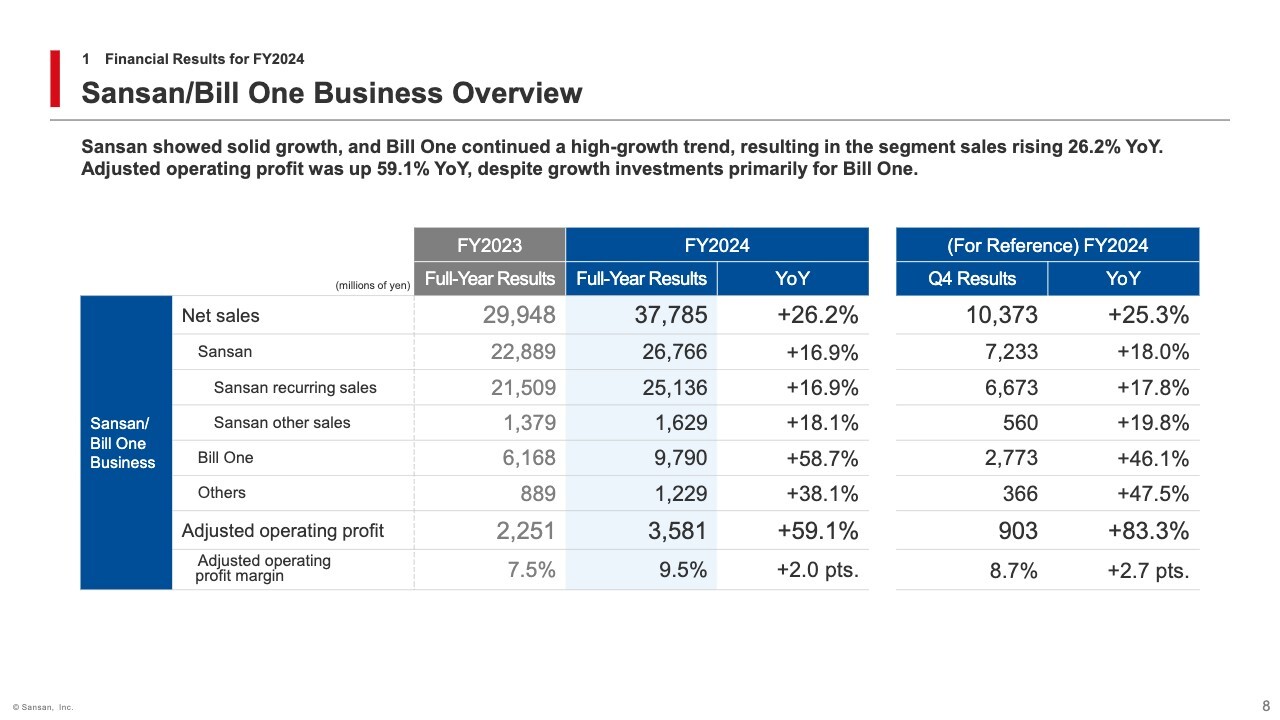

Sansan/Bill One Business Overview

Let me now explain segment performance, beginning with the Sansan/Bill One Business.

Net sales increased 26.2% YoY. By service, Sansan was up 16.9% YoY, with an accelerated growth rate. Bill One continued its high-growth trend with a 58.7% YoY increase.

As for adjusted operating profit, advertising expenses increased due to large-scale promotions including TV commercials for Sansan, Bill One, and Contract One starting in Q4. Nevertheless, driven by top-line growth and improved gross profit margin in Bill One, adjusted operating profit rose 59.1% YoY.

CREATIVE SURVEY INC., a group company included in net sales of Others, changed its name to Nineout Inc. The company’s services are growing steadily.

As for Contract One, also included in net sales of Others, its performance will be discussed later in the growth strategy section.

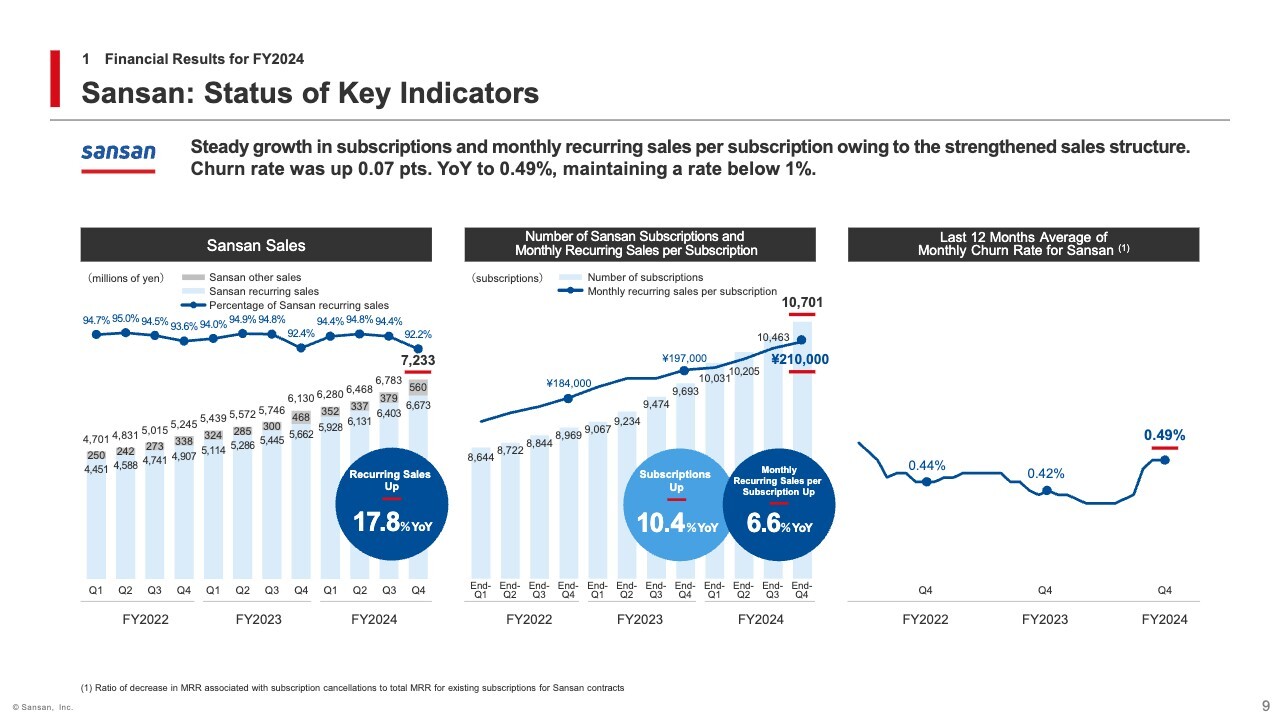

Sansan: Status of Key Indicators

Let me now explain Q4 KPIs for Sansan. The left-hand graph shows Sansan’s recurring sales, which increased 17.8% YoY, indicating accelerated growth.

The center graph shows the number of subscriptions and monthly recurring sales per subscription. The number of subscriptions increased 10.4% YoY, and monthly recurring sales per subscription rose 6.6% YoY, both demonstrating solid performance.

The right-hand graph shows the average monthly churn rate for the last 12 months. For the fiscal year under review, it was 0.49%, maintaining a low level below 1%.

For your reference, let me touch on the status of new orders. The value of new orders shown here is a metric close to the additional recurring sales to be booked in the future, reflecting the impact of churn. It includes orders already recorded in Q4 net sales, as well as those to be booked from Q1 of the next fiscal year.

The value of new orders in Q4 declined 12.6% YoY, mainly due to a slightly higher churn rate compared to the same period of the previous year. Q4 is typically a period with a high volume of contract renewals, and we believe this fluctuation was within the expected range.

Excluding the impact of churn, the acquisition of new orders continues to be steady. Given that the churn rate remains low at 0.49% on a 12-month average basis, we see no significant concern regarding Sansan’s growth trend.

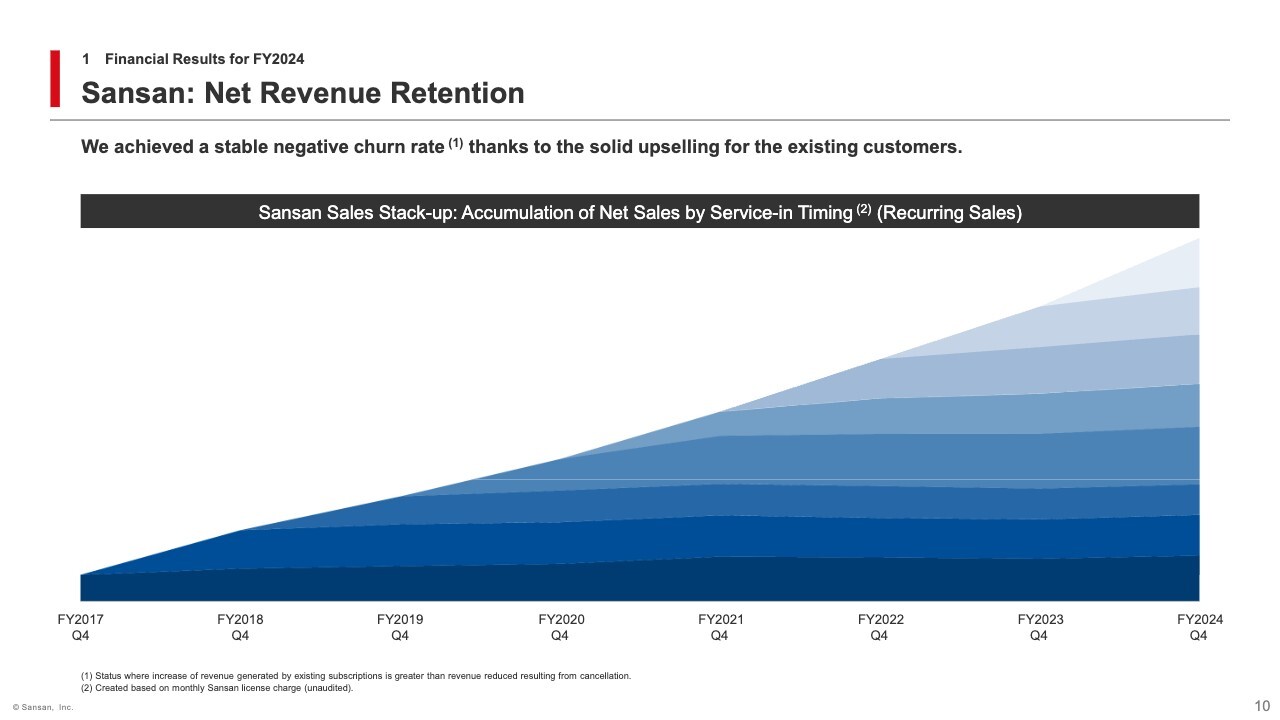

Sansan: Net Revenue Retention

Let me now explain upselling for existing Sansan customers. We have consistently achieved a stable negative churn rate, meaning that revenue growth from existing subscriptions exceeds revenue lost from cancellations. We will continue working to improve our net revenue retention (NRR).

Bill One:Status of Key Indicators

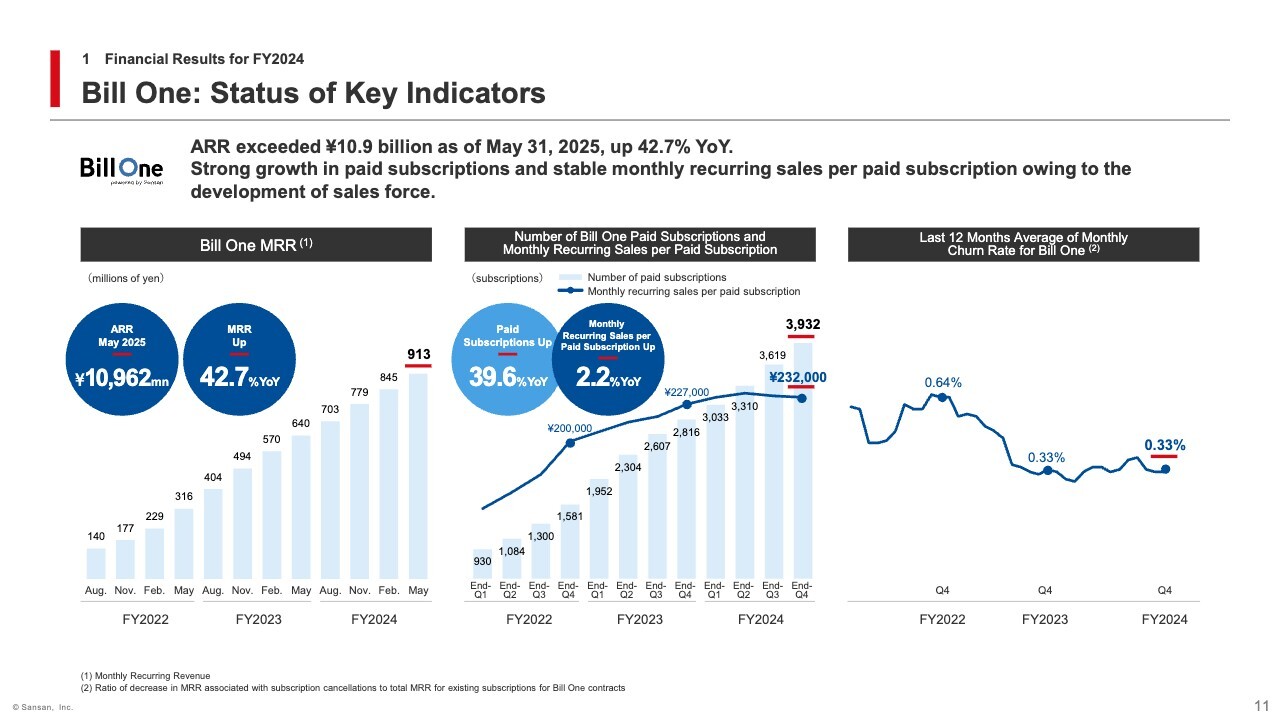

Let me now explain Q4 KPIs for Bill One.

The left-hand graph shows monthly recurring revenue (MRR), which was up 42.7% YoY as of May 2025.

The center graph shows the number of paid subscriptions and monthly recurring sales per paid subscription. The number of paid subscriptions increased 39.6% YoY, while monthly recurring sales per paid subscription rose 2.2% YoY. Although growth in price per subscription was relatively modest compared to the growth in the number of subscriptions, this reflects our recent initiatives and is not a cause for concern.

The right-hand graph shows Bill One’s 12-month average of monthly churn rate, which remained very low at 0.33%.

These KPIs include the performance of Bill One Expense and Bill One Account Receivable, both of which were added last year. Among them, Bill One Expense has been ramping up steadily, with around 30 to 50 new contracts acquired each month over the past six months.

We plan to offer Bill One Invoice Receive, Bill One Expense, and Bill One Account Receivable as a single package, aiming to maximize sales activity.

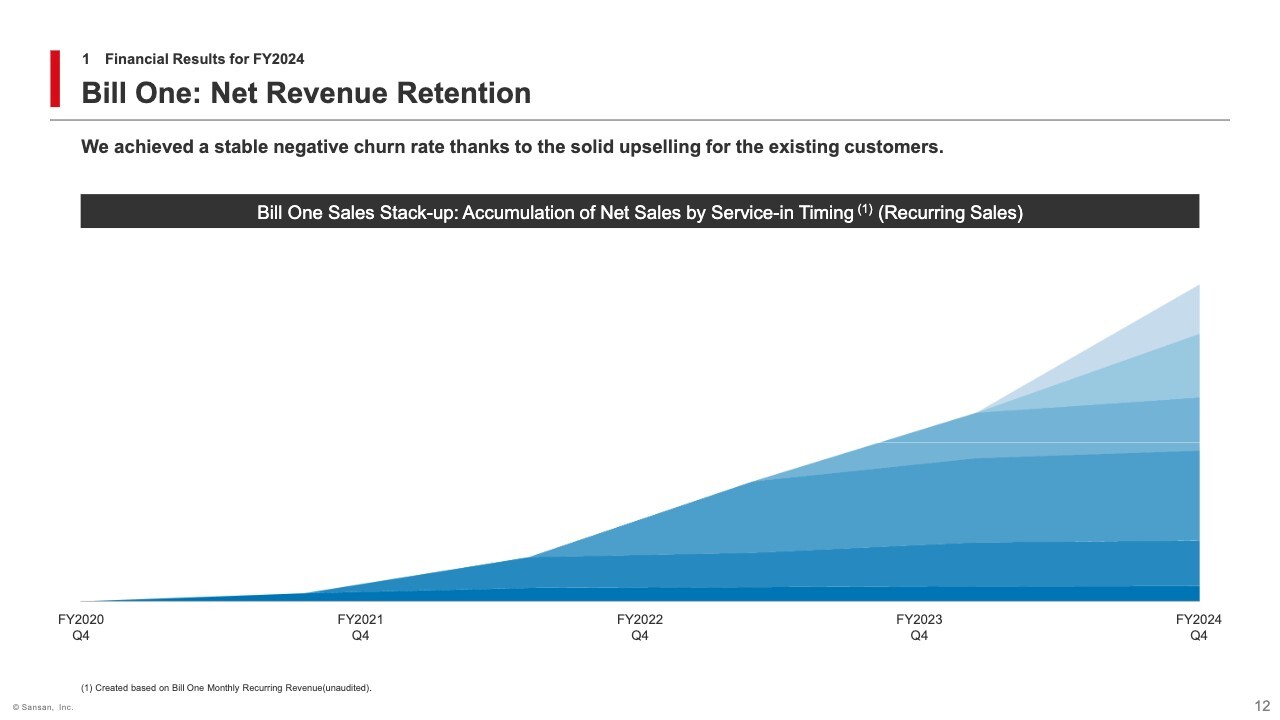

Bill One: Net Revenue Retention

Bill One has also consistently achieved a stable negative churn rate, and we will continue to focus on upselling going forward. For your reference, let me explain the status of new orders in Q4. The value of new orders increased 33.9% QoQ and 14.9% YoY, as the number of sales personnel increased and their ramp-up progressed.

In the Q3 earnings presentation, we noted that the ramp-up of new sales force was slower than expected. However, we expect sufficient ramp-up in the second half of the fiscal year under review, and we also anticipate the positive impact of the new sales strategy introduced earlier. Accordingly, we expect the value of new orders to continue a gradual recovery.

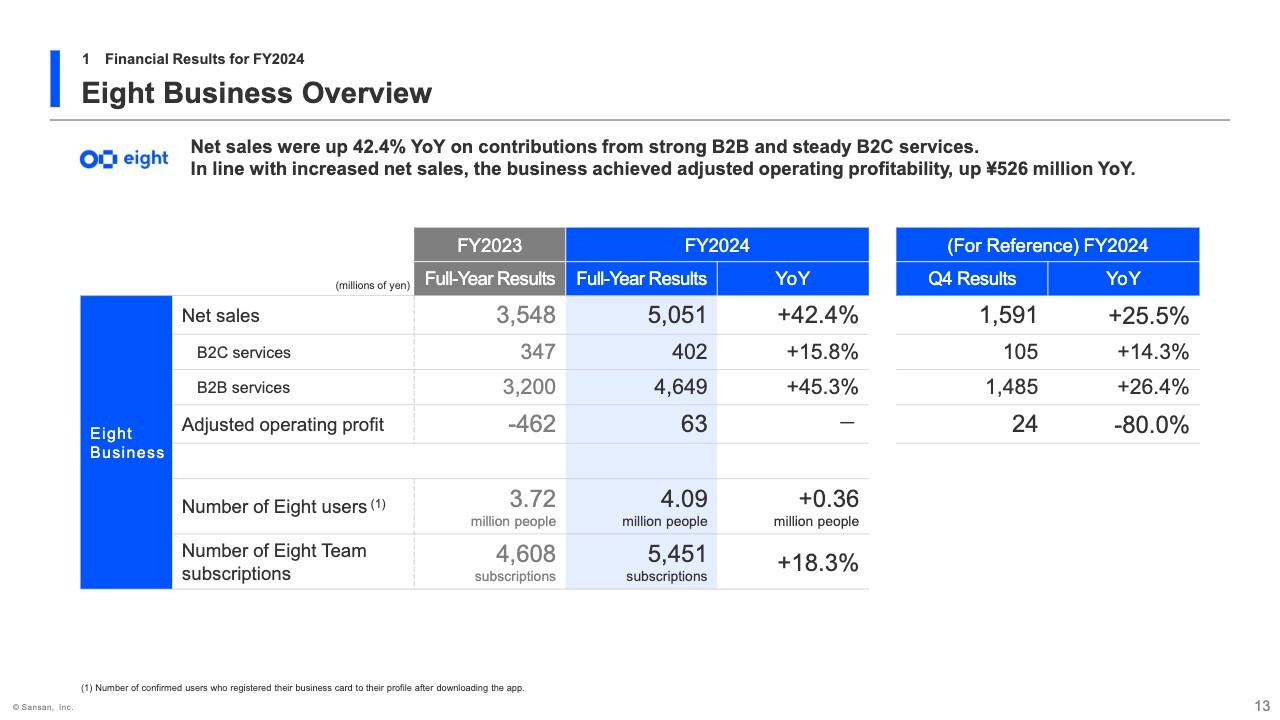

Eight Business Overview

Let me now explain the Eight Business. B2C services continued to deliver steady performance. Although the growth rate of B2B services slightly decelerated in Q4 due in part to the number of business events held, overall performance remained strong.

As a result, net sales increased 42.4% YoY, and adjusted operating profit rose approximately ¥526 million YoY, turning the business profitable for the full year.

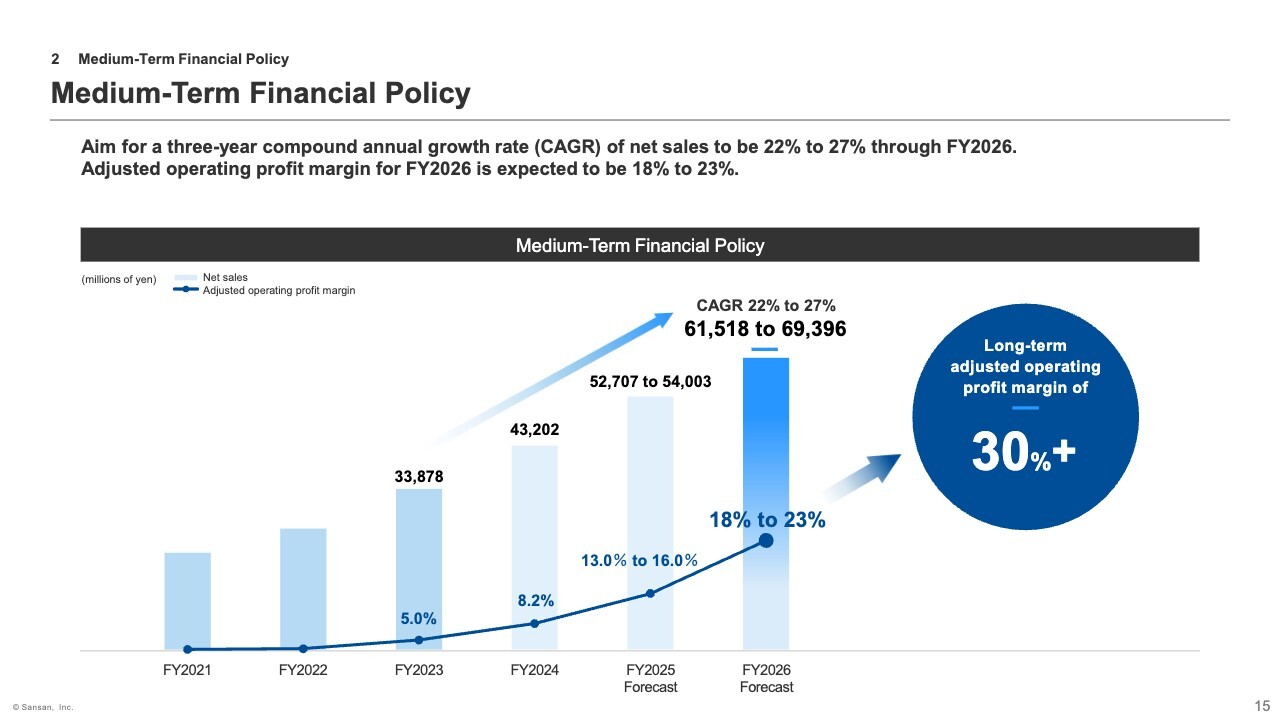

Medium-Term Financial Policy

Let me now explain the progress of our medium-term financial policy and the earnings forecast for the fiscal year ending May 31, 2026. The fiscal year ended May 31, 2025, which was the first year of the policy, delivered solid results. We will present our earnings forecast for the second year—the fiscal year ending May 31, 2026—shortly. The forecast is progressing smoothly and remains on track to achieve the targets for net sales and adjusted operating profit margin in the fiscal year ending May 31, 2027 set forth in the medium-term financial policy

Accordingly, there is no change to our targets under the medium-term financial policy at this time.

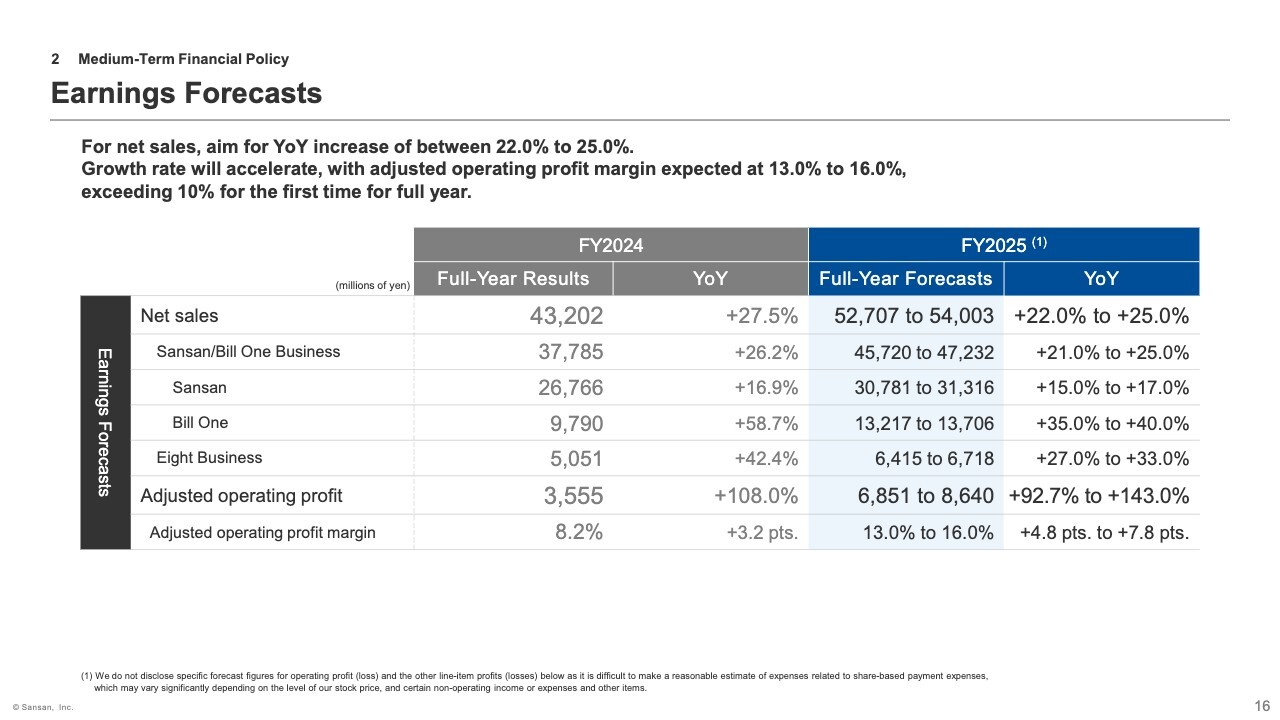

Earnings Forecasts

Let me now explain our full-year earnings forecast for the fiscal year ending May 31, 2026. We project net sales to increase by 22.0% to 25.0% YoY. Breaking this down by service, Sansan is expected to maintain stable growth with an increase of 15.0% to 17.0%.

While the growth rate of Bill One is expected to slow, we anticipate growth of 35.0% to 40.0%, supported by the continued ramp-up of the sales force, which is expected to contribute to results in the second half.

The Eight Business is projected to grow by 27.0% to 33.0%, driven by business events and Eight Team.

As for adjusted operating profit, we expect a significant increase of 92.7% to 143.0% YoY, due to solid net sales growth, improvements in gross profit margin, and a continued decline in the SG&A ratio. The adjusted operating profit margin is forecast to reach 13.0% to 16.0%, surpassing the 10% mark for the first time on a full-year basis.

For you reference, let me touch on the composition of adjusted operating profit between the first and second half. Since the Company’s business model is centered around recurring revenue, sales accumulate gradually each quarter, resulting in earnings that tend to be weighted toward the second half.

Accordingly, adjusted operating profit is also expected to be second-half weighted. Taking into account that advertising and promotion expenses tend to be concentrated in the first half, we anticipate approximately 25% of full-year adjusted operating profit to be recorded in the first half, and around 75% in the second half.

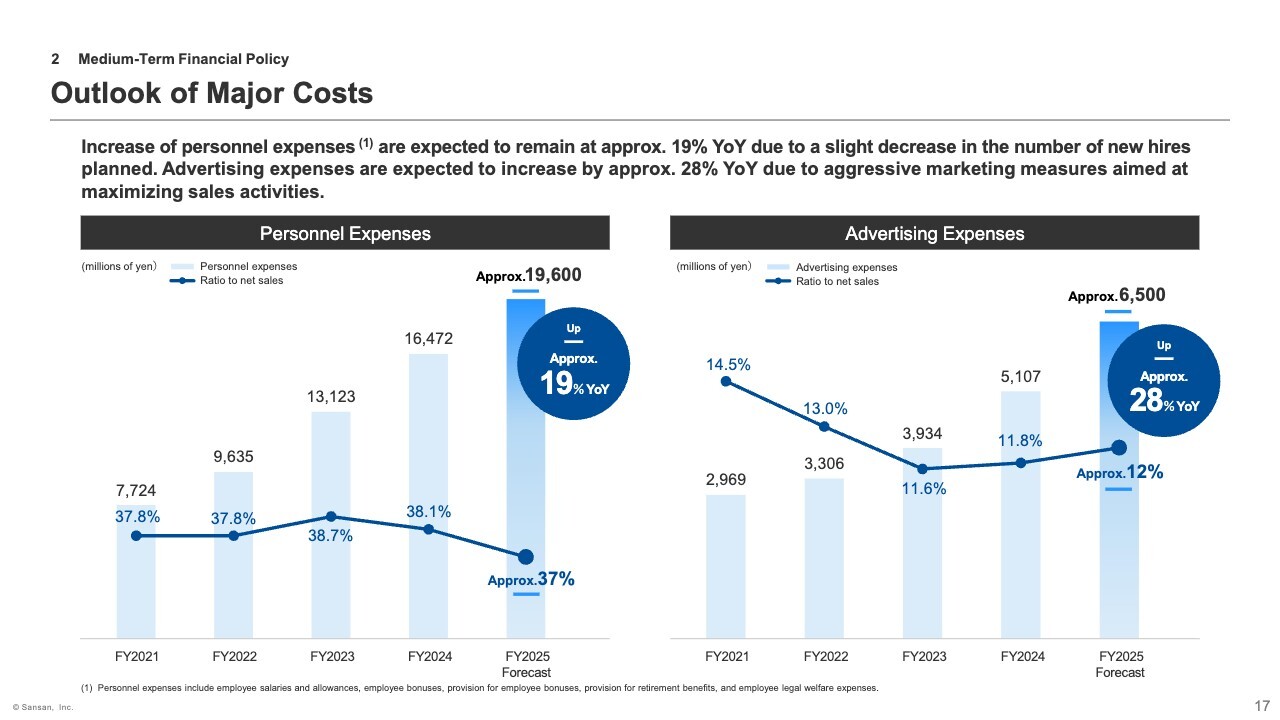

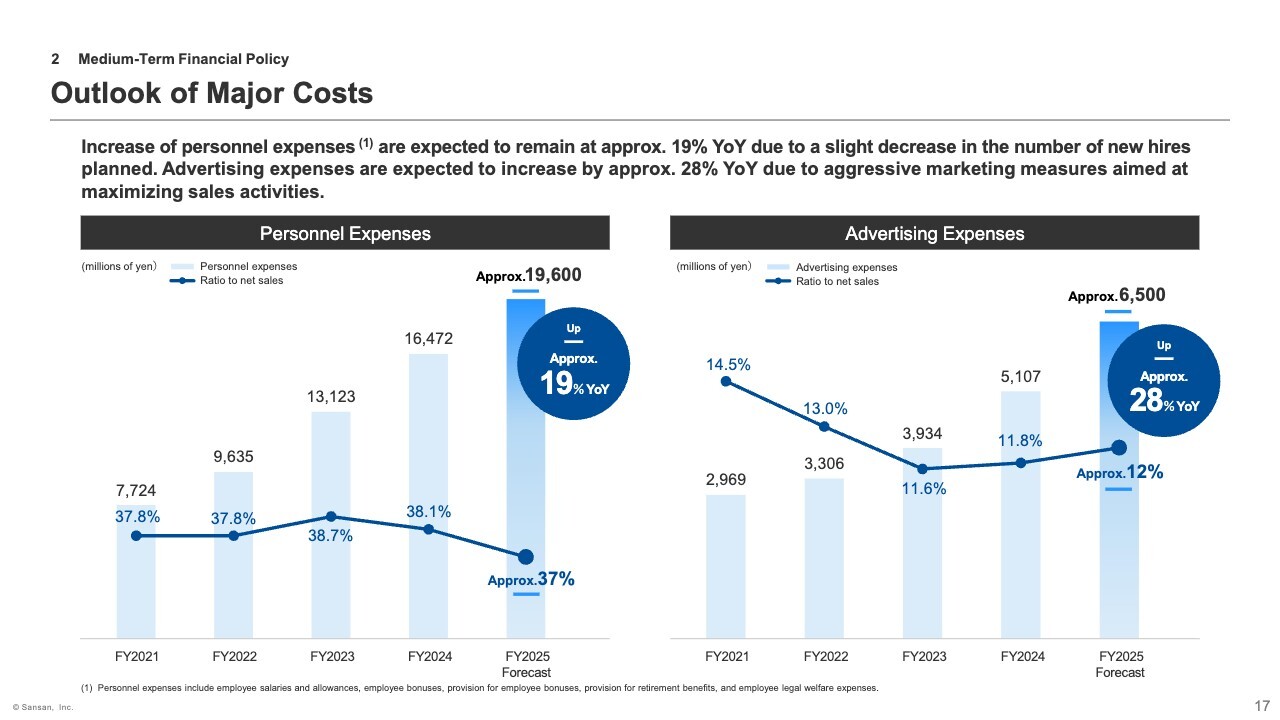

Outlook of Major Costs

Let me now explain the outlook for major costs. Personnel and advertising expenses are the primary cost items associated with our growth strategy. First, regarding personnel expenses, we plan to hire approximately 370 people in FY2025, including both new graduates and mid-career recruits.

Although this is a sufficient hiring plan, the number of hires is expected to decrease compared to FY2024. As a result, personnel expenses are projected to increase by approximately 19% YoY, while the personnel expenses-to-sales ratio is expected to decline.

Next, advertising expenses are projected to increase by approximately 28% YoY, as we launched a large-scale promotional campaign in Q4 FY2024 and are continuing the campaign in Q1 FY2025. Consequently, the advertising expenses-to-sales ratio is expected to rise slightly.

Although we had previously stated that the advertising expenses ratio would gradually decline, we have decided to increase advertising investments based on several factors: the smooth rollout of new services such as Bill One Expense and Contract One, the current strong pace of profit generation, and our ample investment capacity.

That said, there are no significant changes to the overall cost plan, which remains in line with our medium-term financial policy.

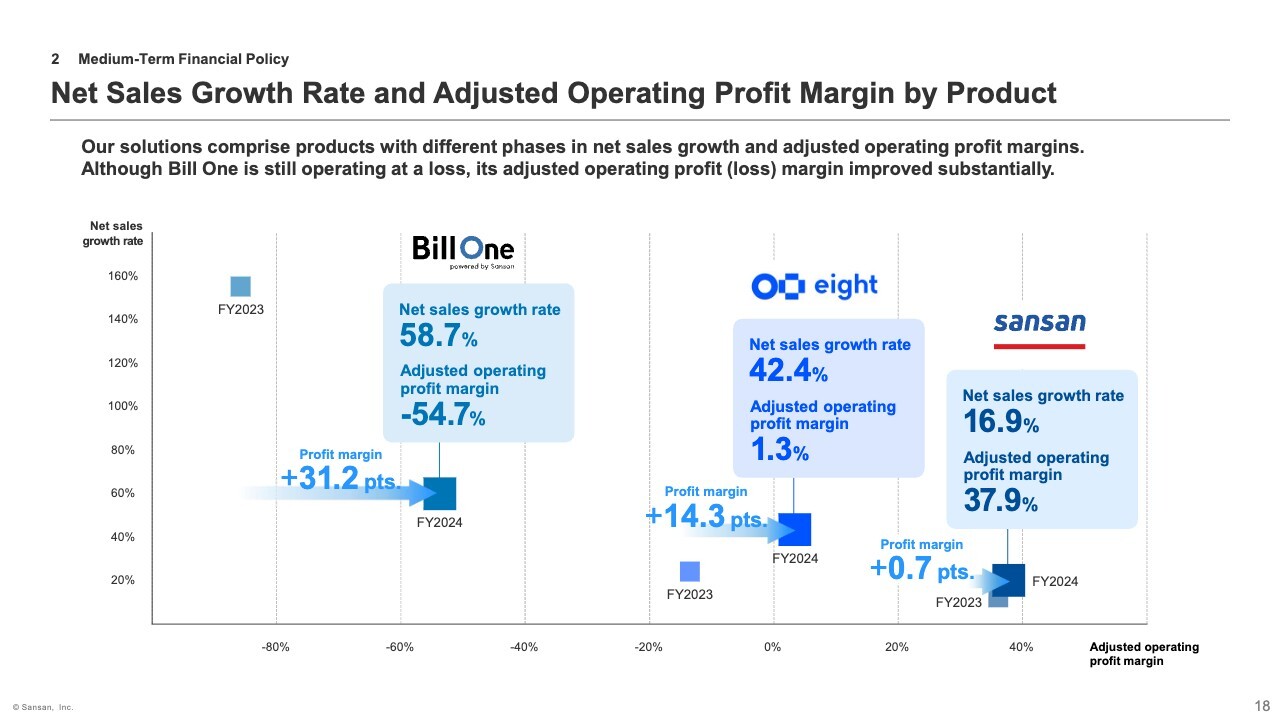

Net Sales Growth Rate and Adjusted Operating Profit Margin by Product

Let me explain the medium-term improvement in profitability based on the current status of our key products. The profit margins presented here reflect the allocation of indirect costs such as head office expenses.

Sansan maintained stable top-line growth and achieved an adjusted operating profit margin of 37.9%, up from the previous fiscal year. We expect this margin to continue improving gradually over time.

On the other hand, Bill One remains in an upfront investment phase and is currently operating at a loss. However, as top-line growth accelerates, the business has made significant progress toward profitability. If this growth trajectory continues, we expect Bill One to turn into profitability in the fiscal year ending May 31, 2027. In the medium to long term, we believe it has the potential to generate a high profit margin, similar to Sansan.

Eight saw a 14.3 percentage point improvement in adjusted operating profit margin compared to the previous fiscal year, achieving full-year profitability. As such, each product is steadily progressing toward our long-term Group-wide goal of achieving an adjusted operating profit margin of over 30%.

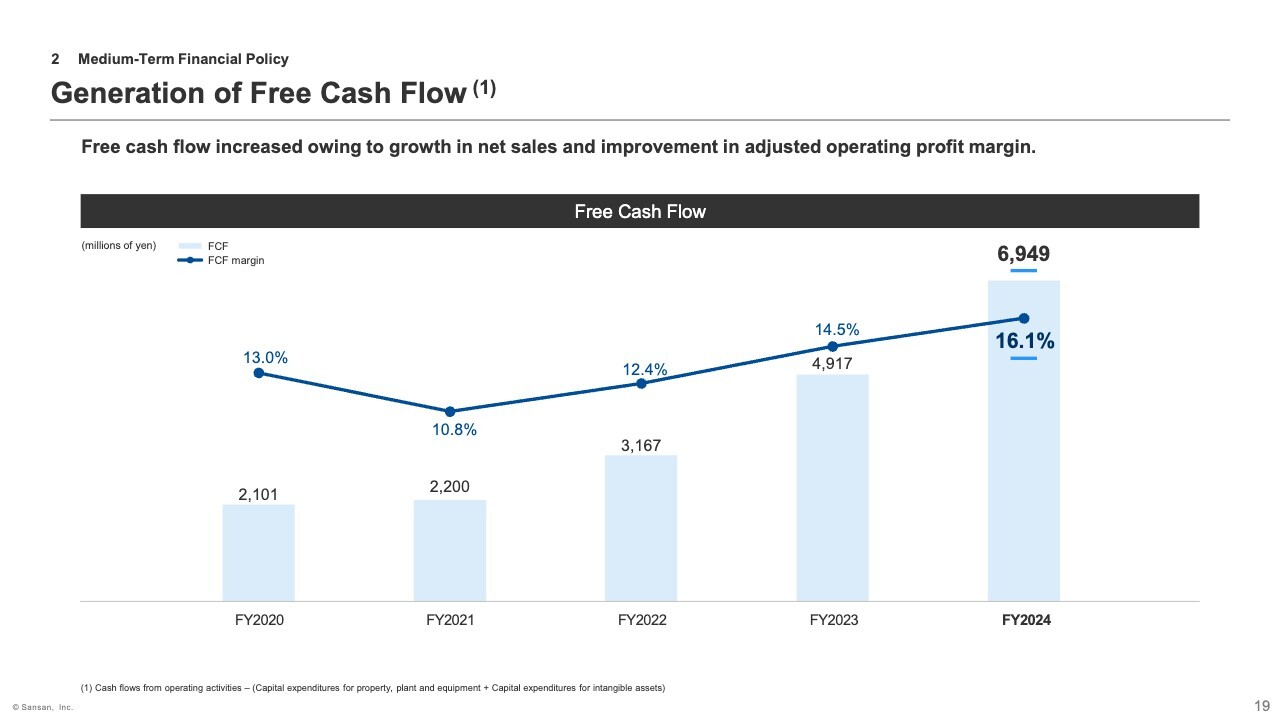

Generation of Free Cash Flow

I will now explain the status of our free cash flow. Backed by solid sales growth and improved profitability, our free cash flow has steadily expanded. In the fiscal year ended May 31, 2025, we recorded one-time capital expenditures of approximately ¥2.0 billion related to the relocation of our head office. Even under these circumstances, our free cash flow margin reached 16.1%.

We expect further expansion of free cash flow in line with our medium-term financial policy.

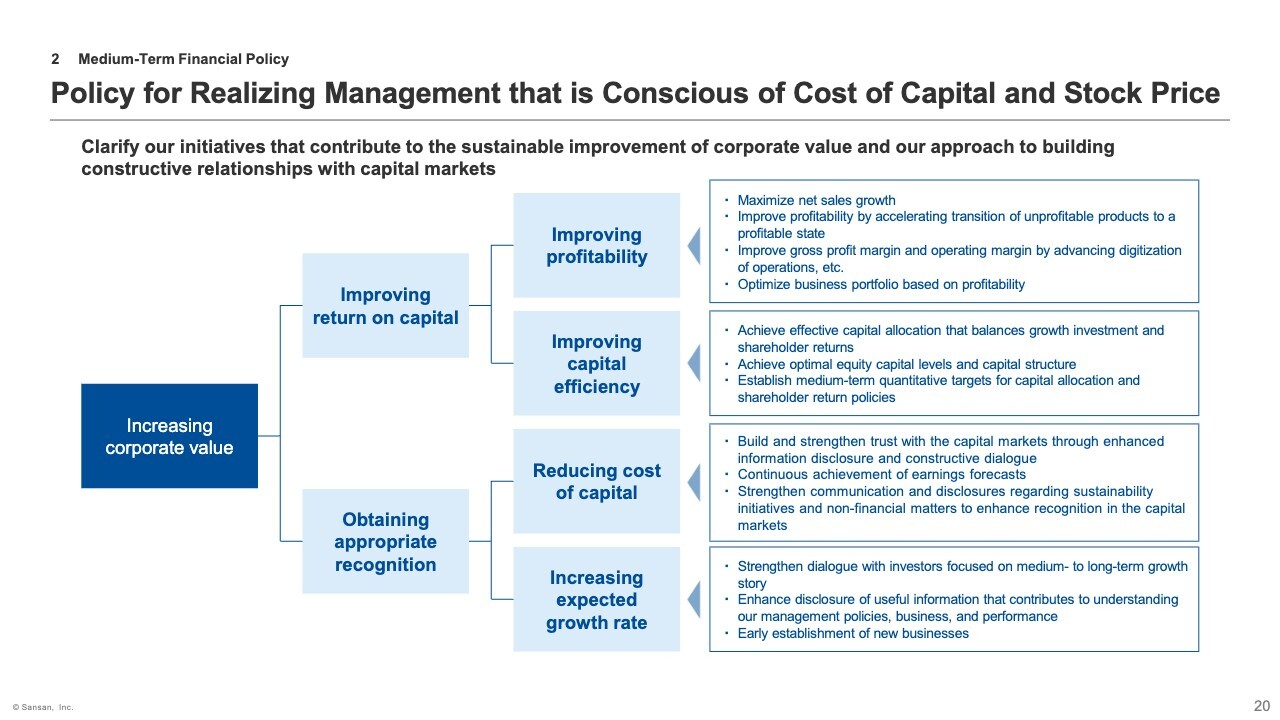

Policy for Realizing Management that is Conscious of Cost of Capital and Stock Price

Lastly, I would like to briefly touch on our policy for enhancing corporate value. Based on the Tokyo Stock Exchange's guidance for “management that is conscious of cost of capital and stock price,” we have summarized our current thinking. While many of the items remain at the basic policy level, today I will explain our views on capital efficiency, particularly capital allocation.

We believe that striking a balance between growth investment and shareholder returns is important. Given our current growth stage, our capital allocation priorities at this point are as follows: the highest priority is creation of new businesses including M&A, followed by share buybacks, and lastly, dividends.

We conducted a share buyback in the previous fiscal year. While there is nothing to announce at this time as a result of our comprehensive assessment of various factors, our policy of considering share buybacks in a flexible manner remains unchanged..

Regarding our shareholder return policy including dividends, we are not in a position to provide a quantitative target at this time due to the limited amount available for distribution under the Companies Act.

Looking ahead, we expect to see further expansion in free cash flow. At the appropriate time, we intend to clarify our capital allocation policy with a focus on capital efficiency and maximizing shareholder value.

This concludes my presentation. Next, our CEO Terada will present our growth strategy.

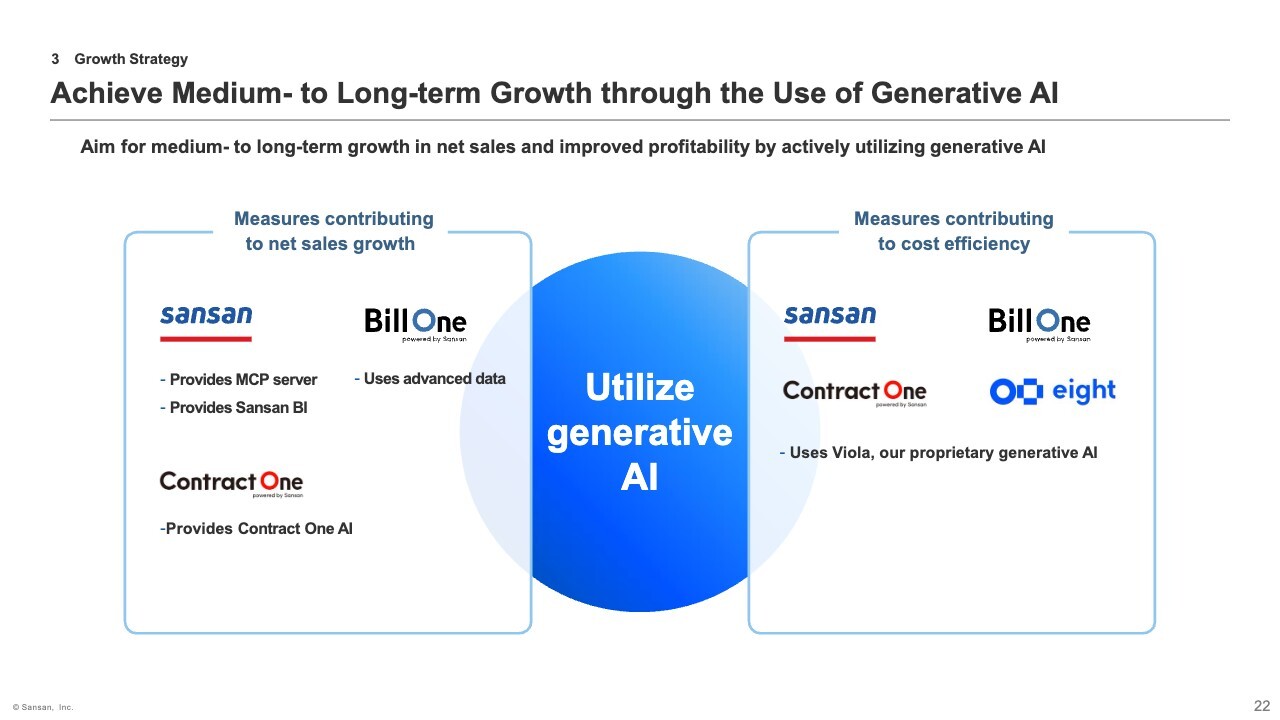

Achieve Medium- to Long-term Growth through the Use of Generative AI

Chikahiro Terada (hereinafter Terada): I am Chikahiro Terada, the CEO. Since CFO Hashimoto has already explained the short-term outlook, I would now like to talk about our medium- to long-term growth strategy. I will focus on the utilization of generative AI, which is essential when discussing our future direction, and share specific topics related to each of our products.

The content I will be covering today can be broadly categorized into two areas: initiatives related to topline growth and those related to cost reduction.

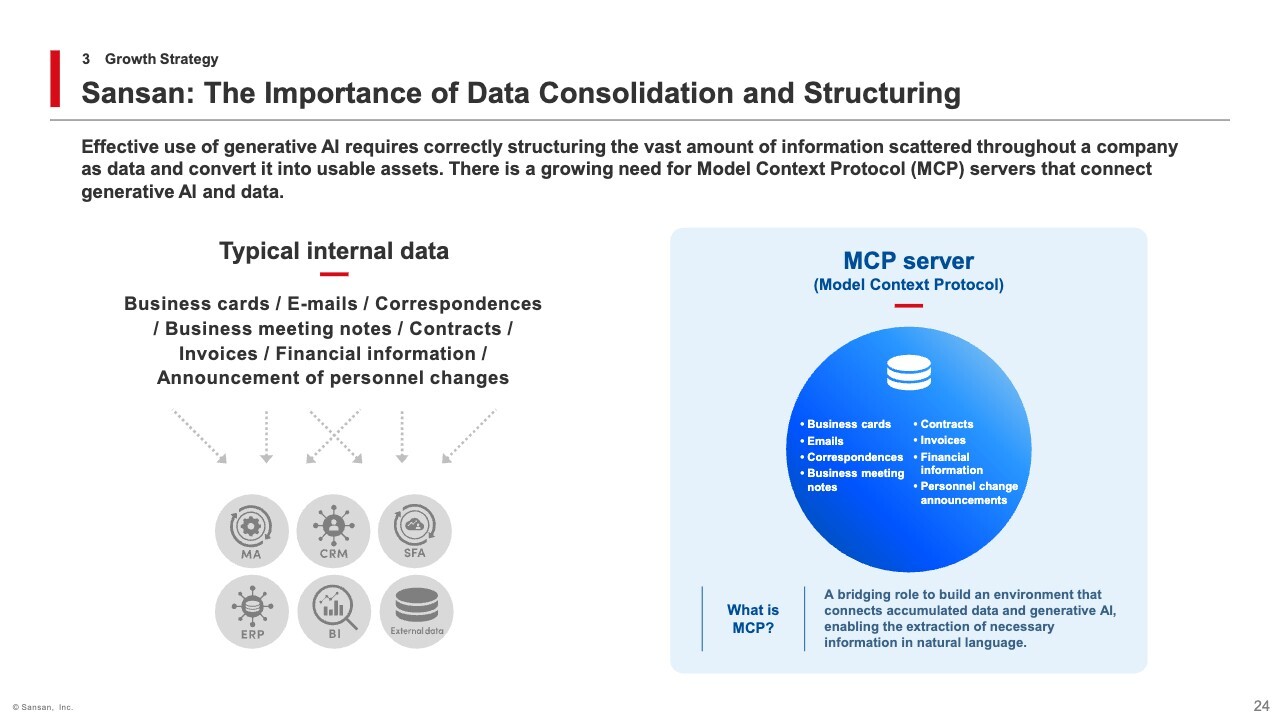

Sansan: The Importance of Data Consolidation and Structuring

Let me explain our initiatives that contribute to top-line growth. I will start with the AI utilization strategy for Sansan.

In recent years, solutions utilizing generative AI have been rapidly evolving. While many companies have begun efforts to improve operational efficiency and utilize knowledge, these efforts often focus on how to use generative AI.

However, to fully leverage generative AI, it is critical to determine what data it learns from, what it infers, and what kind of data is provided to it.

In other words, it is essential to extract and digitize various forms of information scattered across an organization—such as business cards, contracts, invoices, and meeting notes—which often remain in analog and unstructured formats. Furthermore, this data must be organized and contextualized to make it useful. This is the starting point and the most critical step.

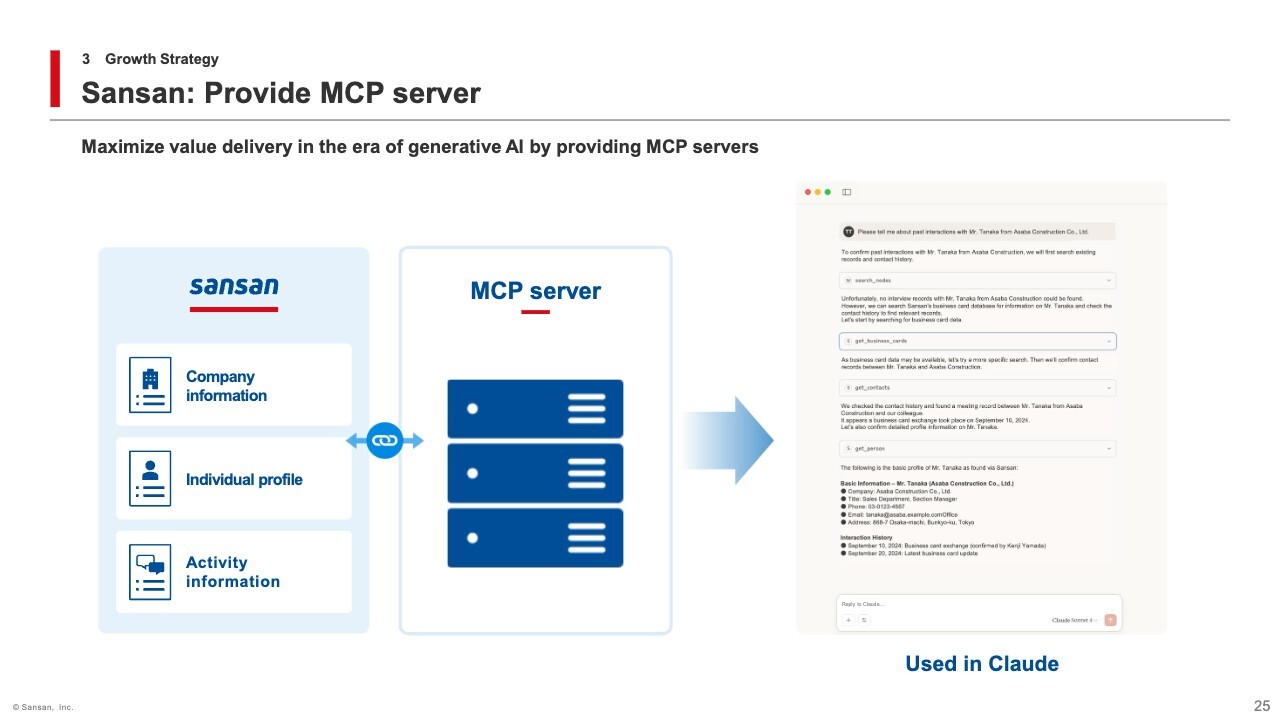

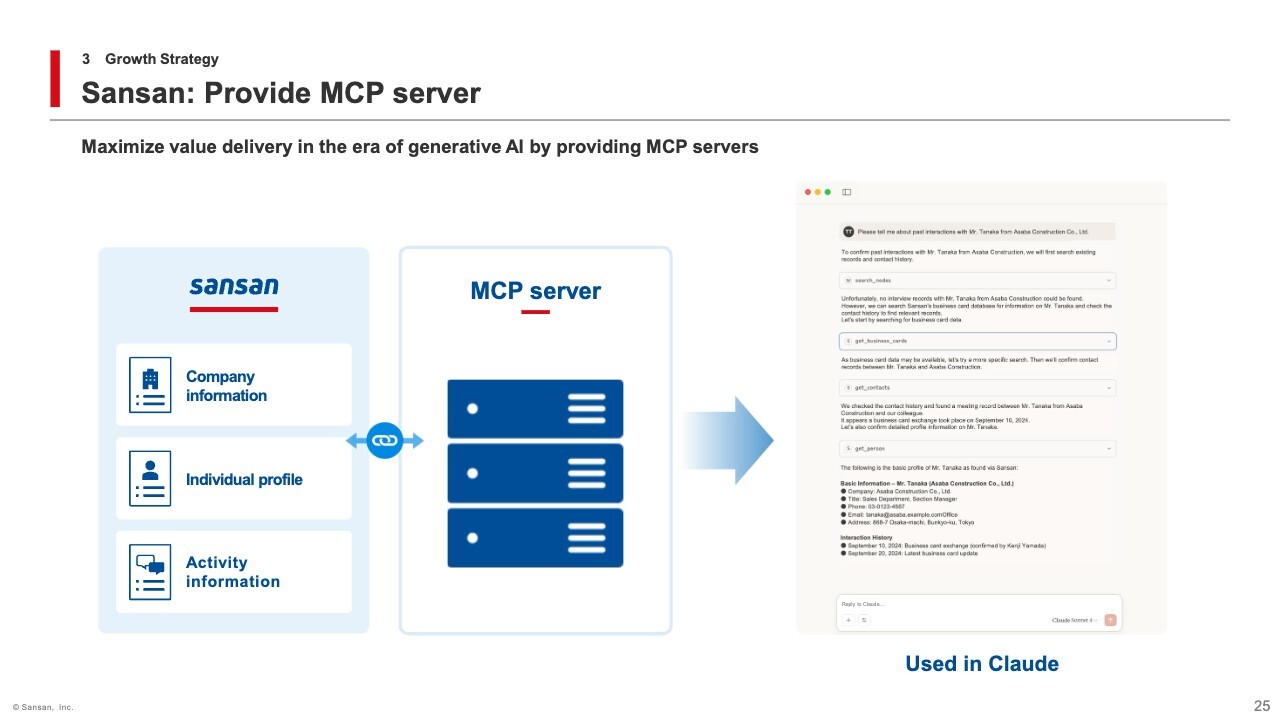

In addition, the Model Context Protocol, or MCP server, has recently been attracting attention. An MCP server plays a bridging role between accumulated data and generative AI, enabling the construction of an environment where necessary information can be retrieved in natural language.

Sansan: Provide MCP server

At Sansan, we have spent more than 18 years digitizing analog information accurately, including manual data entry. We have built a massive database of corporate, individual, and activity information, such as “who met with whom and when,” “what was discussed,” and “whether or not the company has actual contact with key persons identified based on the department they belong to or their position.

It is precisely because we have this foundation that Sansan holds an exceptionally rare position in the generative AI era, capable of providing practical and useful data.

Looking ahead, we plan to offer an MCP Server that will allow integration with AI services like ChatGPT, enabling users to reference and effectively utilize data within Sansan through natural language prompts.

In addition to conventional use cases of Sansan, customers will be able to connect and utilize their proprietary data stored in Sansan through AI, thereby maximizing the value that Sansan delivers.

We are currently developing the MCP Server, with a goal of launching the service in the second half of the fiscal year ending March 31, 2026 at the earliest. We have already received numerous inquiries from companies and expect that this will contribute to an increase in both monthly recurring revenue per paid subscription and unit price of Sansan.

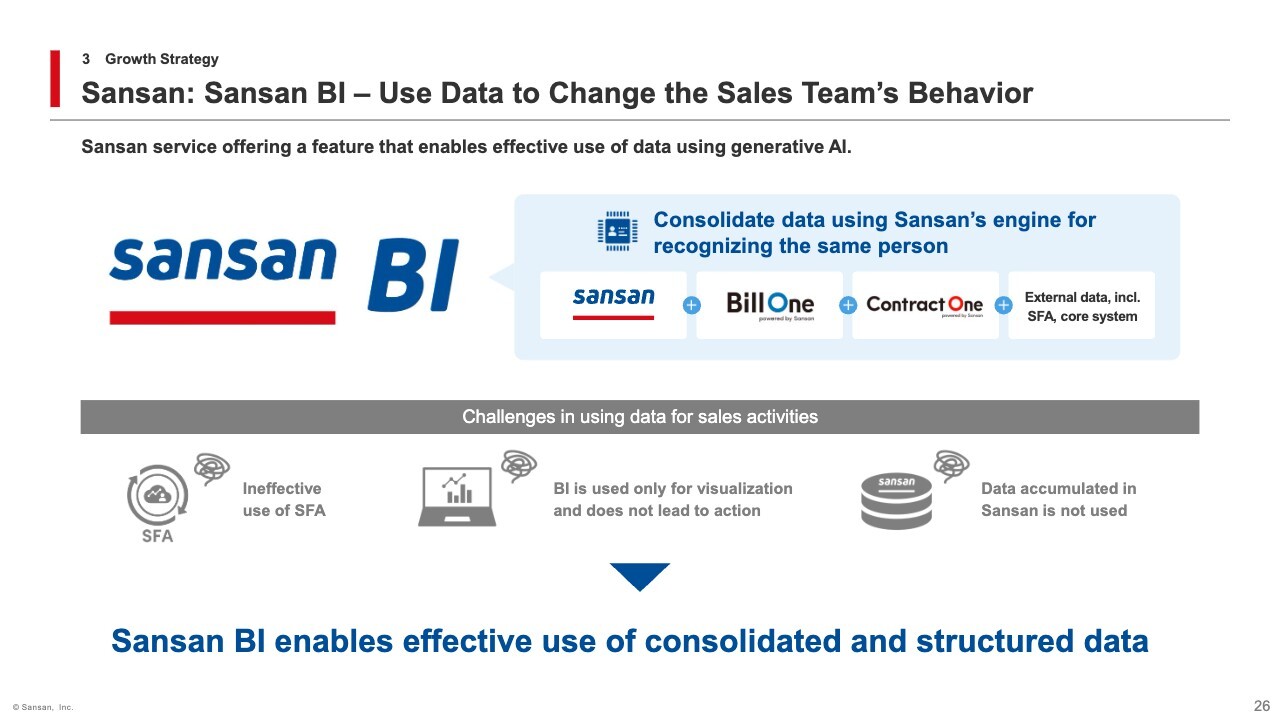

Sansan: Sansan BI – Use Data to Change the Sales Team’s Behavior

In addition to linking with third-party AI services, we have already begun providing generative AI-based data utilization features as native functions within Sansan. These features are offered under the name Sansan BI and are positioned as a solution that drives sales behavior transformation based on data.

By leveraging this feature, data within our other products such as Bill One and Contract One, as well as data stored in customers’ internal core systems or other services, can be integrated with data in Sansan and utilized more effectively.

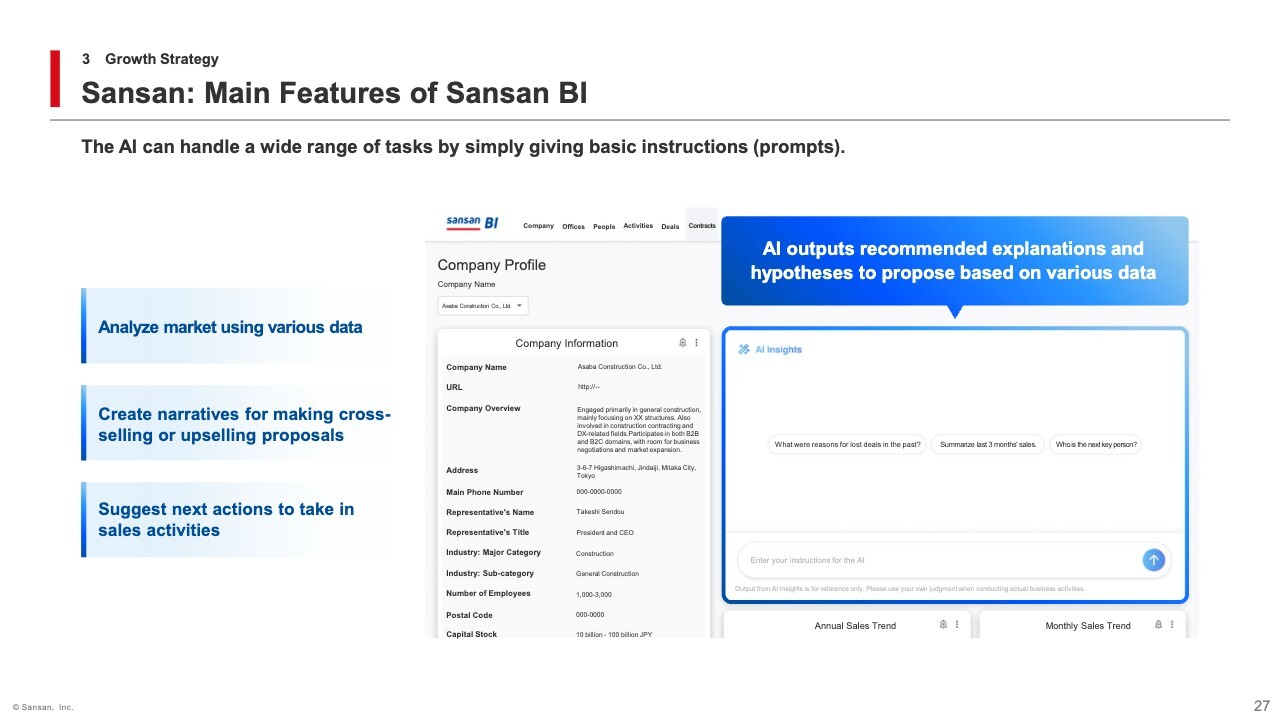

Sansan: Main Features of Sansan BI

Examples of how AI is used include automatically generating suggested proposal stories for cross-selling and up-selling, or identifying potential next actions, based on transaction history and current sales activity with a target company, through simple prompts.

These features are currently provided using Sansan Data Hub, a data integration solution. At the same time, we are also developing a new data integration service that goes beyond the framework of Sansan, aiming to further enhance functionality and service offerings.

Although my presentation today is just an overview, the massive database we have built in Sansan, as well as our advanced technologies for data capture, integration, and structuring, will provide us with a significant competitive advantage that supports medium- to long-term growth in business scenarios where AI utilization is essential.

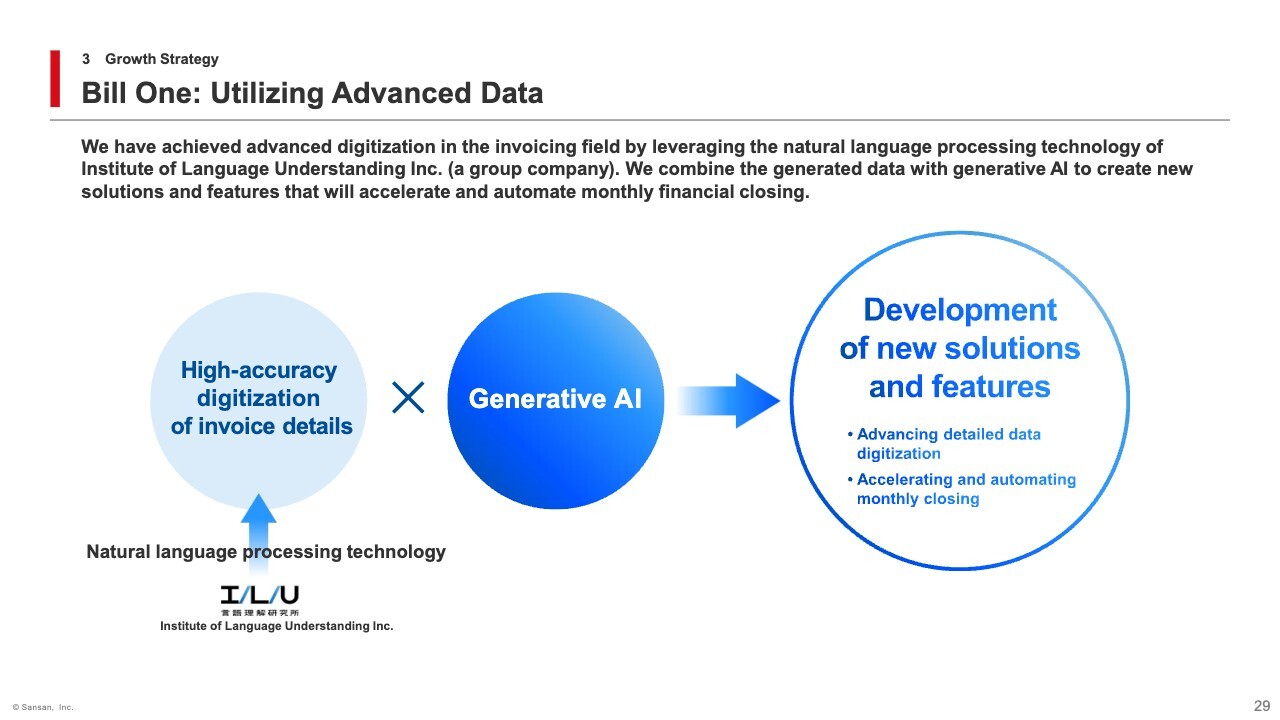

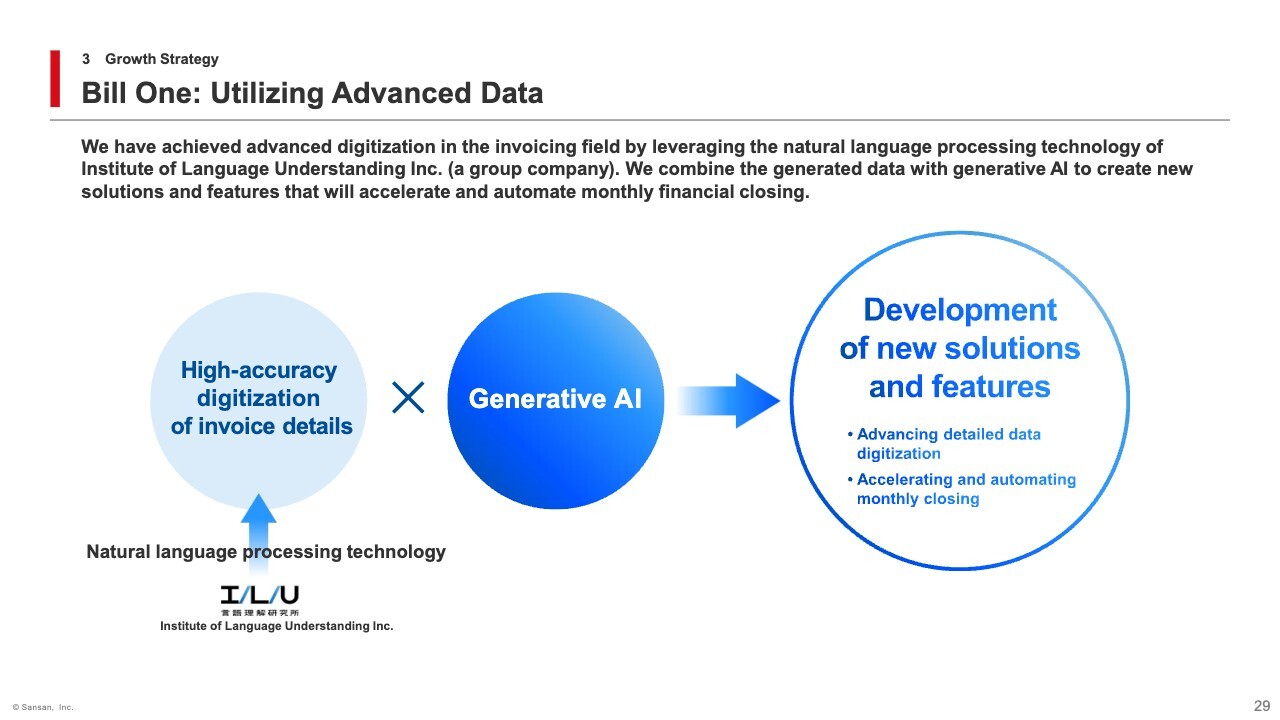

Bill One: Utilizing Advanced Data

Let me explain our AI utilization strategy for Bill One. As is the case with all of our services, we have been working to sophisticate the data generation capabilities of Bill One.

We have a group company named Institute of Language Understanding. Leveraging this company’s natural language processing technologies, we are working to expand the scope of data generation to include elements that were previously difficult to digitize—such as itemized invoice details, which are a unique challenge for Bill One.

Furthermore, by combining these technologies with generative AI, we are not only advancing the digitization of invoice line items but also developing new services and features that will accelerate the monthly financial closing process.

For example, in accounting operations, it is necessary to check whether the itemized information on received invoices matches the corresponding purchase order data. Depending on the industry or type of business, this verification process—when performed by visual inspection—can be highly inefficient and time-consuming.

To address this issue, we are planning to launch a new service within this year that utilizes generative AI based on the generated and itemized data mentioned earlier.

This is just one example. For Bill One, we aim to combine advanced data generation with generative AI to develop innovative services and features that fully automate the monthly financial closing process. We believe that Bill One has significant revenue opportunities going forward.

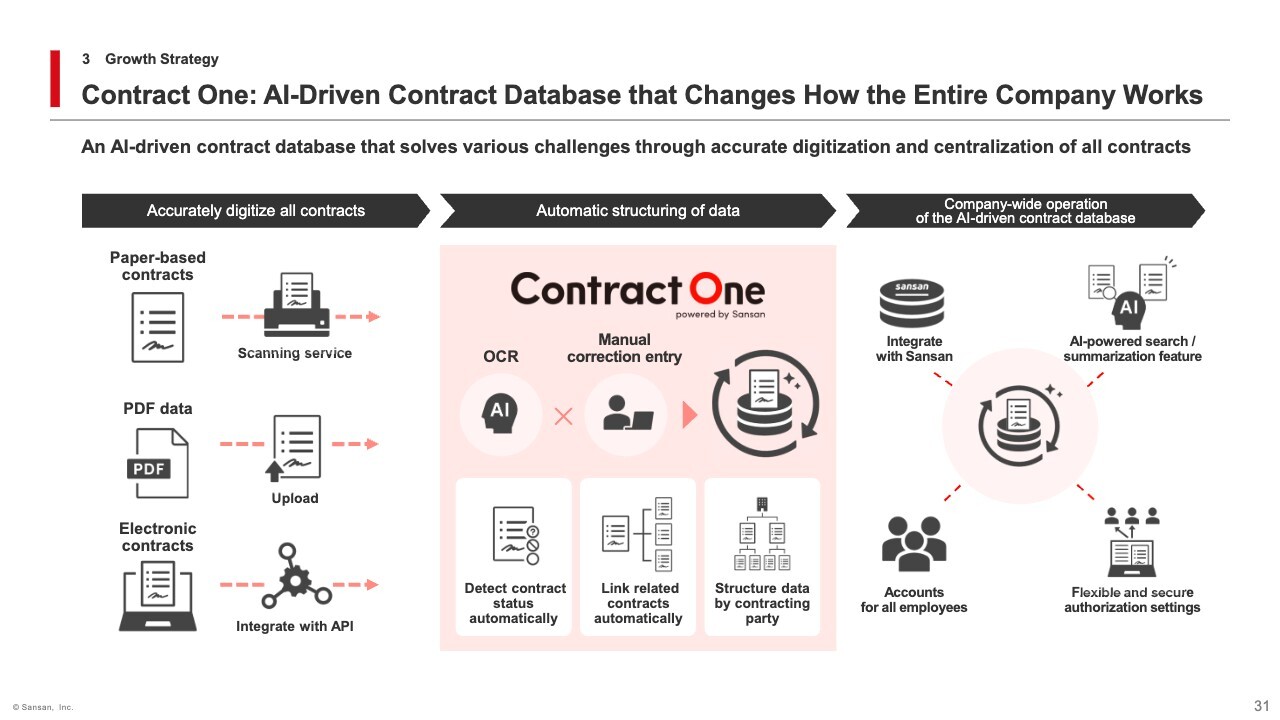

Contract One: AI-Driven Contract Database that Changes How the Entire Company Works

As the final initiative for topline growth, I will now explain our AI utilization strategy for Contract One. Contract One is an AI-driven contract database that transforms company-wide workstyles by creating an environment where contract data can be used on a daily basis. Leveraging our proprietary technologies and operations, we convert all contracts—whether paper-based or digital—into structured data and build a database that enables centralized management.

By combining this contract database with a variety of functions utilizing generative AI and language processing technologies, we aim to improve productivity not only in legal departments responsible for contract management, but also in business units that serve as the point of contact for concluding contracts with other companies.

Contract One: Providing Contract One AI Solution

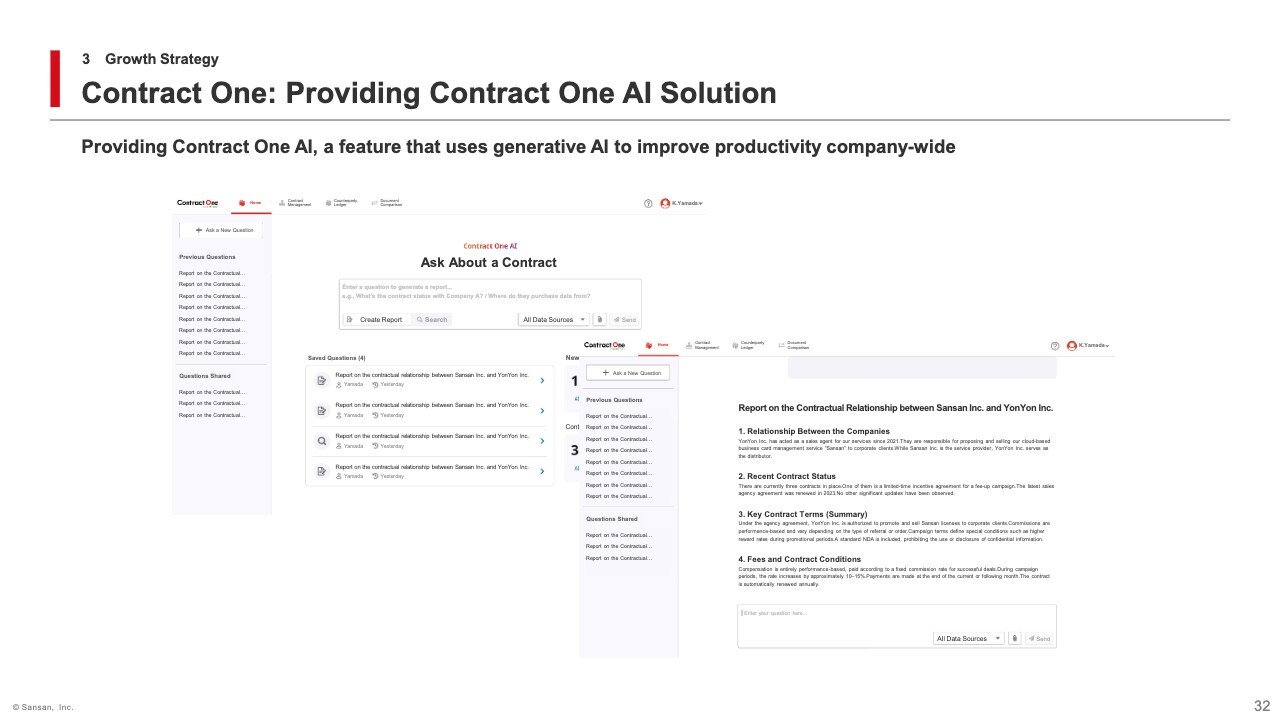

We offer a variety of features in Contract One, and going forward, we intend to focus on Contract One AI—our generative AI-based functionality—as a key growth driver.

Here’s how it works: users can simply ask questions about specific parts of a contract and instantly understand the relevant details. Even in cases where large numbers of individual contracts have been signed over many years under a master agreement, the system can automatically structure the contracts for each counterparty and generate a hierarchical “contract tree” that visualizes parent-child relationships.

This enables users to gain a clear picture of complex contract relationships at a glance. Looking ahead, we are also developing features that will allow for the creation of summary reports by company, as well as custom reports tailored to specific themes.

Tasks that previously required several hours to days to complete by checking with relevant departments can now be accomplished in an instant through the use of generative AI and data utilization. We aim to support a wide range of use cases, including faster decision-making by management, streamlining client negotiations, and enhancing sales strategies.

Contracts, by nature, are highly compatible with generative AI from a language processing perspective. We intend to leverage this unique affinity to further develop functionality going forward.

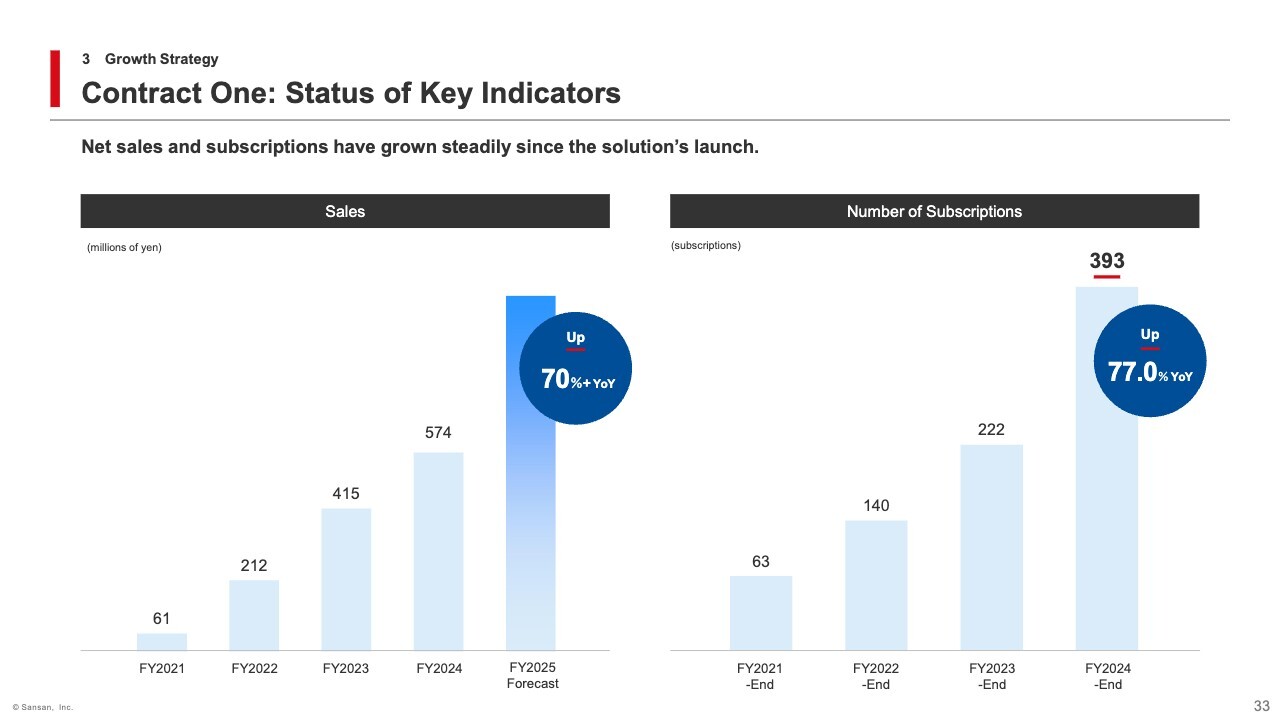

Contract One: Status of Key Indicators

While the KPIs for Contract One were not mentioned in the performance section, I would like to briefly share the current status here.

Although still in its early stages, Contract One has been steadily growing in both revenue and number of contracts since its launch in 2022. For the fiscal year ending May 31, 2025, revenue increased 38.2% YoY to approximately ¥574 million, and the number of contracts as of May 31, 2025 rose 77.0% to 393.

Currently, we are working to strengthen our sales organization, and as of May 31, 2025, we have also launched TV commercials. These initiatives are expected to accelerate revenue growth in the fiscal year ending May 31, 2026, pushing the year-on-year growth rate above 70%.

Looking ahead, we are also exploring the possibility of offering Contract One as an MCP server, as discussed earlier in relation to Sansan. In addition to expanding adoption among small and medium-sized enterprises, we aim to drive further growth by promoting broader use among large enterprises.

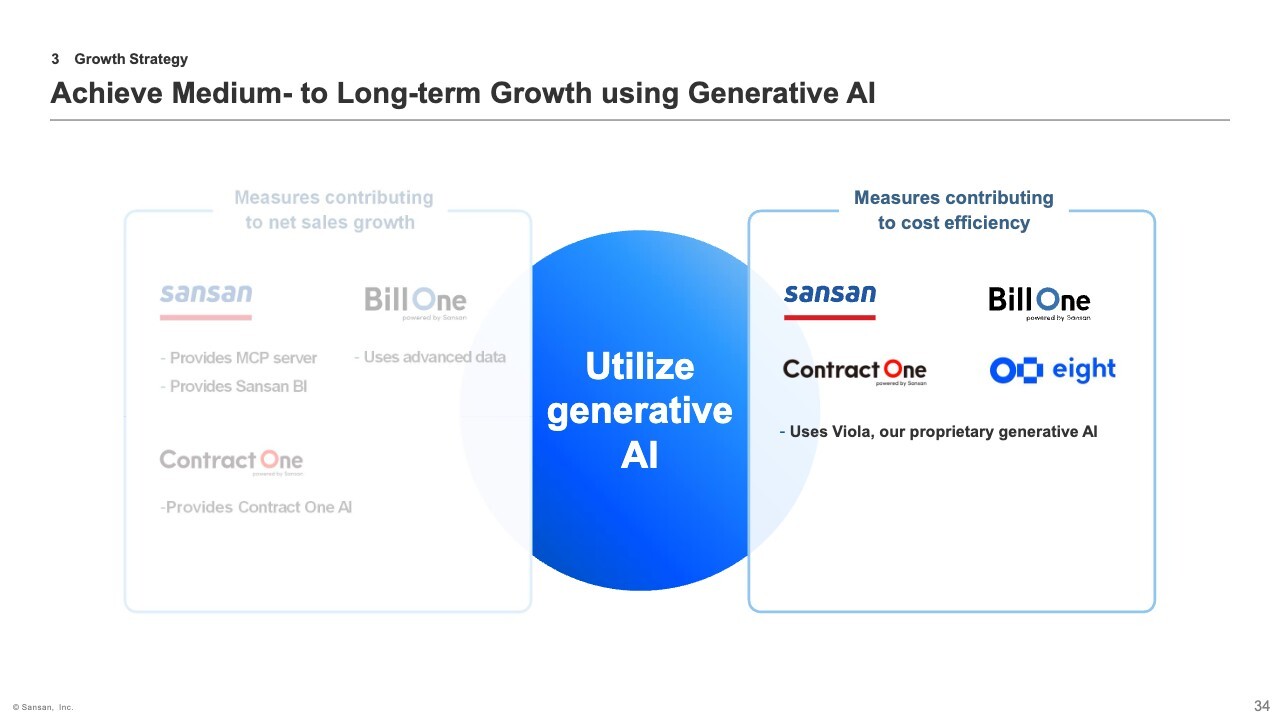

Achieve Medium- to Long-term Growth using Generative AI

Lastly, as an initiative contributing to cost reduction, I would like to introduce our efforts to digitize analog information by leveraging our proprietary generative AI.

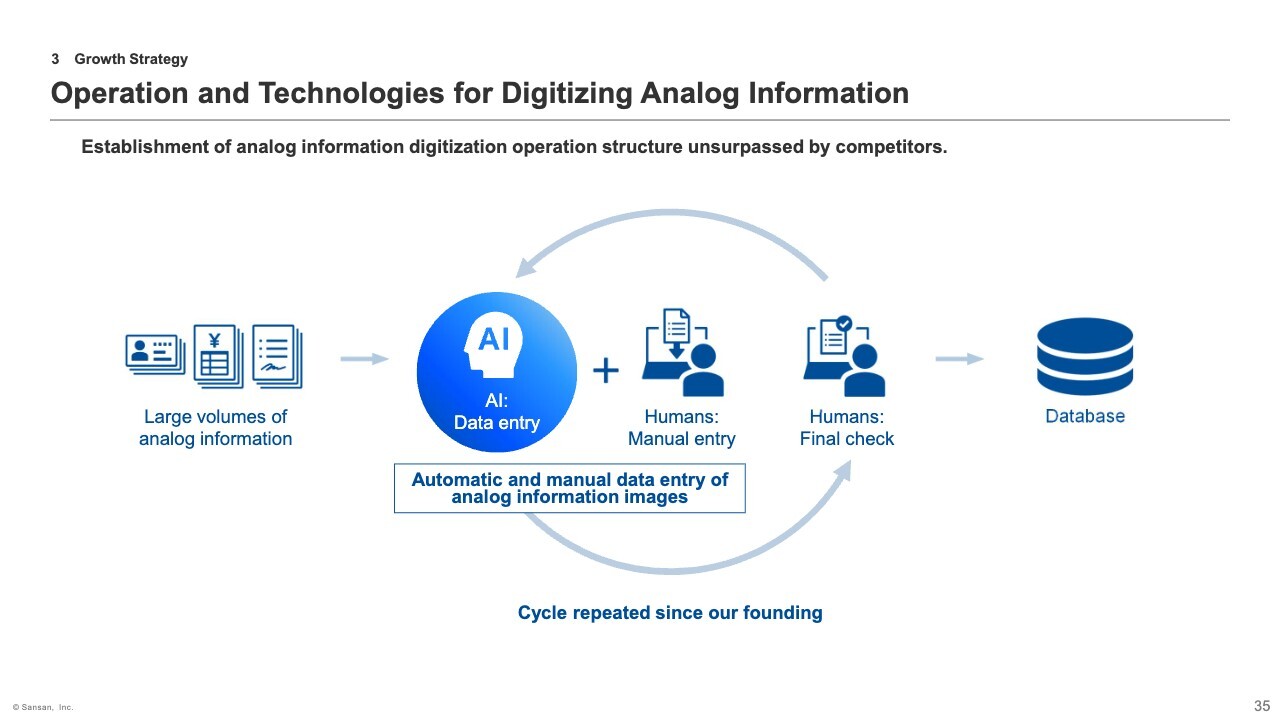

Operation and Technologies for Digitizing Analog Information

To digitize analog information such as business cards, we combine AI-based and manual entry to ensure 99.9% accuracy.

While maintaining the high accuracy of AI-based automation, reducing the share of manual entry is key to enhancing the product’s competitiveness and differentiation.

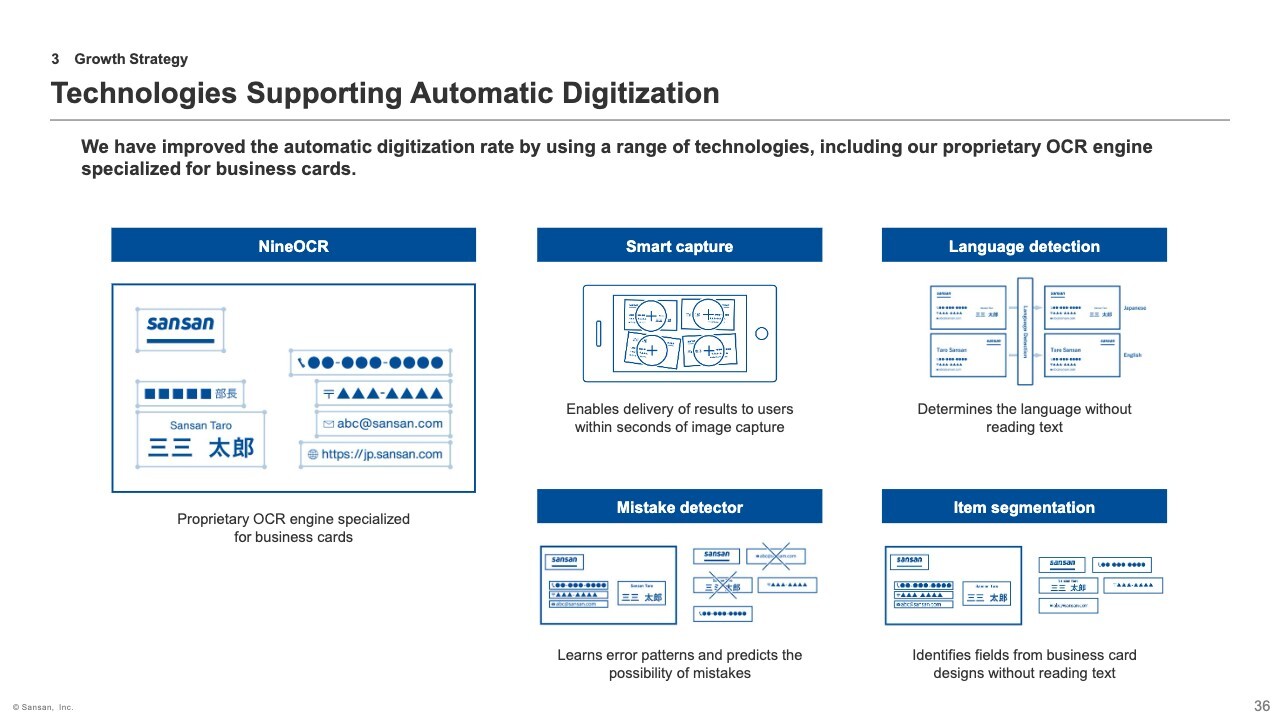

Technologies Supporting Automatic Digitization

We have been working hard to improve our automatic digitization rate by independently developing various image recognition technologies and AI capabilities. These include functionality that can determine language without reading any characters, and technology that learns from common error patterns in data entry to predict potential mistakes.

By utilizing our proprietary AI-OCR engine specialized for business cards, NineOCR, we have significantly improved the automatic digitization rate of business card data entry. As a result, while the volume of business cards requiring data conversion has increased, our cost per card has been reduced to less than one-twentieth of what it was at the time of our founding. Even today, it is possible to deliver the same service quality at just around 5% of the original cost.

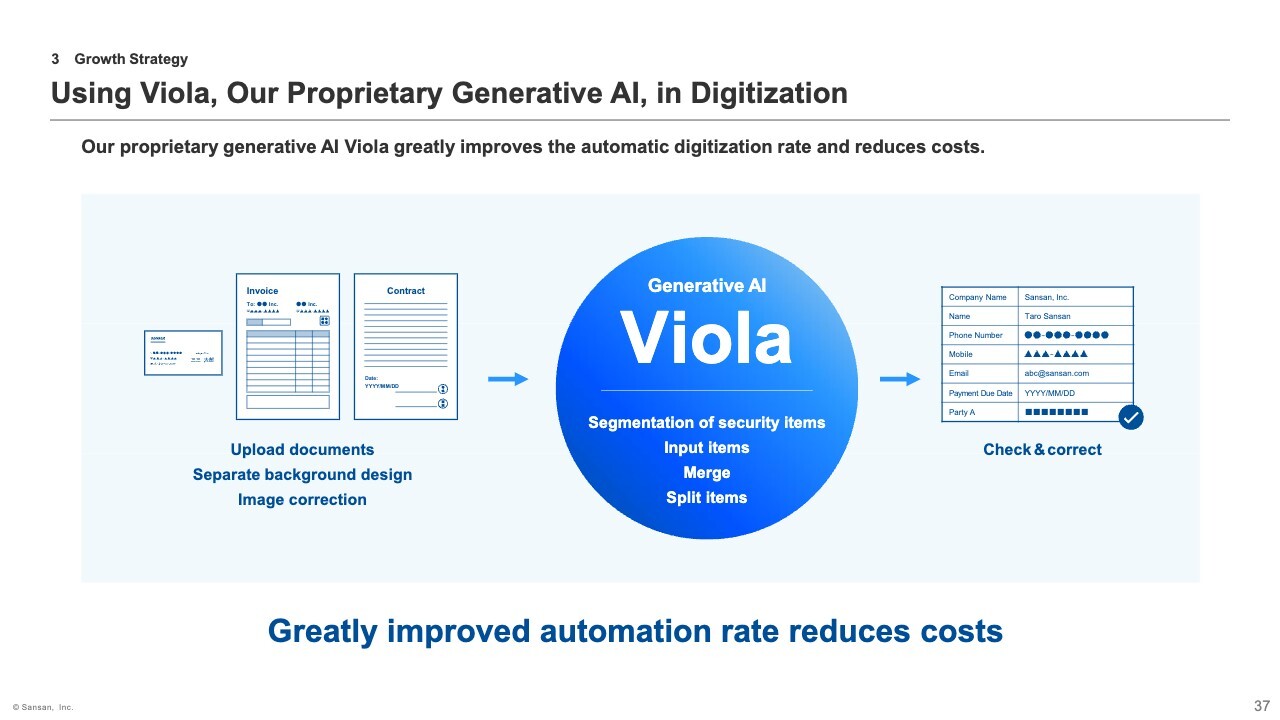

Using Viola, Our Proprietary Generative AI, in Digitization

By combining this digitization operation with Viola, a proprietary generative AI developed in-house, we aim to achieve further improvements at an unprecedented speed.

Viola is a generative AI with advanced character recognition capabilities that learns from a wide range of data. For example, it can perform high-accuracy estimation and recognition of multiple data points such as names, company names, and email addresses from images, taking into account not only visual information but also context and structural meaning. Viola can also learn large volumes of data in a single business day, enabling it to support new languages.

Unlike NineOCR, which was previously discussed, Viola can also be applied to invoices and contracts. It is now being deployed across all major products.

As a result, Viola is enabling further automation of processes that still required manual entry even after applying NineOCR. We expect this to reduce costs by approximately ¥100 million this fiscal year. This achievement is made possible by our extensive experience and expertise accumulated over many years of working on data capture operations while leveraging manual entry. We believe this is a significant competitive advantage for us.

We will continue to refine our capabilities and achieve further cost reduction through digitization. In addition, beyond the initiatives discussed thus far, we are also expanding the use of AI across a wide range of internal operations. Our goal is to improve productivity for all employees and drive a steady increase in our medium-term profit margin.

That concludes my presentation. Thank you very much.

Q&A: Outlook for advertising expenses

Questioner: Regarding future advertising expenses, it seems that the policy has been revised. I’d like to clarify your thinking. With this level of increase, some may see a risk of customer acquisition cost (CAC) worsening.

On the other hand, the Q4 results suggest that a significant portion may be brand-focused advertising. Could you explain how the expenses related to customer acquisition and those related to branding are expected to increase? Please share your views for this fiscal year and beyond.

Hashimoto: The advertising expense budget for this fiscal year is approximately ¥6.5 billion. Given that last year’s actual spending was about ¥5.1 billion, this represents a 28% increase, which exceeds our revenue guidance in growth rate.

The main reason behind this increase is the growth of our products. We have launched large-scale promotions for Bill One Expense and Contract One, which has led to a slight increase in costs.

Naturally, as the number of products increases, advertising and promotional investments must also increase. However, this is based on the premise that such investments make sense because they are contributing to actual customer acquisition. Therefore, we do not currently expect our CAC to deteriorate.

Most of our advertising is not for branding purposes but is rather aimed at generating product leads.

Questioner: Based on your comments, it sounds like the focus is more on acquiring new customers rather than cross-selling to existing ones. Should we assume there is limited contribution from cross-sell to increasing monthly recurring revenue per paid subscription?

Hashimoto: We are, of course, working on initiatives such as selling Bill One and Contract One to existing Sansan users. In that sense, advertising is also effective for cross-selling. Although it's difficult to quantify, I believe that advertising plays an important role in raising awareness—such as “Sansan offers these other services as well”—which can contribute to cross-selling.

Terada: Let me add one point. We are conducting advertising activities for each of our products—Sansan, Bill One, and Contract One. Sansan is being promoted through TV commercials as a new digital business card solution, while Contract One is being featured in a TV commercial for the first time. Bill One has been advertised through TV commercials before, but this is the first time it is being promoted specifically as an expense management solution.

So rather than promoting our existing services as-is, we are running these campaigns as part of a new advertising strategy aligned with the PMF of our new solutions.

Questioner: If the increase in ad spend is primarily to acquire new leads, can we expect accelerated topline growth from next fiscal year onward? That could potentially lead to exceeding your targets under the medium-term financial policy—what’s your view?

Terada: We’re hoping to get a sense of that based on the results of these commercials. This is the first time we are running large-scale TV campaigns for three products simultaneously. Depending on the response, it’s possible that such an outcome could be within reach. We hope to assess that through the current campaign.

Q&A: How to assess the effectiveness of advertising activities

Questioner: I understand that the advertising budget is focused on new products. How can we externally verify the effectiveness of this investment? For example, if the spending was concentrated in Q4 FY2024 and Q1 FY2025, can we expect a spike in KPIs in the second half of FY2025?

Terada: In B2B—especially enterprise-targeted—commercials, we internally track many metrics such as lead volume, brand awareness, and conversion to business discussions. To be honest, it is difficult to conduct a one-to-one analysis in the end.

From our perspective, an increase in sales productivity for each product in Q2 and Q3, driven by the current commercial campaigns, will serve as a way to evaluate their effectiveness. For external observers, revenue or order trends would be the clearest indicators.

Questioner: When advertising new products, there must be several KPIs involved. Which one do you prioritize most? Is lead acquisition the most important metric you focus on?

Terada: The most important metric is orders. Ultimately, what matters is acquired MRR. While we do monitor leading indicators like lead volume and lead-to-deal conversions, unless it leads to actual orders, it doesn’t mean much. So, we mainly track orders internally.

Q&A: Services Utilizing Generative AI

Questioner: We also heard your explanation, Mr. Terada, on the internal and external use of generative AI. Among the various services you offer, which ones are you particularly optimistic about? You also mentioned the possibility of seeing some contribution within this fiscal year. Could you share your thoughts on the expected timeline for a more significant impact on overall company performance? For example, do you expect a major contribution starting next fiscal year, or perhaps around the time of the next medium-term financial policy period?

Terada: To be honest, the outlook isn’t entirely clear yet, but we expect to gain a certain internal sense that these initiatives have "started to contribute" in Q2 of this fiscal year. With the widespread adoption of generative AI, what matters most is data. When our user companies—BtoB companies—engage with generative AI, we believe that, ultimately, it comes down to how they organize and prepare their data.

In that sense, Sansan, Bill One, and Contract One are increasingly being positioned not just as applications but as essential components of our own AI strategy. We believe we can strongly advocate this positioning, and are currently developing our growth and product strategies with the vision that Sansan, Bill One, and Contract One will each bring new perspectives to our overall offering.

Questioner: In the context of data structuring, based on what you've shared, it seems that Sansan's MCP server would have the most direct impact. Is that also the general understanding within your company?

Terada: This is our interpretation, but broadly speaking, when considering enterprise systems with AI, the key question is whether the focus is on knowledge or process. In the case of Bill One, it is more process-oriented, so we believe the important perspective is how to leverage data and AI to advance process automation.

On the other hand, Sansan and Contract One deal with business cards and contracts as forms of knowledge. We believe the significance of AI lies in its ability to semantically extract meaningful information from such data.

To give a tangible example of how our services work together, consider a query such as, “Tell me about our relationship with Company X.” In response, our system can retrieve data from Sansan, bring up relevant contracts from Contract One or Bill One, and go beyond simply presenting the raw data by adding semantic interpretation to deliver a meaningful answer.

This is precisely why I have described Sansan, Bill One, and Contract One as essential components within a structure where an interface—such as Slack or Microsoft Teams as internal communication platforms—is connected to an LLM operating in the background and linked with an MCP server. These services are envisioned to function seamlessly within such a framework.

Naturally, we are working on embedding AI into Sansan, Bill One, and Contract One. However, our true strength lies in our ability to provide data as an interface or context for AI beyond the boundaries of our own services—and we believe this is the very foundation of our growth strategy.

Q&A: MCP server

Questioner: I have a question regarding the MCP server. Looking at page 25, while I was certainly impressed by Viola, it seemed to me that the MCP server may be even more important as a source of competitive advantage. Is my understanding correct? Also, how do you plan to monetize using the MCP server?

I understand that it’s likely still too early for you to estimate the increase in monthly recurring revenue per paid subscription. However, for example, within your industry, have there been any discussions or exchanges of opinions with executives in the industry you belong to, along the lines of, “We expect to see this level of growth across the industry,” or, “On the contrary, shouldn’t we be aiming to raise unit prices to this level by leveraging generative AI?”

Terada: We see the MCP server and Viola as relating respectively to the revenue side and the cost side of our business. The MCP server, in particular, represents a new revenue opportunity. However, at this stage, we do not yet have a clear picture of how much we can charge or what kind of pricing structure we can implement.

However, based on our past practices, when a valuable function emerges, we typically position it as part of a higher-tier edition. Ultimately, our communication will likely be along the lines of: “When you use the MCP server, please purchase a higher edition.”

In addition, pricing and the framework itself are elements that we revisit and update almost every year. As we roll out the MCP server, we hope to carefully assess such opportunities going forward.

Our approach is more product-out in nature—we take the lead in proposing services to customers by saying, “This is the kind of solution we offer.” What’s unique about the MCP server is that even though internal experimentation has only just begun and we are still in the early stages of preparing it as a project, we have already received a significant number of inquiries from companies.

When companies are faced with the need to invest in generative AI and start saying things like, “Let’s invest in generative AI—starting with purchasing tools,” or “Let’s also aim to enable various collaboration tools to be built using LLMs,” the question that inevitably arises is, “What should we do with our data?”

At that point, if they are a Sansan user, they will naturally want to connect with Sansan. We believe that a key challenge going forward will be to determine how much new revenue we can generate by leveraging our market-in approach—namely, a combination of needs-driven development and product-out strategy.

Q&A: Combining the MCP Server with Viola

Questioner: Has the initiative to combine the MCP Server with Viola’s technology already begun? As the solution evolves through versions 1 and 2, do you see potential value that such a combination could bring to the market?

Terada: We position the MCP Server as a platform that provides context by leveraging data accumulated within Sansan, Bill One, and Contract One.

As for Viola, we regard it as a technology for generating that data. So, at this stage, we are not planning to offer Viola as an application on the MCP Server or to directly connect it as an interface. However, I would say that, in effect, they are connected.

Q&A: Background of the impairment loss on Unipos Inc.

Questioner: I would like to ask about the background of the impairment loss on Unipos Inc. Will this impairment loss have any impact on your future M&A strategy?

Hashimoto: To clarify, this is not technically an impairment loss. Rather, it is a provision for the expected loss on the planned sale of shares in Unipos. As for whether this will lead to any changes in our M&A strategy going forward, we do not believe that our overall strategy will change.

That said, a loss will indeed be incurred, and we recognize that the outcome has significantly deviated from our initial expectations at the time of investment. As a result, we expect to take a more cautious approach in future M&A processes, with greater emphasis on due diligence and risk assessment.

Q&A: Potential addressable market (PAM)

Questioner: On page 29, there’s an interesting point about the acceleration of monthly financial closing. Do you get a sense that this is expanding the market outlook or the potential addressable market (PAM)?

Terada: Similar to what I mentioned earlier about the MCP server, it’s still unclear how this can be monetized—whether it can be made chargeable as an add-on or in some other way.

That said, although I skipped over it earlier, we’ve already rolled out a product, for example, for matching purchase order data with invoice data, and we’re planning a version upgrade in the fall that will include features such as generative AI integration and digitization of detailed data.

Given that a certain number of customers are already using this feature, and we’re continuing to enhance it, I do believe the market will expand.

However, rather than viewing this as a separate market from that of Bill One’s invoice receipt function, I see it as an extension. Not just for Bill One, but as our basic approach, we’re committed to creating new markets. If we can take pride in having created the invoice receipt market with Bill One, then I believe this will be the next step in expanding it.

Q&A: Improvement in profit margins

Questioner: I understand that this fiscal year’s margin improvement is about 5 percentage points, and that it’s expected to be around the same level next fiscal year. While it seems you’re not expecting much improvement in personnel or advertising expenses, could you explain what is driving the total 10-point improvement over the two years?

Hashimoto: As you pointed out, if we take the midpoint of our current guidance for this fiscal year, the margin improvement comes out to about 6 percentage points. We don’t yet have a concrete plan for the fiscal year ending May 31, 2027, but based on our medium-term financial policy, we believe a similar level of improvement is achievable.

This fiscal year, we’re forecasting revenue growth of 22% to 25%, while personnel expenses are projected to increase by 19%. So, we expect the ratio of personnel expenses to revenue to decline over time. In fact, since personnel expenses account for slightly less than half of our total costs, we believe this will contribute significantly to margin expansion.

Questioner: So, will the improvement in the next fiscal year also be driven by a decline in personnel expenses?

Hashimoto: At this point, we expect the ratio of personnel expenses to revenue to remain largely unchanged in the fiscal year ending May 31, 2027.

Q&A: Decline in unit price of Bill One

Questioner: It appears that the unit price of Bill One has declined for two consecutive quarters. Do you expect this trend to continue?

Hashimoto: To be precise, I don’t believe the unit price itself is decreasing, but rather that the rate of increase in unit price is slowing down. As you noted, the quarter-on-quarter growth in monthly recurring revenue per paid subscription (the unit price) has slowed to 2.2% this quarter.

That said, my sense is that the current unit price of ¥232,000 is still quite high. At the same time, we’re beginning to offer new peripheral products around Bill One—not just the core invoice receipt functionality, but also expense reimbursement and accounts receivable management—as a bundled package.

Depending on how much these additions contribute, there is potential for the unit price to rise further. However, I don’t have a clear sense that the unit price will continue to grow at a high rate—say, 10% or 20%.